Professional Documents

Culture Documents

AC405 Practice Question

AC405 Practice Question

Uploaded by

Calvin Thompson kamukosiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AC405 Practice Question

AC405 Practice Question

Uploaded by

Calvin Thompson kamukosiCopyright:

Available Formats

Question 1 (25 Marks)

Chommie (Pvt) Ltd is motor cars dealer. During the year ended 31 December 2020, Chommie

(Pvt) Ltd entered into a 15-year lease agreement with a commercial property owner for the

construction of a motor vehicles showroom. The terms of the lease agreement are as follows:

a) Chommie (Pvt) Ltd to construct a showroom at an undeveloped commercial stand situated at

Sam Levy’s village at a total cost of ZWL$5 000 000. Chommie (Pvt) Ltd to further pave the

whole area around the showroom with specified brickwork at a cost of ZWL$800 000. All

the work must be completed within six months from the date of the lease agreement, which

was signed on 1 February 2020.

b) Chommie (Pvt) Ltd to pay a once-off premium of ZWL$900 000 and a monthly rent of

ZWL$100 000 from the lease commencement date. The rent to be reviewed at the beginning

of each calendar year in line with the market rentals for similar properties.

c) The lease agreement to be open to renewal after the expiry of the initial agreed period.

d) Chommie (Pvt) Ltd completed the construction of the warehouse and the pavement on 30

June 2020 at a total cost of ZWL$9 500 000 and ZWL$900 000 respectively and

immediately transferred their inventories to the newly constructed showroom.

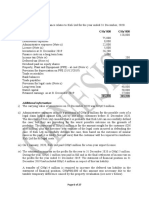

Chommie (Pvt) Ltd’s statement of profit or loss and other comprehensive income for the year

ended 31 December 2020 is as follows:

Note ZWL$

Revenue 16 000 000

Cost of sales (10 600 000)

Gross profit 5 400 000

Other income 1 8 000 000

Distribution costs 2 (700 000)

Administrative expenses 3 (3 600 000)

Other expenses 4 (1 000 000)

Finance costs 5 (800 000)

Profit before tax 7 300 000

Income tax expense 6 (444 972)

Profit for the period 6 855 028

Notes:

1) Other income comprises:

ZWL$

Rental income 5 000 000

Profit on the sale of commercial vehicles (see below) 3 000 000

Total 8 000 000

The commercial vehicles had been purchased in 2019 for ZWL$2 000 000 and were sold

during the year for ZWL$5 000 000.

2) Distribution costs comprise:

ZWL$

Repairs and maintenance 400 000

Fuel and licensing 300 000

Total 700 000

3) Administrative expenses comprise:

ZWL$

Salaries and wages 1 120 000

Lease premium and warehouse rent 930 000

Donations (see below) 300 000

Value added tax (VAT) late payment penalty 50 000

Depreciation 400 000

Provision for directors’ fees 300 000

Protective clothing 200 000

Staff canteen provisions 100 000

Entertainment 200 000

Total 3 600 000

As part of Chommie (Pvt) Ltd’s corporate social responsibility commitment, the following

amounts were donated during the year:

ZWL$

Harare Central hospital (for the procurement of critical drugs) 200 000

Social club (for recurrent expenses) 100 000

4) Other expenses comprise:

ZWL$

Property repairs and maintenance (see below) 600 000

Legal fees (preparation of the shareholder’s agreement) 50 000

New business licences 80 000

Renewal of business licences 270 000

Total 1 000 000

Property repairs and maintenance were as follows:

On leased commercial properties (the rental income from these properties is as detailed in

note 1 above) ZWL$480 000

On an unoccupied commercial building ZWL$120 000

5) Finance costs comprise:

ZWL$

Overdraft facility for recurrent expenditure 300 000

Loan for the construction of the warehouse and paving 500 000

Total 800 000

6) Income tax expense:

This amount relates to the first and second provisional corporate tax payments made by

Chommie (Pvt) Ltd in respect of the year ended 31 December 2020. The payments were

based on a projected taxable income of ZWL$5 143 000. No further provisional corporate tax

payments were made in the year. Due to favourable business circumstances in the second

half of the year, Chommie (Pvt) Ltd revised their 2020 budget on 1 July 2020 and the

projected taxable income for the year ended 31 December 2020 was recalculated as ZWL$8

150 000.

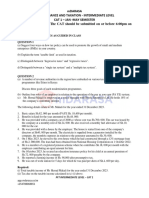

Additional information

Chommie (Pvt) Ltd owned the following fixed assets as at 31 December 2020:

Date acquired Cost/valuation

(ZWL$)

Commercial properties 2019 3 000 000

Furniture and equipment 2019 1 500 000

Commercial vehicles 2019 1 800 000

Chommie (Pvt) Ltd has always claimed the maximum capital allowances possible in any given

year.

Required:

a) (i) State how the commercial property owner should treat the amounts specified in the signed

lease agreement with Chommie (Pvt) Ltd for tax purposes. (4 marks)

(ii) As a tax law and practice student advise the actions Chommie (Pvt) Ltd should have

taken whilst implementing the provisions of the lease agreement to minimise their tax

liability. (4 marks)

b) Calculate the taxable income of and corporate tax payable by Chommie (Pvt) Ltd for the year

ended 31 December 2020. (12 marks)

c) Calculate the provisional tax which should have been paid by Chommie (Pvt) Ltd based on

the revised budget for the year ended 31 December 2020, clearly indicating the due dates and

the respective tax amounts. (5 marks)

You might also like

- Blood Hunter PF2eDocument27 pagesBlood Hunter PF2eRayar32No ratings yet

- Finac 3 TopicsDocument9 pagesFinac 3 TopicsCielo Mae Parungo60% (5)

- 9.2 Assignment - Allowable DeductionsDocument5 pages9.2 Assignment - Allowable Deductionssam imperialNo ratings yet

- Ansi S1.1-1994 R2004 PDFDocument58 pagesAnsi S1.1-1994 R2004 PDFKhairani Zakiya AF67% (3)

- Act1111 Final ExamDocument7 pagesAct1111 Final ExamHaidee Flavier SabidoNo ratings yet

- Trademark License AgreementDocument8 pagesTrademark License AgreementTushar Ballabh100% (1)

- Maf5101 Financial Accounting I Eve SuppDocument6 pagesMaf5101 Financial Accounting I Eve Suppshobasabria187No ratings yet

- AC405 Dec 2019Document8 pagesAC405 Dec 2019hilton magagadaNo ratings yet

- Assessment of Companies: Worked Example 1Document6 pagesAssessment of Companies: Worked Example 1IQBALNo ratings yet

- AnswerDocument53 pagesAnswerM ShNo ratings yet

- Hba 2302 Advanced TaxationDocument4 pagesHba 2302 Advanced TaxationprescoviaNo ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- Intermediate Nov 2019 b4Document24 pagesIntermediate Nov 2019 b4georginageorge254No ratings yet

- 2021 Unit 7 Tutorial QuestionsDocument6 pages2021 Unit 7 Tutorial Questions日日日No ratings yet

- R2.TAXM - .L Solution CMA June 2021 Exam.Document8 pagesR2.TAXM - .L Solution CMA June 2021 Exam.Pavel DhakaNo ratings yet

- Taxation Attempt All Questions (10 10 100)Document6 pagesTaxation Attempt All Questions (10 10 100)Mff DeadsparkNo ratings yet

- © The Institute of Chartered Accountants of India: ST STDocument6 pages© The Institute of Chartered Accountants of India: ST STVishal MehraNo ratings yet

- Financial ReportingDocument9 pagesFinancial ReportingMd. Zakir HossainNo ratings yet

- H.B Commerce ClassesDocument3 pagesH.B Commerce ClassesPavan BachaniNo ratings yet

- QUESTION 6 Financial Reporting May 2021 KOLIDocument6 pagesQUESTION 6 Financial Reporting May 2021 KOLILaud ListowellNo ratings yet

- Valuation AssignmentDocument9 pagesValuation AssignmentNicole TaylorNo ratings yet

- Use The Following Information For The Next Two (2) QuestionsDocument21 pagesUse The Following Information For The Next Two (2) QuestionsJennifer AdvientoNo ratings yet

- Business Accounting and Analysis (Semester I) q1xAKCGPn2Document3 pagesBusiness Accounting and Analysis (Semester I) q1xAKCGPn2PriyankaNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- Advance Accounts TestDocument3 pagesAdvance Accounts Testdivya shahasaneNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- CTPMDocument13 pagesCTPMYogeesh LNNo ratings yet

- Taxation - I: (Please Turn Over)Document3 pagesTaxation - I: (Please Turn Over)Laskar REAZ100% (1)

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- Tutorial Sheet 3Document6 pagesTutorial Sheet 3lemiemwanduNo ratings yet

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- IFRS - 2019 - Solved QPDocument14 pagesIFRS - 2019 - Solved QPSharan ReddyNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial Reportingbelle crisNo ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- 2021 Unit 8 Tutorial QuestionsDocument7 pages2021 Unit 8 Tutorial Questions日日日No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Batch 18 Final Preboard (P1)Document16 pagesBatch 18 Final Preboard (P1)Mike Oliver NualNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- CIT Revision TestDocument4 pagesCIT Revision TestK58 Nguyễn Hương GiangNo ratings yet

- FUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19Document2 pagesFUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19vineetchahar0210No ratings yet

- CIT Exercises - June 2020 - ACEDocument16 pagesCIT Exercises - June 2020 - ACEKHUÊ TRẦN ÁINo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Ias 12 Practice QuestionsDocument9 pagesIas 12 Practice QuestionsKeith P. KatsandeNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Illustrative Examples - Financial StatementsDocument6 pagesIllustrative Examples - Financial StatementsChuchi SubardiagaNo ratings yet

- c4 Grande Finale Solving 2023 Nov (Set 1)Document7 pagesc4 Grande Finale Solving 2023 Nov (Set 1)charlesmicky82No ratings yet

- CAC1201201008 Financial Accounting 1BDocument6 pagesCAC1201201008 Financial Accounting 1Bnyasha gundaniNo ratings yet

- AFAR Exam Midterms 1Document4 pagesAFAR Exam Midterms 1CJ Hernandez BorretaNo ratings yet

- IPCC Gr.I Paper 4 TaxationDocument10 pagesIPCC Gr.I Paper 4 TaxationAyushi RajputNo ratings yet

- Assignment-2 - Mid Term Paxi Ko AssignmentDocument5 pagesAssignment-2 - Mid Term Paxi Ko Assignmenty.yubaraj001No ratings yet

- Assessment of CompaniesDocument5 pagesAssessment of Companiesmohanraokp22790% (1)

- Principles of Taxation: Certificate in Accounting and Finance Stage ExaminationDocument5 pagesPrinciples of Taxation: Certificate in Accounting and Finance Stage ExaminationMobeen SheikhNo ratings yet

- BAC 322 Advanced AccountingDocument9 pagesBAC 322 Advanced AccountingLawrence jnr MwapeNo ratings yet

- Seminar 8 PART BDocument3 pagesSeminar 8 PART BGaba RieleNo ratings yet

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINNo ratings yet

- 6167f0c20cf2c12cd8917628 OriginalDocument34 pages6167f0c20cf2c12cd8917628 OriginalTM GamingNo ratings yet

- Nov 2016 Ques & Answes Taxation-&-Fiscalpolicy-3.4 Nov 2016Document16 pagesNov 2016 Ques & Answes Taxation-&-Fiscalpolicy-3.4 Nov 2016Timore FrancisNo ratings yet

- Jorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Document3 pagesJorpati, Kathmandu Pre-Board Examination-2077 Subject: Principles of Accounting II Grade: XII Time: 3 Hrs FM: 100 PM: 32Abin DhakalNo ratings yet

- Mdarasa PFT CAT 1 - SEM 1 2024Document4 pagesMdarasa PFT CAT 1 - SEM 1 2024Sam OwinoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Passed Ssl101cDocument194 pagesPassed Ssl101cMạnh PhạmNo ratings yet

- ProStream 1000 6 8 UserGuide RevADocument253 pagesProStream 1000 6 8 UserGuide RevAaissamNo ratings yet

- Marketing in The 21st CenturyDocument88 pagesMarketing in The 21st CenturyRedwanul Kabir DigontaNo ratings yet

- SO-0769-G Capella GMDSS User ManualDocument59 pagesSO-0769-G Capella GMDSS User ManualzfodhilNo ratings yet

- PC Refference PDFDocument896 pagesPC Refference PDFshivaboreddyNo ratings yet

- Haedicke Expert ReportDocument25 pagesHaedicke Expert ReportFlorian MuellerNo ratings yet

- IBM Unit I NotesDocument11 pagesIBM Unit I NotessaravmbaNo ratings yet

- Ch69-01 Road Traffic Subsidiary LegislationDocument239 pagesCh69-01 Road Traffic Subsidiary LegislationAntanoid John LangeveldtNo ratings yet

- People Tools 8.51 UpgradeDocument118 pagesPeople Tools 8.51 UpgradeSurbhit_KumarNo ratings yet

- American Bible Society Vs City of ManilaDocument6 pagesAmerican Bible Society Vs City of ManilaBelle MaturanNo ratings yet

- VMAX3 Installation and Maintenance STUDENT LabGuideDocument34 pagesVMAX3 Installation and Maintenance STUDENT LabGuidesbabups77No ratings yet

- NetBackup7.7 RefGuide CommandsDocument858 pagesNetBackup7.7 RefGuide CommandsG MNo ratings yet

- Missouri StatuesDocument83 pagesMissouri StatuesdaringdreuNo ratings yet

- Ica05 1Document702 pagesIca05 1kevshouseNo ratings yet

- H SandalDocument125 pagesH SandalMarco Corona100% (1)

- XLentDocument4 pagesXLentPaola VerdiNo ratings yet

- The Pakistan Airports Authority Act, 2023Document28 pagesThe Pakistan Airports Authority Act, 2023Shahid H. KhanNo ratings yet

- Ib-Licensing & FranchisingDocument16 pagesIb-Licensing & Franchisingsakshi agrawalNo ratings yet

- PD 576-ADocument2 pagesPD 576-Anyan nyan nyanNo ratings yet

- Full Download Test Bank For Environmental Economics and Management Theory Policy and Applications 6th Edition Callan PDF Full ChapterDocument27 pagesFull Download Test Bank For Environmental Economics and Management Theory Policy and Applications 6th Edition Callan PDF Full Chapterscissionrideau941m100% (22)

- Textbook Ebook More Confessions of A Forty Something FK Up The WTF Am I Doing Now Follow Up To The Runaway Bestseller Potter All Chapter PDFDocument43 pagesTextbook Ebook More Confessions of A Forty Something FK Up The WTF Am I Doing Now Follow Up To The Runaway Bestseller Potter All Chapter PDFjulia.catapano134100% (11)

- Delcam - PowerINSPECT 2016 WhatsNew OMV EN - 2015Document36 pagesDelcam - PowerINSPECT 2016 WhatsNew OMV EN - 2015phạm minh hùngNo ratings yet

- Delhi Excise Act, 2009Document31 pagesDelhi Excise Act, 2009manoj1035No ratings yet

- Administrating GoldMineDocument447 pagesAdministrating GoldMineminutemen_usNo ratings yet

- Strawberry Perl Distribution: LicenseDocument2 pagesStrawberry Perl Distribution: LicenseNegckNo ratings yet

- Frozen Application LicenseDocument2 pagesFrozen Application LicenseMáté KissNo ratings yet

- LICENSE TO USE Truck Racing by Renault TrucksDocument4 pagesLICENSE TO USE Truck Racing by Renault TruckskweevelinNo ratings yet