Professional Documents

Culture Documents

Limitations On The Power of Taxation

Limitations On The Power of Taxation

Uploaded by

Janalin Tatil0 ratings0% found this document useful (0 votes)

5 views2 pagesOriginal Title

LIMITATIONS ON THE POWER OF TAXATION

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views2 pagesLimitations On The Power of Taxation

Limitations On The Power of Taxation

Uploaded by

Janalin TatilCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

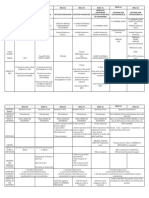

LIMITATIONS ON THE POWER OF TAXATION

INHERENT LIMITATION CONSTITUTIONAL LIMITATIONS

1. Public purpose 1. Prohibition against imprisonment for non-

2. Inherently legislative payment of taxes

Power to assess and collect – EXECUTIVE 2. Uniformity and equality of taxation

3. Grant by congress of authority of the President

3. Territorial to impose tariff rates

4. International comity 4. Prohibition against taxation of religious,

5. Exemptions of government agencies, entities charitable and educational entities (RPT)

and instrumentalities 5. Prohibition against non-stock, non-profit

GOCCs are subject to tax educational institutions

EXC: 6. Majority vote of congress for the grant of tax

a. GSIS exemption

b. SSS Relative majority (majority of quorum) is

c. HDMF sufficient to withdraw exemption

d. PHIC 7. Prohibition on the use of the special tax levied

e. LOCAL water districts 8. President’s veto power on appropriation,

revenue and tariff bills

9. Grant of power to LGU to create its own

income

10. Flexible tariff clause

11. No appropriation or use of public money for

religious purposes

12. Tax bills should originate exclusive from the

HREP

13. Judicial Power to review legality of tax

SITUS OF TAXATION

SOURCES WITHIN THE PHILIPPINES SOURCES WITHOUT PARTLY WITHIN & WITHOUT

1. Interest bearing obligations of

residents of the Philippines

2. Dividends from domestic

corporation

3. Foreign Corp -if at least 50% of Foreign Corp -if at LOWER than 50%

income within 3yrs are derived from of income within 3yrs are derived

Philippines from Philippines

4. compensation for services

performed in the Philippines

5. rentals and royalties for the use

of property and rights within the

Philippines

6. sale of real property located in

the Philippines

7. sale of personal property 7. sale of personal property 7. sale of personal property

Produced within Produced without Produced within or without

Sold within Sold without Sold without or without

* taxpayer if producer * taxpayer if producer * taxpayer if producer

* taxpayer is NOT producer

Income shall be treated as derived from sources within which the personal property was SOLD

EXC:

1. Shares of stock of a domestic corporation

RELIGIOUS, CHARITABLE AND EDUCATIONAL ENTITIES

WHO (TAXPAYER) REVENUES ASSESTS

NON-PROFIT one registered with the (SEC) EXEMPT as long as it is use for EXEMPT from RPT as

NON-STOCK as a non-stock corporation ACTUALLY, DIRECTLY OR long as it is use for

EDUCATIONAL to engage in maintaining and EXCLUSIVELY (ADE), for ACTUALLY, DIRECTLY

INSTITUTION administering a school educational purpose regardless OR EXCLUSIVELY

of its source (ADE)

NON-PROFIT one registered with the (SEC) EXEMPT from INCOME tax if: EXEMPT from RPT as

NON-STOCK as a non-stock corporation a. Organized and operated long as it is use for

HOSPITALS to engage in maintaining and EXCLUSIVELY for charitable ACTUALLY, DIRECTLY

administering a hospital purposes OR EXCLUSIVELY

b. NO PART of its income or (ADE) for charitable

assets inure to the benefit of purposes

any member

INCOME from REAL or

PERSONAL properties or from

activities conducted for profit,

regardless of the disposition

made, SUBJECT to TAX

OTHER NON-PROFIT A charitable institution, also EXEMPT from INCOME tax if: EXEMPT from RPT as

NON-STOCK called a nonprofit c. Organized and operated long as it is use for

CHARITABLE organization, aims to EXCLUSIVELY for charitable ACTUALLY, DIRECTLY

INSITUTIONS advance a public benefit. purposes OR EXCLUSIVELY

Charitable institutions can NO PART of its income or assets (ADE) for charitable

be run publicly or privately. inure to the benefit of any purposes

member

INCOME from REAL or

PERSONAL properties or from

activities conducted for profit,

regardless of the disposition

made, SUBJECT to TAX

PROPRIETARY A proprietary educational EXEMPT from INCOME tax if: EXEMPT from RPT as

NON-PROFIT HOSPITAL institution refers to any d. Organized and operated long as it is use for

& private school maintained EXCLUSIVELY for charitable ACTUALLY, DIRECTLY

EDUCATIONAL and administered by private purposes OR EXCLUSIVELY

INSTITUTIONS individuals or groups with an NO PART of its income or assets (ADE) for charitable

issued permit to operate inure to the benefit of any purposes

from the (DepEd), (CHED), or member

the (TESDA) INCOME EARNED from profit

activities:

a. Retain its EXEMPTION for its

charitable activities

b. BUT will be subjected to 10%

preferential rate

* beginning July 1, 2020 to

June 30, 2023 rate of 1% shall

apply

GROSS income from

UNRELATED trade or business

Does not EXCEED 50% of its

total gross income

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- March 2024 StatementDocument4 pagesMarch 2024 Statementsophiaantoine046No ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tax Chapter 20 No Homework-Forming and Operating PartnershipsDocument99 pagesTax Chapter 20 No Homework-Forming and Operating PartnershipsAnjali Patel64% (11)

- NATURALIZATIONDocument5 pagesNATURALIZATIONJanalin TatilNo ratings yet

- Lease and UsufructuaryDocument3 pagesLease and UsufructuaryJanalin TatilNo ratings yet

- Cyber Crime WarrantsDocument5 pagesCyber Crime WarrantsJanalin TatilNo ratings yet

- Recissible Contracts Voidable Contracts Unenforceable Contracts Void Contracts WhatDocument3 pagesRecissible Contracts Voidable Contracts Unenforceable Contracts Void Contracts WhatJanalin TatilNo ratings yet

- Judicial VS Extra JudforeclosureDocument2 pagesJudicial VS Extra JudforeclosureJanalin TatilNo ratings yet

- Environmental Cases (Civil) Citizen Suit Slapp Criminal Actions Writ of Kalikasan Writ of Continuing Madamus Where Filed MTS/RTC RTCDocument9 pagesEnvironmental Cases (Civil) Citizen Suit Slapp Criminal Actions Writ of Kalikasan Writ of Continuing Madamus Where Filed MTS/RTC RTCJanalin TatilNo ratings yet

- APPEALSDocument2 pagesAPPEALSJanalin TatilNo ratings yet

- Change of Name (Rule 103) Cancellation or Correction of Entries in The Civil Registrar (RULE 108) Clerical Error Law (RA 9048) NatureDocument3 pagesChange of Name (Rule 103) Cancellation or Correction of Entries in The Civil Registrar (RULE 108) Clerical Error Law (RA 9048) NatureJanalin TatilNo ratings yet

- Examination of Witness Before Trial-CriminalDocument1 pageExamination of Witness Before Trial-CriminalJanalin TatilNo ratings yet

- Demurrer To Evidence Civil Cases Criminal Cases Nature Motion To Dismiss Motion To Dismiss When FiledDocument1 pageDemurrer To Evidence Civil Cases Criminal Cases Nature Motion To Dismiss Motion To Dismiss When FiledJanalin TatilNo ratings yet

- Certiorari Prohibition Mandamus Writ of Continuing MandamusDocument2 pagesCertiorari Prohibition Mandamus Writ of Continuing MandamusJanalin TatilNo ratings yet

- Particulars Fees: Citymaxx American Express CardDocument4 pagesParticulars Fees: Citymaxx American Express Cardsifat islamNo ratings yet

- Bill Payment & Voucher Booking: Swiss Belhotel SorongDocument1 pageBill Payment & Voucher Booking: Swiss Belhotel SorongEva ChristianyNo ratings yet

- Od428496262499994100 1Document1 pageOd428496262499994100 1अमित कुमारNo ratings yet

- Module 3 Individual Taxpayers 1Document8 pagesModule 3 Individual Taxpayers 1Chryshelle Anne Marie LontokNo ratings yet

- Proposal Project AyamDocument14 pagesProposal Project AyamIrvan PamungkasNo ratings yet

- Tut Tax Solution - CombineDocument5 pagesTut Tax Solution - CombineSyazliana KasimNo ratings yet

- Module 8 - Value Added TaxDocument28 pagesModule 8 - Value Added TaxKyrah Angelica DionglayNo ratings yet

- Income Lesson One - Plan Your FutureDocument1 pageIncome Lesson One - Plan Your FutureJOHN MENDOZA GALLEGOSNo ratings yet

- ACE Bangladesh Payroll Handbook 2021Document32 pagesACE Bangladesh Payroll Handbook 2021Shuvo YeasinNo ratings yet

- 1680675688236-56 PDFDocument1 page1680675688236-56 PDFHari KrishnanNo ratings yet

- Taxation Torts and Damages Trial Practice Transportation, Admiralty & Maritime LawsDocument16 pagesTaxation Torts and Damages Trial Practice Transportation, Admiralty & Maritime LawsPriMa Ricel Arthur100% (1)

- 2024 08 6 11 16 56 Statement - 1717825616529Document12 pages2024 08 6 11 16 56 Statement - 1717825616529Ritesh ShahuNo ratings yet

- DuplicateDocument4 pagesDuplicateAdinarayana RaoNo ratings yet

- ACCA - Skill Level Paper - F6 Tax Adjusted Trading Profit (Individuals)Document14 pagesACCA - Skill Level Paper - F6 Tax Adjusted Trading Profit (Individuals)Anas KhalilNo ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- Viva Bill StatementDocument6 pagesViva Bill Statementasutosh pradhanNo ratings yet

- The Apex Company Is Evaluating A Capital Budgeting Proposal ForDocument2 pagesThe Apex Company Is Evaluating A Capital Budgeting Proposal ForAmit PandeyNo ratings yet

- MobileDocument1 pageMobilekarri keerthiNo ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- GuionDocument5 pagesGuionJuan Sebastian Beltran GamaNo ratings yet

- E-Ticket ASTON PLUIT HOTELDocument2 pagesE-Ticket ASTON PLUIT HOTELraasyidalfiansyahcjp100% (1)

- Income Tax Schemes, Accounting Periods, Accounting Methods, and ReportingDocument6 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods, and ReportingAilene MendozaNo ratings yet

- Bootylicious 2010 03 OriginalDocument103 pagesBootylicious 2010 03 OriginalJuan Nahui MorettNo ratings yet

- Peza Erd Form No. 03-01 2018Document2 pagesPeza Erd Form No. 03-01 2018John LuNo ratings yet

- Implentation of Direct Tax Code in IndiaDocument193 pagesImplentation of Direct Tax Code in IndiaSugandha GuptaNo ratings yet

- 02-2003 Staggered Filing of ReturnDocument4 pages02-2003 Staggered Filing of Returnapi-247793055No ratings yet

- Revolut Beyond BankingDocument41 pagesRevolut Beyond BankingVivekNo ratings yet

- A Reaction Paper About TaxDocument2 pagesA Reaction Paper About TaxsankNo ratings yet