Professional Documents

Culture Documents

Bonds

Bonds

Uploaded by

Tiso Blackstar Group0 ratings0% found this document useful (0 votes)

78 views3 pages031122 Bonds

Original Title

031122 Bonds

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document031122 Bonds

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

78 views3 pagesBonds

Bonds

Uploaded by

Tiso Blackstar Group031122 Bonds

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

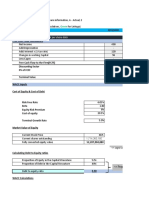

Markets and Commodity figures

03 November 2022

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 1,796 76.05 bn Rbn 72.38 142 38.26 bn Rbn 37.63

Week to Date 5,182 174.78 bn Rbn 164.25 1,128 189.41 bn Rbn 173.70

Month to Date 4,375 149.19 bn Rbn 140.37 940 156.68 bn Rbn 145.42

Year to Date 284,223 8,554.37 bn Rbn 8,164.97 59,765 11,117.59 bn Rbn 10,423.99

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 49 1.59 bn Rbn 1.56 15 4.05 bn Rbn 3.27

Current Day Sell 69 5.80 bn Rbn 5.43 15 5.72 bn Rbn 5.34

Net -20 -4.21 bn Rbn -3.86 -1.67 bn Rbn -2.07

Buy 282 13.59 bn Rbn 12.66 63 13.72 bn Rbn 11.45

Week to Date Sell 288 21.05 bn Rbn 18.91 59 17.45 bn Rbn 15.69

Net -6 -7.46 bn Rbn -6.25 4 -3.74 bn Rbn -4.24

Buy 237 10.67 bn Rbn 9.85 46 11.22 bn Rbn 9.33

Month to Date Sell 212 15.80 bn Rbn 14.42 37 11.82 bn Rbn 10.87

Net 25 -5.13 bn Rbn -4.57 9 -0.60 bn Rbn -1.54

Buy 14,348 971.44 bn Rbn 911.37 3,212 634.54 bn Rbn 557.33

Year to Date Sell 14,871 1,116.37 bn Rbn 1,037.03 3,933 1,114.41 bn Rbn 1,059.69

Net -523 -144.92 bn Rbn -125.66 -721 -479.87 bn Rbn -502.37

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 All Bond Index 10.408% 824.495

Top 20 Composite 826.980 0.51% 0.22%

GOVI ALBI20 Issuer 10.413%

Class Split - 812.722

GOVI 815.219 0.51% 0.10%

OTHI ALBI20 Issuer 10.345%

Class Split - 884.407

OTHI 886.414 0.47% 1.45%

CILI15 4.099%

Composite Inflation 326.267

Linked Index Top 15 322.876 3.30% 4.28%

ICOR 4.318%

CILI15 Issuer Class 409.234

Split - ICOR 411.162 0.00% 6.58%

IGOV 4.082%

CILI15 Issuer Class 322.910

Split - IGOV 319.316 3.45% 4.15%

ISOE 4.384%

CILI15 Issuer Class 354.599

Split - ISOE 354.528 1.51% 7.19%

MMI JSE Money Market Index

0 307.587 307.551 0.04% 4.19%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Aug 2025

AFRICA 9.970% 9.865% 8.33% 10.37%

R203 REPUBLIC OF SOUTH

Apr 2026

AFRICA 9.940% 9.835% 8.47% 10.42%

ES18 ESKOM HOLDINGSOctLIMITED

2026 9.475% 9.370% 7.54% 10.03%

R204 REPUBLIC OF SOUTH

Dec 2026

AFRICA 9.120% 9.015% 7.57% 9.52%

R207 REPUBLIC OF SOUTH

Nov 2027

AFRICA 11.420% 11.315% 9.47% 11.87%

R208 REPUBLIC OF SOUTH

Jan 2030

AFRICA 10.780% 10.705% 9.04% 11.09%

ES23 ESKOM HOLDINGSOctLIMITED

2030 12.340% 12.270% 10.63% 12.69%

DV23 DEVELOPMENT FebBANK

2031

OF SOUTHERN

11.135%AFRICA 11.065% 9.31% 11.41%

R2023 REPUBLIC OF SOUTH

Mar 2032

AFRICA 11.270% 11.195% 9.47% 11.52%

ES26 ESKOM HOLDINGSSepLIMITED

2033 12.585% 12.540% 10.84% 12.80%

R186 REPUBLIC OF SOUTH

Jul 2034

AFRICA 12.420% 12.375% 10.55% 12.64%

R2030 REPUBLIC OF SOUTH

Feb 2035

AFRICA 11.640% 11.595% 9.89% 11.87%

R213 REPUBLIC OF SOUTH

Mar 2036

AFRICA 11.645% 11.600% 9.89% 11.86%

R2032 REPUBLIC OF SOUTH

Jan 2037

AFRICA 11.785% 11.740% 10.08% 12.01%

ES33 ESKOM HOLDINGSJanLIMITED

2040 11.825% 11.800% 10.23% 12.05%

R209 REPUBLIC OF SOUTH

Oct 2040

AFRICA 12.880% 12.850% 11.42% 13.33%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 11.700% 11.670% 10.22% 11.97%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 12.760% 12.730% 11.29% 13.12%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 11.800% 11.750% 10.30% 12.07%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 11.700% 11.670% 10.22% 12.03%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.060% 6.060% 3.58% 6.08%

JIBAR1 JIBAR 1 Month 6.342% 6.325% 3.74% 6.34%

JIBAR3 JIBAR 3 Month 6.533% 6.517% 3.89% 6.53%

JIBAR6 JIBAR 6 Month 7.517% 7.475% 4.66% 7.52%

RSA 2 year retail bond 9.50% 0 0 0

RSA 3 year retail bond 10.00% 0 0 0

RSA 5 year retail bond 11.25% 0 0 0

RSA 3 year inflation linked retail

2.75%

bond 0 0 0

RSA 5 year inflation linked retail

3.00%

bond 0 0 0

RSA 10 year inflation linked retail

4.00%

bond 0 0 0

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- Solution Manual For Essentials of Investments 10th Edition by BodieDocument6 pagesSolution Manual For Essentials of Investments 10th Edition by BodieAnonymous kOrtXVfRNo ratings yet

- Open Letter To President Ramaphosa - FinalDocument3 pagesOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupNo ratings yet

- Derivatives Notes and Tutorial 2017Document16 pagesDerivatives Notes and Tutorial 2017Chantelle RamsayNo ratings yet

- Bonds - May 22 2022Document3 pagesBonds - May 22 2022Lisle Daverin BlythNo ratings yet

- Tesla Motors Expansion StrategyDocument26 pagesTesla Motors Expansion StrategyVu Nguyen75% (4)

- Bonds - November 14 2022Document3 pagesBonds - November 14 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 9 2022Document3 pagesBonds - December 9 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 16 2020Document3 pagesBonds - July 16 2020Lisle Daverin BlythNo ratings yet

- Bonds - April 3 2019Document3 pagesBonds - April 3 2019Tiso Blackstar GroupNo ratings yet

- Bonds - January 12 2022Document3 pagesBonds - January 12 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 1 2022Document3 pagesBonds - December 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 15 2022Document3 pagesBonds - November 15 2022Lisle Daverin BlythNo ratings yet

- Bonds - August 12 2021Document3 pagesBonds - August 12 2021Lisle Daverin BlythNo ratings yet

- Bonds - November 24 2022Document3 pagesBonds - November 24 2022Lisle BlythNo ratings yet

- Bonds - November 9 2022Document3 pagesBonds - November 9 2022Lisle BlythNo ratings yet

- Bonds - October 27 2022Document3 pagesBonds - October 27 2022Lisle BlythNo ratings yet

- Bonds - October 31 2022Document3 pagesBonds - October 31 2022Lisle BlythNo ratings yet

- Bonds - November 20 2022Document3 pagesBonds - November 20 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 5 2022Document3 pagesBonds - September 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - March 23 2022Document3 pagesBonds - March 23 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 4 2022Document3 pagesBonds - April 4 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 8 2022Document3 pagesBonds - November 8 2022Lisle BlythNo ratings yet

- Bonds - November 2 2022Document3 pagesBonds - November 2 2022Lisle BlythNo ratings yet

- Bonds - October 24 2022Document3 pagesBonds - October 24 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 11 2022Document3 pagesBonds - December 11 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 20 2022Document3 pagesBonds - September 20 2022Lisle Daverin BlythNo ratings yet

- Bonds - May 17 2021Document3 pagesBonds - May 17 2021Lisle Daverin BlythNo ratings yet

- Bonds - May 17 2022Document3 pagesBonds - May 17 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Bonds - March 15 2022Document3 pagesBonds - March 15 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 16 2022Document3 pagesBonds - November 16 2022Lisle BlythNo ratings yet

- Bonds - September 20 2021Document3 pagesBonds - September 20 2021Lisle Daverin BlythNo ratings yet

- Bonds - October 16 2022Document3 pagesBonds - October 16 2022Lisle BlythNo ratings yet

- Bonds - September 4 2022Document3 pagesBonds - September 4 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 4 2021Document3 pagesBonds - July 4 2021Lisle Daverin BlythNo ratings yet

- Bonds - May 18 2022Document3 pagesBonds - May 18 2022Lisle Daverin BlythNo ratings yet

- Bonds - March 18 2019Document3 pagesBonds - March 18 2019Tiso Blackstar GroupNo ratings yet

- Bonds - October 18 2022Document3 pagesBonds - October 18 2022Lisle Daverin BlythNo ratings yet

- Bonds - October 18 2020Document3 pagesBonds - October 18 2020Lisle Daverin BlythNo ratings yet

- Bonds - May 5 2021Document3 pagesBonds - May 5 2021Lisle Daverin BlythNo ratings yet

- Bonds - January 16 2022Document3 pagesBonds - January 16 2022Lisle Daverin BlythNo ratings yet

- Bonds - December 7 2021Document3 pagesBonds - December 7 2021Lisle Daverin BlythNo ratings yet

- Bonds - September 14 2022Document3 pagesBonds - September 14 2022Lisle Daverin Blyth100% (1)

- Bonds - September 27 2018Document3 pagesBonds - September 27 2018Tiso Blackstar GroupNo ratings yet

- Bonds - May 11 2020Document3 pagesBonds - May 11 2020Lisle Daverin BlythNo ratings yet

- Bonds - April 20 2022Document3 pagesBonds - April 20 2022Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - December 6 2022Document3 pagesBonds - December 6 2022Lisle Daverin BlythNo ratings yet

- Bonds - November 22 2022Document3 pagesBonds - November 22 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 13 2022Document3 pagesBonds - July 13 2022Lisle Daverin BlythNo ratings yet

- Bonds - July 28 2020Document3 pagesBonds - July 28 2020Lisle Daverin BlythNo ratings yet

- Bonds - July 4 2022Document3 pagesBonds - July 4 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 1 2022Document3 pagesBonds - September 1 2022Lisle Daverin BlythNo ratings yet

- Bonds - September 7 2022Document3 pagesBonds - September 7 2022Lisle Daverin BlythNo ratings yet

- Bonds - August 4 2017Document6 pagesBonds - August 4 2017Tiso Blackstar GroupNo ratings yet

- Bonds - May 31 2022Document3 pagesBonds - May 31 2022Lisle Daverin BlythNo ratings yet

- Bonds - August 9 2021Document3 pagesBonds - August 9 2021Lisle Daverin BlythNo ratings yet

- Bonds - December 7 2022Document3 pagesBonds - December 7 2022Lisle BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsLisle Daverin BlythNo ratings yet

- Bonds - September 6 2022Document3 pagesBonds - September 6 2022Lisle Daverin BlythNo ratings yet

- Bonds - April 13 2020Document3 pagesBonds - April 13 2020Lisle Daverin BlythNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Document2 pagesArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupNo ratings yet

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNo ratings yet

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNo ratings yet

- LibertyDocument1 pageLibertyTiso Blackstar GroupNo ratings yet

- Statement From The SA Tourism BoardDocument1 pageStatement From The SA Tourism BoardTiso Blackstar GroupNo ratings yet

- Anti Corruption Working GuideDocument44 pagesAnti Corruption Working GuideTiso Blackstar GroupNo ratings yet

- JP Verster's Letter To African PhoenixDocument2 pagesJP Verster's Letter To African PhoenixTiso Blackstar GroupNo ratings yet

- Bookmarks 2023 WinnersDocument4 pagesBookmarks 2023 WinnersTiso Blackstar GroupNo ratings yet

- Collective InsightDocument10 pagesCollective InsightTiso Blackstar GroupNo ratings yet

- BondsDocument3 pagesBondsTiso Blackstar GroupNo ratings yet

- Collective Insight September 2022Document14 pagesCollective Insight September 2022Tiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - June 1 2021Document2 pagesSanlam Stratus Funds - June 1 2021Lisle Daverin BlythNo ratings yet

- Tobacco Bill - Cabinet Approved VersionDocument41 pagesTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupNo ratings yet

- JudgmentDocument30 pagesJudgmentTiso Blackstar GroupNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- The ANC's New InfluencersDocument1 pageThe ANC's New InfluencersTiso Blackstar GroupNo ratings yet

- Forward Rates - June 28 2022Document2 pagesForward Rates - June 28 2022Tiso Blackstar GroupNo ratings yet

- Critical Skills List - Government GazetteDocument24 pagesCritical Skills List - Government GazetteTiso Blackstar GroupNo ratings yet

- Forward Rates - June 29 2022Document2 pagesForward Rates - June 29 2022Tiso Blackstar GroupNo ratings yet

- Forward Rates - June 30 2022Document2 pagesForward Rates - June 30 2022Tiso Blackstar GroupNo ratings yet

- Fuel Prices - June 30 2022Document1 pageFuel Prices - June 30 2022Tiso Blackstar GroupNo ratings yet

- Fuel Prices - June 28 2022Document1 pageFuel Prices - June 28 2022Tiso Blackstar GroupNo ratings yet

- Notes Cfa Fixed Income R42Document30 pagesNotes Cfa Fixed Income R42Ayah AkNo ratings yet

- Far/Ap Ocampo/Ocampo LCC-M Accrev and Refreshers Schedule August To December 2020Document2 pagesFar/Ap Ocampo/Ocampo LCC-M Accrev and Refreshers Schedule August To December 2020Andrei Nicole RiveraNo ratings yet

- Vivo Internship ReportDocument51 pagesVivo Internship Reportkavya kiruba100% (2)

- End Term Project: "Fundamental Analysis of Selected Securities of Indian Stock Market"Document73 pagesEnd Term Project: "Fundamental Analysis of Selected Securities of Indian Stock Market"bijegaonkarNo ratings yet

- Bba Unit IvDocument31 pagesBba Unit IvShubham PrasadNo ratings yet

- Statement of Cash Flows - StudentsDocument14 pagesStatement of Cash Flows - StudentsAyushi ThakkarNo ratings yet

- MAT112 (Assignment) Business Mathematics September 2019 - January 2019Document2 pagesMAT112 (Assignment) Business Mathematics September 2019 - January 2019syafiqahNo ratings yet

- Lots, Leverage and Margin - Forex4noobsDocument5 pagesLots, Leverage and Margin - Forex4noobsTesa MuhammadNo ratings yet

- Capital Budgeting SeatworkDocument5 pagesCapital Budgeting SeatworkJOHN RYAN JINGCONo ratings yet

- BUS 5110 Managerial Accounting - Written Assignment Unit 7Document7 pagesBUS 5110 Managerial Accounting - Written Assignment Unit 7LaVida LocaNo ratings yet

- TV18 BroadcastDocument30 pagesTV18 Broadcastrishabh jainNo ratings yet

- 2002 September - Steve Thomas - Regulation in A Deregulated Energy Market British ExperienceDocument15 pages2002 September - Steve Thomas - Regulation in A Deregulated Energy Market British ExperienceSusanne Namer-WaldenstromNo ratings yet

- Ratio Table - ACCT 3BDocument10 pagesRatio Table - ACCT 3BHoàng Minh ChuNo ratings yet

- She Sample ExercisesDocument12 pagesShe Sample ExercisesKii-anne FernandezNo ratings yet

- Chapter 5 - Multiple Choice ProblemsDocument22 pagesChapter 5 - Multiple Choice Problemssol lunaNo ratings yet

- Case 3 Chemalite Inc Cash FlowDocument3 pagesCase 3 Chemalite Inc Cash Flowmohiyuddinsakhib3260No ratings yet

- To Invest in The Multibagger Parag Milk PDFDocument3 pagesTo Invest in The Multibagger Parag Milk PDFChetan PanchamiaNo ratings yet

- SYLL422 Fall 2019 Section 001Document4 pagesSYLL422 Fall 2019 Section 001millieNo ratings yet

- Dell's Working CapitalDocument16 pagesDell's Working CapitalMuhammad MBA65No ratings yet

- 2019legislation - Revised Corporation Code Comparative MatrixDocument176 pages2019legislation - Revised Corporation Code Comparative Matrixkenshin sclanimirNo ratings yet

- Forwards and FuturesDocument49 pagesForwards and FuturesPragya JainNo ratings yet

- Goodwill Calculation ExercisesDocument12 pagesGoodwill Calculation ExercisesHafiz AdeNo ratings yet

- Activity 7 - Equity InvestmentsDocument1 pageActivity 7 - Equity InvestmentsMa. Alexandra Teddy BuenNo ratings yet

- Jul 16 Exam Adv Inv + AnswDocument8 pagesJul 16 Exam Adv Inv + AnswTina ChanNo ratings yet

- Retnavilasam Gopinathan Nair Jishnu: Kalyan Jewellers India LimitedDocument1 pageRetnavilasam Gopinathan Nair Jishnu: Kalyan Jewellers India LimitedUmang AgrawalNo ratings yet

- Chapter 3 International Financial Markets MCQ PDFDocument3 pagesChapter 3 International Financial Markets MCQ PDFtsamrotulj3No ratings yet

- FM Unit 1Document34 pagesFM Unit 1Vïñü MNNo ratings yet