Professional Documents

Culture Documents

Assignment #12

Assignment #12

Uploaded by

Soleil Asier0 ratings0% found this document useful (0 votes)

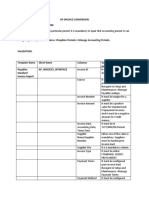

20 views3 pagesThis document summarizes the financial transactions of a business from October 1 to November 4. It records purchases, sales, payments to suppliers and employees, and other cash inflows and outflows. Key events include initial capital investment, purchase and sale of inventory and equipment, issuance and payment of notes, and collection from customers. The periodic financial statements provide a concise record of the company's financial activities and position over time.

Original Description:

Original Title

ASSIGNMENT #12

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the financial transactions of a business from October 1 to November 4. It records purchases, sales, payments to suppliers and employees, and other cash inflows and outflows. Key events include initial capital investment, purchase and sale of inventory and equipment, issuance and payment of notes, and collection from customers. The periodic financial statements provide a concise record of the company's financial activities and position over time.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

20 views3 pagesAssignment #12

Assignment #12

Uploaded by

Soleil AsierThis document summarizes the financial transactions of a business from October 1 to November 4. It records purchases, sales, payments to suppliers and employees, and other cash inflows and outflows. Key events include initial capital investment, purchase and sale of inventory and equipment, issuance and payment of notes, and collection from customers. The periodic financial statements provide a concise record of the company's financial activities and position over time.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

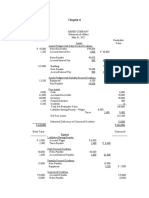

PERIODIC SYSTEM

DATE PARTICULARS F DEBIT CREDIT

OCT 01 Cash In Bank P 350,000

Cash On Hand P 150,000

D. Espiritu, Capital P 500,000

Initial Investment

02 Purchases (11,200 x 10) P 112,000

Freight In P 8,960

Accounts Payable P 120,960

2/10, n/30, FOB Shipping point, freight

prepaid

03 Office Equipment P 33,600

Freight In P 2,240

Cash On Hand P 2,240

Accounts Payable P 33,600

3/10, n/20, FOB shipping point, freight

collect

04 Office Furniture (22,400 x 95%) P 21,280

Accounts Payable P 21,280

1/10, n/30

05 Cash On Hand P 99,500

Interest Expense P 500

Accounts Payable P 100,000

Discounted our 30-day 6% promissory

note with PNB

06 Notes Receivable P 134,904

Interest Income P 504

Sales (16,800 x 8) P 134,400

Record sales on account

07 Store Supplies P 5,600

Notes Payable P 5,600

Issued a 20-day, 12% promissory note

08 Utilities Expense P 24,000

Cash In Bank P 24,000

Paid utilities

09 Accounts Payable P 2,240

Office Furniture P 2,240

Received credit memo

10 Accounts Payable P 11,200

Cash In Bank P 11,200

Partial Payment to Metallica Equipment

11 Accounts Payable P 11,200

Purchase Returns and Allowance P 11,200

Returned computer due to defects.

12 Accounts Payable P 120,960

Purchase Discounts (100,800 x 3%) P 3,024

Cash In Bank P 117,936

Paid our account with Galaxy Co.

13 Accounts Payable P 22,400

Cash In Bank P 22,400

Paid our accounts with Metallica Equip.

14 Office Furniture P 15,000

D. Espiritu, Capital P 11,000

Accounts Payable P 4,000

Additional Investment

15 Accounts Payable P 20,160

Cash In Bank P 20,160

Paid our accounts with Cahoy, INC.

16 Purchases P 112,000

Accounts Payable P 112,000

2/10, n/30

17 Cash In Bank P 67,200

Sales P 67,200

To record cash sales

18 Accounts Receivable (16,800 x 6) P 100,800

Sales P 100,800

Record sales on account, Term: 2/10, n/30

Freight Out P 3,360

Cash On Hand P 3,360

FOB Destination, Freight Prepaid

20 Purchases P 56,000

Cash In Bank P 56,000

Record cash purchases

21 Cash In Bank P 134,904

Notes Receivable P134,904

Collected the note of Josiah Inc.

27 Notes Payable P 5,600

Interest Expense (5,600x12%x20/360) P 37.33

Cash In Bank P 5,637.33

Paid our note with C&E Bookstore

28 Cash In Bank P 98,784

Sales Discount (100,800X 2%) P 2,016

Accounts Receivable P 100,800

Collected the account of Luigi Co.

30 Salaries Expense P 100,000

Withholding Tax Payable (10%) P 10,000

SSS Premiums Payable (4.5%) P 4,500

Philhealth Premiums Payable (2%) P 2,000

Pag-ibig Contributions Payable (2%) P 2,000

Cash In Bank P 81,500

Paid Salaries less deductions

Nov. 03 SSS Premiums Expense (8.5%) P 8,500

Philhealth Premiums Expense (2%) P 2,000

Pag-ibig Contributions Expense (2%) P 2,000

SSS Premiums Payable (8.5%) P 8,500

Philhealth Premiums Payable (2%) P 2,000

Pag-ibig Contributions Payable (2%) P 2,000

Employer’s Share

04 Notes Payable P 100,000

Cash In Bank P 100,000

Paid our discounted note with PNB

You might also like

- Computerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENTDocument24 pagesComputerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENThello nasty100% (1)

- Audit of CashDocument9 pagesAudit of CashEmma Mariz Garcia25% (8)

- CruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleDocument37 pagesCruzJoaquin - ACCCOB1 - Chapter 1 Review of The Accounting CycleInigo CruzNo ratings yet

- SAP - VAT On Customer Down-PaymentDocument5 pagesSAP - VAT On Customer Down-PaymentBhagiradha PinnamareddyNo ratings yet

- Acctg Ass No. 10 Merchandising BusinessDocument5 pagesAcctg Ass No. 10 Merchandising BusinessDaisy Marie A. Rosel80% (5)

- Week 3 Tutorial SolutionsDocument31 pagesWeek 3 Tutorial SolutionsalexandraNo ratings yet

- Group 6Document8 pagesGroup 6Parkiee JamsNo ratings yet

- The Procurement Process: Multiple Choice QuestionsDocument22 pagesThe Procurement Process: Multiple Choice QuestionsMai PhanNo ratings yet

- Assignments #14Document3 pagesAssignments #14Soleil AsierNo ratings yet

- Assignment #13Document3 pagesAssignment #13Soleil AsierNo ratings yet

- Journal EntryDocument3 pagesJournal EntryVincenzo CassanoNo ratings yet

- AC Kendra Raphia Dress ShopDocument13 pagesAC Kendra Raphia Dress ShopNicole San JuanNo ratings yet

- Intermediate Accounting 1 - Cash Straight ProblemsDocument3 pagesIntermediate Accounting 1 - Cash Straight ProblemsCzarhiena SantiagoNo ratings yet

- Cises Accounting For Purchases and Sales of MerchandiseDocument7 pagesCises Accounting For Purchases and Sales of MerchandiseCamelia CanamanNo ratings yet

- Joel Amos Periodic InventoryDocument7 pagesJoel Amos Periodic InventoryJasmine P. Manlungat - EMERALDNo ratings yet

- Periodic Answer Key (Editable)Document44 pagesPeriodic Answer Key (Editable)coleenmaem.04No ratings yet

- PerpetualDocument13 pagesPerpetualEcho ClarosNo ratings yet

- Chapter 5 Caselette Audit of InventoryDocument33 pagesChapter 5 Caselette Audit of InventoryAnna Taylor100% (1)

- COPY1Document30 pagesCOPY1kimberlynroqueNo ratings yet

- MerchDocument10 pagesMerchWere dooomedNo ratings yet

- BRANCH ACCOUNTS - Assignment SolutionsDocument9 pagesBRANCH ACCOUNTS - Assignment SolutionsNaveen C GowdaNo ratings yet

- Post Closing Trial Balance Bella EnterprisesDocument1 pagePost Closing Trial Balance Bella EnterprisesmarivicNo ratings yet

- AC Ace StoreDocument9 pagesAC Ace StoreNicole San JuanNo ratings yet

- Correct Periodic Inventory SystemDocument8 pagesCorrect Periodic Inventory SystemVincenzo CassanoNo ratings yet

- IA2Document14 pagesIA2ALEA MAE THERESE BERMEJONo ratings yet

- Uy Balance SheetDocument8 pagesUy Balance SheetMary Louise CamposanoNo ratings yet

- Audit Practice Accrual Solution PDFDocument19 pagesAudit Practice Accrual Solution PDFEISEN BELWIGANNo ratings yet

- Accounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Document16 pagesAccounting For Nonvat and Vat Registered Business Solution To Assign 1 Quiz 1Fider GracianNo ratings yet

- Espiritu, Rachelle Ann I. ABM 11 - St. ThomasDocument8 pagesEspiritu, Rachelle Ann I. ABM 11 - St. ThomasLLOYD ESPIRITUJRNo ratings yet

- Inv AudDocument32 pagesInv AudAud Balanzi100% (1)

- Peter Pan Accounting Firm General JournalDocument7 pagesPeter Pan Accounting Firm General JournalMarites AmorsoloNo ratings yet

- Merchandising Business PDFDocument5 pagesMerchandising Business PDFJenny Valerie SualNo ratings yet

- PeriodicDocument19 pagesPeriodicAlyssa Mae MarceloNo ratings yet

- 10.20.2020 Merchandising Activity 3 - Answer KeyDocument42 pages10.20.2020 Merchandising Activity 3 - Answer KeyRhadzmae OmalNo ratings yet

- Branch AccountsDocument9 pagesBranch AccountsKalpana SinghNo ratings yet

- JT Merchandise Navasquez (Periodic)Document14 pagesJT Merchandise Navasquez (Periodic)John cook100% (1)

- Date Accounts Titles and ExplanationDocument16 pagesDate Accounts Titles and ExplanationJohn Vincent MirandaNo ratings yet

- Guzon Book Distributors General Journal Date Particulars PR Debit CreditDocument8 pagesGuzon Book Distributors General Journal Date Particulars PR Debit CreditNermeen C. AlapaNo ratings yet

- General JournalDocument1 pageGeneral JournalMary Jane TambisNo ratings yet

- General JournalDocument1 pageGeneral JournalMary Jane TambisNo ratings yet

- Chapter 1 - Review of The Accounting CycleDocument30 pagesChapter 1 - Review of The Accounting CyclekimberlynroqueNo ratings yet

- Sample Worksheet K204050266 P3.5Document16 pagesSample Worksheet K204050266 P3.5Trâm Mai Thị ThùyNo ratings yet

- Tiger Corporation (Contributed by Oliver C. Bucao)Document4 pagesTiger Corporation (Contributed by Oliver C. Bucao)Pia Corine RuitaNo ratings yet

- Advanced Accounting Part 1 Dayag 2015 Chapter 6Document13 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 6Mazikeen DeckerNo ratings yet

- FoA2 Week 2 Lesson and HW 3Document8 pagesFoA2 Week 2 Lesson and HW 3Christine Joyce MagoteNo ratings yet

- Sol Man 17Document7 pagesSol Man 17samsungacerNo ratings yet

- Buenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaDocument21 pagesBuenaventuraej Bsa1bmidterm Activity 1 Edgar DetoyaAnonnNo ratings yet

- Audit-of-Inventory Homework AnswersDocument5 pagesAudit-of-Inventory Homework AnswersMarnelli Catalan100% (1)

- FDNACCT Unit 4 - Part 3 - Merchandising Transactions - Class Ex - Examples - Answer KeyDocument2 pagesFDNACCT Unit 4 - Part 3 - Merchandising Transactions - Class Ex - Examples - Answer Keyrabinoadrian24No ratings yet

- 05 Activity BADocument2 pages05 Activity BATyron Franz AnoricoNo ratings yet

- Quiz 1 Cash and Cash Equivalent (A)Document2 pagesQuiz 1 Cash and Cash Equivalent (A)JHERRY MIG SEVILLANo ratings yet

- T Accounts Trial BalanceDocument7 pagesT Accounts Trial BalanceCamille Pasion100% (1)

- Bus. Plan.3333Document8 pagesBus. Plan.3333Reyn E. Villegas Jr.No ratings yet

- Practice Exam - Set ADocument11 pagesPractice Exam - Set ATin PangilinanNo ratings yet

- PERIODICDocument9 pagesPERIODICJeon Cyrone CuachonNo ratings yet

- ABC - Exercises (Answer Key 2)Document18 pagesABC - Exercises (Answer Key 2)Crystal ApinesNo ratings yet

- Fabm1 L7Document4 pagesFabm1 L7LinNo ratings yet

- CH1 ROBLES & EMPLEO Intermediate Accounting Vol. 1Document39 pagesCH1 ROBLES & EMPLEO Intermediate Accounting Vol. 1Aiki VillorenteNo ratings yet

- Intacc 1 - Chapter2-McDocument7 pagesIntacc 1 - Chapter2-McAbigail TalusanNo ratings yet

- Model Value Analysis Bridgeland Za Hav IDocument7 pagesModel Value Analysis Bridgeland Za Hav Iluiru72No ratings yet

- Vat Reg JPK Extracts Pol Topical EssaysDocument71 pagesVat Reg JPK Extracts Pol Topical EssaysMiguelNo ratings yet

- Junior Accountant Job ResponsibilitiesDocument2 pagesJunior Accountant Job ResponsibilitiesTerefe TadesseNo ratings yet

- Materials Management - Step by Step ConfigurationDocument223 pagesMaterials Management - Step by Step Configurationvinay kumar gedelaNo ratings yet

- Kaplan Audit Procedures GuidanceDocument18 pagesKaplan Audit Procedures Guidancebasit ovaisiNo ratings yet

- Quiz1 2, PrelimDocument14 pagesQuiz1 2, PrelimKyla Mae MurphyNo ratings yet

- FIORI - App - FinanceDocument4 pagesFIORI - App - FinancemayoorNo ratings yet

- Oracle Financials Cloud (Account Payables - AP) On-Hands GuideDocument49 pagesOracle Financials Cloud (Account Payables - AP) On-Hands GuideFernanda Gerevini PereiraNo ratings yet

- Oracle Fusion Payables-Validating Payables Invoice, Roles Required and PreqrequisitesDocument4 pagesOracle Fusion Payables-Validating Payables Invoice, Roles Required and Preqrequisitespriyanka_ravi14No ratings yet

- Account Payable ConfigurationDocument21 pagesAccount Payable ConfigurationSrinivasan SanthanamNo ratings yet

- Using Supply Chain Cost ManagementDocument436 pagesUsing Supply Chain Cost ManagementDeepak Pai100% (1)

- 1 1330 F 1 SAP VIM Unforseen ChallengesDocument16 pages1 1330 F 1 SAP VIM Unforseen ChallengesThanuja MNo ratings yet

- FAIEXDocument146 pagesFAIEXAhmed A. DawoodNo ratings yet

- 2nd Grading Exams Key AnswersDocument19 pages2nd Grading Exams Key AnswersUnknown WandererNo ratings yet

- Audit of Liabilities Answer KeyDocument2 pagesAudit of Liabilities Answer KeyLyca MaeNo ratings yet

- Procurement and AP - SoD FinalDocument4 pagesProcurement and AP - SoD FinalManishNo ratings yet

- Overview of Oracle PayablesDocument22 pagesOverview of Oracle Payablessandeep__27No ratings yet

- RFP Competition Ryker Proposal Boston Team 3 Final Version - 1Document49 pagesRFP Competition Ryker Proposal Boston Team 3 Final Version - 1mananoffical100% (1)

- Quản Lý Quan Hệ Nhà Cung CấpDocument12 pagesQuản Lý Quan Hệ Nhà Cung CấpTrang NguyễnNo ratings yet

- 2019 Auditing Board Exam Practice Questions - CPALEDocument28 pages2019 Auditing Board Exam Practice Questions - CPALEcruztenesseeNo ratings yet

- WALSALL - FIN - AP - INVOICES - USER MANUAL - v1 - 0Document75 pagesWALSALL - FIN - AP - INVOICES - USER MANUAL - v1 - 0Shaik MahamoodNo ratings yet

- Data Analytics For Accounting 1st Edition Richardson Solutions ManualDocument17 pagesData Analytics For Accounting 1st Edition Richardson Solutions Manualflorenceronaldoxo0100% (33)

- Internet BillDocument10 pagesInternet BillsuperiorwebsoftNo ratings yet

- Chapter Four The Audit of Accounting Information SystemsDocument20 pagesChapter Four The Audit of Accounting Information SystemsPrince Hiwot EthiopiaNo ratings yet

- AC09302 Expenditure Cycle Part II QuizDocument11 pagesAC09302 Expenditure Cycle Part II Quizkurai_hana11No ratings yet

- Fixed Assets PDFDocument21 pagesFixed Assets PDFSrihari GullaNo ratings yet

- Business (A-Levels) GlossaryDocument4 pagesBusiness (A-Levels) GlossaryZainab FaisalNo ratings yet

- Solutions To Exercises - Chap 6Document20 pagesSolutions To Exercises - Chap 6InciaNo ratings yet