Professional Documents

Culture Documents

Bajaj Allianz

Bajaj Allianz

Uploaded by

Kolkata Jyote MotorsOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bajaj Allianz

Bajaj Allianz

Uploaded by

Kolkata Jyote MotorsCopyright:

Available Formats

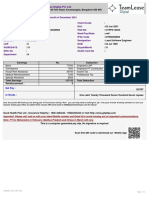

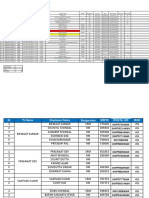

BAJAJ ALLIANZ GENERAL INSURANCE COMPANY LIMITED

Bajaj Allianz House,

Airport Road, Yerwada,

Pune

Maharashtra 411006

Payslip for the month of SEPTEMBER 2021

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

Emp Code :941 PF UAN :100108839696

Emp Name :SUMAN BASU PF No :0000940

Department :MKTBA Aadhar No :736949120069

Location :Kolkata PAN :AIYPB8645G

Grade :GB07A Bank Name :ICIC

DOJ :12/01/2005 Bank AC No :627501513198

Designation :ZONAL SALES MANAGER ESIC NO :

BA Description:Kolkatta Branch Arrear Days:0.00

Payable Days :30.00

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

EARNINGS STANDARD WAGE CURRENT MONTH ARREAR(+/—) YTD | DEDUCTIONS CURRENT MONTH YTD

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

BASIC 67848.00 67848.00 0.00 407088.00| P.F. 8142.00 48852.00

HRA 27139.00 27139.00 0.00 162834.00| INCOME TAX DEDUCTION 20509.00 212964.00

PERSONAL PAY 60530.00 60530.00 0.00 363178.00| PROFESSION TAX 200.00 1200.00

CAR MAINTANCE REIMB. 1800.00 0.00 0.00 10800.00|

DRIVER SALARY REIMB. 900.00 0.00 0.00 5400.00|

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

GROSS EARNINGS 155517.00 0.00 949300.00| TOTAL DEDUCTIONS 28851.00 263016.00

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

NET PAY 126666.00

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

(RUPEES ONE LAKH TWENTY SIX THOUSAND SIX HUNDRED SIXTY SIX ONLY)

————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————

PLEASE MENTION YOUR E—CODE WHILE RAISING QUERY TO PAYROLL

—————————————————————————————————————————————————————————————————————————————————————————————————

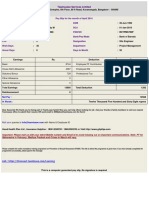

TAX CALCULATIONS NEW REGIME OLD REGIME|HOUSING LOAN INTEREST........................

————————————————— —————————— —————————|Housing Loan Interest 200000

TOTAL EARNING 2154373 2154373|

ADD : PERKS & OTHERS 0 0|INVESTMENTS U/S 80C..........................

TOTAL GROSS 2154373 2154373|PF—DED 97704

|Mutual Fund 75000

LESS: DEDUCTION U/S 10/17 0 0|Public Provident Fund 100000

LESS: PROFESSION TAX 0 2400|TOTAL (Restricted to 150000) 272704

LESS: STANDARD DEDUCTION 0 50000|

NET SALARY 2154373 2101973|INVESTMENTS U/S 80(OTH)......................

|MEDICLAIM 35000

LESS: HOUSING LOAN INTEREST 0 200000|MEDICLAIMP 80D PARENTAL 25000

LESS: INVEST. U/S 80C 0 150000|MEDICLAIM—DED 305

LESS: INVESTMENTS U/S 80(OTH) 0 50000|

|

TAXABLE INCOME 2154373 1701973|

|

TOTAL TAX 399165 336016|

———————————————————————————————————————————————————|

TAX APPLIED AS PER OLD REGIME 336016 |

———————————————————————————————————————————————————|

LESS: TAX DEDUCTED AT SOURCE 212964 |

|

BALANCE TAX PAYABLE 123052 |

BALANCE NUMBER OF MONTHS 6 |

MONTHLY TAX 20509 |

—————————————————————————————————————————————————————————————————————————————————————————————————

You might also like

- SILKE - South African Income Tax 2021Document1,275 pagesSILKE - South African Income Tax 2021sharon goses50% (2)

- Valbuena Machado, NatashaDocument8 pagesValbuena Machado, NatashajpneebNo ratings yet

- Salary Slip Dec 2023Document1 pageSalary Slip Dec 2023Andrew BostonNo ratings yet

- AIRTELDocument2 pagesAIRTELKolkata Jyote MotorsNo ratings yet

- Relieving LetterDocument1 pageRelieving LetterPrithu SinghNo ratings yet

- Abhishek REDocument2 pagesAbhishek REDarshan S PNo ratings yet

- American ExpressDocument1 pageAmerican ExpressKolkata Jyote MotorsNo ratings yet

- Offer Letter: Privileged & ConfidentialDocument4 pagesOffer Letter: Privileged & ConfidentialPatel Mehul0% (1)

- Government of Jharkhand: Receipt of Online Payment of Stamp DDocument4 pagesGovernment of Jharkhand: Receipt of Online Payment of Stamp DAniket RajNo ratings yet

- Chapter 3 Income Taxation Tabag 2019 Sol ManDocument21 pagesChapter 3 Income Taxation Tabag 2019 Sol ManFMM50% (2)

- Income Tax Worksheet For The Financial Year APR-2019 To MAR-2020Document1 pageIncome Tax Worksheet For The Financial Year APR-2019 To MAR-2020SHIBANI CHOUDHURYNo ratings yet

- HCL It City Lucknow Private LimitedDocument10 pagesHCL It City Lucknow Private Limitedmathur1995No ratings yet

- Activity / Assignment: Answer and SolutionDocument3 pagesActivity / Assignment: Answer and SolutionMa. Alexandria Palma0% (1)

- Employee Details Payment & Working Days Details Location Details Neha KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Neha KumariRohit raagNo ratings yet

- December Salary SlipDocument1 pageDecember Salary SlipVipul Tyagi100% (1)

- Pop PDFDocument11 pagesPop PDFKunal BansodeNo ratings yet

- Nee TP D:y: Moil LimitedDocument53 pagesNee TP D:y: Moil LimitedSANJPODDNo ratings yet

- IGA69636 SalSlipWithTaxDetailsMiscDocument1 pageIGA69636 SalSlipWithTaxDetailsMiscHrithik ghoshNo ratings yet

- Payslip For The Month of February - 2022: Spanidea Systems Private LimitedDocument1 pagePayslip For The Month of February - 2022: Spanidea Systems Private LimitedChinmaya SahooNo ratings yet

- January Salary SlipDocument1 pageJanuary Salary SlipAmanNo ratings yet

- CandidateDocument13 pagesCandidateravi lingamNo ratings yet

- Niva Bupa CCTV Invoice1Document2 pagesNiva Bupa CCTV Invoice1KUNDAN KUMAR (KING KILLER)No ratings yet

- Girish V Nandimath Head Talent Acquisition - India: TCS Private & ConfidentialDocument1 pageGirish V Nandimath Head Talent Acquisition - India: TCS Private & ConfidentialSubhankarNo ratings yet

- NTT DATA PayslipDocument1 pageNTT DATA PayslipROHIT RANJANNo ratings yet

- Ashwani Bhardwaj Offer LetterDocument2 pagesAshwani Bhardwaj Offer LetterChetan ChoudharyNo ratings yet

- Mandla - Reddy PayslipDocument1 pageMandla - Reddy PayslipMedi Srikanth NethaNo ratings yet

- Payslip-Sep 2019Document1 pagePayslip-Sep 2019Vijay ChoudharyNo ratings yet

- June 2014Document1 pageJune 2014Deepak GuptaNo ratings yet

- Hardik PaySlipDocument1 pageHardik PaySlipnokia6No ratings yet

- Monthly Payslip SEP 2022Document1 pageMonthly Payslip SEP 2022Vedant GoelNo ratings yet

- Salary January2023Document1 pageSalary January2023AKM Enterprises Pvt LtdNo ratings yet

- Acct Statement XX7000 13032023Document10 pagesAcct Statement XX7000 13032023v prakashNo ratings yet

- December 2021 - PaySlipDocument1 pageDecember 2021 - PaySlipMahendra kumarNo ratings yet

- Jan 2023 PDFDocument1 pageJan 2023 PDFSANJAY KUMARNo ratings yet

- Velpula VenkateshwarareddyDocument1 pageVelpula VenkateshwarareddyManda KarunakarNo ratings yet

- Anusha AervaDocument2 pagesAnusha Aervamrcopy xeroxNo ratings yet

- Offer Letter.Document11 pagesOffer Letter.Suraj BishwasNo ratings yet

- Pay Slip July-22Document1 pagePay Slip July-22KFS BANKINGNo ratings yet

- Pay Slip ANUJDocument1 pagePay Slip ANUJNehal AhmedNo ratings yet

- AEMDocument10 pagesAEMBHARATH MPNo ratings yet

- Randstad India Private Limited: Payslip For The Month of February 2022Document1 pageRandstad India Private Limited: Payslip For The Month of February 2022Aman SharmaNo ratings yet

- Offer Letter - Mohammed MohidDocument3 pagesOffer Letter - Mohammed MohidNARESH UNo ratings yet

- Payslip - May23 - A - SrinivasDocument2 pagesPayslip - May23 - A - SrinivasPonnaganti Tej kumarNo ratings yet

- Vikas Gupta - Salary Slip - October 2022Document1 pageVikas Gupta - Salary Slip - October 2022jigar kanjaniNo ratings yet

- PayslipDocument1 pagePayslipSk Samim AhamedNo ratings yet

- Payslip August 2021Document2 pagesPayslip August 2021Sidharth Chettri100% (1)

- Tharun J - Ford 15.3Document6 pagesTharun J - Ford 15.3Tharun Ricky0% (1)

- Ashok Pay SlipDocument7 pagesAshok Pay SlipVivek WagheNo ratings yet

- Pay Slip June-22Document1 pagePay Slip June-22KFS BANKINGNo ratings yet

- Mar 2021Document1 pageMar 2021Srinivas HkNo ratings yet

- Jocata Financial Advisory & Technology Pay Slip: Attendance Details ValueDocument1 pageJocata Financial Advisory & Technology Pay Slip: Attendance Details ValueAshuNo ratings yet

- April 2016 - PaySlipDocument1 pageApril 2016 - PaySlipMedi Srikanth NethaNo ratings yet

- Acces 01 02Document2 pagesAcces 01 02sasirajareddyNo ratings yet

- Payslip April 2021 State Bank of India: AIOPP6062HDocument1 pagePayslip April 2021 State Bank of India: AIOPP6062HsayanNo ratings yet

- Walmart Global Tech India - Software Engineer LLDocument3 pagesWalmart Global Tech India - Software Engineer LLShbNo ratings yet

- A356536Document1 pageA356536Er Ravi Kant MishraNo ratings yet

- PAYSLIPDocument11 pagesPAYSLIPSaran ManiNo ratings yet

- SfsfgegDocument1 pageSfsfgegvishalNo ratings yet

- Standard Monthly Salary INR Earnings INR Deductions INRDocument1 pageStandard Monthly Salary INR Earnings INR Deductions INRPrashant RajNo ratings yet

- Earnings Deductions: Empl ID Month SEP YearDocument1 pageEarnings Deductions: Empl ID Month SEP Yearharshwardhan prajapatiNo ratings yet

- Dec 2022Document1 pageDec 2022n1234567890987654321No ratings yet

- Leave Letter SalmanDocument1 pageLeave Letter SalmanSALMAN JEETNo ratings yet

- SalarySlipwithTaxDetails 5Document1 pageSalarySlipwithTaxDetails 5Kiran NoraNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document5 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghNo ratings yet

- 2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMDocument1 page2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMMohammad MAAZNo ratings yet

- Payslip Mar 2023-1Document1 pagePayslip Mar 2023-1udaykumarh20No ratings yet

- Balmer LawrieDocument1 pageBalmer LawrieKolkata Jyote MotorsNo ratings yet

- Income Tax Calculation For The Financial Year 2020-2021Document2 pagesIncome Tax Calculation For The Financial Year 2020-2021Kolkata Jyote MotorsNo ratings yet

- July 1 Neha Agarwal 07 07 2Document1 pageJuly 1 Neha Agarwal 07 07 2Kolkata Jyote MotorsNo ratings yet

- BOSCHDocument1 pageBOSCHKolkata Jyote MotorsNo ratings yet

- Bandhan BankDocument1 pageBandhan BankKolkata Jyote MotorsNo ratings yet

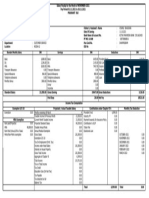

- Variant: All The Payments Should Be Made in Favour of "Jyote Motors (Bengal) Pvt. LTD.", Only in Drafts or ChequesDocument1 pageVariant: All The Payments Should Be Made in Favour of "Jyote Motors (Bengal) Pvt. LTD.", Only in Drafts or ChequesKolkata Jyote MotorsNo ratings yet

- Importance of Wearing Identity CardDocument1 pageImportance of Wearing Identity CardKolkata Jyote MotorsNo ratings yet

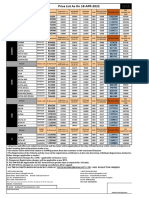

- Price List As On 18-APR-2022: VariantDocument1 pagePrice List As On 18-APR-2022: VariantKolkata Jyote MotorsNo ratings yet

- Dealer Name Dealer City Employee Name Mspin Designation Phone No Simno Ipad Serial No Ipad Cover Ipad ChargerDocument3 pagesDealer Name Dealer City Employee Name Mspin Designation Phone No Simno Ipad Serial No Ipad Cover Ipad ChargerKolkata Jyote MotorsNo ratings yet

- Unit 8Document15 pagesUnit 8Linh Trang Nguyễn ThịNo ratings yet

- Major Project AjeetDocument8 pagesMajor Project AjeetashokhaharoNo ratings yet

- Sample Questions Exam2-S08Document2 pagesSample Questions Exam2-S08denisNo ratings yet

- TaxDocument6 pagesTaxBirs BirsNo ratings yet

- Chapter 12Document76 pagesChapter 123ooobd1234No ratings yet

- Axis Bank LTD Payslip For The Month of April - 2021: Leave DetailsDocument2 pagesAxis Bank LTD Payslip For The Month of April - 2021: Leave Detailssalma saifiNo ratings yet

- UGBS Compiled Past Questions 4 PDFDocument327 pagesUGBS Compiled Past Questions 4 PDFEbunNo ratings yet

- Alab HR Consultants PVT LTD: August'2022 Payslip For The Month ofDocument1 pageAlab HR Consultants PVT LTD: August'2022 Payslip For The Month ofKFS BANKINGNo ratings yet

- 06 Gross IncomeDocument103 pages06 Gross IncomeJSNo ratings yet

- Cup 2 (Far)Document8 pagesCup 2 (Far)Chan DagaleNo ratings yet

- Dealings in PropertyDocument30 pagesDealings in PropertyPrie DitucalanNo ratings yet

- AppEco Lesson 4Document40 pagesAppEco Lesson 4wendell john medianaNo ratings yet

- Introduction To Management Accounting 15th Edition Horngren Solutions ManualDocument46 pagesIntroduction To Management Accounting 15th Edition Horngren Solutions Manualcleopatrafreyane8c100% (23)

- Republic Act No. 11976 (EOPT) - Infographics - SGVDocument3 pagesRepublic Act No. 11976 (EOPT) - Infographics - SGVAlbert SantiagoNo ratings yet

- Paystub 2023 08 15Document1 pagePaystub 2023 08 15Leachim PinedaNo ratings yet

- Final - Year End Tax Planning Toolkit - 2016 - 17Document141 pagesFinal - Year End Tax Planning Toolkit - 2016 - 17yiang.tranNo ratings yet

- Mid-Term Examination: (Please Write Your Roll No. Immediately) Roll NoDocument4 pagesMid-Term Examination: (Please Write Your Roll No. Immediately) Roll NoParikshit GargNo ratings yet

- Payslip For The Month of May, 2022: Annual Salary DetailsDocument1 pagePayslip For The Month of May, 2022: Annual Salary DetailsParveen SainiNo ratings yet

- Finance in BusinessDocument27 pagesFinance in BusinesscomplianceNo ratings yet

- Download Full Solution Manual For Hills Taxation Of Individuals And Business Entities 2021 Edition 12Th Edition Brian Spilker Benjamin Ayers John Barrick John Robinson Ronald Worsham Connie Weaver Troy pdf docx full chapter chapterDocument36 pagesDownload Full Solution Manual For Hills Taxation Of Individuals And Business Entities 2021 Edition 12Th Edition Brian Spilker Benjamin Ayers John Barrick John Robinson Ronald Worsham Connie Weaver Troy pdf docx full chapter chapterplucked.hyoidean.smjav100% (15)

- ZVI - ITR 2022 DraftDocument4 pagesZVI - ITR 2022 DraftMike SyNo ratings yet

- Bir Form No. 2304Document2 pagesBir Form No. 2304mijareschabelita2No ratings yet

- Tax in Canada For NewcomersDocument16 pagesTax in Canada For NewcomersSamNo ratings yet

- Notes and AssignmentDocument4 pagesNotes and AssignmentTatenda GutsaNo ratings yet

- Introduction and National IncomeDocument43 pagesIntroduction and National IncomeHarjas anandNo ratings yet

- Accomplishment Narrative Report RUTH School TreasurerDocument4 pagesAccomplishment Narrative Report RUTH School TreasurerBERNIE CONSOLACIONNo ratings yet