Professional Documents

Culture Documents

Commitment of Trader (COT) Report: E-Mini S&P 500 Stock Index

Commitment of Trader (COT) Report: E-Mini S&P 500 Stock Index

Uploaded by

Văn Thắng HoàngOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commitment of Trader (COT) Report: E-Mini S&P 500 Stock Index

Commitment of Trader (COT) Report: E-Mini S&P 500 Stock Index

Uploaded by

Văn Thắng HoàngCopyright:

Available Formats

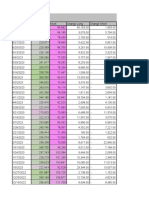

Commitment Of Trader (COT) Report

NON - COMMERCIAL t.me/commitmentoftrader

MM/DD/YY

USDX (U.S. DOLLAR INDEX X $1000) E-MINI S&P 500 STOCK INDEX ($50 X S&P 500 INDEX)

Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT

FEB/02/21 36,894 15,980 30,810 -14830 34.15% 65.85% 611 722 FEB/02/21 2,640,747 364,571 399,433 -34862 47.72% 52.28% -7299 -812

FEB/09/21 36,189 15,939 29,814 -13875 34.84% 65.16% -41 -996 FEB/09/21 2,619,444 342,806 414,309 -71503 45.28% 54.72% -21765 14876

FEB/16/21 35,968 15,842 30,129 -14287 34.46% 65.54% -97 315 FEB/16/21 2,636,295 347,018 426,879 -79861 44.84% 55.16% 4212 12570

FEB/23/21 41,377 17,592 31,443 -13851 35.88% 64.12% 1750 1314 FEB/23/21 2,652,739 355,414 386,701 -31287 47.89% 52.11% 8396 -40178

MAR/02/21 37,546 20,767 30,870 -10103 40.22% 59.78% 3175 -573 MAR/02/21 2,767,213 395,610 372,421 23189 51.51% 48.49% 40196 -14280

MAR/09/21 41,300 23,759 32,646 -8887 42.12% 57.88% 2992 1776 MAR/09/21 2,779,898 399,052 381,261 17791 51.14% 48.86% 3442 8840

MAR/16/21 35,368 26,575 20,738 5837 56.17% 43.83% 2816 -11908 MAR/16/21 3,063,652 386,620 390,794 -4174 49.73% 50.27% -12432 9533

MAR/23/21 36,732 27,846 22,463 5383 55.35% 44.65% 1271 1725 MAR/23/21 2,540,184 304,988 333,294 -28306 47.78% 52.22% -81632 -57500

MAR/30/21 40,306 30,513 24,787 5726 55.18% 44.82% 2667 2324 MAR/30/21 2,564,664 306,648 356,979 -50331 46.21% 53.79% 1660 23685

Click Here !! To Join COT Report Channel Click Here !! To Join COT Report Channel

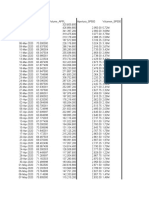

EURX (CONTRACTS OF EUR 125,000) NASDAQ 100 STOCK INDEX (MINI) (NASDAQ 100 STOCK INDEX X $20)

Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT

FEB/02/21 675,520 216,887 79884 137003 73.08% 26.92% -21212 7129 FEB/02/21 234,732 87,172 58,103 29069 60.00% 40.00% -745 9878

FEB/09/21 673,116 220,943 80,721 140222 73.24% 26.76% 4056 837 FEB/09/21 234,372 83,028 57,366 25662 59.14% 40.86% -4144 -737

FEB/16/21 675,761 222,895 82,889 140006 72.89% 27.11% 1952 2168 FEB/16/21 235,353 75,218 54,113 21105 58.16% 41.84% -7810 -3253

FEB/23/21 696,916 228,501 90,136 138365 71.71% 28.29% 5606 7247 FEB/23/21 240,070 67,535 72,923 -5388 48.08% 51.92% -7683 18810

MAR/02/21 698,229 222,655 96,667 125988 69.73% 30.27% -5846 6531 MAR/02/21 244,016 56,614 80,107 -23493 41.41% 58.59% -10921 7184

MAR/09/21 722,123 207,588 105,624 101964 66.28% 33.72% -15067 8957 MAR/09/21 253,528 62,457 74,951 -12494 45.45% 54.55% 5843 -5156

MAR/16/21 638,977 195,857 105,881 89976 64.91% 35.09% -11731 257 MAR/16/21 257,385 57,067 69,394 -12327 45.13% 54.87% -5390 -5557

MAR/23/21 641,428 195,500 102,178 93322 65.67% 34.33% -357 -3703 MAR/23/21 221,777 49,731 62,389 -12658 44.36% 55.64% -7336 -7005

MAR/30/21 645,121 194,763 121,024 73739 61.68% 38.32% -737 18846 MAR/30/21 222,23 48,096 65,961 -17865 42.17% 57.83% -1635 3572

GBPX (CONTRACTS OF GBP 62,500) BITCOIN Futures (NASDAQ 100 STOCK INDEX X $20) (5 Bitcoin)

Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT

FEB/02/21 161,100 53,658 44,042 9616 54.92% 45.08% 6298 4647 FEB/02/21 9,469 5,342 8,016 -2674 39.99% 60.01% -972 -1079

FEB/09/21 170,161 60,513 39,395 21118 60.57% 39.43% 6855 -4647 FEB/09/21 11,055 6,327 9,171 -2844 40.82% 59.18% 985 1155

FEB/16/21 171,218 60,269 38,102 22167 61.27% 38.73% -244 -1293 FEB/16/21 11,426 6,672 9,565 -2893 41.09% 58.91% 345 394

FEB/23/21 176,721 68,266 37,288 30978 64.67% 35.33% 7997 -814 FEB/23/21 10,572 6,559 8,644 -2085 43.14% 56.86% -113 -921

MAR/02/21 169,363 65,138 29,056 36082 69.15% 30.85% -3128 -8232 MAR/02/21 8,068 4,467 6,318 -1851 41.42% 58.58% -2092 -2326

MAR/09/21 181,373 61,271 27,360 33911 69.13% 30.87% -3867 -1696 MAR/09/21 8,785 4,944 6,857 -1913 41.89% 58.11% 477 539

MAR/16/21 148,035 55,190 26,590 28600 67.49% 32.51% -6081 -770 MAR/16/21 9,335 4,797 7,449 -2652 39.17% 60.83% -147 592

MAR/23/21 146,112 51,843 30,024 21819 63.33% 36.67% -3347 3434 MAR/23/21 9,897 5,541 7,946 -2405 41.08% 58.92% 744 497

MAR/30/21 139,779 47,222 22,263 24959 67.96% 32.04% -4621 -7761 MAR/30/21 9,322 5,676 7,891 -2215 41.84% 58.16% 135 -55

JPYX (CONTRACTS OF JPY 12,500,000) GOLD (CONTRACTS OF 100 TROY OUNCES)

Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT

FEB/02/21 190,948 69,602 24,973 44629 73.59% 26.41% 6139 6502 FEB/02/21 520,011 314,352 57,226 257126 84.60% 15.40% 820 1240

FEB/09/21 183,901 60,719 26,101 34618 69.94% 30.06% -8883 1128 FEB/09/21 506,741 309,326 57,919 251407 84.23% 15.77% -5026 693

FEB/16/21 188,119 66,732 29,550 37182 69.31% 30.69% 6013 3449 FEB/16/22 503,016 303,583 68,614 234969 81.57% 18.43% -5743 10695

FEB/23/21 183,247 66,670 38,048 28622 63.67% 36.33% -62 8498 FEB/23/21 481,125 284,081 68,348 215733 80.61% 19.39% -19502 -266

MAR/02/21 189,270 61,259 41,989 19270 59.33% 40.67% -5411 3941 MAR/02/21 467,008 265,533 75,895 189638 77.77% 22.23% -18548 7547

MAR/09/21 211,347 64,027 57,513 6514 52.68% 47.32% 2768 15524 MAR/09/21 473,871 254,839 79,676 175163 76.18% 23.82% -10694 3781

MAR/16/21 145,951 26,003 65,371 -39368 28.46% 71.54% -38024 7858 MAR/16/21 476,467 256,237 76,041 180196 77.12% 22.88% 1398 -3635

MAR/23/21 160,581 27,524 81,049 -53525 25.35% 74.65% 1521 15678 MAR/23/21 485,457 262,774 88,707 174067 74.76% 25.24% 6537 12666

MAR/30/21 166,091 24,724 84,205 -59481 22.70% 77.30% -2800 3156 MAR/30/21 467,321 263,453 95,925 167528 73.31% 26.69% 679 7218

Click Here !! To Join COT Report Channel Click Here !! To Join COT Report Channel

AUDX (CONTRACTS OF AUD 100,000) SILVER (CONTRACTS OF 5,000 TROY OUNCES)

Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT

FEB/02/21 142,644 55,768 57,235 -1467 49.35% 50.65% -604 1634 FEB/02/21 179786 80634 29,225 51409 73.40% 26.60% -3810 -759

FEB/09/21 140,497 55,931 56,147 -216 49.90% 50.10% 163 -1088 FEB/09/21 179,288 80,133 30,590 49543 72.37% 27.63% -501 1365

FEB/16/21 140,954 54,675 57,496 -2821 48.74% 51.26% -1256 1349 FEB/16/21 183,544 81,648 31,824 49824 71.95% 28.05% 1515 1234

FEB/23/21 145,261 55,664 57,300 -1636 49.28% 50.72% 989 -196 FEB/23/21 172,392 78,710 31,067 47643 71.70% 28.30% -2938 -757

MAR/02/21 149,904 61,047 55,006 6041 52.60% 47.40% 5383 -2294 MAR/02/21 158,349 74,925 35,309 39616 67.97% 32.03% -3785 4242

MAR/09/21 150,330 61,848 53,773 8075 53.49% 46.51% 801 -1233 MAR/09/21 155,425 71,445 35,296 36149 66.93% 33.07% -3480 -13

MAR/16/21 129,421 57,840 50,220 7620 53.53% 46.47% -4008 -3553 MAR/16/21 159,092 70,658 37,049 33609 65.60% 34.40% -787 1753

MAR/23/21 133,276 59,032 53,090 5942 52.65% 47.35% 1192 2870 MAR/23/21 160,437 70,257 39,178 31079 64.20% 35.80% -401 2129

MAR/30/21 137,335 66,607 54,344 12263 55.07% 44.93% 7575 1254 MAR/30/21 154,987 66,502 37,532 28970 63.92% 36.08% -3755 -1646

NZDX (CONTRACTS OF NZD 100,000) NATURAL GAS (Contracts of 10,000 MMBTU'S)

Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT

FEB/02/21 50,685 30,501 18,854 11647 61.80% 38.20% 2324 5435 FEB/02/21 1,134,240 282,102 252,521 29581 52.77% 47.23% -7258 -25267

FEB/09/21 48,655 29,133 17,589 11544 62.35% 37.65% -1368 -1265 FEB/09/21 1,159,552 275,534 239,384 36150 53.51% 46.49% -6568 -13137

FEB/16/21 48,103 30,243 16,532 13711 64.66% 35.34% 1110 -1057 FEB/16/22 1,201,588 289,666 250,891 38775 53.59% 46.41% 14132 11507

FEB/23/21 48,209 30,422 15,773 14649 65.86% 34.14% 179 -759 FEB/23/21 1,194,039 274,544 246,434 28110 52.70% 47.30% -15122 -4457

MAR/02/21 48,587 31,825 15,417 16408 67.37% 32.63% 1403 -356 MAR/02/21 1,205,198 270,518 252,713 17805 51.70% 48.30% -4026 6279

MAR/09/21 51,380 32,664 15,538 17126 67.76% 32.24% 839 121 MAR/09/21 1,206,350 267,255 267,297 -42 50.00% 50.00% -3263 14584

MAR/16/21 34,565 20,002 13,973 6029 58.87% 41.13% -12662 -1565 MAR/16/21 1,209,372 257,397 295,419 -38022 46.56% 53.44% -9858 28122

MAR/23/21 38,253 20,354 15,630 4724 56.56% 43.44% 352 1657 MAR/23/21 1,208,032 263,024 299,650 -36626 46.75% 53.25% 5627 4231

MAR/30/21 36,805 18,945 14,899 4046 55.98% 44.02% -1409 -731 MAR/30/21 1,195,449 252,554 290,438 -37884 46.51% 53.49% -10470 -9212

CADX (CONTRACTS OF CAD 100,000) WTI CRUDE OIL (CONTRACTS OF 1,000 BARRELS)

Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT

FEB/02/21 158,155 46,645 30,549 16096 60.43% 39.57% -7035 -9361 FEB/02/21 140,436 64,884 28,452 36432 69.52% 30.48% -5370 -2482

FEB/09/21 158,454 44,274 34,746 9528 56.03% 43.97% -2371 4197 FEB/09/21 151,431 72,150 29,596 42554 70.91% 29.09% 7266 1144

FEB/16/21 159,266 45,021 36,857 8164 54.99% 45.01% 747 2111 FEB/16/21 154,853 73,672 30,484 43188 70.73% 29.27% 1522 888

FEB/23/21 166,868 46,899 37,767 9132 55.39% 44.61% 1878 910 FEB/23/21 160,476 70,006 31,492 38514 68.97% 31.03% -3666 1008

MAR/02/21 168,689 51,391 36,064 15327 58.76% 41.24% 4492 -1703 MAR/02/21 150,784 64,698 29,269 35429 68.85% 31.15% -5308 -2223

MAR/09/21 173,078 50,022 39,041 10981 56.16% 43.84% -1369 2977 MAR/09/21 156,485 66,549 33,126 33423 66.77% 33.23% 1851 3857

MAR/16/21 186,932 50,907 40,644 10263 55.61% 44.39% 885 1603 MAR/16/21 159,214 67,575 33,048 34527 67.16% 32.84% 1026 -78

MAR/23/21 162,170 46,786 41,683 5103 52.88% 47.12% -4121 1039 MAR/23/21 160,706 68,255 34,422 33833 66.48% 33.52% 680 1374

MAR/30/21 164,199 48,462 41,944 6518 53.60% 46.40% 1676 261 MAR/30/21 166,257 72,137 34,782 37355 67.47% 32.53% 3882 360

Click Here !! To Join COT Report Channel

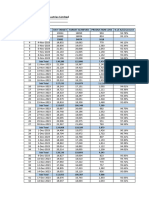

CHFX (CONTRACTS OF CHF 125,000)

Date OPEN INTREST LONG SHORT NET POSITION % LONG % SHORT Δ LONG Δ SHORT

FEB/02/21 50,832 22159 7,518 14641 74.67% 25.33% 4521 -28 Open Intrest - The number of options and/or futures contracts that are still unliquidated (not closed) at

the end of a trading day. Open interest is the number of outstanding contracts held by the longs or the

FEB/09/21 48,656 18,778 7,370 11408 71.81% 28.19% -3381 -148 OPEN INTREST

shorts, not the total of both. A rising open interest reaffirms the current trend because it shows that

FEB/16/21 48,093 15,745 7,374 8371 68.10% 31.90% -3033 4 money is flowing into a futures contract.

FEB/23/21 53,002 21,561 10,038 11523 68.23% 31.77% 5816 2664 % LONG Percentage Of Long / Short Positions With Compare to Total Positions. Very Important To

MAR/02/21 52,707 21,863 9,602 12261 69.48% 30.52% 302 -436 % SHORT Understand Direction Of Wind... :)

MAR/09/21 57,348 23,614 9,221 14393 71.92% 28.08% 1751 -381

MAR/16/21 37,985 13,297 8,626 4671 60.65% 39.35% -10317 -595 Δ LONG Increment / Decrement in Postions With Compare to Previous Week Report. For Example : In

WTI CRUDE OIL, Data As of JAN/26, New 781 Long Contracts Were Added & 936 Shorts Were

MAR/23/21 38,302 12,458 9,586 2872 56.51% 43.49% -839 960 Closed In Compare to JAN/19.

MAR/30/21 42,770 16,086 11,817 4269 57.65% 42.35% 3628 2231 Δ SHORT

Tha s F a n ! Stu h or n it R n S uc on C t. In e t Y i n Ba t n a d F r es g. So n u lN i M r u

in Y ad Sk s. Gre n Tak e! If Yo ke W k Ef o t , The re s R o t Ch el h u Fr s. Don't Fo t T

Fol m o I s a r | Rd he d Yo ve A G e k A a !!! G L

You might also like

- FPC 20Document15 pagesFPC 20zugaboysuperNo ratings yet

- WIDYAWATIDocument38 pagesWIDYAWATIAinul YaqinNo ratings yet

- SomFx Trading COTDocument13 pagesSomFx Trading COTmaxamedyuubuu462No ratings yet

- Ok ExcelDocument12 pagesOk Excelcmario949No ratings yet

- Waste Corugating Ujk 2 TGL 22 Feb 2023Document1 pageWaste Corugating Ujk 2 TGL 22 Feb 2023NindraNo ratings yet

- Energy Consumption 2021-2023Document3 pagesEnergy Consumption 2021-2023Kenny ObayomiNo ratings yet

- Line List Vs VORS Stats 20220110Document4 pagesLine List Vs VORS Stats 20220110John Michael TanNo ratings yet

- Precios Medios Estacionales MEM y TDF 2019 2024 WEBDocument5 pagesPrecios Medios Estacionales MEM y TDF 2019 2024 WEBEduardo lopez garciaNo ratings yet

- Tiket 14.03.23Document112 pagesTiket 14.03.23rodrigoNo ratings yet

- Sales 1-12 Mei 2024 Div 3Document1 pageSales 1-12 Mei 2024 Div 3farahfarkhana1225No ratings yet

- Line List Vs VORS Stats 20220211Document4 pagesLine List Vs VORS Stats 20220211John Michael TanNo ratings yet

- Sales CV Divisi 1 MTD & Ytd Until 02 May, Mds Mandau 258Document1 pageSales CV Divisi 1 MTD & Ytd Until 02 May, Mds Mandau 258julio prathama nugrahaNo ratings yet

- 1.levis Daily Sale Report 2023 Update 27.8Document107 pages1.levis Daily Sale Report 2023 Update 27.8Khánh Ly PhùngNo ratings yet

- DCNR Bureau of State Parks Attendance July 2020Document2 pagesDCNR Bureau of State Parks Attendance July 2020WPXI StaffNo ratings yet

- Rolling March: # of Cases Confirm Received Difference 11,932 11,927 Amount 7,845,087.84 7,845,286Document5 pagesRolling March: # of Cases Confirm Received Difference 11,932 11,927 Amount 7,845,087.84 7,845,286Michael Brian LacadinNo ratings yet

- Summary of December 2020 Visitor Arrivals 29Document6 pagesSummary of December 2020 Visitor Arrivals 29Jay KingNo ratings yet

- (CTSB) Material ConsumptionDocument10 pages(CTSB) Material Consumptionmeerut nazibabad projectNo ratings yet

- S&P 500 y BancosDocument5 pagesS&P 500 y BancosJavier D'cNo ratings yet

- CotdataDocument3 pagesCotdatasanevah539No ratings yet

- TV TV Reg Radio 2019 2020 %var 2019 2020 %var 2019Document3 pagesTV TV Reg Radio 2019 2020 %var 2019 2020 %var 2019DIEGO PORRASNo ratings yet

- Proyecto Flores de Colombia 2019-2Document83 pagesProyecto Flores de Colombia 2019-2Ronnal LealNo ratings yet

- COT ReportDocument67 pagesCOT ReportVisuvaratnam SuseendranNo ratings yet

- P N L Industry1Document14 pagesP N L Industry1Manmeet SinghNo ratings yet

- COT Reports (Updated - 06-07-21)Document62 pagesCOT Reports (Updated - 06-07-21)Ussama AhmedNo ratings yet

- Sample IAS 29 COS ComputationDocument29 pagesSample IAS 29 COS ComputationShingirai CynthiaNo ratings yet

- OEE Áreas de Soporte 2020Document871 pagesOEE Áreas de Soporte 2020José ale Rivera fabelaNo ratings yet

- APPL SP500 NFLIX T BillDocument32 pagesAPPL SP500 NFLIX T BillHjpr JuanNo ratings yet

- CU46 XLS ENokDESCDocument45 pagesCU46 XLS ENokDESCalinaesperanzanarvaezNo ratings yet

- US$ Millions, Except Number of Shares Which Are Reflected in Thousands and Per Share Amounts Consolidated Statement of OperationsDocument31 pagesUS$ Millions, Except Number of Shares Which Are Reflected in Thousands and Per Share Amounts Consolidated Statement of OperationsT CNo ratings yet

- Flash GP Detail - 2024-01-29T162321.154Document7 pagesFlash GP Detail - 2024-01-29T162321.154levernkleinsmith9No ratings yet

- Lab Poa WinterDocument12 pagesLab Poa WinterHanif Cesario AbdullahNo ratings yet

- PasmodDocument6 pagesPasmodRicky WijayaNo ratings yet

- Project1 CustomDashboardDocument12 pagesProject1 CustomDashboardmimikrose82No ratings yet

- Space Cypto QuotaDocument3 pagesSpace Cypto QuotaMateo LucasNo ratings yet

- Nuevo Hoja de Cálculo de Microsoft ExcelDocument14 pagesNuevo Hoja de Cálculo de Microsoft ExcelMarcelo SalasNo ratings yet

- COBADocument4 pagesCOBA121890920No ratings yet

- Podaci AvgustDocument407 pagesPodaci AvgustMNo ratings yet

- APPL SP500 NFLIX T Bill AMZDocument10 pagesAPPL SP500 NFLIX T Bill AMZPaola AlvarezNo ratings yet

- Taller Caso 1 2023.03.02Document84 pagesTaller Caso 1 2023.03.02jvasesNo ratings yet

- Manual de Ingeniería Económica Simulación para Amortizar Creditoe en U.V.R. Cuota Fija en Uvr Amortizacion Constante A Capital en U.V.RDocument25 pagesManual de Ingeniería Económica Simulación para Amortizar Creditoe en U.V.R. Cuota Fija en Uvr Amortizacion Constante A Capital en U.V.RAníbal dario Rodríguez RamírezNo ratings yet

- Management Thesis: Sbi Mutual Fund Is Better Investment PlanDocument19 pagesManagement Thesis: Sbi Mutual Fund Is Better Investment Plansukra vaniNo ratings yet

- Cost ReportsDocument6 pagesCost ReportsmazharNo ratings yet

- Data Ureg Usak 18 Maret 2021Document4 pagesData Ureg Usak 18 Maret 2021Ramdan HatlahNo ratings yet

- Taller Wacc 29 AbrilDocument12 pagesTaller Wacc 29 AbrilJenyfer Q RodriguezNo ratings yet

- Sales CV Divisi 4 MTD & Ytd Until 02 May Mds Mandau 258Document1 pageSales CV Divisi 4 MTD & Ytd Until 02 May Mds Mandau 258julio prathama nugrahaNo ratings yet

- Simulasi Jadwal Angsuran M Fikri Rohmani MMQDocument6 pagesSimulasi Jadwal Angsuran M Fikri Rohmani MMQkantor notarisdwiendahNo ratings yet

- Pal Airline ConsoDocument132 pagesPal Airline Conso175pauNo ratings yet

- Relatorios GGL-28Document2 pagesRelatorios GGL-28Renato Breves GiglioNo ratings yet

- Datos Test 1 2023Document2 pagesDatos Test 1 2023Caslu MontanaNo ratings yet

- Caso 1 Harvard Grupo3 FINALDocument106 pagesCaso 1 Harvard Grupo3 FINALDiego GarcíaNo ratings yet

- Silver Futures Historical Prices - Investing - Com IndiaDocument5 pagesSilver Futures Historical Prices - Investing - Com IndiaArundhathi MNo ratings yet

- ProjektDocument7 pagesProjekticzech1506No ratings yet

- Work IndexDocument8 pagesWork IndexJean Paul DupratNo ratings yet

- Marketing Dashboard: Total Leads This MonthDocument12 pagesMarketing Dashboard: Total Leads This Monthmaya bangunNo ratings yet

- Credit Card Detailed ReconciliationDocument2,072 pagesCredit Card Detailed ReconciliationasdasdasdasNo ratings yet

- MIS ProductionDocument25 pagesMIS ProductionMd TarekNo ratings yet

- CIMBClicks TRX HistoryDocument9 pagesCIMBClicks TRX HistoryQI Ting Tee LooNo ratings yet

- CIMBClicks TRX HistoryDocument9 pagesCIMBClicks TRX HistoryQI Ting Tee LooNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Nial Fuller - So You Want To Be A TraderDocument5 pagesNial Fuller - So You Want To Be A TraderVăn Thắng Hoàng100% (1)

- Nial Fuller - To Trade or Not To Trade, That Is The QuestionDocument5 pagesNial Fuller - To Trade or Not To Trade, That Is The QuestionVăn Thắng Hoàng100% (1)

- x-WjtowiczGlobal ENG NatspDocument18 pagesx-WjtowiczGlobal ENG NatspVăn Thắng HoàngNo ratings yet

- ?inducement - Buy - Sell - (Reversal) - Thread - by - Trader - Hanson - Mar 15, 22 - From - RattibhaDocument6 pages?inducement - Buy - Sell - (Reversal) - Thread - by - Trader - Hanson - Mar 15, 22 - From - RattibhaVăn Thắng HoàngNo ratings yet

- Winning Trader ChecklistDocument1 pageWinning Trader ChecklistVăn Thắng HoàngNo ratings yet

- SMT NotesDocument4 pagesSMT NotesVăn Thắng HoàngNo ratings yet

- Bastrop BBMA 11 20 21Document2 pagesBastrop BBMA 11 20 21Văn Thắng HoàngNo ratings yet

- ZAH Whitepaper - 220725 - 101058Document17 pagesZAH Whitepaper - 220725 - 101058Văn Thắng HoàngNo ratings yet

- Magic: Ice AppDocument32 pagesMagic: Ice AppVăn Thắng HoàngNo ratings yet

- Zonas de Eliminação de TICDocument6 pagesZonas de Eliminação de TICVăn Thắng HoàngNo ratings yet

- Fan TRO 2830Document106 pagesFan TRO 2830dwr234100% (4)

- Waste Heat Boiler Deskbook PDFDocument423 pagesWaste Heat Boiler Deskbook PDFwei zhou100% (1)

- Topic:: SolidsDocument8 pagesTopic:: SolidsDhanBahadurNo ratings yet

- Lecture 5 PDFDocument8 pagesLecture 5 PDFMuhammad Hamza EjazNo ratings yet

- Paint Data Sheet - National Synthetic Enamel Gloss IDocument3 pagesPaint Data Sheet - National Synthetic Enamel Gloss Iaakh0% (1)

- Final INTERNSHIP Report-AshishDocument66 pagesFinal INTERNSHIP Report-AshishAshish PantNo ratings yet

- Marketing Management Project: Submitted byDocument41 pagesMarketing Management Project: Submitted byrpotnisNo ratings yet

- 9479 Inst ManualDocument8 pages9479 Inst ManualfdkaNo ratings yet

- IGBT MitsubishiDocument4 pagesIGBT Mitsubishimadhuvariar100% (3)

- Ecg in AtheletsDocument32 pagesEcg in AtheletsOnon EssayedNo ratings yet

- Neonatal Resuscitation. Advances in Training and PracticeDocument10 pagesNeonatal Resuscitation. Advances in Training and PracticeFer45No ratings yet

- Server Poweredge t610 Tech Guidebook PDFDocument65 pagesServer Poweredge t610 Tech Guidebook PDFMarouani AmorNo ratings yet

- Material ManagementDocument48 pagesMaterial Managementwintoday0150% (2)

- GrammarDocument23 pagesGrammarYMNo ratings yet

- 74 20 03Document6 pages74 20 03vanmorrison69No ratings yet

- Allen StoneDocument4 pagesAllen StoneRubén FernándezNo ratings yet

- Denim A New Export Item For BangladeshDocument2 pagesDenim A New Export Item For Bangladeshhabibun naharNo ratings yet

- SpeechDocument5 pagesSpeechNiza Pinky IchiyuNo ratings yet

- Starkville Dispatch Eedition 5-20-20 CORRDocument16 pagesStarkville Dispatch Eedition 5-20-20 CORRThe DispatchNo ratings yet

- Crane Overhaul ProcedureDocument8 pagesCrane Overhaul ProcedureHưng ĐỗNo ratings yet

- Unit 3 - Promotion - 27 Aug - ShareDocument38 pagesUnit 3 - Promotion - 27 Aug - SharebansaltulikaNo ratings yet

- Reverse CalculationDocument7 pagesReverse CalculationKanishka Thomas Kain100% (1)

- 3storeyresidence Final ModelDocument1 page3storeyresidence Final ModelRheafel LimNo ratings yet

- Biblio 3Document1 pageBiblio 3Ian EdwardsNo ratings yet

- Maya, Aztec, and Inca Civilizations PDFDocument116 pagesMaya, Aztec, and Inca Civilizations PDFGabriel Medina100% (2)

- Whistleblower (20.05.2023)Document743 pagesWhistleblower (20.05.2023)piotrszewczyklondon100% (1)

- Astro-Logics Pub PDFDocument7 pagesAstro-Logics Pub PDFlbedar100% (1)

- GE - Nine CellDocument12 pagesGE - Nine CellNikita SangalNo ratings yet

- Microsoft Excel Is A Spreadsheet Developed by Microsoft For WindowsDocument9 pagesMicrosoft Excel Is A Spreadsheet Developed by Microsoft For WindowsSherryl ZamonteNo ratings yet

- Claims and Counter ClaimsDocument13 pagesClaims and Counter ClaimsRk VaitlaNo ratings yet