Professional Documents

Culture Documents

Pay Slip 2401-280

Pay Slip 2401-280

Uploaded by

Ahmed AlwakeelCopyright:

Available Formats

You might also like

- Pay Slip Mar 2023 PDFDocument1 pagePay Slip Mar 2023 PDFDipendra TomarNo ratings yet

- Urc Construction Private Limited: Payslip For The Month of September - 2020Document1 pageUrc Construction Private Limited: Payslip For The Month of September - 2020Samsudeen SahapudeenNo ratings yet

- S.T.E.M Education Strategies For Teachin PDFDocument249 pagesS.T.E.M Education Strategies For Teachin PDFRian100% (3)

- I'm Thinking of Ending Things PDFDocument138 pagesI'm Thinking of Ending Things PDFRicardo VelaNo ratings yet

- Bose Payslip FebDocument1 pageBose Payslip FebThammineni Vishwanath Naidu100% (1)

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MNo ratings yet

- Mostafa Mahmud Pay SlupDocument1 pageMostafa Mahmud Pay SlupMostofa MahmudNo ratings yet

- Payroll Details: Statement of Earnings and DeductionsDocument2 pagesPayroll Details: Statement of Earnings and Deductionssaleh alamriNo ratings yet

- Retbhhafg 4 Saxsanxw 5 R 10215585111939843733012110549Document1 pageRetbhhafg 4 Saxsanxw 5 R 10215585111939843733012110549SHWETANo ratings yet

- No.1, Thiruvellore High Road, Puduchathram (Po), Thirumazhisai (Via), Chennai, Tamil Nadu, India Pin - 600124 PHONE: 044-39106210Document1 pageNo.1, Thiruvellore High Road, Puduchathram (Po), Thirumazhisai (Via), Chennai, Tamil Nadu, India Pin - 600124 PHONE: 044-39106210amitNo ratings yet

- Iocl FebruaryDocument1 pageIocl FebruaryDipankar BarmanNo ratings yet

- Salary PNB Bank, RakeshDocument1 pageSalary PNB Bank, Rakeshv4959034No ratings yet

- 5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Document1 page5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Shreyash SahayNo ratings yet

- Payslip 172820180712150142Document1 pagePayslip 172820180712150142LakshmananNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- Binit Salary Slip 2Document1 pageBinit Salary Slip 2Akanksha GuptaNo ratings yet

- GLOBAL DILDAR Payslip KotakDocument1 pageGLOBAL DILDAR Payslip KotakAnkit GuptaNo ratings yet

- 5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Document1 page5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Shreyash SahayNo ratings yet

- 5338 - July 2021 - V0R3I53SZ41W1OQXOJYIVDML4673567458157395778055955Document1 page5338 - July 2021 - V0R3I53SZ41W1OQXOJYIVDML4673567458157395778055955Shreyash Sahay0% (1)

- Pay SlipDocument1 pagePay SlipericmebidNo ratings yet

- Payslip Alight ConsultantsDocument1 pagePayslip Alight ConsultantsLalit JainNo ratings yet

- Annie Padilla - Payslip June 1-15 2022Document1 pageAnnie Padilla - Payslip June 1-15 2022Jay Mark DimaanoNo ratings yet

- Binit Salary Slip 1Document1 pageBinit Salary Slip 1Akanksha GuptaNo ratings yet

- Pay Slip Jan23MDocument1 pagePay Slip Jan23MSudheer RawatNo ratings yet

- Shrine Lifesciences Private Limited: Earnings Deductions Amount AmountDocument1 pageShrine Lifesciences Private Limited: Earnings Deductions Amount Amountralesh694No ratings yet

- PayslipDocument1 pagePayslipojhashivam1997No ratings yet

- A2508-Salary Slip-MayDocument1 pageA2508-Salary Slip-MayCAT ClusterNo ratings yet

- Admin 48131116Document1 pageAdmin 48131116Manpreet KambojNo ratings yet

- Noim LPCDocument1 pageNoim LPCmdnoim25No ratings yet

- Pay Slip May Indian Bhushan NathDocument1 pagePay Slip May Indian Bhushan Nathralesh694No ratings yet

- June 2022 - AjithkumarDocument1 pageJune 2022 - AjithkumarDharshan RajNo ratings yet

- Salary Slip MainDocument1 pageSalary Slip MainVineetBaliyan100% (1)

- Pay SlipDocument1 pagePay SlipHajveri Photo State SambrialNo ratings yet

- Cdadc69d Bb7c 4a3d A96a 73cdebed7ab2 5819ad46 18d1 49d8 92ee F2f4aee9ef1d PayslipDocument1 pageCdadc69d Bb7c 4a3d A96a 73cdebed7ab2 5819ad46 18d1 49d8 92ee F2f4aee9ef1d PayslipHenry CagaNo ratings yet

- 0 GPIND TMCGOFFOCT2022 V2 Gpinit01Document2 pages0 GPIND TMCGOFFOCT2022 V2 Gpinit01lakb5304No ratings yet

- Lifestyle International PVT LTD Payslip For The Month of January 2022 Period 01 Jan 2022 - 31 Jan 2022Document1 pageLifestyle International PVT LTD Payslip For The Month of January 2022 Period 01 Jan 2022 - 31 Jan 2022anils9676096970No ratings yet

- Offer Leter 17Document4 pagesOffer Leter 17Pritam GoswamiNo ratings yet

- Offer Leter .Document4 pagesOffer Leter .M.B TrickNo ratings yet

- Sysnet Global Technologies Private Limited: Earnings Deductions Amount AmountDocument1 pageSysnet Global Technologies Private Limited: Earnings Deductions Amount AmountSmart Com TechNo ratings yet

- Salary Slip Oct PacificDocument1 pageSalary Slip Oct PacificBHARAT SHARMANo ratings yet

- Offer LeterDocument4 pagesOffer LeterM.B TrickNo ratings yet

- Angelica Francisco - Payslip June 1-15 2022Document1 pageAngelica Francisco - Payslip June 1-15 2022Jay Mark DimaanoNo ratings yet

- Earning Heads (+) Eads Amount: Gross Salary: Deduction: Net SalaryDocument1 pageEarning Heads (+) Eads Amount: Gross Salary: Deduction: Net SalaryNeeraj BharadwajNo ratings yet

- Payslip Saksham Jain 03-2024Document1 pagePayslip Saksham Jain 03-2024sakshamjain4567No ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat May 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat May 2022 UnlockedArul Mhmmd10No ratings yet

- Cdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipDocument1 pageCdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipHenry CagaNo ratings yet

- Diamond Beverages PVT LTD Salary Slip of Dilip Das MarchDocument1 pageDiamond Beverages PVT LTD Salary Slip of Dilip Das Marchoptimus sales distributionNo ratings yet

- LG PayslipDocument1 pageLG PayslipDipendra TOMARNo ratings yet

- Abubotniclareatbp - Payslip June 1-15 2022Document4 pagesAbubotniclareatbp - Payslip June 1-15 2022Jay Mark DimaanoNo ratings yet

- March 2023 Jagadeesh - SuraDocument1 pageMarch 2023 Jagadeesh - SuraJagadeesh SuraNo ratings yet

- Abdul Rahim Jan-2024Document1 pageAbdul Rahim Jan-2024mohdshahjada77No ratings yet

- A2508-Salary Slip-AprDocument1 pageA2508-Salary Slip-AprCAT ClusterNo ratings yet

- Statement of Salary As of 2019-08-2: Earnings DeductionsDocument1 pageStatement of Salary As of 2019-08-2: Earnings DeductionsHenry CagaNo ratings yet

- PaySlip Jan 2024Document2 pagesPaySlip Jan 2024sanchitnayak21No ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedArul Mhmmd10No ratings yet

- Payslip25797627 PDFDocument1 pagePayslip25797627 PDFObaid KhanNo ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedArul Mhmmd10No ratings yet

- Taxcomp T15038Document1 pageTaxcomp T15038victor.savioNo ratings yet

- Quasar Telecom Consultants Pvt. LTD.: #1, Old Veterinary Hospital Road, Basavanagudi, Bangalore - 560 004Document1 pageQuasar Telecom Consultants Pvt. LTD.: #1, Old Veterinary Hospital Road, Basavanagudi, Bangalore - 560 004Hari KumarNo ratings yet

- Quasar Telecom Consultants Pvt. LTD.: #1, Old Veterinary Hospital Road, Basavanagudi, Bangalore - 560 004Document1 pageQuasar Telecom Consultants Pvt. LTD.: #1, Old Veterinary Hospital Road, Basavanagudi, Bangalore - 560 004Hari KumarNo ratings yet

- Ninja Express Tech Philippines Inc.: Payslip Employee Id/Name: Period Covered: Earnings AmountDocument1 pageNinja Express Tech Philippines Inc.: Payslip Employee Id/Name: Period Covered: Earnings AmountGlen FernandezNo ratings yet

- x431 ProDocument50 pagesx431 ProAhmed AlwakeelNo ratings yet

- Hydraulic Motor/Pump: Series F11/F12 Fixed DisplacementDocument70 pagesHydraulic Motor/Pump: Series F11/F12 Fixed DisplacementAhmed AlwakeelNo ratings yet

- Hand Over 4 22Document2 pagesHand Over 4 22Ahmed AlwakeelNo ratings yet

- C1.5 11ekw 50Hz Spec Sheet HEX OpenDocument4 pagesC1.5 11ekw 50Hz Spec Sheet HEX OpenAhmed AlwakeelNo ratings yet

- Specifications & Consumer Information: - Recommended SAE Viscosity Number - . - . - . - . - . - 8-9Document12 pagesSpecifications & Consumer Information: - Recommended SAE Viscosity Number - . - . - . - . - . - 8-9Ahmed AlwakeelNo ratings yet

- Gas Pressure Regulator Series 240Pl: Serving The Gas Industry WorldwideDocument11 pagesGas Pressure Regulator Series 240Pl: Serving The Gas Industry WorldwideSandro RuizNo ratings yet

- Chiari ExerciseDocument3 pagesChiari ExercisesoliverosteopathyNo ratings yet

- Abus LightweightDocument2 pagesAbus LightweightGloria RomicNo ratings yet

- Individual Field MappingDocument46 pagesIndividual Field MappingAmyNo ratings yet

- Reportable in The Supreme Court of India Criminal Appellate Jurisdiction Criminal Appeal NO. 615 of 2020 (Arising Out of SLP (CRL.) No.8260/2018)Document38 pagesReportable in The Supreme Court of India Criminal Appellate Jurisdiction Criminal Appeal NO. 615 of 2020 (Arising Out of SLP (CRL.) No.8260/2018)GunjeetNo ratings yet

- Overcome Emotional Eating by Healthy & Psyched PDFDocument74 pagesOvercome Emotional Eating by Healthy & Psyched PDFLarissa Veres100% (1)

- Confidential Information PolicyDocument4 pagesConfidential Information PolicyDarren CariñoNo ratings yet

- A Review On The Enhancement of Figure of MeritDocument23 pagesA Review On The Enhancement of Figure of Meritsasa_22No ratings yet

- MASS 2021 10-v2Document121 pagesMASS 2021 10-v2Fidel MangoldNo ratings yet

- UN SMA 2008 Bahasa Inggris: Kode Soal P44Document7 pagesUN SMA 2008 Bahasa Inggris: Kode Soal P44hestyNo ratings yet

- Stretching ExerciesDocument2 pagesStretching ExerciesGanesh Babu100% (1)

- Heridity: Table of SpecificationsDocument8 pagesHeridity: Table of SpecificationsJoseph GratilNo ratings yet

- Natural Remedies For Heart DiseaseDocument8 pagesNatural Remedies For Heart DiseaseNur HowladerNo ratings yet

- Dental and Craniomaxillofacial Implant SurgeryDocument35 pagesDental and Craniomaxillofacial Implant SurgeryJean Carlos Barbosa FerreiraNo ratings yet

- TYPHOIDDocument13 pagesTYPHOIDnaceyjj33No ratings yet

- Fossils Flashcards 3rd GradeDocument3 pagesFossils Flashcards 3rd Gradeapi-345686634100% (1)

- Chlorine Dosing PumpDocument24 pagesChlorine Dosing PumpByron HisseyNo ratings yet

- 2022 Fuenzalida Et Al 2022 New Records OfgigantolaelapswolffsohniDocument10 pages2022 Fuenzalida Et Al 2022 New Records OfgigantolaelapswolffsohniCarlos LandaetaNo ratings yet

- SITREP NUMBER 62 As of 29 January 2020 1100HDocument67 pagesSITREP NUMBER 62 As of 29 January 2020 1100HEdison ManaloNo ratings yet

- 10: Radioactivitysmk Jati Physics Panel: Radioactive EmissionDocument16 pages10: Radioactivitysmk Jati Physics Panel: Radioactive Emissionyudrea88No ratings yet

- Modals of Obligation and Permission WorksheetDocument2 pagesModals of Obligation and Permission Worksheetyuleysi yuleysivelezmorogmail.comNo ratings yet

- Astm F2345-21Document7 pagesAstm F2345-21Tamara Silvana CárcamoNo ratings yet

- 5 ElementosDocument3 pages5 ElementosHectorNo ratings yet

- Agrismart's Farm Water Solution An Alternative To Mains WaterDocument3 pagesAgrismart's Farm Water Solution An Alternative To Mains WaterPR.comNo ratings yet

- Capgemini Excelity Payroll FAQDocument16 pagesCapgemini Excelity Payroll FAQAbhijitNo ratings yet

- 5 Raphael PDFDocument3 pages5 Raphael PDFEl olonesNo ratings yet

- Vidura Niti Snaskrit Text With English TranslationDocument217 pagesVidura Niti Snaskrit Text With English TranslationBivak BhattacharjeeNo ratings yet

- CSE499 Final Report 2023Document56 pagesCSE499 Final Report 2023sayem bin abdullah al mahfuzNo ratings yet

Pay Slip 2401-280

Pay Slip 2401-280

Uploaded by

Ahmed AlwakeelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pay Slip 2401-280

Pay Slip 2401-280

Uploaded by

Ahmed AlwakeelCopyright:

Available Formats

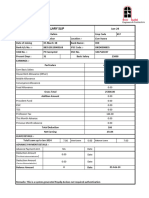

SINO THARWA DRILLING CO.

Month: Sep-22 Payment Date 25-Sep-22

Employement Information Employement Information

Employee Name : Ahmed Sedik El Sayed Bank: HSBC

Employee NO. : 2612 Branch: Tharwa

Starting Date : 1-Jul-14 Currency: EGP

Title : Night Mechanic Account # : 021-108048-001

Working Location : St83 E-Mail: AELsayed2612@sinotharwa.com.eg AELsayed2612@sinothar

Earning (Due to Employee) Deductions & Retentions

Net Salary 11,898.31 Bank Loan 0.00

Representation Allowance 0.00 Salary Tax (Paid by company) 0.00

Medical Claims 0.00 Disabilities Contribution 0.00

Fuel Expenses 0.00 Social Insurance Emp. Share 1,034.00

Overtime Allowance 0.00 Pension Employee Share 102.55

Official Holiday Allowance 0.00 Business Mobile Over limit 0.00

Perdium Allowance 0.00 Private Mobile 0.00

Training Allowance 0.00 Employee Medical Share 0.00

Bonus 0.00 Family Medical Share 0.00

Raise January ( 2022 ) 0.00 Salary Advance 0.00

Duty Allowance 0.00 Penalties 0.00

Land Line Phone 0.00 Others 0.00

Club Subsbription 0.00

Refund 0.00

Transportation Allowance 0.00

Others 0.00

Meal Allowance 0.00

Vacation Balance Fund 745.71

Total Net Dues 12,644.03 Total Dedubtions 1,136.55

Company Shares Information (Paid by monthly basis) Social Insurance Calculation

Pension Share 922.97 Social Insurance Salary 9,400.00

Life Share 213.38

Medical Share 444.58 SI Employee Share 1,034.00

Social Insurance 1,762.50

1% Emergency Fund 2,060.00 SI Company Share 1,762.50

Salary Tax calculations Tax Pool 10,757.47

% Taxes >600,000 600-700 K 700-800 K 800-900 K 900-1,000 K <1,000,000 Monthly Personal Exemption 0.00

0% Exempted 0.00 0.00 0.00 0.00 0.00

2.5% 31.25 0.00 0.00 0.00 0.00 0.00 Annual Tax Pool 129,089.68

10% 125.00 0.00 0.00 0.00 0.00 0.00

15% 187.50 0.00 0.00 0.00 0.00 0.00 Annual Grossing Up Amount 151,518.35

20% 1,151.49 0.00 0.00 0.00 0.00 0.00

22.5% 0.00 0.00 0.00 0.00 0.00 0.00 Total annual tax 22,428.67

25% 0.00 0.00 0.00 0.00 0.00 0.00

1,495.24 0.00 0.00 0.00 0.00 0.00 Total monthly income tax (Paid by company) 0.00

Total income tax 1,495.24

Salary Tax Information to Finance Dept.

Gross Salary 0.00 Gross Raise Refund ( 2021 ) 0.00

0.00 -1,034.00 0.00 0.00

Gross Representation Allowance 0.00 Gross Duty Allowance 0.00

0.00 0.00

Gross Overtime 0.00 Gross Refund 0.00

0.00 0.00

Gross Official Holiday Allowance 0.00 Gross Transportation Allowance 0.00

0.00 0.00

Gross Perdium Allowance 0.00 Gross Others 0.00

0.00 0.00

Gross Training Allowance 0.00 Gross Meal Allowance 0.00

0.00 0.00

Gross Bonus 0.00 Gross Vacation Allowance Fund 0.00

0.00 0.00

Net Due to Employee 0.00

Kuwait Package

Earning (Due to Employee) Deductions & Retentions

Exchange Rate EGP/KWD 60.58

Total Package (KWD) 500.00 Others (KWD) 0.00

Representation Allowance (KWD) 0.00 Penalty (KWD) 0.00

Medical Claims (KWD) 0.00 Bank Loan (KWD) 0.00

Overtime Allowance (KWD) 0.00 Social Insurance Emp. Share (KWD) 17.07

Bonus (KWD) 0.00 Pension Employee Share (KWD) 1.69

Other Allowance (KWD) 0.00 Mobile Bill (KWD) 0.00

Other Refund (KWD) 0.00 Salary Advance (KWD) 0.00

Vacation Balance Fund (KWD) 12.31 Employee Medical Share (KWD) 0.00

Family Medical Share (KWD) 0.00

Total Net Dues (KWD) 512.31 Total Dedubtions (KWD) 18.76

Net Due to Employee (KWD) 493.55

You might also like

- Pay Slip Mar 2023 PDFDocument1 pagePay Slip Mar 2023 PDFDipendra TomarNo ratings yet

- Urc Construction Private Limited: Payslip For The Month of September - 2020Document1 pageUrc Construction Private Limited: Payslip For The Month of September - 2020Samsudeen SahapudeenNo ratings yet

- S.T.E.M Education Strategies For Teachin PDFDocument249 pagesS.T.E.M Education Strategies For Teachin PDFRian100% (3)

- I'm Thinking of Ending Things PDFDocument138 pagesI'm Thinking of Ending Things PDFRicardo VelaNo ratings yet

- Bose Payslip FebDocument1 pageBose Payslip FebThammineni Vishwanath Naidu100% (1)

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MNo ratings yet

- Mostafa Mahmud Pay SlupDocument1 pageMostafa Mahmud Pay SlupMostofa MahmudNo ratings yet

- Payroll Details: Statement of Earnings and DeductionsDocument2 pagesPayroll Details: Statement of Earnings and Deductionssaleh alamriNo ratings yet

- Retbhhafg 4 Saxsanxw 5 R 10215585111939843733012110549Document1 pageRetbhhafg 4 Saxsanxw 5 R 10215585111939843733012110549SHWETANo ratings yet

- No.1, Thiruvellore High Road, Puduchathram (Po), Thirumazhisai (Via), Chennai, Tamil Nadu, India Pin - 600124 PHONE: 044-39106210Document1 pageNo.1, Thiruvellore High Road, Puduchathram (Po), Thirumazhisai (Via), Chennai, Tamil Nadu, India Pin - 600124 PHONE: 044-39106210amitNo ratings yet

- Iocl FebruaryDocument1 pageIocl FebruaryDipankar BarmanNo ratings yet

- Salary PNB Bank, RakeshDocument1 pageSalary PNB Bank, Rakeshv4959034No ratings yet

- 5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Document1 page5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Shreyash SahayNo ratings yet

- Payslip 172820180712150142Document1 pagePayslip 172820180712150142LakshmananNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- Binit Salary Slip 2Document1 pageBinit Salary Slip 2Akanksha GuptaNo ratings yet

- GLOBAL DILDAR Payslip KotakDocument1 pageGLOBAL DILDAR Payslip KotakAnkit GuptaNo ratings yet

- 5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Document1 page5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Shreyash SahayNo ratings yet

- 5338 - July 2021 - V0R3I53SZ41W1OQXOJYIVDML4673567458157395778055955Document1 page5338 - July 2021 - V0R3I53SZ41W1OQXOJYIVDML4673567458157395778055955Shreyash Sahay0% (1)

- Pay SlipDocument1 pagePay SlipericmebidNo ratings yet

- Payslip Alight ConsultantsDocument1 pagePayslip Alight ConsultantsLalit JainNo ratings yet

- Annie Padilla - Payslip June 1-15 2022Document1 pageAnnie Padilla - Payslip June 1-15 2022Jay Mark DimaanoNo ratings yet

- Binit Salary Slip 1Document1 pageBinit Salary Slip 1Akanksha GuptaNo ratings yet

- Pay Slip Jan23MDocument1 pagePay Slip Jan23MSudheer RawatNo ratings yet

- Shrine Lifesciences Private Limited: Earnings Deductions Amount AmountDocument1 pageShrine Lifesciences Private Limited: Earnings Deductions Amount Amountralesh694No ratings yet

- PayslipDocument1 pagePayslipojhashivam1997No ratings yet

- A2508-Salary Slip-MayDocument1 pageA2508-Salary Slip-MayCAT ClusterNo ratings yet

- Admin 48131116Document1 pageAdmin 48131116Manpreet KambojNo ratings yet

- Noim LPCDocument1 pageNoim LPCmdnoim25No ratings yet

- Pay Slip May Indian Bhushan NathDocument1 pagePay Slip May Indian Bhushan Nathralesh694No ratings yet

- June 2022 - AjithkumarDocument1 pageJune 2022 - AjithkumarDharshan RajNo ratings yet

- Salary Slip MainDocument1 pageSalary Slip MainVineetBaliyan100% (1)

- Pay SlipDocument1 pagePay SlipHajveri Photo State SambrialNo ratings yet

- Cdadc69d Bb7c 4a3d A96a 73cdebed7ab2 5819ad46 18d1 49d8 92ee F2f4aee9ef1d PayslipDocument1 pageCdadc69d Bb7c 4a3d A96a 73cdebed7ab2 5819ad46 18d1 49d8 92ee F2f4aee9ef1d PayslipHenry CagaNo ratings yet

- 0 GPIND TMCGOFFOCT2022 V2 Gpinit01Document2 pages0 GPIND TMCGOFFOCT2022 V2 Gpinit01lakb5304No ratings yet

- Lifestyle International PVT LTD Payslip For The Month of January 2022 Period 01 Jan 2022 - 31 Jan 2022Document1 pageLifestyle International PVT LTD Payslip For The Month of January 2022 Period 01 Jan 2022 - 31 Jan 2022anils9676096970No ratings yet

- Offer Leter 17Document4 pagesOffer Leter 17Pritam GoswamiNo ratings yet

- Offer Leter .Document4 pagesOffer Leter .M.B TrickNo ratings yet

- Sysnet Global Technologies Private Limited: Earnings Deductions Amount AmountDocument1 pageSysnet Global Technologies Private Limited: Earnings Deductions Amount AmountSmart Com TechNo ratings yet

- Salary Slip Oct PacificDocument1 pageSalary Slip Oct PacificBHARAT SHARMANo ratings yet

- Offer LeterDocument4 pagesOffer LeterM.B TrickNo ratings yet

- Angelica Francisco - Payslip June 1-15 2022Document1 pageAngelica Francisco - Payslip June 1-15 2022Jay Mark DimaanoNo ratings yet

- Earning Heads (+) Eads Amount: Gross Salary: Deduction: Net SalaryDocument1 pageEarning Heads (+) Eads Amount: Gross Salary: Deduction: Net SalaryNeeraj BharadwajNo ratings yet

- Payslip Saksham Jain 03-2024Document1 pagePayslip Saksham Jain 03-2024sakshamjain4567No ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat May 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat May 2022 UnlockedArul Mhmmd10No ratings yet

- Cdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipDocument1 pageCdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipHenry CagaNo ratings yet

- Diamond Beverages PVT LTD Salary Slip of Dilip Das MarchDocument1 pageDiamond Beverages PVT LTD Salary Slip of Dilip Das Marchoptimus sales distributionNo ratings yet

- LG PayslipDocument1 pageLG PayslipDipendra TOMARNo ratings yet

- Abubotniclareatbp - Payslip June 1-15 2022Document4 pagesAbubotniclareatbp - Payslip June 1-15 2022Jay Mark DimaanoNo ratings yet

- March 2023 Jagadeesh - SuraDocument1 pageMarch 2023 Jagadeesh - SuraJagadeesh SuraNo ratings yet

- Abdul Rahim Jan-2024Document1 pageAbdul Rahim Jan-2024mohdshahjada77No ratings yet

- A2508-Salary Slip-AprDocument1 pageA2508-Salary Slip-AprCAT ClusterNo ratings yet

- Statement of Salary As of 2019-08-2: Earnings DeductionsDocument1 pageStatement of Salary As of 2019-08-2: Earnings DeductionsHenry CagaNo ratings yet

- PaySlip Jan 2024Document2 pagesPaySlip Jan 2024sanchitnayak21No ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat July 2022 UnlockedArul Mhmmd10No ratings yet

- Payslip25797627 PDFDocument1 pagePayslip25797627 PDFObaid KhanNo ratings yet

- MOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedDocument1 pageMOHAMAD ARUL KHAIRULLAH Payroll Slip PT Nusantara Ekspres Kilat June 2022 (1) UnlockedArul Mhmmd10No ratings yet

- Taxcomp T15038Document1 pageTaxcomp T15038victor.savioNo ratings yet

- Quasar Telecom Consultants Pvt. LTD.: #1, Old Veterinary Hospital Road, Basavanagudi, Bangalore - 560 004Document1 pageQuasar Telecom Consultants Pvt. LTD.: #1, Old Veterinary Hospital Road, Basavanagudi, Bangalore - 560 004Hari KumarNo ratings yet

- Quasar Telecom Consultants Pvt. LTD.: #1, Old Veterinary Hospital Road, Basavanagudi, Bangalore - 560 004Document1 pageQuasar Telecom Consultants Pvt. LTD.: #1, Old Veterinary Hospital Road, Basavanagudi, Bangalore - 560 004Hari KumarNo ratings yet

- Ninja Express Tech Philippines Inc.: Payslip Employee Id/Name: Period Covered: Earnings AmountDocument1 pageNinja Express Tech Philippines Inc.: Payslip Employee Id/Name: Period Covered: Earnings AmountGlen FernandezNo ratings yet

- x431 ProDocument50 pagesx431 ProAhmed AlwakeelNo ratings yet

- Hydraulic Motor/Pump: Series F11/F12 Fixed DisplacementDocument70 pagesHydraulic Motor/Pump: Series F11/F12 Fixed DisplacementAhmed AlwakeelNo ratings yet

- Hand Over 4 22Document2 pagesHand Over 4 22Ahmed AlwakeelNo ratings yet

- C1.5 11ekw 50Hz Spec Sheet HEX OpenDocument4 pagesC1.5 11ekw 50Hz Spec Sheet HEX OpenAhmed AlwakeelNo ratings yet

- Specifications & Consumer Information: - Recommended SAE Viscosity Number - . - . - . - . - . - 8-9Document12 pagesSpecifications & Consumer Information: - Recommended SAE Viscosity Number - . - . - . - . - . - 8-9Ahmed AlwakeelNo ratings yet

- Gas Pressure Regulator Series 240Pl: Serving The Gas Industry WorldwideDocument11 pagesGas Pressure Regulator Series 240Pl: Serving The Gas Industry WorldwideSandro RuizNo ratings yet

- Chiari ExerciseDocument3 pagesChiari ExercisesoliverosteopathyNo ratings yet

- Abus LightweightDocument2 pagesAbus LightweightGloria RomicNo ratings yet

- Individual Field MappingDocument46 pagesIndividual Field MappingAmyNo ratings yet

- Reportable in The Supreme Court of India Criminal Appellate Jurisdiction Criminal Appeal NO. 615 of 2020 (Arising Out of SLP (CRL.) No.8260/2018)Document38 pagesReportable in The Supreme Court of India Criminal Appellate Jurisdiction Criminal Appeal NO. 615 of 2020 (Arising Out of SLP (CRL.) No.8260/2018)GunjeetNo ratings yet

- Overcome Emotional Eating by Healthy & Psyched PDFDocument74 pagesOvercome Emotional Eating by Healthy & Psyched PDFLarissa Veres100% (1)

- Confidential Information PolicyDocument4 pagesConfidential Information PolicyDarren CariñoNo ratings yet

- A Review On The Enhancement of Figure of MeritDocument23 pagesA Review On The Enhancement of Figure of Meritsasa_22No ratings yet

- MASS 2021 10-v2Document121 pagesMASS 2021 10-v2Fidel MangoldNo ratings yet

- UN SMA 2008 Bahasa Inggris: Kode Soal P44Document7 pagesUN SMA 2008 Bahasa Inggris: Kode Soal P44hestyNo ratings yet

- Stretching ExerciesDocument2 pagesStretching ExerciesGanesh Babu100% (1)

- Heridity: Table of SpecificationsDocument8 pagesHeridity: Table of SpecificationsJoseph GratilNo ratings yet

- Natural Remedies For Heart DiseaseDocument8 pagesNatural Remedies For Heart DiseaseNur HowladerNo ratings yet

- Dental and Craniomaxillofacial Implant SurgeryDocument35 pagesDental and Craniomaxillofacial Implant SurgeryJean Carlos Barbosa FerreiraNo ratings yet

- TYPHOIDDocument13 pagesTYPHOIDnaceyjj33No ratings yet

- Fossils Flashcards 3rd GradeDocument3 pagesFossils Flashcards 3rd Gradeapi-345686634100% (1)

- Chlorine Dosing PumpDocument24 pagesChlorine Dosing PumpByron HisseyNo ratings yet

- 2022 Fuenzalida Et Al 2022 New Records OfgigantolaelapswolffsohniDocument10 pages2022 Fuenzalida Et Al 2022 New Records OfgigantolaelapswolffsohniCarlos LandaetaNo ratings yet

- SITREP NUMBER 62 As of 29 January 2020 1100HDocument67 pagesSITREP NUMBER 62 As of 29 January 2020 1100HEdison ManaloNo ratings yet

- 10: Radioactivitysmk Jati Physics Panel: Radioactive EmissionDocument16 pages10: Radioactivitysmk Jati Physics Panel: Radioactive Emissionyudrea88No ratings yet

- Modals of Obligation and Permission WorksheetDocument2 pagesModals of Obligation and Permission Worksheetyuleysi yuleysivelezmorogmail.comNo ratings yet

- Astm F2345-21Document7 pagesAstm F2345-21Tamara Silvana CárcamoNo ratings yet

- 5 ElementosDocument3 pages5 ElementosHectorNo ratings yet

- Agrismart's Farm Water Solution An Alternative To Mains WaterDocument3 pagesAgrismart's Farm Water Solution An Alternative To Mains WaterPR.comNo ratings yet

- Capgemini Excelity Payroll FAQDocument16 pagesCapgemini Excelity Payroll FAQAbhijitNo ratings yet

- 5 Raphael PDFDocument3 pages5 Raphael PDFEl olonesNo ratings yet

- Vidura Niti Snaskrit Text With English TranslationDocument217 pagesVidura Niti Snaskrit Text With English TranslationBivak BhattacharjeeNo ratings yet

- CSE499 Final Report 2023Document56 pagesCSE499 Final Report 2023sayem bin abdullah al mahfuzNo ratings yet