Professional Documents

Culture Documents

Acctg Module 2

Acctg Module 2

Uploaded by

pearlyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acctg Module 2

Acctg Module 2

Uploaded by

pearlyCopyright:

Available Formats

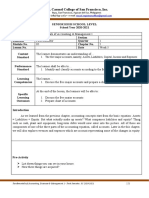

Mt. Carmel College of San Francisco, Inc.

8501, San Francisco, Agusan del Sur, Philippines

Tel. No. (085) 839-2161 • e-mail: mccsf.registrarsoffice@gmail.com

SENIOR HIGH SCHOOL LEVEL

School Year 2020-2021

Subject Fundamentals of Accounting & Management 1

Grade Level Grade 11 Section

Semester First Semester Quarter 1

Module No. 02 Chapter No. 1

Lesson No. 02 Date Week 2

Content The learner demonstrates an understanding of the external and internal users of

Standard financial information.

Performance The learner shall be able to…

Standard (1) solve exercises and problems on the identification of users of information, type of

decisions to be made, and type of information needed by the users.

(2) cite users of financial information and identify whether they are internal and

internal users

Learning The learner…

Competencies 1. define external users and gives example

2. define internal users and give examples

At the end of the lesson, the learners will be able to:

Specific

Learning 1. identify the internal and external users

Outcomes

Introduction

Accounting communicates financial information to decision makers. Different decision makers are

users of this accounting information. Users of accounting information are collectively referred to as

stakeholders. These stakeholders can be classified as internal and external users

Pre-Activity

1. Do we have enough cash to pay bills?

2. Can the company afford to give salary increase?

3. How much is the company’s sales growth for the months?

4. How much is the tax payable to the government?

Analysis

Financial information are the basis in making decisions whether is it and internal users or external

users.

Fundamentals of Accounting, Business & Management 1 - First Semester, SY 2020-2021 |1

Mt. Carmel College of San Francisco, Inc.

8501, San Francisco, Agusan del Sur, Philippines

Tel. No. (085) 839-2161 • e-mail: mccsf.registrarsoffice@gmail.com

INTERNAL USERS

The internal users are those who make decisions that affect the internal operations of the

company. They are the following:

1. Manager. They plan, organize and run a business.

2. Employee/Labor Union. They assess the company’s profitability and stability, its

consequence on their future salary and job security.

3. Owners. They provide the capital to the business. Owners need these accounting

information to help them decide whether they should withdraw or increase their

investments. They are interested to know the results on their investment.

EXTERNAL USERS

The external users of financial report are those who make their decisions based on the

company’s financial information. They are the following:

1. Potential Investors. They need information to help them decide whether they should invest

or not in the business. Through past performance or operating results of the company, they

would want to know potential return on their investment should they decide to invest.

2. Credits and Potential Creditors. They assess the credit worthiness and the capability of the

business to pay its obligations including the related interest on maturity date.

3. Customers. They assess the financial position of their suppliers which is necessary for them

to maintain a stable source of supply in a long term. They are interested to know whether

the business will continue to hones its product warranty.

4. Suppliers. They use the financial statements of their customers to determine whether the

debts owed to them will be paid when due or whether the customer has enough funds or

resources to pay the goods to be delivered or the service to be rendered.

5. Tax Authorities. The use of financial reports to determine the credibility of the tax returns

filed on behalf of the company. They are interested to know if the business paid the correct

amount of taxes.

6. Regulatory Bodies. They want to ensure that the company’s disclosure of accounting

information is in accordance with the rules and regulations set in order to protect the

Fundamentals of Accounting, Business & Management 1 - First Semester, SY 2020-2021 |2

Mt. Carmel College of San Francisco, Inc.

8501, San Francisco, Agusan del Sur, Philippines

Tel. No. (085) 839-2161 • e-mail: mccsf.registrarsoffice@gmail.com

interest of the stakeholders who rely on such information. Example of these regulatory

bodies are the Securities and Exchange Commission (SEC) and the Bangko Sentral ng

Pilipinas (BSP).

7. Pubic. They use financial information to know how the business helps the economy and

whether employment is available in the company.

Application (Questions for Discussion)

1. Distinguish the type of information needed by two major groups of users.

2. How does accounting provide important data to internal users?

3. What are the accounting information needed by

a. Investor

b. Creditors

Summary

The accounting information provided to internal and external users can be in the form of

management report, budgets and financial statements.

Post – Activity

A. The following are users of financial statements. Identify if the users mentioned below is external

and internal.

_____________________________ 1. Customers

_____________________________ 2. Bureau of Internal Revenue

____________________________ __ 3. Labor Unions

_____________________________ 4. Factory Manager

_____________________________ 5. Vice-President of Finance

_____________________________ 6. Security and Exchange Commission

Fundamentals of Accounting, Business & Management 1 - First Semester, SY 2020-2021 |3

Mt. Carmel College of San Francisco, Inc.

8501, San Francisco, Agusan del Sur, Philippines

Tel. No. (085) 839-2161 • e-mail: mccsf.registrarsoffice@gmail.com

_____________________________ 7. Investors

_____________________________ 8. Suppliers

_____________________________ 9. Factory Worker

_____________________________ 10. A Bank Company

B. Multiple Choice. Select the best answer.

1. These are the internal users of financial reports who are interested in determining the return of

investment in the business.

a. Management

b. Employees

c. Owners

d. Creditors

2. The following are the external users who make decisions about their relationship to the

enterprise, except __________.

a. Taxing Authorities

b. Regulatory Agencies

c. Suppliers

d. Employees

3. Which of the following statements about users of accounting information is correct?

a. Management is an external users

b. Tax authorities are internal users.

c. Creditors are external users

d. Employees are external users.

4. The responsibility to review the work of the accountants and issue opinions as to the fairness

of financial statements results with _________.

a. The external auditor

b. The board of directors

c. The internal auditors

d. Management

5. Which of the following is an external user of a company’s financial information?

a. Board of Directors

b. Stockholders in the company

c. Holders of company’s bond

Fundamentals of Accounting, Business & Management 1 - First Semester, SY 2020-2021 |4

Mt. Carmel College of San Francisco, Inc.

8501, San Francisco, Agusan del Sur, Philippines

Tel. No. (085) 839-2161 • e-mail: mccsf.registrarsoffice@gmail.com

d. Creditors with long-term contracts with the company.

C. True or False. Write TRUE if the statement is correct and FALSE if the statement is incorrect.

__________________ 1. Potential investors are interested in financial information that will

help them to know the ability of the entity to pay dividends.

__________________ 2. The financial statements provide all the needed information by

makers.

__________________ 3. Financial reports prove information on the ability of the firm to pay

wage increase their employees.

__________________ 4. Creditors make use of financial report to know how the business

used the money lent to the entity.

_________________ 5. Taxing authorities are external users of the financial information with direct

interest in the business.

References:

Fundamentals of Accountancy, Business and Management by Vibal Group Inc,. and Joy S.

Rabo, Florenz C. Tugas, Herminigilda E. Saledrez, Copyrigth, 2016.

Fundamentals of Accounting, Business and Management 1, by Rex Bookstore, Inc. and Joselito G.

Florendo, Copyright, 2016.

Fundamentals of Accountancy, Business and Management, by The Phoenix Publishing House, Inc.,

and Solita A. Frias, Copyright, 2016.

Fundamentals of Accountancy, Business and Management I, The Commission on Higher

Education in collaboration with the Philippine Normal University, Joselito G.

Florendo, Carlsberg S. Andres, Christopher B. Honoracio, Reymond Patrick P.

Monfero, Dani Rose c. Salazar, published by Commission of Higher Education,

2016, Chairperson: Patricia B. Licuanan, Ph.D.

Fundamentals of Accounting, Business & Management 1 - First Semester, SY 2020-2021 |5

Mt. Carmel College of San Francisco, Inc.

8501, San Francisco, Agusan del Sur, Philippines

Tel. No. (085) 839-2161 • e-mail: mccsf.registrarsoffice@gmail.com

Fundamentals of Accounting, Business & Management 1 - First Semester, SY 2020-2021 |6

You might also like

- BAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryDocument111 pagesBAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryWachirajaneNo ratings yet

- Financial Accounting 1 by HaroldDocument392 pagesFinancial Accounting 1 by Harolddnlkaba0% (1)

- Financial Accounting 1Document530 pagesFinancial Accounting 1aponojecyNo ratings yet

- Early Evidence On The Use of Foreign Cash Following The Tax Cuts and Jobs Act of 2017Document53 pagesEarly Evidence On The Use of Foreign Cash Following The Tax Cuts and Jobs Act of 2017GlennKesslerWPNo ratings yet

- ABM 11 - FABM1 - Q1 - Mod2Document11 pagesABM 11 - FABM1 - Q1 - Mod2Kelvin LansangNo ratings yet

- FABM 1 Lesson-3-Users-of-Accounting-InformationDocument2 pagesFABM 1 Lesson-3-Users-of-Accounting-InformationPrincess Smaeranza Campos-DulayNo ratings yet

- 3 Users of Accounting InformationDocument19 pages3 Users of Accounting Informationcreslyn.atienzaNo ratings yet

- Fundamentals of Accountancy, Business & Management 1Document4 pagesFundamentals of Accountancy, Business & Management 1Rodj Eli Mikael Viernes-IncognitoNo ratings yet

- Module 3 ICT 141 Module 2: Users of AccountingDocument4 pagesModule 3 ICT 141 Module 2: Users of AccountingJanice SeterraNo ratings yet

- Fundamentals: of Accountancy, Business Management 1Document14 pagesFundamentals: of Accountancy, Business Management 1Grace BongalonNo ratings yet

- FABM1 Module 3 Users of Accounting InformationDocument2 pagesFABM1 Module 3 Users of Accounting InformationDonna BautistaNo ratings yet

- Fabm1 Module 1 Week 3Document6 pagesFabm1 Module 1 Week 3Alma A CernaNo ratings yet

- Course Materials BAFINMAX Week3Document11 pagesCourse Materials BAFINMAX Week3emmanvillafuerteNo ratings yet

- Module 1Document23 pagesModule 1Ma Leah TañezaNo ratings yet

- CFAS 1. Devt of Financial Reporting Framework and Standard Setting BodiesDocument42 pagesCFAS 1. Devt of Financial Reporting Framework and Standard Setting Bodieszarah.delossantos.75No ratings yet

- Understanding Financial StatementsDocument151 pagesUnderstanding Financial StatementsCj Lumoctos100% (1)

- Users of Accounting InformationDocument17 pagesUsers of Accounting InformationZybel Rosales67% (3)

- Module 1Document23 pagesModule 1esparagozanichole01No ratings yet

- Course Materials BAFINMAX Week6Document7 pagesCourse Materials BAFINMAX Week6emmanvillafuerteNo ratings yet

- Lesson 3 - Users of Accounting InformationDocument2 pagesLesson 3 - Users of Accounting InformationsweetzelNo ratings yet

- Users of InformatiomDocument29 pagesUsers of InformatiomMary Ann Pacudan GonzaloNo ratings yet

- Accounting I ModuleDocument92 pagesAccounting I ModuleJay Githuku100% (1)

- Accounting Week 3Document11 pagesAccounting Week 3janeNo ratings yet

- Week 3 - Lesson 3 Module ABM1Document3 pagesWeek 3 - Lesson 3 Module ABM1sweetzelNo ratings yet

- IIANHS LASformatDocument7 pagesIIANHS LASformatDystral CliffNo ratings yet

- Fundamentals of Accounting IDocument115 pagesFundamentals of Accounting IYis Esh100% (1)

- Module Template FIN 327 (Financial Analysis and Reporting)Document20 pagesModule Template FIN 327 (Financial Analysis and Reporting)Normae AnnNo ratings yet

- Financial Statement Analasis.: Name of The Student:-SOUMIK DUTTADocument10 pagesFinancial Statement Analasis.: Name of The Student:-SOUMIK DUTTAMD AdnanNo ratings yet

- Module 2 3 and 4Document7 pagesModule 2 3 and 4French Jame RianoNo ratings yet

- Financial Accounting and Auditing Paper V PDFDocument290 pagesFinancial Accounting and Auditing Paper V PDFN Venkata Subramanian100% (1)

- The Environment of Financial Accounting and ReportingDocument59 pagesThe Environment of Financial Accounting and ReportingHeisei De LunaNo ratings yet

- Accounting Information SystemsDocument3 pagesAccounting Information Systems_payal_No ratings yet

- CBSE Class 11 Accountancy Revision Notes Chapter-1 Introduction To AccountingDocument8 pagesCBSE Class 11 Accountancy Revision Notes Chapter-1 Introduction To AccountingMayank Singh Rajawat100% (1)

- Profit.: Unit 1. Introduction To Accounting 1.1Document18 pagesProfit.: Unit 1. Introduction To Accounting 1.1Solomon BetiruNo ratings yet

- Chapter 3Document5 pagesChapter 3Janah MirandaNo ratings yet

- Solution Manual For Managerial Accounting 9th Edition by CrossonDocument28 pagesSolution Manual For Managerial Accounting 9th Edition by Crossonenviecatsalt.ezeld100% (49)

- PA-I Chapter-1Document17 pagesPA-I Chapter-1hailemichaelmekonennNo ratings yet

- Full Download Solution Manual For Principles of Financial Accounting 11th Edition by Needles PDF Full ChapterDocument36 pagesFull Download Solution Manual For Principles of Financial Accounting 11th Edition by Needles PDF Full Chapterpaltryaricinexftu5100% (22)

- ACCT 330-Intermediate Accounting 1Document81 pagesACCT 330-Intermediate Accounting 1Fer LeroyNo ratings yet

- Final Chapter1Document15 pagesFinal Chapter1Hussen AbdulkadirNo ratings yet

- What I Know .Use Separate Paper For Your AnswerDocument7 pagesWhat I Know .Use Separate Paper For Your AnswerWhyljyne GlasanayNo ratings yet

- Chapter-1 Introduction To Accounting and BusinessDocument16 pagesChapter-1 Introduction To Accounting and BusinessYared HussenNo ratings yet

- Fundamentals of Abm 1-Q3-W2-Module 2-Version3Document17 pagesFundamentals of Abm 1-Q3-W2-Module 2-Version3MrBigbozz21100% (2)

- Modul Session 12 Akuntasi FebDocument26 pagesModul Session 12 Akuntasi FebZahraNo ratings yet

- Unit 1. Introduction To Accounting and Business 1.1Document25 pagesUnit 1. Introduction To Accounting and Business 1.1Qabsoo FiniinsaaNo ratings yet

- Quiz 1 Introduction To Accounting Without AnswerDocument9 pagesQuiz 1 Introduction To Accounting Without AnswerJazzy Mercado100% (2)

- AccountingDocument5 pagesAccountingShivam ChandraNo ratings yet

- Temegnu GizawfinanDocument11 pagesTemegnu GizawfinanTemegnugizawNo ratings yet

- ACCTNG Module 2 QuizDocument4 pagesACCTNG Module 2 QuizRenzy Carlo MorteNo ratings yet

- Revised BDM - Sample Q&A SolveDocument13 pagesRevised BDM - Sample Q&A SolveSonam Dema DorjiNo ratings yet

- Week004-Users of Accounting Information JX7cJXDocument6 pagesWeek004-Users of Accounting Information JX7cJXAbdulhakim MautiNo ratings yet

- CBSE Class 11 Accountancy Revision Notes Chapter-1 Introduction To AccountingDocument8 pagesCBSE Class 11 Accountancy Revision Notes Chapter-1 Introduction To AccountingParikshit ChauhanNo ratings yet

- To Accounting: Presented byDocument39 pagesTo Accounting: Presented byManalo BaymosaNo ratings yet

- Level1 F.accDocument85 pagesLevel1 F.accHakizimana FerecieNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document7 pagesFundamentals of Accountancy, Business and Management 1Yannah LongalongNo ratings yet

- Basic Accounting NotesDocument83 pagesBasic Accounting NotesUmutoni ornellaNo ratings yet

- Final Chapter1Document48 pagesFinal Chapter1Nigussie BerhanuNo ratings yet

- 3-ABM-BUSINESS FINANCE 12 - Q1 - W3 - Mod3Document23 pages3-ABM-BUSINESS FINANCE 12 - Q1 - W3 - Mod3melvinlloyd.limheyaNo ratings yet

- Financial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessFrom EverandFinancial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessNo ratings yet

- Financial Intelligence: Mastering the Numbers for Business SuccessFrom EverandFinancial Intelligence: Mastering the Numbers for Business SuccessNo ratings yet

- Lesson 4Document6 pagesLesson 4pearlyNo ratings yet

- Lesson 5Document5 pagesLesson 5pearlyNo ratings yet

- Lesson 2Document9 pagesLesson 2pearlyNo ratings yet

- Lesson 3Document6 pagesLesson 3pearlyNo ratings yet

- Acctg Module 5Document3 pagesAcctg Module 5pearlyNo ratings yet

- Lesson 1Document4 pagesLesson 1pearlyNo ratings yet

- Acctg Module 3Document18 pagesAcctg Module 3pearlyNo ratings yet

- Acctg Module 1Document9 pagesAcctg Module 1pearlyNo ratings yet

- Abm 1 ModulesDocument37 pagesAbm 1 ModulespearlyNo ratings yet

- Jurnal Pendukung 5Document17 pagesJurnal Pendukung 5ARIF MUDJIONONo ratings yet

- National Telecommunications Commission Agency Information InventoryDocument18 pagesNational Telecommunications Commission Agency Information InventoryRaamah DadhwalNo ratings yet

- Test Bank Financial Accounting and Reporting TheoryDocument58 pagesTest Bank Financial Accounting and Reporting TheoryAngelie De LeonNo ratings yet

- HPE ProLiant DL380 Gen9 Server - SpecificationsDocument2 pagesHPE ProLiant DL380 Gen9 Server - Specificationsjoey AlibabaNo ratings yet

- Re RFIV2023-015 Vagamon - Wonderla 1N-2D 40 Std.Document3 pagesRe RFIV2023-015 Vagamon - Wonderla 1N-2D 40 Std.lovetoday2605No ratings yet

- ENG - Ebook Kurangkan Hutang Kita!-1Document21 pagesENG - Ebook Kurangkan Hutang Kita!-1Mr DummyNo ratings yet

- Smith Kline & French Laboratories Vs Court of Appeals, 368 SCRA 9, G.R. No. 121267, October 23, 2001Document17 pagesSmith Kline & French Laboratories Vs Court of Appeals, 368 SCRA 9, G.R. No. 121267, October 23, 2001Gi NoNo ratings yet

- Defining Sustainable 2005Document22 pagesDefining Sustainable 2005emut_mNo ratings yet

- Entrep Lesson 3 DLLDocument6 pagesEntrep Lesson 3 DLLMhea Laurence NiereNo ratings yet

- Deloitte Digital Era Tom v1 PDFDocument68 pagesDeloitte Digital Era Tom v1 PDFميلاد نوروزي رهبرNo ratings yet

- Project Report Mandap DecorationDocument17 pagesProject Report Mandap Decorationkushal chopda100% (1)

- HUL CaseDocument6 pagesHUL CaseShivam KhandelwalNo ratings yet

- CHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTDocument4 pagesCHP 1 NTRO ADVANCED FINANCIAL MANAGEMENTcuteserese roseNo ratings yet

- Reading and Writing 3 Q: Skills For Success Unit 7 Student Book Answer KeyDocument2 pagesReading and Writing 3 Q: Skills For Success Unit 7 Student Book Answer Keybichhanh1420% (1)

- DP Penjualan Tba 2023Document32 pagesDP Penjualan Tba 2023greciNo ratings yet

- Lead Magnet Creation For Nutrition Professionals: A Guide To Building An Irresistible Opt-In That ConvertsDocument18 pagesLead Magnet Creation For Nutrition Professionals: A Guide To Building An Irresistible Opt-In That Convertsjigarjadav147359No ratings yet

- Dr-BARANIDHARAN-KULOTHUNGAN-AP-II-MBA-SRI-SAIRAM-INSTITUTE-OF-TECHNOLOGY-CHENNAI-600048-Cost of CapitalDocument22 pagesDr-BARANIDHARAN-KULOTHUNGAN-AP-II-MBA-SRI-SAIRAM-INSTITUTE-OF-TECHNOLOGY-CHENNAI-600048-Cost of CapitalDr.K BaranidharanNo ratings yet

- Precedent AnalysisDocument2 pagesPrecedent AnalysisSunil SharmaNo ratings yet

- Axis Mutual Fund Annual Report 2020-21Document669 pagesAxis Mutual Fund Annual Report 2020-21Boat08No ratings yet

- Chase StockDocument22 pagesChase Stocktreasurebeachcag7No ratings yet

- Philippines The Manila Electric Company Electricity Company 1 95851Document1 pagePhilippines The Manila Electric Company Electricity Company 1 95851البرنس اليمنيNo ratings yet

- Blair Wilson 5121 N 8th ST Philadelphia, Pa 19120: Order ID: 112-0126365-5726666Document1 pageBlair Wilson 5121 N 8th ST Philadelphia, Pa 19120: Order ID: 112-0126365-5726666ErineNo ratings yet

- My Trading JournalDocument4 pagesMy Trading JournaldaisyazimatNo ratings yet

- First Page Vaibhav 01Document6 pagesFirst Page Vaibhav 01vinayak tiwariNo ratings yet

- Spiceland GE2 SM Ch7.1Document98 pagesSpiceland GE2 SM Ch7.1夜晨曦No ratings yet

- Acct Statement XX3571 07112022Document36 pagesAcct Statement XX3571 07112022ashutoshpal21No ratings yet

- Milk Drinking Behaviors in Vietnam Share by WorldLine TechnologyDocument21 pagesMilk Drinking Behaviors in Vietnam Share by WorldLine TechnologyThanh Thâu TrầnNo ratings yet

- Group 6 - Transforming Luxury Distribution in AsiaDocument5 pagesGroup 6 - Transforming Luxury Distribution in AsiaAnsh LakhmaniNo ratings yet

- Unilever To Cut Emissions To Zero by 2039, Adopt Carbon Labeling - BloombergDocument4 pagesUnilever To Cut Emissions To Zero by 2039, Adopt Carbon Labeling - Bloombergvipinkala1No ratings yet