Professional Documents

Culture Documents

Tax and Exactions

Tax and Exactions

Uploaded by

Janalin TatilOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax and Exactions

Tax and Exactions

Uploaded by

Janalin TatilCopyright:

Available Formats

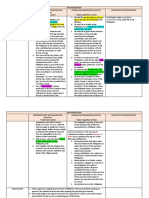

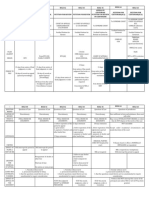

TAX AND OTHER FEES

TAX TOLL LICENSE FEE PENALTY on TAXES CUSTOMS DUTY SPECIAL ASSESMENT DEBT

is a demand of A toll is a demand of License fee is imposed Penalty is any Custom duties are taxes is an enforced Debt is generally

sovereignty, is paid for proprietorship, is paid for regulation and sanction imposed as a imposed on goods proportional based on contract, is

the support of the for the use of another’s involves the exercise punishment for exported from or contribution from assignable and may be

government and may property and may be of police power violation of law or imported to a country. owners of lands for paid in kind while a

be imposed only by the imposed by the acts deemed special benefits resulting tax is based on law,

State government or private injurious. from public cannot generally be

individuals or entities improvements. assigned and is

generally payable in

money.

IMPOSED UPON Persons The use of another’s Exercise of a privilege Violation of law Goods imported or Persons or property who Obligation based on

Property property exported benefited from public contract

Rights etc improvements

AMOUNT Depends on the kind of Fair return of cost or Only necessary to varies varies reasonable Depends on the

tax improvement carry out the contract

regulation

PURPOSE To raise revenue Collect for the use of Regulate punishment regulation Contribute to the cost of Perform obligation

property public improvement

IMPOSING State State state state state state Private persons

AUTHORITY Private individuals/

entities

EFFECTS OF NON- Imprisonment or fine or Derivation of the use of Cannot exercise the Same effects non Cannot exercise the Subjected to penalties Give rise to a cause of

PAYMENT both the property privilege payment of taxes privilege Same effects non action

payment of taxes

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The UK Property Portals Industry Porter's Five Forces AnalysisDocument1 pageThe UK Property Portals Industry Porter's Five Forces AnalysisBoghiu Z0% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Case Study For Business English BBA - BComDocument6 pagesCase Study For Business English BBA - BComAnil Shenoy KNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ARTHUR - Early Greece: The Origins of The Western Attitude Towards WomenDocument53 pagesARTHUR - Early Greece: The Origins of The Western Attitude Towards WomenCamila BelelliNo ratings yet

- TQMDocument25 pagesTQMAadil Kakar0% (1)

- Ards Concept MapDocument1 pageArds Concept Mapchristine louise bernardo100% (1)

- Tonka FinalDocument16 pagesTonka Finalআন নাফি100% (1)

- NATURALIZATIONDocument5 pagesNATURALIZATIONJanalin TatilNo ratings yet

- Lease and UsufructuaryDocument3 pagesLease and UsufructuaryJanalin TatilNo ratings yet

- Cyber Crime WarrantsDocument5 pagesCyber Crime WarrantsJanalin TatilNo ratings yet

- Recissible Contracts Voidable Contracts Unenforceable Contracts Void Contracts WhatDocument3 pagesRecissible Contracts Voidable Contracts Unenforceable Contracts Void Contracts WhatJanalin TatilNo ratings yet

- Judicial VS Extra JudforeclosureDocument2 pagesJudicial VS Extra JudforeclosureJanalin TatilNo ratings yet

- Environmental Cases (Civil) Citizen Suit Slapp Criminal Actions Writ of Kalikasan Writ of Continuing Madamus Where Filed MTS/RTC RTCDocument9 pagesEnvironmental Cases (Civil) Citizen Suit Slapp Criminal Actions Writ of Kalikasan Writ of Continuing Madamus Where Filed MTS/RTC RTCJanalin TatilNo ratings yet

- APPEALSDocument2 pagesAPPEALSJanalin TatilNo ratings yet

- Change of Name (Rule 103) Cancellation or Correction of Entries in The Civil Registrar (RULE 108) Clerical Error Law (RA 9048) NatureDocument3 pagesChange of Name (Rule 103) Cancellation or Correction of Entries in The Civil Registrar (RULE 108) Clerical Error Law (RA 9048) NatureJanalin TatilNo ratings yet

- Examination of Witness Before Trial-CriminalDocument1 pageExamination of Witness Before Trial-CriminalJanalin TatilNo ratings yet

- Demurrer To Evidence Civil Cases Criminal Cases Nature Motion To Dismiss Motion To Dismiss When FiledDocument1 pageDemurrer To Evidence Civil Cases Criminal Cases Nature Motion To Dismiss Motion To Dismiss When FiledJanalin TatilNo ratings yet

- Certiorari Prohibition Mandamus Writ of Continuing MandamusDocument2 pagesCertiorari Prohibition Mandamus Writ of Continuing MandamusJanalin TatilNo ratings yet

- Personal Trading BehaviourDocument5 pagesPersonal Trading Behaviourapi-3739065No ratings yet

- Lead Generation GuideDocument82 pagesLead Generation GuidePepe El FritangasNo ratings yet

- Hummer-Bot Instruction ManualDocument108 pagesHummer-Bot Instruction Manualinghdj100% (1)

- Book 3 SuccessionDocument189 pagesBook 3 SuccessiontatatalaNo ratings yet

- Electricity WorksheetDocument4 pagesElectricity WorksheetSawyerNo ratings yet

- Glamour MagickDocument2 pagesGlamour MagickIşınsu ÇobanoğluNo ratings yet

- Frames in JAVA: Opening A WindowDocument3 pagesFrames in JAVA: Opening A WindowdmybookNo ratings yet

- Sialoree BotoxDocument5 pagesSialoree BotoxJocul DivinNo ratings yet

- Bids & Award ResolutionDocument5 pagesBids & Award ResolutionChrysty Lynn OnairosNo ratings yet

- Vilas County News-Review, July 27, 2011Document28 pagesVilas County News-Review, July 27, 2011News-ReviewNo ratings yet

- Elementary EF 3rd Ed WB-3-11Document9 pagesElementary EF 3rd Ed WB-3-11David CaßNo ratings yet

- Sec5a4 Abs AsrDocument94 pagesSec5a4 Abs AsrTadas PNo ratings yet

- CIA Unclassified: Threat of Serbian Terrorist Attacks, "Kamikaze Pilots" On Nuclear Power StationsDocument10 pagesCIA Unclassified: Threat of Serbian Terrorist Attacks, "Kamikaze Pilots" On Nuclear Power StationsSrebrenica Genocide LibraryNo ratings yet

- Effect of A High-Protein Diet Versus Standard-Protein Diet On Weight Loss and Biomarkers of Metabolic Syndrome A Randomized Clinical TrialDocument14 pagesEffect of A High-Protein Diet Versus Standard-Protein Diet On Weight Loss and Biomarkers of Metabolic Syndrome A Randomized Clinical TrialReni WulansariNo ratings yet

- Carlsberg Sustainability Report 2018Document62 pagesCarlsberg Sustainability Report 2018Mike MichaelidesNo ratings yet

- Adf11 7Document1,182 pagesAdf11 7Parashar ChinniNo ratings yet

- PushkalavatiDocument5 pagesPushkalavatiSana KhanNo ratings yet

- Business Communication Norway PresentationDocument23 pagesBusiness Communication Norway PresentationSheryar NaeemNo ratings yet

- Schwa Worksheets 1Document5 pagesSchwa Worksheets 1mohammedNo ratings yet

- Consumer Behavior: Buying, Having, and Being: Thirteenth Edition, Global EditionDocument52 pagesConsumer Behavior: Buying, Having, and Being: Thirteenth Edition, Global EditionSao Nguyễn Toàn100% (1)

- 2nd PROF ANIL KUMAR THAKUR MEMORIAL NATIONAL DEBATE COMPETITIONDocument9 pages2nd PROF ANIL KUMAR THAKUR MEMORIAL NATIONAL DEBATE COMPETITIONMovies ArrivalNo ratings yet

- Energy-Efficient and Book Mountain Public Library of Urdaneta CityDocument142 pagesEnergy-Efficient and Book Mountain Public Library of Urdaneta CityDarwin PaladoNo ratings yet

- Nutrition Support in Critically Ill PatientDocument19 pagesNutrition Support in Critically Ill PatienttantoNo ratings yet

- Use of English - Evau - MadridDocument1 pageUse of English - Evau - MadridAITANA AZNAR ARELLANONo ratings yet