Professional Documents

Culture Documents

12 Revision p2

12 Revision p2

Uploaded by

LexCopyright:

Available Formats

You might also like

- Pelican Stores Data Analysis ChartDocument17 pagesPelican Stores Data Analysis ChartNaresh Kumar NareshNo ratings yet

- IKEA Case StudyDocument12 pagesIKEA Case StudyAmrit Prasad0% (1)

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Configuration MOP Aircel ICRDocument7 pagesConfiguration MOP Aircel ICRKaran ParmarNo ratings yet

- Digital Name Card - Micro Processor ProjectDocument38 pagesDigital Name Card - Micro Processor ProjectMr. L.B. LeeNo ratings yet

- Question Bank CH-Retirement and DeathDocument6 pagesQuestion Bank CH-Retirement and Deathsuchitasingh1106No ratings yet

- 04 Sample PaperDocument45 pages04 Sample Papergaming loverNo ratings yet

- 12 Accountancy sp04Document45 pages12 Accountancy sp04Priyansh AryaNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Partnership and Non-For-Profit OrganisationsDocument4 pagesPartnership and Non-For-Profit OrganisationsJoshi DrcpNo ratings yet

- Death 2024 SPCC PDFDocument24 pagesDeath 2024 SPCC PDFDaksh YadavNo ratings yet

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- Acc Xii Pt1 PreptDocument5 pagesAcc Xii Pt1 PreptNishi AroraNo ratings yet

- 1 Test Series Accountancy 12th (Fundamentals of Partnership)Document2 pages1 Test Series Accountancy 12th (Fundamentals of Partnership)Rav NeetNo ratings yet

- XII - Accountancy U.T - 1 Set 1Document4 pagesXII - Accountancy U.T - 1 Set 1tanu1304262No ratings yet

- Vineet FileDocument8 pagesVineet FileVineet KumarNo ratings yet

- Sanskriti School Dr. S. Radhakrishnan Marg New DelhiDocument7 pagesSanskriti School Dr. S. Radhakrishnan Marg New DelhiAVNEET XII-CNo ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- 12 Accountancy SQP 4Document11 pages12 Accountancy SQP 4KandaroliNo ratings yet

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmDark SoulNo ratings yet

- Indian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursDocument5 pagesIndian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursRitaNo ratings yet

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentNo ratings yet

- Accountancy Ques PaperDocument5 pagesAccountancy Ques Papersudarshanjha.0001No ratings yet

- Test Retirement Death Dissolution-1Document4 pagesTest Retirement Death Dissolution-1Vibhu VashishthNo ratings yet

- Admission Test No. 2Document5 pagesAdmission Test No. 2Mitesh Sethi0% (1)

- Tar Ge T 100: JS AccountancyDocument33 pagesTar Ge T 100: JS Accountancyvishal joshiNo ratings yet

- Question Bank Accountancy (055) Class XiiDocument5 pagesQuestion Bank Accountancy (055) Class XiiDHIRENDRA KUMARNo ratings yet

- Partnership Fundamentals 2Document6 pagesPartnership Fundamentals 2sainimanish170gmailcNo ratings yet

- CTF Edited Solved Paper 1Document2 pagesCTF Edited Solved Paper 1Umesh JaiswalNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- Saint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Document3 pagesSaint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Abhishek SharmaNo ratings yet

- Cbse Questions Change in PSRDocument4 pagesCbse Questions Change in PSRDeepanshu kaushikNo ratings yet

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDocument5 pagesDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNo ratings yet

- Xii Acct WDocument11 pagesXii Acct WFree Fire KingNo ratings yet

- Aaaccountancy Ques Paper001Document5 pagesAaaccountancy Ques Paper001sudarshanjha.0001No ratings yet

- Assignment On Fundamentals of PartnershipDocument8 pagesAssignment On Fundamentals of Partnershipsainimanish170gmailc100% (1)

- Change in Profit RatioDocument10 pagesChange in Profit RatioHansika SahuNo ratings yet

- Accounts XiiDocument12 pagesAccounts XiiTanya JainNo ratings yet

- 10 Sample PaperDocument41 pages10 Sample Papergaming loverNo ratings yet

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- XII Accounts Test With SolutionDocument12 pagesXII Accounts Test With SolutionKritika Mahalwal100% (1)

- Accountancy Unit Test 1 Paper Shalom 2ndDocument4 pagesAccountancy Unit Test 1 Paper Shalom 2ndTûshar ThakúrNo ratings yet

- 1 VJP 0 LTVX WHN RV ZUCj NLDocument10 pages1 VJP 0 LTVX WHN RV ZUCj NLVanshika BhatiNo ratings yet

- Worksheet - Retirement & DissolutionDocument4 pagesWorksheet - Retirement & DissolutionYogesh AdhikariNo ratings yet

- DR GR Public School, Neyyattinkara PRE-BOARD EXAM 2021-22 AccountancyDocument17 pagesDR GR Public School, Neyyattinkara PRE-BOARD EXAM 2021-22 AccountancyPiyush HazraNo ratings yet

- Module-2 Sample Question PaperDocument18 pagesModule-2 Sample Question PaperRay Ch100% (1)

- 12 Accountancy SQP 5Document13 pages12 Accountancy SQP 5KandaroliNo ratings yet

- AccoutancyRoundTest1 Sample Class 12Document3 pagesAccoutancyRoundTest1 Sample Class 12Samyuktha nairNo ratings yet

- Xii Acc Death WSDocument4 pagesXii Acc Death WSshahidroonissisNo ratings yet

- Cummulative Test: Sowdambikaa Group of SchoolsDocument3 pagesCummulative Test: Sowdambikaa Group of SchoolsDharmaNo ratings yet

- Change in PSR WS 1 - DocxDocument3 pagesChange in PSR WS 1 - DocxGopika BaburajNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- 12 Accounts ch6 tp1Document11 pages12 Accounts ch6 tp1Pawan TalrejaNo ratings yet

- Death of A PartnerDocument2 pagesDeath of A PartnerAarya KhedekarNo ratings yet

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Document5 pagesSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- 03 - Accounts - Prelims 4Document6 pages03 - Accounts - Prelims 4Pawan TalrejaNo ratings yet

- ACCOUNTANCY-Practice QuestionsDocument6 pagesACCOUNTANCY-Practice QuestionsMary JaineNo ratings yet

- XII Test (Death, Ret - Diss)Document4 pagesXII Test (Death, Ret - Diss)MLastTryNo ratings yet

- CBSE Class 12 Accountancy Sample Paper - 1 (Solved) For CBSE Examination March 2019Document25 pagesCBSE Class 12 Accountancy Sample Paper - 1 (Solved) For CBSE Examination March 2019SWAPNIL BHASKERNo ratings yet

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- Revision Fundamentals 1Document7 pagesRevision Fundamentals 1LexNo ratings yet

- XII Commerce PT 2Document1 pageXII Commerce PT 2LexNo ratings yet

- Grade 12 B.ST CH 1Document2 pagesGrade 12 B.ST CH 1LexNo ratings yet

- Class 12 Test On 15.9.20-1Document2 pagesClass 12 Test On 15.9.20-1LexNo ratings yet

- 11 Ratio Analysis PowerPointToPdfDocument11 pages11 Ratio Analysis PowerPointToPdfLexNo ratings yet

- General StudiesDocument9 pagesGeneral StudiesLexNo ratings yet

- ChargeTech PLUG Manual - 42K & 54KDocument6 pagesChargeTech PLUG Manual - 42K & 54KKian GonzagaNo ratings yet

- Teslascada2 Runtime (Android) : User ManualDocument7 pagesTeslascada2 Runtime (Android) : User ManualRodrigo RezendeNo ratings yet

- 2023 CamryDocument8 pages2023 CamrybhargavNo ratings yet

- Alphaplus Product Brochure (2007-08)Document60 pagesAlphaplus Product Brochure (2007-08)praneshVNo ratings yet

- Catalytic Distillation VersionDocument4 pagesCatalytic Distillation Versionlux0008No ratings yet

- Digital Payments in IndiaDocument23 pagesDigital Payments in Indiaabhinav sethNo ratings yet

- P1125P1/P1250E1: Output RatingsDocument6 pagesP1125P1/P1250E1: Output Ratingsmohsen_cumminsNo ratings yet

- Beasiswa Kursus Bhs Spanyol Di ColombiaDocument5 pagesBeasiswa Kursus Bhs Spanyol Di ColombiaAerrosa MurendaNo ratings yet

- Atari VCS 2600 Supercharger Tape File FormatDocument2 pagesAtari VCS 2600 Supercharger Tape File FormatAlainleGuirecNo ratings yet

- Leadership and Governance Dalam SKNDocument13 pagesLeadership and Governance Dalam SKNWenna YolandaNo ratings yet

- Understanding Entrepreneurship: A Case Study On Ms. Namita Sharma "The Queen of NFH"Document3 pagesUnderstanding Entrepreneurship: A Case Study On Ms. Namita Sharma "The Queen of NFH"International Journal of Application or Innovation in Engineering & Management100% (1)

- Tugas Bahasa InggrisDocument10 pagesTugas Bahasa InggrisHunHan SevenNo ratings yet

- Compensation: Introducing The Pay Model and Pay StrategyDocument27 pagesCompensation: Introducing The Pay Model and Pay StrategySyaz AmriNo ratings yet

- Professional English II (Job Interview) 24032021Document8 pagesProfessional English II (Job Interview) 24032021Chaterine FebbyNo ratings yet

- How Do I Manually Boot HP-UX On Integrity (Itanium) Based SystemsDocument6 pagesHow Do I Manually Boot HP-UX On Integrity (Itanium) Based Systemsnilu772008No ratings yet

- Probity Audit PolicyDocument7 pagesProbity Audit PolicyMahmud Toha100% (1)

- Solar Resource Mapping and PV Potential in MyanmarDocument8 pagesSolar Resource Mapping and PV Potential in Myanmarsalem BEN MOUSSA100% (1)

- Universidad de Cuenca Facultad de Ciencias Económicas Carrera EconomíaDocument9 pagesUniversidad de Cuenca Facultad de Ciencias Económicas Carrera EconomíaMireya Ríos CaliNo ratings yet

- Well and Testing From Fekete and EngiDocument6 pagesWell and Testing From Fekete and EngiRovshan1988No ratings yet

- EUROPART Inter Catalog MB Truck 2014 ENDocument400 pagesEUROPART Inter Catalog MB Truck 2014 ENBoumediene CHIKHAOUINo ratings yet

- Polaris InfoDocument4 pagesPolaris InfoSankuri RamNo ratings yet

- Comparative Analysis and Optimization of Active Power and Delay of 1-Bit Full Adder at 45 NM TechnologyDocument3 pagesComparative Analysis and Optimization of Active Power and Delay of 1-Bit Full Adder at 45 NM TechnologyNsrc Nano ScientifcNo ratings yet

- Valvula Piston Buschjost 86500Document2 pagesValvula Piston Buschjost 86500Base SistemasNo ratings yet

- Cases in Torts (Doctrines)Document56 pagesCases in Torts (Doctrines)hmn_scribdNo ratings yet

- Allgon Coverage Systems - Repeater Catalogue - ALGPC0201Document23 pagesAllgon Coverage Systems - Repeater Catalogue - ALGPC0201Virgil Peiulescu0% (1)

- Topographic Map of LemingDocument1 pageTopographic Map of LemingHistoricalMapsNo ratings yet

12 Revision p2

12 Revision p2

Uploaded by

LexOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Revision p2

12 Revision p2

Uploaded by

LexCopyright:

Available Formats

1. Ram, Pan and Sam were partners in the ratio of 4:3:1. Sam died on 30th June2020.

Calculate Sam’s share of

profit till date of death if the share is based on last year sales and profit. Sales during 1st April 2019 and 31st

March 2020 was Rs20,00,000 and Profit earned was Rs50,0000. Sales till date of death was Rs5,00,000. 1

2. P, Q and Rahim are sharing profits and Losses in the ratio of 5:3:2. They decide to share profits and losses in

the ratio of 2:3:5 with effect from 1st April, 2022. They decide to record the effect of the following without

affecting their book values, by passing an adjustment entry: 3

Book Values

General Reserve 1,50,000

Contingency Reserve 25,000

Profit & Loss(Cr) 75,000

3. A and B are partners sharing profits and losses in the ratio of 3:2. They admit C into partnership for 1/4th

share, which he takes 1/4th from A and 1/8th from B. Goodwill exists in the books at Rs 30,000. C brings

Rs20,000 as goodwill out of his share of Rs30,000. It was decided that the shortfall in amount shall be debited

to C’s Current Account. Pass necessary journal entries to record the above. 3

4. M and N are partners sharing profits and losses in the ratio of 3:2. They admit O into partnership for 1/4 th

share, which he takes 1/6th from M and 1/12th from N. Goodwill exists in the books at Rs 20,000. O brings

Rs18,000 as goodwill out of his share of Rs30,000. It was decided that the shortfall in amount shall be debited

to C’s Current Account. Pass necessary journal entries to record the above

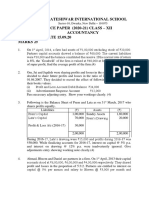

5. The following is the balance sheet of Mohit, Sunny and Raj who are partners sharing profits in the ratio of

2:2:1, as on March 31st 2021. 4

Balance sheet as on March31st 2021

Liabilities Amount(Rs) Assets Amount(Rs)

Creditors 4,00,000 Goodwill 3,00,000

Reserve fund 2,50,000 Fixed Assets 6,00,000

Capitals: Stock 1,00,000

Mohit: 300,000 Sundry Debtors 2,00,000

Sunny : 2,50,000 Cash at Bank 1,50,000

Raj:1,50,000 7,00,000

13,50,000 13,50,000

Sunny died on June 15 2021. According to the deed, his legal representatives are entitled to:

th

i. Balance in capital Account

ii. Share of goodwill valued on the basis of thrice the average of the past 4years profits.

iii. Share of profits up to the date of death on the basis of average profits for the past 4 years.

iv. Interest on capital account @ 12p.a.

Profits for the years ending on March 31 of 2018, 2019, 2020, 2021 respectively were

Rs1,50,000,Rs1,70,000, Rs1,90,000 and Rs1,30,000.

Sunny’s legal representatives were to be paid the amount due. Mohit and Raj decided to take

over Suraj’s share equally. Calculate the amount payable to his legal representatives.

6. . From the following information calculate ‘Interest Coverage Ratio:

Profit after interest and tax Rs7,20,000

10% Debentures Rs8,00,000

Rate of income tax 40%.

ii. From the following information calculate ‘Proprietary Ratio’

Long term Borrowings Rs3,00,000

Long term provisions Rs1,00,000

Current Liabilities Rs 50,000

Non- current Assets Rs 4,60,000

Current Assets Rs 90,000

iii. The fixed assets of a company were Rs45,00,000. Its current assets were Rs5,30,000 and current

liabilities were Rs3,30,000. During the year ended 31st March, 2019 the company earned net profit

before tax Rs15,00,000. The tax rate was 30%. Calculate return on investment.

7. From the following information calculate ‘Interest Coverage Ratio:

Profit after interest and tax Rs6,00,000

10% Debentures Rs8,00,000

Rate of income tax 40%.

ii. From the following information calculate ‘Proprietary Ratio’

Long term Borrowings Rs2,00,000

Long term provisions Rs1,00,000

Current Liabilities Rs 50,000

Non- current Assets Rs 3,60,000

Current Assets Rs 90,000

iii. The fixed assets of a company were Rs35,00,000. Its current assets were Rs4,30,000 and current

liabilities were Rs3,30,000. During the year ended 31st March, 2019 the company earned net profit

before tax Rs18,00,000. The tax rate was 30%. Calculate return on investment.

You might also like

- Pelican Stores Data Analysis ChartDocument17 pagesPelican Stores Data Analysis ChartNaresh Kumar NareshNo ratings yet

- IKEA Case StudyDocument12 pagesIKEA Case StudyAmrit Prasad0% (1)

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Configuration MOP Aircel ICRDocument7 pagesConfiguration MOP Aircel ICRKaran ParmarNo ratings yet

- Digital Name Card - Micro Processor ProjectDocument38 pagesDigital Name Card - Micro Processor ProjectMr. L.B. LeeNo ratings yet

- Question Bank CH-Retirement and DeathDocument6 pagesQuestion Bank CH-Retirement and Deathsuchitasingh1106No ratings yet

- 04 Sample PaperDocument45 pages04 Sample Papergaming loverNo ratings yet

- 12 Accountancy sp04Document45 pages12 Accountancy sp04Priyansh AryaNo ratings yet

- Accountancy QP-Term II-Pre Board 1 - Class XIIDocument6 pagesAccountancy QP-Term II-Pre Board 1 - Class XIIRaunofficialNo ratings yet

- Partnership and Non-For-Profit OrganisationsDocument4 pagesPartnership and Non-For-Profit OrganisationsJoshi DrcpNo ratings yet

- Death 2024 SPCC PDFDocument24 pagesDeath 2024 SPCC PDFDaksh YadavNo ratings yet

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- Acc Xii Pt1 PreptDocument5 pagesAcc Xii Pt1 PreptNishi AroraNo ratings yet

- 1 Test Series Accountancy 12th (Fundamentals of Partnership)Document2 pages1 Test Series Accountancy 12th (Fundamentals of Partnership)Rav NeetNo ratings yet

- XII - Accountancy U.T - 1 Set 1Document4 pagesXII - Accountancy U.T - 1 Set 1tanu1304262No ratings yet

- Vineet FileDocument8 pagesVineet FileVineet KumarNo ratings yet

- Sanskriti School Dr. S. Radhakrishnan Marg New DelhiDocument7 pagesSanskriti School Dr. S. Radhakrishnan Marg New DelhiAVNEET XII-CNo ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- 12 Accountancy SQP 4Document11 pages12 Accountancy SQP 4KandaroliNo ratings yet

- Dissolution of Partnership FirmDocument5 pagesDissolution of Partnership FirmDark SoulNo ratings yet

- Indian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursDocument5 pagesIndian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursRitaNo ratings yet

- Class 12 CBSE ISC Accountancy Assignment 10Document15 pagesClass 12 CBSE ISC Accountancy Assignment 10studentNo ratings yet

- Accountancy Ques PaperDocument5 pagesAccountancy Ques Papersudarshanjha.0001No ratings yet

- Test Retirement Death Dissolution-1Document4 pagesTest Retirement Death Dissolution-1Vibhu VashishthNo ratings yet

- Admission Test No. 2Document5 pagesAdmission Test No. 2Mitesh Sethi0% (1)

- Tar Ge T 100: JS AccountancyDocument33 pagesTar Ge T 100: JS Accountancyvishal joshiNo ratings yet

- Question Bank Accountancy (055) Class XiiDocument5 pagesQuestion Bank Accountancy (055) Class XiiDHIRENDRA KUMARNo ratings yet

- Partnership Fundamentals 2Document6 pagesPartnership Fundamentals 2sainimanish170gmailcNo ratings yet

- CTF Edited Solved Paper 1Document2 pagesCTF Edited Solved Paper 1Umesh JaiswalNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- Saint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Document3 pagesSaint Hood Convent School Assignment Ch.3 (Change in Profit Sharing Ratio Among The Existing Partners)Abhishek SharmaNo ratings yet

- Cbse Questions Change in PSRDocument4 pagesCbse Questions Change in PSRDeepanshu kaushikNo ratings yet

- Date: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusDocument5 pagesDate: 06-03-2021 Subject:Book Keeping & Time: 3 Hrs. Class:XII Com Marks: 80 Syllabus: Full SyllabusPranit PanditNo ratings yet

- Xii Acct WDocument11 pagesXii Acct WFree Fire KingNo ratings yet

- Aaaccountancy Ques Paper001Document5 pagesAaaccountancy Ques Paper001sudarshanjha.0001No ratings yet

- Assignment On Fundamentals of PartnershipDocument8 pagesAssignment On Fundamentals of Partnershipsainimanish170gmailc100% (1)

- Change in Profit RatioDocument10 pagesChange in Profit RatioHansika SahuNo ratings yet

- Accounts XiiDocument12 pagesAccounts XiiTanya JainNo ratings yet

- 10 Sample PaperDocument41 pages10 Sample Papergaming loverNo ratings yet

- Xii Comm Holiday Homework 2020 23Document44 pagesXii Comm Holiday Homework 2020 23Mohit SuryavanshiNo ratings yet

- XII Accounts Test With SolutionDocument12 pagesXII Accounts Test With SolutionKritika Mahalwal100% (1)

- Accountancy Unit Test 1 Paper Shalom 2ndDocument4 pagesAccountancy Unit Test 1 Paper Shalom 2ndTûshar ThakúrNo ratings yet

- 1 VJP 0 LTVX WHN RV ZUCj NLDocument10 pages1 VJP 0 LTVX WHN RV ZUCj NLVanshika BhatiNo ratings yet

- Worksheet - Retirement & DissolutionDocument4 pagesWorksheet - Retirement & DissolutionYogesh AdhikariNo ratings yet

- DR GR Public School, Neyyattinkara PRE-BOARD EXAM 2021-22 AccountancyDocument17 pagesDR GR Public School, Neyyattinkara PRE-BOARD EXAM 2021-22 AccountancyPiyush HazraNo ratings yet

- Module-2 Sample Question PaperDocument18 pagesModule-2 Sample Question PaperRay Ch100% (1)

- 12 Accountancy SQP 5Document13 pages12 Accountancy SQP 5KandaroliNo ratings yet

- AccoutancyRoundTest1 Sample Class 12Document3 pagesAccoutancyRoundTest1 Sample Class 12Samyuktha nairNo ratings yet

- Xii Acc Death WSDocument4 pagesXii Acc Death WSshahidroonissisNo ratings yet

- Cummulative Test: Sowdambikaa Group of SchoolsDocument3 pagesCummulative Test: Sowdambikaa Group of SchoolsDharmaNo ratings yet

- Change in PSR WS 1 - DocxDocument3 pagesChange in PSR WS 1 - DocxGopika BaburajNo ratings yet

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- 12 Accounts ch6 tp1Document11 pages12 Accounts ch6 tp1Pawan TalrejaNo ratings yet

- Death of A PartnerDocument2 pagesDeath of A PartnerAarya KhedekarNo ratings yet

- Suraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Document5 pagesSuraj Gir's Guess Paper For AISSCE-2008: Accountancy (67/1/2)Shalini SharmaNo ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- 03 - Accounts - Prelims 4Document6 pages03 - Accounts - Prelims 4Pawan TalrejaNo ratings yet

- ACCOUNTANCY-Practice QuestionsDocument6 pagesACCOUNTANCY-Practice QuestionsMary JaineNo ratings yet

- XII Test (Death, Ret - Diss)Document4 pagesXII Test (Death, Ret - Diss)MLastTryNo ratings yet

- CBSE Class 12 Accountancy Sample Paper - 1 (Solved) For CBSE Examination March 2019Document25 pagesCBSE Class 12 Accountancy Sample Paper - 1 (Solved) For CBSE Examination March 2019SWAPNIL BHASKERNo ratings yet

- Delhi Public School: ACCOUNTANCY - (Subject Code: 055)Document4 pagesDelhi Public School: ACCOUNTANCY - (Subject Code: 055)AbhishekNo ratings yet

- Revision Fundamentals 1Document7 pagesRevision Fundamentals 1LexNo ratings yet

- XII Commerce PT 2Document1 pageXII Commerce PT 2LexNo ratings yet

- Grade 12 B.ST CH 1Document2 pagesGrade 12 B.ST CH 1LexNo ratings yet

- Class 12 Test On 15.9.20-1Document2 pagesClass 12 Test On 15.9.20-1LexNo ratings yet

- 11 Ratio Analysis PowerPointToPdfDocument11 pages11 Ratio Analysis PowerPointToPdfLexNo ratings yet

- General StudiesDocument9 pagesGeneral StudiesLexNo ratings yet

- ChargeTech PLUG Manual - 42K & 54KDocument6 pagesChargeTech PLUG Manual - 42K & 54KKian GonzagaNo ratings yet

- Teslascada2 Runtime (Android) : User ManualDocument7 pagesTeslascada2 Runtime (Android) : User ManualRodrigo RezendeNo ratings yet

- 2023 CamryDocument8 pages2023 CamrybhargavNo ratings yet

- Alphaplus Product Brochure (2007-08)Document60 pagesAlphaplus Product Brochure (2007-08)praneshVNo ratings yet

- Catalytic Distillation VersionDocument4 pagesCatalytic Distillation Versionlux0008No ratings yet

- Digital Payments in IndiaDocument23 pagesDigital Payments in Indiaabhinav sethNo ratings yet

- P1125P1/P1250E1: Output RatingsDocument6 pagesP1125P1/P1250E1: Output Ratingsmohsen_cumminsNo ratings yet

- Beasiswa Kursus Bhs Spanyol Di ColombiaDocument5 pagesBeasiswa Kursus Bhs Spanyol Di ColombiaAerrosa MurendaNo ratings yet

- Atari VCS 2600 Supercharger Tape File FormatDocument2 pagesAtari VCS 2600 Supercharger Tape File FormatAlainleGuirecNo ratings yet

- Leadership and Governance Dalam SKNDocument13 pagesLeadership and Governance Dalam SKNWenna YolandaNo ratings yet

- Understanding Entrepreneurship: A Case Study On Ms. Namita Sharma "The Queen of NFH"Document3 pagesUnderstanding Entrepreneurship: A Case Study On Ms. Namita Sharma "The Queen of NFH"International Journal of Application or Innovation in Engineering & Management100% (1)

- Tugas Bahasa InggrisDocument10 pagesTugas Bahasa InggrisHunHan SevenNo ratings yet

- Compensation: Introducing The Pay Model and Pay StrategyDocument27 pagesCompensation: Introducing The Pay Model and Pay StrategySyaz AmriNo ratings yet

- Professional English II (Job Interview) 24032021Document8 pagesProfessional English II (Job Interview) 24032021Chaterine FebbyNo ratings yet

- How Do I Manually Boot HP-UX On Integrity (Itanium) Based SystemsDocument6 pagesHow Do I Manually Boot HP-UX On Integrity (Itanium) Based Systemsnilu772008No ratings yet

- Probity Audit PolicyDocument7 pagesProbity Audit PolicyMahmud Toha100% (1)

- Solar Resource Mapping and PV Potential in MyanmarDocument8 pagesSolar Resource Mapping and PV Potential in Myanmarsalem BEN MOUSSA100% (1)

- Universidad de Cuenca Facultad de Ciencias Económicas Carrera EconomíaDocument9 pagesUniversidad de Cuenca Facultad de Ciencias Económicas Carrera EconomíaMireya Ríos CaliNo ratings yet

- Well and Testing From Fekete and EngiDocument6 pagesWell and Testing From Fekete and EngiRovshan1988No ratings yet

- EUROPART Inter Catalog MB Truck 2014 ENDocument400 pagesEUROPART Inter Catalog MB Truck 2014 ENBoumediene CHIKHAOUINo ratings yet

- Polaris InfoDocument4 pagesPolaris InfoSankuri RamNo ratings yet

- Comparative Analysis and Optimization of Active Power and Delay of 1-Bit Full Adder at 45 NM TechnologyDocument3 pagesComparative Analysis and Optimization of Active Power and Delay of 1-Bit Full Adder at 45 NM TechnologyNsrc Nano ScientifcNo ratings yet

- Valvula Piston Buschjost 86500Document2 pagesValvula Piston Buschjost 86500Base SistemasNo ratings yet

- Cases in Torts (Doctrines)Document56 pagesCases in Torts (Doctrines)hmn_scribdNo ratings yet

- Allgon Coverage Systems - Repeater Catalogue - ALGPC0201Document23 pagesAllgon Coverage Systems - Repeater Catalogue - ALGPC0201Virgil Peiulescu0% (1)

- Topographic Map of LemingDocument1 pageTopographic Map of LemingHistoricalMapsNo ratings yet