Professional Documents

Culture Documents

Construction Financing - Performance Measurement

Construction Financing - Performance Measurement

Uploaded by

GeorgeCopyright:

Available Formats

You might also like

- CH 03Document67 pagesCH 03Khoirunnisa Dwiastuti100% (2)

- Advance ITT Exam 1 Day Revision Notes Module Ii Unit 1 - Advanced Excel Chapter 1 - Working With XMLDocument23 pagesAdvance ITT Exam 1 Day Revision Notes Module Ii Unit 1 - Advanced Excel Chapter 1 - Working With XMLvanshika agarwal75% (4)

- Impact of Modern Project Management in Strategic ContentDocument11 pagesImpact of Modern Project Management in Strategic Contentgeeta bhatiaNo ratings yet

- Solution Manual Cost Accounting 14th Ed by Carter HLDocument382 pagesSolution Manual Cost Accounting 14th Ed by Carter HLverlyarin100% (1)

- Financial Planning and Forecasting Financial StatementsDocument5 pagesFinancial Planning and Forecasting Financial StatementsRaven PicorroNo ratings yet

- The Budgeting Survival GuideDocument11 pagesThe Budgeting Survival GuideSara SyedNo ratings yet

- Lecture 18 MGNM571Document33 pagesLecture 18 MGNM571Devyansh GuptaNo ratings yet

- MAS Module 1Document24 pagesMAS Module 1bang yedamiNo ratings yet

- Solution Manual Managerial Accounting Hansen Mowen 8th Editions CH 8 DikonversiDocument44 pagesSolution Manual Managerial Accounting Hansen Mowen 8th Editions CH 8 Dikonversirizky aulia100% (1)

- Solution Manual For Cornerstones of Managerial Accounting Mowen Hansen Heitge 3rd EditionDocument45 pagesSolution Manual For Cornerstones of Managerial Accounting Mowen Hansen Heitge 3rd EditionOliviaHarrisonobijq100% (98)

- Seven Keys To Better Forecasting 11-02Document9 pagesSeven Keys To Better Forecasting 11-02api-3771917No ratings yet

- Fp&A Trends: Cfo Guide ToDocument15 pagesFp&A Trends: Cfo Guide ToaasifmmNo ratings yet

- Solution Manual For Cornerstones of Cost Management 4th Edition Don R Hansen Maryanne M MowenDocument46 pagesSolution Manual For Cornerstones of Cost Management 4th Edition Don R Hansen Maryanne M MowenOliviaHarrisonobijq100% (85)

- Metrics That Matter For A Successful Treasury Transformation Session 22Document5 pagesMetrics That Matter For A Successful Treasury Transformation Session 22vino06cse57No ratings yet

- CH 15 SMDocument44 pagesCH 15 SMwaqtawanNo ratings yet

- The Balanced Scorecard Translating StratDocument4 pagesThe Balanced Scorecard Translating Stratrajdeeptamuli70No ratings yet

- Using Financial Forecasting As A Strategic Catalyst For Enhancing The Financial Performance of Manufacturing Companies in Kigali, RwandaDocument15 pagesUsing Financial Forecasting As A Strategic Catalyst For Enhancing The Financial Performance of Manufacturing Companies in Kigali, RwandaKIU PUBLICATION AND EXTENSIONNo ratings yet

- Leveling Up S&OP: For A Well-Orchestrated Supply ChainDocument6 pagesLeveling Up S&OP: For A Well-Orchestrated Supply ChainSilvia CastilloNo ratings yet

- This Study Resource Was: Employee SatisfactionDocument4 pagesThis Study Resource Was: Employee Satisfactioneduardo.honorato5586No ratings yet

- CH 15 SMDocument44 pagesCH 15 SMrafanashwa.ayuNo ratings yet

- Increase Efficiencies in Your CAPEX Budgeting & OPEX PlanningDocument25 pagesIncrease Efficiencies in Your CAPEX Budgeting & OPEX Planningkmurth_hnNo ratings yet

- FinmanDocument4 pagesFinmanMycah ManriqueNo ratings yet

- Reflective Essay: (Document Subtitle)Document4 pagesReflective Essay: (Document Subtitle)desmondNo ratings yet

- BudgetDocument19 pagesBudgetjaveriaanwar4046No ratings yet

- Budget and Budgetory Control System in HeritageDocument5 pagesBudget and Budgetory Control System in HeritagevarunNo ratings yet

- Management Accounting Report BudgetDocument42 pagesManagement Accounting Report BudgetBilly Maravillas Dela CruzNo ratings yet

- Budget Instrument Management ControlDocument20 pagesBudget Instrument Management ControlabekaforumNo ratings yet

- EY Performance Key Performance IndicatorsDocument8 pagesEY Performance Key Performance IndicatorsIoanaR2011100% (1)

- Chapter 3 Financial Planning Tools and ConceptsDocument28 pagesChapter 3 Financial Planning Tools and ConceptsDEALAGDON, RhyzaNo ratings yet

- Budgeting LectureDocument59 pagesBudgeting LectureCristineNo ratings yet

- Business FinanceDocument51 pagesBusiness FinanceMary Joyce Camille ParasNo ratings yet

- 2024 Financial Planning BlueprintDocument19 pages2024 Financial Planning BlueprintDương Thị Lệ QuyênNo ratings yet

- Costing FinalfffDocument39 pagesCosting FinalfffSaloni Aman SanghviNo ratings yet

- Modern Accounting How To Overcome Financial Close ChallengesDocument26 pagesModern Accounting How To Overcome Financial Close ChallengesGracie BautistaNo ratings yet

- BudgetDocument6 pagesBudgetKedar SonawaneNo ratings yet

- Aeco2 MidtermDocument5 pagesAeco2 MidtermvsplanciaNo ratings yet

- ACCOUNTINGDocument8 pagesACCOUNTINGRijohnna Moreen RamosNo ratings yet

- Pandey 2005 Balanced Scorecard Myth and RealityDocument16 pagesPandey 2005 Balanced Scorecard Myth and RealityEdisson FuentesNo ratings yet

- Group 3 Topic 1: Significance FunctionDocument14 pagesGroup 3 Topic 1: Significance FunctionjsemlpzNo ratings yet

- Budgeting, EnterpreneurshipDocument4 pagesBudgeting, EnterpreneurshipVALENTINE BETTNo ratings yet

- Dokumen - Tips - Jawaban Soal Akmen Bab 8 PDFDocument44 pagesDokumen - Tips - Jawaban Soal Akmen Bab 8 PDFSiswo WartoyoNo ratings yet

- Eguide Funding A4Document15 pagesEguide Funding A4Timothy OkunaNo ratings yet

- Principles of Finance: Financial PlanningDocument8 pagesPrinciples of Finance: Financial PlanningAmeya PatilNo ratings yet

- Evaluating Firm Performance - ReportDocument5 pagesEvaluating Firm Performance - ReportJeane Mae BooNo ratings yet

- Balanced Scorecard and Project ManagerDocument27 pagesBalanced Scorecard and Project ManagerRajat Mehta100% (1)

- Simon Chap. 5Document33 pagesSimon Chap. 5harum77No ratings yet

- Bes'S Institute of Management Studies & Research: Report On Advanced Financial ManagementDocument34 pagesBes'S Institute of Management Studies & Research: Report On Advanced Financial Managementcapricorn_niksNo ratings yet

- Tbbell Document 6077Document68 pagesTbbell Document 6077alma.hedgepeth467No ratings yet

- Topic 6.2 - Budgets & ForecastsDocument4 pagesTopic 6.2 - Budgets & Forecastsmundubijohn1No ratings yet

- Economics ThesisDocument22 pagesEconomics ThesisANGEL ChayNo ratings yet

- Cost-Benefit Analyses For HR InterventionsDocument17 pagesCost-Benefit Analyses For HR Interventionsparioor95No ratings yet

- 2003 Management-Control-SystemDocument11 pages2003 Management-Control-SystemMAHENDRA SHIVAJI DHENAKNo ratings yet

- Subject: Management Accounting and Decision Making Submitted To: MR - Ammar Ud DinDocument8 pagesSubject: Management Accounting and Decision Making Submitted To: MR - Ammar Ud DinUmar Sarfraz KhanNo ratings yet

- Accounting budgetingDocument18 pagesAccounting budgetingRyan Dela Cruz CadacioNo ratings yet

- A Study On Capital Budgetting With Reference To Bescal Steel IndustriesDocument69 pagesA Study On Capital Budgetting With Reference To Bescal Steel IndustriesAman Agarwal100% (2)

- The Balanced Scorecard-Measures That Drive PerformanceDocument9 pagesThe Balanced Scorecard-Measures That Drive Performancezeel patelNo ratings yet

- Chapter 4 Financial PlanningDocument8 pagesChapter 4 Financial PlanningHannah Pauleen G. LabasaNo ratings yet

- Cost AccountingDocument11 pagesCost AccountingShikshya NayakNo ratings yet

- Ebook Cost Management A Strategic Emphasis 8Th Edition Blocher Solutions Manual Full Chapter PDFDocument67 pagesEbook Cost Management A Strategic Emphasis 8Th Edition Blocher Solutions Manual Full Chapter PDFAnthonyWilsonecna100% (13)

- Theoretical Part (Master Budget)Document26 pagesTheoretical Part (Master Budget)salahnaser9999No ratings yet

- The Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)From EverandThe Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Rating: 4.5 out of 5 stars4.5/5 (3)

- b015-2010-Iaasb-handbook-Isrs-4400 What Guided DTT During Special Audit Process (12977)Document10 pagesb015-2010-Iaasb-handbook-Isrs-4400 What Guided DTT During Special Audit Process (12977)GeorgeNo ratings yet

- Working Capital For AGMsDocument44 pagesWorking Capital For AGMsGeorgeNo ratings yet

- Prudential GuidelinesDocument505 pagesPrudential GuidelinesGeorgeNo ratings yet

- Chapter On Valuation of Inventories - T P GhoshDocument28 pagesChapter On Valuation of Inventories - T P GhoshGeorgeNo ratings yet

- Chapetr On Borrowing Cost - TP GhoshDocument15 pagesChapetr On Borrowing Cost - TP GhoshGeorgeNo ratings yet

- Risk AgmDocument30 pagesRisk AgmGeorgeNo ratings yet

- The Rental ConceptDocument10 pagesThe Rental ConceptGeorgeNo ratings yet

- FCNR (B) LoansDocument12 pagesFCNR (B) LoansGeorgeNo ratings yet

- Unveiling Window Dressing in Financial StatementsDocument10 pagesUnveiling Window Dressing in Financial StatementsGeorgeNo ratings yet

- Chapter On Export and Import CreditDocument8 pagesChapter On Export and Import CreditGeorgeNo ratings yet

- Costing For Extra WorkDocument8 pagesCosting For Extra WorkGeorgeNo ratings yet

- Retailer's Business PlanDocument8 pagesRetailer's Business PlanGeorgeNo ratings yet

- Debtor - Creditor AgreementDocument19 pagesDebtor - Creditor AgreementGeorgeNo ratings yet

- Manufacturers 'S FinancialsDocument14 pagesManufacturers 'S FinancialsGeorgeNo ratings yet

- Service Provider's FinancialsDocument12 pagesService Provider's FinancialsGeorgeNo ratings yet

- What Is Project FinanceDocument29 pagesWhat Is Project FinanceGeorgeNo ratings yet

- Construction FinancingDocument33 pagesConstruction FinancingGeorgeNo ratings yet

- Manufacturer's Business PlanDocument8 pagesManufacturer's Business PlanGeorgeNo ratings yet

- Export Credit InsuranceDocument6 pagesExport Credit InsuranceGeorgeNo ratings yet

- Evaluating Mergers & AcquisitionsDocument12 pagesEvaluating Mergers & AcquisitionsGeorgeNo ratings yet

- Finance Facilities - InvesteQ CapitalDocument4 pagesFinance Facilities - InvesteQ CapitalGeorgeNo ratings yet

- Margin TradingDocument5 pagesMargin TradingGeorgeNo ratings yet

- Construction Loan GuaranteeDocument11 pagesConstruction Loan GuaranteeGeorgeNo ratings yet

- Construction - The Owner's PerspectiveDocument19 pagesConstruction - The Owner's PerspectiveGeorgeNo ratings yet

- Corporate Debt RestructuringDocument15 pagesCorporate Debt RestructuringGeorgeNo ratings yet

- Cash Flow Forecasting in Construction Finance 3Document7 pagesCash Flow Forecasting in Construction Finance 3GeorgeNo ratings yet

- Cash Flow Forecasting in Construction Finance 2Document9 pagesCash Flow Forecasting in Construction Finance 2GeorgeNo ratings yet

- Business Plan - Bahari HouseDocument25 pagesBusiness Plan - Bahari HouseGeorgeNo ratings yet

- PetrozuataDocument13 pagesPetrozuataMikhail TitkovNo ratings yet

- BPLR & Base RateDocument25 pagesBPLR & Base Ratemermaid20052002No ratings yet

- 15 RP Vs GrijaldoDocument10 pages15 RP Vs GrijaldoWinchelle DawnNo ratings yet

- Futurpreneur Cash Flow Template EN 09.08.2022 1Document10 pagesFuturpreneur Cash Flow Template EN 09.08.2022 1Alex VelascoNo ratings yet

- LAC - Financial LiteracyDocument19 pagesLAC - Financial Literacyanon_754485983100% (1)

- Financing and Financial Management For Small BusinessDocument39 pagesFinancing and Financial Management For Small BusinessFelistaNo ratings yet

- Barton V Armstrong - DuressDocument16 pagesBarton V Armstrong - DuresssoumyaNo ratings yet

- University of Hertfordshire Student Refund and Compensation PolicyDocument19 pagesUniversity of Hertfordshire Student Refund and Compensation PolicyAura WaxNo ratings yet

- 1) The Fraudulent Signing, Without Any Justification On Contract of Assignment ofDocument21 pages1) The Fraudulent Signing, Without Any Justification On Contract of Assignment ofVoichita AlexandruNo ratings yet

- Managing Cash Flow: Prepared By: Catiban, Ann Rea Garanchon, Jewel Ann Hagopit, Evelyn Tormis, FerlizaDocument30 pagesManaging Cash Flow: Prepared By: Catiban, Ann Rea Garanchon, Jewel Ann Hagopit, Evelyn Tormis, FerlizaChrizel DolleteNo ratings yet

- Share Pledge AgreementDocument7 pagesShare Pledge AgreementVartika KhandujaNo ratings yet

- Corporations Outline 1Document92 pagesCorporations Outline 1shashankbijapur100% (1)

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisElizabeth Espinosa ManilagNo ratings yet

- Risks Associated With Investing in Bonds - Class ExamplesDocument10 pagesRisks Associated With Investing in Bonds - Class ExamplesmohammedNo ratings yet

- TOPIC 4 MR Debentures - 230314 - 081422Document14 pagesTOPIC 4 MR Debentures - 230314 - 081422shivani dholeNo ratings yet

- Harvard Financial Report 2011Document47 pagesHarvard Financial Report 2011Akif MalikNo ratings yet

- HW 2 SolutionsDocument4 pagesHW 2 SolutionsJohn SmithNo ratings yet

- Analysis of Financial Performance of Everest Bank LimitedDocument56 pagesAnalysis of Financial Performance of Everest Bank LimitedHima RijalNo ratings yet

- Case Digest Credit TransactionsDocument11 pagesCase Digest Credit TransactionsChristineNo ratings yet

- SVB Report 2022Document193 pagesSVB Report 2022iqbal maulanaNo ratings yet

- Statement of Affairs - P&sDocument9 pagesStatement of Affairs - P&sLokesh .cNo ratings yet

- Intermediate Finance: Session 7Document54 pagesIntermediate Finance: Session 7rizaunNo ratings yet

- Securities (Lastman) - 2012-13Document69 pagesSecurities (Lastman) - 2012-13scottshear1No ratings yet

- Chapter 8 Fixed Income SecuritiesDocument35 pagesChapter 8 Fixed Income SecuritiesCezarene Fernando100% (1)

- Project Finance 1 Network of Contracts PDFDocument41 pagesProject Finance 1 Network of Contracts PDFSam DhuriNo ratings yet

- FM MCQsDocument74 pagesFM MCQsNidheena K SNo ratings yet

- Review of ScamsDocument19 pagesReview of ScamsKanika JainNo ratings yet

- Lecture Notes - Credit Cards and Consumer LoansDocument18 pagesLecture Notes - Credit Cards and Consumer LoansLuther Ivanne M. DejesusNo ratings yet

Construction Financing - Performance Measurement

Construction Financing - Performance Measurement

Uploaded by

GeorgeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Construction Financing - Performance Measurement

Construction Financing - Performance Measurement

Uploaded by

GeorgeCopyright:

Available Formats

Performance

Measurement:

CFMA BP January-February 2004

The

Guideposts

on Your

Road to

For the construction industry,

the past two years have

Success

been the most difficult period BY JERRY HENDERSON

since the early 1980s. How-

ever, as 2004 gets under-

As with any journey, certain elements must be present for

way, there is hope that the the trip to be successful. One is a travel plan that estimates

worst is over. the resources needed to reach your goals. The foundation of

this plan is a road map marking your expected course of trav-

In many ways, the start of the el. Only by charting your course can you estimate the invest-

ment of time, money, and effort needed to reach your desti-

new year and the prospect nation. A second element necessary for a successful journey

of an improved economy is a method to regularly measure progress – guideposts and

create opportunities for new mile markers to gauge your actual results against your

intended progress.

beginnings. So, now is a

good time to review and So, how do these elements translate into specifics for your

company? The road map and travel plan are the written goals,

refocus your company’s per- developed and used by upper management to plan your com-

formance goals. pany’s future. Admittedly, these written goals are rarely

achieved exactly as forecast. However, their benefit lies in the

Over the past few years, all fact that management undertook a coordinated effort to col-

lectively cast the vision of where the company should be

of us on the financial side of headed, then identified and planned the performance need-

construction have helped ed to reach that destination.

carefully steer our companies A wise man once said, “Plans are nothing, but planning is

down a rocky road. everything!” The company that is committed to planning its

future is much more likely to achieve its potential than the

Now, we are embarking on company that does not undertake this effort. That is why per-

formance planning is a very important process that should be

the next leg of this journey. taken seriously by management. Moreover, as a financial man-

Your actions from this point ager, you are in a unique position to champion this process for

your company.

on will help determine if your

company moves forward on The cornerstone of the performance planning process is the

ability to quantify a company’s targeted performance over

the road to success, or veers the short- to mid-term. By quantifying performance goals, the

off course instead. plan expresses the aim of management in tangible form and

January-February 2004 CFMA BP

provides an objective, measurable means of What is the one overriding goal that

evaluating results. Actual progress can and equates to success for this company?

should be measured regularly against the plan-

“The company ned progress. In other words, determine what the owners

that is committed ultimately want to achieve. Most likely,

to planning So, how do you construct a the goal is either a net income tar-

performance measurement system? get or a prescribed market value

its future

for the company that can be mea-

is much more likely The Basic Elements sured over a series of years.

to achieve its

Certain elements of a performance measure- For example, the goal could be to

potential than the

ment system are so critical to the foundation achieve a net income of $2.5 million by

company of your plan that we must address them at the the end of 2006, when the net income at

that does not outset. First, your financial data must be the end of 2003 was $1.2 million. Or it may

undertake this reliable. Achieving reliable financial data is a be to achieve a market value for the com-

effort.” subject unto itself, but be careful not to take pany (net of debt) of $10 million within the

this element for granted. You must ensure that same time frame.

all internal financial information:

• is adjusted to reflect proper cutoffs of rev- Either way, the overriding goal should be one

enues and expenses, that expresses a mid-term target for achieve-

ment within the targeted time frame.

• contains proper allowances and reserves, and

• properly classifies assets and liabilities as to All other measures and comparisons for the com-

current vs. long-term status. pany flow from your overriding goal. There-

fore, this goal should be achievable, but not eas-

Intertwined with financial data is job cost data.

ily attainable. It must push managers to perform

Second, you must have a system in place that

on all levels in order to reach the set targets.

accurately captures job cost data by project

phase. To ensure its integrity, this data should

That’s why your financial information must

be reconciled regularly with the G/L to ensure

have a high degree of integrity, to ensure that

that a closed loop exists between the job cost

the results are not easily manipulated.

and G/L systems. Contract estimates must also

be routinely updated to ensure that revenue The best way to chart the course for achieving

earnings estimates are accurate. the overriding goal is to formally forecast the

desired results on a quarterly basis in a com-

Third, your financial and job cost data must

prehensive financial model. While this fore-

be available to management in a timely

cast ultimately expresses the overall target, it

manner and useful format. I would suggest

provides management with guideposts to mea-

that interim month-end reports be available to

sure progress along the way.

management no later than 20 days after the

end of each month, with 10 days after the end It also allows management to recognize in a

of the month being the ultimate goal. timely manner if alternate courses should be

followed to achieve the goal, while maintaining

“What is the one overriding compliance with loan covenants or bonding

requirements.

goal that equates to success

for this company?” In this article, we will look at performance mea-

surement in two broad categories, financial and

operating, and define the indicators you should

What to Measure be measuring. In the financial section, we will

also devote particular attention to those ratios

When establishing (or refining) your system of relevant to the “Best in Class” designation in

performance measurement, you should begin CFMA’s 2003 Construction Industry Annual

by asking this fundamental question: Financial Survey.

CFMA BP January-February 2004

FOR

ADDITIONAL

As you begin to compare your organization, Profitability Measures

remember: The individual measures are not FINANCIAL

the goal; they are the guideposts on the road to Profitability measures quantify certain key ele- PERFORMANCE

successfully achieving your company’s overrid- ments of the income statement in order to INFORMATION

ing goal. evaluate the profitability of the business.

These ratios are good short-term indicators of

Financial Performance financial performance and are typically given a For more

Measurement higher weight by lenders than by bond under- information on

writers, though recurring subpar performance ratios, consult

Your company’s performance should be evalu-

will certainly create concern within your bond-

ated against the following three criteria: CFMA’s 2003

ing company. These measures include:

1) The company’s overall plan and forecast. Construction

You want to know if your actual results are Gross Margin (GM) – This is one of the few Industry Annual

matching up to your expected results and, measures that can be quantified on both an indi- Financial Survey,

if not, where the differences lie. vidual job and overall company basis. GM indi-

which contains

cates the difference between revenue and all

2) Industry benchmarks. You want to com- construction-related costs. It tells you the por- invaluable

pare your results against those of others in tion of earnings left to cover SG&A expense, information

your industry. That’s why CFMA’s Annual taxes, and profit.

Financial Survey is such an indispensable

for assessing your

tool for contractors. The key to accurately measuring GM at the company’s financial

With it, you can compare your company to individual job level is to ascertain that the allo- performance,

others in its industry specialty using the cated or applied overhead is representative of as well as certain

most meaningful and recent in- actual overhead, including inter- or intra-com- aspects of operating

formation available, and you pany equipment rental pools and all other in-

performance.

can also benchmark your com- direct overhead.

pany against the Best in Class

contractors. Return on Sales (ROS) – This is the basic

measurement of pre-tax operating profits

Besides the Best in Class data,

before income taxes. In the 2003 survey, ROS

the 2003 survey contains composite For additional

is shown as the percent of “Net Earnings

results, as well as results by contractor

type, size, and geographic region, so you

(Loss) before Income Taxes.” ROS is applica- information on

have the opportunity to really see how ble only on a company-wide basis and reflects analyzing and

your company stacks up under several dif- the company’s ability to generate profit on con-

interpreting

ferent relevant categories. tract volume. It should not be confused with

return on equity, discussed next. financial data,

In establishing your performance targets, I recommend

you may refer to the category that best Return on Equity (ROE) – This is a Best in Analysis for

suits your company or to the industry com- Class measure in the 2003 survey. ROE indi-

posite figures. Financial

cates the actual return on the investment,

The worksheet at the end of this article will allowing owners to compare the results of their Management by

allow you to compare your company’s per- investment in your company against other Robert C. Higgins,

formance and target ratios to others in your alternative investments. ROE is measured by published by

specialty or to the industry as a whole. dividing net earnings by total net worth or total McGraw-Hill/Irwin.

(average) stockholders’ equity. In the 2003

3) Established targets set by your lenders or survey, ROE was 33.5% for Best in Class com-

bond underwriters. If you are not sure what

panies vs. 17.0% for all companies.

those targets are, do some homework to

learn what each expects for your company. Care should be taken in evaluating this ratio for

These targets tend to change periodically; a number of important reasons. For example,

currently, both lenders and bond underwrit- S-corporation earnings do not always reflect a

ers are both using very strict underwriting provision for income taxes because the tax lia-

standards – so don’t assume that what was bility is often reflected through dividends. (See

acceptable in the past is still acceptable now. page 227 of the 2003 survey for financial data

January-February 2004 CFMA BP

for S corporations). ROE calculations should be adjusted to Believed to be a good indicator of a company’s ability to repay

take this into consideration. Significant treasury stock trans- its obligations to the bank, this calculation is a varia-

actions (such as mandatory redemptions under a buy-sell tion of other types of coverage ratios, such as

agreement that are funded with a seller note) can also distort “Times Interest Earned” or “Times Burden

the ROE calculation. Covered.”

Return on Assets (ROA) – Another Best in Class measure While many lenders consider 2.5 acceptable,

in the 2003 survey, ROA indicates the profit generated by the this ratio tends to be in the neighborhood of 1.1

total fixed assets employed. A higher ratio reflects a more or less for the construction industry. Bear in mind,

effective use of company assets. ROA is measured by divid- this calculation can also vary significantly for a con-

ing net earnings by total assets. As with ROE, care should be tractor that borrows heavily against a line of credit

taken when calculating this ratio for S corporations and other during peak operations, but pays the line off by the

pass-through entities. In the 2003 survey, ROA was 9.2 % for end of the normal operating cycle.

Best in Class companies vs. 5.1% for all companies.

Asset Turnover – This

Leverage Ratios measure is calculated as

Leverage ratios measure a

“By revenue as a multiple of

total assets and reflects

variety of indicators, and QUANTIFYING how efficiently assets are

are used to determine how

well the company has PERFORMANCE GOALS, being employed in the

process of generating rev-

leveraged its resources in

order to provide the best

the plan expresses the aim enue. Generally, an asset

turnover of less than 1.0 is

overall return. In order to

evaluate this aspect of fin-

of management in tangible form unacceptable in all in-

stances (except possibly

ancial performance, these and provides an during the start-up phase

ratios utilize data from

both the balance sheet OBJECTIVE, of a business).

and income statement.

Lenders and bond under- MEASURABLE MEANS Months in Backlog –

This measures the ratio of

writers rely on leverage

ratios when evaluating a

of evaluating results.” signed commitments for

work to be performed com-

company’s credit risk. Here pared to the revenue earn-

are the key ratios: ings for the most recently completed 12 months. Its sole pur-

pose should be to assess the amount of work needed to fill

Debt to Equity – This measure indicates the liabilities of a the pipeline for the upcoming 12 months. While months in

company as a multiple of its equity and has long been a backlog is a good overall measure, it fails to consider the

favorite measure of lenders in setting loan covenant guide- specifics of when the work has to be performed.

lines. Generally, this measure should not exceed 3.0 with-

out a plan to bring it back within this limit over the short- Liquidity Ratios

to mid-term. However, at peak operating cycles, it is possible

for this ratio to exceed 3.0, especially in smaller companies. Liquidity ratios indicate a company’s ability to finance growth

internally, to fund fixed expenses during seasonal lulls or to

In recent years, lenders have focused not just on debt to equi- ride the rough road of an economic downturn. Key liquidity

ty, but also on debt to tangible equity. Tangible equity is ratios include:

defined as total equity minus all intangible assets, such as cap-

italized non-compete agreements or leasehold improvements. Current Ratio – This ratio reflects current assets divided by

current liabilities and indicates the number of times such

Funded Debt to EBITDA – The “darling” measure of assets can be used to satisfy those liabilities. Current liabilities

lenders, this is the amount outstanding on borrowing arrange- include amounts outstanding on lines of credit for which the

ments as a multiple of EBITDA (earnings before interest, collateral consists of receivables and job progress payments

taxes, depreciation, and amortization). EBITDA has also be- (regardless of maturity) and exclude all short-term borrow-

come the yardstick for determining value in the acquisition of ings to be refinanced as long-term.

many privately held companies.

CFMA BP January-February 2004

6

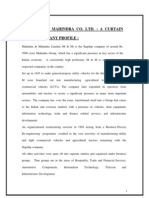

Your company’s forecasted gross margin is 15%.

The actual gross margin is 10%.

“the WHY?

Direct labor costs are 30% greater than originally planned.

Whys”

WHY?

Actual productivity is below planned productivity.

WHY?

25% of labor time is spent “waiting.”

WHY?

Go at least six levels Materials were rarely delivered to the jobsite

deep in asking when needed.

WHY WHY?

The vendor failed to meet clearly communicated and

a variance occurred. agreed-upon ship dates.

(See example at right.)

WHY?

The vendor is unreliable.

As you can see in this example, even though the root problem appears to be a labor issue, a vendor’s failure actually

caused the problem. Only by asking “why” at least six times will you get to the bottom of a problem

and ascertain its true root cause. As you do this, you will identify operating performance measures

– key indicators for your business – that will help your company achieve success.

Generally, a current ratio of at least 1.35 to 1.0 should be Because of this, efficiency ratios and measures are primarily

maintained. A goal of 2.0 to 1.0 should be targeted in order beneficial to management and should be routinely moni-

to provide a cushion needed to weather more than just rou- tored. Some of the key efficiency ratios and measures are:

tine seasonal lulls.

Days in Accounts Receivable (AR) – This Best in Class

Purchasing equipment with working capital funds will quick- measure in the 2003 survey reflects how many days it gen-

ly reduce the current ratio; therefore, equipment purchases erally takes to collect receivables. Care should be taken to

should generally be refinanced with long-term borrowing exclude long-term retainage not expected to be collected in

whenever possible. the current operating cycle.

Working Capital Turnover – This ratio shows the amount This measure can provide a wealth of information and should

of revenue being generated from each dollar of working capi- definitely be part of your performance measurement system.

tal available. Generally, the higher the working capital turn- The following possible interpretations show why:

over, the better – though certain outside limits exist.

• An increase in this measure may indicate specific collection

For example, a ratio in excess of 30 to 1 indicates that work- problems before they become apparent to management.

ing capital is being stretched beyond its reasonable limits

• An increase not attributable to specific customers may

and that a higher degree of net working capital should be in

indicate a general cash flow stress in your customer base,

place.

which could be an indicator of future construction spend-

Efficiency Ratios & Measures ing patterns.

• An increase could indicate the erosion of credit policy

Efficiency ratios and measures are designed to indicate how

within your company, which should be reviewed and

well the company is managing certain resources. These ratios,

strengthened, if necessary.

while useful to lenders and bond underwriters, are rarely used

as the sole basis in denying a credit request. • An increase could also indicate that aggressive overbilling

practices may not be achieving the desired benefit.

Instead, these measures should be seen as leading indicators

for the health of the business. So, if ratios in other areas In the 2003 survey, average days in AR were 38.4 days for

seem to be acceptable, review these ratios to see if they are Best in Class companies vs. 47.9 days for all companies. For a

forecasting certain trends that will affect your business over Best in Class company, this represents an additional $26,300

the next few months. cash on hand for every $1,000,000 in annual revenues.

January-February 2004 CFMA BP

Days in Accounts Payable (AP) – This indicates how many • Financial and job cost reporting performance

days it takes to pay vendors and subcontractors. As with days

• Jobs completed ahead of schedule or with minimal

in AR, exclude long-term retainage payables from your calcu- punchlist items

lations. Though payment terms will vary based on different

jobs and/or negotiations with specific vendors, this measure • The cost of processing certain types of transactions

can be used as an overall guide in assessing how well your • The cost of performing contracts on certain sized jobs

company is managing its payables. Your goal: Days in AR • Productivity of project managers and crews

should be shorter than days in AP in order to contribute to a

positive, operating cash flow cycle. Certainly, this list could go on and on. However, the key here

is to develop measures that directly relate to the achievement

Fixed Asset Ratio – This Best in Class ratio in the 2003 sur- of your company’s overriding goal. There are endless ways to

vey measures the level of stockholders’ equity invested in net measure performance within each of the areas mentioned

fixed assets. A higher ratio could indicate that a dispropor- above. So, start with some basic measures and work forward.

tionate amount of the company’s own funds are tied up in

fixed assets, meaning that the company could lack the liquid- Conclusion

ity needed to fund current operations. In the 2003 survey, the

fixed asset ratio was 20.6% for Best in Class companies vs. The road to success is strewn with the remains of businesses

38.8% for all companies. that began with big dreams and high expectations. None of

those businesses planned to fail, but many of them failed to plan

Operating Performance Measures their course for success, ending up as victims in a competitive

world. In addition, many others have never come close to reach-

You now have a fairly thorough understanding of financial ing their full potential because they didn’t set aggressive goals

performance measures. However, these comprise only half of and measure progress along the way.

a comprehensive, overall performance measurement system.

The other half consists of operating performance measures. Right now, at the beginning of this new year, you have the

These go beyond the data captured in the G/L and look at opportunity to pull your management team together to focus

other operating statistics in order to generate important per- on a comprehensive plan for success. Remember to measure

formance information. Operating performance measures gen- your progress regularly along the way, using the key perfor-

erally flow from financial performance measures and provide mance indicators as your guideposts. And, as you go, cele-

a more detailed analysis of specific areas. brate your successes, learn from your mistakes – and best of

luck in your journey! BP

Prescribed operating performance measures do not exist in

the same generally accepted format as financial performance

measures. Moreover, the number of operating performance This article appeared in the January/February 2000 issue of

this magazine and was reviewed and updated for this reprinting.

measurements is limitless. For these reasons, most companies

develop the operating side of their performance measurement

system to best suit their own needs.

JERRY HENDERSON is a Partner at BKD, LLP in Bowling

Green, KY. He has been providing accounting, consulting,

In reality, your company’s operating performance measure- and auditing services to the construction industry for the

ment system will continually be refined as you focus on ever- past 13 years. He received a BS in Accounting from West-

improving operations. For now, let’s look at some broad areas ern Kentucky University, also in Bowling Green.

for you to consider.

Jerry, a frequent contributor to CFMA Building Profits, is the

Key Operating Indicators editorial chair for BKD’s newsletter, “Blueprint,” and has

published in various other trade publications, including the

Journal of Construction Accounting and Taxation.

The key to determining operating and financial performance

measures is the same: You want indicators that help your com- Jerry belongs to CFMA’s Kentuckiana Chapter and is a for-

pany reach its goal. However, the following areas should always mer member of CFMA’s Accounting & Reporting Com-

be measured because problems in any of these will affect your mittee. He is a council member for the ABC of Kentucky,

bottom line – and the future profitability of your company: and is a member of the AICPA and the Kentucky Society of

CPAs.

• Labor and equipment productivity

Phone: 270-781-0111

• Subcontractor performance

E-Mail: jhenderson@bkd.com

• Vendor and customer quality Web Site: www.bkd.com

CFMA BP January-February 2004

PERFORMANCE MEASUREMENT

WORKSHEET

CFMA

MEASURE FORMULA COMPOSITE TARGET/ACTUAL

Gross Margin revenue – contract costs

(GM) (%) revenue

Return on Sales pre-tax (or net) income

(ROS) revenue

Return on Equity net earnings

(ROE) total net worth

Return on Asset net earnings

(ROA) total assets

Debt to Equity total liabilities

total net worth

Funded Debt to short and long-term debt

EBITDA earnings before interest, taxes,

depreciation, and amortization

Asset Turnover revenue

total assets

Months in Backlog backlog

revenue/12

Current Ratio current assets

current liabilities

Working Capital revenue

Turnover current assets – current liabilities

Days in Accounts net accounts receivable x 360

Receivable total revenue

Days in Accounts accounts payable – retainages x 360

Payable total contract costs

Fixed Asset net fixed assets

Ratio total net worth

January-February 2004 CFMA BP

You might also like

- CH 03Document67 pagesCH 03Khoirunnisa Dwiastuti100% (2)

- Advance ITT Exam 1 Day Revision Notes Module Ii Unit 1 - Advanced Excel Chapter 1 - Working With XMLDocument23 pagesAdvance ITT Exam 1 Day Revision Notes Module Ii Unit 1 - Advanced Excel Chapter 1 - Working With XMLvanshika agarwal75% (4)

- Impact of Modern Project Management in Strategic ContentDocument11 pagesImpact of Modern Project Management in Strategic Contentgeeta bhatiaNo ratings yet

- Solution Manual Cost Accounting 14th Ed by Carter HLDocument382 pagesSolution Manual Cost Accounting 14th Ed by Carter HLverlyarin100% (1)

- Financial Planning and Forecasting Financial StatementsDocument5 pagesFinancial Planning and Forecasting Financial StatementsRaven PicorroNo ratings yet

- The Budgeting Survival GuideDocument11 pagesThe Budgeting Survival GuideSara SyedNo ratings yet

- Lecture 18 MGNM571Document33 pagesLecture 18 MGNM571Devyansh GuptaNo ratings yet

- MAS Module 1Document24 pagesMAS Module 1bang yedamiNo ratings yet

- Solution Manual Managerial Accounting Hansen Mowen 8th Editions CH 8 DikonversiDocument44 pagesSolution Manual Managerial Accounting Hansen Mowen 8th Editions CH 8 Dikonversirizky aulia100% (1)

- Solution Manual For Cornerstones of Managerial Accounting Mowen Hansen Heitge 3rd EditionDocument45 pagesSolution Manual For Cornerstones of Managerial Accounting Mowen Hansen Heitge 3rd EditionOliviaHarrisonobijq100% (98)

- Seven Keys To Better Forecasting 11-02Document9 pagesSeven Keys To Better Forecasting 11-02api-3771917No ratings yet

- Fp&A Trends: Cfo Guide ToDocument15 pagesFp&A Trends: Cfo Guide ToaasifmmNo ratings yet

- Solution Manual For Cornerstones of Cost Management 4th Edition Don R Hansen Maryanne M MowenDocument46 pagesSolution Manual For Cornerstones of Cost Management 4th Edition Don R Hansen Maryanne M MowenOliviaHarrisonobijq100% (85)

- Metrics That Matter For A Successful Treasury Transformation Session 22Document5 pagesMetrics That Matter For A Successful Treasury Transformation Session 22vino06cse57No ratings yet

- CH 15 SMDocument44 pagesCH 15 SMwaqtawanNo ratings yet

- The Balanced Scorecard Translating StratDocument4 pagesThe Balanced Scorecard Translating Stratrajdeeptamuli70No ratings yet

- Using Financial Forecasting As A Strategic Catalyst For Enhancing The Financial Performance of Manufacturing Companies in Kigali, RwandaDocument15 pagesUsing Financial Forecasting As A Strategic Catalyst For Enhancing The Financial Performance of Manufacturing Companies in Kigali, RwandaKIU PUBLICATION AND EXTENSIONNo ratings yet

- Leveling Up S&OP: For A Well-Orchestrated Supply ChainDocument6 pagesLeveling Up S&OP: For A Well-Orchestrated Supply ChainSilvia CastilloNo ratings yet

- This Study Resource Was: Employee SatisfactionDocument4 pagesThis Study Resource Was: Employee Satisfactioneduardo.honorato5586No ratings yet

- CH 15 SMDocument44 pagesCH 15 SMrafanashwa.ayuNo ratings yet

- Increase Efficiencies in Your CAPEX Budgeting & OPEX PlanningDocument25 pagesIncrease Efficiencies in Your CAPEX Budgeting & OPEX Planningkmurth_hnNo ratings yet

- FinmanDocument4 pagesFinmanMycah ManriqueNo ratings yet

- Reflective Essay: (Document Subtitle)Document4 pagesReflective Essay: (Document Subtitle)desmondNo ratings yet

- BudgetDocument19 pagesBudgetjaveriaanwar4046No ratings yet

- Budget and Budgetory Control System in HeritageDocument5 pagesBudget and Budgetory Control System in HeritagevarunNo ratings yet

- Management Accounting Report BudgetDocument42 pagesManagement Accounting Report BudgetBilly Maravillas Dela CruzNo ratings yet

- Budget Instrument Management ControlDocument20 pagesBudget Instrument Management ControlabekaforumNo ratings yet

- EY Performance Key Performance IndicatorsDocument8 pagesEY Performance Key Performance IndicatorsIoanaR2011100% (1)

- Chapter 3 Financial Planning Tools and ConceptsDocument28 pagesChapter 3 Financial Planning Tools and ConceptsDEALAGDON, RhyzaNo ratings yet

- Budgeting LectureDocument59 pagesBudgeting LectureCristineNo ratings yet

- Business FinanceDocument51 pagesBusiness FinanceMary Joyce Camille ParasNo ratings yet

- 2024 Financial Planning BlueprintDocument19 pages2024 Financial Planning BlueprintDương Thị Lệ QuyênNo ratings yet

- Costing FinalfffDocument39 pagesCosting FinalfffSaloni Aman SanghviNo ratings yet

- Modern Accounting How To Overcome Financial Close ChallengesDocument26 pagesModern Accounting How To Overcome Financial Close ChallengesGracie BautistaNo ratings yet

- BudgetDocument6 pagesBudgetKedar SonawaneNo ratings yet

- Aeco2 MidtermDocument5 pagesAeco2 MidtermvsplanciaNo ratings yet

- ACCOUNTINGDocument8 pagesACCOUNTINGRijohnna Moreen RamosNo ratings yet

- Pandey 2005 Balanced Scorecard Myth and RealityDocument16 pagesPandey 2005 Balanced Scorecard Myth and RealityEdisson FuentesNo ratings yet

- Group 3 Topic 1: Significance FunctionDocument14 pagesGroup 3 Topic 1: Significance FunctionjsemlpzNo ratings yet

- Budgeting, EnterpreneurshipDocument4 pagesBudgeting, EnterpreneurshipVALENTINE BETTNo ratings yet

- Dokumen - Tips - Jawaban Soal Akmen Bab 8 PDFDocument44 pagesDokumen - Tips - Jawaban Soal Akmen Bab 8 PDFSiswo WartoyoNo ratings yet

- Eguide Funding A4Document15 pagesEguide Funding A4Timothy OkunaNo ratings yet

- Principles of Finance: Financial PlanningDocument8 pagesPrinciples of Finance: Financial PlanningAmeya PatilNo ratings yet

- Evaluating Firm Performance - ReportDocument5 pagesEvaluating Firm Performance - ReportJeane Mae BooNo ratings yet

- Balanced Scorecard and Project ManagerDocument27 pagesBalanced Scorecard and Project ManagerRajat Mehta100% (1)

- Simon Chap. 5Document33 pagesSimon Chap. 5harum77No ratings yet

- Bes'S Institute of Management Studies & Research: Report On Advanced Financial ManagementDocument34 pagesBes'S Institute of Management Studies & Research: Report On Advanced Financial Managementcapricorn_niksNo ratings yet

- Tbbell Document 6077Document68 pagesTbbell Document 6077alma.hedgepeth467No ratings yet

- Topic 6.2 - Budgets & ForecastsDocument4 pagesTopic 6.2 - Budgets & Forecastsmundubijohn1No ratings yet

- Economics ThesisDocument22 pagesEconomics ThesisANGEL ChayNo ratings yet

- Cost-Benefit Analyses For HR InterventionsDocument17 pagesCost-Benefit Analyses For HR Interventionsparioor95No ratings yet

- 2003 Management-Control-SystemDocument11 pages2003 Management-Control-SystemMAHENDRA SHIVAJI DHENAKNo ratings yet

- Subject: Management Accounting and Decision Making Submitted To: MR - Ammar Ud DinDocument8 pagesSubject: Management Accounting and Decision Making Submitted To: MR - Ammar Ud DinUmar Sarfraz KhanNo ratings yet

- Accounting budgetingDocument18 pagesAccounting budgetingRyan Dela Cruz CadacioNo ratings yet

- A Study On Capital Budgetting With Reference To Bescal Steel IndustriesDocument69 pagesA Study On Capital Budgetting With Reference To Bescal Steel IndustriesAman Agarwal100% (2)

- The Balanced Scorecard-Measures That Drive PerformanceDocument9 pagesThe Balanced Scorecard-Measures That Drive Performancezeel patelNo ratings yet

- Chapter 4 Financial PlanningDocument8 pagesChapter 4 Financial PlanningHannah Pauleen G. LabasaNo ratings yet

- Cost AccountingDocument11 pagesCost AccountingShikshya NayakNo ratings yet

- Ebook Cost Management A Strategic Emphasis 8Th Edition Blocher Solutions Manual Full Chapter PDFDocument67 pagesEbook Cost Management A Strategic Emphasis 8Th Edition Blocher Solutions Manual Full Chapter PDFAnthonyWilsonecna100% (13)

- Theoretical Part (Master Budget)Document26 pagesTheoretical Part (Master Budget)salahnaser9999No ratings yet

- The Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)From EverandThe Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Rating: 4.5 out of 5 stars4.5/5 (3)

- b015-2010-Iaasb-handbook-Isrs-4400 What Guided DTT During Special Audit Process (12977)Document10 pagesb015-2010-Iaasb-handbook-Isrs-4400 What Guided DTT During Special Audit Process (12977)GeorgeNo ratings yet

- Working Capital For AGMsDocument44 pagesWorking Capital For AGMsGeorgeNo ratings yet

- Prudential GuidelinesDocument505 pagesPrudential GuidelinesGeorgeNo ratings yet

- Chapter On Valuation of Inventories - T P GhoshDocument28 pagesChapter On Valuation of Inventories - T P GhoshGeorgeNo ratings yet

- Chapetr On Borrowing Cost - TP GhoshDocument15 pagesChapetr On Borrowing Cost - TP GhoshGeorgeNo ratings yet

- Risk AgmDocument30 pagesRisk AgmGeorgeNo ratings yet

- The Rental ConceptDocument10 pagesThe Rental ConceptGeorgeNo ratings yet

- FCNR (B) LoansDocument12 pagesFCNR (B) LoansGeorgeNo ratings yet

- Unveiling Window Dressing in Financial StatementsDocument10 pagesUnveiling Window Dressing in Financial StatementsGeorgeNo ratings yet

- Chapter On Export and Import CreditDocument8 pagesChapter On Export and Import CreditGeorgeNo ratings yet

- Costing For Extra WorkDocument8 pagesCosting For Extra WorkGeorgeNo ratings yet

- Retailer's Business PlanDocument8 pagesRetailer's Business PlanGeorgeNo ratings yet

- Debtor - Creditor AgreementDocument19 pagesDebtor - Creditor AgreementGeorgeNo ratings yet

- Manufacturers 'S FinancialsDocument14 pagesManufacturers 'S FinancialsGeorgeNo ratings yet

- Service Provider's FinancialsDocument12 pagesService Provider's FinancialsGeorgeNo ratings yet

- What Is Project FinanceDocument29 pagesWhat Is Project FinanceGeorgeNo ratings yet

- Construction FinancingDocument33 pagesConstruction FinancingGeorgeNo ratings yet

- Manufacturer's Business PlanDocument8 pagesManufacturer's Business PlanGeorgeNo ratings yet

- Export Credit InsuranceDocument6 pagesExport Credit InsuranceGeorgeNo ratings yet

- Evaluating Mergers & AcquisitionsDocument12 pagesEvaluating Mergers & AcquisitionsGeorgeNo ratings yet

- Finance Facilities - InvesteQ CapitalDocument4 pagesFinance Facilities - InvesteQ CapitalGeorgeNo ratings yet

- Margin TradingDocument5 pagesMargin TradingGeorgeNo ratings yet

- Construction Loan GuaranteeDocument11 pagesConstruction Loan GuaranteeGeorgeNo ratings yet

- Construction - The Owner's PerspectiveDocument19 pagesConstruction - The Owner's PerspectiveGeorgeNo ratings yet

- Corporate Debt RestructuringDocument15 pagesCorporate Debt RestructuringGeorgeNo ratings yet

- Cash Flow Forecasting in Construction Finance 3Document7 pagesCash Flow Forecasting in Construction Finance 3GeorgeNo ratings yet

- Cash Flow Forecasting in Construction Finance 2Document9 pagesCash Flow Forecasting in Construction Finance 2GeorgeNo ratings yet

- Business Plan - Bahari HouseDocument25 pagesBusiness Plan - Bahari HouseGeorgeNo ratings yet

- PetrozuataDocument13 pagesPetrozuataMikhail TitkovNo ratings yet

- BPLR & Base RateDocument25 pagesBPLR & Base Ratemermaid20052002No ratings yet

- 15 RP Vs GrijaldoDocument10 pages15 RP Vs GrijaldoWinchelle DawnNo ratings yet

- Futurpreneur Cash Flow Template EN 09.08.2022 1Document10 pagesFuturpreneur Cash Flow Template EN 09.08.2022 1Alex VelascoNo ratings yet

- LAC - Financial LiteracyDocument19 pagesLAC - Financial Literacyanon_754485983100% (1)

- Financing and Financial Management For Small BusinessDocument39 pagesFinancing and Financial Management For Small BusinessFelistaNo ratings yet

- Barton V Armstrong - DuressDocument16 pagesBarton V Armstrong - DuresssoumyaNo ratings yet

- University of Hertfordshire Student Refund and Compensation PolicyDocument19 pagesUniversity of Hertfordshire Student Refund and Compensation PolicyAura WaxNo ratings yet

- 1) The Fraudulent Signing, Without Any Justification On Contract of Assignment ofDocument21 pages1) The Fraudulent Signing, Without Any Justification On Contract of Assignment ofVoichita AlexandruNo ratings yet

- Managing Cash Flow: Prepared By: Catiban, Ann Rea Garanchon, Jewel Ann Hagopit, Evelyn Tormis, FerlizaDocument30 pagesManaging Cash Flow: Prepared By: Catiban, Ann Rea Garanchon, Jewel Ann Hagopit, Evelyn Tormis, FerlizaChrizel DolleteNo ratings yet

- Share Pledge AgreementDocument7 pagesShare Pledge AgreementVartika KhandujaNo ratings yet

- Corporations Outline 1Document92 pagesCorporations Outline 1shashankbijapur100% (1)

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisElizabeth Espinosa ManilagNo ratings yet

- Risks Associated With Investing in Bonds - Class ExamplesDocument10 pagesRisks Associated With Investing in Bonds - Class ExamplesmohammedNo ratings yet

- TOPIC 4 MR Debentures - 230314 - 081422Document14 pagesTOPIC 4 MR Debentures - 230314 - 081422shivani dholeNo ratings yet

- Harvard Financial Report 2011Document47 pagesHarvard Financial Report 2011Akif MalikNo ratings yet

- HW 2 SolutionsDocument4 pagesHW 2 SolutionsJohn SmithNo ratings yet

- Analysis of Financial Performance of Everest Bank LimitedDocument56 pagesAnalysis of Financial Performance of Everest Bank LimitedHima RijalNo ratings yet

- Case Digest Credit TransactionsDocument11 pagesCase Digest Credit TransactionsChristineNo ratings yet

- SVB Report 2022Document193 pagesSVB Report 2022iqbal maulanaNo ratings yet

- Statement of Affairs - P&sDocument9 pagesStatement of Affairs - P&sLokesh .cNo ratings yet

- Intermediate Finance: Session 7Document54 pagesIntermediate Finance: Session 7rizaunNo ratings yet

- Securities (Lastman) - 2012-13Document69 pagesSecurities (Lastman) - 2012-13scottshear1No ratings yet

- Chapter 8 Fixed Income SecuritiesDocument35 pagesChapter 8 Fixed Income SecuritiesCezarene Fernando100% (1)

- Project Finance 1 Network of Contracts PDFDocument41 pagesProject Finance 1 Network of Contracts PDFSam DhuriNo ratings yet

- FM MCQsDocument74 pagesFM MCQsNidheena K SNo ratings yet

- Review of ScamsDocument19 pagesReview of ScamsKanika JainNo ratings yet

- Lecture Notes - Credit Cards and Consumer LoansDocument18 pagesLecture Notes - Credit Cards and Consumer LoansLuther Ivanne M. DejesusNo ratings yet