Professional Documents

Culture Documents

Practice Problems, CH 11 Solution

Practice Problems, CH 11 Solution

Uploaded by

scridCopyright:

Available Formats

You might also like

- Book Value Per Share: RequiredDocument19 pagesBook Value Per Share: RequiredLouise67% (12)

- Tugas Ch. 15 - Week 10Document9 pagesTugas Ch. 15 - Week 10Lafidan Rizata FebiolaNo ratings yet

- Problems Chapter 11Document29 pagesProblems Chapter 11Incia100% (1)

- Preferred Stock Issuance TutorialDocument2 pagesPreferred Stock Issuance TutorialSalma HazemNo ratings yet

- Muet 2006 To 2019 Past PapersDocument148 pagesMuet 2006 To 2019 Past PapersUmaid Ali Keerio100% (2)

- Answers 11Document6 pagesAnswers 11Nguyễn Ngọc ÁnhNo ratings yet

- واجب متوسطه 2 مسائل الواجب الثالثDocument5 pagesواجب متوسطه 2 مسائل الواجب الثالثmode.xp.jamelNo ratings yet

- Cercado, Geran Kearn L. ACC 221 2:15 - 4:15PM BSA-2 P.T - 3.3 Shareholder 'S EquityDocument3 pagesCercado, Geran Kearn L. ACC 221 2:15 - 4:15PM BSA-2 P.T - 3.3 Shareholder 'S EquityKearn CercadoNo ratings yet

- Jawaban Review Uts Inter 2 - FixDocument8 pagesJawaban Review Uts Inter 2 - FixCaratmelonaNo ratings yet

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- FA&R-II Assign 3Document2 pagesFA&R-II Assign 3Abdul RafayNo ratings yet

- ACT1106-Midterm Quiz No. 3 With AnswerDocument6 pagesACT1106-Midterm Quiz No. 3 With AnswerPj Dela VegaNo ratings yet

- Answer For Exercises Online Learning 1Document4 pagesAnswer For Exercises Online Learning 1Xiao Yun YapNo ratings yet

- Diluted EPS TutorialDocument3 pagesDiluted EPS TutorialRawan YasserNo ratings yet

- Chapter 11 DrillsDocument6 pagesChapter 11 DrillsBaderNo ratings yet

- 06 Activity 1-InterAcct2Document2 pages06 Activity 1-InterAcct2Jomari EscarillaNo ratings yet

- Sol. Man. - Chapter 11 She 2Document14 pagesSol. Man. - Chapter 11 She 2finn mertensNo ratings yet

- Chapter 11 Shareholders' 2Document13 pagesChapter 11 Shareholders' 2Thalia Rhine AberteNo ratings yet

- Audit of Owner's EquityDocument9 pagesAudit of Owner's EquityHira IdaceiNo ratings yet

- Lets Analyze Bvps and Eps ParconDocument9 pagesLets Analyze Bvps and Eps ParconJeric TorionNo ratings yet

- Midterm Examination AnswersDocument3 pagesMidterm Examination AnswersMilani Joy LazoNo ratings yet

- Course:: Financial AccountingDocument4 pagesCourse:: Financial AccountingNudrat ZaraNo ratings yet

- Sol.-Man. Chapter-14 Bvps 2021Document9 pagesSol.-Man. Chapter-14 Bvps 2021Jean Mira AribalNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For CorporationsDocument15 pagesSol. Man. - Chapter 15 - Accounting For Corporationspehik100% (1)

- Lesson 5x Practice Exercises SolutionsDocument8 pagesLesson 5x Practice Exercises SolutionsBEN CLADONo ratings yet

- Intermediate Accounting II Chapter 15Document3 pagesIntermediate Accounting II Chapter 15izza zahratunnisa100% (1)

- CORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 CompleteDocument8 pagesCORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 Completeruth san joseNo ratings yet

- 2010 08 21 - 023852 - E15 18Document3 pages2010 08 21 - 023852 - E15 18Lương Vân TrangNo ratings yet

- Acc108 Gen 008 p3 Questions and AnswersDocument26 pagesAcc108 Gen 008 p3 Questions and AnswersdgdeguzmanNo ratings yet

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument14 pagesSol. Man. - Chapter 16 - Accounting For DividendscpawannabeNo ratings yet

- Chapter 9 Multiple ChoicesDocument5 pagesChapter 9 Multiple Choicesshiroe raabuNo ratings yet

- Exercises Module 9 For UploadDocument14 pagesExercises Module 9 For UploadjpNo ratings yet

- Assignment 3Document3 pagesAssignment 3Thu YếnNo ratings yet

- DocumentDocument3 pagesDocumentcryNo ratings yet

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDocument23 pagesProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonNo ratings yet

- AKL ch10Document4 pagesAKL ch10Farrell DmNo ratings yet

- Shizfanch 16Document5 pagesShizfanch 16Angel CruzNo ratings yet

- Chapter 8Document10 pagesChapter 8Vip BigbangNo ratings yet

- Advance Financial Assignment #2Document10 pagesAdvance Financial Assignment #2peterNo ratings yet

- Quiz Chapter-15 Eps 2021-1Document4 pagesQuiz Chapter-15 Eps 2021-1Dale JimenoNo ratings yet

- PMBA8020Module 8 SolutionsDocument7 pagesPMBA8020Module 8 SolutionskrunalparikhNo ratings yet

- Tugas Manajemen Keuangan IIDocument8 pagesTugas Manajemen Keuangan IIL RakkimanNo ratings yet

- Sol. Man. - Chapter 14 - BVPS - 2021Document11 pagesSol. Man. - Chapter 14 - BVPS - 2021Crystal Rose TenerifeNo ratings yet

- CHAPTER 16 - ACCOUNTING FOR DIVIDENDS Prob 2-5Document16 pagesCHAPTER 16 - ACCOUNTING FOR DIVIDENDS Prob 2-5ruth san joseNo ratings yet

- Group 6 PDFDocument14 pagesGroup 6 PDFramuxeNo ratings yet

- Equity SHE Transactions MARPDocument2 pagesEquity SHE Transactions MARPKrisha Joselle MilloNo ratings yet

- CFA_L2_2024_Volume3Document114 pagesCFA_L2_2024_Volume3andrewandrew123qweNo ratings yet

- Quiz 3solutionDocument5 pagesQuiz 3solutionAhsan IqbalNo ratings yet

- Problem 4-7 - BVPS Lets Analyze - Pabres - ACC221Document3 pagesProblem 4-7 - BVPS Lets Analyze - Pabres - ACC221Jeric TorionNo ratings yet

- Financial Statements and Cash Flow: Solutions To Questions and ProblemsDocument10 pagesFinancial Statements and Cash Flow: Solutions To Questions and ProblemsTing-An KuoNo ratings yet

- Solutions To End-of-Chapter Three ProblemsDocument13 pagesSolutions To End-of-Chapter Three ProblemsAn HoàiNo ratings yet

- Quiz - Chapter 14 - Book Value Per Share - 2021Document5 pagesQuiz - Chapter 14 - Book Value Per Share - 2021Krezza Amor Maban100% (1)

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument16 pagesSol. Man. - Chapter 16 - Accounting For DividendspehikNo ratings yet

- Anggita Awidiya 041911333129 AKL 1 Pertemuan 13Document4 pagesAnggita Awidiya 041911333129 AKL 1 Pertemuan 13anggitaawidiyaNo ratings yet

- MGT 225 Intermediate Accounting IIDocument6 pagesMGT 225 Intermediate Accounting IIchetna sharmaNo ratings yet

- FIN-AW4 AnswersDocument14 pagesFIN-AW4 AnswersRameesh DeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Practice Problems, CH 12Document6 pagesPractice Problems, CH 12scridNo ratings yet

- Practice Problems, CH 12 SolutionDocument7 pagesPractice Problems, CH 12 SolutionscridNo ratings yet

- Practice Problems, CH 9 10 (MCQ)Document5 pagesPractice Problems, CH 9 10 (MCQ)scridNo ratings yet

- Practice Problems, CH 5 SolutionDocument6 pagesPractice Problems, CH 5 SolutionscridNo ratings yet

- Practice Problems, CH 9 10 SolutionDocument6 pagesPractice Problems, CH 9 10 SolutionscridNo ratings yet

- Philippine Statistics Authority: Date (2021)Document9 pagesPhilippine Statistics Authority: Date (2021)Nah ReeNo ratings yet

- Action ResearchDocument10 pagesAction ResearchNacion EstefanieNo ratings yet

- VIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFDocument83 pagesVIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFOsamaAliMoussaNo ratings yet

- 5054 s16 Ms 41 PDFDocument3 pages5054 s16 Ms 41 PDFKritish RamnauthNo ratings yet

- DX-790-960-65-16.5i-M Model: A79451600v02: Antenna SpecificationsDocument2 pagesDX-790-960-65-16.5i-M Model: A79451600v02: Antenna SpecificationsakiselNo ratings yet

- Technical Drawings of PlasticwareDocument69 pagesTechnical Drawings of PlasticwareGuldu KhanNo ratings yet

- UntitledDocument5 pagesUntitledGerard Phoenix MaximoNo ratings yet

- Lesson Plan Sience - Body PartsDocument4 pagesLesson Plan Sience - Body Partsapi-307376252No ratings yet

- Piping Stress AnalysisDocument10 pagesPiping Stress AnalysisM Alim Ur Rahman100% (1)

- Borneo Sporenburg Final-Ilovepdf-CompressedDocument55 pagesBorneo Sporenburg Final-Ilovepdf-Compressedapi-417024359No ratings yet

- Vision PT 365 Culture 2021 (WWW - Upscpdf.com)Document51 pagesVision PT 365 Culture 2021 (WWW - Upscpdf.com)Swati YadavNo ratings yet

- Oracle Read STATSPACK OutputDocument43 pagesOracle Read STATSPACK OutputRajNo ratings yet

- ADM Marketing Module 4 Lesson 4 Promotional ToolsDocument20 pagesADM Marketing Module 4 Lesson 4 Promotional ToolsMariel Santos75% (8)

- WhatsApp v. Union of India Filing VersionDocument224 pagesWhatsApp v. Union of India Filing VersionVinayNo ratings yet

- Unit Iv Secondary and Auxilary Motions 12Document3 pagesUnit Iv Secondary and Auxilary Motions 129043785763No ratings yet

- OpenFOAM编程指南Document100 pagesOpenFOAM编程指南Feishi XuNo ratings yet

- Gcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Document5 pagesGcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Daniel McDermottNo ratings yet

- (Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodDocument21 pages(Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodSilvia Devi Eka PutriNo ratings yet

- Hot Cool 3 2012Document32 pagesHot Cool 3 2012thermosol5416No ratings yet

- Title of Project:-Military Hospital Report Management SystemDocument4 pagesTitle of Project:-Military Hospital Report Management SystemAkbar AliNo ratings yet

- D5F-F5 (Draft Aug2021)Document6 pagesD5F-F5 (Draft Aug2021)Lame GamerNo ratings yet

- FACTORY IO-Sorting of Boxes (1) / PLC - 1 (CPU 1212C AC/DC/Rly) / Pro Gram BlocksDocument3 pagesFACTORY IO-Sorting of Boxes (1) / PLC - 1 (CPU 1212C AC/DC/Rly) / Pro Gram BlocksHasaan HussainNo ratings yet

- Quick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedDocument20 pagesQuick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedРоманКочневNo ratings yet

- 10 Best JobsitesDocument14 pages10 Best JobsitesHemansu PathakNo ratings yet

- BNVD Eaufrance Metadonnees Vente 20230130Document16 pagesBNVD Eaufrance Metadonnees Vente 20230130moussaouiNo ratings yet

- Experimental and Numerical Modeling of Cavitation ErosionDocument11 pagesExperimental and Numerical Modeling of Cavitation ErosionКонстантин ФинниковNo ratings yet

- SPB ClientDocument4 pagesSPB ClientRKNo ratings yet

- HD Consumer Behavior AssignmentDocument9 pagesHD Consumer Behavior AssignmentAishwaryaNo ratings yet

- Английская грамматика в тестах - РомановаDocument152 pagesАнглийская грамматика в тестах - РомановаLi FeNo ratings yet

Practice Problems, CH 11 Solution

Practice Problems, CH 11 Solution

Uploaded by

scridOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Practice Problems, CH 11 Solution

Practice Problems, CH 11 Solution

Uploaded by

scridCopyright:

Available Formats

Problem 1

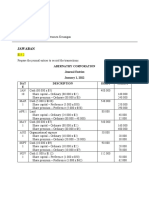

(a) 1. Dividends Payable

(Preferred - 2,000 X $8) 16,000

Dividends Payable

(Common - 25,000 X $3) 75,000

Cash 91,000

2. Common Shares 14,800

Contributed Surplus 114,700

Cash (3,700 X $35) 129,500

($100,000 / 25,000 X 3,700 = $14,800)

3. Cash (1,000 X $105) 105,000

Preferred Shares 105,000

4. Retained Earnings 95,850

Common Stock Dividends

Stock dividend to be issued 95,850

[(25,000 – 3,700) X 10% = 2,130 X $45]

5. Common Stock Dividends

Stock dividend to be issued 95,850

Common Shares 95,850

6. Retained Earnings 70,860

Dividends Payable 24,000

(Preferred - 3,000 X $8)

Dividends Payable 46,860

[(Common - 25,000 – 3,700 + 2,130) X $2]

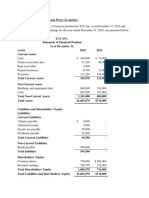

(b) ABC Corp.

Statement of Financial Position (Partial)

At December 31, 2015

Shareholders’ Equity

Share capital

Preferred shares $305,000

Common shares 181,050

Total share capital 486,050

Contributed surplus 40,300

Total contributed capital 526,350

Retained earnings 533,290

Total shareholders’ equity $1,059,640

Calculations:

Preferred shares: $200,000 + $105,000 = $305,000

Common shares: $100,000 – $14,800 + $95,850 = $181,050

Contributed surplus: $155,000 – $114,700 = $40,300

Retained earnings: $250,000 – $95,850 – $70,860 + $450,000 = $533,290

(c) (2 Marks)

Return on Equity: = Net earnings / Av Shareholders’ Equity

= [450,000 / ((705,000 + 1,059,640)/2)] = 0.51 = 51%

Earnings per share for 2015:

Net earnings – preferred dividends

Average number of common shares outstanding

($450,000 – $24,000)

= $17.59

((25,000 + 23,430)/2)

Management seems effective in utilizing shareholders’ equity: for every dollar invested by

shareholders, management is able to create 51 cents in earnings.

EPS ratio shows a return of $17.59 per common share outstanding: this seems like an excellent

return per share, of course depending on how this compares to ABC’s competitors.

You might also like

- Book Value Per Share: RequiredDocument19 pagesBook Value Per Share: RequiredLouise67% (12)

- Tugas Ch. 15 - Week 10Document9 pagesTugas Ch. 15 - Week 10Lafidan Rizata FebiolaNo ratings yet

- Problems Chapter 11Document29 pagesProblems Chapter 11Incia100% (1)

- Preferred Stock Issuance TutorialDocument2 pagesPreferred Stock Issuance TutorialSalma HazemNo ratings yet

- Muet 2006 To 2019 Past PapersDocument148 pagesMuet 2006 To 2019 Past PapersUmaid Ali Keerio100% (2)

- Answers 11Document6 pagesAnswers 11Nguyễn Ngọc ÁnhNo ratings yet

- واجب متوسطه 2 مسائل الواجب الثالثDocument5 pagesواجب متوسطه 2 مسائل الواجب الثالثmode.xp.jamelNo ratings yet

- Cercado, Geran Kearn L. ACC 221 2:15 - 4:15PM BSA-2 P.T - 3.3 Shareholder 'S EquityDocument3 pagesCercado, Geran Kearn L. ACC 221 2:15 - 4:15PM BSA-2 P.T - 3.3 Shareholder 'S EquityKearn CercadoNo ratings yet

- Jawaban Review Uts Inter 2 - FixDocument8 pagesJawaban Review Uts Inter 2 - FixCaratmelonaNo ratings yet

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- FA&R-II Assign 3Document2 pagesFA&R-II Assign 3Abdul RafayNo ratings yet

- ACT1106-Midterm Quiz No. 3 With AnswerDocument6 pagesACT1106-Midterm Quiz No. 3 With AnswerPj Dela VegaNo ratings yet

- Answer For Exercises Online Learning 1Document4 pagesAnswer For Exercises Online Learning 1Xiao Yun YapNo ratings yet

- Diluted EPS TutorialDocument3 pagesDiluted EPS TutorialRawan YasserNo ratings yet

- Chapter 11 DrillsDocument6 pagesChapter 11 DrillsBaderNo ratings yet

- 06 Activity 1-InterAcct2Document2 pages06 Activity 1-InterAcct2Jomari EscarillaNo ratings yet

- Sol. Man. - Chapter 11 She 2Document14 pagesSol. Man. - Chapter 11 She 2finn mertensNo ratings yet

- Chapter 11 Shareholders' 2Document13 pagesChapter 11 Shareholders' 2Thalia Rhine AberteNo ratings yet

- Audit of Owner's EquityDocument9 pagesAudit of Owner's EquityHira IdaceiNo ratings yet

- Lets Analyze Bvps and Eps ParconDocument9 pagesLets Analyze Bvps and Eps ParconJeric TorionNo ratings yet

- Midterm Examination AnswersDocument3 pagesMidterm Examination AnswersMilani Joy LazoNo ratings yet

- Course:: Financial AccountingDocument4 pagesCourse:: Financial AccountingNudrat ZaraNo ratings yet

- Sol.-Man. Chapter-14 Bvps 2021Document9 pagesSol.-Man. Chapter-14 Bvps 2021Jean Mira AribalNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For CorporationsDocument15 pagesSol. Man. - Chapter 15 - Accounting For Corporationspehik100% (1)

- Lesson 5x Practice Exercises SolutionsDocument8 pagesLesson 5x Practice Exercises SolutionsBEN CLADONo ratings yet

- Intermediate Accounting II Chapter 15Document3 pagesIntermediate Accounting II Chapter 15izza zahratunnisa100% (1)

- CORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 CompleteDocument8 pagesCORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 Completeruth san joseNo ratings yet

- 2010 08 21 - 023852 - E15 18Document3 pages2010 08 21 - 023852 - E15 18Lương Vân TrangNo ratings yet

- Acc108 Gen 008 p3 Questions and AnswersDocument26 pagesAcc108 Gen 008 p3 Questions and AnswersdgdeguzmanNo ratings yet

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument14 pagesSol. Man. - Chapter 16 - Accounting For DividendscpawannabeNo ratings yet

- Chapter 9 Multiple ChoicesDocument5 pagesChapter 9 Multiple Choicesshiroe raabuNo ratings yet

- Exercises Module 9 For UploadDocument14 pagesExercises Module 9 For UploadjpNo ratings yet

- Assignment 3Document3 pagesAssignment 3Thu YếnNo ratings yet

- DocumentDocument3 pagesDocumentcryNo ratings yet

- Problem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalDocument23 pagesProblem 1 Summary 35 Problem 1 Solution 21 Problem 2 Jes 60 Problem 2 Worksheet 116 Grand TotalAngelica DizonNo ratings yet

- AKL ch10Document4 pagesAKL ch10Farrell DmNo ratings yet

- Shizfanch 16Document5 pagesShizfanch 16Angel CruzNo ratings yet

- Chapter 8Document10 pagesChapter 8Vip BigbangNo ratings yet

- Advance Financial Assignment #2Document10 pagesAdvance Financial Assignment #2peterNo ratings yet

- Quiz Chapter-15 Eps 2021-1Document4 pagesQuiz Chapter-15 Eps 2021-1Dale JimenoNo ratings yet

- PMBA8020Module 8 SolutionsDocument7 pagesPMBA8020Module 8 SolutionskrunalparikhNo ratings yet

- Tugas Manajemen Keuangan IIDocument8 pagesTugas Manajemen Keuangan IIL RakkimanNo ratings yet

- Sol. Man. - Chapter 14 - BVPS - 2021Document11 pagesSol. Man. - Chapter 14 - BVPS - 2021Crystal Rose TenerifeNo ratings yet

- CHAPTER 16 - ACCOUNTING FOR DIVIDENDS Prob 2-5Document16 pagesCHAPTER 16 - ACCOUNTING FOR DIVIDENDS Prob 2-5ruth san joseNo ratings yet

- Group 6 PDFDocument14 pagesGroup 6 PDFramuxeNo ratings yet

- Equity SHE Transactions MARPDocument2 pagesEquity SHE Transactions MARPKrisha Joselle MilloNo ratings yet

- CFA_L2_2024_Volume3Document114 pagesCFA_L2_2024_Volume3andrewandrew123qweNo ratings yet

- Quiz 3solutionDocument5 pagesQuiz 3solutionAhsan IqbalNo ratings yet

- Problem 4-7 - BVPS Lets Analyze - Pabres - ACC221Document3 pagesProblem 4-7 - BVPS Lets Analyze - Pabres - ACC221Jeric TorionNo ratings yet

- Financial Statements and Cash Flow: Solutions To Questions and ProblemsDocument10 pagesFinancial Statements and Cash Flow: Solutions To Questions and ProblemsTing-An KuoNo ratings yet

- Solutions To End-of-Chapter Three ProblemsDocument13 pagesSolutions To End-of-Chapter Three ProblemsAn HoàiNo ratings yet

- Quiz - Chapter 14 - Book Value Per Share - 2021Document5 pagesQuiz - Chapter 14 - Book Value Per Share - 2021Krezza Amor Maban100% (1)

- Sol. Man. - Chapter 16 - Accounting For DividendsDocument16 pagesSol. Man. - Chapter 16 - Accounting For DividendspehikNo ratings yet

- Anggita Awidiya 041911333129 AKL 1 Pertemuan 13Document4 pagesAnggita Awidiya 041911333129 AKL 1 Pertemuan 13anggitaawidiyaNo ratings yet

- MGT 225 Intermediate Accounting IIDocument6 pagesMGT 225 Intermediate Accounting IIchetna sharmaNo ratings yet

- FIN-AW4 AnswersDocument14 pagesFIN-AW4 AnswersRameesh DeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Practice Problems, CH 12Document6 pagesPractice Problems, CH 12scridNo ratings yet

- Practice Problems, CH 12 SolutionDocument7 pagesPractice Problems, CH 12 SolutionscridNo ratings yet

- Practice Problems, CH 9 10 (MCQ)Document5 pagesPractice Problems, CH 9 10 (MCQ)scridNo ratings yet

- Practice Problems, CH 5 SolutionDocument6 pagesPractice Problems, CH 5 SolutionscridNo ratings yet

- Practice Problems, CH 9 10 SolutionDocument6 pagesPractice Problems, CH 9 10 SolutionscridNo ratings yet

- Philippine Statistics Authority: Date (2021)Document9 pagesPhilippine Statistics Authority: Date (2021)Nah ReeNo ratings yet

- Action ResearchDocument10 pagesAction ResearchNacion EstefanieNo ratings yet

- VIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFDocument83 pagesVIETNAM. PROCESSING OF AROMA CHEMICALS AND FRAGRANCE MATERIALS. TECHNICAL REPORT - AROMA CHEMICALS AND PERFUME BLENDING (20598.en) PDFOsamaAliMoussaNo ratings yet

- 5054 s16 Ms 41 PDFDocument3 pages5054 s16 Ms 41 PDFKritish RamnauthNo ratings yet

- DX-790-960-65-16.5i-M Model: A79451600v02: Antenna SpecificationsDocument2 pagesDX-790-960-65-16.5i-M Model: A79451600v02: Antenna SpecificationsakiselNo ratings yet

- Technical Drawings of PlasticwareDocument69 pagesTechnical Drawings of PlasticwareGuldu KhanNo ratings yet

- UntitledDocument5 pagesUntitledGerard Phoenix MaximoNo ratings yet

- Lesson Plan Sience - Body PartsDocument4 pagesLesson Plan Sience - Body Partsapi-307376252No ratings yet

- Piping Stress AnalysisDocument10 pagesPiping Stress AnalysisM Alim Ur Rahman100% (1)

- Borneo Sporenburg Final-Ilovepdf-CompressedDocument55 pagesBorneo Sporenburg Final-Ilovepdf-Compressedapi-417024359No ratings yet

- Vision PT 365 Culture 2021 (WWW - Upscpdf.com)Document51 pagesVision PT 365 Culture 2021 (WWW - Upscpdf.com)Swati YadavNo ratings yet

- Oracle Read STATSPACK OutputDocument43 pagesOracle Read STATSPACK OutputRajNo ratings yet

- ADM Marketing Module 4 Lesson 4 Promotional ToolsDocument20 pagesADM Marketing Module 4 Lesson 4 Promotional ToolsMariel Santos75% (8)

- WhatsApp v. Union of India Filing VersionDocument224 pagesWhatsApp v. Union of India Filing VersionVinayNo ratings yet

- Unit Iv Secondary and Auxilary Motions 12Document3 pagesUnit Iv Secondary and Auxilary Motions 129043785763No ratings yet

- OpenFOAM编程指南Document100 pagesOpenFOAM编程指南Feishi XuNo ratings yet

- Gcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Document5 pagesGcrouch@wsu - Edu Rmancini@wsu - Edu Andreakl@wsu - Edu: Groups/chem.345Daniel McDermottNo ratings yet

- (Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodDocument21 pages(Shuangzhu Jia Et Al 2020) Study On The Preparing and Mechanism of Chitosan-Based Nanomesoporous Carbons by Hydrothermal MethodSilvia Devi Eka PutriNo ratings yet

- Hot Cool 3 2012Document32 pagesHot Cool 3 2012thermosol5416No ratings yet

- Title of Project:-Military Hospital Report Management SystemDocument4 pagesTitle of Project:-Military Hospital Report Management SystemAkbar AliNo ratings yet

- D5F-F5 (Draft Aug2021)Document6 pagesD5F-F5 (Draft Aug2021)Lame GamerNo ratings yet

- FACTORY IO-Sorting of Boxes (1) / PLC - 1 (CPU 1212C AC/DC/Rly) / Pro Gram BlocksDocument3 pagesFACTORY IO-Sorting of Boxes (1) / PLC - 1 (CPU 1212C AC/DC/Rly) / Pro Gram BlocksHasaan HussainNo ratings yet

- Quick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedDocument20 pagesQuick Reference Guide: 65 Degree 1800 MHZ Dual Polarized 90 Degree 1800 MHZ Dual PolarizedРоманКочневNo ratings yet

- 10 Best JobsitesDocument14 pages10 Best JobsitesHemansu PathakNo ratings yet

- BNVD Eaufrance Metadonnees Vente 20230130Document16 pagesBNVD Eaufrance Metadonnees Vente 20230130moussaouiNo ratings yet

- Experimental and Numerical Modeling of Cavitation ErosionDocument11 pagesExperimental and Numerical Modeling of Cavitation ErosionКонстантин ФинниковNo ratings yet

- SPB ClientDocument4 pagesSPB ClientRKNo ratings yet

- HD Consumer Behavior AssignmentDocument9 pagesHD Consumer Behavior AssignmentAishwaryaNo ratings yet

- Английская грамматика в тестах - РомановаDocument152 pagesАнглийская грамматика в тестах - РомановаLi FeNo ratings yet