Professional Documents

Culture Documents

Chapter 9

Chapter 9

Uploaded by

sweet shilaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 9

Chapter 9

Uploaded by

sweet shilaCopyright:

Available Formats

Chapter 9 (1, 2, 4, 6, 8, 11, 17)

Q1. What is the payback period for the following set of cash flows?

Year Cash Flow

0 -$8,300

1 2,100

2 3,000

3 2,300

4 1,700

Q2. An investment project provides cash inflows of $745 per year for eight years. What is the

project payback period if the initial cost is $1,700? What if the initial cost is $3,300? What if

it is $6,100?

Q4. An investment project has annual cash inflows of $2,800, $3,700, $5,100, and $4,300 for

the next four years, respectively, and a discount rate is 11 percent. What is the discounted

payback period for these cash flows if the initial cost is $5,200? What if the initial cost is

$6,400? What if it is $10,400?

Q6. You are trying to determine whether to expand your business by building a new

manufacturing plant. The plant has an installation cost of $13.5 million, which will be

deprecated straight-line to zero over its four-year life. If the plant has projected net income of

$1,570,000, $1,684, 200, $1,716,300 and $1,097,400 over these four years, respectively, what

is the project’s average accounting return (AAR)?

Q8. The firm has initial investment of $34,000 and the project yields $15,000 in year 1, $17,000

in year 2 and $13,000 in year 3, respectively. At a required return of 11 percent, should the

firm accept this project? What if the required return is 24 percent?

Q11. Consider the following cash flows for a project:

Year Cash Flow

0 -$15,400

1 7,300

2 9,100

3 5,900

What is the NVP at a discount rate of zero percent? What if the discount rate is 10 percent? If

it is 20 percent? If it is 30 percent?

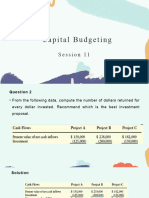

Q17. Consider the following two mutually exclusive projects:

Year Cash Flow (A) Cash Flow (B)

0 -$364,000 -$52,000

1 46,000 25,000

2 68,000 22,000

3 68,000 21,500

4 458,000 17,500

Whichever project you choose, if any, you require a return of 11 percent on your investment.

a. If you apply the payback criterion, which investment will you choose? Why?

b. If you apply the discounted payback criterion, which investment will you choose? Why?

c. If you apply the NVP criterion, which investment will you choose? Why?

d. If you apply the IRR criterion, which investment will you choose? Why?

e. If you apply the profitability index criterion, which investment will you choose? Why?

f. Based on your answers in (a) through (e), which project will you finally choose? Why?

You might also like

- Template CV UBSDocument1 pageTemplate CV UBSSilvio0% (1)

- Solutions - Capital BudgetingDocument6 pagesSolutions - Capital BudgetingFarzan Yahya Habib100% (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Case Solutions For Case Studies in Finance 7th Edition by BrunerDocument1 pageCase Solutions For Case Studies in Finance 7th Edition by BrunerbhaskkarNo ratings yet

- Worksheet No.1 GenMathDocument1 pageWorksheet No.1 GenMathMaria AngelaNo ratings yet

- Account StatementDocument12 pagesAccount Statementmeraj shaikhNo ratings yet

- Homework Week4Document6 pagesHomework Week4Baladashyalan Rajandran0% (1)

- Corporate FinanceDocument10 pagesCorporate FinancePuteri Nelissa MilaniNo ratings yet

- Strategic Management Term PaperDocument34 pagesStrategic Management Term PaperEhsanul Azim100% (2)

- Exercises Chap3Document3 pagesExercises Chap3Nguyễn Phương Nhi 12C2No ratings yet

- PPP2&SolutionDocument52 pagesPPP2&SolutionPrithvi BhushanNo ratings yet

- Exercise Chapter 3Document3 pagesExercise Chapter 3Phương ThảoNo ratings yet

- Handout 5 - 6 - Review Exercises - Questions in TextDocument6 pagesHandout 5 - 6 - Review Exercises - Questions in Text6kb4nm24vjNo ratings yet

- Ejercicios Semana 3 Sesión 1 B (Evaluación de Proyectos)Document3 pagesEjercicios Semana 3 Sesión 1 B (Evaluación de Proyectos)Alison Joyce Herrera Maldonado0% (1)

- Tutorial 4 - Investment AppraisalDocument3 pagesTutorial 4 - Investment AppraisalAmy LimnaNo ratings yet

- Tutorial Sheet For Engineering EconomicsDocument12 pagesTutorial Sheet For Engineering EconomicsTinashe ChikariNo ratings yet

- Corporate Finance Tutorial 3 - SolutionsDocument16 pagesCorporate Finance Tutorial 3 - Solutionsandy033003No ratings yet

- Practice 6 - QuestionsDocument4 pagesPractice 6 - QuestionsantialonsoNo ratings yet

- Tutorial Questions - Capital Budgeting 2023-1Document16 pagesTutorial Questions - Capital Budgeting 2023-1Richie Ric JuniorNo ratings yet

- CNC Problemset7Document2 pagesCNC Problemset7jibberish yoNo ratings yet

- Homework4 With Ans JDocument18 pagesHomework4 With Ans JBarakaNo ratings yet

- Problem Set4 Ch09 and Ch10-SolutionsDocument6 pagesProblem Set4 Ch09 and Ch10-SolutionszainebkhanNo ratings yet

- Practice Questions May 2018Document11 pagesPractice Questions May 2018Minnie.NNo ratings yet

- Problem Set: Capital Budgeting: RJW 4 Ed. Chapter 6Document1 pageProblem Set: Capital Budgeting: RJW 4 Ed. Chapter 6alan david melchor lopezNo ratings yet

- Cap Budg QuestionsDocument6 pagesCap Budg QuestionsSikandar AsifNo ratings yet

- Tutorial Week 11 QuestionsDocument2 pagesTutorial Week 11 QuestionsLogan zhengNo ratings yet

- Financial Management Session 11Document17 pagesFinancial Management Session 11vaidehirajput03No ratings yet

- ACCT 2200 - Chapter 11 P2 - With SolutionsDocument26 pagesACCT 2200 - Chapter 11 P2 - With Solutionsafsdasdf3qf4341f4asDNo ratings yet

- Problems & Solns - Capital Budgeting - SFM - Pooja GuptaDocument6 pagesProblems & Solns - Capital Budgeting - SFM - Pooja Guptaritesh_gandhi_70% (1)

- Financial Management Tutorial 2 AnswersDocument6 pagesFinancial Management Tutorial 2 AnswersDelfPDF100% (2)

- Practice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Document3 pagesPractice Question For Capital Budgeting: Ans: NPV (P) Rs. 5381, NPV (Q) Rs. 3814Sumit Kumar SahooNo ratings yet

- FM Questions MSDocument7 pagesFM Questions MSUdayan KarnatakNo ratings yet

- Present Worth Analysis: Engineering Economy With AccountingDocument21 pagesPresent Worth Analysis: Engineering Economy With AccountingCamilo Dela Cruz Jr.No ratings yet

- ch6 IM 1EDocument20 pagesch6 IM 1EJoan MaryNo ratings yet

- Documents - MX - FM Questions MsDocument7 pagesDocuments - MX - FM Questions MsgopalNo ratings yet

- Booklet Exercises 2Document7 pagesBooklet Exercises 2Talhaa MaqsoodNo ratings yet

- Man Acc 1Document4 pagesMan Acc 1KathleneGabrielAzasHaoNo ratings yet

- Time Value of Money and Net Present ValueDocument9 pagesTime Value of Money and Net Present ValueYashrajsing LuckkanaNo ratings yet

- Sample Problems-Capital Budgeting-Part 1: Expected Net Cash Flows Year Project L Project SDocument7 pagesSample Problems-Capital Budgeting-Part 1: Expected Net Cash Flows Year Project L Project SYasir ShaikhNo ratings yet

- Investment Decision CriteriaDocument71 pagesInvestment Decision CriteriaBitu GuptaNo ratings yet

- Capital Budgeting QuestionsDocument3 pagesCapital Budgeting QuestionsTAYYABA AMJAD L1F16MBAM0221100% (1)

- FM Second AssignmentDocument3 pagesFM Second AssignmentpushmbaNo ratings yet

- DSM 9Document5 pagesDSM 9SoahNo ratings yet

- sFikv8tLO3DuTOB3I8bY 4762Document2 pagessFikv8tLO3DuTOB3I8bY 4762dipusharma4200No ratings yet

- R21 Capital Budgeting Q Bank PDFDocument10 pagesR21 Capital Budgeting Q Bank PDFZidane KhanNo ratings yet

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- Feasibility Assignment 1&2 AnswersDocument12 pagesFeasibility Assignment 1&2 AnswersSouliman MuhammadNo ratings yet

- Management of Cost and RiskDocument39 pagesManagement of Cost and RisktechnicalvijayNo ratings yet

- Tutorial 9 AnswersDocument5 pagesTutorial 9 AnswersPhụng KimNo ratings yet

- Investment Appraisal Techniques 2Document24 pagesInvestment Appraisal Techniques 2Jul 480wesh100% (1)

- Ques On Capital BudgetingDocument5 pagesQues On Capital BudgetingMonika KauraNo ratings yet

- Capital Budgeting Techniques PDFDocument21 pagesCapital Budgeting Techniques PDFAvinav SrivastavaNo ratings yet

- QuesDocument5 pagesQuesMonika KauraNo ratings yet

- Brealey6ce Ch08 Final2Document54 pagesBrealey6ce Ch08 Final2Derron WhittleNo ratings yet

- Discounted Cash Flow - 082755Document3 pagesDiscounted Cash Flow - 082755EuniceNo ratings yet

- Tugas Individu I MKB Capital BudgetingDocument4 pagesTugas Individu I MKB Capital BudgetingAndryo RachmatNo ratings yet

- Year 0 Year 1 Year 2 Year 3 Year 4 Project PQR (60,000) 25,000 10,000 25,000 30,000 Project XYZ (90,000) 40,000 25,000 25,000 25,000Document1 pageYear 0 Year 1 Year 2 Year 3 Year 4 Project PQR (60,000) 25,000 10,000 25,000 30,000 Project XYZ (90,000) 40,000 25,000 25,000 25,000Sudhanshu Kumar SinghNo ratings yet

- Final Exam Review Part 1Document4 pagesFinal Exam Review Part 1Savan ParmarNo ratings yet

- 05 - Investment Decision RulesDocument74 pages05 - Investment Decision RulesĐỗ Kim NgânNo ratings yet

- Investment Appraisal AccurateDocument53 pagesInvestment Appraisal AccurateZachary HaddockNo ratings yet

- SolutionDocument6 pagesSolutionaskdgasNo ratings yet

- Investment Appraisal: Mas Educational CentreDocument7 pagesInvestment Appraisal: Mas Educational CentreSaad Khan YTNo ratings yet

- Practice Question On Capital BudgetingDocument4 pagesPractice Question On Capital BudgetingTekNo ratings yet

- Answers To Warm-Up Exercises: AnswerDocument21 pagesAnswers To Warm-Up Exercises: AnswerMeyzla Ativa HuslikNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Role of Indian Microfinance Institutions in Financial InclusionsDocument7 pagesRole of Indian Microfinance Institutions in Financial InclusionsIJRASETPublicationsNo ratings yet

- ICICI Marketing ReportDocument75 pagesICICI Marketing ReportMansi MeenaNo ratings yet

- Internship Report: Stamford University BangladeshDocument103 pagesInternship Report: Stamford University BangladeshLakshmi NairNo ratings yet

- Celesta Terms and ConditionsDocument6 pagesCelesta Terms and ConditionsLUCtech win10No ratings yet

- Comparison of Cryptocurrency Regulations in Kenya & Other JurisdictionsDocument23 pagesComparison of Cryptocurrency Regulations in Kenya & Other JurisdictionsSancho SanchezNo ratings yet

- Executive Summary: MTBL Tries To Introduce International Standard Products and Services To Attract The CustomersDocument43 pagesExecutive Summary: MTBL Tries To Introduce International Standard Products and Services To Attract The CustomersTabassum Iffat TannieNo ratings yet

- Raihan FarafieeDocument53 pagesRaihan FarafieeNiaz MorshedNo ratings yet

- Chapter 6 2Document7 pagesChapter 6 2ArkokhanNo ratings yet

- Islamic Banking Liquidity Management in Bangladesh SukukDocument10 pagesIslamic Banking Liquidity Management in Bangladesh SukukInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Internet Banking Sbi TrainingDocument58 pagesInternet Banking Sbi Trainingnarens385No ratings yet

- PM Ch-7 - Project FinancingDocument27 pagesPM Ch-7 - Project FinancingWondmageneUrgessaNo ratings yet

- Finman Module 5 8 ReviewerDocument22 pagesFinman Module 5 8 ReviewerChoco ButternutNo ratings yet

- Cambridge IGCSE: Accounting 0452/13Document12 pagesCambridge IGCSE: Accounting 0452/13Shannon LimNo ratings yet

- Outdoor Training Program For Retail Banking - ReportDocument18 pagesOutdoor Training Program For Retail Banking - ReportBibek ShresthaNo ratings yet

- Effect of Microfinance On Poverty Reduction A Critical Scrutiny of Theoretical LiteratureDocument18 pagesEffect of Microfinance On Poverty Reduction A Critical Scrutiny of Theoretical LiteratureLealem tayeworkNo ratings yet

- Syllabus AD312 - Spring23Document3 pagesSyllabus AD312 - Spring23Ekin MadenNo ratings yet

- Advanced Banking Law May 2010 Main PaperDocument3 pagesAdvanced Banking Law May 2010 Main PaperBasilio MaliwangaNo ratings yet

- Monthly Current Affairs 2023 For July 26Document30 pagesMonthly Current Affairs 2023 For July 26vivekkushwah100No ratings yet

- Citibank - WikipediaDocument10 pagesCitibank - Wikipediasharin kulalNo ratings yet

- Local TransferDocument1 pageLocal TransferمحمدNo ratings yet

- A Study On Cashless Economy and Its ImpactDocument34 pagesA Study On Cashless Economy and Its ImpactTehreem RehmanNo ratings yet

- Chapter 10 NOTES 2021Document8 pagesChapter 10 NOTES 2021giannimizrahi5No ratings yet

- HaseenaDocument4 pagesHaseenaRema RajagopalNo ratings yet

- Gmail - Attention To - Firaol Wondesen BulbulaDocument2 pagesGmail - Attention To - Firaol Wondesen BulbulaFira tube100% (1)

- Ac - Enyichukwu Precious Miracle - December, 2020 - 502578300 - FullstmtDocument9 pagesAc - Enyichukwu Precious Miracle - December, 2020 - 502578300 - FullstmtPreciousMimiNo ratings yet