Professional Documents

Culture Documents

Activity 3

Activity 3

Uploaded by

Dela Cruz, Crystal Jane OsorioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity 3

Activity 3

Uploaded by

Dela Cruz, Crystal Jane OsorioCopyright:

Available Formats

The Enron scandal involves four fraudsters: Kenneth Lay, Founder of Enron, Jeffrey Skilling, CEO,

Andrew Fastow, Former CFO, and Kenneth Rice, Former Broadband Unit CEO. Kenneth Lay started Enron

in 1985 by combining Houston Natural Gas and InterNorth Inc. Kenny Boy started the Valhalla Scandal in

1987. Two oil dealers bet heavily on the company by funding false accounts. Lay didn't make any

changes or fire the two traitors because he said they were helping the firm. Ken Lay claimed astonished

when the two traitors were convicted, saying he didn't know about their gambling and larceny. After the

incident, Lay named Jeffery Skilling CEO and became Chairman. Lay's biggest asset was Jeffrey Skilling.

Mark-to-Market Accounting led the corporation to falsely earn billions. He used this strategy to hide

trading losses and other firm operations. The MTM disguised losses and made the company appear

more lucrative. With the support of former CFO Andrew Fastow, he worked with other top officials to

mask Enron's failing finances, especially when he helped set up off-books partnerships to avoid declaring

losses. He also defrauded Enron through partnerships. Kenneth Rice lied with others about the

company's software progress. In the end, the company's fraudsters were convicted of securities,

conspiracy, bank, insider trading, and wire fraud. I would also like to mention Lou Pai. He was the CEO of

an Enron subsidiary and left the company with hundreds of millions of dollars, while his business division

lost a billion dollars.

In the Enron case, the employees were the first source of ethical issues. As we talked about in

the third part, Enron's culture led to many bad things and helped the company commit fraud and go

bankrupt. Enron had competitive environments and high standards for judging employee performance.

Aside from that, Enron only cared about making money. If Enron gave their workers more job stability,

they might be less likely to cheat at work. Also, if companies cared about their employees and other

stakeholders, they couldn't make as many decisions as they do. Because of this, businesses should work

to create a healthy corporate culture. Second, everyone at Enron is only interested in making money. It's

good that they were thinking about how to make their business more profitable, but it's bad that they

didn't handle it well. They only cared about making money by making good financial numbers, not about

what the company was really worth. Another thing is that they forget about their employees, their

needs, wants, etc., because they only care about making more money. This is some of what the Enron

Company brought and talked about. It's a wake-up call for people in business that ethical values are

important or necessary in an organization. This will help you make better decisions about how to make

your business profitable.

To combat fraud, companies must design and maintain a corporate governance system. Access

to bank account records, inventories, expense reimbursements, overtime, writing checks, accounting,

and payroll, as well as reviewing audit logs to make sure records are accurate, are all examples.

Employees who take part in the company's scams must know how to spot signs of fraud, how to stop it,

and how to keep track of their peers' and customers' odd behavior. If they have a way to track someone

without anyone knowing, they can tell their bosses about a coworker. Companies must have individuals

to take care of these tasks, keep cash and accounting tasks separate, or hire someone else to do them

through a virtual CFO partnership. These are things the company is doing to stop fraud.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ReflectiveEssay Option3 DelaCruz 128Document3 pagesReflectiveEssay Option3 DelaCruz 128Dela Cruz, Crystal Jane OsorioNo ratings yet

- Activity 4Document1 pageActivity 4Dela Cruz, Crystal Jane OsorioNo ratings yet

- Rflection PaperDocument3 pagesRflection PaperDela Cruz, Crystal Jane OsorioNo ratings yet

- Titles For ResearchDocument1 pageTitles For ResearchDela Cruz, Crystal Jane OsorioNo ratings yet

- Team - Ferris - BUSN460 - Final PaperDocument15 pagesTeam - Ferris - BUSN460 - Final PapermarcusNo ratings yet

- Middle East ContractorsDocument8 pagesMiddle East ContractorsDeepak Nair100% (1)

- Corporate Finance ProjectDocument6 pagesCorporate Finance ProjectInsha GhafoorNo ratings yet

- Trial - Intro To Accounting Ch. 2 (12th Ed)Document5 pagesTrial - Intro To Accounting Ch. 2 (12th Ed)Bambang HasmaraningtyasNo ratings yet

- GSECL TenderDocument116 pagesGSECL TenderUBPL mktgNo ratings yet

- Actrel™ 3356 L: Hydrocarbon FluidDocument1 pageActrel™ 3356 L: Hydrocarbon FluidFirdausNo ratings yet

- Bdo Vs YpilDocument2 pagesBdo Vs YpilCE SherNo ratings yet

- FAR 4202 Discontinued Operation NCA Held For SaleDocument4 pagesFAR 4202 Discontinued Operation NCA Held For SaleMaximusNo ratings yet

- Cif Palm Kernel ShellDocument14 pagesCif Palm Kernel ShellPanwascam PurwoharjoNo ratings yet

- Assessment Point Essay 2 - R1508D933901Document14 pagesAssessment Point Essay 2 - R1508D933901Rue Spargo ChikwakwataNo ratings yet

- Decision MakingDocument29 pagesDecision MakingSiti Azizah - FAPETNo ratings yet

- CasestudyzoomDocument3 pagesCasestudyzoomaditya khandelwalNo ratings yet

- Haas Mill Operators Manual NGC EnglishDocument458 pagesHaas Mill Operators Manual NGC EnglishVijayKumarNo ratings yet

- Teresita Gandiongco Oledan For Petitioner. Acaban & Sabado For Private RespondentDocument3 pagesTeresita Gandiongco Oledan For Petitioner. Acaban & Sabado For Private Respondentwenny capplemanNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument23 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsFery AnnNo ratings yet

- Clean Air ActDocument31 pagesClean Air ActJulienne Mae Valmonte MapaNo ratings yet

- Revenue Regulations No. 02-40Document46 pagesRevenue Regulations No. 02-40zelayneNo ratings yet

- Resource 1 - IndoAust Jaya - CRM Project BriefDocument25 pagesResource 1 - IndoAust Jaya - CRM Project BriefRahmi Can ÖzmenNo ratings yet

- Gbm-Balaji Mba College - KadapaDocument172 pagesGbm-Balaji Mba College - KadapaMounishaNo ratings yet

- Implementing Information Security System: Prof. Georgette Carpio-Balajadia, Cpa, PHDDocument33 pagesImplementing Information Security System: Prof. Georgette Carpio-Balajadia, Cpa, PHDMike AntolinoNo ratings yet

- Letter of Termination Contract: Subject: ( (Subject) )Document3 pagesLetter of Termination Contract: Subject: ( (Subject) )Duyen NguyenNo ratings yet

- Warlock Lair #09 - The Returners' TowerDocument7 pagesWarlock Lair #09 - The Returners' TowerAllysonNo ratings yet

- FM Assignment 4 - Group 4Document6 pagesFM Assignment 4 - Group 4Puspita RamadhaniaNo ratings yet

- Asif Ahmed Ayon 1712987630 - Human Resource Management - Alternative Individual AssessmentDocument9 pagesAsif Ahmed Ayon 1712987630 - Human Resource Management - Alternative Individual AssessmentValak100% (1)

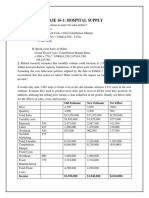

- Case 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Document6 pagesCase 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Lalit SapkaleNo ratings yet

- NandithaDocument15 pagesNandithasajijasmyNo ratings yet

- Chapter 3 - Good Governance and Code of EthicsDocument31 pagesChapter 3 - Good Governance and Code of Ethicscj.terragoNo ratings yet

- Notre Dame Vs LaguesmaDocument2 pagesNotre Dame Vs LaguesmaClarence ProtacioNo ratings yet

- Chapter 14 QuizDocument7 pagesChapter 14 QuizSherri BonquinNo ratings yet

- Quote: Bill ToDocument2 pagesQuote: Bill ToaceroadmarkingNo ratings yet