Professional Documents

Culture Documents

1991 Crisis

1991 Crisis

Uploaded by

410 Lovepreet Kaur0 ratings0% found this document useful (0 votes)

18 views6 pagesECONOMIC CRISIS

Original Title

1991 crisis

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentECONOMIC CRISIS

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

18 views6 pages1991 Crisis

1991 Crisis

Uploaded by

410 Lovepreet KaurECONOMIC CRISIS

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 6

1991 Indian economic crisis

Towards the end of 1980s, India was facing a Balance of Payments (BoP)

crisis, due to unsustainable borrowing and high expenditure. The Current

Account Deficit (3.5 percent) in 1990-91 massively weakened the ability

to finance deficit.

Macroeconomic Indicators and Balance of Payments Situation in

1990-1991:

The trade deficit increased from Rs. 12,400 crore in 1989-90 to Rs.

16,900 crore in 1990-91. The current account deficit increased from

Rs. 11,350 crore in 1989-90 to Rs. 17,350 crore in 1990-91.

The CAD/GDP ratio increased from 2.3 in 1989-90 to 3.1 percent

in 1990-91. Besides this, the fiscal deficit to GDP ratio was more

than 7 percent during the two years 1989-90 and 1990-91. The

foreign exchange reserves, meant to cover import costs for two

years (1989-1991),were just sufficient to cover close to two and

half months of imports.

‘The average rate of inflation was 7.5 percent in 1989-90, which

went up to 10 percent in the year 1990-91. In 1991-92, it crossed

13 percent. The GDP growth rate which was 6.5 percent in 1989-

90, went down to 5.5 percent in 1990-91.

The Balance of Payments crisis also affected the performance of industrial

sector. The average industrial growth rate was 8 percent in the second half

of 1980s. In 1989-90, it was 8.6 percent and in 1990-91 it was 8.2 percent.

India’s foreign exchange reserves stood at Rs. 5,277 crore on 31 December

1989, which declined to Rs. 2,152 crore by the end of December 1990. Between

May and July 1991, these reserves ranged between Rs. 2,500 crore to 3,300

crore.

The 1991 Indian economic crisis was an economic crisis in India that resulted

from poor economic policies and the resulting trade deficits. India's economic

problems started worsening in 1985 as the imports swelled, leaving the country

in a twin doficit: the Indian trade balance was in deficit at a time when the

government was running on a huge fiscal deficit. By the end of 1990, in the run-

up to the Gulf War, the dire situation meant that the Indian foreign exchange

reserves could have barely financed three weeks’ worth of imports. Meanwhile,

the government came close to defaulting on its own financial obligations. By

July that year, the low reserves had led to a sharp depreciation of the rupee,

which in turn exacerbated the twin deficit problem. The Chandrasekhar

government could not pass the budget in February

199lafter Moody downgraded India's bond ratings. The ratings further

deteriorated due to the unsuccessful passage of the fiscal budget. This made it

impossible for the country to seek short term loans and exacerbated the existing

economic crisis. The World Bank and IMF also stopped their assistance,

leaving the government with no option except to mortgage the country’s gold to

avoid defaulting on payments.

In an attempt to seek an economic bailout from the IMF, the Indian government

airlifted its national gold reserves.

The crisis, in turn, paved the way for the liberalization of the Indian economy,

since one of the conditions stipulated in the World Bank loan (structural reform),

required India to open itself up to participation from foreign entities in its

industries, including its state owned enterprises.

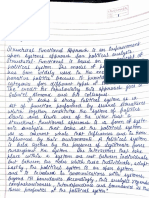

Economic Crisis. vad Cyto? A me oe the teonomy

is of acount ue

__downtwin — baought on by afi Aunaneidl_

A—tasis: An ee mr

inflation) deflation- 2 sis

Asasons for Fro. Cuisis. 199) i=

| 2 9 || IC Domestic Factans:

@ falitical dn-stability

() Excessive Soctalistic

Comme ment

eeellelels| Date i} ih

2 51 export of dndia Exporis =: 5 =)

© Global Recession =.

+ Collapsed _savi np A anid |

Buco of oil increased

ee frdian~ economy also. dietedae sae

De Basin, of Savin A nee —

toma fackons =

er peoiod of timo.

Se a shaded

lye ues emma suse ot

>

fl FB ‘

[Mo] tu [we] m | [se [sa] Date ra = /

(b) Excessive _Socialistic Commitments‘ Je:

+ Economy based _on _Socialsfie fatten

+ 4 led tothe slowdoton of he _econom r

tose scale industries fad great im portagnce ay

0 lange quaritity ef. coptal gocds yaodeds

+ lot of fueian exchange spent fow importing

the: heavy machinontes £ other — capital type

©)_duflation:= a ie ___- pat,

+ Supply Side inflation-moans_ shoflage. of Supply gd

— tach of feed grains £ import these items.

4+ Sach of industvial production dire to lack of firme

<___+ approximately _22/. — increase _in_prices of goods.

@d) fiscal Deficit 1- ae ania

- 4 shows the borrowing -of the govt.

2 tn 6th 2 gth_five yeast_plans, govt: borrowed

a sector _as= well_as agricultural, sectors

5 + Thal’s why fiscal dolicit widened: “

- @) Evoston of pileinational Cowdibility :=

licais® intel sane

+ dt led do the loch of the sasowces: for the

ee

a Z

+ Because of slowdown of economic _adhivities 2

4 ine 7 : ibrlil ipod

—_—

4G \ W

405 .

foes _ ‘ is aeaDale / /

@. Ol Poel | Debit: — ir

, fue to Gulf war, ca woriees. rene Rete li:

» Asan imposrted cau {ndia faced oi! pool

deficit widened:

«Ability to pay impostts was deel nad-day “hy day:

ion Valued Rupee :~ .

. dndia adopted the fixed exdange rte _ policy Hee

19a ~

+ -Honetany —authosely- / Govt. estimated the value of

___wupee over and abuve _ the basket of cusdencies

and gold

Jack of demand. of yupee was accused. at

___that__ time.

~ 4H fed to the esosion of rupee value .

th) Joss making Publie Secton Undertakings Asus) ___

__ lea bP &Us¢ coymante— was vert bad -£ nit suained-

Sc thaslbssh Yeough —sluleyiaina

+ Onder = poroduchian | __—

= fubic_Setgstdmnen- bil net managed

ity in the Indian

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Law As A Means of Social Engineering by Roscoe PoundDocument9 pagesLaw As A Means of Social Engineering by Roscoe Pound410 Lovepreet KaurNo ratings yet

- Research Proposition 4Document63 pagesResearch Proposition 4410 Lovepreet KaurNo ratings yet

- Law On ProbationDocument12 pagesLaw On Probation410 Lovepreet KaurNo ratings yet

- Drafting Assignment 6Document2 pagesDrafting Assignment 6410 Lovepreet KaurNo ratings yet

- Drafting Assignment .8Document6 pagesDrafting Assignment .8410 Lovepreet Kaur100% (1)

- Research Proposition 3Document8 pagesResearch Proposition 3410 Lovepreet KaurNo ratings yet

- Establishment of SC Unit 3Document6 pagesEstablishment of SC Unit 3410 Lovepreet KaurNo ratings yet

- Balance of PaymentDocument8 pagesBalance of Payment410 Lovepreet KaurNo ratings yet

- Adobe Scan 31-May-2022Document7 pagesAdobe Scan 31-May-2022410 Lovepreet KaurNo ratings yet

- Charter Act 1853Document5 pagesCharter Act 1853410 Lovepreet KaurNo ratings yet

- Adobe Scan 26-Jun-2021Document1 pageAdobe Scan 26-Jun-2021410 Lovepreet KaurNo ratings yet

- (Patriarchy) Roll No. 69 Lovepreet KaurDocument14 pages(Patriarchy) Roll No. 69 Lovepreet Kaur410 Lovepreet KaurNo ratings yet

- Adobe Scan 21-Dec-2021Document4 pagesAdobe Scan 21-Dec-2021410 Lovepreet KaurNo ratings yet

- Adobe Scan 16-Nov-2020Document5 pagesAdobe Scan 16-Nov-2020410 Lovepreet KaurNo ratings yet

- Adobe Scan 06-Jun-2022Document12 pagesAdobe Scan 06-Jun-2022410 Lovepreet KaurNo ratings yet

- Major Sourceso: Ancient Indian HlstorvDocument7 pagesMajor Sourceso: Ancient Indian Hlstorv410 Lovepreet KaurNo ratings yet

- The Specific Relief ActDocument14 pagesThe Specific Relief Act410 Lovepreet KaurNo ratings yet

- SavignyDocument10 pagesSavigny410 Lovepreet KaurNo ratings yet

- Theories of Justice PPT Geog 3Document22 pagesTheories of Justice PPT Geog 3410 Lovepreet KaurNo ratings yet