Professional Documents

Culture Documents

Draft Letter - Change in GST Rates

Draft Letter - Change in GST Rates

Uploaded by

Ashish SaxenaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Draft Letter - Change in GST Rates

Draft Letter - Change in GST Rates

Uploaded by

Ashish SaxenaCopyright:

Available Formats

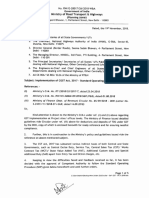

Ref No: GDC/C1503012/NGP/FLY/LASA/

To,

The Team Leader,

LEA Associates South Asia Pvt.Ltd.

Plot No.18, Swaraj Vihar Wathoda

Nagpur

Kind Attn: Mr. Bipul Chakraborty

Sub: Construction of 4 lane flyover on NH-6 integrated with ROB,s and river bridge including

approach ramps, service roads, footpath over RCC utility duct from Pardi Octroi Naka to Itwari

(CH.544/665 to 548/065) and inner ring road from Manewada to Kalamna (CH.20/760 to 23/190),

and from Rani Prajapati square to Vaishno Devi square (CH.00/000 to 00/596) including rub on

LC.No. 71, 72 and connecting inner ring road junction to APMC Kalamna Market gate No.1&2,

Nagpur, Maharashtra Reg:"Regarding Reimbursement of additional amount under clause no

19.17 due to change in GST rates.

Ref : 1.GDC/C1503012/NGP/FLY/NHAI/2251 dated 05.03.2022

2.Authority Email dated 27 .11.2021

3.NHAI/F&A/IA/2019-20/GST Audit Reports/5586 dated 22.11.2021

4. GDC/C1503012/NGP/FLY/NHAI/2792 dated 12.08.2022

Dear Sir,

We have been awarded this contract vide LOA No. NHAI/Tech/MH/Nag/2014/76071 dated

28.12.2015. As per clause 19.1.2 the total contract price is inclusive of all the taxes as applicable

in pre-GST regime i.e. Excise duty, VAT etc.

After introduction of GST from 01.07.2017 this work has been wholly taxable under GST rules

and we were liable to pay GST @ 12% on the work done amount as per bill. Due to change in tax

law, the tax payable on the project has increased as compared to the previous tax regime under

which we had submitted the tender.

In this regard we have submitted the cost implication as per clause 19.17 of contract agreement in

the NHAI prescribed format vide letter under reference 1, and accordingly NHAI appointed

special GST Auditor for finalization of additional impact due to implementation of GST. Vide

letter under ref 2; NHAI conveyed the recommendation of special GST Auditor, which

recommended an additional impact of 4.73% due to change in tax regime. Details of the

recommendation by Special Auditor are as under:

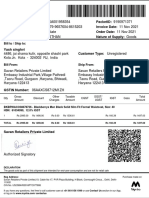

Total value of contract = Rs. 448,31,54,716/-

Physical work completed before GST regime up to 30.06.2017 as per certification of

Authority Engineer= Rs.370039353/- (Bill Certified Rs. 11,76,82,929/-)

The balance value of contract to execute post GST regime = Rs 4113119847/-.

The cost of Pre GST taxes for balance work (excise duty, VAT, CST etc.) = Rs.

266856257/-

Percentage of Pre GST taxes = 6.488%

Revised Value of Project Cost = Rs 3846263590/-

Amount of GST payable @ 12 % = Rs 461551631 /-

Total Project Cost including GST = Rs 4307815221/-

Impact of additional amount due implementation of GST = Rs. 194695374/-

Impact of additional amount due implementation of GST in % = 4.73 %

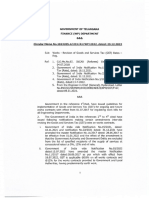

Further as per Govt of India Finance Ministry Notification 03/2022 dated 13.07.2022 and RCM

Notification 05/2022 Central Tax rate, GST rate has been revised from 12% to 18% with effect from

18.07.2022 which is applicable for our project under contract clause 19.17 of contract agreement

under Change of Law and same in informed vide letter under ref 4.

As on 17.07.2022 i.e. before the change in GST rate, certified works are in tune of Rs 2639789184/-

(Certified from IPC-03 to IPC-40) for the period 01.07.2017 to 17.07.2022. Hence for balance value

of works amounting Rs 1473330663/- GST @ 18% will be applicable, whereas pre GST taxes

deducted @ 6.488% as per recommendation of special GST auditor. Please find hereunder details of

overall impact due to implementation of GST w.e.f 30.06.2017 and revision in GST rate 18.07.2022:

WD

Balance Works

July'2017 to

WD up to after 17th July

Sr. 17th July 2022 Total Project

Description June'2017 2022 (GST -18% Remark

No. (GST -12 % Cost

(Pre-GST) From IPC - 41

from IPC-03

onwards)

to IPC-40)

Value of Work up

1 Value Of Works 370039353 2639789184 1473330663 4483159200 to 30.07.2016

certified from AE

% of Factored Taxes

2 6.488% 6.488%

(Pre GST Taxes)

Total Value of

Pre-GST Taxes

Certified by

Value of Factored Taxes

3 171269522 95586735 266856257 Special Audit

(Pre GST Taxes)

Committee of

NHAI amounting

Rs 26.69 Cr.

4 Net Workdone 370039353 2468519662 1377743928 4216302943

5 GST % 12.0% 18.00%

6 Value of GST Paid 296222359 247993907 544216266.4

Total Cost Including

7

GST

370039353 2764742021 1625737835 4760519209

Additional Amount to

8 be paid due to Change 124952837 152407172 277360009

in Law

% of Additional

Amount to be paid

9

due to Change in

4.73% 10.34% 6.19%

Law

In view of the above, we request your goodself to verify the above details and recommend the

additional reimbursement @ 10.34 % from IPC-41 onwards under Clause 19.17 change of law of

contract agreement against revision in GST rate w.e.f. 18.07.2022

Thanking you and assuring our best services at all times.

Yours Sincerely

For GDCL-SMSIL JOINT VENTURE

(Ranjit Wahi)

General Manager

Encl: 1. NHAI Email dated 27.11.2021

2. Annexure -1 Recommended by GST Auditor

CC: 1. Project Director PIU-1 NHAI Nagpur

2. F & A Unit RO Nagpur

You might also like

- Sanand Gidc Company ListDocument3 pagesSanand Gidc Company ListMITULMECWAN42% (19)

- GST Act, 2017-SorDocument6 pagesGST Act, 2017-SorMohit NagarNo ratings yet

- Final Calculation As Per NRRDA NABARD - ChatriDocument3 pagesFinal Calculation As Per NRRDA NABARD - ChatriRajesh ChandelNo ratings yet

- GST 12 To 18Document34 pagesGST 12 To 18Rajesh ChandelNo ratings yet

- 15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.Document3 pages15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.manohar meenaNo ratings yet

- IPFC Academy IPFC Academy: Certified Management Accountant (CMA) Certified Management Accountant (CMA)Document1 pageIPFC Academy IPFC Academy: Certified Management Accountant (CMA) Certified Management Accountant (CMA)Ridwan MohsinNo ratings yet

- Information in Respect of Central Excise (Petroleum)Document4 pagesInformation in Respect of Central Excise (Petroleum)Bbc1994216No ratings yet

- Go 67 - GSTDocument4 pagesGo 67 - GSTPrabhakar PothunuriNo ratings yet

- 2018fin MS58Document3 pages2018fin MS58Rajesh KarriNo ratings yet

- BGMG & Associates: Chartered AccountantsDocument33 pagesBGMG & Associates: Chartered AccountantsAjit GuptaNo ratings yet

- Shubham Construction Dhule 01.07.2017 TO 31.01.2020Document1 pageShubham Construction Dhule 01.07.2017 TO 31.01.2020Sourabh GangradeNo ratings yet

- Modified Note Sheet For L&T AMCDocument9 pagesModified Note Sheet For L&T AMCMadhavKishoreNo ratings yet

- Statement of Axis Account No:918010050126397 For The Period (From: 01-04-2022 To: 31-03-2023)Document2 pagesStatement of Axis Account No:918010050126397 For The Period (From: 01-04-2022 To: 31-03-2023)seervisupremeNo ratings yet

- August 2022 NewsLetterDocument34 pagesAugust 2022 NewsLetterSabrina CanoNo ratings yet

- Letter To GST - Authorities For Allowing Input Tax Available in 2ADocument3 pagesLetter To GST - Authorities For Allowing Input Tax Available in 2ADorababu KampalliNo ratings yet

- TaxesDocument2 pagesTaxesRameshNadarNo ratings yet

- CGG TOO RehostingDocument2 pagesCGG TOO RehostingMega rani RNo ratings yet

- QutotionDocument1 pageQutotionmanishsngh24No ratings yet

- Standardised PPT On GST: GST & Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument112 pagesStandardised PPT On GST: GST & Indirect Taxes Committee The Institute of Chartered Accountants of IndiavsyamkumarNo ratings yet

- Anitha Reddy 16.052023Document1 pageAnitha Reddy 16.052023Sridhar GandikotaNo ratings yet

- F22nb01a00044 Nb01a F2410989Document1 pageF22nb01a00044 Nb01a F2410989HEMANTHNo ratings yet

- G.Ravi 16.052023Document1 pageG.Ravi 16.052023Sridhar GandikotaNo ratings yet

- A Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINN - SAP Blogs PDFDocument11 pagesA Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINN - SAP Blogs PDFPankaj KumarNo ratings yet

- A Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINN - SAP Blogs PDFDocument11 pagesA Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINN - SAP Blogs PDFPankaj KumarNo ratings yet

- Revision of GST - Orders IssuedDocument4 pagesRevision of GST - Orders IssuedSE PR MedakNo ratings yet

- Krishn Vilas (Normal Plot) Price List 01.03.2022Document1 pageKrishn Vilas (Normal Plot) Price List 01.03.2022Kuldeep SinghNo ratings yet

- Print GSTDocument2 pagesPrint GSTAdit NairNo ratings yet

- Tax Invoice: Input CGST Input SGSTDocument1 pageTax Invoice: Input CGST Input SGSTOmprakash BaralaNo ratings yet

- Bill 108376076708047264836597531Document1 pageBill 108376076708047264836597531Priyanshu UpadhyayNo ratings yet

- Epl SCT L 0262Document4 pagesEpl SCT L 0262Khan ShahrukhNo ratings yet

- A Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNDocument12 pagesA Solution For Indian GST Implementation For Simple Procurement Scenario Using TAXINNShane India RazaNo ratings yet

- GST InvoiceDocument13 pagesGST InvoiceConstruction gstNo ratings yet

- WP 388 2023Document33 pagesWP 388 2023mahadevsladliNo ratings yet

- Same Calculation To Be Done For The Resale Buyers.: 1. Delay in Possession Compensation - This Is Go in HRERADocument9 pagesSame Calculation To Be Done For The Resale Buyers.: 1. Delay in Possession Compensation - This Is Go in HRERAAnanya PatilNo ratings yet

- Chapter III: Planning and Implementation of GST IT ProjectDocument43 pagesChapter III: Planning and Implementation of GST IT ProjectNeha SathayeNo ratings yet

- Mamatha Traders Adjuducation Order Us 73 - CompressedDocument31 pagesMamatha Traders Adjuducation Order Us 73 - Compressedurmilachoudhary1999No ratings yet

- 123Document11 pages123VSC MouryaNo ratings yet

- Design & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueDocument1 pageDesign & Engineering: 3 RAB:25 1 3 RAB:25 1 3 RAB:25 1 True True True RAB:25 True True RAB:25 True True RAB:25 True TrueRinjumon RinjuNo ratings yet

- Vehicle BillsDocument5 pagesVehicle BillsRamakrishna RagamNo ratings yet

- GST Project: by Devanuj RoyDocument15 pagesGST Project: by Devanuj Roydevanuj royNo ratings yet

- AIMTCDocument2 pagesAIMTCPriyanka 2277 -ANo ratings yet

- 27-Local GovernmentDocument87 pages27-Local GovernmentIrfan RazaNo ratings yet

- GST Input Tax Report: Month: July Year: 2017Document5 pagesGST Input Tax Report: Month: July Year: 2017vijay sainiNo ratings yet

- Go Digit General Insurance LTDDocument2 pagesGo Digit General Insurance LTDYODHAA GAMMERNo ratings yet

- Laxmi Metal Press Ing Works Pvt. LTD.: Invoice Cum ChallanDocument5 pagesLaxmi Metal Press Ing Works Pvt. LTD.: Invoice Cum ChallanSujit Kumar SinghNo ratings yet

- GSTDocument6 pagesGSTPWD r&b nagalandNo ratings yet

- aGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceDocument2 pagesaGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceSandeep KumarNo ratings yet

- A Solution For Indian GST: Indirect Tax Central StateDocument17 pagesA Solution For Indian GST: Indirect Tax Central StateSrikanth MNo ratings yet

- BusyComp0216 GST 579 InvDocument1 pageBusyComp0216 GST 579 InvVIR MALIKNo ratings yet

- GST Times - Vol.1, Issue-2Document25 pagesGST Times - Vol.1, Issue-2Milna JosephNo ratings yet

- Central Taxes Replaced by GSTDocument6 pagesCentral Taxes Replaced by GSTBijosh ThomasNo ratings yet

- Interest Notice 07aaecc0515b1zg 2Document2 pagesInterest Notice 07aaecc0515b1zg 2Abhishek MohanNo ratings yet

- Bill T25Document1 pageBill T25Sameer PatelNo ratings yet

- GST Times - Vol.1, Issue-5Document24 pagesGST Times - Vol.1, Issue-5Milna JosephNo ratings yet

- Chapter IV: Compliance Audit of GST: 4.1 Lack of Access To DataDocument24 pagesChapter IV: Compliance Audit of GST: 4.1 Lack of Access To DataharshNo ratings yet

- Nit 27 - 30 2Document1 pageNit 27 - 30 2Prasun SinghNo ratings yet

- Profor 1Document1 pageProfor 1John FernendiceNo ratings yet

- Sinvoice 4000025727 9394530Document2 pagesSinvoice 4000025727 9394530ajit23nayakNo ratings yet

- Patanjali Arogya Kendra 2018-19Document5 pagesPatanjali Arogya Kendra 2018-19tuensangnagaland2018No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Chapter 3: Liberalisation, Privatisation & Globalisation - An AppraisalDocument12 pagesChapter 3: Liberalisation, Privatisation & Globalisation - An AppraisalNikunjmanglaNo ratings yet

- TablesDocument3 pagesTablesJPNo ratings yet

- Forex Roll No 28 Ty Bba IbDocument11 pagesForex Roll No 28 Ty Bba IbsayaliNo ratings yet

- International Monetary Fund: Articles of Agreement, and Began Operations On March 1, 1947. (Note: There Are 184 MemberDocument6 pagesInternational Monetary Fund: Articles of Agreement, and Began Operations On March 1, 1947. (Note: There Are 184 MemberSohaib AshfaqNo ratings yet

- Corporate TaxationDocument2 pagesCorporate TaxationPaym entNo ratings yet

- Nielsen Sri Lanka 2016 ReviewDocument37 pagesNielsen Sri Lanka 2016 ReviewSameera ChathurangaNo ratings yet

- Impact of COVID-19 (Coronavirus) On Global Economy - Group Discussion Ideas PDFDocument7 pagesImpact of COVID-19 (Coronavirus) On Global Economy - Group Discussion Ideas PDFAshutosh SharmaNo ratings yet

- Nov-21 Pay SlipSF0061089Document1 pageNov-21 Pay SlipSF0061089Pravalika SiliveriNo ratings yet

- 1 Evolution of BankingDocument5 pages1 Evolution of BankingAastha PrakashNo ratings yet

- Jotun DavidHorvathDocument12 pagesJotun DavidHorvathMuthuKumarNo ratings yet

- Chapter - 2 (International Flow of Funds)Document23 pagesChapter - 2 (International Flow of Funds)shohag30121991100% (1)

- Cocoa Cultivation in GhanaDocument3 pagesCocoa Cultivation in GhanaBala RanganathNo ratings yet

- Pax Britannica (1815-1914)Document4 pagesPax Britannica (1815-1914)IzzahIkramIllahiNo ratings yet

- Positive and Negatives Effects of The GlobalizationDocument2 pagesPositive and Negatives Effects of The GlobalizationAriana Loria RuizNo ratings yet

- Oxford EAP A2 Elementary Student - S BookDocument175 pagesOxford EAP A2 Elementary Student - S BookNhân Trần100% (1)

- Appendix Table IV.1: Indian Banking Sector at A GlanceDocument1 pageAppendix Table IV.1: Indian Banking Sector at A GlancePankaj PrabhaNo ratings yet

- Mergers & Acquisition in Banking SectorDocument21 pagesMergers & Acquisition in Banking SectorHimani HarsheNo ratings yet

- Foreign Exchange Rate and PoliciesDocument24 pagesForeign Exchange Rate and PoliciesbharatNo ratings yet

- Sickness in Small Scale IndustriesDocument25 pagesSickness in Small Scale Industriesnandani sharma80% (5)

- Great DepressionDocument4 pagesGreat DepressionKamran RaufNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountYash SinghviNo ratings yet

- Project Allotment SheetDocument20 pagesProject Allotment SheetRoushan RajNo ratings yet

- LatinFocus Consensus Forecast - February 2020Document142 pagesLatinFocus Consensus Forecast - February 2020Felipe OrnellesNo ratings yet

- Tax Table For Period 2020-2021 - FinalDocument2,129 pagesTax Table For Period 2020-2021 - FinalTHABI2No ratings yet

- Individual Tax - ProblemsDocument5 pagesIndividual Tax - ProblemsJulienne Julio100% (1)

- Ass AsDocument177 pagesAss AsMukesh BishtNo ratings yet

- Global North and Global SouthDocument4 pagesGlobal North and Global SouthJessia Marie LacanariaNo ratings yet

- North American EconomyDocument17 pagesNorth American EconomyBharat MimaniNo ratings yet

- Tax Invoice: Akbar & CompanyDocument1 pageTax Invoice: Akbar & CompanyTTIPLNo ratings yet