Professional Documents

Culture Documents

Afa 19

Afa 19

Uploaded by

Fahim FaysalCopyright:

Available Formats

You might also like

- Marriott Corporation-Project Chariot: Case QuestionsDocument7 pagesMarriott Corporation-Project Chariot: Case Questionssurya rajanNo ratings yet

- MODULE IN Special Topics in Finance CORRESPONDENCEDocument78 pagesMODULE IN Special Topics in Finance CORRESPONDENCETaylor Tomlinson100% (12)

- Ey The Insolvency and Bankruptcy Code 2016 An Overview PDFDocument6 pagesEy The Insolvency and Bankruptcy Code 2016 An Overview PDFRaghav DhootNo ratings yet

- Consolidated Financial Statements (IFRS 10) : Objective of The StandardDocument2 pagesConsolidated Financial Statements (IFRS 10) : Objective of The StandardYared HussenNo ratings yet

- Ifrs 10Document6 pagesIfrs 10Najam Huda0% (1)

- AFA II UU Unit 2 Consolidation Date of Aquisition PDF ProtectedDocument24 pagesAFA II UU Unit 2 Consolidation Date of Aquisition PDF Protectednatnaelsleshi3No ratings yet

- Abebayehu Hailu.1pdfDocument18 pagesAbebayehu Hailu.1pdfletagemechu29No ratings yet

- Separate and Consolidated Financial Statements Stock AcquisitionDocument67 pagesSeparate and Consolidated Financial Statements Stock AcquisitionMARTINEZ Wyssa ElaineNo ratings yet

- Principles of Consolidated Financial StatementsDocument13 pagesPrinciples of Consolidated Financial StatementsADEYANJU AKEEM100% (1)

- Abridged IFRS 10Document41 pagesAbridged IFRS 10Melanie ChewNo ratings yet

- Ifrs 10,11,3. Ias 27,28 All About Bus CombiDocument52 pagesIfrs 10,11,3. Ias 27,28 All About Bus CombiLynDioquinoNo ratings yet

- Summary of IFRS 10Document2 pagesSummary of IFRS 10Tin BatacNo ratings yet

- Consolidation - Investment Entities: IFRS Project InsightsDocument6 pagesConsolidation - Investment Entities: IFRS Project InsightsRodrigo Alberto González UricoecheaNo ratings yet

- Ifrs 10: Consolidated Financial InstrumentDocument5 pagesIfrs 10: Consolidated Financial InstrumentAira Nhaira Mecate100% (1)

- UAE Company LawDocument28 pagesUAE Company LawAgastya ChauhanNo ratings yet

- Ifrs 10Document1 pageIfrs 10Gani LatiNo ratings yet

- Consolidated Financial Statement HandoutDocument9 pagesConsolidated Financial Statement HandoutMary Jane BarramedaNo ratings yet

- Summary of IFRS 10Document5 pagesSummary of IFRS 10Dwight Bent0% (1)

- Practical Guide To IFRS Practical Guide To IFRS Practical Guide To IFRS 10Document29 pagesPractical Guide To IFRS Practical Guide To IFRS Practical Guide To IFRS 10Vk0306No ratings yet

- AFAR - 7.0 & 8.0 - Version 2 - AnsweredDocument34 pagesAFAR - 7.0 & 8.0 - Version 2 - AnsweredJunel PlanosNo ratings yet

- Introduction To Group Financial StatementsDocument52 pagesIntroduction To Group Financial StatementsTafadzwaNo ratings yet

- IFRS 10 and 12 CPD September 2013Document75 pagesIFRS 10 and 12 CPD September 2013Nicolaus CopernicusNo ratings yet

- ACCTG 110 Group3 Consolidated Statement Financial Position DateofAcquisitionDocument22 pagesACCTG 110 Group3 Consolidated Statement Financial Position DateofAcquisitionKathlin Delos ReyesNo ratings yet

- Consolidated and Separate Financial Statements: International Accounting Standard 27Document15 pagesConsolidated and Separate Financial Statements: International Accounting Standard 27Muhammad FaisalNo ratings yet

- SEC Simplifies Financial Reporting For Small Entities: April 4, 2018Document9 pagesSEC Simplifies Financial Reporting For Small Entities: April 4, 2018AndriaNo ratings yet

- Consolidated Financial Statements 2016 RevisedDocument89 pagesConsolidated Financial Statements 2016 Revisednaomimaboni53No ratings yet

- 13.2 Therteenth Lecture - The Consolidated Statement of Financial PositionDocument20 pages13.2 Therteenth Lecture - The Consolidated Statement of Financial PositionTIKO LIANo ratings yet

- Resume 2Document9 pagesResume 2MariaNo ratings yet

- Subsedaries Working ProcessDocument5 pagesSubsedaries Working ProcessKaiumNo ratings yet

- Group Account Week 1Document8 pagesGroup Account Week 1Omolaja IbukunNo ratings yet

- Pra 371Document3 pagesPra 371Nikesh SapkotaNo ratings yet

- IFRS 10 Consolidated Financial Statements: Technical SummaryDocument1 pageIFRS 10 Consolidated Financial Statements: Technical SummarydskrishnaNo ratings yet

- Summary of IND As 110 and IFRS 10 Consolidated Financial Statements - Taxguru - inDocument7 pagesSummary of IND As 110 and IFRS 10 Consolidated Financial Statements - Taxguru - inalok kumarNo ratings yet

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Document8 pagesIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNo ratings yet

- IAS 27: Consolidated andDocument31 pagesIAS 27: Consolidated andashiakas8273No ratings yet

- IFRS 10 Consolidated Financial Statements-1Document3 pagesIFRS 10 Consolidated Financial Statements-1Mahammad AlkhalilyNo ratings yet

- ConsolidationDocument5 pagesConsolidationM.Celeste DiazNo ratings yet

- Part D-20-SMEsDocument40 pagesPart D-20-SMEsnfakhar2808No ratings yet

- Ca - en - 13-3505 - IFRS - Practical - Guides - Design PDFDocument20 pagesCa - en - 13-3505 - IFRS - Practical - Guides - Design PDFKamran Imam GhouriNo ratings yet

- Consolidated Financial Statements - IFRS 10Document3 pagesConsolidated Financial Statements - IFRS 10akii ramNo ratings yet

- Acc411-Short Notes 2022Document22 pagesAcc411-Short Notes 2022darylNo ratings yet

- ACTIVITY 8 - Intermediate AccountingDocument2 pagesACTIVITY 8 - Intermediate AccountingMicky BernalNo ratings yet

- Ias 27Document10 pagesIas 27Jona Mae MillaNo ratings yet

- 05 Bbfa4403 T1Document40 pages05 Bbfa4403 T1BABYNo ratings yet

- Consolidation GAAPDocument77 pagesConsolidation GAAPMisganaw DebasNo ratings yet

- 2010 Illustrative Fs Sme Final Clean New - UnlockedDocument74 pages2010 Illustrative Fs Sme Final Clean New - UnlockedKendall JennerNo ratings yet

- Philippine Accounting Standard No. 1: Presentation of Financial StatementsDocument58 pagesPhilippine Accounting Standard No. 1: Presentation of Financial StatementsDark PrincessNo ratings yet

- PDF 01Document4 pagesPDF 01Hiruni LakshaniNo ratings yet

- ACT 3113 Advanced Financial Accounting: Consolidated AccountsDocument75 pagesACT 3113 Advanced Financial Accounting: Consolidated AccountsPraveena BelgodaNo ratings yet

- CA Mehul Shah CA Mehul Shah: Accounting Standard - 21 Consolidated Financial StatementsDocument26 pagesCA Mehul Shah CA Mehul Shah: Accounting Standard - 21 Consolidated Financial StatementsVarun BhallaNo ratings yet

- Important Notes For Consolidation and Business CombinationDocument10 pagesImportant Notes For Consolidation and Business CombinationSajib Kumar DasNo ratings yet

- AFAR-09 (Separate & Consolidated Financial Statements)Document10 pagesAFAR-09 (Separate & Consolidated Financial Statements)Hasmin AmpatuaNo ratings yet

- International Accounting Standard 27 Consolidated and Separate Financial StatementsDocument17 pagesInternational Accounting Standard 27 Consolidated and Separate Financial StatementsShariful Islam JoyNo ratings yet

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Document10 pagesIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNo ratings yet

- As 28 Investments in Associates and Joint VenturesDocument5 pagesAs 28 Investments in Associates and Joint VenturesRaymund CabidogNo ratings yet

- Combinations Explains How To Account For Any Related Goodwill)Document2 pagesCombinations Explains How To Account For Any Related Goodwill)Samuel FerolinoNo ratings yet

- Chapter 22Document6 pagesChapter 22JOANNE PEÑARANDANo ratings yet

- RULE68-2005 (Audited Financial Statements)Document17 pagesRULE68-2005 (Audited Financial Statements)Michael AlinaoNo ratings yet

- Afar 09Document14 pagesAfar 09RENZEL MAGBITANGNo ratings yet

- Ifrs 10Document42 pagesIfrs 10BUKWANo ratings yet

- True or FalseDocument2 pagesTrue or FalseMae RamosNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Managerial Accounting - HW Case 5-2 Celtex Feb 05 2011Document1 pageManagerial Accounting - HW Case 5-2 Celtex Feb 05 2011Gautam RandhawaNo ratings yet

- Credit Operations QuestionDocument2 pagesCredit Operations QuestionSumon AhmedNo ratings yet

- Discuss The Concept of Strategic Model. (5 PTS.) : A. Wright, Kroll and Parnell ModelDocument9 pagesDiscuss The Concept of Strategic Model. (5 PTS.) : A. Wright, Kroll and Parnell ModelMelissa Jane ViveroNo ratings yet

- Bachrach vs. SeifertDocument2 pagesBachrach vs. SeifertNichole John UsonNo ratings yet

- TTR IDeals Brazil MA Handbook 2022Document63 pagesTTR IDeals Brazil MA Handbook 2022Vitor SáNo ratings yet

- India Glycols Limited: 2-B, +911206860000, 3090200 3090111, E-MailDocument179 pagesIndia Glycols Limited: 2-B, +911206860000, 3090200 3090111, E-MailPriyam RoyNo ratings yet

- Far410 Tutorial Chapter 2 QuestionDocument1 pageFar410 Tutorial Chapter 2 Question2023289894No ratings yet

- 0000 AB - 3 Perfect collateral-under-UCC Article 8Document17 pages0000 AB - 3 Perfect collateral-under-UCC Article 8Bálint Fodor100% (1)

- 032017Document107 pages032017Aditya MakwanaNo ratings yet

- ABM 1 Reviewer ModuleDocument9 pagesABM 1 Reviewer Modulejoseph christopher vicenteNo ratings yet

- Genuime Company Required 1 Debit CreditDocument15 pagesGenuime Company Required 1 Debit CreditAnonnNo ratings yet

- Level 4 Code 1 Answer-1Document10 pagesLevel 4 Code 1 Answer-1biniam100% (1)

- Accruals & Defferals Chapter-3Document6 pagesAccruals & Defferals Chapter-3mareg malgeNo ratings yet

- Third Week - Dsadfor PrintingDocument14 pagesThird Week - Dsadfor Printingyukiro rineva0% (2)

- Jumantoc 2NDDocument1 pageJumantoc 2NDevgciikNo ratings yet

- Performance Task 2Document1 pagePerformance Task 2wivadaNo ratings yet

- 3rd India Family Office Summit & Awards 2024 - 30-01-2024Document10 pages3rd India Family Office Summit & Awards 2024 - 30-01-2024sreewealthNo ratings yet

- Ifrs15 (Students) Đáp Án Cô S ADocument5 pagesIfrs15 (Students) Đáp Án Cô S AXuân AnhNo ratings yet

- Summer Assignment 2Document10 pagesSummer Assignment 2Wm LiNo ratings yet

- Bcoe 143Document9 pagesBcoe 143Yashita KansalNo ratings yet

- 7Document7 pages7Lyza Molina ParadoNo ratings yet

- Cbleacpu 08Document10 pagesCbleacpu 08Agastya KarnwalNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (67)

- Fin & Acc For MGT - Interpretation of Accounts HandoutDocument16 pagesFin & Acc For MGT - Interpretation of Accounts HandoutSvosvetNo ratings yet

- Conceptual Frameworks and Accounting Standards PDFDocument58 pagesConceptual Frameworks and Accounting Standards PDFJieyan Oliveros0% (1)

- CA SFM Chapter 6 CompilationDocument57 pagesCA SFM Chapter 6 CompilationRaul KarkyNo ratings yet

- MBA507Document10 pagesMBA507pheeyonaNo ratings yet

Afa 19

Afa 19

Uploaded by

Fahim FaysalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Afa 19

Afa 19

Uploaded by

Fahim FaysalCopyright:

Available Formats

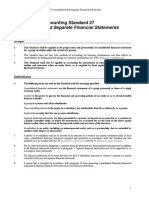

IFRS 10

International Financial Reporting Standard 10 (IFRS-10) specifies guidelines for the preparation

and presentation of consolidated financial statements when an entity controls one or more other

entities. It is important for parent companies with several subsidiaries and other legal entities to

ensure that they present their complete financial picture of the company. Consolidated financial

statements are required when the parent controls one or more other subsidiaries. The

consolidated financial statements won't always be accurate if all transactions are included in

them because of transfer pricing or intercompany transactions. These intercompany transactions

must be recognized, matched, and removed so that they do not appear on the consolidated

financial statements. And for this IFRS 10 is used here for eliminate manipulation or

misrepresentation of financial information.

Requirements of IFRS 10 for the consolidation of financial statements:

1. Objective

The objective of IFRS 10 is to establish consistent principles for the presentation and preparation

of consolidated financial statements. To meet this objective, it:

> Requires a parent entity (an entity that controls one or more other entities) to present

consolidated financial statements

> Defines the principle of control, and establishes control as the basis for consolidation

> Sets out how to apply the principle of control to identify whether an investor controls

an investee and therefore must consolidate the investee

> Sets out the accounting requirements for the preparation of consolidated financial

statements

> Defines an investment entity and sets out an exception to consolidating particular

subsidiaries of an investment entity.

2. Scope and exemptions

However, under IFRS standards, not all parent companies need to prepare consolidated financial

statements. According to Paragraph 4 of IFRS 10, these exemption criteria are:

> The parent company is a wholly owned subsidiary or is a partially owned subsidiary of

another entity and its other owners, including those not entitled to vote, have been

informed about, and do not object to, the parent not presenting consolidated financial

statements

> The parent company’s debt or equity instruments are not traded in a public market (a

domestic or foreign stock exchange or an over-the-counter market, including local and

regional markets

> The parent company did not file, nor is it in the process of filing, its financial

statements with a securities commission or other regulatory organization for the purpose

of issuing any class of instruments in a public market

> The ultimate or any intermediate parent of the parent produces financial statements

available for public use that comply with IFRSs, in which subsidiaries are consolidated or

are measured at fair value through profit and loss in accordance with IFRS 10.

3. Control

Under IFRS 10, the parent company must be very clear about whether it has ‘control’ of the

subsidiary, defined as:

> Power over the investee: the investor has existing rights that give it the ability to direct the

relevant activities (the activities that significantly affect the investee's returns)

> Exposure, or rights, to variable returns from its involvement with the investee

> The ability to use its power over the investee to affect the amount of the investor's returns.

If these three elements are present, then the parent company is considered to control the

subsidiary. It must therefore prepare consolidated financial statements unless otherwise exempt.

4. Preparation of consolidated financial statements

IFRS 10 lays out best practice in preparation of consolidated financial statements. The

framework for this is:

> Intracompany transactions and investments from the parents must be identified and

eliminated from the consolidated financial statement

> Accounting policies should be consistent and clear across the group in order to reduce the

risk of error

> Financial information upon which the consolidated financial statements are based must

have the same reporting date

> Non-controlling interests must be correctly allocated their comprehensive income and

equity

> Changes in ownership interest’s without loss of control must be accounted for, as must

losing control of a subsidiary.

You might also like

- Marriott Corporation-Project Chariot: Case QuestionsDocument7 pagesMarriott Corporation-Project Chariot: Case Questionssurya rajanNo ratings yet

- MODULE IN Special Topics in Finance CORRESPONDENCEDocument78 pagesMODULE IN Special Topics in Finance CORRESPONDENCETaylor Tomlinson100% (12)

- Ey The Insolvency and Bankruptcy Code 2016 An Overview PDFDocument6 pagesEy The Insolvency and Bankruptcy Code 2016 An Overview PDFRaghav DhootNo ratings yet

- Consolidated Financial Statements (IFRS 10) : Objective of The StandardDocument2 pagesConsolidated Financial Statements (IFRS 10) : Objective of The StandardYared HussenNo ratings yet

- Ifrs 10Document6 pagesIfrs 10Najam Huda0% (1)

- AFA II UU Unit 2 Consolidation Date of Aquisition PDF ProtectedDocument24 pagesAFA II UU Unit 2 Consolidation Date of Aquisition PDF Protectednatnaelsleshi3No ratings yet

- Abebayehu Hailu.1pdfDocument18 pagesAbebayehu Hailu.1pdfletagemechu29No ratings yet

- Separate and Consolidated Financial Statements Stock AcquisitionDocument67 pagesSeparate and Consolidated Financial Statements Stock AcquisitionMARTINEZ Wyssa ElaineNo ratings yet

- Principles of Consolidated Financial StatementsDocument13 pagesPrinciples of Consolidated Financial StatementsADEYANJU AKEEM100% (1)

- Abridged IFRS 10Document41 pagesAbridged IFRS 10Melanie ChewNo ratings yet

- Ifrs 10,11,3. Ias 27,28 All About Bus CombiDocument52 pagesIfrs 10,11,3. Ias 27,28 All About Bus CombiLynDioquinoNo ratings yet

- Summary of IFRS 10Document2 pagesSummary of IFRS 10Tin BatacNo ratings yet

- Consolidation - Investment Entities: IFRS Project InsightsDocument6 pagesConsolidation - Investment Entities: IFRS Project InsightsRodrigo Alberto González UricoecheaNo ratings yet

- Ifrs 10: Consolidated Financial InstrumentDocument5 pagesIfrs 10: Consolidated Financial InstrumentAira Nhaira Mecate100% (1)

- UAE Company LawDocument28 pagesUAE Company LawAgastya ChauhanNo ratings yet

- Ifrs 10Document1 pageIfrs 10Gani LatiNo ratings yet

- Consolidated Financial Statement HandoutDocument9 pagesConsolidated Financial Statement HandoutMary Jane BarramedaNo ratings yet

- Summary of IFRS 10Document5 pagesSummary of IFRS 10Dwight Bent0% (1)

- Practical Guide To IFRS Practical Guide To IFRS Practical Guide To IFRS 10Document29 pagesPractical Guide To IFRS Practical Guide To IFRS Practical Guide To IFRS 10Vk0306No ratings yet

- AFAR - 7.0 & 8.0 - Version 2 - AnsweredDocument34 pagesAFAR - 7.0 & 8.0 - Version 2 - AnsweredJunel PlanosNo ratings yet

- Introduction To Group Financial StatementsDocument52 pagesIntroduction To Group Financial StatementsTafadzwaNo ratings yet

- IFRS 10 and 12 CPD September 2013Document75 pagesIFRS 10 and 12 CPD September 2013Nicolaus CopernicusNo ratings yet

- ACCTG 110 Group3 Consolidated Statement Financial Position DateofAcquisitionDocument22 pagesACCTG 110 Group3 Consolidated Statement Financial Position DateofAcquisitionKathlin Delos ReyesNo ratings yet

- Consolidated and Separate Financial Statements: International Accounting Standard 27Document15 pagesConsolidated and Separate Financial Statements: International Accounting Standard 27Muhammad FaisalNo ratings yet

- SEC Simplifies Financial Reporting For Small Entities: April 4, 2018Document9 pagesSEC Simplifies Financial Reporting For Small Entities: April 4, 2018AndriaNo ratings yet

- Consolidated Financial Statements 2016 RevisedDocument89 pagesConsolidated Financial Statements 2016 Revisednaomimaboni53No ratings yet

- 13.2 Therteenth Lecture - The Consolidated Statement of Financial PositionDocument20 pages13.2 Therteenth Lecture - The Consolidated Statement of Financial PositionTIKO LIANo ratings yet

- Resume 2Document9 pagesResume 2MariaNo ratings yet

- Subsedaries Working ProcessDocument5 pagesSubsedaries Working ProcessKaiumNo ratings yet

- Group Account Week 1Document8 pagesGroup Account Week 1Omolaja IbukunNo ratings yet

- Pra 371Document3 pagesPra 371Nikesh SapkotaNo ratings yet

- IFRS 10 Consolidated Financial Statements: Technical SummaryDocument1 pageIFRS 10 Consolidated Financial Statements: Technical SummarydskrishnaNo ratings yet

- Summary of IND As 110 and IFRS 10 Consolidated Financial Statements - Taxguru - inDocument7 pagesSummary of IND As 110 and IFRS 10 Consolidated Financial Statements - Taxguru - inalok kumarNo ratings yet

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Document8 pagesIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNo ratings yet

- IAS 27: Consolidated andDocument31 pagesIAS 27: Consolidated andashiakas8273No ratings yet

- IFRS 10 Consolidated Financial Statements-1Document3 pagesIFRS 10 Consolidated Financial Statements-1Mahammad AlkhalilyNo ratings yet

- ConsolidationDocument5 pagesConsolidationM.Celeste DiazNo ratings yet

- Part D-20-SMEsDocument40 pagesPart D-20-SMEsnfakhar2808No ratings yet

- Ca - en - 13-3505 - IFRS - Practical - Guides - Design PDFDocument20 pagesCa - en - 13-3505 - IFRS - Practical - Guides - Design PDFKamran Imam GhouriNo ratings yet

- Consolidated Financial Statements - IFRS 10Document3 pagesConsolidated Financial Statements - IFRS 10akii ramNo ratings yet

- Acc411-Short Notes 2022Document22 pagesAcc411-Short Notes 2022darylNo ratings yet

- ACTIVITY 8 - Intermediate AccountingDocument2 pagesACTIVITY 8 - Intermediate AccountingMicky BernalNo ratings yet

- Ias 27Document10 pagesIas 27Jona Mae MillaNo ratings yet

- 05 Bbfa4403 T1Document40 pages05 Bbfa4403 T1BABYNo ratings yet

- Consolidation GAAPDocument77 pagesConsolidation GAAPMisganaw DebasNo ratings yet

- 2010 Illustrative Fs Sme Final Clean New - UnlockedDocument74 pages2010 Illustrative Fs Sme Final Clean New - UnlockedKendall JennerNo ratings yet

- Philippine Accounting Standard No. 1: Presentation of Financial StatementsDocument58 pagesPhilippine Accounting Standard No. 1: Presentation of Financial StatementsDark PrincessNo ratings yet

- PDF 01Document4 pagesPDF 01Hiruni LakshaniNo ratings yet

- ACT 3113 Advanced Financial Accounting: Consolidated AccountsDocument75 pagesACT 3113 Advanced Financial Accounting: Consolidated AccountsPraveena BelgodaNo ratings yet

- CA Mehul Shah CA Mehul Shah: Accounting Standard - 21 Consolidated Financial StatementsDocument26 pagesCA Mehul Shah CA Mehul Shah: Accounting Standard - 21 Consolidated Financial StatementsVarun BhallaNo ratings yet

- Important Notes For Consolidation and Business CombinationDocument10 pagesImportant Notes For Consolidation and Business CombinationSajib Kumar DasNo ratings yet

- AFAR-09 (Separate & Consolidated Financial Statements)Document10 pagesAFAR-09 (Separate & Consolidated Financial Statements)Hasmin AmpatuaNo ratings yet

- International Accounting Standard 27 Consolidated and Separate Financial StatementsDocument17 pagesInternational Accounting Standard 27 Consolidated and Separate Financial StatementsShariful Islam JoyNo ratings yet

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Document10 pagesIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNo ratings yet

- As 28 Investments in Associates and Joint VenturesDocument5 pagesAs 28 Investments in Associates and Joint VenturesRaymund CabidogNo ratings yet

- Combinations Explains How To Account For Any Related Goodwill)Document2 pagesCombinations Explains How To Account For Any Related Goodwill)Samuel FerolinoNo ratings yet

- Chapter 22Document6 pagesChapter 22JOANNE PEÑARANDANo ratings yet

- RULE68-2005 (Audited Financial Statements)Document17 pagesRULE68-2005 (Audited Financial Statements)Michael AlinaoNo ratings yet

- Afar 09Document14 pagesAfar 09RENZEL MAGBITANGNo ratings yet

- Ifrs 10Document42 pagesIfrs 10BUKWANo ratings yet

- True or FalseDocument2 pagesTrue or FalseMae RamosNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Managerial Accounting - HW Case 5-2 Celtex Feb 05 2011Document1 pageManagerial Accounting - HW Case 5-2 Celtex Feb 05 2011Gautam RandhawaNo ratings yet

- Credit Operations QuestionDocument2 pagesCredit Operations QuestionSumon AhmedNo ratings yet

- Discuss The Concept of Strategic Model. (5 PTS.) : A. Wright, Kroll and Parnell ModelDocument9 pagesDiscuss The Concept of Strategic Model. (5 PTS.) : A. Wright, Kroll and Parnell ModelMelissa Jane ViveroNo ratings yet

- Bachrach vs. SeifertDocument2 pagesBachrach vs. SeifertNichole John UsonNo ratings yet

- TTR IDeals Brazil MA Handbook 2022Document63 pagesTTR IDeals Brazil MA Handbook 2022Vitor SáNo ratings yet

- India Glycols Limited: 2-B, +911206860000, 3090200 3090111, E-MailDocument179 pagesIndia Glycols Limited: 2-B, +911206860000, 3090200 3090111, E-MailPriyam RoyNo ratings yet

- Far410 Tutorial Chapter 2 QuestionDocument1 pageFar410 Tutorial Chapter 2 Question2023289894No ratings yet

- 0000 AB - 3 Perfect collateral-under-UCC Article 8Document17 pages0000 AB - 3 Perfect collateral-under-UCC Article 8Bálint Fodor100% (1)

- 032017Document107 pages032017Aditya MakwanaNo ratings yet

- ABM 1 Reviewer ModuleDocument9 pagesABM 1 Reviewer Modulejoseph christopher vicenteNo ratings yet

- Genuime Company Required 1 Debit CreditDocument15 pagesGenuime Company Required 1 Debit CreditAnonnNo ratings yet

- Level 4 Code 1 Answer-1Document10 pagesLevel 4 Code 1 Answer-1biniam100% (1)

- Accruals & Defferals Chapter-3Document6 pagesAccruals & Defferals Chapter-3mareg malgeNo ratings yet

- Third Week - Dsadfor PrintingDocument14 pagesThird Week - Dsadfor Printingyukiro rineva0% (2)

- Jumantoc 2NDDocument1 pageJumantoc 2NDevgciikNo ratings yet

- Performance Task 2Document1 pagePerformance Task 2wivadaNo ratings yet

- 3rd India Family Office Summit & Awards 2024 - 30-01-2024Document10 pages3rd India Family Office Summit & Awards 2024 - 30-01-2024sreewealthNo ratings yet

- Ifrs15 (Students) Đáp Án Cô S ADocument5 pagesIfrs15 (Students) Đáp Án Cô S AXuân AnhNo ratings yet

- Summer Assignment 2Document10 pagesSummer Assignment 2Wm LiNo ratings yet

- Bcoe 143Document9 pagesBcoe 143Yashita KansalNo ratings yet

- 7Document7 pages7Lyza Molina ParadoNo ratings yet

- Cbleacpu 08Document10 pagesCbleacpu 08Agastya KarnwalNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (67)

- Fin & Acc For MGT - Interpretation of Accounts HandoutDocument16 pagesFin & Acc For MGT - Interpretation of Accounts HandoutSvosvetNo ratings yet

- Conceptual Frameworks and Accounting Standards PDFDocument58 pagesConceptual Frameworks and Accounting Standards PDFJieyan Oliveros0% (1)

- CA SFM Chapter 6 CompilationDocument57 pagesCA SFM Chapter 6 CompilationRaul KarkyNo ratings yet

- MBA507Document10 pagesMBA507pheeyonaNo ratings yet