Professional Documents

Culture Documents

Chapter 3

Chapter 3

Uploaded by

Thùy DungOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3

Chapter 3

Uploaded by

Thùy DungCopyright:

Available Formats

CHAPTER 3: THE ACCOUNTING DOCUMENTATION IN BUSINESS

3.1. Sources of documents

3.2. Books of prime entry

PRINCIPLE OF ACCOUNTING - CHAPTER 3 1

CHAPTER 3: THE ACCOUNTING DOCUMENTATION IN BUSINESS

OBJECTIVE: After studying this chapter, you should be able to:

ü Identify types of sources of documentation

ü Understand the contents of book of prime entry

ü Preparation documentations for common transactions in business

PRINCIPLE OF ACCOUNTING - CHAPTER 3 2

3.1. Sources of documents

3.1.1.The purpose of Sources of documents

3.1.2.Types of Sources of documents

PRINCIPLE OF ACCOUNTING - CHAPTER 3 3

3.1. SOURCES OF DOCUMENTS

Source documents: are the documents which are produced by or input into a business's

accounting system as the starting point to recording the transactions of a business for accounting

purposes

The documents may be hard copy or electronic

PRINCIPLE OF ACCOUNTING - CHAPTER 3 4

3.1.1.THE PURPOSE OF SOURCES OF DOCUMENTS

The purpose of source document

Recording financial transactions

TRANSACTIONS RECORDED BY

OCCUR SOURCE DOCUMENT

To support

EVIDENCE

Source documents are the source of all information recorded by a business

PRINCIPLE OF ACCOUNTING - CHAPTER 3 5

3.1.2.TYPES OF SOURCES OF DOCUMENTS

Sale system: customer order, dispatch

goods, invoice, receive payment

Purchase system: Purchase order, Receive

goods, invoice, payment

Bank transaction: receipt, remittance

advice, ….

PRINCIPLE OF ACCOUNTING - CHAPTER 3 6

SALE SYSTEM

PRINCIPLE OF ACCOUNTING - CHAPTER 3 7

3.1.2.TYPES OF SOURCES OF DOCUMENTS

Sales order. A document of the company that details an order placed by a customer for goods or

services. The customer may have sent a purchase order to the company from which the company

will then generate a sales order. Sales orders are usually sequentially numbered so that the

company can keep track of orders placed by customers

PRINCIPLE OF ACCOUNTING - CHAPTER 3 8

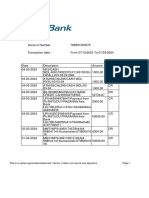

3.1.2.TYPES OF SOURCES OF DOCUMENTS

Invoice

An invoice may relate to a sales

or purchase order.

Invoices are source documents

for credit transactions.

PRINCIPLE OF ACCOUNTING - CHAPTER 3 9

Credit note

Credit note: A document issued to a

customer relating to returned goods,

or refunds when a customer has been

overcharged for whatever reason.

It can be regarded as a negative

invoice.

PRINCIPLE OF ACCOUNTING - CHAPTER 3 10

Go o d s d e s p atc h e d

note.

A document of the company that

lists the goods that the company

has sent out to a customer.

The company will keep a record of

goods despatched notes in case of

any queries by customers about the

goods sent.

The customer will compare the

goods despatched note to what

they receive to make sure all the

items listed have been delivered

and are the right specification

PRINCIPLE OF ACCOUNTING - CHAPTER 3 11

PURCHASE SYSTEM

PRINCIPLE OF ACCOUNTING - CHAPTER 3 12

Invoice

An invoice may relate to a sales

or purchase order.

Invoices are source documents

for credit transactions.

PRINCIPLE OF ACCOUNTING - CHAPTER 3 13

Debit notes

A debit note might be issued to a

supplier as a means of formally

requesting a credit note from that

supplier.

A debit note is not a source document.

PRINCIPLE OF ACCOUNTING - CHAPTER 3 14

Goods received note

A document of the company that lists the

goods that a business has received from a

supplier.

A goods received note is usually prepared

by the business's own

warehouse or goods receiving area

PRINCIPLE OF ACCOUNTING - CHAPTER 3 15

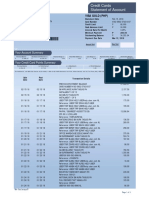

3.1.2.TYPES OF SOURCES OF DOCUMENTS

SOURCES DOCUMENTS FOR BANK TRANSACTION:

Ø Bank statement. This contains a number of adjustments to a company's book balance of cash on hand

that the company should reference to bring its records into alignment with those of the bank.

Ø Cash register tape. This can be used as evidence of cash sales, which supports the recordation of a

sale transaction.

Ø Remittance advice. A document sent to a supplier with a payment, detailing which invoices are being

paid and which credit notes offset. A remittance advice allows the supplier to update the customer's

records to show which invoices have been paid and which are still outstanding. It also confirms the

amount being paid, so that any discrepancies can be easily identified and investigated.

Ø Receipt. A document confirming confirmation that a payment has been received. This is usually in

respect of cash sales, eg a till receipt from a cash register

PRINCIPLE OF ACCOUNTING - CHAPTER 3 16

3.2. Books of prime entry

3.2.1. The purpose of books of prime entry

3.2.2. Types of books of prime entry

PRINCIPLE OF ACCOUNTING - CHAPTER 3 17

3.2.1. THE PURPOSE OF BOOKS OF PRIME ENTRY

ü Books of prime entry (books of original entry) records of source

documents – of transactions – so that it knows what is going on.

ü Books of prime entry are books in which we first record transactions.

ü The details on these source documents need to be summarised, as

otherwise the business might forget to ask for some money, or forget to

pay some, or even accidentally pay something twice.

The books of prime entry serve to ‘capture’ transactions as soon as

possible so that they are not subsequently lost or forgotten about

PRINCIPLE OF ACCOUNTING - CHAPTER 3 18

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

The main books of original entry are:

Sales day book Petty cash book

Purchases day book The payroll

Cash book The journal

PRINCIPLE OF ACCOUNTING - CHAPTER 3 19

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Sales day book

Sales day book: The book of original entry in respect of credit sales, including both

invoices and credit notes

PRINCIPLE OF ACCOUNTING - CHAPTER 3 20

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Purchases day book

Purchases day book: The book of original entry in respect of credit purchases,

including both invoices and credit notes.

PRINCIPLE OF ACCOUNTING - CHAPTER 3 21

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Cash book

Cash book: The book of original entry for receipts and payments in the business's bank

account

PRINCIPLE OF ACCOUNTING - CHAPTER 3 22

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Cash book

• The cash book is used to record money received and paid out by the business

through the business bank account.

• Some cash, in notes and coins, is usually kept on the business premises in order to

make occasional payments for odd items of expense.

• Accounted for separately in a petty cash book.

PRINCIPLE OF ACCOUNTING - CHAPTER 3 23

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Petty cash book: The book of original entry for small payments and receipts of cash.

Most common, petty cash use the imprest system reimburse/ refund the total

amount paid out in a period (i.e. if on 1 Dec petty cash paid out $100 under imprest

system, on 2 Dec accountant will draw $100 to top-up the amount paid in yesterday).

Under what is called the imprest system, the amount of money in petty cash is kept at

an agreed sum or 'float' , so that each toping is equal to the amount paid out in the

period.

Although the amounts are small, petty cash transactions still need to be recorded to

prevent fraudulent or misuse of funds (i.e. IOU).

There are usually more payments than receipts in petty cash

PRINCIPLE OF ACCOUNTING - CHAPTER 3 24

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Petty cash book

PRINCIPLE OF ACCOUNTING - CHAPTER 3 25

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Journal

The final book of original entry is the journal. This is the record of transactions which

do not appear in any of the other books of original entry. Non-current asset purchases

are usually recorded via the journal.

Journal is also ONE of the books of original entry.

Journal keeps a record of unusual movement between accounts

Record any double entry made but do not arise from other books of original entry

(i.e. Journal entries are made when corrected errors or adjustment like prepayment…)

PRINCIPLE OF ACCOUNTING - CHAPTER 3 26

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Computerised books of prime entry

Books of prime entry still exist within the workings of a

computerised system.

• Most companies now use a computerised system to manage

their accounting transactions and to prepare their financial

statements, rather than manual books.

• Most systems still use the concepts of the books of prime

entry for recording sales and purchases, cash receipts and

payments

• Entries are usually made by entering a sale or a purchase

which is then recorded in a book of prime entry within the

working of the accounting system.

PRINCIPLE OF ACCOUNTING - CHAPTER 3 27

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Computerised books of prime entry

PRINCIPLE OF ACCOUNTING - CHAPTER 3 28

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Computerised books of prime entry: example

Input: Orders are input over the internet

Processing: Prices are accessed on a product file and the order value worked out.

The customers’ account in the receivables ledger (now held on a computer file) is debited.

Inventory records (now on a computer file) are updated.

Output: An invoice is printed for the customer.

Despatch information is displayed on a screen in the warehouse to show the goods that

have to be sent.

PRINCIPLE OF ACCOUNTING - CHAPTER 3 29

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Computerised books of prime entry: example

File: A group of similar records.

So, a receivables ledger file contains records for each customer.

Record: Each record refers to a single entity.

So, a customer record will hold all the information about a customer; a product record will hold all the information about

a product. Records are collected together into files.

Field: (Also known as an attribute.) Each field holds a separate piece of data relating to a record. Thus a customer record

would have fields for: name, address, telephone number, credit limit, invoices outstanding, etc.

Key field: The field that uniquely identifies a record.

For example, a part code or an employee number.

Character: Characters make up fields and are typically a – z, 0 – 9.

Often a character holds no meaning on its own, but occasionally a character will be the whole field. For example M or F

for male or female

PRINCIPLE OF ACCOUNTING - CHAPTER 3 30

3.2.2. TYPES OF BOOKS OF PRIME ENTRY

Computerised books of prime entry: Function & Benefit

Most accounting information is numerical and, of course, computers excel at dealing with

that type of data. Computerised accounting systems should offer the following advantages

over manual systems:

ü faster provision of information

ü provision of information that would not be easily available without a computerised

accounting system

ü once the system is set up, cheaper information

ü more accurate information because arithmetic and certain other errors will be

eliminated.

PRINCIPLE OF ACCOUNTING - CHAPTER 3 31

3.1.2.TYPES OF SOURCES OF DOCUMENTS

PRINCIPLE OF ACCOUNTING - CHAPTER 3 32

3.1.2.TYPES OF SOURCES OF DOCUMENTS

PRINCIPLE OF ACCOUNTING - CHAPTER 3 33

You might also like

- Contoh Business Plan (T-Shirt)Document12 pagesContoh Business Plan (T-Shirt)Mira100% (26)

- Principle of Accounting Notes PDFDocument22 pagesPrinciple of Accounting Notes PDFFahad Rizwan75% (4)

- Chapter3 Final 1-DoneDocument157 pagesChapter3 Final 1-Donelebahaidang090No ratings yet

- Books of Original EntryDocument12 pagesBooks of Original EntrySangeeta SadeoNo ratings yet

- Alpesh Accountancy ProjectDocument16 pagesAlpesh Accountancy Projectalpeshupadhyay2810No ratings yet

- Financial Accountancy Chapter 4 Notes PDFDocument55 pagesFinancial Accountancy Chapter 4 Notes PDFHarshavardhanNo ratings yet

- Chapter3 Accounting PrincipleDocument156 pagesChapter3 Accounting PrincipleMinh Huyền NguyễnNo ratings yet

- Ncert Solutions For Class 11 Accountancy Chapter 4 Recording of Transactions 2Document69 pagesNcert Solutions For Class 11 Accountancy Chapter 4 Recording of Transactions 2Prateek TodurNo ratings yet

- Business and FinanceDocument21 pagesBusiness and Financeabelu habite neriNo ratings yet

- 005 Caaccst Ch03 Amndd Hs SecDocument20 pages005 Caaccst Ch03 Amndd Hs SecshubratadigitalNo ratings yet

- Source DocumentsDocument21 pagesSource Documentssharks ruparzNo ratings yet

- ICAEW Chapter 3 Recording Financial TransactionsDocument25 pagesICAEW Chapter 3 Recording Financial Transactionsvothituongnhi7703No ratings yet

- Latest Subsidiary BooksDocument12 pagesLatest Subsidiary BooksRaghuNo ratings yet

- L 3 Course 01Document42 pagesL 3 Course 01aman64709263No ratings yet

- The Accounting ProcessDocument156 pagesThe Accounting ProcessMạnh Đỗ ĐứcNo ratings yet

- Principles of Accounting 1 Chapter II Student's NotesDocument7 pagesPrinciples of Accounting 1 Chapter II Student's NotesLorna MeganeNo ratings yet

- The Role of Source Documents Sales and Purchase Day Books Cash BooksDocument10 pagesThe Role of Source Documents Sales and Purchase Day Books Cash BooksBekv BaNo ratings yet

- O Level Chapter 2 TheoryDocument3 pagesO Level Chapter 2 TheoryZeeshan MalikNo ratings yet

- Double Entry BookkeepingDocument26 pagesDouble Entry BookkeepingarthurNo ratings yet

- Bca Fam Unit 2Document21 pagesBca Fam Unit 2ayushsingh96510No ratings yet

- Accounting 1 Module 9 - The Books of Accounts - Journals Part 1Document19 pagesAccounting 1 Module 9 - The Books of Accounts - Journals Part 1Blanche MargateNo ratings yet

- Golden Rule of AccountingDocument2 pagesGolden Rule of Accountingnazalam059No ratings yet

- BS Book 4 Lesson Notes-1Document89 pagesBS Book 4 Lesson Notes-1Geoffrey ObongoNo ratings yet

- Week 3: 1. Please Read, For Understanding, All The CONTENT Information in This Module For WEEK 3Document3 pagesWeek 3: 1. Please Read, For Understanding, All The CONTENT Information in This Module For WEEK 3Javan SmithNo ratings yet

- Subsidiary BooksDocument6 pagesSubsidiary BooksBamidele AdegboyeNo ratings yet

- 4TH Reviewer (Fabm)Document13 pages4TH Reviewer (Fabm)Jihane TanogNo ratings yet

- Our Lady of Fatima University For Accounting For Sole Proprietorship For BS Accountancy DiscussionDocument8 pagesOur Lady of Fatima University For Accounting For Sole Proprietorship For BS Accountancy DiscussionJANNA RAZONNo ratings yet

- 5 Original EntryDocument4 pages5 Original Entryparwez_0505No ratings yet

- Accounting ConventionDocument26 pagesAccounting Conventionxavierpaul1000No ratings yet

- Books of Orginal EntryDocument6 pagesBooks of Orginal EntryMuhammad BilalNo ratings yet

- Documents That Are Used For Business Transactions and Their FormatDocument12 pagesDocuments That Are Used For Business Transactions and Their FormatYakkstar 21No ratings yet

- FOA - UNIT 3 (A) - Double Entry Accounting and Books of Original EntryDocument9 pagesFOA - UNIT 3 (A) - Double Entry Accounting and Books of Original EntryRealGenius (Carl)No ratings yet

- Chapter 6 NotesDocument16 pagesChapter 6 NotesNavroopamNo ratings yet

- Subsidiary BooksDocument7 pagesSubsidiary BooksADEYANJU AKEEMNo ratings yet

- POA Assessment 1Document4 pagesPOA Assessment 1Dave ChowtieNo ratings yet

- Types of Accounts and Golden Rule, jOURNAL, LEDGER TBDocument11 pagesTypes of Accounts and Golden Rule, jOURNAL, LEDGER TBlaadla3951No ratings yet

- Dpa1013 Note Chapter 2cDocument18 pagesDpa1013 Note Chapter 2cMohd Noor HamamNo ratings yet

- Befa Unit IVDocument12 pagesBefa Unit IVNaresh Guduru93% (15)

- Accounting and Financial ManagementDocument18 pagesAccounting and Financial ManagementRocky SinghNo ratings yet

- Accounting Personal NotesDocument6 pagesAccounting Personal Notesamaz1ingNo ratings yet

- Source Documents AccountsDocument4 pagesSource Documents AccountsVarsha GhanashNo ratings yet

- The Accounting CycleDocument14 pagesThe Accounting CyclezainjamilNo ratings yet

- Double Entry Recording ProcessDocument4 pagesDouble Entry Recording ProcessOlugbodi EmmanuelNo ratings yet

- Accountancy: Submitted by Sisira K PDocument17 pagesAccountancy: Submitted by Sisira K PSisira ChandranNo ratings yet

- Chapter 6 Books of AccountingDocument21 pagesChapter 6 Books of AccountingAina Charisse DizonNo ratings yet

- Cma End Game NotesDocument75 pagesCma End Game NotesManish BabuNo ratings yet

- CH-2 Financial Accounting ConceptsDocument40 pagesCH-2 Financial Accounting Conceptsnemik007No ratings yet

- NCERT SolutionsDocument55 pagesNCERT SolutionsArif ShaikhNo ratings yet

- Chapter 1Document5 pagesChapter 1palash khannaNo ratings yet

- Ch. 2.& 3 Recording of TransactionsDocument16 pagesCh. 2.& 3 Recording of TransactionsvaishnavibankarNo ratings yet

- Books of Original EntriesDocument22 pagesBooks of Original EntriesMazharul SamiNo ratings yet

- Part 2 - AccDocument9 pagesPart 2 - AccSheikh Mass JahNo ratings yet

- Source Document of AccountancyDocument7 pagesSource Document of AccountancyVinod GandhiNo ratings yet

- Simple Book KeepingDocument57 pagesSimple Book KeepinglagunzadjidNo ratings yet

- Basics of Accounting PDFDocument10 pagesBasics of Accounting PDFBenhur Leo0% (1)

- SLK Fabm1 Week 6Document8 pagesSLK Fabm1 Week 6Mylene SantiagoNo ratings yet

- ABM101 - M7 - Business Transactions and Their Analysis As Applied To Accounting Cycle of A Service Business Pt.1Document14 pagesABM101 - M7 - Business Transactions and Their Analysis As Applied To Accounting Cycle of A Service Business Pt.1stephaniefaithbrina28No ratings yet

- Accounting UNIT 2Document20 pagesAccounting UNIT 2newaybeyene5No ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- The Bedb and Law Society'S: Icentre, Bandar Seri Begawan, Brunei DarussalamDocument24 pagesThe Bedb and Law Society'S: Icentre, Bandar Seri Begawan, Brunei Darussalamtsar_philip2010No ratings yet

- 2024 07 3 17 57 38 Statement - 1709814458008Document7 pages2024 07 3 17 57 38 Statement - 1709814458008golusharma55966No ratings yet

- Reverse Innovation A Global Growth Strategy That Could Pre-Empt Disruption at HomeDocument9 pagesReverse Innovation A Global Growth Strategy That Could Pre-Empt Disruption at HomePitaloka RanNo ratings yet

- Ajay Khandelwal PDFDocument12 pagesAjay Khandelwal PDFAditya SinghNo ratings yet

- A Using The Following Scenario Consider Organizational Level 1 KeyDocument2 pagesA Using The Following Scenario Consider Organizational Level 1 KeyAmit PandeyNo ratings yet

- SAMPLE Assignment Madoff Ponzi Scheme 2010Document2 pagesSAMPLE Assignment Madoff Ponzi Scheme 2010scholarsassistNo ratings yet

- Pastel Cute Interface Marketing Plan PresentationDocument25 pagesPastel Cute Interface Marketing Plan PresentationrachanaNo ratings yet

- Lesson 3 - Word CardsDocument1 pageLesson 3 - Word Cardsapi-240816434No ratings yet

- Project ScopeDocument2 pagesProject ScopeRahul SinhaNo ratings yet

- My Player Aid Version 1.2Document1 pageMy Player Aid Version 1.2Armand GuerreNo ratings yet

- Applied ValuationDocument1 pageApplied ValuationIrfan ZaKiNo ratings yet

- Chapter - 12 - Inventory Accounting For Consumable SuppliesDocument10 pagesChapter - 12 - Inventory Accounting For Consumable SuppliesJa Mi LahNo ratings yet

- A Minor Project Report On - MMDocument16 pagesA Minor Project Report On - MMShivani SethNo ratings yet

- Managerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreDocument21 pagesManagerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreAR finance ID Ex BOGORNo ratings yet

- Labor Economics Research PapersDocument7 pagesLabor Economics Research Papersnbaamubnd100% (1)

- Stock Exchange: Long Term FinancingDocument10 pagesStock Exchange: Long Term FinancingmeenasarathaNo ratings yet

- Air India and It's HR Problems: Case Study OnDocument2 pagesAir India and It's HR Problems: Case Study OnPUSPENDRA RANANo ratings yet

- Social Security System 2017Document35 pagesSocial Security System 2017NJ Geerts100% (1)

- MGT382 Lecture 1 2021-22 Intro & Assessment BriefDocument71 pagesMGT382 Lecture 1 2021-22 Intro & Assessment Briefhamza farooqNo ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- Maxis Bill Presentment - St...Document1 pageMaxis Bill Presentment - St...Kratos Vs DanteNo ratings yet

- Determining The Optimal Level of Product AvailabilityDocument74 pagesDetermining The Optimal Level of Product AvailabilitydevendrasinghchavhanNo ratings yet

- LawDocument3 pagesLawKhenett Ramirez PuertoNo ratings yet

- Financial Statement Analysis of Kohat Cement Company LimitedDocument67 pagesFinancial Statement Analysis of Kohat Cement Company LimitedSaif Ali Khan BalouchNo ratings yet

- Tax Case Digest 5Document11 pagesTax Case Digest 5Tammy YahNo ratings yet

- Ti TechDocument4 pagesTi Techmadddy_hyd100% (3)

- MWG CEO Bai Thuyet Trinh FINAL BAN TIENG ANHDocument21 pagesMWG CEO Bai Thuyet Trinh FINAL BAN TIENG ANHRandyNo ratings yet

- FIDIC Clause 14.2 - Advance PaymentDocument4 pagesFIDIC Clause 14.2 - Advance Paymentaashik.esnNo ratings yet

- Pestle Analysis For Cebu AirlineDocument9 pagesPestle Analysis For Cebu AirlineKevo KarisNo ratings yet