Professional Documents

Culture Documents

Entity A Va Prob

Entity A Va Prob

Uploaded by

Neil Ryan PontanaresCopyright:

Available Formats

You might also like

- TAX Ch06Document11 pagesTAX Ch06GabriellaNo ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Finac 3 TopicsDocument9 pagesFinac 3 TopicsCielo Mae Parungo60% (5)

- Corporate Finance Assignment Chapter 2 PDFDocument12 pagesCorporate Finance Assignment Chapter 2 PDFAna Carolina Silva100% (1)

- Problem SolvingDocument10 pagesProblem SolvingRegina De LunaNo ratings yet

- Chapter 12 ExercisesDocument2 pagesChapter 12 ExercisesAreeba QureshiNo ratings yet

- Practice Question: Recognition and MeasurementDocument2 pagesPractice Question: Recognition and MeasurementJong HannahNo ratings yet

- Problem A - SFP For UploadDocument3 pagesProblem A - SFP For UploadLuisa Janelle Boquiren50% (2)

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Entity A Va ProbDocument2 pagesEntity A Va ProbAngelica CondenoNo ratings yet

- Colleagues CoDocument7 pagesColleagues CoKeahlyn BoticarioNo ratings yet

- Name Registration No Sex Sign: Salum Warsh Dicholile T/UDOM/2020/07895 MDocument4 pagesName Registration No Sex Sign: Salum Warsh Dicholile T/UDOM/2020/07895 MSam DizongaNo ratings yet

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Assets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Document2 pagesAssets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Usama RajaNo ratings yet

- Final Exam Intermediate Acctg. 3 Copy of Long ProblemsDocument3 pagesFinal Exam Intermediate Acctg. 3 Copy of Long ProblemsFerlyn Trapago ButialNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Colleagues Co. Statement of Financial Statements December 31, 20X1Document6 pagesColleagues Co. Statement of Financial Statements December 31, 20X1Keahlyn BoticarioNo ratings yet

- TPBALANCESHEET DeloyDocument1 pageTPBALANCESHEET DeloyJen DeloyNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Problem 3Document2 pagesProblem 3Vicente, Liza Mae C.No ratings yet

- Activity 1.4.A Preparation of Financial ReportsDocument1 pageActivity 1.4.A Preparation of Financial ReportsheyheyNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- Midterm Practice QuestionsDocument4 pagesMidterm Practice QuestionsGio RobakidzeNo ratings yet

- Bheverlynn Corporation Data SetDocument2 pagesBheverlynn Corporation Data SetDaisy Macuroy PurcaNo ratings yet

- Activity - Financial StatementsDocument5 pagesActivity - Financial StatementsPhilip Jhon BayoNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document12 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Shane KimNo ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- 15 Tips For Acctg StudyDocument36 pages15 Tips For Acctg StudyClyde RamosNo ratings yet

- Chapter Solutions I3Document15 pagesChapter Solutions I3Clyde RamosNo ratings yet

- Illustrative Problem 2.1-2Document3 pagesIllustrative Problem 2.1-2Chincel G. ANINo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (30)

- Accounting For Managers ExerciseDocument34 pagesAccounting For Managers ExerciseJessica BernaciliaNo ratings yet

- Assets Current AssetsDocument3 pagesAssets Current AssetsJere Mae MarananNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- IFA FR222 Intermediate Financial AccountingDocument22 pagesIFA FR222 Intermediate Financial Accountingsiamrahman994No ratings yet

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocument8 pagesAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- AFE5008-B Exam Type Question-2-Model AnswerDocument2 pagesAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerNo ratings yet

- ACC 203 Ch05 SolutionDocument11 pagesACC 203 Ch05 Solutionomaritani2005No ratings yet

- 20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Document3 pages20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Takudzwa LanceNo ratings yet

- TT10 QuestionDocument1 pageTT10 QuestionUyển Nhi TrầnNo ratings yet

- Bài 4 - CMBCTC2Document2 pagesBài 4 - CMBCTC2Phan Thị Mỹ DuyênNo ratings yet

- Relax CompanyDocument7 pagesRelax CompanyRegine CalipusanNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- Single StepDocument1 pageSingle StepMerza DyanNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- TUGAS Topik Bab 5Document2 pagesTUGAS Topik Bab 5Imanuel ChrisNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDocument4 pagesQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNo ratings yet

- Trial Balance February 28, 20X1Document3 pagesTrial Balance February 28, 20X1Angelica MaeNo ratings yet

- Finacct+202 F03Document4 pagesFinacct+202 F03LijelNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- QUIZ 2-Mid.-Problems On Statement of Cash FlowsDocument2 pagesQUIZ 2-Mid.-Problems On Statement of Cash FlowsMonica GeronaNo ratings yet

- Kale and Kombucha: QuestionsDocument2 pagesKale and Kombucha: QuestionsmaddrajNo ratings yet

- Peso Starter Fund Product Highlight Sheet - 082321Document11 pagesPeso Starter Fund Product Highlight Sheet - 082321Frost ByteNo ratings yet

- Intergovernmental RelationshipDocument24 pagesIntergovernmental Relationshipsaaduabubakar9No ratings yet

- Customer Declaration Form Entity 1Document3 pagesCustomer Declaration Form Entity 1KjNo ratings yet

- Inheritance Tax1Document24 pagesInheritance Tax1Yoven VeerasamyNo ratings yet

- Balance Sheet Asset: Total Current AssetsDocument2 pagesBalance Sheet Asset: Total Current AssetsTrinh VũNo ratings yet

- Reference: Picker Et Al (2012) - Chapter 12 IAS 16 Property, Plant and EquipmentDocument25 pagesReference: Picker Et Al (2012) - Chapter 12 IAS 16 Property, Plant and EquipmentBrenden KapoNo ratings yet

- Tax InterviewDocument1 pageTax InterviewCHRISTIAN CAMILO VELILLA CEPEDANo ratings yet

- DrtftyDocument1 pageDrtftySri Ganesh ComputersNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- Application Form HEC Need Base Scholarship 2022-23Document6 pagesApplication Form HEC Need Base Scholarship 2022-23Hussnain RasheedNo ratings yet

- Lesson 6Document10 pagesLesson 6Jean LeysonNo ratings yet

- Year 0 1 2 3 Income StatementDocument6 pagesYear 0 1 2 3 Income StatementDaniyal AsifNo ratings yet

- Internship ProjectDocument40 pagesInternship ProjectAshutosh SinghNo ratings yet

- 5 6053042764831000707Document16 pages5 6053042764831000707SoNam ZaNgmoNo ratings yet

- Soal Compre 020418Document7 pagesSoal Compre 020418mayda nurul alamsariNo ratings yet

- Conceptual Framework and Accounting Standards (CFAS)Document5 pagesConceptual Framework and Accounting Standards (CFAS)Dummy GoogleNo ratings yet

- Bianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreDocument50 pagesBianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreJOJONo ratings yet

- UntitledDocument22 pagesUntitledKajal SahooNo ratings yet

- Principles of Managerial Finance Brief 8th Edition Zutter Solutions ManualDocument4 pagesPrinciples of Managerial Finance Brief 8th Edition Zutter Solutions ManualBrianCoxbtqeo100% (13)

- FAC511S - Financial Accounting 101-1st Opp-Nov 2017Document8 pagesFAC511S - Financial Accounting 101-1st Opp-Nov 2017Uno VeiiNo ratings yet

- Non-Resident Income Tax Return Guide 2020: Ir3NrgDocument35 pagesNon-Resident Income Tax Return Guide 2020: Ir3NrgAyman Al HasaarNo ratings yet

- The New Fiscal SociologyDocument16 pagesThe New Fiscal SociologyalmasdhakaNo ratings yet

- TAXATION LESSON NO 4 PART 1 Computation of Income Under RA8424 UP TO DE MINIMIS BENEFITSDocument13 pagesTAXATION LESSON NO 4 PART 1 Computation of Income Under RA8424 UP TO DE MINIMIS BENEFITSJhe CaNo ratings yet

- Acfrogbrsgwr97zglf2pin9itvktgg Alwadwnyiulutsjl6a0p70rrroomprbrbu83yieu6w8sxjlh4qqqxzff26fhu2ii Xo Oe4cfxgwcgu4hqfuuuq8fejhnlkkDocument1 pageAcfrogbrsgwr97zglf2pin9itvktgg Alwadwnyiulutsjl6a0p70rrroomprbrbu83yieu6w8sxjlh4qqqxzff26fhu2ii Xo Oe4cfxgwcgu4hqfuuuq8fejhnlkkLuchelina FranciscoNo ratings yet

- Cost Sheet Analysis of GCPL: Group 5Document8 pagesCost Sheet Analysis of GCPL: Group 5shreyansh naharNo ratings yet

- Ragasa 2Document1 pageRagasa 2Jam DiolazoNo ratings yet

Entity A Va Prob

Entity A Va Prob

Uploaded by

Neil Ryan PontanaresOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Entity A Va Prob

Entity A Va Prob

Uploaded by

Neil Ryan PontanaresCopyright:

Available Formats

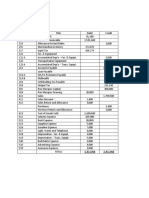

BACC103 VERTICAL ANALYSIS

The statement of financial position and comparative statements of profit or loss of Entity A are shown

below:

Entity A

Statements of Financial Position

As of December 31, 20x1

ASSETS

Cash and cash equivalents ₱159,600

Trade and other receivables 320,400

Inventory 306,000

Prepaid assets 48,000

Total current assets 834,000

Property, plant & equipment 1,886,000

Total noncurrent assets 1,886,000

TOTAL ASSETS ₱2,720,000

LIABILITIES

Trade and other payables ₱556,200

Total current liabilities 556,200

Notes Payable 1,120,000

Total noncurrent liabilities 1,120,000

TOTAL LIABILITIES 1,676,200

BACC103 VERTICAL ANALYSIS

EQUITY

Owner’s capital 1,043,800

TOTAL LIABILITIES & EQUITY ₱2,720,000

Entity A

Statement of profit or loss

For the years ended December 31, 20x1

Sales ₱2,296,000

Cost of slaes (1,010,240)

GROSS PROFIT 1,285,760

Salaries expense (943,400)

Depreciation expense (66,010)

Bad debts expense (16,020)

Interest expense (112,000)

PROFIT FOR THE YEAR ₱148,330

Requirements:

a. Perform a vertical analysis of the financial statements shown above.

b. Answer the TRUE OR FALSE questions below.

1. Entity A has more current resources than concurrent.

2. A larger portion of Entity A’s resources pertain to the owner.

3. Entity A uses leverage to finance its operations more than equity financing.

4. After cost of sales, the next largest expenditure of Entity A pertains to its employees.

5. Assuming all other income and expenses remain constant, if Entity A employs additional

employees, Entity A will probably incur loss.

You might also like

- TAX Ch06Document11 pagesTAX Ch06GabriellaNo ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Finac 3 TopicsDocument9 pagesFinac 3 TopicsCielo Mae Parungo60% (5)

- Corporate Finance Assignment Chapter 2 PDFDocument12 pagesCorporate Finance Assignment Chapter 2 PDFAna Carolina Silva100% (1)

- Problem SolvingDocument10 pagesProblem SolvingRegina De LunaNo ratings yet

- Chapter 12 ExercisesDocument2 pagesChapter 12 ExercisesAreeba QureshiNo ratings yet

- Practice Question: Recognition and MeasurementDocument2 pagesPractice Question: Recognition and MeasurementJong HannahNo ratings yet

- Problem A - SFP For UploadDocument3 pagesProblem A - SFP For UploadLuisa Janelle Boquiren50% (2)

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Entity A Va ProbDocument2 pagesEntity A Va ProbAngelica CondenoNo ratings yet

- Colleagues CoDocument7 pagesColleagues CoKeahlyn BoticarioNo ratings yet

- Name Registration No Sex Sign: Salum Warsh Dicholile T/UDOM/2020/07895 MDocument4 pagesName Registration No Sex Sign: Salum Warsh Dicholile T/UDOM/2020/07895 MSam DizongaNo ratings yet

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- Chapter 9 Financial Reporting in Hyperinflationary EconomiesDocument10 pagesChapter 9 Financial Reporting in Hyperinflationary EconomiesKathrina RoxasNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Assets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Document2 pagesAssets 20X3 20X2: Travis Engineering Balance Sheet December 31, 20X3 and 20X2Usama RajaNo ratings yet

- Final Exam Intermediate Acctg. 3 Copy of Long ProblemsDocument3 pagesFinal Exam Intermediate Acctg. 3 Copy of Long ProblemsFerlyn Trapago ButialNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Colleagues Co. Statement of Financial Statements December 31, 20X1Document6 pagesColleagues Co. Statement of Financial Statements December 31, 20X1Keahlyn BoticarioNo ratings yet

- TPBALANCESHEET DeloyDocument1 pageTPBALANCESHEET DeloyJen DeloyNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Problem 3Document2 pagesProblem 3Vicente, Liza Mae C.No ratings yet

- Activity 1.4.A Preparation of Financial ReportsDocument1 pageActivity 1.4.A Preparation of Financial ReportsheyheyNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- Midterm Practice QuestionsDocument4 pagesMidterm Practice QuestionsGio RobakidzeNo ratings yet

- Bheverlynn Corporation Data SetDocument2 pagesBheverlynn Corporation Data SetDaisy Macuroy PurcaNo ratings yet

- Activity - Financial StatementsDocument5 pagesActivity - Financial StatementsPhilip Jhon BayoNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document12 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Shane KimNo ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- 15 Tips For Acctg StudyDocument36 pages15 Tips For Acctg StudyClyde RamosNo ratings yet

- Chapter Solutions I3Document15 pagesChapter Solutions I3Clyde RamosNo ratings yet

- Illustrative Problem 2.1-2Document3 pagesIllustrative Problem 2.1-2Chincel G. ANINo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (30)

- Accounting For Managers ExerciseDocument34 pagesAccounting For Managers ExerciseJessica BernaciliaNo ratings yet

- Assets Current AssetsDocument3 pagesAssets Current AssetsJere Mae MarananNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- IFA FR222 Intermediate Financial AccountingDocument22 pagesIFA FR222 Intermediate Financial Accountingsiamrahman994No ratings yet

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocument8 pagesAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- AFE5008-B Exam Type Question-2-Model AnswerDocument2 pagesAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerNo ratings yet

- ACC 203 Ch05 SolutionDocument11 pagesACC 203 Ch05 Solutionomaritani2005No ratings yet

- 20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Document3 pages20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Takudzwa LanceNo ratings yet

- TT10 QuestionDocument1 pageTT10 QuestionUyển Nhi TrầnNo ratings yet

- Bài 4 - CMBCTC2Document2 pagesBài 4 - CMBCTC2Phan Thị Mỹ DuyênNo ratings yet

- Relax CompanyDocument7 pagesRelax CompanyRegine CalipusanNo ratings yet

- 16 B 3 Supplemental - Problems - and - Solutions - CH - 1Document6 pages16 B 3 Supplemental - Problems - and - Solutions - CH - 1minajovanovicNo ratings yet

- Single StepDocument1 pageSingle StepMerza DyanNo ratings yet

- Description Income Expenses Assets LiabilitiesDocument12 pagesDescription Income Expenses Assets LiabilitiesNipuna Perera100% (1)

- TUGAS Topik Bab 5Document2 pagesTUGAS Topik Bab 5Imanuel ChrisNo ratings yet

- Cash Flow Statement and Financial Ratio AssignDocument4 pagesCash Flow Statement and Financial Ratio AssignChristian TanNo ratings yet

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDocument4 pagesQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNo ratings yet

- Trial Balance February 28, 20X1Document3 pagesTrial Balance February 28, 20X1Angelica MaeNo ratings yet

- Finacct+202 F03Document4 pagesFinacct+202 F03LijelNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- QUIZ 2-Mid.-Problems On Statement of Cash FlowsDocument2 pagesQUIZ 2-Mid.-Problems On Statement of Cash FlowsMonica GeronaNo ratings yet

- Kale and Kombucha: QuestionsDocument2 pagesKale and Kombucha: QuestionsmaddrajNo ratings yet

- Peso Starter Fund Product Highlight Sheet - 082321Document11 pagesPeso Starter Fund Product Highlight Sheet - 082321Frost ByteNo ratings yet

- Intergovernmental RelationshipDocument24 pagesIntergovernmental Relationshipsaaduabubakar9No ratings yet

- Customer Declaration Form Entity 1Document3 pagesCustomer Declaration Form Entity 1KjNo ratings yet

- Inheritance Tax1Document24 pagesInheritance Tax1Yoven VeerasamyNo ratings yet

- Balance Sheet Asset: Total Current AssetsDocument2 pagesBalance Sheet Asset: Total Current AssetsTrinh VũNo ratings yet

- Reference: Picker Et Al (2012) - Chapter 12 IAS 16 Property, Plant and EquipmentDocument25 pagesReference: Picker Et Al (2012) - Chapter 12 IAS 16 Property, Plant and EquipmentBrenden KapoNo ratings yet

- Tax InterviewDocument1 pageTax InterviewCHRISTIAN CAMILO VELILLA CEPEDANo ratings yet

- DrtftyDocument1 pageDrtftySri Ganesh ComputersNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- Application Form HEC Need Base Scholarship 2022-23Document6 pagesApplication Form HEC Need Base Scholarship 2022-23Hussnain RasheedNo ratings yet

- Lesson 6Document10 pagesLesson 6Jean LeysonNo ratings yet

- Year 0 1 2 3 Income StatementDocument6 pagesYear 0 1 2 3 Income StatementDaniyal AsifNo ratings yet

- Internship ProjectDocument40 pagesInternship ProjectAshutosh SinghNo ratings yet

- 5 6053042764831000707Document16 pages5 6053042764831000707SoNam ZaNgmoNo ratings yet

- Soal Compre 020418Document7 pagesSoal Compre 020418mayda nurul alamsariNo ratings yet

- Conceptual Framework and Accounting Standards (CFAS)Document5 pagesConceptual Framework and Accounting Standards (CFAS)Dummy GoogleNo ratings yet

- Bianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreDocument50 pagesBianca LTD Also Purchased Two Second-Hand Cars On 1 April 2022. Details AreJOJONo ratings yet

- UntitledDocument22 pagesUntitledKajal SahooNo ratings yet

- Principles of Managerial Finance Brief 8th Edition Zutter Solutions ManualDocument4 pagesPrinciples of Managerial Finance Brief 8th Edition Zutter Solutions ManualBrianCoxbtqeo100% (13)

- FAC511S - Financial Accounting 101-1st Opp-Nov 2017Document8 pagesFAC511S - Financial Accounting 101-1st Opp-Nov 2017Uno VeiiNo ratings yet

- Non-Resident Income Tax Return Guide 2020: Ir3NrgDocument35 pagesNon-Resident Income Tax Return Guide 2020: Ir3NrgAyman Al HasaarNo ratings yet

- The New Fiscal SociologyDocument16 pagesThe New Fiscal SociologyalmasdhakaNo ratings yet

- TAXATION LESSON NO 4 PART 1 Computation of Income Under RA8424 UP TO DE MINIMIS BENEFITSDocument13 pagesTAXATION LESSON NO 4 PART 1 Computation of Income Under RA8424 UP TO DE MINIMIS BENEFITSJhe CaNo ratings yet

- Acfrogbrsgwr97zglf2pin9itvktgg Alwadwnyiulutsjl6a0p70rrroomprbrbu83yieu6w8sxjlh4qqqxzff26fhu2ii Xo Oe4cfxgwcgu4hqfuuuq8fejhnlkkDocument1 pageAcfrogbrsgwr97zglf2pin9itvktgg Alwadwnyiulutsjl6a0p70rrroomprbrbu83yieu6w8sxjlh4qqqxzff26fhu2ii Xo Oe4cfxgwcgu4hqfuuuq8fejhnlkkLuchelina FranciscoNo ratings yet

- Cost Sheet Analysis of GCPL: Group 5Document8 pagesCost Sheet Analysis of GCPL: Group 5shreyansh naharNo ratings yet

- Ragasa 2Document1 pageRagasa 2Jam DiolazoNo ratings yet