Professional Documents

Culture Documents

0 Control Sheet - Charge of Tax & 4 Key Concepts

0 Control Sheet - Charge of Tax & 4 Key Concepts

Uploaded by

Arman Khan0 ratings0% found this document useful (0 votes)

87 views1 pageThis document provides a summary of key tax concepts including the charge of tax, definitions of a person, taxable income, tax year, and tax rates. It outlines that income tax shall be imposed annually on taxable income according to the rates specified in the First Schedule. It defines various types of persons including individuals, associations of persons, companies, governments, and organizations. It also defines concepts such as taxable income, tax year, normal tax year, special tax year, and transitional tax year.

Original Description:

CAF 2 Tax Practice Sir Tariq Tunio Control sheets

Original Title

0 Control Sheet_ Charge of Tax & 4 Key Concepts

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a summary of key tax concepts including the charge of tax, definitions of a person, taxable income, tax year, and tax rates. It outlines that income tax shall be imposed annually on taxable income according to the rates specified in the First Schedule. It defines various types of persons including individuals, associations of persons, companies, governments, and organizations. It also defines concepts such as taxable income, tax year, normal tax year, special tax year, and transitional tax year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

87 views1 page0 Control Sheet - Charge of Tax & 4 Key Concepts

0 Control Sheet - Charge of Tax & 4 Key Concepts

Uploaded by

Arman KhanThis document provides a summary of key tax concepts including the charge of tax, definitions of a person, taxable income, tax year, and tax rates. It outlines that income tax shall be imposed annually on taxable income according to the rates specified in the First Schedule. It defines various types of persons including individuals, associations of persons, companies, governments, and organizations. It also defines concepts such as taxable income, tax year, normal tax year, special tax year, and transitional tax year.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

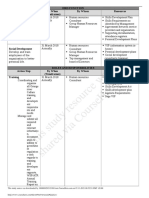

CONTROL SHEET OF CHARGE OF TAX & 4 KEY CONCEPTS

PREPARED BY SIR TARIQ TUNIO THE TAXMAN (ARTT 0332-2130867)

Income tax shall be imposed for each tax year, at rate or rates specified

CHARGE OF TAX in First Schedule, on every person who has taxable income for the year.

PERSON TAXABLE INCOME TAX YEAR TAX RATES

MR. TAXPAYER TYPE PROVISION SALARIED PERSON

(i) Individual (ii) AOP (iii) Company (iv) Federal Government

COMPUTATION OF TAXABLE INCOME & TAX LIABILITY

(v) Foreign Government (vi) Political Subdivision of Foreign FOR TAX YEAR 20X1 Normal Tax Period of 12 months S.

TAXABLE INCOME RATE OF TAX

NO

Government (vii) Public International Organization A SALARY Year ending on 30th June Where TI does not exceed Rs. 0%

denoted by calendar 1

PSI FSI 600,000

Amounts Chargeable XX XX year in which said 2

Where TI > Rs. 600,000 but 5% of the amount exceeding Rs.

PERSON WHEN RESIDENT [No deduction Allowed] — — date falls does not exceed Rs. 1,200,000 600,000

Where TI > Rs. 1,200,000 but Rs. 30,000 plus 10% of the amount

Income under the Head ‘Salary’ XX Special Tax Period of 12-months 3

does not exceed Rs. 1,800,000 exceeding Rs. 1,200,000

Individual Presence in Pakistan of 183 days or more in different from NTY

B INCOME FROM PROPERTY Year Where TI > Rs. 1,800,000 but Rs. 90,000 plus 15% of the amount

aggregate in a TY, or 4

Amounts Chargeable XX XX that person is allowed does not exceed Rs. 2,500,000 exceeding Rs. 1,800,000

Employee/official of Federal/Provincial Less: Deductions Allowed (XX) (XX) by CIR by order, & 5

Where TI > Rs. 2,500,000 but Rs. 195,000 plus 17.5% of the

does not exceed Rs. 3,500,000 amount exceeding Rs. 2,500,000

Govt. posted abroad Income under the Head ‘Income from Property’ XX denoted by calendar

Where TI > Rs. 3,500,000 but Rs. 370,000 plus 20% of the

AOP Control & Management of the affairs of C INCOME FROM BUSINESS year relevant to NTY 6

does not exceed Rs. 5,000,000 amount exceeding Rs. 3,500,000

AOP is situated wholly or partly in Pakistan (I) Business Income Other Than Speculation Business in which the closing Where TI > Rs. 5,000,000 but Rs. 670,000 plus 22.5% of the

7

at any time during the year Amount Chargeable XX XX date of the STY falls does not exceed Rs. 8,000,000 amount exceeding Rs. 5,000,000

Less: Deductions Allowed (XX) (XX) Transitional Period that comes Where TI > Rs. 8,000,000 but Rs. 1,345,000 plus 5% of the

Company Company incorporated/ formed by or 8

does not > Rs. 12,000,000 amount exceeding Rs. 8,000,000

PSI/FSI Business Income (other than SB) XX XX Tax Year between end of last Where TI > Rs. 12,000,000 but Rs. 2,345,000 + 27.5% of the

under Pakistani law 9

(Ii) Speculation Business TY prior to change & does not > Rs. 30,000,000 amount exceeding Rs. 12,000,000

Control & Management of the affairs of Amount Chargeable XX XX date on which Where TI > Rs. 30,000,000 but Rs. 7,295,000 + 30% of amount

company is situated wholly in Pakistan at 10

Less: Deductions Allowed (XX) (XX) changed TY does not > Rs. 50,000,000 exceeding Rs. 30,000,000

any time in the year PSI/FSI SB Income XX XX commences 11

Where TI > Rs. 50,000,000 but Rs. 13,295,000 + 32.5% of amount

does not > Rs. 75,000,000 > Rs. 50,000,000

Provincial Government Income under the Head ‘Income from Business’ XX

Where TI > Rs. 75,000,000 Rs. 21,420,000 + 35% of the

Local Government D CAPITAL GAIN PROCEDURE FOR TRANSITION 12

amount > Rs. 75,000,000

Fed. Govt. Always Resident Person (I) CG on Disposal of Capital Asset other than Immovable Property →Person having NTY/STY apply to CIR

Consideration received XX XX to allow him to use STY/NTY NON-SALARIED PERSON

Foreign Govt. Always Non-resident Person L: Cost of Capital Asset (XX) (XX) → CIR by order allow/reject request. Sr. TAXABLE INCOME RATE OF TAX

PSI/FSI Gain Relating to CA O/T Immovable Property XX XX After giving opportunity of being Where TI does not > Rs.

Political Sub- Always Non-resident Person (Ii) CG on Disposal of Capital Asset Being Immovable Property 1 0%

heard to the taxpayer 400,000

division of Foreign Consideration received XX XX → CIR to allow only when compelling Where TI > Rs.400,000 but 5% of amount

2

L: Cost of Immovable Property (XX) (XX) need is shown by taxpayer does not exceed Rs. 600,000 exceeding Rs. 400,000

Govt. PSI/FSI Gain Relating to CA being Immovable Property XX XX Where TI > Rs. 600,000 but Rs. 10,000 + 10% of the amount

→ In case of acceptance conditions by 3

does not exceed Rs.1200000 exceeding Rs. 600,000

(Iii) CG on Disposal of Securities CIR may apply

Public International Always Non-resident Person 4

Where TI > Rs.1,200,000 but Rs. 70,000 + 15% of the amount

Consideration received XX XX → In case of rejection, order to be does not exceed Rs.2400000 exceeding Rs. 1,200,000

Organization L: Cost of Security (XX) (XX) Where TI > Rs. 2,400,000 but Rs. 250,000 + 20% of the amount

passed after recording reasons for 5

PSI/FSI Gain relating to Securities XX XX does not > Rs. 3,000,000 exceeding Rs. 2,400,000

rejection in writing

Income under the Head ‘Capital Gains’ XX Where TI > Rs. 3,000,000 but Rs. 370,000 + 25% of

6

COMPUTING DAYS AN INDIVIDUAL IS PRESENT IN PAKISTAN E INCOME FROM OTHER SOURCES

does not > Rs. 4,000,000 the amount > Rs. 3,000,000

Where TI > Rs. 4,000,000 but Rs. 620,000 + 30% of

→ Days Counted as Whole Days Amounts Chargeable XX XX Board may permit class of persons 7

does not > Rs. 6,000,000 the amount > Rs. 4,000,000

- Part of a day an individual is present in Pakistan (day of Less: Deductions Allowed (XX) (XX) having NTY to use STY or vice versa Where TI > Rs. 6,000,000 Rs. 1,220,000 + 35%

8

arrival and day of departure) Income under the Head ‘Income from Other Sources’ XX of the amount > Rs. 6,000,000

` F SUM OF ALL HEADS XX

- Public holiday

Add: Exempt Income XX REJECTION SALARIED PERSON

- Day of leave (including sick leave) If income of an individual under the head “salary” exceeds 75% of his

G TOTAL INCOME XX →Review by FBR →FBR’s decision is final taxable income, the individual is termed as ‘Salaried Individual’.

- Day an individual’s activity in Pakistan is interrupted WITHDRAWN

Less: Exempt Income (XX)

because of strike, lock-out or delay in receipt of supplies H NET TOTAL INCOME XX CIR may withdraw permission to use COMPANY TAX RATES

- Holiday spent in Pakistan before, during or after any Less: Deductible Allowances [Cannot Reduce T/I Before Zero] STY/NTY by order after giving NORMAL COMPANY

activity in Pakistan. 29% for TY 2019 and onwards

→ Zakat § 60 opportunity of being heard. SMALL COMPANY

→ Workers’ Welfare Fund § 60A Against this order, taxpayer may file 20% for TY 2023 and onwards

→ Day Not Counted → Workers’ Participation Fund § 60B review application to the Board. 21% for TY 2022

→ Deductible allowance for profit on debt § 65C Board’s decision on review shall be 22% for TY 2021

- Day or part of day an individual is in transit in Pakistan → Deductible allowance for education expenses § 60D (XX) BANKING COMPANY

final. 35% for banking companies from 2007 and onwards

I TAXABLE INCOME XX

You might also like

- Annual Accomplishment Report - Jan - Nov 2021Document5 pagesAnnual Accomplishment Report - Jan - Nov 2021Valerie SantiagoNo ratings yet

- Shares and DividendsDocument4 pagesShares and Dividendsricha_saini1953% (17)

- Presentation On CRISILDocument14 pagesPresentation On CRISILChanchal Gulati80% (5)

- 1 Charge of Tax & 4 Key Concepts - Control Sheet - SirTariqTunio - ARTTDocument1 page1 Charge of Tax & 4 Key Concepts - Control Sheet - SirTariqTunio - ARTTJAMES RATHERNo ratings yet

- Income Tax Quick Recap CapsulDocument24 pagesIncome Tax Quick Recap CapsulAmanNo ratings yet

- Bos 44566Document24 pagesBos 44566Bhavani KannanNo ratings yet

- Chap 1 BasicluolDocument10 pagesChap 1 BasicluolAlex DcostaNo ratings yet

- Income Tax Law - A Capsule For Quick Recap IPCC Nov 18Document28 pagesIncome Tax Law - A Capsule For Quick Recap IPCC Nov 18k moviesNo ratings yet

- Inter QuestionnareDocument23 pagesInter QuestionnareAnsh NayyarNo ratings yet

- Advance Taxation (P6) Summary of NoteDocument31 pagesAdvance Taxation (P6) Summary of NoteYivon TeoNo ratings yet

- Income Tax Summary NotesDocument102 pagesIncome Tax Summary NotesShreya lathNo ratings yet

- Chapter 1 - Basic ConceptsDocument4 pagesChapter 1 - Basic ConceptschoudharyNo ratings yet

- 4 Direct Tax RevisionDocument149 pages4 Direct Tax RevisionDeep MehtaNo ratings yet

- Law of Taxation ShivaniDocument29 pagesLaw of Taxation ShivaniShivani Singh ChandelNo ratings yet

- Income Tax: (As Amended by The Finance Act, 2017) Short Notes On Basic Concepts (A.Y. 2018-19)Document5 pagesIncome Tax: (As Amended by The Finance Act, 2017) Short Notes On Basic Concepts (A.Y. 2018-19)gdmurugan2k7No ratings yet

- Direct Tax Chapter 1 To 10 AmendedDocument45 pagesDirect Tax Chapter 1 To 10 AmendedAsad RizviNo ratings yet

- Tax Rebate Calculator of Salaried Class Indviduals 2013-14Document4 pagesTax Rebate Calculator of Salaried Class Indviduals 2013-14waheedNo ratings yet

- One and Done 2307Document2 pagesOne and Done 2307Maricris LegaspiNo ratings yet

- REVIEWER-NI-LOVE HeheDocument6 pagesREVIEWER-NI-LOVE HeheSteph GonzagaNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument3 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasRonaldo CatindigNo ratings yet

- Tax & Taxation of BangladeshDocument31 pagesTax & Taxation of BangladeshAl JamiNo ratings yet

- Bir Form 2307 SampleDocument3 pagesBir Form 2307 SampleErick Echual75% (4)

- Intro To Msian Taxation - 2023 (Week 1)Document13 pagesIntro To Msian Taxation - 2023 (Week 1)leery-wb22No ratings yet

- Amendment Consolidated FileDocument128 pagesAmendment Consolidated FileRanga AmarNo ratings yet

- Mega Marathon Direct Tax. YtDocument257 pagesMega Marathon Direct Tax. Ytsubroshakar gamerNo ratings yet

- 2307 Jan - Feb 2020Document4 pages2307 Jan - Feb 2020Marvin CeledioNo ratings yet

- Tax Card PakistanDocument1 pageTax Card PakistanMalik Muhammad MuzamilNo ratings yet

- Salient Features: Company-Confidential 26.02.2010Document9 pagesSalient Features: Company-Confidential 26.02.2010Coolvishal AgnihotriNo ratings yet

- BIR Form 2307Document2 pagesBIR Form 2307Angelique MasupilNo ratings yet

- 2307 FormDocument3 pages2307 FormK and F Construction Dev't CorpNo ratings yet

- Income Tax Ready Reckoner PDFDocument15 pagesIncome Tax Ready Reckoner PDFtushar sharmaNo ratings yet

- On MAT and AMT WRO0533356 - FinalDocument25 pagesOn MAT and AMT WRO0533356 - FinalOffensive SeriesNo ratings yet

- Withholding Income Tax Regime (WHT Rates Card) : DisclaimerDocument2 pagesWithholding Income Tax Regime (WHT Rates Card) : Disclaimersimran jeswaniNo ratings yet

- 2307 Jan 2018 ENCS v3Document2 pages2307 Jan 2018 ENCS v3SK GACAO PALO, LEYTENo ratings yet

- Assignment - Com Tax Sys ChinaDocument10 pagesAssignment - Com Tax Sys ChinaTanvir SiddiqueNo ratings yet

- 2307 Creditable Tax Withheld at SourceDocument6 pages2307 Creditable Tax Withheld at SourceBarangay BugasNo ratings yet

- 2307 BlankDocument2 pages2307 BlankJames Brooke PalomaNo ratings yet

- RR 12-2007Document9 pagesRR 12-2007Aris Basco DuroyNo ratings yet

- Gnesh - Thakkar.7 Ncometaxguru/ Ajigneshthakkar: Poured in by MeDocument111 pagesGnesh - Thakkar.7 Ncometaxguru/ Ajigneshthakkar: Poured in by Mepandeyaman7608No ratings yet

- Sections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021Document6 pagesSections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021BablooNo ratings yet

- Directors' Manual 2012Document54 pagesDirectors' Manual 2012harshagarwal5No ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument4 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas Internaszairah jean baquilarNo ratings yet

- PC Square2307Document3 pagesPC Square2307SirManny ReyesNo ratings yet

- Test 5 (QP)Document4 pagesTest 5 (QP)iamneonkingNo ratings yet

- Bir Form 2307 SampleDocument3 pagesBir Form 2307 SampleEliza Cortez Castro50% (2)

- 9Document2 pages9Le Lhiin CariñoNo ratings yet

- Roydz - Gls Optimum PrimeDocument2 pagesRoydz - Gls Optimum PrimeJig-Etten SaxorNo ratings yet

- Test 6 (QP)Document4 pagesTest 6 (QP)iamneonkingNo ratings yet

- 01the Economic Times WealthDocument5 pages01the Economic Times WealthvivoposNo ratings yet

- CAF 2 Spring 2021Document8 pagesCAF 2 Spring 2021Muhammad Ahsan RiazNo ratings yet

- 2307 - CTT Synergy - CorporationDocument2 pages2307 - CTT Synergy - CorporationRACHEL DAMALERIONo ratings yet

- TDS Ready ReckonerDocument29 pagesTDS Ready ReckonerShivani Singh ChandelNo ratings yet

- Income Tax Deductions List - Deductions On Section 80C, 80CCC, 80CCD and 80D - FY 2022-23 (AY 2023-24) - Tax2winDocument26 pagesIncome Tax Deductions List - Deductions On Section 80C, 80CCC, 80CCD and 80D - FY 2022-23 (AY 2023-24) - Tax2winJaydeep DasadiyaNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument2 pagesCertificate of Creditable Tax Withheld at SourceMaricar Lelaine SecretarioNo ratings yet

- Sample 2307Document4 pagesSample 2307kaysNo ratings yet

- 1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Document109 pages1h DT Revision Short Notes Selected Chapters Cma Inter Dec 2023Vaheed AliNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Health Economics: From Wikipedia, The Free EncyclopediaDocument20 pagesHealth Economics: From Wikipedia, The Free EncyclopediaKamran Ali AbbasiNo ratings yet

- 19BMC205B - Unit1 - Nature of Banking BusinessDocument102 pages19BMC205B - Unit1 - Nature of Banking BusinessTenny .BNo ratings yet

- Meaning of A Director: " Any Person Occupying The Position of Director, by Whatever Name Called" - Sec. 2Document21 pagesMeaning of A Director: " Any Person Occupying The Position of Director, by Whatever Name Called" - Sec. 2smsmbaNo ratings yet

- Fin542 Individual AssDocument8 pagesFin542 Individual AssImran AziziNo ratings yet

- E - Commerce Chapter 11Document19 pagesE - Commerce Chapter 11Md. RuHul A.No ratings yet

- Management Accounting and Control For Sustainability: July 2020Document18 pagesManagement Accounting and Control For Sustainability: July 2020Bhanuka GamageNo ratings yet

- Ecological Degradation and Environmental Pollution: Lecture 37: Population and Sustainable DevelopmentDocument8 pagesEcological Degradation and Environmental Pollution: Lecture 37: Population and Sustainable DevelopmentJaf ShahNo ratings yet

- Unit 5Document22 pagesUnit 5Shivam ChandraNo ratings yet

- Urbanization and Economic Growth: The Arguments and Evidence For Africa and AsiaDocument19 pagesUrbanization and Economic Growth: The Arguments and Evidence For Africa and AsiamaizansofiaNo ratings yet

- Implementation of Tax Regulations On Internet-Based Business Activity Case Study: Google'S Tax Avoidance in IndonesiaDocument11 pagesImplementation of Tax Regulations On Internet-Based Business Activity Case Study: Google'S Tax Avoidance in IndonesiagilangNo ratings yet

- Howden Capabilities Oct 2017 ScreenDocument68 pagesHowden Capabilities Oct 2017 ScreenukdealsNo ratings yet

- Conceptual Framework DraftDocument3 pagesConceptual Framework DraftJp CombisNo ratings yet

- Evaluation of Business Idea For Developing An Enterprise: PresentationDocument8 pagesEvaluation of Business Idea For Developing An Enterprise: PresentationPeter DindahNo ratings yet

- Grade 4 Multiplication: Answer The QuestionsDocument6 pagesGrade 4 Multiplication: Answer The QuestionsEduGainNo ratings yet

- Ronald Shone - An Introduction To Economic Dynamics (2001, Cambridge University Press) PDFDocument235 pagesRonald Shone - An Introduction To Economic Dynamics (2001, Cambridge University Press) PDFPedro Camargo100% (1)

- 7110 Principles of Accounts: MARK SCHEME For The May/June 2008 Question PaperDocument8 pages7110 Principles of Accounts: MARK SCHEME For The May/June 2008 Question PaperShehroze Ali JanNo ratings yet

- Problem For Total Quality ManagementDocument7 pagesProblem For Total Quality ManagementReb RenNo ratings yet

- AP World Chapter 25 HWDocument3 pagesAP World Chapter 25 HWMatthew ComptonNo ratings yet

- Revista de AdministraçãoDocument12 pagesRevista de AdministraçãoJoe BotelloNo ratings yet

- Expansion of The Menu Option DescriptionDocument57 pagesExpansion of The Menu Option DescriptionGeraldine NkankumeNo ratings yet

- MBABANE Report Final Corrected Mark - 2018Document62 pagesMBABANE Report Final Corrected Mark - 2018LindaNo ratings yet

- Lesson 2 Career OpportunitiesDocument24 pagesLesson 2 Career OpportunitiesQueen AzurNo ratings yet

- 8011 and 9011 AS - A Level Accounting Syllabus 2005Document16 pages8011 and 9011 AS - A Level Accounting Syllabus 2005Haran MuraliNo ratings yet

- SHRM Action PlanDocument3 pagesSHRM Action PlanAvery Jan Magabanua SilosNo ratings yet

- Government Suspense AccountsDocument63 pagesGovernment Suspense Accountsbharanivldv9No ratings yet

- Salient Points of TRAIN LawDocument21 pagesSalient Points of TRAIN LawNani kore100% (1)