Professional Documents

Culture Documents

Reviwer Midterm

Reviwer Midterm

Uploaded by

Myrish Queen Anghag0 ratings0% found this document useful (0 votes)

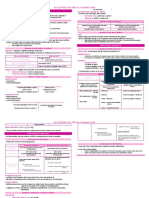

21 views2 pagesThis document covers topics related to partnership formation, operation, dissolution, and changes in membership. It discusses the different types of partnerships, how partnerships are formed, how profits and losses are allocated, how partnerships can be dissolved, and what considerations are involved when a partner retires or the partnership incorporates. The document is divided into three modules that cover partnership operation, dissolution, and retirement or withdrawal of a partner and incorporation of the partnership.

Original Description:

Original Title

reviwer midterm

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document covers topics related to partnership formation, operation, dissolution, and changes in membership. It discusses the different types of partnerships, how partnerships are formed, how profits and losses are allocated, how partnerships can be dissolved, and what considerations are involved when a partner retires or the partnership incorporates. The document is divided into three modules that cover partnership operation, dissolution, and retirement or withdrawal of a partner and incorporation of the partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

21 views2 pagesReviwer Midterm

Reviwer Midterm

Uploaded by

Myrish Queen AnghagThis document covers topics related to partnership formation, operation, dissolution, and changes in membership. It discusses the different types of partnerships, how partnerships are formed, how profits and losses are allocated, how partnerships can be dissolved, and what considerations are involved when a partner retires or the partnership incorporates. The document is divided into three modules that cover partnership operation, dissolution, and retirement or withdrawal of a partner and incorporation of the partnership.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Module 1 PARTNERSHIP: FORMATION, OPERATION,

AND CHANGES IN MEMBERSHIP MODULE 2 PARTNERSHIP OPERATION

Partnership Partnership law

A person In case of profit or loss

Common features of partnership Formula of ff. features technique

Requirements for partnership Equally, arbitrary, ratio of partnership

Content articles of partnership capital acc.

Partnership pros and cons Original capital

Partnership form org.: income tax reporting Average capital partnership agreement

Non-taxability of gpps Approach average capital balance (simple

Provisions on the civil code for law on partnership average and weighted average)

Regulation:article 1767-1867 of the civil code Interest on capital balances

Type of partnership Interest on capital acc. With resultant net

Nature contribution loss

Capitalist partner Personal services rendered in net income

Industrial partner and loss sharing agreement

Capital-industrial partner Salary allowances

Liabilities to third person Salary allowances with resultant net loss

General partner Bonuses

Limited partner Basis of computation for bonus

Types of partner interest in or obligations to Bonus with resultant net loss

business (managing, secret, silent, dormant, Special problems in allocation of profit and

ostensible) loss-salaries and interest as an expense

Types of partnership as liability of partners Correction of partnership net income of

Limited partnership prior period

General partnership Subsequent changes in methods to allocate

Types of partnership as to object net income or loss

Universal partnership of all present property

Universal partnership of profits

Particular partnership

Types of partnership as duration

Partnership at will

Partnership with a fixed term

Types of partnership as purpose

Commercial or trading partnership

Professional partnership

Recording capital contribution

Cash investment

Non-ash investment

Liabilities

Admission of an industrial partner

Partners account

Each partner can have: (capital account, drawing

account, loan account)

Numerous ways to form a partnership

Valuation problem

MODULE 3 RETIREMENT/WITHDRAWAL OF

MODULE 3 PARTNERSHIP DISSOLUTION PARTNERSHIP AND INCORPORATION OF

Partnership dissolution PARTNERSHIP

Partners cspital interest Before acctg. For partnership

Partners interest in p/l withdrawal or retirement, some

Partnership liquidation considerations shall include:

Partner dissolution comes in many Death of partner

forms: Incorporation of partnership

Civil code a partnership is dissolved

through:

Assignment of an interest does not

dissolve partnership

Basis of partnership

Partnership commonly deviate in gaap

through the following: MODULE 3 PARTNERSHIP DISSOLUTION:

Revaluation approach CHANGES IN OWNERSHIP

Bonus approach Admission by investment

Admission of new partner No bonus or revaluation (goodwill)

Before dissolving the partnership Bonus (absence of revaluation)

Admission by purchase of interest approach

Total agreed captl=book value of

previous partnership less any write down or

impairment

Revaluation (goodwill)approach

Total agreed captl=book value of

previous partnership plus unrecognized

appreciation/less unrecognized dept

traceable to prev. partnership plus

2 step in the process of analyzing

admission by investment

You might also like

- Partnership and Corporation AccountingDocument13 pagesPartnership and Corporation AccountingOrestes Mendoza91% (66)

- CAF 1 - Accounting For PartnershipDocument48 pagesCAF 1 - Accounting For PartnershipAhsan Kamran100% (1)

- Accspec 1Document2 pagesAccspec 1Aye ChavezNo ratings yet

- Mod 1 FullDocument42 pagesMod 1 FullZAIL JEFF ALDEA DALENo ratings yet

- Parcor ActgDocument7 pagesParcor Actgoneddd439No ratings yet

- PARTNERSHIPDocument7 pagesPARTNERSHIPoneddd439No ratings yet

- Accounting For Special TransactionsDocument13 pagesAccounting For Special Transactionsviva nazarenoNo ratings yet

- Bonus Method: Whose Liability Extends To His Separate PropertiesDocument6 pagesBonus Method: Whose Liability Extends To His Separate PropertiesRobert ApolinarNo ratings yet

- AFAR - Sir BradDocument36 pagesAFAR - Sir BradOliveros JaymarkNo ratings yet

- Chapter 3Document16 pagesChapter 3Les CariñoNo ratings yet

- Module 4 - Introduction To Partnership and Partnership FormationDocument14 pagesModule 4 - Introduction To Partnership and Partnership Formation1BSA5-ABM Espiritu, CharlesNo ratings yet

- Chapter 1Document3 pagesChapter 1Jemima FernandezNo ratings yet

- Notes AstDocument19 pagesNotes AstMaria DubloisNo ratings yet

- Level Up MIDTERMS AE111 112Document17 pagesLevel Up MIDTERMS AE111 112Jim ButuyanNo ratings yet

- Advacc BookDocument4 pagesAdvacc Book20220633No ratings yet

- AYB320 0122 Week1PartnershipsDocument24 pagesAYB320 0122 Week1PartnershipsLinh ĐanNo ratings yet

- Part II Partnerhsip Corporation FAR PDFDocument101 pagesPart II Partnerhsip Corporation FAR PDFMary Joy Albandia100% (1)

- Complete TheoryDocument28 pagesComplete TheoryGODSPEED. AltNo ratings yet

- Partnershi P Formation: (A Review) : Kim Nicole M. Reyes, Cpa, MBMDocument23 pagesPartnershi P Formation: (A Review) : Kim Nicole M. Reyes, Cpa, MBMHannahbea LindoNo ratings yet

- Part II Partnerhsip CorporationDocument101 pagesPart II Partnerhsip CorporationKhrestine ElejidoNo ratings yet

- Partnership Operation and FormatinDocument2 pagesPartnership Operation and FormatinJoshua AlvarezNo ratings yet

- Session 4 - Partnership AccountsDocument23 pagesSession 4 - Partnership AccountsFrederickNo ratings yet

- Module. Partnership AccountingDocument45 pagesModule. Partnership AccountingRonalie Alindugan100% (4)

- Partnership FormationDocument3 pagesPartnership FormationJasmin Abigail MoradasNo ratings yet

- Topic 7 - Partnership (R)Document38 pagesTopic 7 - Partnership (R)michael krueseiNo ratings yet

- AFAR 01 - Partnership AccountingDocument7 pagesAFAR 01 - Partnership AccountingcheoreciNo ratings yet

- Afar NotesDocument20 pagesAfar NotesChristian James Umali BrionesNo ratings yet

- PartnershipsDocument27 pagesPartnershipssamuel debebeNo ratings yet

- PartnershipDocument6 pagesPartnershipJoanne TolentinoNo ratings yet

- PDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdfDocument57 pagesPDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdflinkin soyNo ratings yet

- Partnership Study GuideDocument5 pagesPartnership Study GuidejtNo ratings yet

- Exercise chh7Document13 pagesExercise chh7Micah AluadNo ratings yet

- PArtDocument6 pagesPArtMay DabuNo ratings yet

- Chapter-15 Partnership Accounts PDFDocument20 pagesChapter-15 Partnership Accounts PDFTarushi Yadav , 51BNo ratings yet

- Chapter 2. Partnership Operations.Document15 pagesChapter 2. Partnership Operations.michaelasobrevega03No ratings yet

- p2 ReviewerDocument14 pagesp2 Reviewerirish solimanNo ratings yet

- Accounts Partnership ProjectDocument24 pagesAccounts Partnership ProjectastrobhavikNo ratings yet

- Basic Consideration and FormationDocument56 pagesBasic Consideration and FormationKristine Joy EbradoNo ratings yet

- Ent CH 10Document9 pagesEnt CH 10fahad BataviaNo ratings yet

- Partnership Accounting: Learning ObjectivesDocument31 pagesPartnership Accounting: Learning ObjectivesnuggsNo ratings yet

- Dayag Notes Partnership FormationDocument3 pagesDayag Notes Partnership FormationGirl Lang AkoNo ratings yet

- PARTNERSHIPDocument8 pagesPARTNERSHIPShayne BenaweNo ratings yet

- 1 - PDFsam - 01 Partnership Formation & Admission of A Partnerxx PDFDocument43 pages1 - PDFsam - 01 Partnership Formation & Admission of A Partnerxx PDFnash67% (3)

- 01a Partnership Formation & Admission of A PartnerxxDocument73 pages01a Partnership Formation & Admission of A PartnerxxAnaliza OndoyNo ratings yet

- Acc 9 TestbankDocument143 pagesAcc 9 TestbankPaula de Torres100% (2)

- Special TransactionsDocument3 pagesSpecial TransactionsTracy AguirreNo ratings yet

- Chapter 1 - PartnershipDocument19 pagesChapter 1 - PartnershipSri Renugha Kaliaasan100% (1)

- Partnership Formation and OperationDocument2 pagesPartnership Formation and OperationRyan Malanum AbrioNo ratings yet

- Practical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionDocument46 pagesPractical Accounting 2: Theory & Practice Advance Accounting Partnership - Formation & AdmissionKeith Anthony AmorNo ratings yet

- Partnership Act 1932Document5 pagesPartnership Act 1932Erfan KhanNo ratings yet

- Reviewer in Partnership PDF FreeDocument120 pagesReviewer in Partnership PDF Free잔잔No ratings yet

- Chapter 7 Partnership FormationDocument3 pagesChapter 7 Partnership FormationAngelica Joy ManaoisNo ratings yet

- Partnership OperationsDocument16 pagesPartnership OperationsobaldefrenchNo ratings yet

- Xparcoac Midterms ReviewerDocument11 pagesXparcoac Midterms ReviewerKristine dela CruzNo ratings yet

- Provisions of The Description of Partnership ActDocument4 pagesProvisions of The Description of Partnership ActSuptoNo ratings yet

- 4 - Change in Capital StructureDocument18 pages4 - Change in Capital Structurelou-924No ratings yet

- Subhash Dey's ACC XII Partnership Theory (1 Page)Document1 pageSubhash Dey's ACC XII Partnership Theory (1 Page)Darshpreet SinghNo ratings yet

- Surbana Jurong, SingaporeDocument3 pagesSurbana Jurong, SingaporeKS LeeNo ratings yet

- List-of-Drug-Manufacturing 1Document66 pagesList-of-Drug-Manufacturing 1Guru KrupaNo ratings yet

- Economic Environment Course Outline 2021-22 - PGP - 25Document4 pagesEconomic Environment Course Outline 2021-22 - PGP - 25Swati PorwalNo ratings yet

- Unit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Document23 pagesUnit 6: Value Added Tax (Proclamation 285/2002 Regulation 79/2002 Proclamation 609/2008)Bizu AtnafuNo ratings yet

- International EconomicsDocument7 pagesInternational EconomicsJohn WarrenNo ratings yet

- Group 3 Arevalo Balita Desamito Lopez PeñaDocument108 pagesGroup 3 Arevalo Balita Desamito Lopez PeñaSophia PeñaNo ratings yet

- Metal Recycling DPRDocument14 pagesMetal Recycling DPRAashish VermaNo ratings yet

- Case 1 Maranan & SantiagoDocument2 pagesCase 1 Maranan & SantiagoJere Mae MarananNo ratings yet

- Fisd 2 05.02.2021Document201 pagesFisd 2 05.02.2021srinivasNo ratings yet

- UntitledDocument32 pagesUntitledAswinNo ratings yet

- Pip Lord After The News Effect VenomDocument19 pagesPip Lord After The News Effect VenomFx ToolkitNo ratings yet

- Exchange Rate FluctuationDocument3 pagesExchange Rate FluctuationMd. Shakil Ahmed 1620890630No ratings yet

- Practice MC Questions CH 11Document3 pagesPractice MC Questions CH 11business docNo ratings yet

- Financial Institutions J Market and Services CIA 3Document18 pagesFinancial Institutions J Market and Services CIA 3Mansehaj SinghNo ratings yet

- Asb Proceedings 1998 Hochstein ADocument9 pagesAsb Proceedings 1998 Hochstein ANajwa FirdhaNo ratings yet

- Leo HistoryDocument14 pagesLeo HistoryJeamil Esthiff Terán ToledoNo ratings yet

- Economic Problems Ch.1 2024Document6 pagesEconomic Problems Ch.1 2024Muhammad AbdelazizNo ratings yet

- 5 Chapter Five - OwnershipDocument6 pages5 Chapter Five - OwnershipLixieNo ratings yet

- Socio-Economic in IndiaDocument33 pagesSocio-Economic in IndiaAshok Kumar100% (1)

- Project ReportDocument37 pagesProject ReportAshu SharmaNo ratings yet

- KORME Atyrau 2023Document1 pageKORME Atyrau 202364y27f4wwtNo ratings yet

- Cityfheps Verification of Eligibility: 1. Referral SourceDocument2 pagesCityfheps Verification of Eligibility: 1. Referral SourceAbc FghNo ratings yet

- 281 REVIEW 9 ConditionalsDocument7 pages281 REVIEW 9 ConditionalsNguyen Yen XuanNo ratings yet

- Natural Gas Prices and Charts - Data From QuandlDocument4 pagesNatural Gas Prices and Charts - Data From QuandlPrakarn KorkiatNo ratings yet

- Logistics Project ReportDocument62 pagesLogistics Project Reporttusharcwg79% (80)

- HaridwarDocument14 pagesHaridwarak9772595No ratings yet

- Work Flow For MSW Biomining (Kes)Document6 pagesWork Flow For MSW Biomining (Kes)girish krishnegowdaNo ratings yet

- MSME Development Programs in The PhilippinesDocument14 pagesMSME Development Programs in The PhilippinesMathilda Angela Denise ReyesNo ratings yet

- Chapter 8 - AgricultureDocument26 pagesChapter 8 - AgricultureGracias100% (1)

- 32 5 3 Social ScienceDocument23 pages32 5 3 Social SciencePriya SuriyakumarNo ratings yet