Professional Documents

Culture Documents

FDLQuiz

FDLQuiz

Uploaded by

John Luca0 ratings0% found this document useful (0 votes)

8 views3 pagesThe document provides a lesson on accounting concepts related to cash such as petty cash funds, bank reconciliation, and methods for recording credit sales and freight charges. It includes examples of reconciling bank statements and calculating uncollectible accounts expense. Students are asked to define accounting terms, classify reconciling items, and determine adjusting journal entries related to allowance for doubtful accounts.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a lesson on accounting concepts related to cash such as petty cash funds, bank reconciliation, and methods for recording credit sales and freight charges. It includes examples of reconciling bank statements and calculating uncollectible accounts expense. Students are asked to define accounting terms, classify reconciling items, and determine adjusting journal entries related to allowance for doubtful accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views3 pagesFDLQuiz

FDLQuiz

Uploaded by

John LucaThe document provides a lesson on accounting concepts related to cash such as petty cash funds, bank reconciliation, and methods for recording credit sales and freight charges. It includes examples of reconciling bank statements and calculating uncollectible accounts expense. Students are asked to define accounting terms, classify reconciling items, and determine adjusting journal entries related to allowance for doubtful accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

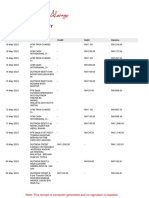

MAPUSAO, MARK CEASAR J.

BA3DB

AE15-IA1 – TASK FOR FULL DISTANCE LEARNING (FDL)-Module 1 to Module 5

A. Fill in the blanks with the correct answer.

CASH 1. Is the money in the form of currency.

CASH EQUIVALENTS 2. Are investments that can be readily converted to cash

PETTY CASH FUND 3. Is a small amount of company cash, often kept on hand to pay for minor or

incidental

expenses, such as office supplies or employee reimbursements.

IMPREST SYSTEM 4. Is a system of control of cash which requires that all cash receipts should be

deposited

intact, and all cash disbursements should be made by means of check.

BANK OVERDRAFT 5. It is the results of issuance of checks in excess of the deposits.

RECONCILING ITEMS 6. A difference between balances from two sources that are being compared.

BANK DEPOSITS 7. Consist of money placed into banking institutions for safekeeping. These

deposits are

made to deposit accounts such as savings accounts, checking accounts, and money

market accounts.

BANK RECONCILIATION 8. A statement which brings into agreement the cash balance per book and cash

balance per bank.

BANK STATEMENT 9. A monthly report of the bank to the depositor showing the cash balance per

bank at the beginning, the deposits acknowledged, the checks paid, other

charges and credits and the daily cash balance per bank during the month.

BOOK BALANCE 10. It is a company cash balance according to its accounting records.

Questions: Classify each item as: (1) an addition to the book balance, (2) a subtraction from the book

balance, (3) an addition to the bank balance, or (4) a subtraction from the bank balance.

The following items could appear on a bank reconciliation:

1. Interest earned on bank balance, P200. AN ADDITION TO THE BOOK BALANCE

2. Deposits in transit, P1,500. AN ADDITION TO THE BANK BALANCE

3. Service charge, P10. SUBTRACTION FROM THE BOOK BALANCE

4. The bank incorrectly decreased the business

account by P350 for a check written by another

business. AN ADDITION TO THE BOOK BALANCE

5. Bank collection of note receivable of P800, and interest of P80. AN ADDITION TO THE BOOK BALANCE

6. NSF check from customer, #548, for P1,750. SUBTRACTION FROM THE BOOK BALANCE

7. Outstanding checks, P6,700. AN ADDITION TO THE BOOK BALANCE

8. The business credited Cash for P200. The correct amount was P2,000. SUBTRACTION FROM THE

BOOK BALANCE

B. Answer the following questions.

1. What is a Proof of Cash?

Proof of cash is basically a reconciliation of the cash receipts as per the cash receipts journal and the

cash deposited at the bank. It is carried for both the beginning and the ending period cash balance.

2. What is a Banks Debit & Bank Credit?

Bank debit is when you deposit your money to the bank and Bank Credit is when you borrow money

from the bank.

3. What is a Book Debit & Book Credit?

It refers to cash receipts or all items that are debited to the bank account's cash are referred to as book

debits and book credits refers to all goods credited to the cash in bank account or cash disbursements.

4. Give the formula for computation of book balance

Balance per book-beginning of the month

Add: Book debits during the month

TOTAL:

Less: Book credits during the month

Balance per book- end of month

5. Give the formula for computation of bank balance.

Balance per bank- beginning of month

Add: Bank credits during the month

TOTAL:

Less: Bank debits during the month

Balance per bank- end of month

C. Answer the following questions.

6. What are the methods of recording credit sales?

A. Gross methods – Sales and accounts receivable are both reported at the invoice's gross amount. Due

to its ease of use, this approach is popular and frequently employed.

B. Net method –The net amount of the invoice, or the invoice price less the cash discount, is used to

record sales and accounts receivable.

7. What are the terms related to freight charges?

A. FOB Destination- Indicates that upon receipt of the acquired items, the buyer acquires ownership of

them. The seller will be responsible for carrying the freight charge to its final destination.

B. FOB Shipping point – It indicates that upon shipment of the purchased goods, ownership passes to

the buyer. The cost of moving the charge from the place of shipment to the point of destination will be

covered by the customer

8. What are the methods for accounting for bad debts?

There are two approaches used to account for bad loans. It is both the Direct-off technique and the

allowance approach.

D. Answer the following questions.

Uncollectible accounts expense is estimated at ¼ of 1% of net sales of P4,000,000 for the year.

The current balance in Allowance for Doubtful Accounts is P300 credit.

Determine the following:

a) The uncollectible accounts expense for the year.

4,000,000 X 1% X ¼ = ₱10,000

b) The adjusting entry to be made on December 31.

Uncollectible Account Expense ₱10,000

Allowance for uncollectible account 10,000

c) The balance in Allowance for Doubtful Accounts after adjustment.

₱300 + 10,000 = ₱10,300 credit balance

You might also like

- FARAP-4501 (Cash and Cash Equivalents)Document10 pagesFARAP-4501 (Cash and Cash Equivalents)Marya NvlzNo ratings yet

- Auditing and Assurance Concept and Application 1Document48 pagesAuditing and Assurance Concept and Application 1mary jhoy100% (2)

- Reimers Finacct03 Sm04Document46 pagesReimers Finacct03 Sm04Maxime HinnekensNo ratings yet

- Pq-Cash and Cash EquivalentsDocument3 pagesPq-Cash and Cash EquivalentsJanella PatriziaNo ratings yet

- Accounting Mcqs 1Document20 pagesAccounting Mcqs 1Pramod Gowda BNo ratings yet

- Jawaban P5-5aDocument2 pagesJawaban P5-5arezky100% (1)

- AuditingDocument9 pagesAuditingRenNo ratings yet

- ReviewerDocument7 pagesReviewerangel maeNo ratings yet

- Quiz 2 Cash To ARDocument4 pagesQuiz 2 Cash To ARGraziela MercadoNo ratings yet

- BA 114.1 - Quiz 1 SamplexDocument12 pagesBA 114.1 - Quiz 1 SamplexPamela May NavarreteNo ratings yet

- FA Objectives (Batch B)Document16 pagesFA Objectives (Batch B)ssreemurugNo ratings yet

- Bank ReconciliationDocument18 pagesBank ReconciliationFem FataleNo ratings yet

- Unit 5 CashDocument9 pagesUnit 5 CashNigussie BerhanuNo ratings yet

- Valix TOADocument51 pagesValix TOARose Aubrey A CordovaNo ratings yet

- Accounting Application: Tech-FSM 223Document52 pagesAccounting Application: Tech-FSM 223Rey Ann EstopaNo ratings yet

- Ncert Solutions For Class 11 Accountancy Chapter 5 Bank Reconciliation StatementDocument24 pagesNcert Solutions For Class 11 Accountancy Chapter 5 Bank Reconciliation StatementLivin Verghese LijuNo ratings yet

- Bookkeeping To Trial Balance 9Document17 pagesBookkeeping To Trial Balance 9elelwaniNo ratings yet

- FABM2 Q4 Module 2Document23 pagesFABM2 Q4 Module 2Jet Planes100% (1)

- Physical Protection of Cash BalancesDocument2 pagesPhysical Protection of Cash BalancesJemal SeidNo ratings yet

- Module 9. Bank ReconciliationDocument22 pagesModule 9. Bank ReconciliationValerie De los ReyesNo ratings yet

- Intermediate Accounting 1A 2019 by Millan Chapter 1-Summary (Accounting Process)Document5 pagesIntermediate Accounting 1A 2019 by Millan Chapter 1-Summary (Accounting Process)Shaina DellomesNo ratings yet

- Bank ReconciliationDocument30 pagesBank ReconciliationshannelebelenNo ratings yet

- Week 2 Leap FabmDocument7 pagesWeek 2 Leap FabmDanna Marie EscalaNo ratings yet

- Theories and Problem Solving AKDocument19 pagesTheories and Problem Solving AKJob CastonesNo ratings yet

- Fabm2 Q2 W1 QaDocument16 pagesFabm2 Q2 W1 Qajoshua.mayo.09152004No ratings yet

- Reviewer - Cash & Cash EquivalentsDocument5 pagesReviewer - Cash & Cash EquivalentsMaria Kathreena Andrea Adeva100% (1)

- ACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Document76 pagesACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Christel Oruga100% (1)

- Aud Pro Cash and Cash Equi-1-4Document4 pagesAud Pro Cash and Cash Equi-1-4Mikaella JonaNo ratings yet

- Cash and Cash Equivalents Composition and Other TopicsDocument27 pagesCash and Cash Equivalents Composition and Other Topicscpaluna0No ratings yet

- Finals FABM2 Lesson 1 Accounting For Cash in BankDocument4 pagesFinals FABM2 Lesson 1 Accounting For Cash in BankFrancine Joy AvenidoNo ratings yet

- 2nd Q EXAMDocument6 pages2nd Q EXAMChristian TonogbanuaNo ratings yet

- C6Document20 pagesC6AkkamaNo ratings yet

- Fundamentas of Accounting I CH 5Document24 pagesFundamentas of Accounting I CH 5israelbedasa3100% (1)

- Written Report CashDocument16 pagesWritten Report CashFatima BalagaNo ratings yet

- Chp1 Bank Bank Recon STMTDocument16 pagesChp1 Bank Bank Recon STMTMichael AsieduNo ratings yet

- CH 10Document6 pagesCH 10Cris LuNo ratings yet

- FABM 2 Module 4Document14 pagesFABM 2 Module 4Gotenk JujuNo ratings yet

- Audit 2-Prelim-Quiz 1 (1663899998)Document3 pagesAudit 2-Prelim-Quiz 1 (1663899998)Ella Mae Clavano NuicaNo ratings yet

- C&CEDocument11 pagesC&CEAnne VinuyaNo ratings yet

- Auditing Cash and Cash EquivalentsDocument11 pagesAuditing Cash and Cash EquivalentsJustine FloresNo ratings yet

- Chapter 7Document22 pagesChapter 7Genanew AbebeNo ratings yet

- Chapter Eight Bank Reconciliation-2Document67 pagesChapter Eight Bank Reconciliation-2Kingsley MweembaNo ratings yet

- BRS Bank Reconcilation StatementDocument15 pagesBRS Bank Reconcilation Statementbabluon22No ratings yet

- Session 6. The Statement of Cash FlowsDocument22 pagesSession 6. The Statement of Cash FlowsAmrutaNo ratings yet

- Ncert AccountancyDocument23 pagesNcert AccountancyArif ShaikhNo ratings yet

- 1st Long Exam (Summer 2022) WITHOUT ANSWERDocument10 pages1st Long Exam (Summer 2022) WITHOUT ANSWERDaphnie Kitch CatotalNo ratings yet

- Assessment Test 2nd Cash&RecDocument6 pagesAssessment Test 2nd Cash&RecMellowNo ratings yet

- BRS and Accounting Standards - OthersDocument10 pagesBRS and Accounting Standards - OthersRangabashyamNo ratings yet

- Lecture File On Bank Reconciliation StatementDocument2 pagesLecture File On Bank Reconciliation StatementRizwan umerNo ratings yet

- Business Finance Module 6Document11 pagesBusiness Finance Module 6Kanton FernandezNo ratings yet

- Chapter 7 SolutionsDocument64 pagesChapter 7 SolutionssevtenNo ratings yet

- Audit of Cash and Cash EquivalentsDocument2 pagesAudit of Cash and Cash EquivalentsJhedz Cartas0% (1)

- Audit of Cash TheoryDocument7 pagesAudit of Cash TheoryShulamite Ignacio GarciaNo ratings yet

- Aaconapps2 03RHDocument12 pagesAaconapps2 03RHAngelica DizonNo ratings yet

- Intermediate Accounting I - Notes (9.13.2022)Document18 pagesIntermediate Accounting I - Notes (9.13.2022)Mainit, Shiela Mae, S.No ratings yet

- Bank Reconciliation StatementDocument6 pagesBank Reconciliation StatementamnatariqshahNo ratings yet

- Problem Solving (With Answers)Document12 pagesProblem Solving (With Answers)sunflower100% (1)

- Bank Reconciliation Theory & ProblemsDocument9 pagesBank Reconciliation Theory & ProblemsSalvador DapatNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- Chapter 2 Problem SolvingDocument20 pagesChapter 2 Problem SolvingJohn LucaNo ratings yet

- SCRIPTDocument5 pagesSCRIPTJohn LucaNo ratings yet

- Self CheckDocument2 pagesSelf CheckJohn LucaNo ratings yet

- MOA Module5-STSDocument20 pagesMOA Module5-STSJohn LucaNo ratings yet

- WRITTEN TASK FN 3.2.1 Module 13Document1 pageWRITTEN TASK FN 3.2.1 Module 13John LucaNo ratings yet

- Quiz Btaxxx 1Document3 pagesQuiz Btaxxx 1John LucaNo ratings yet

- Conceptual FrameworkDocument14 pagesConceptual FrameworkJohn LucaNo ratings yet

- The Heroificati-WPS OfficeDocument4 pagesThe Heroificati-WPS OfficeJohn LucaNo ratings yet

- MS Case Study ProjectDocument6 pagesMS Case Study ProjectJohn LucaNo ratings yet

- Assignment # 2 - Chapter 3 - March 2023Document2 pagesAssignment # 2 - Chapter 3 - March 2023GIAN ALEXANDER CARTAGENA100% (1)

- Ans KMKTDocument13 pagesAns KMKTsyahmiafndiNo ratings yet

- Acc103 P2 Exam With AnswersDocument10 pagesAcc103 P2 Exam With AnswersMary Lyn DatuinNo ratings yet

- 29Document3 pages29sharathk916No ratings yet

- Quarter 3 Module Entrepreneurship 10Document7 pagesQuarter 3 Module Entrepreneurship 10Jowel BernabeNo ratings yet

- Mba Ii Syllabus - MmuDocument79 pagesMba Ii Syllabus - Mmuraja_verma007No ratings yet

- Accounting Workbook Section 3 AnswersDocument30 pagesAccounting Workbook Section 3 AnswersAhmed Zeeshan83% (12)

- Internship Report BankDocument28 pagesInternship Report BankHumera TariqNo ratings yet

- TS Grewal Solutions For Class 11 Accountancy Chapter 13 - Rectification of ErrorsDocument57 pagesTS Grewal Solutions For Class 11 Accountancy Chapter 13 - Rectification of ErrorsDhruv ThakkarNo ratings yet

- Value DimensionDocument18 pagesValue Dimensionmohan krishnaNo ratings yet

- ABM - FABM11-IIIg - J - 28Document2 pagesABM - FABM11-IIIg - J - 28Mary Grace Pagalan Ladaran0% (1)

- Accounting - MBA IDocument22 pagesAccounting - MBA ISayyed AliNo ratings yet

- Chapter 3 Balance of Payments: International Financial Management, 8e (Eun)Document30 pagesChapter 3 Balance of Payments: International Financial Management, 8e (Eun)shouqNo ratings yet

- Please Sign These DocumentsDocument3 pagesPlease Sign These DocumentsErika T AcostaNo ratings yet

- C. Limited PartnerDocument13 pagesC. Limited PartnerKrisha BendijoNo ratings yet

- Credit CardDocument55 pagesCredit CardAnil Batra100% (3)

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- 2022 Gr11 Mathematical Literacy WRKBK ENGDocument20 pages2022 Gr11 Mathematical Literacy WRKBK ENGmanganyeNo ratings yet

- For Billing Enquiry Visit Https://selfcare - Tikona.inDocument2 pagesFor Billing Enquiry Visit Https://selfcare - Tikona.inVivek Jain100% (1)

- Rcvbls ProblemsDocument6 pagesRcvbls ProblemsJerric CristobalNo ratings yet

- Trial Balance As On 31Document3 pagesTrial Balance As On 31Lipson ThomasNo ratings yet

- Opinio New CommissionDocument3 pagesOpinio New CommissionAbhishek GuptaNo ratings yet

- Transaction HistoryDocument10 pagesTransaction Historyrosmini mustapaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument22 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancevrushaliNo ratings yet

- Course Syllabus in Accounting IDocument4 pagesCourse Syllabus in Accounting Igerwin gananNo ratings yet

- Tut 2-AfaDocument10 pagesTut 2-AfaDiệp HyNo ratings yet

- Journal Accounts To Trial BalanceDocument47 pagesJournal Accounts To Trial Balancebhaskyban100% (1)