Professional Documents

Culture Documents

Miser Assignment 5

Miser Assignment 5

Uploaded by

Mariella Anne GloriaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Miser Assignment 5

Miser Assignment 5

Uploaded by

Mariella Anne GloriaCopyright:

Available Formats

Name: Mary Claire Y.

Miser

Section & Subject: BUS3 Governance, Business Ethics, Risk Management, and Internal Control

Class Schedule: 8am - 9am M/W/F

Teacher:Ruth Munieza

1. Will you comply with what the owner tells you to do? Why or why not?

No, I will not comply when the owner of the business asks me to do something unethical or illegal, in this issue

we face one of the most challenging dilemmas in our career. There are potential negative consequences for

speaking up, as well as for complying. It can feel like a lose situation but as an accounting staff for a sole

proprietorship business we should never comply with an illegal request. If the owner of the business asks me to do

something I know I shouldn't, I should first understand the facts, know my options, and consider the potential

outcomes before giving my response. This is my career, so I have to live with my choices for a lifetime. And

depending on the situation, it might adversely affect others' lives, too. So, I will make a way or solution on that. I

will send my boss an email restating the request. Hopefully at that point, any manager would see the poor choice

they're making. If the owner of the business is insistent, then I will record that in writing to the owner and explain

why I won't comply.

2. What will you say to the owner?

I will talk to the owner about the problem and seek advice. If he/she wants to achieve income tax reduction he/she

should do the right thing. Like invest in health insurance, claim deduction on your house rent allowance, claim

deduction on your home loan interest, contribute to charity and etc. There's a lot of way to reduce taxable income

of the business subject to income tax. As a business owner you should separate business and personal finances.

One of the simplest ways to get in tax trouble is having personal expenses recorded as business expenses. The

more on top of your business and personal tax records you are, the less likely that the internal revenue service will

find anything wrong with these records. Every business owner needs to pay taxes. While the exact amount you’ll

pay varies by state and business structure, taxes are one of the biggest costs associated with running a retail store.

Along with being one of the largest business expenses, taxes are one of the most important bills. Small business

owners that file their taxes late, inaccurately, or abandon them altogether face fines or in extreme cases, criminal

prosecution. Small business taxes aren’t as complex as you might think. A certified public accountant will help

you legally reduce your tax liability so you’re not left with a huge bill to pay at year end.

3. Will you report this to the authorities?

As long as the owner of the business listen to what I've said I will not report this to the authorities. But If he/she

do what he/she wants using illegal and unethical acts I will report it. Taxation is very important to the economy

that's why governments impose charges on their citizens and businesses as a means of raising revenue, which is

then used to meet their budgetary demands. This includes financing government and public projects as well as

making the business environment in the country conducive for economic growth. So, the owner should choose

wisely to what he/she acts.

4. 4. Is it right to justify unethical acts?

For me, unethical behavior cannot be justified. But someone can decide it is not unethical, hence no justification

is needed. Justification is argument that the behavior is, in fact, ethical. People justifying one's behavior can be a

defense mechanism for dealing with their actions or how their actions impacted and hurt other people.

Accountability is something easily prescribed to others but harder to swallow for yourself. It is, of course,

important to understand why people respond the way that they do.

You might also like

- Direct Deposit Info PDFDocument1 pageDirect Deposit Info PDFJustin hill100% (1)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Examples of Ethical DilemmasDocument6 pagesExamples of Ethical DilemmasAngelica PetronaNo ratings yet

- Piper Mike - Surprisingly SimpleDocument54 pagesPiper Mike - Surprisingly SimpleMoona Wahab100% (2)

- Unit II Applying Ethics in BusinessDocument2 pagesUnit II Applying Ethics in BusinessFirelight ZyNo ratings yet

- Notes On Sole ProprietorshipsDocument6 pagesNotes On Sole ProprietorshipsRavneet KaurNo ratings yet

- Bus. EthicsDocument11 pagesBus. EthicsRuby Joy Lopez100% (1)

- Work for Yourself: 20 Questions You Must Answer to Start Your Own BusinessFrom EverandWork for Yourself: 20 Questions You Must Answer to Start Your Own BusinessNo ratings yet

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- 1 Getting Started For Computer BusinessDocument11 pages1 Getting Started For Computer BusinessDawn VillanuevaNo ratings yet

- Don't Sue Me: What Business Owners Should Know About Hiring, Firing & Keeping EmployeesFrom EverandDon't Sue Me: What Business Owners Should Know About Hiring, Firing & Keeping EmployeesNo ratings yet

- Sole TradersDocument4 pagesSole TradersZain Ul AbideenNo ratings yet

- Business Adventures: A Beginner's Guide to Becoming a Pro In BusinessFrom EverandBusiness Adventures: A Beginner's Guide to Becoming a Pro In BusinessNo ratings yet

- Start Your Cleaning Business the Right WayFrom EverandStart Your Cleaning Business the Right WayRating: 2.5 out of 5 stars2.5/5 (2)

- Based On The Article, Identify The Ethical Issues and Discuss Why The Activities Are Alleged To BeDocument1 pageBased On The Article, Identify The Ethical Issues and Discuss Why The Activities Are Alleged To BeCaiti brownNo ratings yet

- The Seriously Lighthearted Guide to Basic Compliance for Small Businesses!: The Seriously Lighthearted Guide Series, #2From EverandThe Seriously Lighthearted Guide to Basic Compliance for Small Businesses!: The Seriously Lighthearted Guide Series, #2No ratings yet

- Dapat - Activity 1Document1 pageDapat - Activity 1Hymaries DapatNo ratings yet

- The Tax-Help Directory: A Do-It-Yourself Guide to Tax ResolutionFrom EverandThe Tax-Help Directory: A Do-It-Yourself Guide to Tax ResolutionNo ratings yet

- Sole ProprietorshipsDocument3 pagesSole ProprietorshipsMadhur KheraNo ratings yet

- Types of Ownership TextsDocument5 pagesTypes of Ownership TextsIana BurlacuNo ratings yet

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- Micro LendingDocument4 pagesMicro LendingKeith BalbinNo ratings yet

- ReactionPaper PDFDocument3 pagesReactionPaper PDFMyra DomingoNo ratings yet

- Bus. Ethics Module 2Document9 pagesBus. Ethics Module 2Dustin LabsanNo ratings yet

- What Is Business EthicsDocument4 pagesWhat Is Business Ethicsabegail capistranoNo ratings yet

- Unethical Behavior Unethical Behavior - It's Impact On Today's WorkplaceDocument15 pagesUnethical Behavior Unethical Behavior - It's Impact On Today's WorkplaceBernward MwakatunduNo ratings yet

- Reaction Paper of Corporation LawDocument4 pagesReaction Paper of Corporation LawBing Logagay PandyaNo ratings yet

- Unit Introduction To Accounting ReadingDocument2 pagesUnit Introduction To Accounting ReadingCorindan BiancaNo ratings yet

- Paint Professionally: How To Start A House Painting BusinessFrom EverandPaint Professionally: How To Start A House Painting BusinessRating: 1 out of 5 stars1/5 (1)

- Legal Underpinnings of Business LawDocument5 pagesLegal Underpinnings of Business Lawswtmelz209No ratings yet

- The 4 Major Business Organization FormsDocument6 pagesThe 4 Major Business Organization FormsReno EstrelonNo ratings yet

- How To Choose Business StructureDocument44 pagesHow To Choose Business Structureredg de guzmanNo ratings yet

- 1 Learn-Bookkeeping Pg81Document101 pages1 Learn-Bookkeeping Pg81Jose MendeeNo ratings yet

- Starting A Biz in Fairfax: Opening A Business Bank AccountDocument5 pagesStarting A Biz in Fairfax: Opening A Business Bank AccountDeepanshu SaxenaNo ratings yet

- Moneybags Series 101: Seven Important Tax Questions for a Business OwnerFrom EverandMoneybags Series 101: Seven Important Tax Questions for a Business OwnerRating: 5 out of 5 stars5/5 (1)

- Employee Warning Letter 02Document4 pagesEmployee Warning Letter 02Nguyễn Thế Phong100% (1)

- Business Ethics: Morally & ProfessionallyDocument3 pagesBusiness Ethics: Morally & ProfessionallyKristina Fe L. MagtibayNo ratings yet

- Success in Incorporating Small Businesses: (Twelve Cardinal Steps to Establish a Business in New York)From EverandSuccess in Incorporating Small Businesses: (Twelve Cardinal Steps to Establish a Business in New York)No ratings yet

- Disagreement With Employees: Legal ImplicationDocument2 pagesDisagreement With Employees: Legal Implicationshru sivaNo ratings yet

- Ethical Case in LawDocument2 pagesEthical Case in Lawmilfhunter80No ratings yet

- Unfair Dismissal and Personal GrievancesDocument9 pagesUnfair Dismissal and Personal Grievanceskuldeep6421No ratings yet

- Forms of Business Organization & Business StructureDocument38 pagesForms of Business Organization & Business Structuresamwel pascalNo ratings yet

- AF308 WK 05 Text 2020Document18 pagesAF308 WK 05 Text 2020Prisha NarayanNo ratings yet

- Ethics in Finance and AccountingDocument4 pagesEthics in Finance and AccountingAkumjungla AierNo ratings yet

- BookkeepingDocument93 pagesBookkeepingIc Abacan100% (4)

- Lesson 1Document12 pagesLesson 1riyaz878100% (2)

- Santillan, Kendrick M - BSBA3117Document2 pagesSantillan, Kendrick M - BSBA3117nenitaNo ratings yet

- Santillan, Kendrick M - BSBA3117Document2 pagesSantillan, Kendrick M - BSBA3117nenitaNo ratings yet

- Tax Problem Resolution Scam: How Some Tax Resolution Companies Steal Your Money!From EverandTax Problem Resolution Scam: How Some Tax Resolution Companies Steal Your Money!No ratings yet

- Accounting EnglishDocument17 pagesAccounting EnglishDiana Irimescu0% (1)

- Bus Ethics M2Document19 pagesBus Ethics M2Jennery Sortegosa PototNo ratings yet

- CRA Audit InfoDocument3 pagesCRA Audit InfoFairylake50No ratings yet

- Unit 1: Vocabulary: AKT 9 OctDocument3 pagesUnit 1: Vocabulary: AKT 9 OctPecinta bobaNo ratings yet

- Short Questions Dhrity RoyDocument6 pagesShort Questions Dhrity RoyRuslan AdibNo ratings yet

- Michael Assignment 5Document2 pagesMichael Assignment 5Mariella Anne GloriaNo ratings yet

- Short Activity GloriaDocument2 pagesShort Activity GloriaMariella Anne GloriaNo ratings yet

- Short Activity MiserDocument2 pagesShort Activity MiserMariella Anne GloriaNo ratings yet

- Ref 3Document7 pagesRef 3Mariella Anne GloriaNo ratings yet

- ABM12A Group 2 Chapter2 ReviewofRelatedLiteratureDocument17 pagesABM12A Group 2 Chapter2 ReviewofRelatedLiteratureMariella Anne GloriaNo ratings yet

- Revised Negotiable Instruments Law Annotated MPPDocument69 pagesRevised Negotiable Instruments Law Annotated MPPLyka Mae Palarca IrangNo ratings yet

- Acct Statement - XX2519 - 10022024Document1 pageAcct Statement - XX2519 - 10022024rashidfcrfinNo ratings yet

- 1 - Income Tax Introduction With Lecture NotesDocument14 pages1 - Income Tax Introduction With Lecture NotesdjNo ratings yet

- Foreign Contractor Tax (FCT) : Section A - Multiple Choice QuestionsDocument16 pagesForeign Contractor Tax (FCT) : Section A - Multiple Choice QuestionsWanda NguyenNo ratings yet

- Sap 9Th Bn. Sandhya Krishnagar Nadia Pay Slip Government of West BengalDocument1 pageSap 9Th Bn. Sandhya Krishnagar Nadia Pay Slip Government of West BengalSI Debasish MandalNo ratings yet

- Misc Remittance Request LetterDocument1 pageMisc Remittance Request LetterNaina ChaudharyNo ratings yet

- Baucar Bayaran - AinDocument7 pagesBaucar Bayaran - AinAienShafaainNo ratings yet

- Bustax Answer KeyDocument18 pagesBustax Answer KeyMarchelle CaelNo ratings yet

- Your Reliance Communications BillDocument2 pagesYour Reliance Communications BillbharathmathakiNo ratings yet

- Medicard PhilippinesDocument2 pagesMedicard PhilippinesNFNLNo ratings yet

- Vp°Ffiv 'Phf Lh° Hpμvπka°' 'F: Your DetailsDocument2 pagesVp°Ffiv 'Phf Lh° Hpμvπka°' 'F: Your DetailsSantosh MaliNo ratings yet

- BILLDocument1 pageBILLAswin MuraleedharanNo ratings yet

- Module 4 Estate Taxation 3Document4 pagesModule 4 Estate Taxation 3Melanie SamsonaNo ratings yet

- Invoice - 2023-09-25T133901.713Document5 pagesInvoice - 2023-09-25T133901.713Surendra PanwarNo ratings yet

- Price List - Ford New Endeavour - ICA Bhavna Ford: VariantsDocument1 pagePrice List - Ford New Endeavour - ICA Bhavna Ford: VariantsTanmay KhanolkarNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsRajNo ratings yet

- Sample - Chapter 5 - Problem 48 (Due 10.11.20)Document2 pagesSample - Chapter 5 - Problem 48 (Due 10.11.20)Tenaj KramNo ratings yet

- ITAD Ruling No. 198-00 (Rental Payments-Singapore)Document3 pagesITAD Ruling No. 198-00 (Rental Payments-Singapore)Joey SulteNo ratings yet

- Cost of Material Consumed Purchases of Stock in Trade Changes in Inventory Total Variable CostDocument4 pagesCost of Material Consumed Purchases of Stock in Trade Changes in Inventory Total Variable CostPrabhakaran RajenthiranNo ratings yet

- Presumptive - Taxation BriefDocument8 pagesPresumptive - Taxation BriefStephan KJNo ratings yet

- Attar Singh Gurmukh Singh. Vs ITO (SC)Document3 pagesAttar Singh Gurmukh Singh. Vs ITO (SC)pcbhandariNo ratings yet

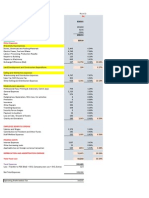

- Operating Cash Flow CalculatorDocument6 pagesOperating Cash Flow CalculatorGomv ConsNo ratings yet

- PDF Ambit Bill CompressDocument3 pagesPDF Ambit Bill CompressJim ShortNo ratings yet

- Sales Invoice SI 2021 22 784 289483Document1 pageSales Invoice SI 2021 22 784 289483NAVNEET CHOUDHURYNo ratings yet

- Taxation Topic 3Document29 pagesTaxation Topic 3Philip Gwadenya100% (2)

- Tos & Vos PDFDocument42 pagesTos & Vos PDFRatulNo ratings yet

- Payroll Summary For The Month of AugustDocument46 pagesPayroll Summary For The Month of AugustAida MohammedNo ratings yet

- Wire Transfer FAQs What Is A Wire TransferDocument1 pageWire Transfer FAQs What Is A Wire TransferAlejandro MardueñoNo ratings yet