Professional Documents

Culture Documents

Financial Accounting Sample Problems

Financial Accounting Sample Problems

Uploaded by

Lia AtilanoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting Sample Problems

Financial Accounting Sample Problems

Uploaded by

Lia AtilanoCopyright:

Available Formats

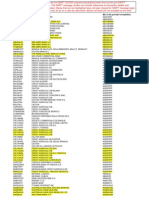

Case 1.

PPE

Shanghai Co. had the following transactions regarding its property, plant and equipment:

a. Issued Php 5.00 200,000 ordinary shares out of its 400,000 authorized shares in exchange for 4,000,000

cash annd land with a fair value of Php 2,500,000. On the same date, shares of Shanghai Corporation are

selling at Php 26.00.

b. Incurred the following expenses for the contruction of building:

Direct Materials

Site Labor Cost

Incremental Cost Incurred

Interest imputed from financing the construction

Wasted Materials (300,000 abnormal)

Total Costs Incurred

Building could have been purchased from outside parties at Php 5,250,000

c. Purchased machinery for Php 250,000 cash

d. Purchased truck #1 for Php 500,000 (3/10, N/30) . The discount was not availed.

e. Purchased truck #2 at an installment price of Php600,000 by issuing notes. The installment will be

payable in 3 equal installment. The cash price equivalent of the purchase is 450,000.

f. Issued 8% 1,000 bonds of Php1,000 par to finance the purchase of equipment. The bonds are selling in

the market at 98. The equipment's fair value at that time was Php900,000.

g. An investment in equity security valued at the market for Php700,000 and costing Php 800,000 was

exchange for an equipment with a fair value of Php 750,000. Additional cash payment was made by

Shanghai for Php30,000.

h. Raynum entity traded an old equipment with a dealer of a new model. The following data are available:

Old Equipment: PHP

Cost 1,000,000

Accumulated Depreciation 750,000

Book Value 250,000

Fair Value 300,000

Trade-in Value 400,000

New Equipment:

List Price 2,000,000

Trade-in value of old equipment (400,000)

Cash Payment 1,600,000

Kindly perform the journal entries for each scenario.

Case 2. Depreciation

Mis Hart Co. has an asset with a cost amounting to Php1,000 original cost, Php100 salvage value and 5 years

of useful life.

Php

Historical Cost 1000

Salvage Value 100

Useful Life 5

Straight Line Method:

Year Depreciable Cost Depreciation Rate Depreciation Expense

1st 900 20% 180

2nd 900 20% 180

3rd 900 20% 180

4th 900 20% 180

5th 900 20% 180

Declining-Balance:

Depreciation Rate 20%

Double Rate 2

Double Declining Rate 40%

Year Depreciation Rate Accumulated Depreciation Book Value

Beg 1000

1st 400 400 600

2nd 240 640 360

3rd 144 784 216

4th 86.4 870.4 129.6

5th 129.6 1000 0

Note 1 Ignore the salvage value in the computation

Note 2 Since its useful life is only up to the 5th year, therefore, the BV at the end of 4th year

would be the whole depreciation expense recognized at the end of the term

Sum-of-the-years Digits:

1. Determine year's digits. 1,2,3,4,5

2. Caculate the sum of the digits 15(1+2+3,+4+5)

Total

Depreciable Depreciatio Depreciation Accumulated Book

Year Cost n Rate Expense Depreciation Value

Beg 1000

1st 900 33% 300 300 700

2nd 900 27% 240 540 460

3rd 900 20% 180 720 280

4th 900 13% 120 840 160

5th 900 7% 60 900 100

You might also like

- Illustrative Problem Worksheet ADocument6 pagesIllustrative Problem Worksheet AJoy Santos80% (5)

- Taking Sides - Clashing Views On Economic Issues - Issue 2.4Document4 pagesTaking Sides - Clashing Views On Economic Issues - Issue 2.4Shawn Rutherford0% (1)

- Worksheet Data For Savaglia Company Are Presented Below. The Owner Did Not Make Any Additional Investments in The Business in April.Document6 pagesWorksheet Data For Savaglia Company Are Presented Below. The Owner Did Not Make Any Additional Investments in The Business in April.Risky FernandoNo ratings yet

- Course Assignment Due On 5 December Part I: Essays QuestionsDocument4 pagesCourse Assignment Due On 5 December Part I: Essays QuestionsAbdo Salem9090No ratings yet

- Illustrative Problem Worksheet ADocument6 pagesIllustrative Problem Worksheet AJoy Santos33% (3)

- Hola Kola Solution Base AbhinavDocument17 pagesHola Kola Solution Base Abhinavnisha0% (2)

- 3 Column Cash BookDocument4 pages3 Column Cash BookMuketoi AlexNo ratings yet

- Answer KEY PPEDocument6 pagesAnswer KEY PPExjammerNo ratings yet

- Lec04 SolutionDocument12 pagesLec04 SolutionedrianclydeNo ratings yet

- Book 1Document4 pagesBook 1Swapan Kumar SahaNo ratings yet

- Answer Key - Midterm ExamDocument5 pagesAnswer Key - Midterm ExamSilvermist AriaNo ratings yet

- Fabm OutputsDocument3 pagesFabm OutputsElaine Joyce GarciaNo ratings yet

- Breakeven Point Analysis: Fix CostDocument7 pagesBreakeven Point Analysis: Fix CostKankanNguyenNo ratings yet

- Group 2-Fin 6000BDocument7 pagesGroup 2-Fin 6000BBellindah wNo ratings yet

- $RMJJZ4MDocument5 pages$RMJJZ4MAdam CuencaNo ratings yet

- Mushroom Farming Project ReportDocument2 pagesMushroom Farming Project ReportSuman Kumar AdhikaryNo ratings yet

- Ch.08 Kinney 9e SM - FinalDocument6 pagesCh.08 Kinney 9e SM - FinalMarceliano Deguit100% (1)

- Statement - I Cost of Project Particulars Sl. No. Ref. Annex Total CostDocument15 pagesStatement - I Cost of Project Particulars Sl. No. Ref. Annex Total Costsohalsingh1No ratings yet

- Unit 5 MADocument8 pagesUnit 5 MAismshift2.hodNo ratings yet

- Fair Value Fair ValueDocument4 pagesFair Value Fair ValueJay Ann DomeNo ratings yet

- Gilbert Company-WPS OfficeDocument17 pagesGilbert Company-WPS OfficeTrina Mae Garcia100% (1)

- Depreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Document14 pagesDepreciation Expense: For Year Ended 2015 Elimination Debit Credit P S..Agitha Juniaty PasalliNo ratings yet

- FM 2019 SolutionsDocument6 pagesFM 2019 Solutionsaditikotere92No ratings yet

- Tutorial Question 2 201909 BBCA 2053Document8 pagesTutorial Question 2 201909 BBCA 2053Theva LetchumananNo ratings yet

- Tutorial Question 2 201909 BBCA 2053Document8 pagesTutorial Question 2 201909 BBCA 2053Theva LetchumananNo ratings yet

- Unadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditDocument5 pagesUnadjusted Trial Balance Adjusting Journal Entries Account Debit Credit Debit CreditChristine RepuldaNo ratings yet

- Illustrative Problem Worksheet ADocument6 pagesIllustrative Problem Worksheet AJoy SantosNo ratings yet

- EXERCISES - Gross IncomeDocument4 pagesEXERCISES - Gross IncomeDanna ClaireNo ratings yet

- UTS AkutansiDocument24 pagesUTS AkutansiAbraham KristiyonoNo ratings yet

- Costing Solution 12-12-2022Document7 pagesCosting Solution 12-12-2022Isha SinghNo ratings yet

- This Study Resource Was: Cash Out Lear Flows FlowsDocument7 pagesThis Study Resource Was: Cash Out Lear Flows FlowsLayNo ratings yet

- JamilAhmed - 2355 - 19750 - 1 - Lecture003-Cash Flow EstimationDocument29 pagesJamilAhmed - 2355 - 19750 - 1 - Lecture003-Cash Flow Estimationmuskan.j.talrejaNo ratings yet

- Hyper Star Traders Income Statement As of Dec 31, 2009: Net SalesDocument6 pagesHyper Star Traders Income Statement As of Dec 31, 2009: Net SalesomairpkNo ratings yet

- 1 Quantity Sold Per Month Unit Sales Price Total Revenue Per Month Changes in Total RevenueDocument15 pages1 Quantity Sold Per Month Unit Sales Price Total Revenue Per Month Changes in Total RevenueGillu BilluNo ratings yet

- ACCT 213 Exercise (Chapter 10)Document6 pagesACCT 213 Exercise (Chapter 10)MohammedNo ratings yet

- DepreciationDocument3 pagesDepreciationPrince-SimonJohnMwanza100% (1)

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- CostingDocument56 pagesCostingKartNo ratings yet

- CorporateAccounting Costing New October2018 B B A WithCredits RegularJune-2017PatternSecondYearB B A 26ED856ADocument4 pagesCorporateAccounting Costing New October2018 B B A WithCredits RegularJune-2017PatternSecondYearB B A 26ED856AMubin Shaikh NooruNo ratings yet

- SW - Chapter 7Document8 pagesSW - Chapter 7andrie gardoseNo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Day-21 Inventory ValuationDocument12 pagesDay-21 Inventory ValuationSandeep RayNo ratings yet

- Bmac5203 AssgDocument8 pagesBmac5203 AssgMadhu SudhanNo ratings yet

- Working Capital - Inventory & CASH MANAGEMENTDocument24 pagesWorking Capital - Inventory & CASH MANAGEMENTenicanNo ratings yet

- DepreciationDocument21 pagesDepreciationcaraaatbongNo ratings yet

- Documents - Tips Cpa Aditional CorlynDocument34 pagesDocuments - Tips Cpa Aditional CorlynCarol Ferreros PanganNo ratings yet

- QPractical Accounting Problems IIDocument34 pagesQPractical Accounting Problems IIZee GuillebeauxNo ratings yet

- Fine Manufacturing CompanyDocument4 pagesFine Manufacturing CompanyexquisiteNo ratings yet

- Jawaban Contoh Soal PA 2Document8 pagesJawaban Contoh Soal PA 2Radinne Fakhri Al WafaNo ratings yet

- Problem 2.3.Document4 pagesProblem 2.3.ArtisanNo ratings yet

- Period of Construction of RestaurantDocument6 pagesPeriod of Construction of RestaurantSejal PriyaNo ratings yet

- Practical Accounting 1Document18 pagesPractical Accounting 1Unknown WandererNo ratings yet

- Copper Mine Economics Q4 2016Document2 pagesCopper Mine Economics Q4 2016bernd81No ratings yet

- Project Report For Broiler Farm: 4,000 NOS BIRDSDocument6 pagesProject Report For Broiler Farm: 4,000 NOS BIRDSManish GovilNo ratings yet

- Latihan Soal Akuntansi BiayaDocument5 pagesLatihan Soal Akuntansi Biayaaufa alfayedhaNo ratings yet

- Case1: Exercise Number 1Document8 pagesCase1: Exercise Number 1Pearl Isabelle SudarioNo ratings yet

- Departmental Accounting IllustrationsDocument13 pagesDepartmental Accounting IllustrationsHarsha BabyNo ratings yet

- Page 1 of 9Document9 pagesPage 1 of 9Huzaifa AbdullahNo ratings yet

- 03 - HO - Statement of Comprehensive IncomeDocument3 pages03 - HO - Statement of Comprehensive IncomeYoung MetroNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- Cost and Cost ConceptsDocument2 pagesCost and Cost ConceptsCamie YoungNo ratings yet

- The Process of Capitalist Production as a Whole (Capital Vol. III)From EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)No ratings yet

- 2023 Financial StatementsDocument27 pages2023 Financial Statementsdemo040804No ratings yet

- IFMIS Telangana DADocument13 pagesIFMIS Telangana DAAskani KurumaiahNo ratings yet

- Savings Account Statement: Capitec B AnkDocument8 pagesSavings Account Statement: Capitec B AnkFikile Eem50% (2)

- HBL Annual Report 2023Document386 pagesHBL Annual Report 2023azeem sandhuNo ratings yet

- Mid-Sem Exam NotesDocument21 pagesMid-Sem Exam Notesdaksh.aggarwal26No ratings yet

- Banking Services Online and OfflineDocument39 pagesBanking Services Online and Offlineonkarskulkarni0% (1)

- Comparative Study On Services of Public Sector and Private Sector BanksDocument49 pagesComparative Study On Services of Public Sector and Private Sector BanksvimalaNo ratings yet

- 2013 SGV Cup Level Up FinalDocument17 pages2013 SGV Cup Level Up FinalAndrei GoNo ratings yet

- Chapter 4 - MONETARY - POLICYDocument11 pagesChapter 4 - MONETARY - POLICYLe MinouNo ratings yet

- 426 Exam 2 Questions AnswersDocument25 pages426 Exam 2 Questions AnswersIlya StadnikNo ratings yet

- TPH Day4Document100 pagesTPH Day4adyani_0997100% (1)

- ClarificationDocument6 pagesClarificationSiddhantNo ratings yet

- General CashierDocument1 pageGeneral CashierJob MaldivesNo ratings yet

- Lesson 4 - The Steps in The Accounting CycleDocument5 pagesLesson 4 - The Steps in The Accounting Cycleamora elyseNo ratings yet

- Chapter 2Document7 pagesChapter 2Trần NanamiNo ratings yet

- Matching TypeDocument2 pagesMatching Type채문길No ratings yet

- Audit 3 Midterm Exam (CH 17,18,19,20 Cabrera)Document3 pagesAudit 3 Midterm Exam (CH 17,18,19,20 Cabrera)Roldan Hiano ManganipNo ratings yet

- Concept of BookkeepingDocument2 pagesConcept of BookkeepingGhost DemonNo ratings yet

- IB1 CH 3.4 Final Accounts 2020 PDFDocument38 pagesIB1 CH 3.4 Final Accounts 2020 PDFamira zahari100% (1)

- SwiftersDocument16 pagesSwiftersVipul ShepherdNo ratings yet

- Practice QuestionsDocument15 pagesPractice QuestionsKumarNo ratings yet

- 11A. HDFC Feb 2021 EstatementDocument10 pages11A. HDFC Feb 2021 EstatementNanu PatelNo ratings yet

- Ferreycorp Audited Financial Statements 2020Document84 pagesFerreycorp Audited Financial Statements 2020Eduardo ArcosNo ratings yet

- (AMALEAKS - BLOGSPOT.COM) BFIN-121 Week 1-9Document21 pages(AMALEAKS - BLOGSPOT.COM) BFIN-121 Week 1-9Daniel John D. VelascoNo ratings yet

- Acctng 1Document1 pageAcctng 1LilyNo ratings yet

- Score: - : Logarithmic Form Exponential FormDocument4 pagesScore: - : Logarithmic Form Exponential FormSherren Marie Nala0% (1)

- Questions, Anwers Chapter 22Document3 pagesQuestions, Anwers Chapter 22basit111No ratings yet