Professional Documents

Culture Documents

Role of Artificial Intelligence in Providing Customer Services With Special Reference To SBI and HDFC Bank

Role of Artificial Intelligence in Providing Customer Services With Special Reference To SBI and HDFC Bank

Uploaded by

iocsachinCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- International Standard: Hydrogen Fuel Quality - Product SpecificationDocument24 pagesInternational Standard: Hydrogen Fuel Quality - Product Specificationiocsachin100% (6)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cadchart 2 PDFDocument2 pagesCadchart 2 PDFLouriel NopalNo ratings yet

- 1Document4 pages1iocsachinNo ratings yet

- Artificial Intelligence in Indian Banking Sector: Challenges and OpportunitiesDocument8 pagesArtificial Intelligence in Indian Banking Sector: Challenges and OpportunitiesiocsachinNo ratings yet

- NSTSE Class 5 Solved Paper 2022Document26 pagesNSTSE Class 5 Solved Paper 2022iocsachinNo ratings yet

- Emotional Labout Meta AnalysisDocument51 pagesEmotional Labout Meta AnalysisiocsachinNo ratings yet

- Banking Industry and AIDocument8 pagesBanking Industry and AIiocsachinNo ratings yet

- Review On Artificial Intelligence A BoonDocument3 pagesReview On Artificial Intelligence A BooniocsachinNo ratings yet

- Mediation Effect1Document18 pagesMediation Effect1iocsachinNo ratings yet

- EM - 2017.04.24 - Air Pollution & Accelerated Switch To BS VI Emission NormsDocument3 pagesEM - 2017.04.24 - Air Pollution & Accelerated Switch To BS VI Emission NormsiocsachinNo ratings yet

- 7 54 2022 Pesb - 1Document5 pages7 54 2022 Pesb - 1iocsachinNo ratings yet

- A B C D E F G H I: Files Without This Message by Purchasing Novapdf PrinterDocument22 pagesA B C D E F G H I: Files Without This Message by Purchasing Novapdf PrinteriocsachinNo ratings yet

- Terms and Conditions For Postpaid International Roaming PacksDocument5 pagesTerms and Conditions For Postpaid International Roaming PacksiocsachinNo ratings yet

- Technical Program: DECEMBER 5-9, 2021Document45 pagesTechnical Program: DECEMBER 5-9, 2021iocsachin100% (1)

- IJHE-Fuel Cell-Paper 2Document11 pagesIJHE-Fuel Cell-Paper 2iocsachinNo ratings yet

- Circular 54 - CLASS 3 EVS PLATE IT LIKE A PRODocument2 pagesCircular 54 - CLASS 3 EVS PLATE IT LIKE A PROiocsachinNo ratings yet

- Experimental and Modelling Studies of Low Temperature PEMFC PerformanceDocument10 pagesExperimental and Modelling Studies of Low Temperature PEMFC PerformanceiocsachinNo ratings yet

- E-Bike Electronic Control Unit: Florin Dumitrache, Marius Catalin Carp, and Gheorghe PanaDocument4 pagesE-Bike Electronic Control Unit: Florin Dumitrache, Marius Catalin Carp, and Gheorghe PanaiocsachinNo ratings yet

- Winter Holiday Homework: Class 3Document23 pagesWinter Holiday Homework: Class 3iocsachinNo ratings yet

- Byju's Magazine (PDFDrive)Document23 pagesByju's Magazine (PDFDrive)iocsachinNo ratings yet

- The Nexus Between International Law and The Sustainable Development GoalsDocument13 pagesThe Nexus Between International Law and The Sustainable Development GoalsiocsachinNo ratings yet

- PPG TestDocument2 pagesPPG TestAljon MendozaNo ratings yet

- HR Practices NTPCDocument16 pagesHR Practices NTPCRuchika SinhaNo ratings yet

- 4.3 Introduction To Database ManagementDocument14 pages4.3 Introduction To Database ManagementppghoshinNo ratings yet

- 4thh Quarter Pre TestDocument1 page4thh Quarter Pre TestAlona Camino100% (2)

- Marketing Project OutlineDocument3 pagesMarketing Project OutlineRana AhmedNo ratings yet

- Instrument Assist Soft Tissue MassageDocument6 pagesInstrument Assist Soft Tissue MassageGilang MarcelinoNo ratings yet

- Indian Heart JournalDocument18 pagesIndian Heart JournalSanaSofiyahNo ratings yet

- M&I Two Marks With Answer-All UnitsDocument16 pagesM&I Two Marks With Answer-All UnitsVijay KM83% (6)

- US International Trade CommissionDocument148 pagesUS International Trade CommissionSherazButtNo ratings yet

- Dance: Choreographic Forms inDocument29 pagesDance: Choreographic Forms inROCELYN IMPERIALNo ratings yet

- Tutorial (Equlibrium) AnswersDocument4 pagesTutorial (Equlibrium) Answersoh khang chiangNo ratings yet

- Grp4 EconomicGrowth Report-1Document14 pagesGrp4 EconomicGrowth Report-1Fredilyn DomingoNo ratings yet

- H2scan 720as-Gc Hydrogen Sensor System ManualDocument22 pagesH2scan 720as-Gc Hydrogen Sensor System ManualMohammed SaberNo ratings yet

- EconomicsDocument136 pagesEconomicsAbdi Teshome100% (1)

- IMAP TRANSTEC Complete Drive ShaftsDocument16 pagesIMAP TRANSTEC Complete Drive Shaftslv621048No ratings yet

- 151-Enablon Orm - Permit To WorkDocument2 pages151-Enablon Orm - Permit To WorkRishikesh GunjalNo ratings yet

- Breast CA SeminarDocument60 pagesBreast CA SeminarAliyi MuktarNo ratings yet

- Sony Kdf-E50a12uDocument105 pagesSony Kdf-E50a12uTriptau357No ratings yet

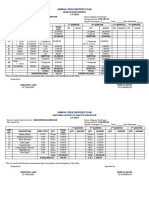

- Annual Procurement Plan-AppDocument6 pagesAnnual Procurement Plan-AppJonas MapacpacNo ratings yet

- DLL - Week - 12 - Statistics and ProbabilityDocument3 pagesDLL - Week - 12 - Statistics and ProbabilityRoboCopyNo ratings yet

- Lesson Plan Ces422 PDFDocument2 pagesLesson Plan Ces422 PDFdzikrydsNo ratings yet

- Year 2018 Best Ongoing Practices Bijhari Block by Vijay Kumar Heer, BRCC PrimaryDocument24 pagesYear 2018 Best Ongoing Practices Bijhari Block by Vijay Kumar Heer, BRCC PrimaryVIJAY KUMAR HEERNo ratings yet

- A Teacher's Guide To CosmosDocument45 pagesA Teacher's Guide To CosmosMSU UrbanSTEM100% (2)

- Indriver CloneDocument31 pagesIndriver Clonenetwork.oyelabsNo ratings yet

- 12 Sample MCQsDocument3 pages12 Sample MCQssweety49No ratings yet

- CT Secondary InjectionDocument2 pagesCT Secondary InjectionHumayun AhsanNo ratings yet

- Extraefi - Co.Uk Reset Problems: Ms1-Extra and Ms2-ExtraDocument8 pagesExtraefi - Co.Uk Reset Problems: Ms1-Extra and Ms2-Extraasser_salehNo ratings yet

- Notes 4 - Stresses in SoilsDocument45 pagesNotes 4 - Stresses in SoilsWen Sen SimNo ratings yet

- Catalogue Product M-Plus FilterDocument40 pagesCatalogue Product M-Plus FilterAdrian Samuel ThenochNo ratings yet

Role of Artificial Intelligence in Providing Customer Services With Special Reference To SBI and HDFC Bank

Role of Artificial Intelligence in Providing Customer Services With Special Reference To SBI and HDFC Bank

Uploaded by

iocsachinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Role of Artificial Intelligence in Providing Customer Services With Special Reference To SBI and HDFC Bank

Role of Artificial Intelligence in Providing Customer Services With Special Reference To SBI and HDFC Bank

Uploaded by

iocsachinCopyright:

Available Formats

International Journal of Recent Technology and Engineering (IJRTE)

ISSN: 2277-3878, Volume-8 Issue-4, November 2019

Role of Artificial Intelligence in Providing

Customer Services with Special Reference to SBI

and HDFC Bank

Ritu TuliSameer Salunkhe

Abstract: Technology has changed the operating psychology business and management operations and Financial

of the businesses over the last couple of years. There is a growing operations. Following are the uses of AI in the banking

need and demand to use Artificial Intelligence (AI) and the industry.

Indian banking Sector is gradually shifting itself towards using Customer Interface: Banks are using virtual customer

AI. Banks are exploring and implementing technology in various assistance to provide resolution to their queries and for this

ways. Artificial Intelligence is getting better and smarter day by

Chatbot is being used on platforms such as mobile

day. The adoption of AI in banking has grown a lot than other

sectors. This is happened because banking sector still has lot of

applications and websites, as well as social media platforms

human intervention in the operations. Indian banking sector is such as Facebook Messenger, Telegram, WhatsApp and

exploring the ways to enhance customer services with the help of Twitter.

Artificial Intelligence. This paper is about how Artificial Customer Insights and Personalization: AI has the

Intelligence (AI) is used by Indian banks with reference to SBI potential to provide customers with personalized

and HDFC Bank to improvise customer services in future. engagement services through the use of AI algorithms. The

technology observes clients‟ behavior patterns based on

Key words:Artificial Intelligence, Customer Service, App. digital profiles and transactional history it suggests products

which are tailored to meet their requirements. By using

A. Introduction: emotional Analytics for Social Enterprises, it is possible to

Technology is the cornerstone of India's banking sector. gain better insights into the emotional and cognitive state of

Indian banks may have embarked on their technological clients. From the video and audio inputs, the application will

journey only in the mid-to late 1990s, they have more than help microfinance advisors better understand the topics that

made up for this relatively late start. The banking sector has would cause users to engage or disengage during the

deployed the latest technologies from core banking and microfinance process.

payment systems to risk management and, more recently, Business and Strategy Insights: With the availability of

digital strategies.Artificial Intelligence (AI) has been around large amount of data with banks, AI can enable better

for decades, ever since John McCarthy defined it as “the understanding. Such analysis can facilitate deeper and real-

science and engineering of making intelligent machines”. time insights into internal operations and external market

Due to its high potential, its adoption is being treated as the dynamics, informing potential strategies across various

fourth industrial revolution. As with any major advancement departments. Deeper insights into customer data, for

in technology, it brings with it a spectrum of opportunities example, can facilitate marketing and portfolio strategies. It

as well as challenges. Several applications have been can also be used for digital payments.

developed or under development with potential to improve Facilitating Backend Processes: AI is being utilized to

the quality of life significantly. But it is only lately that AI assist with backend office operations that often involve high

technology has undergone rapid evolution and raised volume, rules based and highly organized and systematic

significant interest among the banking sector. Artificial work. AI technologies can be used to perform “intelligent

Intelligence is the theory and development of computer automation” like automating the writing of

systems which can perform tasks that normally require investment/earning reports, or extracting functional

human intelligence, such as visual perception, speech information from relevant financial documents.

recognition, decision-making, and translation between Credit Scoring and Loan Decisions: AI is used by lenders

languages.The Indian banking sector is adopting AI quite to calculate credit scores and develop credit profiles. Firms

aggressively. According to Fintech India report by PwC in can make fast credit decisions by analyzing individual‟s

2017, the global spending in AI applications touched $5.1 banking transactions, their past decisions, their spending and

billion, up from $4 billion in 2015. There is a keen interest earning habits and, familial history, mobile data etc.

in the Indian banking sector as well. Natural Language Fraud Detection and Risk Management: AI is used to

Processing, Natural Language Generation, Machine monitor and prevent various instances of fraud, money

Learning (such as Neural networks/deep learning), and laundering, malpractice and the detection of potential risks.

Computer Vision have been adopted by the sector. The Government Initiatives

banking industry has found the use of AI in the area of In India, the government is investing heavily in AI. The

Revised Manuscript Received on November 15, 2019 finance minister in her budget speech of 2019 emphasized

on development of new-age skills like Artificial Intelligence

Ritu TuliSameer Salunkhe, Guru Nanak Institute of Management (AI), Internet of Things, Big Data, 3D Printing, Virtual

Studies, Guru Nanak Institute of Management Studies

Reality and Robotics. The

2018 budget allocated $480

Retrieval Number: C6065098319/2019©BEIESP Published By:

DOI:10.35940/ijrte.C6065.118419 Blue Eyes Intelligence Engineering

12251 & Sciences Publication

Role of Artificial Intelligence in Providing Customer Services with Special Reference to SBI and HDFC

Bank

Mn (Rs. 3,703 Crore) to the Digital India programme, Karippur Nanda Kumar & Pushpa Rani Balaramachandran,

effectively doubling its past investment. These initiatives are S P Jain School of Global Management, Journal of Internet

seen in the form of joint projects, internal programs, and the Banking and Commerce, December 2018, vol. 23, no. 3

AI Task Force. While most of these initiatives concern a The paper discusses challenges retail banking industry has

broader implementation of AI, there are several initiatives faced due to disruptive technology such as intelligent

specific to, and others that indirectly affect the banking and automation and competition from Fintech startups. It

finance industry. emphasizes on usage of Robotic Process Automation

B. Review of Literature: (RPA)to maintain competitive advantage and increase

How Artificial Intelligence Is Changing The Banking profitability, thereby improving efficiency, accuracy, 24/7

Sector –A Case Study of top four Commercial Indian operations, reduce cost and offering innovative services and

Banks better experience to customers. The relationship of four

Dr. Simran Jewandah, Associate professor, Chandigarh independent factors ie Security and Privacy; Reliability;

University, International Journal of Management, Usefulness and Human-like interaction were studied with

Technology And Engineering, pg no 525 - 530 ISSN NO : dependent variable i.e. RPA in order to identify the usage of

2249-7455, Volume 8, Issue VII, JULY/2018 RPA in retail banking industry.

The Banking sector cannot stay aloof from technology if it Artificial Intelligence in Indian Banking Sector:

intends to be updated and competitive for providing prompt Challenges And Opportunities.

services to its customers. AI is used to provide personalize

financial services, smart wallets, underwriting, voice Business & Mgmt

Financial Operations

assisted banking, application to assist in lending decisions, Operations

customer support and digitization. It covers usage of AI and

its implication on the top banks in India. AI has assisted in • Customer Interface • Credit scoring & loan

detection of frauds, reduction in cost and increase in • Customer Insights & decisions

revenue, making customer experience better. It was Personalization • Fraud detection &

identified that SBI, HDFC, ICICI and Axis Bank have • Business & strategy risk mgmt

Insights • Wealth Mgmt

entered the digital era through chatbots and usage of robotic

• Facilitating backend • Algorithmic trading

software. processes • Transactions

Artificial Intelligence: Way Forward for India

Sunil Kumar Srivastava, Government of India, Ministry of

Electronics and Information Technology, New Delhi,

Dr.C.Vijai. Assistant Professor,Department of

Journal of Information Systems and Technology

Commerce,St.Peter„s Institute of Higher Education and

Management – Jistem USP, Vol. 15, 2018, e201815004,

Research, Chennai,Tamil Nadu,India, International Journal

ISSN online: 1807-1775, DOI: 10.4301/S1807

of Advanced Research 7(5), pg no 1581-1587, ISSN: 2320-

1775201815004

5407, April, 2019

This paper covers evolution of AI from its inception to till

This paper evolves from conceptual understanding of AI, its

date. Late fifties and early sixties focused on development

types, history, contribution to the growth of banking sector

of general techniques which could be applied in several

through development and support of various regulatory

domains which weren‟t that successful till late eighties.

bodies, enabling acceleration in the usage of latest

With the increase in storage capacity and computational

technology like AI and block chain technology. Formulation

ability of computers, AI has progressed since the last

of regulatory body, academic research unit by various

decade. Eminent scholars have raised concerns like

players, presence of major IT companies in India have

existential threat, safety, slowdown in the growth of

contributed to the growth story of India as a tech hub. It has

economy, unemployment etc. The international scenario of

changed business processes and customer-facing services

application of AI was studied via sectoral analysis of

significantly. The paper also emphasizes on the benefits and

healthcare, education, cyber security, law, finance,

challenges faced in implementing AI in India. It accentuates

information browsing, transport, virtual assistants,

the usage of AI to shift only from private players and

ecommerce, customer care, energy etc. Policy documents

consumer goods. Public and private funding models should

framed by US, UK, Japan, Singapore and even China was

be encouraged to promote development of research on AI in

studied. The report concluded with AI developments in

India. There is a huge need to change the traditional

India. Various startup companies are providing AI expertise

education mechanism, as the nature of jobs and skills

in sectors likehealthcare, e-commerce, finance etc. IT

required to do them are changing rapidly.

majors like TCS, IBM and Infosys are contributing to AI

No job losses due to chatbots, artificial intelligence:

development. India has huge knowledge resources, however

Banks [Banking]

issues of infrastructure development, policy & regulations,

Shetty, Mayur . The Economic Times ; New Delhi [New

research & development, and human resource development

Delhi]06 Apr 2017.

needs to be addressed in collaboration with government and

The financial sector in India has seen tremendous

corporates.

investments into chatbots and artificial intelligence (AI) to

Robotic Process Automation - A Study Of The Impact

augment customer service. The

On Customer Experience In Retail Banking Industry

routine queries will be moved

Retrieval Number: C6065098319/2019©BEIESP Published By:

Blue Eyes Intelligence Engineering

DOI:10.35940/ijrte.C6065.118419 12252 & Sciences Publication

International Journal of Recent Technology and Engineering (IJRTE)

ISSN: 2277-3878, Volume-8 Issue-4, November 2019

to the self-service mode. Chatbots will not replace customer ICICI Bank, YES Bank and HDFC Bank all use the services

executives but will complement them, providing customers of ToneTag, which has created databases of encrypted sound

with a richer experience. The bankers believe there would waves for them, allowing customers to make payments

not be job losses. without touching a button. A humanoid is placed by HDFC

SBI is working with IBM to make use of Watson -- an Bank at three select branches in Mumbai, Kochi and

answering computer software to assist staff and employees. Bengaluru, called Ira

HDFC Bank has tied up with AI firm Niki to bring in Various banks are handholding fintech firms like ICICI

conversational banking. YesBank partnered Payjo to launch Bank supported FinoPaytech, YES Bank through its

AI-led digital initiatives with focus on speech recognition. programme called Yes Fintech has supported 1,000 fintech

The bank launched Yes Tag--a chatbot-based app on five start-ups, HDFC Bank came up with 'Industry Academia'

messaging platforms: Facebook Messenger, Twitter, Skype, initiative, which allied with engineering and management

Telegram and WeChat. The chatbot experience is extended schools to

to insurance firms and NBFC too. Bot would recommend promote fintech start-ups, as well as an annual Digital

best insurance plans after quizzing the user for 60 seconds. Innovation Summit where start-ups make their presentations

Fullerton became the first to launch a loan acquisition and and the bank selects and backs the five best ones. Bank of

fulfilment chatbot “Asha." Baroda and Lakshmi Vilas Bank have partnered with

How HDFC Bank is giving shape to its digital vision Fisdom, to offer financial planning and wealth management

Mint ; New Delhi [New Delhi]19 May 2017. services. Axis Bank has teamed up with US-based fitness

The article encapsulates digital innovations of HDFC bank technology company GOQii to use the latter's fitness band -

till date. It envisions to be a completely customer-centric which measures steps taken, calories expended, etc - for

organization, for which it has taken initiatives towards making payments as well, using the internet of things (IoT)

digitization. and near-field communication (NFC).

The bank developed a humanoid IRA (Intelligent Robotic ICICI Bank is working on IoT and machine learning in

Assistant) which guides people at a branch to find the matters concerning HR. In September 2016, the bank

relevant counter. The bank is testing if customers expect announced the deployment of software robotics in over 200

more than this basic interaction like assistance for business processes, including agribusiness, trade, and

transactions and better interaction. foreign exchange, apart from retail banking and HR. The

EVA (Electronic Virtual Assistant) is created to answer investment in these processes led to reduce response time by

common queries of bank website users. A Facebook 60 per cent and increase accuracy to 100 per cent. Many

Messenger bot assists users in transactions like bill fintech companies are working on improvising chatbots that

payments, mobile recharges and even booking cabs. EVA will be able to comprehend regional languages as well as the

was created by fintech firmSenseforth and facebook Hindi-English combination.

messenger integration was done by Niki.ai. C. Research Gaps:

The bank intends to provide a uniform experience to app The banking sector has grown leaps and bounds in terms of

operated, or the internet or social media or walk-in branch technological development and use of artificial intelligence.

customers. It focuses on providing a platform-led approach. However, not much research evidence is seen in the usage of

The emphasis is not on product-specific or channel-led or humanoid robots in the sector. More research is required in

segment-led approach, but it should be subsets of a the activities which the robot can undertake as presently it

platform-led approach. only focuses on handling customer basic queries.

The bank engaged with at least 25 fintech companies for AI The present research has laid emphasis only on the

and marketing to risk analytics and payments as it intends to implementation of AI for various services but there is need

move from a multichannel to an omnichannel experience. It to have more research on customer satisfaction.

also experimented with holographic conversations which it There is tremendous scope to cover the challenges faced by

discontinued due to poor customer acceptance. Smartwatch banks in providing such services, and how cost effective and

banking could not scale up because the watch itself did not competitive has it proved to the bank. The entire scope of AI

do well. Bank is bullish on the smartwatch as a potential has been only on providing basic information to clients on

banking interface as it will communicate on its own and primary banking products, but which other services can it

multiple things can be connected to watch even if the cover is something which needs much research.

smartphone is at home as it doesn't have to be paired with it. D. Scope of the Study:

A report from Accenture Plc estimates competition from Study is restricted to HDFC Bank and SBI only in Mumbai

digital players could erode as much as one-third of region.

traditional retail bank revenues by 2020, hence it puts Study of AI is limited to customer services only.

pressing needs on banks to outperform the competitors. E. Objectives of the Study:

Rise Of The Robo-Banker 1) To study the methodology of adoption of AI in banks.

Gupta, Kanishka . Business Today ; New Delhi (Jul 15, 2) To understand challenges faced by banks while adoption

2018). of AI.

The banking sector witnessed surge in the usage of chatbots 3) To understand how AI helped banks in betterment of

thereby reducing human interface, bringing down operating customer services of HDFC and SBI as well

expenses and improving efficiency. HDFC bank‟s EVA, as customer feedback on the

Onchat, ICICI Bank‟s iPal, YES Bank‟s Yes Robot are same.

some examples to name. F. Research Methodology:

Retrieval Number: C6065098319/2019©BEIESP Published By:

DOI:10.35940/ijrte.C6065.118419 Blue Eyes Intelligence Engineering

12253 & Sciences Publication

Role of Artificial Intelligence in Providing Customer Services with Special Reference to SBI and HDFC

Bank

Research is based on exploratory research. Present study is satisfaction level of AI enables services. Secondary data was

based on primary as well as secondary data. Primary data is collected from various sources like research journals,

collected from customers of top two commercial banks i.e. websites and articles to ensure detailed understanding of the

HDFC bank and SBI consisting of questions related to subject and authenticity of information.

improvement in customer services through AI, challenges G.Data Analysis & Interpretation:

faced and customers‟ feedback. 50 customers of each bank

were surveyed to collect data on awareness, usage and

1. Gender:

SBI - Gender HDFC - Gender

MALE MALE

46% 54% 52% 48%

FEMALE FEMALE

2. Age Group

SBI -Age Group HDFC - Age Group

20-30 11, 22 20-30

11, 227, 14% 0, 0%

16, 32

% 30-40 % % 30-40

13, 26

% 40-50 40-50

19, 38 23, 46

% 50 & above % 50 & above

3. Occupation

SBI - Occupation HDFC - Occupation

Service 0% Service

14%

30% 26%

12% Business 38% Business

Students Students

44% Others 36% Others

4. Are the customers aware about the app?

Retrieval Number: C6065098319/2019©BEIESP Published By:

Blue Eyes Intelligence Engineering

DOI:10.35940/ijrte.C6065.118419 12254 & Sciences Publication

International Journal of Recent Technology and Engineering (IJRTE)

ISSN: 2277-3878, Volume-8 Issue-4, November 2019

SBI - Occupation HDFC - Occupation

Service 0% Service

14%

30% 26%

12% Business 38% Business

Students Students

44% Others 36% Others

SBI - Awareness - Gender wise HDFC Awareness - Gender

wise

21

18

8

2 18

9 11 13

YES NO YES NO

M F M F

SBI - Awareness - Occupation HDFC - Awareness -

wise Occupation wise

0

6 16

6 0

3

13 11 7

1

0 14 8

9 5

1

YES NO YES NO

Service Business Student Others Service Business Student Others

5. How often do you use the app? If No, what are the reasons for not using the app?

SBI - Usage Frequency HDFC - Usage Frequency

Never

Never

14% Not very

6% 26% 26%

2% Not very often often

often often

16%

78% 32%

Always

Always

Retrieval Number: C6065098319/2019©BEIESP Published By:

DOI:10.35940/ijrte.C6065.118419 Blue Eyes Intelligence Engineering

12255 & Sciences Publication

Role of Artificial Intelligence in Providing Customer Services with Special Reference to SBI and HDFC

Bank

SBI - Usage - Gender Wise Usage - Gender Wise

21 2

3 2

1 4

18 1 2 2 3

0

1 1

2 6

NEVER NOT VERY OFTEN ALWAYS NEVER NOT VERY OFTEN ALWAYS

OFTEN OFTEN

M F M F

SBI - Usage Occupation wise HDFC - Usage Occupation

wise

6

6 0

1

0

1 0

13

3 0

1 4 4

0

14 2

2 7 1 1 1

1 1 0

NEVER NOT VERY OFTEN ALWAYS NEVER NOT VERY OFTEN ALWAYS

OFTEN OFTEN

Service Business Student Others Service Business Student Others

6. Did you find the interface user friendly? If no, what are the concerns?

SBI - Interface Experience HDFC - Interface

Experience

18%

YES

36% YES

NO

82% 64% NO

SBI - Interface - Gender HDFC - Interface - Gender

Wise Wise

2 3

7 2

6

0 3

2

Y N Y N

M F M F

Retrieval Number: C6065098319/2019©BEIESP Published By:

Blue Eyes Intelligence Engineering

DOI:10.35940/ijrte.C6065.118419 12256 & Sciences Publication

International Journal of Recent Technology and Engineering (IJRTE)

ISSN: 2277-3878, Volume-8 Issue-4, November 2019

SBI - Interface - Occupation HDFC - Interface - Occupation

wise wise

1 0

0 2

7 0 5

3

1 2 2 2

Y N Y N

Service Business Student Others Service Business Student Others

7. Specify the purpose for which you use the app?

SBI - Purpose HDFC - Purpose

Fund Fund

Transfer Transfer

22% Bills Payment 0% Bills

Payment

44%

11% Personal 56%

67% Personal

0% Loan Loan

0% Buying Buying

Insurance Insurance

SBI - Purpose - HDFC - Purpose - Gender

Wise

Gender Wise

4

1

1

1 6 5 4

2 01 0 0 0

0 0

M F M F

Retrieval Number: C6065098319/2019©BEIESP Published By:

DOI:10.35940/ijrte.C6065.118419 Blue Eyes Intelligence Engineering

12257 & Sciences Publication

Role of Artificial Intelligence in Providing Customer Services with Special Reference to SBI and HDFC

Bank

SBI - Purpose - Occupation Wise HDFC - Purpose -

Occupation Wise

1

0 0

0 6 7 0

2 2

1 0

1 1

0 0 0 0 2 2

0 0 0

Service Business Student Others Service Business Student Others

8. Will you prefer transacting with bank employees personally or via application?

SBI - Mode of HDFC - Mode of

Transaction Transaction

18% In Person In Person

36%

Via app 64% Via app

82%

SBI - Mode of Transaction HDFC - Mode of Transaction

- Gender Wise

- Gender Wise

1 3

8 2

6

1 3

1

IN PERSON VIA APP IN PERSON VIA APP

M F M F

Retrieval Number: C6065098319/2019©BEIESP Published By:

Blue Eyes Intelligence Engineering

DOI:10.35940/ijrte.C6065.118419 12258 & Sciences Publication

International Journal of Recent Technology and Engineering (IJRTE)

ISSN: 2277-3878, Volume-8 Issue-4, November 2019

SBI - Mode of Transaction - HDFC - Mode of Transaction -

Occupation wise Occupation wise

3

7

2 5 0

1 2 1 2 2

0 0 0 0

SERVICE BUSINESS STUDENT OTHERS SERVICE BUSINESS STUDENT OTHERS

In Person Via App In Person Via App

Analysis - SBI

1. In case of SBI 80% of the respondents were not aware 3. 58% of service and businessmen use the app often to

about YoNo as well as NoQueue app only 20% regularly and 26% are not using the app at all.

respondents are aware, out of which maximum 4. 64% respondents are unhappy with the user interface of

awareness is among male respondents. which a majority of 55% businessmen are unhappy with

2. Around 54% respondents belonging to service and app interface.

business are unaware about these app services of SBI, 5. 68% respondents use the app for fund transfer and

however only 22% of the people are aware of the app remaining use for bill payment. The popularity of the

services, which indicates there is huge potential for app for other services is negligible.

bank to tap the service and business class. SBI should 6. 64% respondents found visit to bank preferable over the

start promotion activities emphasizing more towards the app. The customers are highly dissatisfied with the app.

service class as it comprises maximum population of 7. There is a group of respondents who are aware about

Mumbai. Since awareness is very limited, the usage of the services provided via Mobile Application but these

the YoNo as well as NoQueue app is also restricted to respondents are not at all comfortable with

limited population. technological developments due to security issues and

3. 42% of females and 36% males are not using the app user friendliness.

services of SBI through mobile app. While analyzing H. Findings of the Study:

the frequency of transactions, it was observed that only 1. There is no gender disparity observed as both male

12% male and 2% female respondents were regularly and female equally use the app of both banks.

using the app. However only 4% of male respondents However, more male respondents were active in

were using it often. despite huge investments in AI, using the app.

there is limited usage from females for the banking 2. Businessmen and service professionals are highly

services via mobile app. aware and frequent users of the app. Student

4. Only 14% respondents from business class category are customers with SBI are not aware, however

using app services regularly, 28% from service and HDFC‟s student customers have a decent

business class are not using services at all. The usage is awareness.

very less in case of students as well. It is observed that 3. SBI customers were satisfied with the user

the usage is limited across all occupations. SBI should interface, however HDFC businessmen were highly

focus more on utility of the application in all categories. dissatisfied with the user interface as they found

5. 63% of businessmen and 9% of service class found the the app difficult to use, poor customer support,

user interface customer friendly, whereas 18% of refund issues and transaction failure.

businessmen were unhappy. 4. Fund transfer and bill payments were highly

6. A majority of 63% comprising of businessmen and utilized services for both the banks. However,

housewife use the app services for YoNo cash, whereas YoNo cash was highly utilized service of SBI

27% of service and businessmen use it for fund transfer YoNo app. This app provided instant cash

and a mere 9% use it for bill payments. No keen interest withdrawal up to Rs. 10,000 without the physical

was taken by respondents for buying insurance and ATM card.Insurance, personal loan service was not

personal loan via app. Personal visit to bank is utilized by the customers as they preferred in

preferable. person visit over app. Despite limited utility for

Analysis - HDFC personal loan and insurance, new products are in

1. A majority of 62% of respondents are unaware & 38% pipeline to be incorporated in the SBI app.

are aware out of which 57% are male & 42% females. 5. In spite being aware, there are certain customers

2. 57% businessmen are aware of the app. 51% of students who are not using the app, hence banks need to

are unaware of the app, which is equally influential. focus on converting them into productive

HDFC should tap these students through promotional customers through

campaigns emphasizing on student friendly products. app usage.

Retrieval Number: C6065098319/2019©BEIESP Published By:

DOI:10.35940/ijrte.C6065.118419 Blue Eyes Intelligence Engineering

12259 & Sciences Publication

Role of Artificial Intelligence in Providing Customer Services with Special Reference to SBI and HDFC

Bank

6. Banks need to put efforts in increasing the volume Management, Journal of Internet Banking and Commerce, December

2018, vol. 23, no. 3

of transactions through this app as regular users are

equally concerned about data safety, account

hacking and other online frauds, impairing the

usage of the app to its potential.

I. Conclusion

There are huge investments from the banking

industry in AI implementation. However, the sector

has challenges in terms of awareness, acceptance of

new technology, issues with security and data threat.

Banks need to promote these products and should

have strong policies in place to enable its optimum

usage.

J. Scope for Further Research

The paper covered the customer satisfaction in the usage of

few AI services of two banks. AI is not restricted only to

app services, feeback of chatbots, humanoid robots‟

implementation in banks is yet to be measured as it is in

early stages of implementation.

REFERENCES

1. Scherer, M. U. (2016). Regulating artificial intelligence systems:

risks,challenges, competencies, and strategies. Harvard J. Law

Technol. 29,1–48. doi: 10.2139/ssrn.2609777

2. Billio,M., Getmansky,M., Lo, A. and Pellizzon, L. (2012)

Econometric measures ofsystemic risk in the finance and insurance

sector. J. Finan. Econ. 104, 535–559.doi:

10.1016/j.jfineco.2011.12.010

3. Mohandas, S. (2018, February 7). AI in Banking and Finance:

Looking Forward. Centre for Internet and Society. Retrieved from

https://cis-india.org/internet-governance/files/draft-roundtablereport-

on-ai-and-banking/view

4. Artificial intelligence and machine learning in financial services:

Market developments andfinancial stability implications. (2017,

November 01). Financial Stability Board. Retrieved from

http://www.fsb.org/wp-content/uploads/P011117.pdf

5. Mishra, A. (2016, January 14). SBI Launches First Dedicated Branch

For Startups InCube. Inc42.Retrieved from https://inc42.com/flash-

feed/sbi-launches-branch-for-startups-incube/

6. https://www.businesstoday.in/magazine/special/hdfc-bank-

digittransformationbest-indian-large-bank-2014/story/213957.html

7. https://www.financialexpress.com/money/8-amazing-ways-

consumers-can-benefit-from-artificial-intelligences- impact-on-

banking-financial-sectors/985652

8. Busayo Ogunsanya. AskMyUncleSam.

http://venturebeat.com/2017/01/27/how-this-chatbot-powered-

bymachine-learning-can-help-with-your-taxes/ [Accessed February

20, 2018].

9. India-based AI startups draw attention of tech biggies like Apple,

Facebook. http://economictimes.indiatimes.com/small-

biz/startups/india-based-ai-startups-draw-attention-of-tech-biggies-

like-apple-facebook/articleshow/55589444.cms.

10. Punit, Itika Sharma. Why are Indian engineers so afraid of „artificial

intelligence‟? https://scroll.in/article/829652/why-are-indian-

engineers-so-afraid-of-artificial-intelligence

11. Shetty, M. (2017, Apr 06). No job losses due to chatbots, artificial

intelligence: Banks banking]. The Economic Times Retrieved from

https://search.proquest.com/docview/1884293551?accountid=131417

12. How HDFC bank is giving shape to its digital vision. (2017, May

19). Mint Retrieved from

https://search.proquest.com/docview/1899962231?accountid=131417

13. Menon, R. (2018). AI: THE NEXT FRONTIER FOR INDIAN

BANKS. The Banker, , 70. Retrieved from

https://search.proquest.com/docview/2098933155?accountid=131417

14. Gupta, K. (2018, Jul 15). Rise of the robo-banker: How financial

technology companies are transforming the banking sector. Business

Today, Retrieved from

https://search.proquest.com/docview/2060783533?accountid=131417

15. Robotic Process Automation - A Study Of The Impact On Customer

Experience In Retail Banking IndustryKarippur Nanda Kumar &

Pushpa Rani Balaramachandran, S P Jain School of Global

Retrieval Number: C6065098319/2019©BEIESP Published By:

Blue Eyes Intelligence Engineering

DOI:10.35940/ijrte.C6065.118419 12260 & Sciences Publication

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- International Standard: Hydrogen Fuel Quality - Product SpecificationDocument24 pagesInternational Standard: Hydrogen Fuel Quality - Product Specificationiocsachin100% (6)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Cadchart 2 PDFDocument2 pagesCadchart 2 PDFLouriel NopalNo ratings yet

- 1Document4 pages1iocsachinNo ratings yet

- Artificial Intelligence in Indian Banking Sector: Challenges and OpportunitiesDocument8 pagesArtificial Intelligence in Indian Banking Sector: Challenges and OpportunitiesiocsachinNo ratings yet

- NSTSE Class 5 Solved Paper 2022Document26 pagesNSTSE Class 5 Solved Paper 2022iocsachinNo ratings yet

- Emotional Labout Meta AnalysisDocument51 pagesEmotional Labout Meta AnalysisiocsachinNo ratings yet

- Banking Industry and AIDocument8 pagesBanking Industry and AIiocsachinNo ratings yet

- Review On Artificial Intelligence A BoonDocument3 pagesReview On Artificial Intelligence A BooniocsachinNo ratings yet

- Mediation Effect1Document18 pagesMediation Effect1iocsachinNo ratings yet

- EM - 2017.04.24 - Air Pollution & Accelerated Switch To BS VI Emission NormsDocument3 pagesEM - 2017.04.24 - Air Pollution & Accelerated Switch To BS VI Emission NormsiocsachinNo ratings yet

- 7 54 2022 Pesb - 1Document5 pages7 54 2022 Pesb - 1iocsachinNo ratings yet

- A B C D E F G H I: Files Without This Message by Purchasing Novapdf PrinterDocument22 pagesA B C D E F G H I: Files Without This Message by Purchasing Novapdf PrinteriocsachinNo ratings yet

- Terms and Conditions For Postpaid International Roaming PacksDocument5 pagesTerms and Conditions For Postpaid International Roaming PacksiocsachinNo ratings yet

- Technical Program: DECEMBER 5-9, 2021Document45 pagesTechnical Program: DECEMBER 5-9, 2021iocsachin100% (1)

- IJHE-Fuel Cell-Paper 2Document11 pagesIJHE-Fuel Cell-Paper 2iocsachinNo ratings yet

- Circular 54 - CLASS 3 EVS PLATE IT LIKE A PRODocument2 pagesCircular 54 - CLASS 3 EVS PLATE IT LIKE A PROiocsachinNo ratings yet

- Experimental and Modelling Studies of Low Temperature PEMFC PerformanceDocument10 pagesExperimental and Modelling Studies of Low Temperature PEMFC PerformanceiocsachinNo ratings yet

- E-Bike Electronic Control Unit: Florin Dumitrache, Marius Catalin Carp, and Gheorghe PanaDocument4 pagesE-Bike Electronic Control Unit: Florin Dumitrache, Marius Catalin Carp, and Gheorghe PanaiocsachinNo ratings yet

- Winter Holiday Homework: Class 3Document23 pagesWinter Holiday Homework: Class 3iocsachinNo ratings yet

- Byju's Magazine (PDFDrive)Document23 pagesByju's Magazine (PDFDrive)iocsachinNo ratings yet

- The Nexus Between International Law and The Sustainable Development GoalsDocument13 pagesThe Nexus Between International Law and The Sustainable Development GoalsiocsachinNo ratings yet

- PPG TestDocument2 pagesPPG TestAljon MendozaNo ratings yet

- HR Practices NTPCDocument16 pagesHR Practices NTPCRuchika SinhaNo ratings yet

- 4.3 Introduction To Database ManagementDocument14 pages4.3 Introduction To Database ManagementppghoshinNo ratings yet

- 4thh Quarter Pre TestDocument1 page4thh Quarter Pre TestAlona Camino100% (2)

- Marketing Project OutlineDocument3 pagesMarketing Project OutlineRana AhmedNo ratings yet

- Instrument Assist Soft Tissue MassageDocument6 pagesInstrument Assist Soft Tissue MassageGilang MarcelinoNo ratings yet

- Indian Heart JournalDocument18 pagesIndian Heart JournalSanaSofiyahNo ratings yet

- M&I Two Marks With Answer-All UnitsDocument16 pagesM&I Two Marks With Answer-All UnitsVijay KM83% (6)

- US International Trade CommissionDocument148 pagesUS International Trade CommissionSherazButtNo ratings yet

- Dance: Choreographic Forms inDocument29 pagesDance: Choreographic Forms inROCELYN IMPERIALNo ratings yet

- Tutorial (Equlibrium) AnswersDocument4 pagesTutorial (Equlibrium) Answersoh khang chiangNo ratings yet

- Grp4 EconomicGrowth Report-1Document14 pagesGrp4 EconomicGrowth Report-1Fredilyn DomingoNo ratings yet

- H2scan 720as-Gc Hydrogen Sensor System ManualDocument22 pagesH2scan 720as-Gc Hydrogen Sensor System ManualMohammed SaberNo ratings yet

- EconomicsDocument136 pagesEconomicsAbdi Teshome100% (1)

- IMAP TRANSTEC Complete Drive ShaftsDocument16 pagesIMAP TRANSTEC Complete Drive Shaftslv621048No ratings yet

- 151-Enablon Orm - Permit To WorkDocument2 pages151-Enablon Orm - Permit To WorkRishikesh GunjalNo ratings yet

- Breast CA SeminarDocument60 pagesBreast CA SeminarAliyi MuktarNo ratings yet

- Sony Kdf-E50a12uDocument105 pagesSony Kdf-E50a12uTriptau357No ratings yet

- Annual Procurement Plan-AppDocument6 pagesAnnual Procurement Plan-AppJonas MapacpacNo ratings yet

- DLL - Week - 12 - Statistics and ProbabilityDocument3 pagesDLL - Week - 12 - Statistics and ProbabilityRoboCopyNo ratings yet

- Lesson Plan Ces422 PDFDocument2 pagesLesson Plan Ces422 PDFdzikrydsNo ratings yet

- Year 2018 Best Ongoing Practices Bijhari Block by Vijay Kumar Heer, BRCC PrimaryDocument24 pagesYear 2018 Best Ongoing Practices Bijhari Block by Vijay Kumar Heer, BRCC PrimaryVIJAY KUMAR HEERNo ratings yet

- A Teacher's Guide To CosmosDocument45 pagesA Teacher's Guide To CosmosMSU UrbanSTEM100% (2)

- Indriver CloneDocument31 pagesIndriver Clonenetwork.oyelabsNo ratings yet

- 12 Sample MCQsDocument3 pages12 Sample MCQssweety49No ratings yet

- CT Secondary InjectionDocument2 pagesCT Secondary InjectionHumayun AhsanNo ratings yet

- Extraefi - Co.Uk Reset Problems: Ms1-Extra and Ms2-ExtraDocument8 pagesExtraefi - Co.Uk Reset Problems: Ms1-Extra and Ms2-Extraasser_salehNo ratings yet

- Notes 4 - Stresses in SoilsDocument45 pagesNotes 4 - Stresses in SoilsWen Sen SimNo ratings yet

- Catalogue Product M-Plus FilterDocument40 pagesCatalogue Product M-Plus FilterAdrian Samuel ThenochNo ratings yet