Professional Documents

Culture Documents

The Effects of TRAIN Law To The Philippine Economy

The Effects of TRAIN Law To The Philippine Economy

Uploaded by

Ivanhoe BalaroteCopyright:

Available Formats

You might also like

- ZICA T5 - TaxationDocument521 pagesZICA T5 - TaxationMongu Rice95% (42)

- Chapter 1 Ethical Dimension of Human ExistenceDocument9 pagesChapter 1 Ethical Dimension of Human ExistenceJayjo Segundo100% (1)

- What Is TRAIN Law and Its PurposeDocument6 pagesWhat Is TRAIN Law and Its PurposeNica BastiNo ratings yet

- Deasis - Educational Planning at The National and Sub-National LevelsDocument32 pagesDeasis - Educational Planning at The National and Sub-National LevelsRuben70% (10)

- Lawsuit Filed On Behalf of Woman Critically Hurt at Wheaton Railroad CrossingDocument23 pagesLawsuit Filed On Behalf of Woman Critically Hurt at Wheaton Railroad CrossingShannon Margaret BlumNo ratings yet

- Sample Letter To The PresidentDocument1 pageSample Letter To The PresidentHryyyy100% (4)

- 1997 Tax Code Tax Reform Rates: Adjustments in The Personal Income TaxationDocument12 pages1997 Tax Code Tax Reform Rates: Adjustments in The Personal Income TaxationQuendrick SurbanNo ratings yet

- Critical Review Paper On Tax - LucarezaDocument4 pagesCritical Review Paper On Tax - LucarezaAngel LucarezaNo ratings yet

- Ranie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Document2 pagesRanie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Ranie MonteclaroNo ratings yet

- Ranie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Document2 pagesRanie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Ranie MonteclaroNo ratings yet

- Spee ComDocument13 pagesSpee ComIrvin LimNo ratings yet

- TAXATIONDocument2 pagesTAXATIONleah may sorenoNo ratings yet

- Taxation Theory 1 CanonsDocument6 pagesTaxation Theory 1 Canonsmarvadomarvellous67No ratings yet

- Analysis and Reaction To Train LawDocument4 pagesAnalysis and Reaction To Train LawandengNo ratings yet

- Tax101 Alonzo CasesummaryDocument5 pagesTax101 Alonzo CasesummaryLauren Nicole AlonzoNo ratings yet

- The Cry of Balintawak or Pugad LawinDocument6 pagesThe Cry of Balintawak or Pugad LawinMiguel VienesNo ratings yet

- Erica Joy Cabasag Batalla Bsba-Fm-3CDocument3 pagesErica Joy Cabasag Batalla Bsba-Fm-3CElimar BatallaNo ratings yet

- Concept Paper: "Train Law"Document3 pagesConcept Paper: "Train Law"Landersol De Vera CrisostomoNo ratings yet

- Train LawDocument10 pagesTrain LawkimNo ratings yet

- Tax Reform For Acceleration & Inclusion: University of Northern PhilippinesDocument4 pagesTax Reform For Acceleration & Inclusion: University of Northern PhilippinesDiana PobladorNo ratings yet

- Buque - Prelim Exam-Income TaxationDocument3 pagesBuque - Prelim Exam-Income TaxationVillanueva, Jane G.No ratings yet

- Forming A Policy For Tax Reform: by Thomas H. Spitters, CPADocument5 pagesForming A Policy For Tax Reform: by Thomas H. Spitters, CPAThomas H. SpittersNo ratings yet

- Tax Paper Public FinanceDocument13 pagesTax Paper Public FinanceFabrice GadeauNo ratings yet

- An Economic Impact Analysis On Tax Reform For Acceleration and Inclusion or Train BillDocument6 pagesAn Economic Impact Analysis On Tax Reform For Acceleration and Inclusion or Train BillZarina BartolayNo ratings yet

- Train Law RecommendationDocument10 pagesTrain Law RecommendationMaria Angelica PanongNo ratings yet

- Budget 6Document4 pagesBudget 6Atul SinghNo ratings yet

- Finance Compiled FinalDocument21 pagesFinance Compiled Finaljadyn nicholasNo ratings yet

- My Canons of TaxationDocument3 pagesMy Canons of Taxationmarvadomarvellous67No ratings yet

- Metro Manila (CNN Philippines) - Poor and Middle-Class Filipinos CouldDocument13 pagesMetro Manila (CNN Philippines) - Poor and Middle-Class Filipinos CouldMayAnn SisonNo ratings yet

- Train Law in The Final AnalysisDocument3 pagesTrain Law in The Final AnalysisMarianne SasingNo ratings yet

- RP - Ta2019Document2 pagesRP - Ta2019Alaine DobleNo ratings yet

- Train LawDocument11 pagesTrain LawKurtlyn Ann Oliquino100% (2)

- Train LawDocument5 pagesTrain LawKyrell MaeNo ratings yet

- Taxation JunaDocument551 pagesTaxation JunaJuna DafaNo ratings yet

- Notes 1 & 2Document8 pagesNotes 1 & 2babuaditya1998No ratings yet

- Explain The Effect of Taxation On: A, ProductionDocument10 pagesExplain The Effect of Taxation On: A, ProductionTony LithimbiNo ratings yet

- Tax-Cutting Front of 2015Document2 pagesTax-Cutting Front of 2015Novie Marie Balbin AnitNo ratings yet

- Policy Analysis - Train LawDocument6 pagesPolicy Analysis - Train LawJoyce GemNo ratings yet

- Economics Year 11 Wk1Document4 pagesEconomics Year 11 Wk1Miracle JosiahNo ratings yet

- Relevance of Taxation1Document10 pagesRelevance of Taxation1einol padalNo ratings yet

- Tax Reform For Acceleration and Inclusion: TrainDocument5 pagesTax Reform For Acceleration and Inclusion: TrainEla Gloria MolarNo ratings yet

- Critic TRAINDocument5 pagesCritic TRAINWeddanever CornelNo ratings yet

- HOMEWORK No. 1 - The Three Goals of TaxationDocument2 pagesHOMEWORK No. 1 - The Three Goals of TaxationJoven MendozaNo ratings yet

- 1.characteristics of Taxes 2.classification of Taxes 3.roles of Taxation 4.principles of TaxationDocument10 pages1.characteristics of Taxes 2.classification of Taxes 3.roles of Taxation 4.principles of TaxationMugwanya AsadNo ratings yet

- TAXATIONDocument17 pagesTAXATIONLamaire Abalos BatoyogNo ratings yet

- Tax Reform For Acceleration and Inclusion: I. Lowering Personal Income Tax (PIT)Document8 pagesTax Reform For Acceleration and Inclusion: I. Lowering Personal Income Tax (PIT)ZeroNo ratings yet

- What Is The RGSTDocument7 pagesWhat Is The RGSTWaqas YousafNo ratings yet

- CHP 3 Pad370 MDM SarehanDocument8 pagesCHP 3 Pad370 MDM SarehanPaikuna sumoNo ratings yet

- Value Added Tax and EVATDocument2 pagesValue Added Tax and EVATImperator FuriosaNo ratings yet

- Chapter-1: What Is GST Definition of Goods & Services TaxDocument46 pagesChapter-1: What Is GST Definition of Goods & Services TaxSalman RazaNo ratings yet

- Co3 TaxationDocument2 pagesCo3 TaxationChristian Gabriel TondagNo ratings yet

- LAW 323-Tax Law-Asim Zulfiqar-Akhtar AliDocument7 pagesLAW 323-Tax Law-Asim Zulfiqar-Akhtar AliWajahat GhafoorNo ratings yet

- University of Rwanda Huye Campus Principle of Taxation Cat Marketing Departiment MPIRANYA Jean Marie Vianney REG NUMBER: 220009329Document5 pagesUniversity of Rwanda Huye Campus Principle of Taxation Cat Marketing Departiment MPIRANYA Jean Marie Vianney REG NUMBER: 220009329gatete samNo ratings yet

- University of Rwanda Huye Campus Principle of Taxation Cat Marketing Departiment MPIRANYA Jean Marie Vianney REG NUMBER: 220009329Document5 pagesUniversity of Rwanda Huye Campus Principle of Taxation Cat Marketing Departiment MPIRANYA Jean Marie Vianney REG NUMBER: 220009329gatete samNo ratings yet

- Income of All FilipinosDocument1 pageIncome of All FilipinosEmer MartinNo ratings yet

- Lowering Personal Income Tax (PIT) : Tax Reform For Acceleration and InclusionDocument4 pagesLowering Personal Income Tax (PIT) : Tax Reform For Acceleration and InclusionChristine Joy RamirezNo ratings yet

- BtaxDocument2 pagesBtaxcristine albanoNo ratings yet

- Escaping True Tax Liability of The Government Amidst PandemicsDocument7 pagesEscaping True Tax Liability of The Government Amidst PandemicsMaria Carla Roan AbelindeNo ratings yet

- Train Law NotesDocument9 pagesTrain Law NotesMa Angeli Gomez100% (1)

- The Value Added TaxDocument5 pagesThe Value Added TaxCherry Marquez-de DiosNo ratings yet

- Contemporary Economic Issues Affecting The Filipino EntrepreneurDocument8 pagesContemporary Economic Issues Affecting The Filipino EntrepreneurLouiseNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

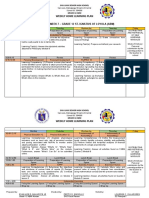

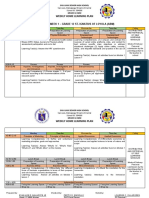

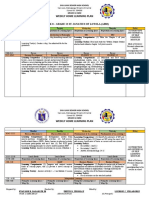

- WHLP-Q2W7 12abmDocument2 pagesWHLP-Q2W7 12abmIvanhoe BalaroteNo ratings yet

- WHLP-Q4W2 12abmDocument2 pagesWHLP-Q4W2 12abmIvanhoe BalaroteNo ratings yet

- Gr8math Q1W1&W2 - LasDocument23 pagesGr8math Q1W1&W2 - LasIvanhoe BalaroteNo ratings yet

- WHLP-Q1W6 12abmDocument2 pagesWHLP-Q1W6 12abmIvanhoe BalaroteNo ratings yet

- WHLP-Q2W5 12abmDocument2 pagesWHLP-Q2W5 12abmIvanhoe BalaroteNo ratings yet

- WHLP-Q3W1 12abmDocument2 pagesWHLP-Q3W1 12abmIvanhoe BalaroteNo ratings yet

- WHLP-Q4W7 12abmDocument2 pagesWHLP-Q4W7 12abmIvanhoe BalaroteNo ratings yet

- Gr9math Q1W1 - LasDocument22 pagesGr9math Q1W1 - LasIvanhoe BalaroteNo ratings yet

- WHLP-Q1W8 12abmDocument2 pagesWHLP-Q1W8 12abmIvanhoe BalaroteNo ratings yet

- Gr7math Q1W1 - LasDocument17 pagesGr7math Q1W1 - LasIvanhoe BalaroteNo ratings yet

- SHS CoverDocument1 pageSHS CoverIvanhoe BalaroteNo ratings yet

- Medieval and Renaissance Mathematics: BY: Tajana Novak, Andrea Gudelj, Srđana Obradović, Mirna Marković April, 2013Document12 pagesMedieval and Renaissance Mathematics: BY: Tajana Novak, Andrea Gudelj, Srđana Obradović, Mirna Marković April, 2013Ivanhoe BalaroteNo ratings yet

- Module 5 Study NotebookDocument6 pagesModule 5 Study NotebookIvanhoe BalaroteNo ratings yet

- Weekly Home Learning Plan: Quarter 2 Week 6 - Grade 12 St. Ignatius of Loyola (Abm)Document2 pagesWeekly Home Learning Plan: Quarter 2 Week 6 - Grade 12 St. Ignatius of Loyola (Abm)Ivanhoe BalaroteNo ratings yet

- Shopee-WPS OfficeDocument11 pagesShopee-WPS OfficeIvanhoe BalaroteNo ratings yet

- Weekly Home Learning Plan: Q1 Week 5 - Grade 12 St. Ignatius of Loyola (Abm)Document2 pagesWeekly Home Learning Plan: Q1 Week 5 - Grade 12 St. Ignatius of Loyola (Abm)Ivanhoe BalaroteNo ratings yet

- Rosie G. Tan, PH.D.: Department of Mathematics EducationDocument16 pagesRosie G. Tan, PH.D.: Department of Mathematics EducationIvanhoe BalaroteNo ratings yet

- Commitment CertificateDocument1 pageCommitment CertificateIvanhoe BalaroteNo ratings yet

- (FINAL) Business - Ethics - Q3 - Mod1 - The - Role - of - Business - in - Social - and - Economic - Develop-V3Document37 pages(FINAL) Business - Ethics - Q3 - Mod1 - The - Role - of - Business - in - Social - and - Economic - Develop-V3Ivanhoe Balarote83% (6)

- 1.1 Budgeting in Public Sector - Micaela GuerzoDocument50 pages1.1 Budgeting in Public Sector - Micaela GuerzoSahra PajarillaNo ratings yet

- 3556 17113 1 PB PDFDocument14 pages3556 17113 1 PB PDFSuci RahmadhaniNo ratings yet

- Bill of Rights 1 13Document111 pagesBill of Rights 1 13Jhon carlo CastroNo ratings yet

- Indiafrica Poster GuidelineDocument5 pagesIndiafrica Poster GuidelineAbhishek ShuklaNo ratings yet

- HW 2.10 - CollocationsDocument4 pagesHW 2.10 - Collocationslongcnttvn1404No ratings yet

- BLANKING VAM® FJL 6.625in. 32lb-ft API DriftDocument1 pageBLANKING VAM® FJL 6.625in. 32lb-ft API DriftDianaNo ratings yet

- G10 Q2 Health Module 5 - For Reg - L EditingDocument8 pagesG10 Q2 Health Module 5 - For Reg - L EditingSALGIE SERNALNo ratings yet

- Article Vi - Legislative Department: (Hodge-Podge Legislation) (Enrolled Bill Doctrine)Document1 pageArticle Vi - Legislative Department: (Hodge-Podge Legislation) (Enrolled Bill Doctrine)Kriston LipatNo ratings yet

- Warning Letter For Late ComingDocument1 pageWarning Letter For Late Comingwaseef4mvs91% (23)

- BBA - VTH - INDUSTRIAL LAW - UNIT1 - FACTORY ACT, 1948 - PROVISIONS REGARDING WELFAREDocument5 pagesBBA - VTH - INDUSTRIAL LAW - UNIT1 - FACTORY ACT, 1948 - PROVISIONS REGARDING WELFARERupali Singh0% (1)

- Land Tenure Information and Land PolicyDocument33 pagesLand Tenure Information and Land PolicyMunirudeen RajiNo ratings yet

- Trust Treated As Private Foundation - Open SocietyDocument200 pagesTrust Treated As Private Foundation - Open SocietyMatias SmithNo ratings yet

- CLASS 9 Social SCIENCE SA2 SAMPLE PAPER PDFDocument4 pagesCLASS 9 Social SCIENCE SA2 SAMPLE PAPER PDFSupersssNo ratings yet

- Fee Schedule Notice of Intent-TemplateDocument8 pagesFee Schedule Notice of Intent-TemplateRosebonbonNo ratings yet

- Political Economy of Us Arms Sales in The 21ST CenturyDocument7 pagesPolitical Economy of Us Arms Sales in The 21ST CenturyThomas Arthur TolentinoNo ratings yet

- NEC4 Alliance Contract ConsultationDocument60 pagesNEC4 Alliance Contract ConsultationAaronNo ratings yet

- State Vs NeelamDocument21 pagesState Vs NeelamAcchu SrinivasNo ratings yet

- John Bandimere JR., Et Al., v. Jared Polis, Et Al.Document136 pagesJohn Bandimere JR., Et Al., v. Jared Polis, Et Al.Michael_Roberts2019100% (1)

- Crim LawDocument42 pagesCrim LawGerberNo ratings yet

- Legal Responsibilities of Business OrganizationsDocument29 pagesLegal Responsibilities of Business OrganizationsGuray RoseanneNo ratings yet

- BRIEF Assignment 2Document6 pagesBRIEF Assignment 2uyenntm44No ratings yet

- Constitutional and Non Constitutional BodiesDocument3 pagesConstitutional and Non Constitutional BodiesAnubhav SrivastavaNo ratings yet

- Sources of Cultural, Social, Political ChangeDocument9 pagesSources of Cultural, Social, Political Changeprefect of studentsNo ratings yet

- Di Stefano, P. and M. Henaway - "Boycotting Apartheid From South Africa To Palestine", Peace Review, 26 (1), 19-27 (2014)Document11 pagesDi Stefano, P. and M. Henaway - "Boycotting Apartheid From South Africa To Palestine", Peace Review, 26 (1), 19-27 (2014)808gramNo ratings yet

- Legal Forms1 - 161915-2008-Dela - Cruz - v. - Dimaano - JR DigestDocument1 pageLegal Forms1 - 161915-2008-Dela - Cruz - v. - Dimaano - JR DigestRene BalloNo ratings yet

- q3 Grade 8 Module 8 Together Homeroom Guidance EnglishDocument10 pagesq3 Grade 8 Module 8 Together Homeroom Guidance EnglishZabNo ratings yet

The Effects of TRAIN Law To The Philippine Economy

The Effects of TRAIN Law To The Philippine Economy

Uploaded by

Ivanhoe BalaroteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Effects of TRAIN Law To The Philippine Economy

The Effects of TRAIN Law To The Philippine Economy

Uploaded by

Ivanhoe BalaroteCopyright:

Available Formats

The Effects of TRAIN Law to the Philippine Economy

Tax Reform for Acceleration and Inclusion Act or TRAIN law is a law that pushes for a big change

on the tax scheme in the Philippine setting. The tax reform it introduces are lower personal income tax

and higher consumption tax. Taxpayers with taxable income not exceeding Php 250,000 annually are

exempted from income tax. On the other hand, it has increased the consumption taxes, in the form of

excise tax on tobacco products, petroleum products, automobiles, and additional excise tax on

sweetened beverages and non-essential, invasive cosmetic produces. It has also expanded the VAT base

by repealing exemption provisions in numerous special laws. With all of this tax reform, will it benefit or

worsen the Philippine Economy?

The Philippine Economy depends on numerous factors for it to flourish or fail, but ultimately it

banks on the tax revenue that the government is getting to check and balance the growth of the

country. With this being said, the tax reform introduced by TRAIN law created an impact with our

economy itself. First, it has lowered the personal income tax thus exempting a big chunk of taxpayers to

the equation since a lot of the workforce are minimum wage earners. Although it has increased the tax

paid by those who earned way above minimum still it has not balanced the scale of the tax collected

from the workforce of our country. However, as mentioned, it increased consumption tax which I think

made a balance to the tax and even further giving the government a bigger revenue with the tax

collected. The law may have exempted the minimum wage earners from the tax bracket but the

deficiency on the tax collected from the earners exempted was passed on to all of us thru the increased

in the consumption tax. It simply distributed the burden further to all of us and benefitting a few. The

Economy might not be affected directly but it will create an impact on how people moves within the

economy. This law also affects workers and manufacturers of the products who were reformed to have

a higher tax. It will be hard for them to compete in the market since their product will be more

expensive due to the higher tax. It may cause them to budget cut or downsizing which will greatly affect

the economy itself.

With this realization, I think TRAIN law just shifted some scale weight to different sectors of the

taxpayers to give way for a more “relaxed” tax bracket for the small time earners and giving it to the big

time earners. Although, a counter scale weight was given to everyone, in the form of a high excise tax,

so that the government won’t be have a deficiency on the tax collection even with the chance in the tax

bracket. It may have even increased the tax collected generally. Overall, this law affected the Philippine

Economy by changing the behavior and the movement of the people in the country itself and it has yet

to be more reformed since there will be more TRAIN laws coming into play in the years to come.

You might also like

- ZICA T5 - TaxationDocument521 pagesZICA T5 - TaxationMongu Rice95% (42)

- Chapter 1 Ethical Dimension of Human ExistenceDocument9 pagesChapter 1 Ethical Dimension of Human ExistenceJayjo Segundo100% (1)

- What Is TRAIN Law and Its PurposeDocument6 pagesWhat Is TRAIN Law and Its PurposeNica BastiNo ratings yet

- Deasis - Educational Planning at The National and Sub-National LevelsDocument32 pagesDeasis - Educational Planning at The National and Sub-National LevelsRuben70% (10)

- Lawsuit Filed On Behalf of Woman Critically Hurt at Wheaton Railroad CrossingDocument23 pagesLawsuit Filed On Behalf of Woman Critically Hurt at Wheaton Railroad CrossingShannon Margaret BlumNo ratings yet

- Sample Letter To The PresidentDocument1 pageSample Letter To The PresidentHryyyy100% (4)

- 1997 Tax Code Tax Reform Rates: Adjustments in The Personal Income TaxationDocument12 pages1997 Tax Code Tax Reform Rates: Adjustments in The Personal Income TaxationQuendrick SurbanNo ratings yet

- Critical Review Paper On Tax - LucarezaDocument4 pagesCritical Review Paper On Tax - LucarezaAngel LucarezaNo ratings yet

- Ranie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Document2 pagesRanie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Ranie MonteclaroNo ratings yet

- Ranie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Document2 pagesRanie B. Monteclaro TAX 311 - Income Taxation Case Study No.1Ranie MonteclaroNo ratings yet

- Spee ComDocument13 pagesSpee ComIrvin LimNo ratings yet

- TAXATIONDocument2 pagesTAXATIONleah may sorenoNo ratings yet

- Taxation Theory 1 CanonsDocument6 pagesTaxation Theory 1 Canonsmarvadomarvellous67No ratings yet

- Analysis and Reaction To Train LawDocument4 pagesAnalysis and Reaction To Train LawandengNo ratings yet

- Tax101 Alonzo CasesummaryDocument5 pagesTax101 Alonzo CasesummaryLauren Nicole AlonzoNo ratings yet

- The Cry of Balintawak or Pugad LawinDocument6 pagesThe Cry of Balintawak or Pugad LawinMiguel VienesNo ratings yet

- Erica Joy Cabasag Batalla Bsba-Fm-3CDocument3 pagesErica Joy Cabasag Batalla Bsba-Fm-3CElimar BatallaNo ratings yet

- Concept Paper: "Train Law"Document3 pagesConcept Paper: "Train Law"Landersol De Vera CrisostomoNo ratings yet

- Train LawDocument10 pagesTrain LawkimNo ratings yet

- Tax Reform For Acceleration & Inclusion: University of Northern PhilippinesDocument4 pagesTax Reform For Acceleration & Inclusion: University of Northern PhilippinesDiana PobladorNo ratings yet

- Buque - Prelim Exam-Income TaxationDocument3 pagesBuque - Prelim Exam-Income TaxationVillanueva, Jane G.No ratings yet

- Forming A Policy For Tax Reform: by Thomas H. Spitters, CPADocument5 pagesForming A Policy For Tax Reform: by Thomas H. Spitters, CPAThomas H. SpittersNo ratings yet

- Tax Paper Public FinanceDocument13 pagesTax Paper Public FinanceFabrice GadeauNo ratings yet

- An Economic Impact Analysis On Tax Reform For Acceleration and Inclusion or Train BillDocument6 pagesAn Economic Impact Analysis On Tax Reform For Acceleration and Inclusion or Train BillZarina BartolayNo ratings yet

- Train Law RecommendationDocument10 pagesTrain Law RecommendationMaria Angelica PanongNo ratings yet

- Budget 6Document4 pagesBudget 6Atul SinghNo ratings yet

- Finance Compiled FinalDocument21 pagesFinance Compiled Finaljadyn nicholasNo ratings yet

- My Canons of TaxationDocument3 pagesMy Canons of Taxationmarvadomarvellous67No ratings yet

- Metro Manila (CNN Philippines) - Poor and Middle-Class Filipinos CouldDocument13 pagesMetro Manila (CNN Philippines) - Poor and Middle-Class Filipinos CouldMayAnn SisonNo ratings yet

- Train Law in The Final AnalysisDocument3 pagesTrain Law in The Final AnalysisMarianne SasingNo ratings yet

- RP - Ta2019Document2 pagesRP - Ta2019Alaine DobleNo ratings yet

- Train LawDocument11 pagesTrain LawKurtlyn Ann Oliquino100% (2)

- Train LawDocument5 pagesTrain LawKyrell MaeNo ratings yet

- Taxation JunaDocument551 pagesTaxation JunaJuna DafaNo ratings yet

- Notes 1 & 2Document8 pagesNotes 1 & 2babuaditya1998No ratings yet

- Explain The Effect of Taxation On: A, ProductionDocument10 pagesExplain The Effect of Taxation On: A, ProductionTony LithimbiNo ratings yet

- Tax-Cutting Front of 2015Document2 pagesTax-Cutting Front of 2015Novie Marie Balbin AnitNo ratings yet

- Policy Analysis - Train LawDocument6 pagesPolicy Analysis - Train LawJoyce GemNo ratings yet

- Economics Year 11 Wk1Document4 pagesEconomics Year 11 Wk1Miracle JosiahNo ratings yet

- Relevance of Taxation1Document10 pagesRelevance of Taxation1einol padalNo ratings yet

- Tax Reform For Acceleration and Inclusion: TrainDocument5 pagesTax Reform For Acceleration and Inclusion: TrainEla Gloria MolarNo ratings yet

- Critic TRAINDocument5 pagesCritic TRAINWeddanever CornelNo ratings yet

- HOMEWORK No. 1 - The Three Goals of TaxationDocument2 pagesHOMEWORK No. 1 - The Three Goals of TaxationJoven MendozaNo ratings yet

- 1.characteristics of Taxes 2.classification of Taxes 3.roles of Taxation 4.principles of TaxationDocument10 pages1.characteristics of Taxes 2.classification of Taxes 3.roles of Taxation 4.principles of TaxationMugwanya AsadNo ratings yet

- TAXATIONDocument17 pagesTAXATIONLamaire Abalos BatoyogNo ratings yet

- Tax Reform For Acceleration and Inclusion: I. Lowering Personal Income Tax (PIT)Document8 pagesTax Reform For Acceleration and Inclusion: I. Lowering Personal Income Tax (PIT)ZeroNo ratings yet

- What Is The RGSTDocument7 pagesWhat Is The RGSTWaqas YousafNo ratings yet

- CHP 3 Pad370 MDM SarehanDocument8 pagesCHP 3 Pad370 MDM SarehanPaikuna sumoNo ratings yet

- Value Added Tax and EVATDocument2 pagesValue Added Tax and EVATImperator FuriosaNo ratings yet

- Chapter-1: What Is GST Definition of Goods & Services TaxDocument46 pagesChapter-1: What Is GST Definition of Goods & Services TaxSalman RazaNo ratings yet

- Co3 TaxationDocument2 pagesCo3 TaxationChristian Gabriel TondagNo ratings yet

- LAW 323-Tax Law-Asim Zulfiqar-Akhtar AliDocument7 pagesLAW 323-Tax Law-Asim Zulfiqar-Akhtar AliWajahat GhafoorNo ratings yet

- University of Rwanda Huye Campus Principle of Taxation Cat Marketing Departiment MPIRANYA Jean Marie Vianney REG NUMBER: 220009329Document5 pagesUniversity of Rwanda Huye Campus Principle of Taxation Cat Marketing Departiment MPIRANYA Jean Marie Vianney REG NUMBER: 220009329gatete samNo ratings yet

- University of Rwanda Huye Campus Principle of Taxation Cat Marketing Departiment MPIRANYA Jean Marie Vianney REG NUMBER: 220009329Document5 pagesUniversity of Rwanda Huye Campus Principle of Taxation Cat Marketing Departiment MPIRANYA Jean Marie Vianney REG NUMBER: 220009329gatete samNo ratings yet

- Income of All FilipinosDocument1 pageIncome of All FilipinosEmer MartinNo ratings yet

- Lowering Personal Income Tax (PIT) : Tax Reform For Acceleration and InclusionDocument4 pagesLowering Personal Income Tax (PIT) : Tax Reform For Acceleration and InclusionChristine Joy RamirezNo ratings yet

- BtaxDocument2 pagesBtaxcristine albanoNo ratings yet

- Escaping True Tax Liability of The Government Amidst PandemicsDocument7 pagesEscaping True Tax Liability of The Government Amidst PandemicsMaria Carla Roan AbelindeNo ratings yet

- Train Law NotesDocument9 pagesTrain Law NotesMa Angeli Gomez100% (1)

- The Value Added TaxDocument5 pagesThe Value Added TaxCherry Marquez-de DiosNo ratings yet

- Contemporary Economic Issues Affecting The Filipino EntrepreneurDocument8 pagesContemporary Economic Issues Affecting The Filipino EntrepreneurLouiseNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- WHLP-Q2W7 12abmDocument2 pagesWHLP-Q2W7 12abmIvanhoe BalaroteNo ratings yet

- WHLP-Q4W2 12abmDocument2 pagesWHLP-Q4W2 12abmIvanhoe BalaroteNo ratings yet

- Gr8math Q1W1&W2 - LasDocument23 pagesGr8math Q1W1&W2 - LasIvanhoe BalaroteNo ratings yet

- WHLP-Q1W6 12abmDocument2 pagesWHLP-Q1W6 12abmIvanhoe BalaroteNo ratings yet

- WHLP-Q2W5 12abmDocument2 pagesWHLP-Q2W5 12abmIvanhoe BalaroteNo ratings yet

- WHLP-Q3W1 12abmDocument2 pagesWHLP-Q3W1 12abmIvanhoe BalaroteNo ratings yet

- WHLP-Q4W7 12abmDocument2 pagesWHLP-Q4W7 12abmIvanhoe BalaroteNo ratings yet

- Gr9math Q1W1 - LasDocument22 pagesGr9math Q1W1 - LasIvanhoe BalaroteNo ratings yet

- WHLP-Q1W8 12abmDocument2 pagesWHLP-Q1W8 12abmIvanhoe BalaroteNo ratings yet

- Gr7math Q1W1 - LasDocument17 pagesGr7math Q1W1 - LasIvanhoe BalaroteNo ratings yet

- SHS CoverDocument1 pageSHS CoverIvanhoe BalaroteNo ratings yet

- Medieval and Renaissance Mathematics: BY: Tajana Novak, Andrea Gudelj, Srđana Obradović, Mirna Marković April, 2013Document12 pagesMedieval and Renaissance Mathematics: BY: Tajana Novak, Andrea Gudelj, Srđana Obradović, Mirna Marković April, 2013Ivanhoe BalaroteNo ratings yet

- Module 5 Study NotebookDocument6 pagesModule 5 Study NotebookIvanhoe BalaroteNo ratings yet

- Weekly Home Learning Plan: Quarter 2 Week 6 - Grade 12 St. Ignatius of Loyola (Abm)Document2 pagesWeekly Home Learning Plan: Quarter 2 Week 6 - Grade 12 St. Ignatius of Loyola (Abm)Ivanhoe BalaroteNo ratings yet

- Shopee-WPS OfficeDocument11 pagesShopee-WPS OfficeIvanhoe BalaroteNo ratings yet

- Weekly Home Learning Plan: Q1 Week 5 - Grade 12 St. Ignatius of Loyola (Abm)Document2 pagesWeekly Home Learning Plan: Q1 Week 5 - Grade 12 St. Ignatius of Loyola (Abm)Ivanhoe BalaroteNo ratings yet

- Rosie G. Tan, PH.D.: Department of Mathematics EducationDocument16 pagesRosie G. Tan, PH.D.: Department of Mathematics EducationIvanhoe BalaroteNo ratings yet

- Commitment CertificateDocument1 pageCommitment CertificateIvanhoe BalaroteNo ratings yet

- (FINAL) Business - Ethics - Q3 - Mod1 - The - Role - of - Business - in - Social - and - Economic - Develop-V3Document37 pages(FINAL) Business - Ethics - Q3 - Mod1 - The - Role - of - Business - in - Social - and - Economic - Develop-V3Ivanhoe Balarote83% (6)

- 1.1 Budgeting in Public Sector - Micaela GuerzoDocument50 pages1.1 Budgeting in Public Sector - Micaela GuerzoSahra PajarillaNo ratings yet

- 3556 17113 1 PB PDFDocument14 pages3556 17113 1 PB PDFSuci RahmadhaniNo ratings yet

- Bill of Rights 1 13Document111 pagesBill of Rights 1 13Jhon carlo CastroNo ratings yet

- Indiafrica Poster GuidelineDocument5 pagesIndiafrica Poster GuidelineAbhishek ShuklaNo ratings yet

- HW 2.10 - CollocationsDocument4 pagesHW 2.10 - Collocationslongcnttvn1404No ratings yet

- BLANKING VAM® FJL 6.625in. 32lb-ft API DriftDocument1 pageBLANKING VAM® FJL 6.625in. 32lb-ft API DriftDianaNo ratings yet

- G10 Q2 Health Module 5 - For Reg - L EditingDocument8 pagesG10 Q2 Health Module 5 - For Reg - L EditingSALGIE SERNALNo ratings yet

- Article Vi - Legislative Department: (Hodge-Podge Legislation) (Enrolled Bill Doctrine)Document1 pageArticle Vi - Legislative Department: (Hodge-Podge Legislation) (Enrolled Bill Doctrine)Kriston LipatNo ratings yet

- Warning Letter For Late ComingDocument1 pageWarning Letter For Late Comingwaseef4mvs91% (23)

- BBA - VTH - INDUSTRIAL LAW - UNIT1 - FACTORY ACT, 1948 - PROVISIONS REGARDING WELFAREDocument5 pagesBBA - VTH - INDUSTRIAL LAW - UNIT1 - FACTORY ACT, 1948 - PROVISIONS REGARDING WELFARERupali Singh0% (1)

- Land Tenure Information and Land PolicyDocument33 pagesLand Tenure Information and Land PolicyMunirudeen RajiNo ratings yet

- Trust Treated As Private Foundation - Open SocietyDocument200 pagesTrust Treated As Private Foundation - Open SocietyMatias SmithNo ratings yet

- CLASS 9 Social SCIENCE SA2 SAMPLE PAPER PDFDocument4 pagesCLASS 9 Social SCIENCE SA2 SAMPLE PAPER PDFSupersssNo ratings yet

- Fee Schedule Notice of Intent-TemplateDocument8 pagesFee Schedule Notice of Intent-TemplateRosebonbonNo ratings yet

- Political Economy of Us Arms Sales in The 21ST CenturyDocument7 pagesPolitical Economy of Us Arms Sales in The 21ST CenturyThomas Arthur TolentinoNo ratings yet

- NEC4 Alliance Contract ConsultationDocument60 pagesNEC4 Alliance Contract ConsultationAaronNo ratings yet

- State Vs NeelamDocument21 pagesState Vs NeelamAcchu SrinivasNo ratings yet

- John Bandimere JR., Et Al., v. Jared Polis, Et Al.Document136 pagesJohn Bandimere JR., Et Al., v. Jared Polis, Et Al.Michael_Roberts2019100% (1)

- Crim LawDocument42 pagesCrim LawGerberNo ratings yet

- Legal Responsibilities of Business OrganizationsDocument29 pagesLegal Responsibilities of Business OrganizationsGuray RoseanneNo ratings yet

- BRIEF Assignment 2Document6 pagesBRIEF Assignment 2uyenntm44No ratings yet

- Constitutional and Non Constitutional BodiesDocument3 pagesConstitutional and Non Constitutional BodiesAnubhav SrivastavaNo ratings yet

- Sources of Cultural, Social, Political ChangeDocument9 pagesSources of Cultural, Social, Political Changeprefect of studentsNo ratings yet

- Di Stefano, P. and M. Henaway - "Boycotting Apartheid From South Africa To Palestine", Peace Review, 26 (1), 19-27 (2014)Document11 pagesDi Stefano, P. and M. Henaway - "Boycotting Apartheid From South Africa To Palestine", Peace Review, 26 (1), 19-27 (2014)808gramNo ratings yet

- Legal Forms1 - 161915-2008-Dela - Cruz - v. - Dimaano - JR DigestDocument1 pageLegal Forms1 - 161915-2008-Dela - Cruz - v. - Dimaano - JR DigestRene BalloNo ratings yet

- q3 Grade 8 Module 8 Together Homeroom Guidance EnglishDocument10 pagesq3 Grade 8 Module 8 Together Homeroom Guidance EnglishZabNo ratings yet