Professional Documents

Culture Documents

Unemployment Notice CANDACE

Unemployment Notice CANDACE

Uploaded by

Candy ValentineCopyright:

Available Formats

You might also like

- Social Security Blank Card Template PDFDocument1 pageSocial Security Blank Card Template PDFCandy Valentine100% (1)

- Benefit Verification LetterDocument2 pagesBenefit Verification LetterTAWFIYNo ratings yet

- Wellsfargo CurrentDocument3 pagesWellsfargo CurrentNina BernardiniNo ratings yet

- Adp Pay Stub Template 1Document1 pageAdp Pay Stub Template 1Candy ValentineNo ratings yet

- Declarations For 571 Academy InsuranceDocument1 pageDeclarations For 571 Academy Insurancelesly malebrancheNo ratings yet

- Earnings Statement Earnings Statement Earnings Statement Earnings StatementDocument1 pageEarnings Statement Earnings Statement Earnings Statement Earnings StatementAbu Mohammad Omar Shehab Uddin AyubNo ratings yet

- Luis Felipe Driver REcordDocument2 pagesLuis Felipe Driver REcordBrunaJamillyNo ratings yet

- Bank StatementDocument4 pagesBank StatementCandy Valentine0% (1)

- Schedule of Liabilities (SBA Form 2202)Document1 pageSchedule of Liabilities (SBA Form 2202)Vaé Ribera100% (1)

- Signed PackageDocument35 pagesSigned PackageRocio OchoaNo ratings yet

- Sample Layoff LettersDocument4 pagesSample Layoff Lettersjoo2585No ratings yet

- Poblacion 2: Republic of The Philippines Province of Batangas City of Sto. TomasDocument3 pagesPoblacion 2: Republic of The Philippines Province of Batangas City of Sto. TomasSalanie Samonte BacarroNo ratings yet

- Mortgage Statement: Account Number 9903045785Document2 pagesMortgage Statement: Account Number 9903045785amarah buckner100% (1)

- All in A Health 05976Document2 pagesAll in A Health 05976mike jonesNo ratings yet

- Martita Togba - Social - Security - StatementDocument4 pagesMartita Togba - Social - Security - StatementRichlue GeegbaeNo ratings yet

- Fine Print Pay Stub 1Document3 pagesFine Print Pay Stub 1api-584843897No ratings yet

- Monetary Determination: Department of Labor and Human ResourcesDocument3 pagesMonetary Determination: Department of Labor and Human ResourcesBradley KirtsNo ratings yet

- CertainGovernmentPayments1099G JamesSmith-654202001310815Document4 pagesCertainGovernmentPayments1099G JamesSmith-654202001310815ireaditallNo ratings yet

- PFF049 MembersChangeInformation V05Document2 pagesPFF049 MembersChangeInformation V05Bernie L. DaytecNo ratings yet

- CasesDocument193 pagesCasesKenanNo ratings yet

- Important Information About Your Unemployment Insurance ClaimDocument3 pagesImportant Information About Your Unemployment Insurance ClaimSolomonNo ratings yet

- Ssa 1099 - Ssa 1042s Letter 6 5Document2 pagesSsa 1099 - Ssa 1042s Letter 6 5Dutchavelli5thNo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNo ratings yet

- Gerald A Maxwell Benefit-Verification-letterDocument2 pagesGerald A Maxwell Benefit-Verification-letterjennymark8866No ratings yet

- 1120S Case StudyDocument5 pages1120S Case StudyHimani SachdevNo ratings yet

- Benefit Verification LetterDocument2 pagesBenefit Verification Letteroh lampNo ratings yet

- BenefitVerificationLetter July August 2015Document1 pageBenefitVerificationLetter July August 2015Steven SchoferNo ratings yet

- MGPTaxReturn 2020Document64 pagesMGPTaxReturn 2020KGW NewsNo ratings yet

- Request For A Certificate of Eligibility: Coe Ref. NoDocument3 pagesRequest For A Certificate of Eligibility: Coe Ref. NoMoyo MitchellNo ratings yet

- BenefitVerificationLetter (1) .ActionDocument4 pagesBenefitVerificationLetter (1) .ActionJoshua CoverstoneNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableanandsoggyNo ratings yet

- Va Form SEP 2009 Supersedes Va Form 21-526, Jan 2004, Which Will Not Be UsedDocument12 pagesVa Form SEP 2009 Supersedes Va Form 21-526, Jan 2004, Which Will Not Be UsedChris Layton100% (1)

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- LTC Renewal PDFDocument12 pagesLTC Renewal PDFVashisth SoniNo ratings yet

- Bill of Sale of Motor Vehicle / Automobile: (Sold "As-Is" Without Warranty)Document2 pagesBill of Sale of Motor Vehicle / Automobile: (Sold "As-Is" Without Warranty)David SmithNo ratings yet

- Compass Application 2.14Document11 pagesCompass Application 2.14Matthew SweeneyNo ratings yet

- Vanessa Cooper - Fine Print Pay Stubs - 1516621Document3 pagesVanessa Cooper - Fine Print Pay Stubs - 1516621Vanessa CooperNo ratings yet

- Va Invoice To Be Paid TomorrowDocument2 pagesVa Invoice To Be Paid TomorrowmikeNo ratings yet

- Paystub 2022 04 17Document1 pagePaystub 2022 04 17Vivian TorresNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableSrilatha YagniNo ratings yet

- Non-Negotiable: Nvidia CorporationDocument1 pageNon-Negotiable: Nvidia CorporationSteven LinNo ratings yet

- Certain Government Payments: 4. Federal Income Tax WithheldDocument2 pagesCertain Government Payments: 4. Federal Income Tax WithheldWhisnu Wardhana0% (1)

- Amanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Document6 pagesAmanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Amanda Scott100% (1)

- Citi 201205Document10 pagesCiti 201205sinnlosNo ratings yet

- Health Insurance Forms 1Document1 pageHealth Insurance Forms 1api-453439542No ratings yet

- Income Tax Information 2023Document4 pagesIncome Tax Information 2023Village of new londonNo ratings yet

- Paystub 80280Document1 pagePaystub 80280AngelaNo ratings yet

- 1481546265426Document3 pages1481546265426api-370784582No ratings yet

- 2019 CorporateDocument32 pages2019 Corporateapi-167637329No ratings yet

- Form1095a 2017 PDFDocument8 pagesForm1095a 2017 PDFTina Reyes100% (1)

- DD 2870 Health Release Form - Scan PDFDocument1 pageDD 2870 Health Release Form - Scan PDFremolacha147No ratings yet

- On-Site Guide (BS 7671 - 2018) (Electrical Regulations)Document4 pagesOn-Site Guide (BS 7671 - 2018) (Electrical Regulations)Farshid AhmadiNo ratings yet

- SnapDocument10 pagesSnapAaron DeloachNo ratings yet

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- How To Log in To Your FRS Online AccountDocument4 pagesHow To Log in To Your FRS Online AccountSharan FosbinderNo ratings yet

- $0 Copy B: Miscellaneous InformationDocument2 pages$0 Copy B: Miscellaneous InformationGustavo BonillaNo ratings yet

- DOL RDWSU 2020 Form 5500Document205 pagesDOL RDWSU 2020 Form 5500seanredmondNo ratings yet

- C000584C A322285781A 0117017620C: Dennis M Hassett The Marquis Lounge 584Document2 pagesC000584C A322285781A 0117017620C: Dennis M Hassett The Marquis Lounge 584BrianNo ratings yet

- Swe Win 2022 1099 PDFDocument2 pagesSwe Win 2022 1099 PDFKuka Win50% (2)

- Document2 PDFDocument1 pageDocument2 PDFErma MonieNo ratings yet

- You Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToDocument6 pagesYou Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToAbhishek MeeNo ratings yet

- Bluebird Statement - Bluebird - 1625594969518Document2 pagesBluebird Statement - Bluebird - 1625594969518daniel floydNo ratings yet

- Vba 21 4192 AreDocument2 pagesVba 21 4192 AreGene GloverNo ratings yet

- 2016 1098-MORT MORTGAGE 4868 WellsFargoDocument2 pages2016 1098-MORT MORTGAGE 4868 WellsFargoJay EvansNo ratings yet

- W 2Document6 pagesW 2prads1259No ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument10 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramLoriNo ratings yet

- SafariDocument2 pagesSafarileachsteven67No ratings yet

- Police ReportDocument1 pagePolice ReportCandy ValentineNo ratings yet

- Katherine Gonzalez Adp PaystubDocument1 pageKatherine Gonzalez Adp PaystubCandy ValentineNo ratings yet

- 2021 w2Document1 page2021 w2Candy ValentineNo ratings yet

- Images 2Document1 pageImages 2Candy ValentineNo ratings yet

- 1040 Form 2022Document1 page1040 Form 2022Candy ValentineNo ratings yet

- Large 6Document1 pageLarge 6Candy ValentineNo ratings yet

- Bank of America Bank StatementDocument1 pageBank of America Bank StatementCandy ValentineNo ratings yet

- 2019-Form-1099-Misc DONE FOR EDDDocument1 page2019-Form-1099-Misc DONE FOR EDDCandy ValentineNo ratings yet

- 2019-Form-1099-Misc DONEDocument1 page2019-Form-1099-Misc DONECandy ValentineNo ratings yet

- Blank 2021Document1 pageBlank 2021Candy ValentineNo ratings yet

- SCAL FileDocument1 pageSCAL FileCandy ValentineNo ratings yet

- PropppsDocument1 pagePropppsCandy ValentineNo ratings yet

- Kaiser Permanente Sample BillDocument4 pagesKaiser Permanente Sample BillCandy Valentine0% (1)

- Alabama LicenceDocument1 pageAlabama LicenceCandy ValentineNo ratings yet

- c7e8d93a6e6648a3507c8d8f6c1d1a52Document1 pagec7e8d93a6e6648a3507c8d8f6c1d1a52Candy ValentineNo ratings yet

- Sample Hospital Bill Hancock Health CentersDocument1 pageSample Hospital Bill Hancock Health CentersCandy ValentineNo ratings yet

- Proof HancockSG PDF PPImport Runseq SAMPLE-002 Page 1-600x777Document1 pageProof HancockSG PDF PPImport Runseq SAMPLE-002 Page 1-600x777Candy ValentineNo ratings yet

- P InterestDocument1 pageP InterestCandy ValentineNo ratings yet

- Istockphoto 483321293 1024x1024 3Document1 pageIstockphoto 483321293 1024x1024 3Candy ValentineNo ratings yet

- b12f5c679af853e5c3ff81d646097ea9Document1 pageb12f5c679af853e5c3ff81d646097ea9Candy ValentineNo ratings yet

- Image 001Document1 pageImage 001Candy ValentineNo ratings yet

- HRH Sample BillDocument1 pageHRH Sample BillCandy ValentineNo ratings yet

- LargeDocument1 pageLargeCandy ValentineNo ratings yet

- Edd Sample LetterDocument1 pageEdd Sample LetterCandy ValentineNo ratings yet

- ThumbDocument1 pageThumbCandy ValentineNo ratings yet

- Sample Letter To Judge Before SentencingDocument2 pagesSample Letter To Judge Before SentencingCandy ValentineNo ratings yet

- Sample Character Letter Federal SentencingDocument3 pagesSample Character Letter Federal SentencingCandy ValentineNo ratings yet

- Nehru ReportDocument3 pagesNehru ReportAbdul Qadeer ZhmanNo ratings yet

- DAR Application For ExemptionDocument1 pageDAR Application For ExemptionMaria100% (2)

- Rizal Police Provincial Office Angono Municipal Police StationDocument3 pagesRizal Police Provincial Office Angono Municipal Police StationAmeerah NurkhalizahNo ratings yet

- Ethics in Ict: Prepared By: Rohani Binti Hashim M20181001204Document22 pagesEthics in Ict: Prepared By: Rohani Binti Hashim M20181001204Leena MuniandyNo ratings yet

- Final Ko To Umayos KaDocument37 pagesFinal Ko To Umayos Kakenjie krisNo ratings yet

- Alvarado vs. GaviolaDocument9 pagesAlvarado vs. GaviolaAnonymous H3cuzFAxNo ratings yet

- Dudh Nath Pandey v. State of U.PDocument10 pagesDudh Nath Pandey v. State of U.PYash GargNo ratings yet

- Malangas v. Zaide (Case Brief)Document2 pagesMalangas v. Zaide (Case Brief)nikkisalsNo ratings yet

- TOP 10 Arbitration Judgements Jan Sep 2023 1696870342Document40 pagesTOP 10 Arbitration Judgements Jan Sep 2023 1696870342Anil BabuNo ratings yet

- Harris The Archival SliverDocument24 pagesHarris The Archival Sliverdaniel martinNo ratings yet

- Public Interest LitigationDocument32 pagesPublic Interest LitigationPratyush GuptaNo ratings yet

- Mabutol vs. PascualDocument3 pagesMabutol vs. Pascualhmn_scribdNo ratings yet

- Novus Actus InterveniensDocument15 pagesNovus Actus InterveniensA Prem '1010'No ratings yet

- House RulingDocument42 pagesHouse RulingBusinessTechNo ratings yet

- UST Golden Notes - Administrative LawDocument10 pagesUST Golden Notes - Administrative LawPio Guieb AguilarNo ratings yet

- Memorandum of Association PTVDocument4 pagesMemorandum of Association PTVfarooq61No ratings yet

- United States v. Joseph, 4th Cir. (2009)Document4 pagesUnited States v. Joseph, 4th Cir. (2009)Scribd Government DocsNo ratings yet

- Travels in The Great Desert of Sahara, in The Years of 1845 and 1846 by Richardson, James, 1806-1851Document12 pagesTravels in The Great Desert of Sahara, in The Years of 1845 and 1846 by Richardson, James, 1806-1851Gutenberg.orgNo ratings yet

- Employees Compensation Act 1923Document14 pagesEmployees Compensation Act 1923Divyang Patil100% (1)

- International Hotel Corporation, Petitioner, vs. Francisco B. Joaquin, JR. and RAFAEL SUAREZ, RespondentsDocument21 pagesInternational Hotel Corporation, Petitioner, vs. Francisco B. Joaquin, JR. and RAFAEL SUAREZ, RespondentsAli Sinsuat MusurNo ratings yet

- IPC 3rd SemDocument17 pagesIPC 3rd SemRahul kumarNo ratings yet

- KYC-BE - Official Final VersionDocument34 pagesKYC-BE - Official Final VersionMarcelo OliveiraNo ratings yet

- Renato Cayetano Vs Christian MonsodDocument3 pagesRenato Cayetano Vs Christian MonsodDon Ycay100% (1)

- Leonard Williamson v. Oregon Department of Corrections, Colette PetersDocument21 pagesLeonard Williamson v. Oregon Department of Corrections, Colette PetersStatesman Journal100% (1)

- LawFinder 2037240Document6 pagesLawFinder 2037240Khushy YNo ratings yet

- Whole Women's Health v. HellerstedtDocument6 pagesWhole Women's Health v. HellerstedtLyanne Alexia GuarecucoNo ratings yet

Unemployment Notice CANDACE

Unemployment Notice CANDACE

Uploaded by

Candy ValentineOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unemployment Notice CANDACE

Unemployment Notice CANDACE

Uploaded by

Candy ValentineCopyright:

Available Formats

EMPLOYMENT DEVELOPEMENT DEPARTMENT

PO BOX 2228

RANCHO CORDOBA, CA. 95741-2190

Mail Date: 01/11/2022

Social Security Number: XXX-XX-2325

EDD Phone Numbers:

English 1-800-300-5616

CANDACE JARRETT Spanish 1-800-326-8937

11916 WINDOM PEAK WAY Cantonese 1-800-547-3506

SAN DIEGO, CA 92131 Mandarin 1-866-303-0706

Vietnamese 1-800-547-2058

TTY (nonvoice) 1-800-815-9387

website: www.edd.ca.gov

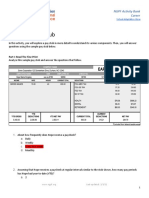

NOTICE OF UNEMPLOYMENT INSURANCE AWARD

This Notice is not a final decision on whether you are eligible to receive Unemployment Insurance (UI) benefits. Review this

Notice carefully to ensure your employer and wage information in the table below are accurate. Refer to the back of this Notice

for information regarding the several reasons why wages may not be showing in the table below and for additional instructions,

including what you should do if you disagree with any of the information in this table or if you think information is missing from

the table.

1. Claim Beginning Date: 01/11/2022 2. Claim Ending Date: 01/11/2023

3. Maximum Benefit Amount: $5,072.00 4. Weekly Benefit Amount: $167.00

5. Total Wages: $3,833.00 6. Highest Quarter Earnings: $2,290.80

7. This item does not apply to your claim. For more information, see item 7 on the reverse.

8. You must look for full time work each week. For more information, refer to the handbook, A Guide to Benefits and

Employment Services, DE 1275A, available online at www.edd.ca.gov/forms/.

9. This item does not apply to your claim.

10. This Claim Award is calculated based on the (Standard or Alternate) Base Period.

11. Employee Name: 12. Employee Wages for the Quarter Ending: 13. Employer Name:

DEC 20 MAR 21 JUNE 21 SEPT 21

Candace Jarrett $ 0.00 $ 2,290.00 $ 1,543.00 $ 0.00 Cathleen Calvert

14. TOTALS: $ 0.00 $ 2,290.00 $ 1,543.00 $ 0.00 $ 3,833.00

Important Information On Next Page

DE 429Z Rev. 10 (12-20) (INTERNET) Page 1 of 2

YOUR EMPLOYEE WAGES MAY SHOW “$0” AND/OR AN EMPLOYER MAY BE MISSING FROM THE TABLE ON THE OTHER

SIDE OF THIS NOTICE IF:

Your identity needs to be verified by the EDD. In this case, the EDD will send you a Request for Identity Verification, and you must

follow the instructions on that form in order to proceed with your claim.

Your earnings were reported under an incorrect SSN. In this case, please contact the EDD. (See instructions below.)

You worked for a federal agency and wages are being verified. In this case, the EDD will mail you an Amended Notice of Award once

the wages are verified or contact you by mail if additional information is needed from you.

Your employer failed to report your earnings. For example, this could be the case if your employer called you an independent

contractor and issued you a 1099 tax form. In this case, please contact the EDD. (See instructions below.)

IF YOU DISAGREE WITH INFORMATION IN THE TABLE ON THE OTHER SIDE OF THIS NOTICE, including:

Your wages are missing or incorrect.

An employer is not listed, or an employer is listed for which you did not work (and you were not a federal employee).

THEN YOU MUST CONTACT THE EDD by mailing a letter to the EDD mailing address on the other side of this Notice within

30 calendar days of the “Mail Date” printed at the top of this Notice. If you do not contact the EDD within 30 days, you may miss your

opportunity to inform the EDD that your claim should be investigated to determine whether your award should be changed to a different

amount. The EDD may extend this 30 day period for good cause.

PLEASE PROVIDE:

Your full name, address, and Social Security number, and

Proof of wages (including a W-2 or 1099, pay stubs, cash receipts or other documents showing your earnings) and any

employment information you want to add to your claim, or

If you did not work for an employer in the table, a statement that you did not work for a listed employer.

IMPORTANT: If you fail to notify the EDD of any inaccurate employment or wage information on the other side of this Notice, you

may be subject to an overpayment, and other disqualifications and penalties if you intentionally withhold information.

THE FOLLOWING IS ADDITIONAL INFORMATION FOR EACH ITEM LISTED ON THE OTHER SIDE OF THIS NOTICE:

1. The date your claim begins.

2. The date your claim ends.

3. The total amount of money you can receive from this claim.

4. The maximum amount you can be paid each week, if you meet the weekly eligibility requirements.

5. The total amount of earnings reported by the employer(s) during the quarters listed in the table for item 12. These earnings were

used to compute your maximum benefit amount.

6. The calendar quarter listed in the table for item 12 with the highest amount of earnings. These earnings determine your weekly

benefit amount.

7. The amount listed, if applicable, is your award without the wages earned from a public or nonprofit school. If you worked for a public

or nonprofit school during any of the quarters listed in the table for item 12, you may not be able to use those wages in your claim

during a school recess period.

8. Under the law, you must make all reasonable efforts to find work when claiming benefits.

9. The Unemployment Insurance Code (Section 1277) requires that you work between the beginning and the ending dates of a prior

claim to have a valid claim the next year. If this applies to your claim you will receive additional instructions.

10. The type of base period used to establish your claim; it will be either the Standard Base Period or the Alternate Base Period.

11. The name used by your employer(s) to report your earnings to the EDD during each calendar quarter listed.

12. These are the potentially usable wages for UI purposes that your employer(s) reported you earned during each calendar quarter

listed. Each calendar quarter spans a three-month period. These earnings determine the amount of your benefits award.

13. The name(s) of the employer(s) you worked for during the calendar quarters listed in the table for item 12.

14. The total amount of earnings reported by all employer(s) in each calendar quarter listed in the table for item 12.

YOU ARE RESPONSIBLE for knowing the content of the Unemployment Insurance Benefits: What You Need To Know (DE 1275B),

AND the content of the handbook, A Guide To Benefits And Employment Services, (DE 1275A). Both publications explain your

unemployment rights and responsibilities and are available at edd.ca.gov/forms/.

To receive Ul Benefits, you must certify for benefits initially and then every two weeks using one of the following methods:

UI OnlineSM, EDD Tele-CertSM, or submit a paper Continued Claim Form, (DE 4581). For more information on certifying for benefits,

refer to the DE 1275 handbook available at edd.ca.gov/forms/.

HOW TO CANCEL A UI CLAIM

You have the option of canceling your claim after receiving this Notice. If you want to cancel your claim, you need to contact the EDD

right away. Do not certify for UI benefits. The law only allows you to cancel a UI claim if no benefits have been paid, no notice of

disqualification has been mailed to you, no overpayment has been established on the claim, and the benefit year of your claim has not

ended. If the claim is cancelled, it cannot be reopened.

DE 429Z Rev. 10 (12-20) (INTERNET) Page 2 of 2

You might also like

- Social Security Blank Card Template PDFDocument1 pageSocial Security Blank Card Template PDFCandy Valentine100% (1)

- Benefit Verification LetterDocument2 pagesBenefit Verification LetterTAWFIYNo ratings yet

- Wellsfargo CurrentDocument3 pagesWellsfargo CurrentNina BernardiniNo ratings yet

- Adp Pay Stub Template 1Document1 pageAdp Pay Stub Template 1Candy ValentineNo ratings yet

- Declarations For 571 Academy InsuranceDocument1 pageDeclarations For 571 Academy Insurancelesly malebrancheNo ratings yet

- Earnings Statement Earnings Statement Earnings Statement Earnings StatementDocument1 pageEarnings Statement Earnings Statement Earnings Statement Earnings StatementAbu Mohammad Omar Shehab Uddin AyubNo ratings yet

- Luis Felipe Driver REcordDocument2 pagesLuis Felipe Driver REcordBrunaJamillyNo ratings yet

- Bank StatementDocument4 pagesBank StatementCandy Valentine0% (1)

- Schedule of Liabilities (SBA Form 2202)Document1 pageSchedule of Liabilities (SBA Form 2202)Vaé Ribera100% (1)

- Signed PackageDocument35 pagesSigned PackageRocio OchoaNo ratings yet

- Sample Layoff LettersDocument4 pagesSample Layoff Lettersjoo2585No ratings yet

- Poblacion 2: Republic of The Philippines Province of Batangas City of Sto. TomasDocument3 pagesPoblacion 2: Republic of The Philippines Province of Batangas City of Sto. TomasSalanie Samonte BacarroNo ratings yet

- Mortgage Statement: Account Number 9903045785Document2 pagesMortgage Statement: Account Number 9903045785amarah buckner100% (1)

- All in A Health 05976Document2 pagesAll in A Health 05976mike jonesNo ratings yet

- Martita Togba - Social - Security - StatementDocument4 pagesMartita Togba - Social - Security - StatementRichlue GeegbaeNo ratings yet

- Fine Print Pay Stub 1Document3 pagesFine Print Pay Stub 1api-584843897No ratings yet

- Monetary Determination: Department of Labor and Human ResourcesDocument3 pagesMonetary Determination: Department of Labor and Human ResourcesBradley KirtsNo ratings yet

- CertainGovernmentPayments1099G JamesSmith-654202001310815Document4 pagesCertainGovernmentPayments1099G JamesSmith-654202001310815ireaditallNo ratings yet

- PFF049 MembersChangeInformation V05Document2 pagesPFF049 MembersChangeInformation V05Bernie L. DaytecNo ratings yet

- CasesDocument193 pagesCasesKenanNo ratings yet

- Important Information About Your Unemployment Insurance ClaimDocument3 pagesImportant Information About Your Unemployment Insurance ClaimSolomonNo ratings yet

- Ssa 1099 - Ssa 1042s Letter 6 5Document2 pagesSsa 1099 - Ssa 1042s Letter 6 5Dutchavelli5thNo ratings yet

- Copy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Document4 pagesCopy B To Be Filed With Employee S FEDERAL Tax Return: See Instructions For Box 12Andy BipesNo ratings yet

- Gerald A Maxwell Benefit-Verification-letterDocument2 pagesGerald A Maxwell Benefit-Verification-letterjennymark8866No ratings yet

- 1120S Case StudyDocument5 pages1120S Case StudyHimani SachdevNo ratings yet

- Benefit Verification LetterDocument2 pagesBenefit Verification Letteroh lampNo ratings yet

- BenefitVerificationLetter July August 2015Document1 pageBenefitVerificationLetter July August 2015Steven SchoferNo ratings yet

- MGPTaxReturn 2020Document64 pagesMGPTaxReturn 2020KGW NewsNo ratings yet

- Request For A Certificate of Eligibility: Coe Ref. NoDocument3 pagesRequest For A Certificate of Eligibility: Coe Ref. NoMoyo MitchellNo ratings yet

- BenefitVerificationLetter (1) .ActionDocument4 pagesBenefitVerificationLetter (1) .ActionJoshua CoverstoneNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableanandsoggyNo ratings yet

- Va Form SEP 2009 Supersedes Va Form 21-526, Jan 2004, Which Will Not Be UsedDocument12 pagesVa Form SEP 2009 Supersedes Va Form 21-526, Jan 2004, Which Will Not Be UsedChris Layton100% (1)

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- LTC Renewal PDFDocument12 pagesLTC Renewal PDFVashisth SoniNo ratings yet

- Bill of Sale of Motor Vehicle / Automobile: (Sold "As-Is" Without Warranty)Document2 pagesBill of Sale of Motor Vehicle / Automobile: (Sold "As-Is" Without Warranty)David SmithNo ratings yet

- Compass Application 2.14Document11 pagesCompass Application 2.14Matthew SweeneyNo ratings yet

- Vanessa Cooper - Fine Print Pay Stubs - 1516621Document3 pagesVanessa Cooper - Fine Print Pay Stubs - 1516621Vanessa CooperNo ratings yet

- Va Invoice To Be Paid TomorrowDocument2 pagesVa Invoice To Be Paid TomorrowmikeNo ratings yet

- Paystub 2022 04 17Document1 pagePaystub 2022 04 17Vivian TorresNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableSrilatha YagniNo ratings yet

- Non-Negotiable: Nvidia CorporationDocument1 pageNon-Negotiable: Nvidia CorporationSteven LinNo ratings yet

- Certain Government Payments: 4. Federal Income Tax WithheldDocument2 pagesCertain Government Payments: 4. Federal Income Tax WithheldWhisnu Wardhana0% (1)

- Amanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Document6 pagesAmanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Amanda Scott100% (1)

- Citi 201205Document10 pagesCiti 201205sinnlosNo ratings yet

- Health Insurance Forms 1Document1 pageHealth Insurance Forms 1api-453439542No ratings yet

- Income Tax Information 2023Document4 pagesIncome Tax Information 2023Village of new londonNo ratings yet

- Paystub 80280Document1 pagePaystub 80280AngelaNo ratings yet

- 1481546265426Document3 pages1481546265426api-370784582No ratings yet

- 2019 CorporateDocument32 pages2019 Corporateapi-167637329No ratings yet

- Form1095a 2017 PDFDocument8 pagesForm1095a 2017 PDFTina Reyes100% (1)

- DD 2870 Health Release Form - Scan PDFDocument1 pageDD 2870 Health Release Form - Scan PDFremolacha147No ratings yet

- On-Site Guide (BS 7671 - 2018) (Electrical Regulations)Document4 pagesOn-Site Guide (BS 7671 - 2018) (Electrical Regulations)Farshid AhmadiNo ratings yet

- SnapDocument10 pagesSnapAaron DeloachNo ratings yet

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- How To Log in To Your FRS Online AccountDocument4 pagesHow To Log in To Your FRS Online AccountSharan FosbinderNo ratings yet

- $0 Copy B: Miscellaneous InformationDocument2 pages$0 Copy B: Miscellaneous InformationGustavo BonillaNo ratings yet

- DOL RDWSU 2020 Form 5500Document205 pagesDOL RDWSU 2020 Form 5500seanredmondNo ratings yet

- C000584C A322285781A 0117017620C: Dennis M Hassett The Marquis Lounge 584Document2 pagesC000584C A322285781A 0117017620C: Dennis M Hassett The Marquis Lounge 584BrianNo ratings yet

- Swe Win 2022 1099 PDFDocument2 pagesSwe Win 2022 1099 PDFKuka Win50% (2)

- Document2 PDFDocument1 pageDocument2 PDFErma MonieNo ratings yet

- You Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToDocument6 pagesYou Can Get This Information in Large Print and Braille. Call 1-800-841-2900 From Monday ToAbhishek MeeNo ratings yet

- Bluebird Statement - Bluebird - 1625594969518Document2 pagesBluebird Statement - Bluebird - 1625594969518daniel floydNo ratings yet

- Vba 21 4192 AreDocument2 pagesVba 21 4192 AreGene GloverNo ratings yet

- 2016 1098-MORT MORTGAGE 4868 WellsFargoDocument2 pages2016 1098-MORT MORTGAGE 4868 WellsFargoJay EvansNo ratings yet

- W 2Document6 pagesW 2prads1259No ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument10 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramLoriNo ratings yet

- SafariDocument2 pagesSafarileachsteven67No ratings yet

- Police ReportDocument1 pagePolice ReportCandy ValentineNo ratings yet

- Katherine Gonzalez Adp PaystubDocument1 pageKatherine Gonzalez Adp PaystubCandy ValentineNo ratings yet

- 2021 w2Document1 page2021 w2Candy ValentineNo ratings yet

- Images 2Document1 pageImages 2Candy ValentineNo ratings yet

- 1040 Form 2022Document1 page1040 Form 2022Candy ValentineNo ratings yet

- Large 6Document1 pageLarge 6Candy ValentineNo ratings yet

- Bank of America Bank StatementDocument1 pageBank of America Bank StatementCandy ValentineNo ratings yet

- 2019-Form-1099-Misc DONE FOR EDDDocument1 page2019-Form-1099-Misc DONE FOR EDDCandy ValentineNo ratings yet

- 2019-Form-1099-Misc DONEDocument1 page2019-Form-1099-Misc DONECandy ValentineNo ratings yet

- Blank 2021Document1 pageBlank 2021Candy ValentineNo ratings yet

- SCAL FileDocument1 pageSCAL FileCandy ValentineNo ratings yet

- PropppsDocument1 pagePropppsCandy ValentineNo ratings yet

- Kaiser Permanente Sample BillDocument4 pagesKaiser Permanente Sample BillCandy Valentine0% (1)

- Alabama LicenceDocument1 pageAlabama LicenceCandy ValentineNo ratings yet

- c7e8d93a6e6648a3507c8d8f6c1d1a52Document1 pagec7e8d93a6e6648a3507c8d8f6c1d1a52Candy ValentineNo ratings yet

- Sample Hospital Bill Hancock Health CentersDocument1 pageSample Hospital Bill Hancock Health CentersCandy ValentineNo ratings yet

- Proof HancockSG PDF PPImport Runseq SAMPLE-002 Page 1-600x777Document1 pageProof HancockSG PDF PPImport Runseq SAMPLE-002 Page 1-600x777Candy ValentineNo ratings yet

- P InterestDocument1 pageP InterestCandy ValentineNo ratings yet

- Istockphoto 483321293 1024x1024 3Document1 pageIstockphoto 483321293 1024x1024 3Candy ValentineNo ratings yet

- b12f5c679af853e5c3ff81d646097ea9Document1 pageb12f5c679af853e5c3ff81d646097ea9Candy ValentineNo ratings yet

- Image 001Document1 pageImage 001Candy ValentineNo ratings yet

- HRH Sample BillDocument1 pageHRH Sample BillCandy ValentineNo ratings yet

- LargeDocument1 pageLargeCandy ValentineNo ratings yet

- Edd Sample LetterDocument1 pageEdd Sample LetterCandy ValentineNo ratings yet

- ThumbDocument1 pageThumbCandy ValentineNo ratings yet

- Sample Letter To Judge Before SentencingDocument2 pagesSample Letter To Judge Before SentencingCandy ValentineNo ratings yet

- Sample Character Letter Federal SentencingDocument3 pagesSample Character Letter Federal SentencingCandy ValentineNo ratings yet

- Nehru ReportDocument3 pagesNehru ReportAbdul Qadeer ZhmanNo ratings yet

- DAR Application For ExemptionDocument1 pageDAR Application For ExemptionMaria100% (2)

- Rizal Police Provincial Office Angono Municipal Police StationDocument3 pagesRizal Police Provincial Office Angono Municipal Police StationAmeerah NurkhalizahNo ratings yet

- Ethics in Ict: Prepared By: Rohani Binti Hashim M20181001204Document22 pagesEthics in Ict: Prepared By: Rohani Binti Hashim M20181001204Leena MuniandyNo ratings yet

- Final Ko To Umayos KaDocument37 pagesFinal Ko To Umayos Kakenjie krisNo ratings yet

- Alvarado vs. GaviolaDocument9 pagesAlvarado vs. GaviolaAnonymous H3cuzFAxNo ratings yet

- Dudh Nath Pandey v. State of U.PDocument10 pagesDudh Nath Pandey v. State of U.PYash GargNo ratings yet

- Malangas v. Zaide (Case Brief)Document2 pagesMalangas v. Zaide (Case Brief)nikkisalsNo ratings yet

- TOP 10 Arbitration Judgements Jan Sep 2023 1696870342Document40 pagesTOP 10 Arbitration Judgements Jan Sep 2023 1696870342Anil BabuNo ratings yet

- Harris The Archival SliverDocument24 pagesHarris The Archival Sliverdaniel martinNo ratings yet

- Public Interest LitigationDocument32 pagesPublic Interest LitigationPratyush GuptaNo ratings yet

- Mabutol vs. PascualDocument3 pagesMabutol vs. Pascualhmn_scribdNo ratings yet

- Novus Actus InterveniensDocument15 pagesNovus Actus InterveniensA Prem '1010'No ratings yet

- House RulingDocument42 pagesHouse RulingBusinessTechNo ratings yet

- UST Golden Notes - Administrative LawDocument10 pagesUST Golden Notes - Administrative LawPio Guieb AguilarNo ratings yet

- Memorandum of Association PTVDocument4 pagesMemorandum of Association PTVfarooq61No ratings yet

- United States v. Joseph, 4th Cir. (2009)Document4 pagesUnited States v. Joseph, 4th Cir. (2009)Scribd Government DocsNo ratings yet

- Travels in The Great Desert of Sahara, in The Years of 1845 and 1846 by Richardson, James, 1806-1851Document12 pagesTravels in The Great Desert of Sahara, in The Years of 1845 and 1846 by Richardson, James, 1806-1851Gutenberg.orgNo ratings yet

- Employees Compensation Act 1923Document14 pagesEmployees Compensation Act 1923Divyang Patil100% (1)

- International Hotel Corporation, Petitioner, vs. Francisco B. Joaquin, JR. and RAFAEL SUAREZ, RespondentsDocument21 pagesInternational Hotel Corporation, Petitioner, vs. Francisco B. Joaquin, JR. and RAFAEL SUAREZ, RespondentsAli Sinsuat MusurNo ratings yet

- IPC 3rd SemDocument17 pagesIPC 3rd SemRahul kumarNo ratings yet

- KYC-BE - Official Final VersionDocument34 pagesKYC-BE - Official Final VersionMarcelo OliveiraNo ratings yet

- Renato Cayetano Vs Christian MonsodDocument3 pagesRenato Cayetano Vs Christian MonsodDon Ycay100% (1)

- Leonard Williamson v. Oregon Department of Corrections, Colette PetersDocument21 pagesLeonard Williamson v. Oregon Department of Corrections, Colette PetersStatesman Journal100% (1)

- LawFinder 2037240Document6 pagesLawFinder 2037240Khushy YNo ratings yet

- Whole Women's Health v. HellerstedtDocument6 pagesWhole Women's Health v. HellerstedtLyanne Alexia GuarecucoNo ratings yet