Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 views7.2 Anthony

7.2 Anthony

Uploaded by

RAGHU MALLEGOWDAThe document summarizes depreciation calculations for 3 assets purchased and disposed of at different times using Straight Line Method (SLM), Written Down Value method (WDV) and Sum of Years Digits (SYD) method. It shows depreciation expense and book value for each year of useful life and calculates total book value, disposal value and loss on disposal for all assets in 2006.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Urban Water PartnersDocument2 pagesUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- Senior High School S.Y. 2019-2020Document4 pagesSenior High School S.Y. 2019-2020Cy Dollete-Suarez100% (1)

- CapitalBudgeting HindPetrochemicalsDocument6 pagesCapitalBudgeting HindPetrochemicalsAryanSinghNo ratings yet

- Phuket Beach Case SolutionDocument8 pagesPhuket Beach Case SolutionGmitNo ratings yet

- S Sold A Parcel of Land To B For P240Document2 pagesS Sold A Parcel of Land To B For P240kateangel elleso100% (1)

- Case - Demand For Toffe IncDocument16 pagesCase - Demand For Toffe IncSaikat MukherjeeeNo ratings yet

- Lab 1Document7 pagesLab 1Areeb Nasir MughalNo ratings yet

- AssignmentDocument120 pagesAssignmentPrashant MakwanaNo ratings yet

- Fructose Financial PlanDocument10 pagesFructose Financial PlandoieNo ratings yet

- Bhimsen CaseDocument2 pagesBhimsen CaseNikhil Gauns DessaiNo ratings yet

- Past Papers2Document46 pagesPast Papers2leylaNo ratings yet

- Project Report For Spare PartsDocument5 pagesProject Report For Spare Partsrajesh patelNo ratings yet

- Schedule of Depreciation: FIXED ASSET ACCOUNT (Both Method)Document11 pagesSchedule of Depreciation: FIXED ASSET ACCOUNT (Both Method)Nipun AhujaNo ratings yet

- Deals PlanDocument9 pagesDeals PlanVarun AkashNo ratings yet

- Depreciation Schedules:: Land Building Plant and Machinery Miscellaneous Fix Assets Intangible AssetsDocument14 pagesDepreciation Schedules:: Land Building Plant and Machinery Miscellaneous Fix Assets Intangible Assetshitesh184No ratings yet

- Liquidity, Solvency, & Leverage RatiosDocument8 pagesLiquidity, Solvency, & Leverage RatiosAparna Raji SunilNo ratings yet

- Taller N°1 AulaDocument10 pagesTaller N°1 AulaArmand VcsNo ratings yet

- Income StatementDocument3 pagesIncome StatementBiswajit SarmaNo ratings yet

- Investment AppraisalDocument18 pagesInvestment AppraisalKwasi MmehNo ratings yet

- Phuket BeachDocument10 pagesPhuket BeachNepathya NmImsNo ratings yet

- Alternative 1Document10 pagesAlternative 1Sreyas S KumarNo ratings yet

- Delta ProjectDocument14 pagesDelta ProjectAyush SinghNo ratings yet

- Book 1Document4 pagesBook 1Areeb Nasir MughalNo ratings yet

- ACCOWTANCYDocument47 pagesACCOWTANCYleylaNo ratings yet

- MockDocument5 pagesMockamna noorNo ratings yet

- Business Plan For Biofuel Industry (Briquette)Document7 pagesBusiness Plan For Biofuel Industry (Briquette)Sudarshan GovindarajanNo ratings yet

- Unit 14, 15 and 16 - SolutionDocument5 pagesUnit 14, 15 and 16 - SolutionHemant bhanawatNo ratings yet

- Performance of CompanyDocument4 pagesPerformance of CompanyMd Shadab HussainNo ratings yet

- Cash Flow and RatiosDocument8 pagesCash Flow and RatiosAnindya BasuNo ratings yet

- Aayushi Kumar 21501355Document17 pagesAayushi Kumar 21501355damacio45No ratings yet

- Unitech - Sample - FinanceDocument11 pagesUnitech - Sample - Financeilmasami477No ratings yet

- Muhammad Usman 2077 Cert 4 AccountingDocument10 pagesMuhammad Usman 2077 Cert 4 AccountinggazanNo ratings yet

- ASSIGNMENT NO.2 (Entrepreneurship)Document9 pagesASSIGNMENT NO.2 (Entrepreneurship)Malik Mughees AwanNo ratings yet

- Sheet3.b2 5500: Year Profit TaxDocument4 pagesSheet3.b2 5500: Year Profit TaxibilalhussainNo ratings yet

- Cup Pa Mania ProjectDocument4 pagesCup Pa Mania ProjectDurgaprasad VelamalaNo ratings yet

- Module-10 Additional Material FSA Template - Session-11 vrTcbcH4leDocument6 pagesModule-10 Additional Material FSA Template - Session-11 vrTcbcH4leBhavya PatelNo ratings yet

- Double Skin Floor Mounted Air Handling Unit:-: Date:27/02/2012 Customer Name: Project Name-Offer NoDocument5 pagesDouble Skin Floor Mounted Air Handling Unit:-: Date:27/02/2012 Customer Name: Project Name-Offer NoAbdul SamadNo ratings yet

- FM Assignment 02Document1 pageFM Assignment 02Sufyan SarwarNo ratings yet

- QUIZ 2 Sufyan Sarwar 02-112192-060Document1 pageQUIZ 2 Sufyan Sarwar 02-112192-060Sufyan SarwarNo ratings yet

- Ex TCDN Chap 16 & 18Document16 pagesEx TCDN Chap 16 & 18Đặng Diễm NgọcNo ratings yet

- ZYBEAK Balance SheetDocument1 pageZYBEAK Balance SheetVidhya SelvamNo ratings yet

- Q4 Q1 Q2 Sales 200000 300000 400000 Purchase 126000 186000 246000Document6 pagesQ4 Q1 Q2 Sales 200000 300000 400000 Purchase 126000 186000 246000Shakib ArafatNo ratings yet

- Exercise 5 Activity 5Document2 pagesExercise 5 Activity 5Omar KatogNo ratings yet

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Document17 pagesSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikNo ratings yet

- FR AssDocument10 pagesFR Asssimon mtNo ratings yet

- Personal Computer Case Study SolutionDocument3 pagesPersonal Computer Case Study Solutionfaraz ahmad khanNo ratings yet

- EEV ANALYSIS BVDocument10 pagesEEV ANALYSIS BVcyics TabNo ratings yet

- Qs Answers p4Document214 pagesQs Answers p4HunainNo ratings yet

- 132 Saqlain ShaikhDocument10 pages132 Saqlain ShaikhCemon FredNo ratings yet

- Book1Document5 pagesBook1Pankaj TripathiNo ratings yet

- Case StudyDocument6 pagesCase Studyrajan mishraNo ratings yet

- End Term Examination Corporate Restructuring and Business Valuation TERM IV, PGP, 2020 Name - Puneet Garg Roll No - 19P101Document7 pagesEnd Term Examination Corporate Restructuring and Business Valuation TERM IV, PGP, 2020 Name - Puneet Garg Roll No - 19P101Puneet GargNo ratings yet

- Practice 6 Consolidated Statement One Year After AcquisitionDocument10 pagesPractice 6 Consolidated Statement One Year After AcquisitionGloria Lisa SusiloNo ratings yet

- Loan Pine Cafe BSDocument12 pagesLoan Pine Cafe BSAnindya SharmaNo ratings yet

- Shaikh Mustakmiyaproject Report For Auto Spare PartsDocument6 pagesShaikh Mustakmiyaproject Report For Auto Spare Partsrajesh patelNo ratings yet

- IndraDocument2 pagesIndraIndranil SenguptaNo ratings yet

- Sub Total: ID Name Designation DepartmentDocument6 pagesSub Total: ID Name Designation DepartmentMd.Amir hossain khanNo ratings yet

- Ghazi Fabrics: Ratio Analysis of Last Five YearsDocument6 pagesGhazi Fabrics: Ratio Analysis of Last Five YearsASIF RAFIQUE BHATTINo ratings yet

- CB Numericals 1Document13 pagesCB Numericals 1Vedashree MaliNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Calender NewDocument20 pagesCalender NewRAGHU MALLEGOWDANo ratings yet

- 3 - Company Law SessionsDocument14 pages3 - Company Law SessionsRAGHU MALLEGOWDANo ratings yet

- 4 - 5 - Discharge and Remedies For Breach of ContractDocument16 pages4 - 5 - Discharge and Remedies For Breach of ContractRAGHU MALLEGOWDANo ratings yet

- CRM - RosewoodDocument2 pagesCRM - RosewoodRAGHU MALLEGOWDANo ratings yet

- 2 - Contract - Law and ManagementDocument17 pages2 - Contract - Law and ManagementRAGHU MALLEGOWDANo ratings yet

- 1-Legal ManagementDocument15 pages1-Legal ManagementRAGHU MALLEGOWDANo ratings yet

- RNS 3.6Document5 pagesRNS 3.6RAGHU MALLEGOWDANo ratings yet

- Example-2 - ICI-FSA - FOR CLASS DISCUSSIONDocument12 pagesExample-2 - ICI-FSA - FOR CLASS DISCUSSIONRAGHU MALLEGOWDANo ratings yet

- 2 - Company Law SessionsDocument22 pages2 - Company Law SessionsRAGHU MALLEGOWDANo ratings yet

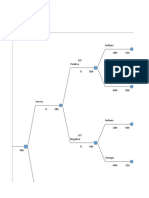

- New Vehicle Decision TreeDocument5 pagesNew Vehicle Decision TreeRAGHU MALLEGOWDANo ratings yet

- Newsvendor GameDocument5 pagesNewsvendor GameRAGHU MALLEGOWDANo ratings yet

- Ratio AnalysisDocument62 pagesRatio AnalysisRAGHU MALLEGOWDANo ratings yet

- Kaffee Kostuum - Reco 2Document3 pagesKaffee Kostuum - Reco 2RAGHU MALLEGOWDANo ratings yet

- Oily Waters ProjectDocument8 pagesOily Waters ProjectRAGHU MALLEGOWDANo ratings yet

- Oily WatersDocument8 pagesOily WatersRAGHU MALLEGOWDANo ratings yet

- Case - FRADocument12 pagesCase - FRARAGHU MALLEGOWDANo ratings yet

- Maria Hernandes and AssociatesDocument5 pagesMaria Hernandes and AssociatesRAGHU MALLEGOWDANo ratings yet

- Indemnity - Bond - For - Payout - Without - Opd - English WordDocument3 pagesIndemnity - Bond - For - Payout - Without - Opd - English WordDivya SreekumarNo ratings yet

- CIL308 100% CA Compilations by TDMWritersDocument3 pagesCIL308 100% CA Compilations by TDMWritersfaith olaNo ratings yet

- Personal Loan Application Form: Bank Use OnlyDocument4 pagesPersonal Loan Application Form: Bank Use OnlyTasneef ChowdhuryNo ratings yet

- What Is A Silent Partnership AgreementDocument2 pagesWhat Is A Silent Partnership AgreementDeinarNo ratings yet

- Guide To Companies in The British Virgin Islands (February 2015)Document12 pagesGuide To Companies in The British Virgin Islands (February 2015)kalinovskayaNo ratings yet

- Discuss The Impact of Depreciation Expense Unit2Document2 pagesDiscuss The Impact of Depreciation Expense Unit2Djahan RanaNo ratings yet

- Chapter X (Sections. 182 To 238) of The Contract Act, 1872Document27 pagesChapter X (Sections. 182 To 238) of The Contract Act, 1872UmairNo ratings yet

- The Nature of Credit Instruments - A Credit InstrumentDocument2 pagesThe Nature of Credit Instruments - A Credit Instrumentjoshua aguirreNo ratings yet

- Digest of Liwanag v. CA (G.R. No. 114398)Document1 pageDigest of Liwanag v. CA (G.R. No. 114398)Rafael Pangilinan100% (1)

- BL Banking Law QuestionsDocument10 pagesBL Banking Law Questionskowc kousalyaNo ratings yet

- RBL Bank Limited: Fund BasedDocument3 pagesRBL Bank Limited: Fund Basedjaipal thakurNo ratings yet

- Company DistinguishedDocument4 pagesCompany DistinguishedSrishti MalhotraNo ratings yet

- 【Exclusive Contract】-Dangerous Love-Joseph Elizabeth YewandeDocument18 pages【Exclusive Contract】-Dangerous Love-Joseph Elizabeth YewandeYanni GonzalesNo ratings yet

- Entrepreneurship Lecture No: 27 BY Ch. Shahzad Ansar Entrepreneurship Lecture No: 27 BY Ch. Shahzad AnsarDocument8 pagesEntrepreneurship Lecture No: 27 BY Ch. Shahzad Ansar Entrepreneurship Lecture No: 27 BY Ch. Shahzad Ansarskeleton1sNo ratings yet

- Doctrine of PrivityDocument5 pagesDoctrine of PrivityRANDAN SADIQNo ratings yet

- Business LawDocument19 pagesBusiness LawRizia Feh Eustaquio100% (2)

- Short Form Consultancy Agreement-GhassanDocument6 pagesShort Form Consultancy Agreement-GhassanhymerchmidtNo ratings yet

- Safeco Auto InsuranceDocument2 pagesSafeco Auto InsuranceVitorNo ratings yet

- Dino VS CaDocument2 pagesDino VS CaJulioNo ratings yet

- Article 1590 and 1591Document3 pagesArticle 1590 and 1591MariaHannahKristenRamirezNo ratings yet

- M4.5.1 Marine Insurance TypesDocument6 pagesM4.5.1 Marine Insurance TypesDhruvin ManekNo ratings yet

- Memorandum of AssociationDocument2 pagesMemorandum of AssociationpratikpatilpNo ratings yet

- Nava V Peers PDFDocument2 pagesNava V Peers PDFAndrea GerongaNo ratings yet

- Sale Deed of Lease Hold RightsDocument8 pagesSale Deed of Lease Hold RightsShunna BhaiNo ratings yet

- Study Unit 1 Introduction To Company Law Tutorial MemorandumDocument2 pagesStudy Unit 1 Introduction To Company Law Tutorial Memorandumu22619942No ratings yet

- Ladder Series MCQ - Ramesh Devarakonda (26) 20191231230312 PDFDocument101 pagesLadder Series MCQ - Ramesh Devarakonda (26) 20191231230312 PDFRitesh SharmaNo ratings yet

- Letter Template: Notice of Default - Bank of AmericaDocument3 pagesLetter Template: Notice of Default - Bank of AmericabrittanilpeedinNo ratings yet

- TRUST RECEIPT Draft TemplateDocument2 pagesTRUST RECEIPT Draft TemplateMark LozanoNo ratings yet

- Authors Guarantee FormDocument1 pageAuthors Guarantee FormAlan BensonNo ratings yet

7.2 Anthony

7.2 Anthony

Uploaded by

RAGHU MALLEGOWDA0 ratings0% found this document useful (0 votes)

7 views3 pagesThe document summarizes depreciation calculations for 3 assets purchased and disposed of at different times using Straight Line Method (SLM), Written Down Value method (WDV) and Sum of Years Digits (SYD) method. It shows depreciation expense and book value for each year of useful life and calculates total book value, disposal value and loss on disposal for all assets in 2006.

Original Description:

FRA

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes depreciation calculations for 3 assets purchased and disposed of at different times using Straight Line Method (SLM), Written Down Value method (WDV) and Sum of Years Digits (SYD) method. It shows depreciation expense and book value for each year of useful life and calculates total book value, disposal value and loss on disposal for all assets in 2006.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views3 pages7.2 Anthony

7.2 Anthony

Uploaded by

RAGHU MALLEGOWDAThe document summarizes depreciation calculations for 3 assets purchased and disposed of at different times using Straight Line Method (SLM), Written Down Value method (WDV) and Sum of Years Digits (SYD) method. It shows depreciation expense and book value for each year of useful life and calculates total book value, disposal value and loss on disposal for all assets in 2006.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 3

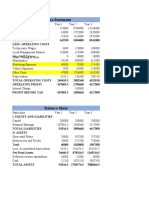

301 415 573

Purchase Date Feb-98 Jul-05 Jun-04

Date of Disposal Oct-06 Jul-06 Mar-06

Cost 70300 96000 94500

Disposal Value 14300 63000 38000

Useful life 10 5 6

Method SLM WDV SYD

SLM Cost DepreciatiAcc Depreciation Book Value

1998 70300 7030 7030 63270 full year provided as acquisiti

1999 70300 7030 14060 56240

301 2000 70300 7030 21090 49210

2001 70300 7030 28120 42180

2002 70300 7030 35150 35150

2003 70300 7030 42180 28120

2004 70300 7030 49210 21090

2005 70300 7030 56240 14060

2006 70300 3515 59755 10545 half year depreciation as disp

Depreciation Rat 0.30

SLM Cost DepreciatiAcc Depreciation Book Value

1998

1999

2000

415 2001

2002

2003

2004

2005 96000 14400 14400 81600 half year depreciation since a

2006 96000 12240 26640 69360 half year depreciation as disp

SYD Cost DepreciatiAcc Depreciation Book Value

1998

1999

2000

2001

573 2002

2003

2004 94500 27000 27000 67500 full year provided as acquisiti

2005 94500 22500 49500 45000

2006 94500 49500 45000 No depeciation as disposal is

Book Value of all Assets in 2006 124905

Disposal Value of All three Assets 115300

Loss from disposal 9605

Journal Entry

Cash Dr 115300

Acc Depreciation Dr 135895

Loss from Disposal Dr 9605

Asset (all 3) Cr 260800

Can be posted individually as well

full year provided as acquisition is before July

half year depreciation as disposal is after July

half year depreciation since acquisition is after July

half year depreciation as disposal is after July

Useful years available in 2004 6

Useful years available in 2005 5

Useful years available in 2006 4

Sum of 6 year 21

full year provided as acquisition is before July

No depeciation as disposal is before July

You might also like

- Urban Water PartnersDocument2 pagesUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- Senior High School S.Y. 2019-2020Document4 pagesSenior High School S.Y. 2019-2020Cy Dollete-Suarez100% (1)

- CapitalBudgeting HindPetrochemicalsDocument6 pagesCapitalBudgeting HindPetrochemicalsAryanSinghNo ratings yet

- Phuket Beach Case SolutionDocument8 pagesPhuket Beach Case SolutionGmitNo ratings yet

- S Sold A Parcel of Land To B For P240Document2 pagesS Sold A Parcel of Land To B For P240kateangel elleso100% (1)

- Case - Demand For Toffe IncDocument16 pagesCase - Demand For Toffe IncSaikat MukherjeeeNo ratings yet

- Lab 1Document7 pagesLab 1Areeb Nasir MughalNo ratings yet

- AssignmentDocument120 pagesAssignmentPrashant MakwanaNo ratings yet

- Fructose Financial PlanDocument10 pagesFructose Financial PlandoieNo ratings yet

- Bhimsen CaseDocument2 pagesBhimsen CaseNikhil Gauns DessaiNo ratings yet

- Past Papers2Document46 pagesPast Papers2leylaNo ratings yet

- Project Report For Spare PartsDocument5 pagesProject Report For Spare Partsrajesh patelNo ratings yet

- Schedule of Depreciation: FIXED ASSET ACCOUNT (Both Method)Document11 pagesSchedule of Depreciation: FIXED ASSET ACCOUNT (Both Method)Nipun AhujaNo ratings yet

- Deals PlanDocument9 pagesDeals PlanVarun AkashNo ratings yet

- Depreciation Schedules:: Land Building Plant and Machinery Miscellaneous Fix Assets Intangible AssetsDocument14 pagesDepreciation Schedules:: Land Building Plant and Machinery Miscellaneous Fix Assets Intangible Assetshitesh184No ratings yet

- Liquidity, Solvency, & Leverage RatiosDocument8 pagesLiquidity, Solvency, & Leverage RatiosAparna Raji SunilNo ratings yet

- Taller N°1 AulaDocument10 pagesTaller N°1 AulaArmand VcsNo ratings yet

- Income StatementDocument3 pagesIncome StatementBiswajit SarmaNo ratings yet

- Investment AppraisalDocument18 pagesInvestment AppraisalKwasi MmehNo ratings yet

- Phuket BeachDocument10 pagesPhuket BeachNepathya NmImsNo ratings yet

- Alternative 1Document10 pagesAlternative 1Sreyas S KumarNo ratings yet

- Delta ProjectDocument14 pagesDelta ProjectAyush SinghNo ratings yet

- Book 1Document4 pagesBook 1Areeb Nasir MughalNo ratings yet

- ACCOWTANCYDocument47 pagesACCOWTANCYleylaNo ratings yet

- MockDocument5 pagesMockamna noorNo ratings yet

- Business Plan For Biofuel Industry (Briquette)Document7 pagesBusiness Plan For Biofuel Industry (Briquette)Sudarshan GovindarajanNo ratings yet

- Unit 14, 15 and 16 - SolutionDocument5 pagesUnit 14, 15 and 16 - SolutionHemant bhanawatNo ratings yet

- Performance of CompanyDocument4 pagesPerformance of CompanyMd Shadab HussainNo ratings yet

- Cash Flow and RatiosDocument8 pagesCash Flow and RatiosAnindya BasuNo ratings yet

- Aayushi Kumar 21501355Document17 pagesAayushi Kumar 21501355damacio45No ratings yet

- Unitech - Sample - FinanceDocument11 pagesUnitech - Sample - Financeilmasami477No ratings yet

- Muhammad Usman 2077 Cert 4 AccountingDocument10 pagesMuhammad Usman 2077 Cert 4 AccountinggazanNo ratings yet

- ASSIGNMENT NO.2 (Entrepreneurship)Document9 pagesASSIGNMENT NO.2 (Entrepreneurship)Malik Mughees AwanNo ratings yet

- Sheet3.b2 5500: Year Profit TaxDocument4 pagesSheet3.b2 5500: Year Profit TaxibilalhussainNo ratings yet

- Cup Pa Mania ProjectDocument4 pagesCup Pa Mania ProjectDurgaprasad VelamalaNo ratings yet

- Module-10 Additional Material FSA Template - Session-11 vrTcbcH4leDocument6 pagesModule-10 Additional Material FSA Template - Session-11 vrTcbcH4leBhavya PatelNo ratings yet

- Double Skin Floor Mounted Air Handling Unit:-: Date:27/02/2012 Customer Name: Project Name-Offer NoDocument5 pagesDouble Skin Floor Mounted Air Handling Unit:-: Date:27/02/2012 Customer Name: Project Name-Offer NoAbdul SamadNo ratings yet

- FM Assignment 02Document1 pageFM Assignment 02Sufyan SarwarNo ratings yet

- QUIZ 2 Sufyan Sarwar 02-112192-060Document1 pageQUIZ 2 Sufyan Sarwar 02-112192-060Sufyan SarwarNo ratings yet

- Ex TCDN Chap 16 & 18Document16 pagesEx TCDN Chap 16 & 18Đặng Diễm NgọcNo ratings yet

- ZYBEAK Balance SheetDocument1 pageZYBEAK Balance SheetVidhya SelvamNo ratings yet

- Q4 Q1 Q2 Sales 200000 300000 400000 Purchase 126000 186000 246000Document6 pagesQ4 Q1 Q2 Sales 200000 300000 400000 Purchase 126000 186000 246000Shakib ArafatNo ratings yet

- Exercise 5 Activity 5Document2 pagesExercise 5 Activity 5Omar KatogNo ratings yet

- Sui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010Document17 pagesSui Southern Gas Company Limited: Analysis of Financial Statements Financial Year 2004 - 2001 Q Financial Year 2010mumairmalikNo ratings yet

- FR AssDocument10 pagesFR Asssimon mtNo ratings yet

- Personal Computer Case Study SolutionDocument3 pagesPersonal Computer Case Study Solutionfaraz ahmad khanNo ratings yet

- EEV ANALYSIS BVDocument10 pagesEEV ANALYSIS BVcyics TabNo ratings yet

- Qs Answers p4Document214 pagesQs Answers p4HunainNo ratings yet

- 132 Saqlain ShaikhDocument10 pages132 Saqlain ShaikhCemon FredNo ratings yet

- Book1Document5 pagesBook1Pankaj TripathiNo ratings yet

- Case StudyDocument6 pagesCase Studyrajan mishraNo ratings yet

- End Term Examination Corporate Restructuring and Business Valuation TERM IV, PGP, 2020 Name - Puneet Garg Roll No - 19P101Document7 pagesEnd Term Examination Corporate Restructuring and Business Valuation TERM IV, PGP, 2020 Name - Puneet Garg Roll No - 19P101Puneet GargNo ratings yet

- Practice 6 Consolidated Statement One Year After AcquisitionDocument10 pagesPractice 6 Consolidated Statement One Year After AcquisitionGloria Lisa SusiloNo ratings yet

- Loan Pine Cafe BSDocument12 pagesLoan Pine Cafe BSAnindya SharmaNo ratings yet

- Shaikh Mustakmiyaproject Report For Auto Spare PartsDocument6 pagesShaikh Mustakmiyaproject Report For Auto Spare Partsrajesh patelNo ratings yet

- IndraDocument2 pagesIndraIndranil SenguptaNo ratings yet

- Sub Total: ID Name Designation DepartmentDocument6 pagesSub Total: ID Name Designation DepartmentMd.Amir hossain khanNo ratings yet

- Ghazi Fabrics: Ratio Analysis of Last Five YearsDocument6 pagesGhazi Fabrics: Ratio Analysis of Last Five YearsASIF RAFIQUE BHATTINo ratings yet

- CB Numericals 1Document13 pagesCB Numericals 1Vedashree MaliNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Calender NewDocument20 pagesCalender NewRAGHU MALLEGOWDANo ratings yet

- 3 - Company Law SessionsDocument14 pages3 - Company Law SessionsRAGHU MALLEGOWDANo ratings yet

- 4 - 5 - Discharge and Remedies For Breach of ContractDocument16 pages4 - 5 - Discharge and Remedies For Breach of ContractRAGHU MALLEGOWDANo ratings yet

- CRM - RosewoodDocument2 pagesCRM - RosewoodRAGHU MALLEGOWDANo ratings yet

- 2 - Contract - Law and ManagementDocument17 pages2 - Contract - Law and ManagementRAGHU MALLEGOWDANo ratings yet

- 1-Legal ManagementDocument15 pages1-Legal ManagementRAGHU MALLEGOWDANo ratings yet

- RNS 3.6Document5 pagesRNS 3.6RAGHU MALLEGOWDANo ratings yet

- Example-2 - ICI-FSA - FOR CLASS DISCUSSIONDocument12 pagesExample-2 - ICI-FSA - FOR CLASS DISCUSSIONRAGHU MALLEGOWDANo ratings yet

- 2 - Company Law SessionsDocument22 pages2 - Company Law SessionsRAGHU MALLEGOWDANo ratings yet

- New Vehicle Decision TreeDocument5 pagesNew Vehicle Decision TreeRAGHU MALLEGOWDANo ratings yet

- Newsvendor GameDocument5 pagesNewsvendor GameRAGHU MALLEGOWDANo ratings yet

- Ratio AnalysisDocument62 pagesRatio AnalysisRAGHU MALLEGOWDANo ratings yet

- Kaffee Kostuum - Reco 2Document3 pagesKaffee Kostuum - Reco 2RAGHU MALLEGOWDANo ratings yet

- Oily Waters ProjectDocument8 pagesOily Waters ProjectRAGHU MALLEGOWDANo ratings yet

- Oily WatersDocument8 pagesOily WatersRAGHU MALLEGOWDANo ratings yet

- Case - FRADocument12 pagesCase - FRARAGHU MALLEGOWDANo ratings yet

- Maria Hernandes and AssociatesDocument5 pagesMaria Hernandes and AssociatesRAGHU MALLEGOWDANo ratings yet

- Indemnity - Bond - For - Payout - Without - Opd - English WordDocument3 pagesIndemnity - Bond - For - Payout - Without - Opd - English WordDivya SreekumarNo ratings yet

- CIL308 100% CA Compilations by TDMWritersDocument3 pagesCIL308 100% CA Compilations by TDMWritersfaith olaNo ratings yet

- Personal Loan Application Form: Bank Use OnlyDocument4 pagesPersonal Loan Application Form: Bank Use OnlyTasneef ChowdhuryNo ratings yet

- What Is A Silent Partnership AgreementDocument2 pagesWhat Is A Silent Partnership AgreementDeinarNo ratings yet

- Guide To Companies in The British Virgin Islands (February 2015)Document12 pagesGuide To Companies in The British Virgin Islands (February 2015)kalinovskayaNo ratings yet

- Discuss The Impact of Depreciation Expense Unit2Document2 pagesDiscuss The Impact of Depreciation Expense Unit2Djahan RanaNo ratings yet

- Chapter X (Sections. 182 To 238) of The Contract Act, 1872Document27 pagesChapter X (Sections. 182 To 238) of The Contract Act, 1872UmairNo ratings yet

- The Nature of Credit Instruments - A Credit InstrumentDocument2 pagesThe Nature of Credit Instruments - A Credit Instrumentjoshua aguirreNo ratings yet

- Digest of Liwanag v. CA (G.R. No. 114398)Document1 pageDigest of Liwanag v. CA (G.R. No. 114398)Rafael Pangilinan100% (1)

- BL Banking Law QuestionsDocument10 pagesBL Banking Law Questionskowc kousalyaNo ratings yet

- RBL Bank Limited: Fund BasedDocument3 pagesRBL Bank Limited: Fund Basedjaipal thakurNo ratings yet

- Company DistinguishedDocument4 pagesCompany DistinguishedSrishti MalhotraNo ratings yet

- 【Exclusive Contract】-Dangerous Love-Joseph Elizabeth YewandeDocument18 pages【Exclusive Contract】-Dangerous Love-Joseph Elizabeth YewandeYanni GonzalesNo ratings yet

- Entrepreneurship Lecture No: 27 BY Ch. Shahzad Ansar Entrepreneurship Lecture No: 27 BY Ch. Shahzad AnsarDocument8 pagesEntrepreneurship Lecture No: 27 BY Ch. Shahzad Ansar Entrepreneurship Lecture No: 27 BY Ch. Shahzad Ansarskeleton1sNo ratings yet

- Doctrine of PrivityDocument5 pagesDoctrine of PrivityRANDAN SADIQNo ratings yet

- Business LawDocument19 pagesBusiness LawRizia Feh Eustaquio100% (2)

- Short Form Consultancy Agreement-GhassanDocument6 pagesShort Form Consultancy Agreement-GhassanhymerchmidtNo ratings yet

- Safeco Auto InsuranceDocument2 pagesSafeco Auto InsuranceVitorNo ratings yet

- Dino VS CaDocument2 pagesDino VS CaJulioNo ratings yet

- Article 1590 and 1591Document3 pagesArticle 1590 and 1591MariaHannahKristenRamirezNo ratings yet

- M4.5.1 Marine Insurance TypesDocument6 pagesM4.5.1 Marine Insurance TypesDhruvin ManekNo ratings yet

- Memorandum of AssociationDocument2 pagesMemorandum of AssociationpratikpatilpNo ratings yet

- Nava V Peers PDFDocument2 pagesNava V Peers PDFAndrea GerongaNo ratings yet

- Sale Deed of Lease Hold RightsDocument8 pagesSale Deed of Lease Hold RightsShunna BhaiNo ratings yet

- Study Unit 1 Introduction To Company Law Tutorial MemorandumDocument2 pagesStudy Unit 1 Introduction To Company Law Tutorial Memorandumu22619942No ratings yet

- Ladder Series MCQ - Ramesh Devarakonda (26) 20191231230312 PDFDocument101 pagesLadder Series MCQ - Ramesh Devarakonda (26) 20191231230312 PDFRitesh SharmaNo ratings yet

- Letter Template: Notice of Default - Bank of AmericaDocument3 pagesLetter Template: Notice of Default - Bank of AmericabrittanilpeedinNo ratings yet

- TRUST RECEIPT Draft TemplateDocument2 pagesTRUST RECEIPT Draft TemplateMark LozanoNo ratings yet

- Authors Guarantee FormDocument1 pageAuthors Guarantee FormAlan BensonNo ratings yet