Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

12 views71844bos Interp5q

71844bos Interp5q

Uploaded by

Mayank RajputInter question paper 5

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Solution Manual For Financial Statement Analysis and Valuation 2nd Edition by EastonDocument32 pagesSolution Manual For Financial Statement Analysis and Valuation 2nd Edition by EastonJenniferPalmerdqwf98% (45)

- Test Bank For Financial Accounting Theory and Analysis Text and Cases 11th Edition Schroeder, Clark, CatheyDocument15 pagesTest Bank For Financial Accounting Theory and Analysis Text and Cases 11th Edition Schroeder, Clark, Catheya150592788No ratings yet

- Practical Accounting 2Document16 pagesPractical Accounting 2Rowena NijNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- 69587bos55533-P1.pdf 2Document46 pages69587bos55533-P1.pdf 2pittujb2002No ratings yet

- 71696bos57679 Inter p5qDocument8 pages71696bos57679 Inter p5qMayank RajputNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Banking QaDocument10 pagesBanking QaBijay AgrawalNo ratings yet

- Vidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document9 pagesVidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54shrenik bhuratNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingIndhuNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- Accounting New Syllabus Question PaperDocument7 pagesAccounting New Syllabus Question Paperpradhiba meenakshisundaramNo ratings yet

- 71859bos57825 Inter P5aDocument16 pages71859bos57825 Inter P5aVishnuNo ratings yet

- Class Test 1Document4 pagesClass Test 1vsy9926No ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Paper 33Document6 pagesPaper 33AVS InfraNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- Test - Section B - Corporate AccountingDocument3 pagesTest - Section B - Corporate AccountingNathoNo ratings yet

- Cash Flow Statement New For YoutubeDocument48 pagesCash Flow Statement New For YoutubeTapan BarikNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- MTP 2Document5 pagesMTP 2Arpit GuptaNo ratings yet

- © The Institute of Chartered Accountants of India: TH STDocument46 pages© The Institute of Chartered Accountants of India: TH STheikNo ratings yet

- 0 ScheduleDocument7 pages0 ScheduleKusuma MNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- Indian Accounting Standard 101Document19 pagesIndian Accounting Standard 101RITZ BROWNNo ratings yet

- Super 60 QuestionsDocument75 pagesSuper 60 Questionskaushikshivam291No ratings yet

- 63926bos51394finalold p1Document42 pages63926bos51394finalold p1marshadNo ratings yet

- Accounts QPDocument9 pagesAccounts QPHARSHIT DHANWANINo ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- Cma Question PaperDocument4 pagesCma Question PaperHilary GaureaNo ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Questions On AccountancyDocument34 pagesQuestions On AccountancyAshwin ChoudharyNo ratings yet

- RTP May 2018 New Gr1Document122 pagesRTP May 2018 New Gr1subhanvts7781No ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Accounting MTP Question Series I 1676966561047406Document9 pagesAccounting MTP Question Series I 1676966561047406Tushar MittalNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- TH STDocument34 pagesTH STShivani KumariNo ratings yet

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Document4 pagesCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurNo ratings yet

- Adv Acc Q.P 2Document7 pagesAdv Acc Q.P 2Swetha ReddyNo ratings yet

- Paper 1Document180 pagesPaper 1Please Ok0% (1)

- Paper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaDocument24 pagesPaper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaVijayasri KumaravelNo ratings yet

- Corporate Finance and Capital BudgetingDocument3 pagesCorporate Finance and Capital BudgetingRAHUL kumarNo ratings yet

- Ma 2020Document8 pagesMa 2020Hamsa PNo ratings yet

- Questions On Net Profit Before Tax and Extraordinary ItemsDocument3 pagesQuestions On Net Profit Before Tax and Extraordinary ItemspuxvashuklaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaRahul AgrawalNo ratings yet

- CA Inter Accounts RTP Nov23 Castudynotes ComDocument33 pagesCA Inter Accounts RTP Nov23 Castudynotes ComAbhishant KapahiNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Accounting Questions 27.04.2022Document5 pagesAccounting Questions 27.04.2022psree7281No ratings yet

- 73601bos59426 Inter p5qDocument7 pages73601bos59426 Inter p5qKali KhannaNo ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Advance Accountancy Inter PaperDocument14 pagesAdvance Accountancy Inter PaperAbhishek goyalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/32 March 2021Document19 pagesCambridge International AS & A Level: Accounting 9706/32 March 2021Ahmed NaserNo ratings yet

- Solution Manual For Advanced Accounting 4th Edition Jeter, ChaneyDocument7 pagesSolution Manual For Advanced Accounting 4th Edition Jeter, ChaneyAlif Nurjanah0% (2)

- WNC Investor Update - March 2015Document31 pagesWNC Investor Update - March 2015drk_999100% (1)

- Sample Question Paper Accountancy (055) : Class XII: 2017-18Document15 pagesSample Question Paper Accountancy (055) : Class XII: 2017-18AvinashNo ratings yet

- Module 6: What You Will LearnDocument30 pagesModule 6: What You Will Learn刘宝英No ratings yet

- Chapter 3 Business CombinationDocument9 pagesChapter 3 Business CombinationAnonymous XOv12G100% (1)

- Goodwill Valuation TestDocument14 pagesGoodwill Valuation TestAmritaNo ratings yet

- Unit: 2: Prepared By: Togadiya JigneshDocument24 pagesUnit: 2: Prepared By: Togadiya JigneshJignesh TogadiyaNo ratings yet

- 6 InvestmentsDocument219 pages6 InvestmentsKRISTINA DENISSE SAN JOSENo ratings yet

- Multiple Choice Problem (Dayag) Page 76 Items 2-6Document3 pagesMultiple Choice Problem (Dayag) Page 76 Items 2-6Cookies And CreamNo ratings yet

- Retirement AnswersDocument7 pagesRetirement AnswersshubhamsundraniNo ratings yet

- Afar 1stpb Exam-5.21Document7 pagesAfar 1stpb Exam-5.21NananananaNo ratings yet

- Buscom SPDocument16 pagesBuscom SPCatherine Joy Vasaya100% (1)

- Reconstitution of Partnership FirmDocument36 pagesReconstitution of Partnership FirmjdsiNo ratings yet

- Test Series - Test No. - 5. Advanced Accounting120413115441Document5 pagesTest Series - Test No. - 5. Advanced Accounting120413115441Kansal AbhishekNo ratings yet

- Accounting For Business CombinationsDocument13 pagesAccounting For Business CombinationsLu CasNo ratings yet

- Final PreboardDocument10 pagesFinal PreboardJan Victor AdanNo ratings yet

- Royal Bank of Scotland Research Report - ICBCDocument8 pagesRoyal Bank of Scotland Research Report - ICBCjkzhouNo ratings yet

- LVMH Consolidated Statements PDFDocument74 pagesLVMH Consolidated Statements PDFThomasNo ratings yet

- Assessed Coursework 2 - S2 2020 UpdateDocument7 pagesAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNo ratings yet

- Adv AFARDocument145 pagesAdv AFARDvcLouisNo ratings yet

- Solution:: M's Share Taken by R and S in Ratio of 1: 2Document57 pagesSolution:: M's Share Taken by R and S in Ratio of 1: 2meeraNo ratings yet

- Chapter 17 Answer Key-1Document4 pagesChapter 17 Answer Key-1NCTNo ratings yet

- FR MTP-1 May-24Document11 pagesFR MTP-1 May-24chandrakantchainani606No ratings yet

- Accounting, Organizations and Society. 5, No. 3, 263 - 283. 0Document21 pagesAccounting, Organizations and Society. 5, No. 3, 263 - 283. 0Jenalyn MenesesNo ratings yet

- Valuatio of Goodwill WS-1Document2 pagesValuatio of Goodwill WS-1Srishti SinghNo ratings yet

- M&a PpaDocument41 pagesM&a PpaAnna LinNo ratings yet

71844bos Interp5q

71844bos Interp5q

Uploaded by

Mayank Rajput0 ratings0% found this document useful (0 votes)

12 views7 pagesInter question paper 5

Original Title

71844bos-interp5q (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInter question paper 5

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

12 views7 pages71844bos Interp5q

71844bos Interp5q

Uploaded by

Mayank RajputInter question paper 5

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

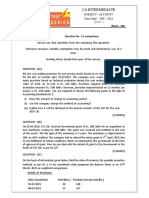

Test Series: October, 2022

MOCK TEST PAPER – 2

INTERMEDIATE: GROUP – II

PAPER – 5: ADVANCED ACCOUNTING

Question No. 1 is compulsory.

Answer any four questions from the remaining five questions.

Wherever necessary, suitable assumptions may be made and disclosed by way of a note.

Working Notes should form part of the answer.

Time Allowed: 3 Hours Maximum Marks: 100

1. (a) Surya Ltd. had the following transactions during the year ended 31 st March, 2021.

(i) It acquired the business of Gomati Limited on a going concern basis for ` 25,00,000 on

1st June,2020. The fair value of the Net Assets of Gomati Limited was ` 18,75,000. Surya Ltd.

believes that due to popularity of the products of Gomati Limited in the m arket, its goodwill

exists.

(ii) On 20th August, 2020, Surya Ltd. incurred cost of ` 6,00,000 to register the patent for its

product. Surya Ltd. expects the Patent’s economic life to be 8 years.

(iii) On 1st October, 2020, Surya Ltd. has taken a franchise to operate an ice cream parlour from

Volga Ltd. for ` 4,50,000 and at an Annual Fee of 10 % of Net Revenues (after deducting

expenditure). The franchise expires after six years. Net Revenue for the year ended

31st March, 2021 amounted to ` 1,50,000.

Surya Ltd. follows an accounting policy to amortize all Intangibles on Straight Line basis (SLM)

over the maximum period permitted by the Accounting Standards taking a full year amortization in

the year of acquisition. Goodwill on acquisition of business is to be amortized over 5 years (SLM).

Prepare an extract showing the Intangible Assets section in the Balance Sheet of Surya Ltd. as at

31st March, 2021.

(b) Given below is the following information of B.S. Ltd.

(i) Goods of ` 50,000 were sold on 18-03-2021 but at the request of the buyer these were

delivered on 15-04-2021.

(ii) On 13-01-2021 goods of ` 1,25,000 are sent on consignment basis of which 20% of the goods

unsold are lying with the consignee as on 31-03-2021.

(iii) ` 1,00,000 worth of goods were sold on approval basis on 01-12-2020. The period of approval

was 3 months after which they were considered sold. Buyer sent approval for 75% goods up

to 31-01-2021 and no approval or disapproval received for the remaining goods till 31 -03-

2021.

You are required to advise the accountant of B.S. Ltd., with valid reasons, the amount to be

recognized as revenue for the year ended 31 st March, 2021 in above cases in the context of AS-9.

(c) The management of Pluto Limited has sought your opinion with relevant reasons, whether the

following transactions will be treated as changes in Accounting Policy or not for the year ended

31st March, 2021. Please advise them in the following situations in accordance with the provisions

of Accounting Standard 5:

(i) During the year ended 31st March, 2021, the management has introduced a formal retirement

gratuity scheme in place of ad-hoc ex-gratia payments to its employees on retirement.

© The Institute of Chartered Accountants of India

(ii) Management decided to pay pension to those employees who have retired after completing

5 years of service in the organization. Such employees would receive a pension of ` 25,000

per month. Earlier there was no such scheme of pension in the organization.

(iii) Provision for doubtful Trade Receivables was created @2.5% till 31 st March, 2020. From

1st April,2020, the rate of provision has been changed to 5%

(iv) For the year ended 31 st March,2021 there was change in the cost formula in measuring the

cost of Inventories.

(v) Till the end of the previous year, Computers were depreciated on Straight Line Basis over a

period of 5 years. From current year, the useful life of Computers has been changed to 3

years.

(d) A Company dealing in software provides after sales warranty for 2 years to its customer. Based on

past experience, the company has been following policy for making provision for warranties on the

invoice amount, on the remaining balance warranty period:

Less than 1 year: 3% provision

More than 1 year: 4% provision

The company has raised invoices as under:

Invoice Date Amount (`)

19th January, 2019 1,20,000

29th January, 2020 75,000

15th October, 2020 2,70,000

You are required to calculate the provision to be made for warranty under Accounting Standard 29

as at 31 st March, 2020 and 31 st March, 2021. Also compute the amount to be debited to Profit and

Loss Account for the year ended 31 st March, 2021. (4 Parts x 5 Marks = 20 Marks)

2. A Limited and B Limited are carrying on business of same nature. On 31 st March, 2021 the information

given by both these companies is as follows:

A Ltd.(`) B Ltd.

(`)

Share Capital

- Equity Shares 10 each (Fully Paid) 12,00,000 7,20,000

- 10% Preference Shares of ` 100 each 6,00,000 -

- 8% Preference Shares of ` 100 each - 5,00,000

General Reserve 3,00,000 2,50,000

Investment Allowance Reserve - 60,000

Security Premium 2,40,000 -

Export Profit Reserve 1,80,000 1,20,000

Profit & Loss Account 2,16,000 1,92,000

9% Debentures (` 10 each) 3,00,000 2,00,000

Secured Loan - 3,60,000

Sundry Creditors 3,12,000 2,04,000

Bills Payable 75,000 1,00,000

Other Current Liabilities 50,000 75,000

Land and Building 10,80,000 8,40,000

Plant and Machinery 6,00,000 5,60,000

2

© The Institute of Chartered Accountants of India

Office Equipment 3,45,000 2,10,000

Investments 96,000 3,00,000

Stock in Trade 6,30,000 4,20,000

Sundry Debtors 4,90,000 3,20,000

Bills Receivables 60,000 70,000

Cash at Bank 1,72,000 61,000

A Limited take over B Limited on the above date, both companies agreeing on a scheme of

Amalgamation on the following terms:

(a) A Limited will issue 80,000 Equity Shares of ` 10 each at par to the Equity Shareholders of B

Limited.

(b) A Limited will issue 10% Preference Shares of ` 100 each to discharge the Preference

Shareholders of B Limited at 15% premium in such a way that the existing dividend quantum of the

preference shareholders of B Limited will not get affected. Accordingly, ` 5,00,000 pref. shares are

discharged at ` 5,75,000 (5,00,000X 115%) by issue of 4,000 preference shares of ` 100 each at

premium of ` 43.75 each.

(c) The Debentures of B Limited will be converted into equivalent number of Debentures of

A Limited.

(d) All the Bills Receivable of A Limited were accepted by B Limited.

(e) A contingent liability of B Limited amounting to ` 72,000 to be treated as actual liability in trade

payables.

(f) Expenses of Amalgamation amounted to ` 12,000 were borne by A Limited.

You are required to pass opening Journal Entries in the books of A Limited and prepare the opening

Balance Sheet of A Limited as on 1 st April, 2021 after amalgamation, assuming that the amalgamation

is in the nature of Merger. (20 Marks)

3. A and B and are partners of AB & Co., sharing Profit and Losses in the ratio of 4: 1 and B and C are

partners of BC & Co., sharing profits and losses in the ratio of 2: 1. On 31 st March,2021, they decided

to amalgamate and form a new firm namely M/s ABC & Co., wherein A, B and C would be partners

sharing profits and losses in the ratio of 3:2:1. The Balance Sheets of two firms on the above date are

as under:

Equity and Liabilities AB & Co. BC & Co. Assets AB & Co. BC & Co.

` ` ` `

Partners’ Capital Fixed assets:

accounts:

A 3,50,000 - Building 1,10,000 90,000

B 1,50,000 2,50,000 Plant &

C - 1,20,000 Machinery 1,80,000 1,34,000

Reserves 39,000 1,47,000 Furniture 24,000 26,000

Sundry creditors 90,000 1,15,000 Current assets:

Due to AB & Co. - 75,000 Stock-in-trade 80,000 1,00,000

Loan from Bank 50,000 Sundry debtors 1,40,000 1,80,000

Bank balance 45,000 1,65,000

Cash in hand 25,000 12,000

Due from BC &

© The Institute of Chartered Accountants of India

Co. 75,000 -

6,79,000 7,07,000 6,79,000 7,07,000

The amalgamated firm took over the business on the following terms:

(i) The assets and liabilities of AB & Co. and BC & Co. are to be valued as under:

Particulars AB & Co. ` BC & Co. `

Building No change 1,50,000

Plant & machinery 2,40,000 1,90,000

Stock-in trade to be appreciated by to be appreciated by

10 % 10%

Goodwill [Note (a)]–to 5 year’s purchase of 6 year’s purchase of

be valued super profit super profit

Provision for doubtful 14,000 30,000

debts to be created

Note the following:

(a) Goodwill should not appear in the books of ABC & Co. For the purpose of goodwill valuation,

actual profit to be considered are ` 1,20,000 and ` 81,600 for AB & Co. and BC & Co. and BC

& Co. respectively and normal rate of return for both firms is 18% per annum of Fixed Capital.

(b) All other assets and liabilities, appearing in the balance sheet of AB & Co. and BC & Co. are

taken over by ABC & Co. at book value just before amalgamation.

(c) An unrecorded liability of ` 15,300 of AB & Co. must also be taken over by ABC & Co. The sundry

creditors of AB & Co. do not include this unrecorded liability.

(ii) Partner of new firm will bring the necessary cash to pay other partners to adjust their capitals

according to the profit -sharing ratio.

You are required to prepare the Balance Sheet of new firm and capital accounts of the partners in the

books of old firms. Ignore taxation. (20 Marks)

4. Sun Ltd. acquired 3,200 ordinary shares of ` 100 each of Star Ltd. on 1st October, 2021. On 31st March,

2022, the balance sheets of the two companies were as given below:

Balance Sheet of Sun Ltd. and its subsidiary, Star Ltd.

as at 31 st March, 2022

Particulars Note No. Sun Ltd. (`) Star Ltd. (`)

I. Equity and Liabilities

(1) Shareholder's Funds

(a) Share Capital 1 10,00,000 4,00,000

(b) Reserves and Surplus 2 5,94,400 3,64,000

(2) Current Liabilities

(a) Trade Payables 94,200 34,800

(b) Short term borrowings 3 1,60,000 -

Total 18,48,600 7,98,800

II. Assets

(1) Non-current assets

(a) Property, Plant and Equipment 4 7,80,000 6,30,000

© The Institute of Chartered Accountants of India

(b) Non-current Investments 5 6,80,000

(2) Current assets

(a) Inventories 2,40,000 72,800

(b) Trade receivables 1,19,600 80,000

(c) Cash & Cash equivalents 6 29,000 16,000

Total 18,48,600 7,98,800

Notes to Accounts

Sun Ltd. Star Ltd..

` `

1 Share Capital

10,000 shares of ` 100 each, fully paid up 10,00,000

4,000 shares of ` 100 each, fully paid up 4,00,000

Total 10,00,000 4,00,000

2 Reserves and Surplus

General Reserves 4,80,000 2,00,000

Profit & loss 1,14,400 1,64,000

Total 5,94,400 3,64,000

3 Short term borrowings

Bank overdraft 1,60,000

4 Property plant and equipment

Land and building 3,00,000 3,60,000

Plant & Machinery 4,80,000 2,70,000

Total 7,80,000 6,30,000

5 Non-current Investments

Investment in Star Ltd. (at cost) 6,80,000

6 Cash & Cash equivalents

Cash 29,000 16,000

The Profit & Loss Account of Star Ltd. showed a credit balance of ` 60,000 on 1st April, 2021 out of

which a dividend of 10% was paid on 1 st November, 2021; Sun Ltd. credited the dividend received to its

Profit & Loss Account. The Plant & Machinery which stood at ` 3,00,000 on 1st April, 2021 was

considered as worth ` 3,60,000 on 1st October, 2021; this figure is to be considered while consolidating

the Balance Sheets. The rate of depreciation on plant & machinery is 10% (computed on the basis of

useful lives).

Prepare consolidated Balance Sheet as at 31 st March, 2022. (20 Marks)

5. (a) The following are the Capital funds of Shreya Bank (Commercial).

` in Crores

Paid up Equity Share Capital 950

Statutory Reserve 380

Share Premium 250

Capital Reserve (of which ` 26 Crores were due to Revaluation of Assets and 118

balance due to Sale of Capital Assets)

© The Institute of Chartered Accountants of India

Assets:

(a) Cash Balances with RBI 78

(b) Balance with other Banks 240

Other Investments 98

Loans and Advances:

(a) Guaranteed by the Government 600

(b) Granted to Staff of Bank, fully covered by Superannuation Benefits &

Mortgage. 800

(c) Other Loans & Advances. 6,000

Premises, Furniture & Fixtures 100

Intangible Assets 20

Off Balance Sheet Items:

(a) Guarantees and Other Obligations 1,000

(b) Acceptance, Endorsements and Letter of Credit 6,000

You are required to segregate the Capital Funds into Tier I and Tier II Capitals and also to find out

the Risk Adjusted Asset and Risk weighted Assets Ratio.

(b) Super Ltd. gives the following information as on 31st March, 2022.

Liabilities In `

Equity Shares of ` 10 each fully paid up 17,00,000

Revenue Reserve 23,50,000

Securities Premium 2,50,000

Profit & Loss Account 2,00,000

Infrastructure Development Reserve 1,50,000

9% Debentures 38,00,000

Unsecured Loan 8,50,000

Property, plant & equipment 58,50,000

Current Assets 34,50,000

Super Limited wants to buy back 35,000 equity shares of ` 10 each fully paid up on

1st April, 2022 at ` 30 per share.

Buy Back of shares is fully authorised by its articles and necessary resolutions have been passed

by the company towards this. The payment for buy back of shares will be made by the company

out of sufficient bank balance available as part of the Current Assets. Comment with calculations,

whether the Buy Back of shares by the company is within the provisions of the

Companies Act, 2013. (10 + 10 = 20 Marks)

6. Answer any four of the following:

(a) Jaya Ltd. took a machine on lease from Deluxe Ltd., the fair value being ` 11,50,000. Economic

life of the machine as well as lease term is 4 years. At the end of each year, lessee pays ` 3,50,000

to lessor. Jaya Ltd. has guaranteed a residual value of ` 70,000 on expiry of the lease to Deluxe

Ltd., however Deluxe Ltd. estimates that residual value will be only ` 25,000. The implicit rate of

return is 10% p.a. and present value factors at 10% are : 0.909, 0.826, 0.751 and 0.683 at the end

of 1st, 2nd, 3rd and 4th year respectively.

Calculate the value of machinery to be considered by Jaya Ltd. and the value of the lease liability

as per AS-19.

© The Institute of Chartered Accountants of India

(b) A liquidator is entitled to receive remuneration at 5% of the assets realized and 8% of the amount

distributed among the unsecured creditors. The assets realized ` 13,75,000. Payment was made

from realised amount as follows:

`

Liquidation expenses 13,000

Preferential creditors (treated as unsecured creditors) 88,500

Secured creditors 1,00,000

There are no unsecured creditors (other than preferential creditors who are treated as unsecured

creditors).

You are required to calculate remuneration payable to the liquidator.

(c) Explain the criterion of income recognition in the case of Non-Banking Financial Companies.

(d) For a banking company, bills for collection were amounting ` 21 lakhs as on 1st April, 2021. During

2021-22, bills received for collection amounted to ` 193.50 lakhs. Bills collected were ` 141 lakhs.

Bills dishonoured was ` 16.50 lakhs. Prepare Bills for Collection (Assets) and Bills for Collection

(Liabilities) Account.

(e) The following data is provided for M/s. Raj Construction Co.

(i) Contract Price - ` 85 lakhs

(ii) Materials issued - ` 21 Lakhs out of which Materials costing ` 4 Lakhs is still lying unused.at

the end of the period.

(iii) Labour Expenses for workers engaged at site - ` 16 Lakhs (out of which ` 1 Lakh is still

unpaid)

(iv) Specific Contract Costs = ` 5 Lakhs

(v) Sub-Contract Costs for work executed - ` 7 Lakhs, Advances paid to Suh-Contractors - ` 4

Lakhs

(vi) Further Cost estimated to be incurred to complete the contract - ` 35 Lakhs

You are required to compute the Percentage of Completion, the Contract Revenue and Cost to be

recognized as per AS-7.

(4 Parts x 5 Marks = 20 Marks)

© The Institute of Chartered Accountants of India

You might also like

- Solution Manual For Financial Statement Analysis and Valuation 2nd Edition by EastonDocument32 pagesSolution Manual For Financial Statement Analysis and Valuation 2nd Edition by EastonJenniferPalmerdqwf98% (45)

- Test Bank For Financial Accounting Theory and Analysis Text and Cases 11th Edition Schroeder, Clark, CatheyDocument15 pagesTest Bank For Financial Accounting Theory and Analysis Text and Cases 11th Edition Schroeder, Clark, Catheya150592788No ratings yet

- Practical Accounting 2Document16 pagesPractical Accounting 2Rowena NijNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- Test Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingDocument7 pagesTest Series: March 2022 Mock Test Paper 1 Intermediate: Group - Ii Paper - 5: Advanced AccountingShrwan SinghNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Mock Questions ICAiDocument7 pagesMock Questions ICAiPooja GalaNo ratings yet

- Test 4Document8 pagesTest 4govarthan1976No ratings yet

- 69587bos55533-P1.pdf 2Document46 pages69587bos55533-P1.pdf 2pittujb2002No ratings yet

- 71696bos57679 Inter p5qDocument8 pages71696bos57679 Inter p5qMayank RajputNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Banking QaDocument10 pagesBanking QaBijay AgrawalNo ratings yet

- Vidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54Document9 pagesVidya Sagar Career Institute Limited Mobile: 93514 - 68666 Phone: 7821821250 / 51 / 52 / 53 / 54shrenik bhuratNo ratings yet

- Test Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingDocument7 pagesTest Series: October, 2020 Mock Test Paper Intermediate (New) : Group - I Paper - 1: AccountingIndhuNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- Accounting New Syllabus Question PaperDocument7 pagesAccounting New Syllabus Question Paperpradhiba meenakshisundaramNo ratings yet

- 71859bos57825 Inter P5aDocument16 pages71859bos57825 Inter P5aVishnuNo ratings yet

- Class Test 1Document4 pagesClass Test 1vsy9926No ratings yet

- 1 2 3 4 5 6 7 8 MergedDocument78 pages1 2 3 4 5 6 7 8 MergedKartik GuptaNo ratings yet

- Test Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Paper 33Document6 pagesPaper 33AVS InfraNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Test Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: November, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingRajesh MondewadNo ratings yet

- Test - Section B - Corporate AccountingDocument3 pagesTest - Section B - Corporate AccountingNathoNo ratings yet

- Cash Flow Statement New For YoutubeDocument48 pagesCash Flow Statement New For YoutubeTapan BarikNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- MTP 2Document5 pagesMTP 2Arpit GuptaNo ratings yet

- © The Institute of Chartered Accountants of India: TH STDocument46 pages© The Institute of Chartered Accountants of India: TH STheikNo ratings yet

- 0 ScheduleDocument7 pages0 ScheduleKusuma MNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- AccountancyDocument32 pagesAccountancysunil kumarNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- Indian Accounting Standard 101Document19 pagesIndian Accounting Standard 101RITZ BROWNNo ratings yet

- Super 60 QuestionsDocument75 pagesSuper 60 Questionskaushikshivam291No ratings yet

- 63926bos51394finalold p1Document42 pages63926bos51394finalold p1marshadNo ratings yet

- Accounts QPDocument9 pagesAccounts QPHARSHIT DHANWANINo ratings yet

- CAFM FULL SYLLABUS FREE TEST DEC 23-Executive-RevisionDocument7 pagesCAFM FULL SYLLABUS FREE TEST DEC 23-Executive-Revisionyogeetha saiNo ratings yet

- Cma Question PaperDocument4 pagesCma Question PaperHilary GaureaNo ratings yet

- 2021 Business AccountingDocument5 pages2021 Business AccountingVISHESH 0009No ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- IMP 2225 Advance Accounts Prelims QUESTION PAPERDocument8 pagesIMP 2225 Advance Accounts Prelims QUESTION PAPERArnik AgarwalNo ratings yet

- Questions On AccountancyDocument34 pagesQuestions On AccountancyAshwin ChoudharyNo ratings yet

- RTP May 2018 New Gr1Document122 pagesRTP May 2018 New Gr1subhanvts7781No ratings yet

- TtryuiopDocument6 pagesTtryuiopNAVEENNo ratings yet

- Accounting MTP Question Series I 1676966561047406Document9 pagesAccounting MTP Question Series I 1676966561047406Tushar MittalNo ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- TH STDocument34 pagesTH STShivani KumariNo ratings yet

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Document4 pagesCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurNo ratings yet

- Adv Acc Q.P 2Document7 pagesAdv Acc Q.P 2Swetha ReddyNo ratings yet

- Paper 1Document180 pagesPaper 1Please Ok0% (1)

- Paper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaDocument24 pagesPaper - 1: Principles and Practice of Accounting: © The Institute of Chartered Accountants of IndiaVijayasri KumaravelNo ratings yet

- Corporate Finance and Capital BudgetingDocument3 pagesCorporate Finance and Capital BudgetingRAHUL kumarNo ratings yet

- Ma 2020Document8 pagesMa 2020Hamsa PNo ratings yet

- Questions On Net Profit Before Tax and Extraordinary ItemsDocument3 pagesQuestions On Net Profit Before Tax and Extraordinary ItemspuxvashuklaNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaRahul AgrawalNo ratings yet

- CA Inter Accounts RTP Nov23 Castudynotes ComDocument33 pagesCA Inter Accounts RTP Nov23 Castudynotes ComAbhishant KapahiNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Accounting Questions 27.04.2022Document5 pagesAccounting Questions 27.04.2022psree7281No ratings yet

- 73601bos59426 Inter p5qDocument7 pages73601bos59426 Inter p5qKali KhannaNo ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Advance Accountancy Inter PaperDocument14 pagesAdvance Accountancy Inter PaperAbhishek goyalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Cambridge International AS & A Level: Accounting 9706/32 March 2021Document19 pagesCambridge International AS & A Level: Accounting 9706/32 March 2021Ahmed NaserNo ratings yet

- Solution Manual For Advanced Accounting 4th Edition Jeter, ChaneyDocument7 pagesSolution Manual For Advanced Accounting 4th Edition Jeter, ChaneyAlif Nurjanah0% (2)

- WNC Investor Update - March 2015Document31 pagesWNC Investor Update - March 2015drk_999100% (1)

- Sample Question Paper Accountancy (055) : Class XII: 2017-18Document15 pagesSample Question Paper Accountancy (055) : Class XII: 2017-18AvinashNo ratings yet

- Module 6: What You Will LearnDocument30 pagesModule 6: What You Will Learn刘宝英No ratings yet

- Chapter 3 Business CombinationDocument9 pagesChapter 3 Business CombinationAnonymous XOv12G100% (1)

- Goodwill Valuation TestDocument14 pagesGoodwill Valuation TestAmritaNo ratings yet

- Unit: 2: Prepared By: Togadiya JigneshDocument24 pagesUnit: 2: Prepared By: Togadiya JigneshJignesh TogadiyaNo ratings yet

- 6 InvestmentsDocument219 pages6 InvestmentsKRISTINA DENISSE SAN JOSENo ratings yet

- Multiple Choice Problem (Dayag) Page 76 Items 2-6Document3 pagesMultiple Choice Problem (Dayag) Page 76 Items 2-6Cookies And CreamNo ratings yet

- Retirement AnswersDocument7 pagesRetirement AnswersshubhamsundraniNo ratings yet

- Afar 1stpb Exam-5.21Document7 pagesAfar 1stpb Exam-5.21NananananaNo ratings yet

- Buscom SPDocument16 pagesBuscom SPCatherine Joy Vasaya100% (1)

- Reconstitution of Partnership FirmDocument36 pagesReconstitution of Partnership FirmjdsiNo ratings yet

- Test Series - Test No. - 5. Advanced Accounting120413115441Document5 pagesTest Series - Test No. - 5. Advanced Accounting120413115441Kansal AbhishekNo ratings yet

- Accounting For Business CombinationsDocument13 pagesAccounting For Business CombinationsLu CasNo ratings yet

- Final PreboardDocument10 pagesFinal PreboardJan Victor AdanNo ratings yet

- Royal Bank of Scotland Research Report - ICBCDocument8 pagesRoyal Bank of Scotland Research Report - ICBCjkzhouNo ratings yet

- LVMH Consolidated Statements PDFDocument74 pagesLVMH Consolidated Statements PDFThomasNo ratings yet

- Assessed Coursework 2 - S2 2020 UpdateDocument7 pagesAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNo ratings yet

- Adv AFARDocument145 pagesAdv AFARDvcLouisNo ratings yet

- Solution:: M's Share Taken by R and S in Ratio of 1: 2Document57 pagesSolution:: M's Share Taken by R and S in Ratio of 1: 2meeraNo ratings yet

- Chapter 17 Answer Key-1Document4 pagesChapter 17 Answer Key-1NCTNo ratings yet

- FR MTP-1 May-24Document11 pagesFR MTP-1 May-24chandrakantchainani606No ratings yet

- Accounting, Organizations and Society. 5, No. 3, 263 - 283. 0Document21 pagesAccounting, Organizations and Society. 5, No. 3, 263 - 283. 0Jenalyn MenesesNo ratings yet

- Valuatio of Goodwill WS-1Document2 pagesValuatio of Goodwill WS-1Srishti SinghNo ratings yet

- M&a PpaDocument41 pagesM&a PpaAnna LinNo ratings yet