Professional Documents

Culture Documents

Tugas 1 Bhs Inggris

Tugas 1 Bhs Inggris

Uploaded by

firedragonnagaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tugas 1 Bhs Inggris

Tugas 1 Bhs Inggris

Uploaded by

firedragonnagaCopyright:

Available Formats

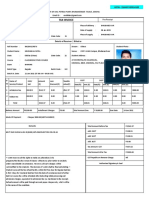

Name :MARJOKO

NIM : 045048398

UPBJJ Serang

The central bank in a country, in general, is an agency responsible for monetary policy in that country's territory. The

Central Bank strives to maintain currency stability, the stability of the banking sector, and the financial system as a

whole. In Indonesia, the function of the central bank is carried out by Bank Indonesia. The central bank is an

institution that is responsible for maintaining price stability or the value of a currency prevailing in that country, which

in this case is known as inflation or rising prices, which in other words means a decrease in the value of money. The

Central Bank keeps the inflation rate under control and is always at the lowest possible value or in an optimal position

for the economy (low/zero inflation), by controlling the balance of money and goods. If the amount of money in

circulation is too much, the central bank uses the instruments and authorities it has.

As the monetary, banking and payment system authority, Bank Indonesia's main task is not only to maintain

monetary stability, but also financial system stability (banking and payment systems). Bank Indonesia's success in

maintaining monetary stability without being followed by financial system stability will not mean much in supporting

sustainable economic growth. Monetary stability and financial stability are like two sides of a coin that cannot be

separated. Monetary policy has a significant impact on financial stability and vice versa, financial stability is a pillar

that underlies the effectiveness of monetary policy. The financial system is one of the transmission lines of monetary

policy, so that in the event of instability in the financial system, the transmission of monetary policy cannot run

normally. On the other hand, monetary instability will fundamentally affect financial system stability due to the

ineffective functioning of the financial system. This is the background why financial system stability is still the duty

and responsibility of Bank Indonesia.

The question is, what is the role of Bank Indonesia in maintaining financial system stability? As the central bank,

Bank Indonesia has five main roles in maintaining financial system stability. The five main roles that include policies

and instruments in maintaining financial system stability are: First, Bank Indonesia has the task of maintaining

monetary stability, among others, through interest rate instruments in open market operations. Second, Bank

Indonesia has a vital role in creating sound performance of financial institutions, particularly banks. Third, Bank

Indonesia has the authority to regulate and maintain the smooth running of the payment system. Fourth, through its

function in research and monitoring, Bank Indonesia can access information that is considered to threaten financial

stability. Fifth, Bank Indonesia has a function as a financial system safety net through the central bank's function as

lender of the last resort (LoLR). Yes I agree that a floating exchange rate adds uncertainty to international tradeThe

exchange rate is one of the determinants in international trade. Depreciation of the exchange rate will change the

position of the trade balance. Where in theory the depreciation of the exchange rate will increase the trade balance.

You might also like

- M5 - Problem Set - Introduction To Statistics-2021 - LagiosDocument12 pagesM5 - Problem Set - Introduction To Statistics-2021 - LagiosAmandeep SinghNo ratings yet

- Basic - Problems 2Document4 pagesBasic - Problems 2Maryam KamashkiNo ratings yet

- Overview of Functions and Operations BSPDocument2 pagesOverview of Functions and Operations BSPKarla GalvezNo ratings yet

- Module 2 - Functions of BSPDocument14 pagesModule 2 - Functions of BSPQuenie De la CruzNo ratings yet

- TMK 1 BinDocument2 pagesTMK 1 BinRenaltha SyarelNo ratings yet

- Tugas Writing SoftskillDocument4 pagesTugas Writing SoftskillkartikasandiutamiNo ratings yet

- Bank IndonesiaDocument7 pagesBank IndonesiaHABIBUL WAHID HARMADANNo ratings yet

- Michelle Maria Khrisanthi Kaunang Faculty of Economics and Business Management (IBA) 6 SemesterDocument1 pageMichelle Maria Khrisanthi Kaunang Faculty of Economics and Business Management (IBA) 6 Semestermichelle kaunangNo ratings yet

- Tugas 1 - Bahasa Inggris Tata NiagaDocument2 pagesTugas 1 - Bahasa Inggris Tata NiagaNabilaNo ratings yet

- 042834696-B.inggris niaga-ADBI4201-Tugas 1Document2 pages042834696-B.inggris niaga-ADBI4201-Tugas 1trpafrichiaNo ratings yet

- B Ing Niaga Tugas1 PDFDocument2 pagesB Ing Niaga Tugas1 PDFMuti AladiaNo ratings yet

- PENGAWASAN Macro Prudential & Mikro PrudentialDocument20 pagesPENGAWASAN Macro Prudential & Mikro PrudentialFatihNo ratings yet

- Peran Bank Indonesia Dalam Menghadapi Krisis EkonomiDocument4 pagesPeran Bank Indonesia Dalam Menghadapi Krisis EkonomiAprilia Sekar AsihNo ratings yet

- Takeaways About Central BankingDocument1 pageTakeaways About Central BankingFaith VidallonNo ratings yet

- Central Banking: S D Nilanka ChamindaniDocument7 pagesCentral Banking: S D Nilanka ChamindaniGayan De SilvaNo ratings yet

- Course: FINC6189 Introduction To Financial Market and Fin-Tech Effective Period: September 2021Document67 pagesCourse: FINC6189 Introduction To Financial Market and Fin-Tech Effective Period: September 2021Stivon LayNo ratings yet

- KEBIJAKAN MAKROPUDENSIAL BANK INDONESIA UNTUK MENDORONG PEMBIAYAAN INKLUSIF - HARI MURTI & HARDINI TRISTYA - Id.enDocument7 pagesKEBIJAKAN MAKROPUDENSIAL BANK INDONESIA UNTUK MENDORONG PEMBIAYAAN INKLUSIF - HARI MURTI & HARDINI TRISTYA - Id.enHari MurtiNo ratings yet

- Tugas 1 Bahasa Inggris NiagaDocument2 pagesTugas 1 Bahasa Inggris NiagaindiNo ratings yet

- BankingDocument6 pagesBankingMd Hafizul HaqueNo ratings yet

- The Philippine Financial System .2Document9 pagesThe Philippine Financial System .2Khyell PayasNo ratings yet

- The Monetary SystemDocument3 pagesThe Monetary Systembgdp8hzbzyNo ratings yet

- Tugas 1 Bahasa Inggris Niaga Jenita ApriliaDocument3 pagesTugas 1 Bahasa Inggris Niaga Jenita Apriliajenita apriliaNo ratings yet

- Diskusi 2 Bahasa Inggris NiagaDocument2 pagesDiskusi 2 Bahasa Inggris NiagaDinda SukmaNo ratings yet

- Tugas 1 B.inggris NiagaDocument2 pagesTugas 1 B.inggris NiagaKristie liandoNo ratings yet

- 3B - Putriyani Foenale - Research Journal ReviewDocument14 pages3B - Putriyani Foenale - Research Journal ReviewLaurensius Wilhelmus LoliNo ratings yet

- The Evolution of Central BankingDocument6 pagesThe Evolution of Central Bankingdamenegasa21No ratings yet

- Monetary Policy Refers To The Management of A CountryDocument5 pagesMonetary Policy Refers To The Management of A CountryB I N O D ツNo ratings yet

- Financial MarketsDocument5 pagesFinancial MarketsCristel TannaganNo ratings yet

- Monetary Policy and Banking EssayDocument4 pagesMonetary Policy and Banking EssayMaria Elena Sitoy BarroNo ratings yet

- Tugas 1 Bahasa Inggris NiagaDocument2 pagesTugas 1 Bahasa Inggris NiagaPNM MEKAAR KEDONDONGNo ratings yet

- Bahasa Inggris Paragraf M.ajie LaksonoDocument4 pagesBahasa Inggris Paragraf M.ajie LaksonokartikasandiutamiNo ratings yet

- Banko Sentral NG PilipinasDocument8 pagesBanko Sentral NG PilipinasJoshua OrobiaNo ratings yet

- Rinna oDocument4 pagesRinna oOlea RinnaNo ratings yet

- 0777Document10 pages0777REFALDI R. IHSANNo ratings yet

- Central Bank of SrilankaDocument14 pagesCentral Bank of Srilankadharadhakan99No ratings yet

- Examination of Monetary Policy and Financial Performance of Deposit Money Bank in NigeriaDocument71 pagesExamination of Monetary Policy and Financial Performance of Deposit Money Bank in NigeriaDaniel ObasiNo ratings yet

- Central Bank SamaDocument13 pagesCentral Bank Samamdhanjalah08No ratings yet

- Aymi FM4Document7 pagesAymi FM4devy mar topiaNo ratings yet

- Fim 6Document3 pagesFim 6Asfand YarNo ratings yet

- Veline Paul BAN102 Assessment1Document4 pagesVeline Paul BAN102 Assessment1Veline OsiferaNo ratings yet

- TOPIC VII: Bangko Sentral NG Pilipinas: Learning ObjectivesDocument8 pagesTOPIC VII: Bangko Sentral NG Pilipinas: Learning ObjectivesJoshua OrobiaNo ratings yet

- Written Report FM4Document15 pagesWritten Report FM4jay diazNo ratings yet

- Function and Role of Central Bank in Economic Sistem Pay Bank Dan Lembaga Ke Uangan Lainya (BLKL) AssigmentDocument8 pagesFunction and Role of Central Bank in Economic Sistem Pay Bank Dan Lembaga Ke Uangan Lainya (BLKL) AssigmentFauzan KarimNo ratings yet

- Central BankDocument5 pagesCentral BankMohammad JamilNo ratings yet

- Diskusi 5Document10 pagesDiskusi 5Sudar YantoNo ratings yet

- Part ADocument3 pagesPart Alucxu2003No ratings yet

- Mission and Vision of The BSPDocument3 pagesMission and Vision of The BSPAnonymous loixthr100% (1)

- Lesson 5Document21 pagesLesson 5Carlos miguel GonzagaNo ratings yet

- QN 3Document2 pagesQN 3officialrrk06No ratings yet

- TT1 Bahasa Inggris Niaga Adbi4201Document1 pageTT1 Bahasa Inggris Niaga Adbi4201lutfiNo ratings yet

- Statement Kebijaksanaan Moneter - Teguh SihonoDocument17 pagesStatement Kebijaksanaan Moneter - Teguh SihonolincerprojectNo ratings yet

- Pengaruh Car, Bopo, NPL Dan LDR Terhadap ProfitabilitasDocument30 pagesPengaruh Car, Bopo, NPL Dan LDR Terhadap ProfitabilitasMayyarif AkbarNo ratings yet

- 576 1195 1 SM PDFDocument20 pages576 1195 1 SM PDFirwandkNo ratings yet

- Central BankingDocument15 pagesCentral BankingjosesoniaNo ratings yet

- How Does The Reserve Bank of India Conduct Its Monetary Policy?Document18 pagesHow Does The Reserve Bank of India Conduct Its Monetary Policy?only4u_787No ratings yet

- Task1 CommercialEnglishDocument2 pagesTask1 CommercialEnglishnur khoNo ratings yet

- Economics 2ND Sem FDDocument17 pagesEconomics 2ND Sem FDJitesh SharmaNo ratings yet

- BSP 2024Document6 pagesBSP 2024taccadandengNo ratings yet

- CH-2 Ethiopian Banking SectorDocument20 pagesCH-2 Ethiopian Banking Sectoraddisu bezaNo ratings yet

- Monetary PolicyDocument10 pagesMonetary PolicyAshish MisraNo ratings yet

- Chapter 6 BDocument25 pagesChapter 6 Bbirook27No ratings yet

- Demand PDFDocument15 pagesDemand PDFHasan RabyNo ratings yet

- Chp06 Decision MakingDocument25 pagesChp06 Decision MakingRohan GulatiNo ratings yet

- Anti-Oedipus I 02 (1971-12-14) PDFDocument8 pagesAnti-Oedipus I 02 (1971-12-14) PDFMatejaNo ratings yet

- Document (960) - 5 - Copy-DikonversiDocument2 pagesDocument (960) - 5 - Copy-DikonversiLeon S KenedyNo ratings yet

- Chapter I.Document4 pagesChapter I.keith tambaNo ratings yet

- Unit 2 Efficient Market HypothesisDocument10 pagesUnit 2 Efficient Market HypothesisNikita ShekhawatNo ratings yet

- Forex Robotron EA 28V - (Cost $999) - For FREE - ForexCrackedDocument8 pagesForex Robotron EA 28V - (Cost $999) - For FREE - ForexCrackedTrislad InoharaNo ratings yet

- Sipcot - SriperambudurDocument7 pagesSipcot - SriperambudurAakash Santhanam83% (6)

- Does Hotel Location Tell A True Story? Evidence From Geographically Weighted T Regression Analysis of Hotels in Hong KongDocument14 pagesDoes Hotel Location Tell A True Story? Evidence From Geographically Weighted T Regression Analysis of Hotels in Hong KongWas-Yous TorauballyNo ratings yet

- Appendix 44: Liquidation ReportDocument16 pagesAppendix 44: Liquidation ReportRendrey MacaraegNo ratings yet

- Annex CDocument2 pagesAnnex CGeraldineNo ratings yet

- Intro To Engineering EconomicsDocument12 pagesIntro To Engineering EconomicsShayan AmjadNo ratings yet

- Exercise#1 Earlmathew VisarraDocument2 pagesExercise#1 Earlmathew VisarraMathew VisarraNo ratings yet

- Email ID G20Document13 pagesEmail ID G20richaNo ratings yet

- Strategic Management - Phase 1 - Valentina Restrepo Castaño - 19Document9 pagesStrategic Management - Phase 1 - Valentina Restrepo Castaño - 19valentinaNo ratings yet

- Economic Data - 9 Countries (1980-2020)Document24 pagesEconomic Data - 9 Countries (1980-2020)The HuntNo ratings yet

- Vanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQDocument1 pageVanik Education PVT LTD: GSTIN - 21AAFCV2531H1ZQNRUSINGHA PATRANo ratings yet

- My - Statement - 20 Sep, 2022 - 19 Oct, 2022 - 6397471579Document11 pagesMy - Statement - 20 Sep, 2022 - 19 Oct, 2022 - 6397471579Rinku RajpootNo ratings yet

- STA408 AppendixDocument2 pagesSTA408 AppendixMUHAMMAD SYAZWAN MOHD SUKRINo ratings yet

- IKIGAYDocument10 pagesIKIGAYAna Luiza BaptistaNo ratings yet

- Green Tea ExtractDocument1 pageGreen Tea Extractajitbadboy2No ratings yet

- Balance of Payments AUSDocument36 pagesBalance of Payments AUSKoushik SenNo ratings yet

- SHS Applied Eco Module - 19 and 20Document10 pagesSHS Applied Eco Module - 19 and 20Ronald AlmagroNo ratings yet

- The First Principle of Economics: OptimizationDocument1 pageThe First Principle of Economics: OptimizationCeyp Inem CaliNo ratings yet

- Banakhat With Possesion EnglishDocument4 pagesBanakhat With Possesion EnglishSreejith NairNo ratings yet

- CO - Stepbystep Config & User Manual Part 1Document251 pagesCO - Stepbystep Config & User Manual Part 1Srinivasa Kasireddy100% (4)

- Nokia Tool Kit Checklist - From TI GuidelinesDocument4 pagesNokia Tool Kit Checklist - From TI GuidelinesakkmalNo ratings yet

- Money Supply: Economics ProjectDocument9 pagesMoney Supply: Economics ProjectabhimussoorieNo ratings yet