Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

9 views61b9db5fed321000117d0767-1639570412-ACC 212 - Week 7-8 ULO A

61b9db5fed321000117d0767-1639570412-ACC 212 - Week 7-8 ULO A

Uploaded by

Chrissa Nova VelilaThe document discusses equity instruments and their categories. It states that at the end of the ACC 212 financial markets unit, students are expected to describe equity instruments and elaborate on derivatives financial instruments. It defines an equity instrument as a document that legally evidences ownership in a firm, like a share certificate. Equity instruments are issued to shareholders to fund businesses and may or may not return dividends depending on profits. Common categories of equity instruments discussed include common stock, convertible debentures, preferred stock, depository receipts, and transferable subscription rights.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Methodology SP Us IndicesDocument40 pagesMethodology SP Us IndicesJohn DoeNo ratings yet

- CIMA F2 Course Notes PDFDocument293 pagesCIMA F2 Course Notes PDFganNo ratings yet

- Chapter 6Document20 pagesChapter 6Alliyah KayeNo ratings yet

- Equity and Debt Securities (Presentation)Document23 pagesEquity and Debt Securities (Presentation)jefferkosgeiNo ratings yet

- Share Capital and DebenturesDocument43 pagesShare Capital and DebenturesRehanbhikanNo ratings yet

- Corporate Accounting Assignment 2 Mansha TulsyanDocument11 pagesCorporate Accounting Assignment 2 Mansha TulsyanSana AkhtarNo ratings yet

- Untitled PresentationDocument8 pagesUntitled Presentationnimaichadha265No ratings yet

- My PartDocument6 pagesMy Partkdoshi23No ratings yet

- Chapter 5 CorporationDocument12 pagesChapter 5 CorporationMamaru SewalemNo ratings yet

- Module in Financial Management - 07Document10 pagesModule in Financial Management - 07Karla Mae GammadNo ratings yet

- Equity Market: Equity Market Is One of The Key Sectors of Financial Markets Where Long-Term FinancialDocument10 pagesEquity Market: Equity Market Is One of The Key Sectors of Financial Markets Where Long-Term Financialfrancis dungcaNo ratings yet

- What Are Preferred SharesDocument9 pagesWhat Are Preferred SharesMariam LatifNo ratings yet

- Investment LawDocument90 pagesInvestment LawROHIT SINGH RajputNo ratings yet

- Business Law Class 10 Legal Aspect of Financing A CorporationDocument24 pagesBusiness Law Class 10 Legal Aspect of Financing A Corporationmr singhNo ratings yet

- Shares of StockDocument7 pagesShares of StockAdityaMohanNo ratings yet

- MBI Corporate Finance Topic 4 Share CapitalDocument124 pagesMBI Corporate Finance Topic 4 Share Capitaljonas sserumagaNo ratings yet

- Chapter 4 FIDocument7 pagesChapter 4 FISeid KassawNo ratings yet

- Advantages and Disadvantages of Preferred StockDocument5 pagesAdvantages and Disadvantages of Preferred StockVaibhav Rolihan100% (2)

- Corporate Structure and AdministrationDocument10 pagesCorporate Structure and AdministrationDr.Sree Lakshmi KNo ratings yet

- StocksDocument9 pagesStocksHassan Tahir SialNo ratings yet

- MB II Unit Final StudentsDocument70 pagesMB II Unit Final StudentsHema vijay sNo ratings yet

- Week 09 - Module 07 - Banking Industry and Nonbanking Financial InstitutionsDocument11 pagesWeek 09 - Module 07 - Banking Industry and Nonbanking Financial Institutions지마리No ratings yet

- Equity Financing: Sresth Verma Bba 6A 05290201718Document12 pagesEquity Financing: Sresth Verma Bba 6A 05290201718Sresth VermaNo ratings yet

- Business LawDocument15 pagesBusiness LawHimanshi YadavNo ratings yet

- FM ReviewerDocument20 pagesFM ReviewerBSA - Cabangon, MerraquelNo ratings yet

- Stock Valuation Written ReportDocument14 pagesStock Valuation Written ReportJesse John A. CorpuzNo ratings yet

- Share 3Document19 pagesShare 3manishchaudhary3537No ratings yet

- MGMT2023 Lecture 7 STOCK VALUATION - Parts I, II IIIDocument86 pagesMGMT2023 Lecture 7 STOCK VALUATION - Parts I, II IIIIsmadth2918388100% (1)

- Fmi Lecture 3Document22 pagesFmi Lecture 3shakirNo ratings yet

- Chapter 4 Corporate StockDocument5 pagesChapter 4 Corporate StockJhanice MartinezNo ratings yet

- Primary MarketDocument15 pagesPrimary MarketKapil KumarNo ratings yet

- M3 - Sources of FinanceDocument22 pagesM3 - Sources of Financehats300972No ratings yet

- Managerial Finance chp7Document11 pagesManagerial Finance chp7Linda Mohammad FarajNo ratings yet

- Law On CorporationsDocument6 pagesLaw On Corporationsjokjok021904No ratings yet

- BMS CL Unit 4Document30 pagesBMS CL Unit 4RKS KRNo ratings yet

- Company Law PresentationDocument6 pagesCompany Law Presentationnavoditakm04No ratings yet

- What Is Equity Investment? (A Guide To Understanding It) - Indeed - Com UKDocument6 pagesWhat Is Equity Investment? (A Guide To Understanding It) - Indeed - Com UKvbawan11No ratings yet

- Interview QuestionsDocument7 pagesInterview QuestionsGaurav TripathiNo ratings yet

- Meaning: Asset Company Call Shares Money Creditor Interest Ordinary Shares Means Share Profits ReturnsDocument10 pagesMeaning: Asset Company Call Shares Money Creditor Interest Ordinary Shares Means Share Profits ReturnskhuushbuNo ratings yet

- SHARESDocument12 pagesSHARESHIMANSHU DARGANNo ratings yet

- CH 6Document91 pagesCH 6EyobedNo ratings yet

- Further Reading On Shares and EquitiesDocument6 pagesFurther Reading On Shares and Equitiesshazlina_liNo ratings yet

- Chapter 6 CorporationDocument7 pagesChapter 6 CorporationAmaa AmaaNo ratings yet

- Assignment, StockDocument5 pagesAssignment, StockNawshad HasanNo ratings yet

- Equity Share and Its TypesDocument4 pagesEquity Share and Its TypeslakshmibabymaniNo ratings yet

- Personal Finance Chapter 14 Part 1: CanadayDocument25 pagesPersonal Finance Chapter 14 Part 1: Canaday陈皮乌鸡No ratings yet

- Unit-1: Investment SettingDocument61 pagesUnit-1: Investment SettingKarthika NathanNo ratings yet

- Financed by LectureDocument5 pagesFinanced by LectureEng Abdikarim WalhadNo ratings yet

- Equity Securities MarketDocument23 pagesEquity Securities MarketILOVE MATURED FANSNo ratings yet

- How To Invest in Stocks For BeginnersDocument72 pagesHow To Invest in Stocks For BeginnersAnjelyn Hernando100% (2)

- Company Accounts-Updated-1Document44 pagesCompany Accounts-Updated-1cleophacerevivalNo ratings yet

- Accounting 2 - Book NotesDocument11 pagesAccounting 2 - Book NotesSimona PutnikNo ratings yet

- 08 - Chapter 2 PDFDocument42 pages08 - Chapter 2 PDFManvendraSinghRathoreNo ratings yet

- Module 5 - Share Capital & BorrowingsDocument7 pagesModule 5 - Share Capital & BorrowingsAlishaNo ratings yet

- Capital Markets: Presented by AbhishekDocument22 pagesCapital Markets: Presented by AbhishekBeerappa RamakrishnaNo ratings yet

- What Is A Capital Market?Document8 pagesWhat Is A Capital Market?Mohammad Taha KhanNo ratings yet

- Financial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120Document5 pagesFinancial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120wajid2345No ratings yet

- Stock Valuation Module 4.2Document98 pagesStock Valuation Module 4.2Jemille MangawanNo ratings yet

- Fa Unit 4Document13 pagesFa Unit 4VTNo ratings yet

- Types of EquityDocument2 pagesTypes of EquityPrasanthNo ratings yet

- Types of MarketsDocument8 pagesTypes of MarketsManas JainNo ratings yet

- RBSDocument66 pagesRBSankit_sinha1990No ratings yet

- Fred Tam News LetterDocument7 pagesFred Tam News LetterTan Lip SeongNo ratings yet

- BAV Assignment WalmartDocument3 pagesBAV Assignment WalmartVidushi ThapliyalNo ratings yet

- Metropolis Share Price - Google SearchDocument1 pageMetropolis Share Price - Google SearchVikram Kumar JapaNo ratings yet

- Shareholders' EquityDocument16 pagesShareholders' Equitymaria evangelistaNo ratings yet

- Mutual Fund Project 3387 123Document87 pagesMutual Fund Project 3387 123sagarNo ratings yet

- Uas AKMDocument14 pagesUas AKMThorieq Mulya MiladyNo ratings yet

- PublicationDocument84 pagesPublicationandreiNo ratings yet

- Unit6 2-ValuationofPreferredandCommonStockDocument77 pagesUnit6 2-ValuationofPreferredandCommonStockHay JirenyaaNo ratings yet

- Syllabus ECO 4201 Fall 2016.v3Document4 pagesSyllabus ECO 4201 Fall 2016.v3Ahsan RiazNo ratings yet

- How To Trade Intraday Using Advanced Volatility CalculatorDocument6 pagesHow To Trade Intraday Using Advanced Volatility CalculatorShubham WaghmareNo ratings yet

- Waterfall Analysis - 1X Liquidation PreferenceDocument9 pagesWaterfall Analysis - 1X Liquidation PreferenceMonish KartheekNo ratings yet

- Research Proposal For Us MarketDocument13 pagesResearch Proposal For Us MarketTayyaub khalidNo ratings yet

- Trac Nghiem Cuoi Ky Ly Thuyet Tai ChinhDocument46 pagesTrac Nghiem Cuoi Ky Ly Thuyet Tai ChinhLê QuỳnhNo ratings yet

- Study of Consumer Behaviour Towards Stock Market in NCR Delhi at India BullsDocument21 pagesStudy of Consumer Behaviour Towards Stock Market in NCR Delhi at India BullsRahul ShoriNo ratings yet

- The Real Value of Investing Nimesh ShahDocument1 pageThe Real Value of Investing Nimesh Shahvikas_ojha54706No ratings yet

- Unit 1: Understanding Equity: Public Equity Vs Private EquityDocument10 pagesUnit 1: Understanding Equity: Public Equity Vs Private EquityPulkit AggarwalNo ratings yet

- Stock ExchangeDocument12 pagesStock ExchangeGirish ChouguleNo ratings yet

- CircleDocument173 pagesCircleKarthikeya Saravana KumarNo ratings yet

- Risk PremiumDocument29 pagesRisk PremiumNabilah Usman100% (1)

- 707-Article Text-1912-1-10-20200529Document10 pages707-Article Text-1912-1-10-20200529Kevin GintingNo ratings yet

- Solution Manual For Principles of Managerial Finance 14Th Edition Gitman Zutter 9780133507690 Full Chapter PDFDocument36 pagesSolution Manual For Principles of Managerial Finance 14Th Edition Gitman Zutter 9780133507690 Full Chapter PDFdoris.fuentes765100% (20)

- OIAL High Yld and Distressed Pricing - 30 Apr '19Document19 pagesOIAL High Yld and Distressed Pricing - 30 Apr '19SSNo ratings yet

- Orbe Brazil Fund - Dec2012Document7 pagesOrbe Brazil Fund - Dec2012José Enrique MorenoNo ratings yet

- THE BOH WAY - v1Document13 pagesTHE BOH WAY - v1mrrrkkk100% (2)

- Commission Structure Classic Account PDFDocument1 pageCommission Structure Classic Account PDFYasirNo ratings yet

- 1 Risk and ReturnDocument24 pages1 Risk and ReturnMohammad DwidarNo ratings yet

- 3 Mulunesh Gizachew PDFDocument77 pages3 Mulunesh Gizachew PDFMugea MgaNo ratings yet

61b9db5fed321000117d0767-1639570412-ACC 212 - Week 7-8 ULO A

61b9db5fed321000117d0767-1639570412-ACC 212 - Week 7-8 ULO A

Uploaded by

Chrissa Nova Velila0 ratings0% found this document useful (0 votes)

9 views9 pagesThe document discusses equity instruments and their categories. It states that at the end of the ACC 212 financial markets unit, students are expected to describe equity instruments and elaborate on derivatives financial instruments. It defines an equity instrument as a document that legally evidences ownership in a firm, like a share certificate. Equity instruments are issued to shareholders to fund businesses and may or may not return dividends depending on profits. Common categories of equity instruments discussed include common stock, convertible debentures, preferred stock, depository receipts, and transferable subscription rights.

Original Description:

Original Title

6cfcc18c-83ce-47f1-ba9c-8b8589f9fb7f-61b9db5fed321000117d0767-1639570412-ACC 212 - Week 7-8 ULO A

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses equity instruments and their categories. It states that at the end of the ACC 212 financial markets unit, students are expected to describe equity instruments and elaborate on derivatives financial instruments. It defines an equity instrument as a document that legally evidences ownership in a firm, like a share certificate. Equity instruments are issued to shareholders to fund businesses and may or may not return dividends depending on profits. Common categories of equity instruments discussed include common stock, convertible debentures, preferred stock, depository receipts, and transferable subscription rights.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

9 views9 pages61b9db5fed321000117d0767-1639570412-ACC 212 - Week 7-8 ULO A

61b9db5fed321000117d0767-1639570412-ACC 212 - Week 7-8 ULO A

Uploaded by

Chrissa Nova VelilaThe document discusses equity instruments and their categories. It states that at the end of the ACC 212 financial markets unit, students are expected to describe equity instruments and elaborate on derivatives financial instruments. It defines an equity instrument as a document that legally evidences ownership in a firm, like a share certificate. Equity instruments are issued to shareholders to fund businesses and may or may not return dividends depending on profits. Common categories of equity instruments discussed include common stock, convertible debentures, preferred stock, depository receipts, and transferable subscription rights.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 9

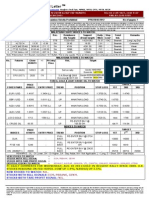

ACC 212 – Financial Market

Unit Learning

At the end of the unit, you are expected to:

a.Describe Equity Instruments

b.Elaborate Derivatives Financial Instruments

Metalanguage

Equity instrument. This term refers to a document

which serves as a legally applicable evidence of the

ownership right in a firm, like a share certificate.

Essential Language

An equity instrument refers to a document which serves as a

legally applicable evidence of the ownership right in a firm,

like a share certificate. Equity instruments are, generally,

issued to company shareholders and are used to fund the

business. It is, however, not necessary that the issued equity

must return a dividend for it is based on profits and the terms

of business.

Categories of equity instrument

The equity instruments can be divided into numerous categories, the most

common ones being:

ØCommon stock is one of the equity instruments issued by a public

company to raise funds from the public. The shareholders have the

privilege of being entitled to co-ownership of the company in addition to

having the right to vote at the shareholders meeting as per the

proportion of shares. Besides, they also have rights to take decision in

important issues like raising capital to pay dividends and merging

business. Moreover, the shareholders can also apply for new shares when

the company has increased capital or issues a new allocation to the

shareholders.

Categories of equity instrument

The equity instruments can be divided into numerous categories, the

most common ones being:

• Convertible debenture is another type of equity instrument which is

similar to common bonds, the only difference being that a

convertible debenture can be converted into common stock during

the particular rates and prices mentioned in the prospectus.

Convertible debentures are quite popular for profitable returns from

converted stock are higher than those form common bonds.

Categories of equity instrument

The equity instruments can be divided into numerous categories, the

most common ones being:

• Preferred stock, another equity instrument, involves shareholders’

participation as a business owner as in common stock. The variation

lies in that the preferred shareholders are entitled to receive

repayment of capital prior to the common shareholders.

Categories of equity instrument

The equity instruments can be divided into numerous categories, the

most common ones being:

• Depository receipt is an equity instrument which entitles the rights

to reference common bonds, ordinary debentures, and convertible

debentures. Investors holding a depository receipt get benefits as

shareholders of listed companies in every respects, be it the voting

rights or financial rights in the listed companies.

Categories of equity instrument

The equity instruments can be divided into numerous categories, the

most common ones being:

• Transferable Subscription Rights (TSR) is an equity instrument

issued by a company to all shareholders in proportion numbers of

shares already held by them. This instrument is used as evidence in

shares of the company. The existing shareholders can sell/transfer

their rights to others if they do not want to exercise their shares.

You might also like

- Methodology SP Us IndicesDocument40 pagesMethodology SP Us IndicesJohn DoeNo ratings yet

- CIMA F2 Course Notes PDFDocument293 pagesCIMA F2 Course Notes PDFganNo ratings yet

- Chapter 6Document20 pagesChapter 6Alliyah KayeNo ratings yet

- Equity and Debt Securities (Presentation)Document23 pagesEquity and Debt Securities (Presentation)jefferkosgeiNo ratings yet

- Share Capital and DebenturesDocument43 pagesShare Capital and DebenturesRehanbhikanNo ratings yet

- Corporate Accounting Assignment 2 Mansha TulsyanDocument11 pagesCorporate Accounting Assignment 2 Mansha TulsyanSana AkhtarNo ratings yet

- Untitled PresentationDocument8 pagesUntitled Presentationnimaichadha265No ratings yet

- My PartDocument6 pagesMy Partkdoshi23No ratings yet

- Chapter 5 CorporationDocument12 pagesChapter 5 CorporationMamaru SewalemNo ratings yet

- Module in Financial Management - 07Document10 pagesModule in Financial Management - 07Karla Mae GammadNo ratings yet

- Equity Market: Equity Market Is One of The Key Sectors of Financial Markets Where Long-Term FinancialDocument10 pagesEquity Market: Equity Market Is One of The Key Sectors of Financial Markets Where Long-Term Financialfrancis dungcaNo ratings yet

- What Are Preferred SharesDocument9 pagesWhat Are Preferred SharesMariam LatifNo ratings yet

- Investment LawDocument90 pagesInvestment LawROHIT SINGH RajputNo ratings yet

- Business Law Class 10 Legal Aspect of Financing A CorporationDocument24 pagesBusiness Law Class 10 Legal Aspect of Financing A Corporationmr singhNo ratings yet

- Shares of StockDocument7 pagesShares of StockAdityaMohanNo ratings yet

- MBI Corporate Finance Topic 4 Share CapitalDocument124 pagesMBI Corporate Finance Topic 4 Share Capitaljonas sserumagaNo ratings yet

- Chapter 4 FIDocument7 pagesChapter 4 FISeid KassawNo ratings yet

- Advantages and Disadvantages of Preferred StockDocument5 pagesAdvantages and Disadvantages of Preferred StockVaibhav Rolihan100% (2)

- Corporate Structure and AdministrationDocument10 pagesCorporate Structure and AdministrationDr.Sree Lakshmi KNo ratings yet

- StocksDocument9 pagesStocksHassan Tahir SialNo ratings yet

- MB II Unit Final StudentsDocument70 pagesMB II Unit Final StudentsHema vijay sNo ratings yet

- Week 09 - Module 07 - Banking Industry and Nonbanking Financial InstitutionsDocument11 pagesWeek 09 - Module 07 - Banking Industry and Nonbanking Financial Institutions지마리No ratings yet

- Equity Financing: Sresth Verma Bba 6A 05290201718Document12 pagesEquity Financing: Sresth Verma Bba 6A 05290201718Sresth VermaNo ratings yet

- Business LawDocument15 pagesBusiness LawHimanshi YadavNo ratings yet

- FM ReviewerDocument20 pagesFM ReviewerBSA - Cabangon, MerraquelNo ratings yet

- Stock Valuation Written ReportDocument14 pagesStock Valuation Written ReportJesse John A. CorpuzNo ratings yet

- Share 3Document19 pagesShare 3manishchaudhary3537No ratings yet

- MGMT2023 Lecture 7 STOCK VALUATION - Parts I, II IIIDocument86 pagesMGMT2023 Lecture 7 STOCK VALUATION - Parts I, II IIIIsmadth2918388100% (1)

- Fmi Lecture 3Document22 pagesFmi Lecture 3shakirNo ratings yet

- Chapter 4 Corporate StockDocument5 pagesChapter 4 Corporate StockJhanice MartinezNo ratings yet

- Primary MarketDocument15 pagesPrimary MarketKapil KumarNo ratings yet

- M3 - Sources of FinanceDocument22 pagesM3 - Sources of Financehats300972No ratings yet

- Managerial Finance chp7Document11 pagesManagerial Finance chp7Linda Mohammad FarajNo ratings yet

- Law On CorporationsDocument6 pagesLaw On Corporationsjokjok021904No ratings yet

- BMS CL Unit 4Document30 pagesBMS CL Unit 4RKS KRNo ratings yet

- Company Law PresentationDocument6 pagesCompany Law Presentationnavoditakm04No ratings yet

- What Is Equity Investment? (A Guide To Understanding It) - Indeed - Com UKDocument6 pagesWhat Is Equity Investment? (A Guide To Understanding It) - Indeed - Com UKvbawan11No ratings yet

- Interview QuestionsDocument7 pagesInterview QuestionsGaurav TripathiNo ratings yet

- Meaning: Asset Company Call Shares Money Creditor Interest Ordinary Shares Means Share Profits ReturnsDocument10 pagesMeaning: Asset Company Call Shares Money Creditor Interest Ordinary Shares Means Share Profits ReturnskhuushbuNo ratings yet

- SHARESDocument12 pagesSHARESHIMANSHU DARGANNo ratings yet

- CH 6Document91 pagesCH 6EyobedNo ratings yet

- Further Reading On Shares and EquitiesDocument6 pagesFurther Reading On Shares and Equitiesshazlina_liNo ratings yet

- Chapter 6 CorporationDocument7 pagesChapter 6 CorporationAmaa AmaaNo ratings yet

- Assignment, StockDocument5 pagesAssignment, StockNawshad HasanNo ratings yet

- Equity Share and Its TypesDocument4 pagesEquity Share and Its TypeslakshmibabymaniNo ratings yet

- Personal Finance Chapter 14 Part 1: CanadayDocument25 pagesPersonal Finance Chapter 14 Part 1: Canaday陈皮乌鸡No ratings yet

- Unit-1: Investment SettingDocument61 pagesUnit-1: Investment SettingKarthika NathanNo ratings yet

- Financed by LectureDocument5 pagesFinanced by LectureEng Abdikarim WalhadNo ratings yet

- Equity Securities MarketDocument23 pagesEquity Securities MarketILOVE MATURED FANSNo ratings yet

- How To Invest in Stocks For BeginnersDocument72 pagesHow To Invest in Stocks For BeginnersAnjelyn Hernando100% (2)

- Company Accounts-Updated-1Document44 pagesCompany Accounts-Updated-1cleophacerevivalNo ratings yet

- Accounting 2 - Book NotesDocument11 pagesAccounting 2 - Book NotesSimona PutnikNo ratings yet

- 08 - Chapter 2 PDFDocument42 pages08 - Chapter 2 PDFManvendraSinghRathoreNo ratings yet

- Module 5 - Share Capital & BorrowingsDocument7 pagesModule 5 - Share Capital & BorrowingsAlishaNo ratings yet

- Capital Markets: Presented by AbhishekDocument22 pagesCapital Markets: Presented by AbhishekBeerappa RamakrishnaNo ratings yet

- What Is A Capital Market?Document8 pagesWhat Is A Capital Market?Mohammad Taha KhanNo ratings yet

- Financial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120Document5 pagesFinancial Accounting Class: Bba Ii Submitted To: Sir Ghulam Mustafa Shaikh Submitted By: Sarah Khan Chandio Registration No: 0911120wajid2345No ratings yet

- Stock Valuation Module 4.2Document98 pagesStock Valuation Module 4.2Jemille MangawanNo ratings yet

- Fa Unit 4Document13 pagesFa Unit 4VTNo ratings yet

- Types of EquityDocument2 pagesTypes of EquityPrasanthNo ratings yet

- Types of MarketsDocument8 pagesTypes of MarketsManas JainNo ratings yet

- RBSDocument66 pagesRBSankit_sinha1990No ratings yet

- Fred Tam News LetterDocument7 pagesFred Tam News LetterTan Lip SeongNo ratings yet

- BAV Assignment WalmartDocument3 pagesBAV Assignment WalmartVidushi ThapliyalNo ratings yet

- Metropolis Share Price - Google SearchDocument1 pageMetropolis Share Price - Google SearchVikram Kumar JapaNo ratings yet

- Shareholders' EquityDocument16 pagesShareholders' Equitymaria evangelistaNo ratings yet

- Mutual Fund Project 3387 123Document87 pagesMutual Fund Project 3387 123sagarNo ratings yet

- Uas AKMDocument14 pagesUas AKMThorieq Mulya MiladyNo ratings yet

- PublicationDocument84 pagesPublicationandreiNo ratings yet

- Unit6 2-ValuationofPreferredandCommonStockDocument77 pagesUnit6 2-ValuationofPreferredandCommonStockHay JirenyaaNo ratings yet

- Syllabus ECO 4201 Fall 2016.v3Document4 pagesSyllabus ECO 4201 Fall 2016.v3Ahsan RiazNo ratings yet

- How To Trade Intraday Using Advanced Volatility CalculatorDocument6 pagesHow To Trade Intraday Using Advanced Volatility CalculatorShubham WaghmareNo ratings yet

- Waterfall Analysis - 1X Liquidation PreferenceDocument9 pagesWaterfall Analysis - 1X Liquidation PreferenceMonish KartheekNo ratings yet

- Research Proposal For Us MarketDocument13 pagesResearch Proposal For Us MarketTayyaub khalidNo ratings yet

- Trac Nghiem Cuoi Ky Ly Thuyet Tai ChinhDocument46 pagesTrac Nghiem Cuoi Ky Ly Thuyet Tai ChinhLê QuỳnhNo ratings yet

- Study of Consumer Behaviour Towards Stock Market in NCR Delhi at India BullsDocument21 pagesStudy of Consumer Behaviour Towards Stock Market in NCR Delhi at India BullsRahul ShoriNo ratings yet

- The Real Value of Investing Nimesh ShahDocument1 pageThe Real Value of Investing Nimesh Shahvikas_ojha54706No ratings yet

- Unit 1: Understanding Equity: Public Equity Vs Private EquityDocument10 pagesUnit 1: Understanding Equity: Public Equity Vs Private EquityPulkit AggarwalNo ratings yet

- Stock ExchangeDocument12 pagesStock ExchangeGirish ChouguleNo ratings yet

- CircleDocument173 pagesCircleKarthikeya Saravana KumarNo ratings yet

- Risk PremiumDocument29 pagesRisk PremiumNabilah Usman100% (1)

- 707-Article Text-1912-1-10-20200529Document10 pages707-Article Text-1912-1-10-20200529Kevin GintingNo ratings yet

- Solution Manual For Principles of Managerial Finance 14Th Edition Gitman Zutter 9780133507690 Full Chapter PDFDocument36 pagesSolution Manual For Principles of Managerial Finance 14Th Edition Gitman Zutter 9780133507690 Full Chapter PDFdoris.fuentes765100% (20)

- OIAL High Yld and Distressed Pricing - 30 Apr '19Document19 pagesOIAL High Yld and Distressed Pricing - 30 Apr '19SSNo ratings yet

- Orbe Brazil Fund - Dec2012Document7 pagesOrbe Brazil Fund - Dec2012José Enrique MorenoNo ratings yet

- THE BOH WAY - v1Document13 pagesTHE BOH WAY - v1mrrrkkk100% (2)

- Commission Structure Classic Account PDFDocument1 pageCommission Structure Classic Account PDFYasirNo ratings yet

- 1 Risk and ReturnDocument24 pages1 Risk and ReturnMohammad DwidarNo ratings yet

- 3 Mulunesh Gizachew PDFDocument77 pages3 Mulunesh Gizachew PDFMugea MgaNo ratings yet