Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

14 viewsMCM311 - FIFO, LIFO, Avg Cost

MCM311 - FIFO, LIFO, Avg Cost

Uploaded by

sundeep drgThis document discusses various methods of inventory valuation including FIFO, LIFO, average cost, and market value. It also covers reconciliation and record keeping for inventory. Some key points covered are:

1) FIFO matches the oldest costs to cost of goods sold, while LIFO matches the most recent costs. Average cost splits issues equally across receipts.

2) Reconciliation objectives include quality control, minimizing costs and handling time, controlling payments, and authorizing issues.

3) Good record keeping includes purchase, issue, return, transfer and loss records, internal audits, periodic verification, and payment validation. Consistent valuation methods and control accounts are also important.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Case Problem 2 Phoenix ComputerDocument3 pagesCase Problem 2 Phoenix ComputerSomething ChicNo ratings yet

- Inventory Valuation-ProblemsDocument3 pagesInventory Valuation-ProblemsKaran100% (1)

- Petty Cash & Bank Reconciliation TemplatesDocument1 pagePetty Cash & Bank Reconciliation TemplatesManual StoreeNo ratings yet

- Chapter 7 - Just-in-Time (JIT) and Lean SystemsDocument34 pagesChapter 7 - Just-in-Time (JIT) and Lean SystemsVernier Miranda67% (3)

- VALUATION Sir NotesDocument22 pagesVALUATION Sir NotesKimberly Quin CanasNo ratings yet

- Saving TrackerDocument2 pagesSaving TrackerDanica Marie DanielNo ratings yet

- Saving Tracker: Goal For 2018 Total Allowance Total Spending Total Saving Week Start Date AllowanceDocument2 pagesSaving Tracker: Goal For 2018 Total Allowance Total Spending Total Saving Week Start Date AllowanceDanica Marie DanielNo ratings yet

- AP at Green MillsDocument3 pagesAP at Green Millspgp39356No ratings yet

- Unit 10 - Stock Valuation Methods 2Document21 pagesUnit 10 - Stock Valuation Methods 2Jabari BrowneNo ratings yet

- Analysis of The Interrelationship Between Listed Real Estate Share Index and Other Stock Market IndexesDocument20 pagesAnalysis of The Interrelationship Between Listed Real Estate Share Index and Other Stock Market IndexesClaudiu OprescuNo ratings yet

- Credit Suisse - Sell SX5E SkewDocument3 pagesCredit Suisse - Sell SX5E SkewZhenhuan SongNo ratings yet

- Pom Course ProjectDocument20 pagesPom Course ProjectNithishNo ratings yet

- Averages and Indices: Application in Stock Markets: Dr. Adeel NasirDocument14 pagesAverages and Indices: Application in Stock Markets: Dr. Adeel NasirAdeel NasirNo ratings yet

- Lecture+2 1+Direct+and+Absorption+costing+systemsDocument31 pagesLecture+2 1+Direct+and+Absorption+costing+systemsashveerklaNo ratings yet

- Daniel Gramza - Building Your E-Mini Trading StrategyDocument121 pagesDaniel Gramza - Building Your E-Mini Trading StrategyBig Tex100% (4)

- Problem 3 Chapter1 (Accounting in Action)Document4 pagesProblem 3 Chapter1 (Accounting in Action)Amelia LarasatiNo ratings yet

- Emin I Trading StrategyDocument122 pagesEmin I Trading StrategyindofilesNo ratings yet

- Stock ValuationDocument3 pagesStock ValuationnishankNo ratings yet

- Aluminium Warehousing, Premiums and PricesDocument11 pagesAluminium Warehousing, Premiums and Pricesfiki arifNo ratings yet

- Daily Equity Technical 11 06 2024 1718072009Document6 pagesDaily Equity Technical 11 06 2024 1718072009localetherNo ratings yet

- COMA 1 Notes Chap 2 AllDocument24 pagesCOMA 1 Notes Chap 2 Allannur azalillahNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingShubhamNo ratings yet

- Annual Procurement PlanDocument6 pagesAnnual Procurement Planlynnard18100% (1)

- Subsequent Measurement of Inventory: 2. First in First Out Method (FIFO) : (Interchangeable Inventory)Document6 pagesSubsequent Measurement of Inventory: 2. First in First Out Method (FIFO) : (Interchangeable Inventory)Syed MunibNo ratings yet

- Agg Plan Math FinalDocument19 pagesAgg Plan Math Finalabdulmoktadir801No ratings yet

- Inventory AccountingDocument23 pagesInventory AccountingKaranNo ratings yet

- Chapter 8 (Brooks) : Modelling Volatility and CorrelationDocument64 pagesChapter 8 (Brooks) : Modelling Volatility and Correlationahmad_hassan_59No ratings yet

- Valuation of Inventories: by Surbhi Khandelwal (26) Pooja Raut (42) Zeenal Shah (54) Rashmi SinhaDocument37 pagesValuation of Inventories: by Surbhi Khandelwal (26) Pooja Raut (42) Zeenal Shah (54) Rashmi SinhaRashmi SinhaNo ratings yet

- Statistic Project Roll No. 23Document4 pagesStatistic Project Roll No. 23Nikunj WaghelaNo ratings yet

- Financial PlanningDocument7 pagesFinancial PlanningVikash YadavNo ratings yet

- Rr110000 - 88 Pprrooject Plan - FSB - Phase I R100-8 Project Plan - Idt Rr110000-8-8..0011 Roadmap Erp Implementation R100-8.01 Eppms ImplementationDocument2 pagesRr110000 - 88 Pprrooject Plan - FSB - Phase I R100-8 Project Plan - Idt Rr110000-8-8..0011 Roadmap Erp Implementation R100-8.01 Eppms Implementationmsvs.suresh8630No ratings yet

- Ifrs 9 Review Questions and Ias 1 QNSDocument4 pagesIfrs 9 Review Questions and Ias 1 QNSsaidkhatib368No ratings yet

- Indices Product Specification Sheet 20141Document4 pagesIndices Product Specification Sheet 20141Murphy AnifowoseNo ratings yet

- Baf2202-Management Accounting I Take Away CatDocument3 pagesBaf2202-Management Accounting I Take Away Catyasipi casmirNo ratings yet

- Manage Finances 2Document7 pagesManage Finances 2Ashish JaatNo ratings yet

- Knot Master 1Document1 pageKnot Master 1maulajutt324No ratings yet

- Cost Accounting Unit 2 - Methods of Pricing Material IssuesDocument7 pagesCost Accounting Unit 2 - Methods of Pricing Material IssuesSHANMUGHA SHETTY S S100% (1)

- Manegrial Economics en G66 006Document21 pagesManegrial Economics en G66 006Mohamed EhabNo ratings yet

- Konti For RusDocument24 pagesKonti For RusdragananedeljkovicNo ratings yet

- Assignment Receassignment Subtopic Rate AgrredDocument34 pagesAssignment Receassignment Subtopic Rate AgrredSaima AsadNo ratings yet

- Rhu 2021 Aip Supplemental Budget ProposalDocument12 pagesRhu 2021 Aip Supplemental Budget ProposalIvoneZarahDingleAbaoNo ratings yet

- Forex Revaluation Delta Logic and Reversal of Excess Gain - Loss Posted After Payment - SAP BlogsDocument8 pagesForex Revaluation Delta Logic and Reversal of Excess Gain - Loss Posted After Payment - SAP BlogsTito TalesNo ratings yet

- Details of Listed TFCsDocument6 pagesDetails of Listed TFCsAhsan SeedNo ratings yet

- Store LedegrDocument6 pagesStore LedegrAdib Ahnaf NafiNo ratings yet

- ELSS - Effective Way of Tax Planning & Creation of WealthDocument2 pagesELSS - Effective Way of Tax Planning & Creation of WealthLoknath AgarwallaNo ratings yet

- Lifo and Fifo MethodDocument12 pagesLifo and Fifo MethodSrinivas R. Khode50% (8)

- Rka Bok 2018 Final Update 1 - 2Document233 pagesRka Bok 2018 Final Update 1 - 2asmiyatunNo ratings yet

- Questions Folder - 2024Document22 pagesQuestions Folder - 2024Shumail AkhundNo ratings yet

- Chapter 4 Inventorie Ifa 4Document38 pagesChapter 4 Inventorie Ifa 4Nigussie BerhanuNo ratings yet

- Cost Accounting Unit 2 - Methods of Pricing Material IssuesDocument8 pagesCost Accounting Unit 2 - Methods of Pricing Material IssuesSHANMUGHA SHETTY S SNo ratings yet

- Trend Analysis: September 2020Document6 pagesTrend Analysis: September 2020Sharmarke Mohamed AhmedNo ratings yet

- United States Nonfarm PayrollsDocument1 pageUnited States Nonfarm PayrollsLuis ChigchónNo ratings yet

- FM - Modern Portfolio Theory 4Document8 pagesFM - Modern Portfolio Theory 4Lipika haldarNo ratings yet

- HedgingDocument2 pagesHedgingParvathareddy RishithaNo ratings yet

- Advance Management Accounting: Individual AssignmentDocument10 pagesAdvance Management Accounting: Individual AssignmentAditya AnandaNo ratings yet

- Slide Idriss Tsafack CIREQDocument50 pagesSlide Idriss Tsafack CIREQNielNo ratings yet

- Gj-Ud BuanaDocument1 pageGj-Ud BuanaAldi HidayatullahNo ratings yet

- Ar EdfhcfDocument45 pagesAr EdfhcfPrasen RajNo ratings yet

- Material Planning and EstimationDocument2 pagesMaterial Planning and Estimationsundeep drgNo ratings yet

- NuclearDocument24 pagesNuclearsundeep drgNo ratings yet

- Materials PolicyDocument11 pagesMaterials Policysundeep drgNo ratings yet

- Creer DevtDocument28 pagesCreer Devtsundeep drgNo ratings yet

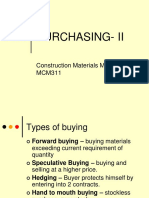

- Purchasing IIDocument16 pagesPurchasing IIsundeep drgNo ratings yet

- Conflict MGTDocument33 pagesConflict MGTsundeep drgNo ratings yet

- Competence BuidingDocument33 pagesCompetence Buidingsundeep drgNo ratings yet

- Chapter 9Document30 pagesChapter 9Thức NguyễnNo ratings yet

- CH 08Document22 pagesCH 08Abdalelah FrarjehNo ratings yet

- Rater-Reliability of A 5S Audit ChecklistDocument1 pageRater-Reliability of A 5S Audit ChecklistAizz D'Tech AbeNo ratings yet

- Chapter 5 Lean Enterprise Sakichi ToyodaDocument10 pagesChapter 5 Lean Enterprise Sakichi ToyodaAMIEL TACULAONo ratings yet

- Wiwien Tantio M: Personal ProfileDocument1 pageWiwien Tantio M: Personal ProfileDwi AgnesiaNo ratings yet

- Assignment 2: ERP - BPI (MM Cycle) (10 Marks)Document3 pagesAssignment 2: ERP - BPI (MM Cycle) (10 Marks)Karthik ManjunathNo ratings yet

- QUIZ 3. Audit of Inventories ManuscriptDocument3 pagesQUIZ 3. Audit of Inventories ManuscriptJulie Mae Caling MalitNo ratings yet

- Quiz 5 InventoryDocument4 pagesQuiz 5 InventoryCindy CrausNo ratings yet

- Group 4 - StartechDocument7 pagesGroup 4 - StartechSubhasish BalaNo ratings yet

- Nicmar: Stores and Inventory Management (Infrastructure Projects)Document19 pagesNicmar: Stores and Inventory Management (Infrastructure Projects)searchers007No ratings yet

- Chapter-9 Inventory Text-2 MathsDocument50 pagesChapter-9 Inventory Text-2 Mathsbckup789No ratings yet

- Methods of Inventory Control - BHM - MGDocument12 pagesMethods of Inventory Control - BHM - MGmanik ghoshNo ratings yet

- Inventory p1Document5 pagesInventory p1Rüel DellovaNo ratings yet

- Assessment of Inventory Management Practices at The Ethiopian Pharmaceuticals Supply AgencyDocument3 pagesAssessment of Inventory Management Practices at The Ethiopian Pharmaceuticals Supply AgencyshewameneBegashawNo ratings yet

- Principles of Inventory Management Oct 2018Document5 pagesPrinciples of Inventory Management Oct 2018Ahmad AliNo ratings yet

- Unit - Iv Materials ManagementDocument4 pagesUnit - Iv Materials Managementsabha5121021No ratings yet

- Pepco Co Establishes A Petty Cash Fund For Payments ofDocument1 pagePepco Co Establishes A Petty Cash Fund For Payments ofAmit PandeyNo ratings yet

- CH 1Document20 pagesCH 1MathewosNo ratings yet

- Nilofar SipDocument8 pagesNilofar Siptechpert.hr22No ratings yet

- On May 1 2014 Lowell Company Began The Manufacture ofDocument1 pageOn May 1 2014 Lowell Company Began The Manufacture ofAmit PandeyNo ratings yet

- LearnSmart Assignment 6Document5 pagesLearnSmart Assignment 6Bei Recordi DesignNo ratings yet

- Class 02 (Material Costing)Document14 pagesClass 02 (Material Costing)FizaNo ratings yet

- INVENTORIESDocument64 pagesINVENTORIESLuisa Janelle BoquirenNo ratings yet

- SAP MM Tables + Tcode + MM ReportDocument7 pagesSAP MM Tables + Tcode + MM ReportNguyen Ngoc Minh100% (2)

- AIA Test 1 2021Document4 pagesAIA Test 1 2021Zukiswa Sibiya0% (1)

- "First Purchased, First Sold ": Note Well That Under FIFO-periodic and FIFO Perpetual, The Inventory Costs Are The SameDocument4 pages"First Purchased, First Sold ": Note Well That Under FIFO-periodic and FIFO Perpetual, The Inventory Costs Are The SameKristia AnagapNo ratings yet

- PAS 8 Accounting Policies, Estimates and ErrorsDocument3 pagesPAS 8 Accounting Policies, Estimates and Errorspanda 1No ratings yet

- A Study On Inventory ManagementDocument3 pagesA Study On Inventory ManagementEditor IJTSRDNo ratings yet

- 01 Input Output: CKD Ti CKD Mi PurchaseDocument1 page01 Input Output: CKD Ti CKD Mi PurchaseJulian RazifNo ratings yet

MCM311 - FIFO, LIFO, Avg Cost

MCM311 - FIFO, LIFO, Avg Cost

Uploaded by

sundeep drg0 ratings0% found this document useful (0 votes)

14 views34 pagesThis document discusses various methods of inventory valuation including FIFO, LIFO, average cost, and market value. It also covers reconciliation and record keeping for inventory. Some key points covered are:

1) FIFO matches the oldest costs to cost of goods sold, while LIFO matches the most recent costs. Average cost splits issues equally across receipts.

2) Reconciliation objectives include quality control, minimizing costs and handling time, controlling payments, and authorizing issues.

3) Good record keeping includes purchase, issue, return, transfer and loss records, internal audits, periodic verification, and payment validation. Consistent valuation methods and control accounts are also important.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses various methods of inventory valuation including FIFO, LIFO, average cost, and market value. It also covers reconciliation and record keeping for inventory. Some key points covered are:

1) FIFO matches the oldest costs to cost of goods sold, while LIFO matches the most recent costs. Average cost splits issues equally across receipts.

2) Reconciliation objectives include quality control, minimizing costs and handling time, controlling payments, and authorizing issues.

3) Good record keeping includes purchase, issue, return, transfer and loss records, internal audits, periodic verification, and payment validation. Consistent valuation methods and control accounts are also important.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

14 views34 pagesMCM311 - FIFO, LIFO, Avg Cost

MCM311 - FIFO, LIFO, Avg Cost

Uploaded by

sundeep drgThis document discusses various methods of inventory valuation including FIFO, LIFO, average cost, and market value. It also covers reconciliation and record keeping for inventory. Some key points covered are:

1) FIFO matches the oldest costs to cost of goods sold, while LIFO matches the most recent costs. Average cost splits issues equally across receipts.

2) Reconciliation objectives include quality control, minimizing costs and handling time, controlling payments, and authorizing issues.

3) Good record keeping includes purchase, issue, return, transfer and loss records, internal audits, periodic verification, and payment validation. Consistent valuation methods and control accounts are also important.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 34

Inventory

(Valuation, Reconciliation

& Records)

MCM311 – Construction Materials Management

Prof. Rajiv Gupta

FIFO Method of Valuation of

Inventories

FIFO – First In First Out

Oldest stock is depleted first

The value of stocks on hand is the money

that has been paid for that amount, this

reflects the true value of inventory

Becomes unwieldy when too many

changes in price levels occur

Encounters problem in costing of returns

to store

MCM311- Prof.Rajiv Gupta 2

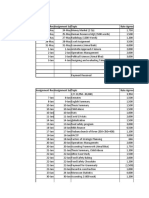

FIFO

FIFO

Receipts Issues Stock on Hand

Date

Qty. Rate Value Qty. Rate Value Qty. Rate Value

01-Feb 1000 1 1000 0 0 0 1000 1 1000

14-Feb 2000 1.1 2200 0 0 0

1000 1

2000 1.1 3200

20-Feb 0 0 0 500 1 500

500 1

2000 1.1 2700

28-Feb 0 0 0 1500

1 500

1.1 1100 1000 1.1 1100

MCM311- Prof.Rajiv Gupta 3

LIFO Method of Valuation of

Inventories

Latest prices are charged to the issues,

thereby leading to lower reported profits

During wide fluctuations in price levels,

LIFO tends to minimise unrealised gains

or losses in inventory

Applied in a period of rising price.

MCM311- Prof.Rajiv Gupta 4

LIFO

LIFO

Receipts Issues Stock on Hand

Date

Qty. Rate Value Qty. Rate Value Qty. Rate Value

01-Feb 1000 1 1000 0 0 0 1000 1 1000

14-Feb 2000 1.1 2200 0 0 0

1000 1

2000 1.1 3200

20-Feb 0 0 0

1000 1

500 1.1 550 1500 1.1 2650

28-Feb 0 0 0 1000 1

1500 1.1 1650 1000

MCM311- Prof.Rajiv Gupta 5

Average Cost Method

The issues are split into equal batches

from each shipment at stock

It is a realistic method reflecting the price

levels and stabilizing the cost figures

As more purchases are made, new

average is computed and this average is

applied to the subsequent issues

MCM311- Prof.Rajiv Gupta 6

Average Cost

Average cost

Receipts Issues Stock on Hand

Date

Qty. Rate Value Qty. Rate Value Qty. Rate Value

01-Feb 1000 1 1000 0 0 0 1000 1 1000

14-Feb 2000 1.1 2200 0 0 0

3000 1.067 3200

20-Feb 0 0 0

500 1.067 533 2500 1.067 2667

28-Feb 0 0 0 1000 1.067

1500 1.067 1600 1067

MCM311- Prof.Rajiv Gupta 7

Market Value Method

Also called replacement rate costing

Materials that are issued are costed at the

market rate prevailing at the time of

issue.

This method requires continuous

monitoring of the market rates for all

materials, hence it is unwieldy.

MCM311- Prof.Rajiv Gupta 8

Standard Cost Method

In this method a standard rate is

determined based on detailed analysis of

market price and trends.

This method of accounting evens out

fluctuations in rates.

The standard rate is kept fixed for a

considerable time i.e. 6 months or more.

This method has limited application – in

management control.

MCM311- Prof.Rajiv Gupta 9

Closing Stock Valuation

As per accounting principles for the

purpose of valuation of stock for balance

sheet purpose the market price or stock

at cost is used, which ever is less.

MCM311- Prof.Rajiv Gupta 10

RECONCILIATION

&

RECORDS

MCM311- Prof.Rajiv Gupta 11

Aspects of material control

Accounting and procedural

aspect – concerned with laying down

detailed procedures for requisitioning,

ordering, receiving, stocking, issuing

and paying for materials.

Operational aspect – deals with

maintaining adequate supplies of all

types of materials for smooth conduct

of the construction operations and

dealing with obsolescence, wastage,

spoilage, scrap, empties

MCM311- Prof.Rajiv Gupta 12

Objectives of material control for reconciliation

Strict quality control – materials should be

tested at the time of receipts and responsibility

fixed for testing.

Minimum handling cost and time –

materials should be stored at such a place and

in such a manner that i) they can be located

with ease ii) made available to user departments

with least effort iii) time consumed in tracing

the materials and making them reach the user

department should be least.

MCM311- Prof.Rajiv Gupta 13

Contd.

Control on payments for materials – ensure

that no payment is made for materials not ordered

though received, or for materials not received or

for materials of defective quality.

Authorized issues – ensure that no issues from

stores take place without proper authorizations.

Store keeper to be held accountable for all issues.

Control on misappropriations – ensure that

no misappropriation of materials takes place. Once

leakages develop in the system they tend to

become recurring in character.

MCM311- Prof.Rajiv Gupta 14

Contd.

Minimize wastages – at the time of

receipt, issues, usage. Fix norms at each

stage. Higher wastages should be

investigated.

Control on leakages and pilferages –

especially for those materials prone to

pilferage.

Minimize spoilage and obsolescence

– fix norm for each item.

Detect slow and non-moving items

MCM311- Prof.Rajiv Gupta 15

Material accounting and reporting

Complete records of all purchases, issues,

returns, transfers and losses of materials to be

maintained.

An efficient system of internal audit of material

records should be maintained.

All materials should be periodically verified.

Payments of all suppliers bills should be made

only after comparing the supplier’s bill with the

copy of purchase order and the receiving and

inspection report.

Method of valuation of stocks should be

followed on consistent basis.

MCM311- Prof.Rajiv Gupta 16

Material accounting and reporting..contd.

Control accounts and subsidiary

ledgers should be maintained for

obtaining summarized information.

Special reports should be prepared

regarding spoilage, return to suppliers,

obsolete items, defectives and

abnormal losses.

MCM311- Prof.Rajiv Gupta 17

Pre-requisites for a good inventory system

Up-to-date records – all issues and

receipts should be immediately recorded in

the bin cards and stores ledger. Balance in

hand should be recorded after each

transaction.

Continuous stock-taking

Detailed advance programme – should

be prepared for weekly or monthly stock

taking well in advance. The duties of stock

taking staff as regards counting, weighing,

measuring, reconciling, listing and

preparation of stock verification sheets etc.

should be determined.

MCM311- Prof.Rajiv Gupta 18

Contd.

Separate recorded and

unrecorded stocks – stores items

which have been received but have not

yet been recorded in bin cards and

stores ledger because their documents

have not yet been received or they

have not yet been inspected, should be

separated from recorded items.

MCM311- Prof.Rajiv Gupta 19

Contd.

Use inventory tags – to avoid confusion

between the portion of inventory which has been

verified and that to be verified

Reconcile bin cards and stores ledger –

receipts, issues and quantity in hand should be

same in bin cards and stores ledger. The two

records should be tallied. Discrepancy, if any,

should be located. It can arise due to some

arithmetical error in balancing or wrong posting or

non-posting either in bin card or in store ledger.

Such errors should be rectified by passing a

rectifying entry and initialed.

MCM311- Prof.Rajiv Gupta 20

Contd.

Regularly reconcile book figures

with physical stocks – In case of any

difference an enquiry should be made,

the difference should be ascertained and

records be rectified.

Stock verification sheets – should be

prepared to record verification of stocks

in chronological order. They convey how

much verification work has been done

by whom and by what time. These

facilitate future stock-taking

programmes.

MCM311- Prof.Rajiv Gupta 21

Stock Discrepancies

Discrepancy may be observed between

quantity of stock as shown in stock

ledger and bin cards and that verified by

physical counting of stocks. The causes

can be categorized as:

- i) Avoidable causes

- ii) Unavoidable causes

MCM311- Prof.Rajiv Gupta 22

Avoidable causes or abnormal losses

These are causes which can be avoided through

reasonable skill and care in material handling and

recording. These are:

Improper storage

Carelessness in counting, weighing and measuring-

resulting in under or over issues.

Losses due to evaporation, moisture, shrinkage etc.

beyond the expected level.

Loss due to carelessness and breaking bulk, cutting etc.

Clerical errors resulting in wrong recording

Theft and pilferage.

MCM311- Prof.Rajiv Gupta 23

Unavoidable or normal losses

Losses which are inherent in the nature

of materials or material handling .

Normal losses due to evaporation,

moisture, shrinkage etc.

Normal pilferage.

Normal storage losses.

Normal losses in breaking bulk or cutting

Normal obsolescence.

Normal defectives and scraps.

Losses due to accidents inherent in the

nature of business activity.

MCM311- Prof.Rajiv Gupta 24

Treatment of stock discrepancies

Normal material losses must be

charged to output. This must be done in

two ways.

a) By suitably inflating the rate of issue of

material so that normal loss is

distributed over normal output.

b) The normal loss of materials may be

debited to construction overheads and

credited in stores ledger so as to bring

stores ledger balance in agreement with

the actual physical balance in stores.

MCM311- Prof.Rajiv Gupta 25

Checks for Receipt Function

a) Check valid documentation for material & carrier entry.

b) Monitor arrival of material at Warehouse.

c) Verify PO, identify material and tally the order and acknowledge

the delivery,

d) Report to buyer all deliveries without valid Purchase Order in SAP.

e) Verify Third Party Inspection documents or Arrange for Incoming

Inspection & Confirm QM acceptance.

f) Usage decision, Prepare GRN and Post to Inventory.

g) Lodging claim on supplier for shortages, discrepancies, wrong or

substandard supplies. Intimate buyer and commercial.

h) Intimate Insurance group for claims of transit damage or losses or

pilferage if any. Arrange for insurance survey, lodge preliminary claim

on insurance.

MCM311- Prof.Rajiv Gupta 26

Checks for Material Storage.

a) Review the warehouse functions including facilities

planning, layout and material handling equipment.

b) Ensure insurance cover for all material in stock at

warehouses, in transit and on sites.

c) Follow statutory guidelines and licensing requirements

for specialty material such as HSD, LDO, Explosives,

corrosive chemicals etc.

d) Ensure Store hygiene through routine activities such as

sweeping, cleaning, dusting.

MCM311- Prof.Rajiv Gupta 27

Checks Inventory Accounting & Control

a) Review the construction program, stock availability and

consumption pattern.

b) Ensure proper documentation in SAP for material receipt, Issue

and return receipts of usable, used and scrap material.

c) Draw up annual stock verification and audit program and arrange

for material audit including spot checks.

d) Implement Inventory control & Analysis methods – ABC, XYZ

and VED, Max/Min Inventory.

e) Review non-moving, slow moving and life expiring stock and

initiate action, for return to vendor or disposal in consultation with

user group.

f) Investigate binning errors, audit discrepancies and advice

corrective action.

MCM311- Prof.Rajiv Gupta 28

Material Issue.

a)Ensure compliance of Standard Operating procedure.

b) Ensure proper authority and statutory approvals

(custom/excise) for material movement to other warehouses

or to outside agencies.

c) In case of Block-to-Block transfer (including issue on loan)

ensure necessary Govt.approvals and Essentiality certificate is

in place.

d) Ensure compliance of Sales Tax, Entry tax, Octroi and other

statutory regulations in force time to time.

e) Regulate gate passes and vehicle authorizations at out-

bound gate.

f) Post all Stock Transfer Orders and Sale Orders for material

issued.

g) Report and reconcile any discrepancy in material

receipt/issue during transit.

MCM311- Prof.Rajiv Gupta 29

Some typical results due to effective control

(basis: an audit report)

The estimated requirement of material in Depots is based

on Anticipated Annual Consumption (AAC).

Any irregular issues i.e. materials shown as issued but not

physically lifted, could lead to computation of incorrect

AAC and thus, estimation of excess quantity.

In 4,274 cases, material worth Rs.20.67 crore was

fictitiously shown as issued but not actually removed

from the depots.

Based on these inflated issues, the requirement estimated

for the next year also got inflated. 383 items were found

in excess of the requirement assessed with reference to

Anticipated Annual Consumption (AAC).

MCM311- Prof.Rajiv Gupta 30

The material received in the Receipt Section should be

got inspected promptly. A test check of 819 receipt

challans in 33 depots revealed that in 322 cases, the

inspection was not completed even after a period of 3

months of receipt. In 47 cases, the inspection was kept

pending deliberately to avoid inflation of inventory.

Audit Review of rejected material cases in 32 depots

disclosed that out of 2826 pending rejection cases, 758

cases valued at Rs.2.79 crore were more than 3 years

old. In 1231 cases, the entire consignment were

rejected by the consignee due to non-conformity of

the material to the specification. This indicates poor

quality of inspection by Inspecting Agencies.

MCM311- Prof.Rajiv Gupta 31

The efficiency of Inventory Control is

judged by Turn Over Ratio (TOR) which

is expressed in percentage of value of

closing balance at end of financial year to

the value of issues during the year. The

TOR was manipulated by delaying

accounting of receipts and showing

materials as issued without lifting these

in the same year. A review of 29 depots

disclosed that in respect of 12598 cases,

material worth Rs.43.50 crore was

shown as issued but material was not

lifted in the same years. This

tantamounted to manipulation of TOR.

MCM311- Prof.Rajiv Gupta 32

MCM311- Prof.Rajiv Gupta 33

MCM311- Prof.Rajiv Gupta 34

You might also like

- Case Problem 2 Phoenix ComputerDocument3 pagesCase Problem 2 Phoenix ComputerSomething ChicNo ratings yet

- Inventory Valuation-ProblemsDocument3 pagesInventory Valuation-ProblemsKaran100% (1)

- Petty Cash & Bank Reconciliation TemplatesDocument1 pagePetty Cash & Bank Reconciliation TemplatesManual StoreeNo ratings yet

- Chapter 7 - Just-in-Time (JIT) and Lean SystemsDocument34 pagesChapter 7 - Just-in-Time (JIT) and Lean SystemsVernier Miranda67% (3)

- VALUATION Sir NotesDocument22 pagesVALUATION Sir NotesKimberly Quin CanasNo ratings yet

- Saving TrackerDocument2 pagesSaving TrackerDanica Marie DanielNo ratings yet

- Saving Tracker: Goal For 2018 Total Allowance Total Spending Total Saving Week Start Date AllowanceDocument2 pagesSaving Tracker: Goal For 2018 Total Allowance Total Spending Total Saving Week Start Date AllowanceDanica Marie DanielNo ratings yet

- AP at Green MillsDocument3 pagesAP at Green Millspgp39356No ratings yet

- Unit 10 - Stock Valuation Methods 2Document21 pagesUnit 10 - Stock Valuation Methods 2Jabari BrowneNo ratings yet

- Analysis of The Interrelationship Between Listed Real Estate Share Index and Other Stock Market IndexesDocument20 pagesAnalysis of The Interrelationship Between Listed Real Estate Share Index and Other Stock Market IndexesClaudiu OprescuNo ratings yet

- Credit Suisse - Sell SX5E SkewDocument3 pagesCredit Suisse - Sell SX5E SkewZhenhuan SongNo ratings yet

- Pom Course ProjectDocument20 pagesPom Course ProjectNithishNo ratings yet

- Averages and Indices: Application in Stock Markets: Dr. Adeel NasirDocument14 pagesAverages and Indices: Application in Stock Markets: Dr. Adeel NasirAdeel NasirNo ratings yet

- Lecture+2 1+Direct+and+Absorption+costing+systemsDocument31 pagesLecture+2 1+Direct+and+Absorption+costing+systemsashveerklaNo ratings yet

- Daniel Gramza - Building Your E-Mini Trading StrategyDocument121 pagesDaniel Gramza - Building Your E-Mini Trading StrategyBig Tex100% (4)

- Problem 3 Chapter1 (Accounting in Action)Document4 pagesProblem 3 Chapter1 (Accounting in Action)Amelia LarasatiNo ratings yet

- Emin I Trading StrategyDocument122 pagesEmin I Trading StrategyindofilesNo ratings yet

- Stock ValuationDocument3 pagesStock ValuationnishankNo ratings yet

- Aluminium Warehousing, Premiums and PricesDocument11 pagesAluminium Warehousing, Premiums and Pricesfiki arifNo ratings yet

- Daily Equity Technical 11 06 2024 1718072009Document6 pagesDaily Equity Technical 11 06 2024 1718072009localetherNo ratings yet

- COMA 1 Notes Chap 2 AllDocument24 pagesCOMA 1 Notes Chap 2 Allannur azalillahNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingShubhamNo ratings yet

- Annual Procurement PlanDocument6 pagesAnnual Procurement Planlynnard18100% (1)

- Subsequent Measurement of Inventory: 2. First in First Out Method (FIFO) : (Interchangeable Inventory)Document6 pagesSubsequent Measurement of Inventory: 2. First in First Out Method (FIFO) : (Interchangeable Inventory)Syed MunibNo ratings yet

- Agg Plan Math FinalDocument19 pagesAgg Plan Math Finalabdulmoktadir801No ratings yet

- Inventory AccountingDocument23 pagesInventory AccountingKaranNo ratings yet

- Chapter 8 (Brooks) : Modelling Volatility and CorrelationDocument64 pagesChapter 8 (Brooks) : Modelling Volatility and Correlationahmad_hassan_59No ratings yet

- Valuation of Inventories: by Surbhi Khandelwal (26) Pooja Raut (42) Zeenal Shah (54) Rashmi SinhaDocument37 pagesValuation of Inventories: by Surbhi Khandelwal (26) Pooja Raut (42) Zeenal Shah (54) Rashmi SinhaRashmi SinhaNo ratings yet

- Statistic Project Roll No. 23Document4 pagesStatistic Project Roll No. 23Nikunj WaghelaNo ratings yet

- Financial PlanningDocument7 pagesFinancial PlanningVikash YadavNo ratings yet

- Rr110000 - 88 Pprrooject Plan - FSB - Phase I R100-8 Project Plan - Idt Rr110000-8-8..0011 Roadmap Erp Implementation R100-8.01 Eppms ImplementationDocument2 pagesRr110000 - 88 Pprrooject Plan - FSB - Phase I R100-8 Project Plan - Idt Rr110000-8-8..0011 Roadmap Erp Implementation R100-8.01 Eppms Implementationmsvs.suresh8630No ratings yet

- Ifrs 9 Review Questions and Ias 1 QNSDocument4 pagesIfrs 9 Review Questions and Ias 1 QNSsaidkhatib368No ratings yet

- Indices Product Specification Sheet 20141Document4 pagesIndices Product Specification Sheet 20141Murphy AnifowoseNo ratings yet

- Baf2202-Management Accounting I Take Away CatDocument3 pagesBaf2202-Management Accounting I Take Away Catyasipi casmirNo ratings yet

- Manage Finances 2Document7 pagesManage Finances 2Ashish JaatNo ratings yet

- Knot Master 1Document1 pageKnot Master 1maulajutt324No ratings yet

- Cost Accounting Unit 2 - Methods of Pricing Material IssuesDocument7 pagesCost Accounting Unit 2 - Methods of Pricing Material IssuesSHANMUGHA SHETTY S S100% (1)

- Manegrial Economics en G66 006Document21 pagesManegrial Economics en G66 006Mohamed EhabNo ratings yet

- Konti For RusDocument24 pagesKonti For RusdragananedeljkovicNo ratings yet

- Assignment Receassignment Subtopic Rate AgrredDocument34 pagesAssignment Receassignment Subtopic Rate AgrredSaima AsadNo ratings yet

- Rhu 2021 Aip Supplemental Budget ProposalDocument12 pagesRhu 2021 Aip Supplemental Budget ProposalIvoneZarahDingleAbaoNo ratings yet

- Forex Revaluation Delta Logic and Reversal of Excess Gain - Loss Posted After Payment - SAP BlogsDocument8 pagesForex Revaluation Delta Logic and Reversal of Excess Gain - Loss Posted After Payment - SAP BlogsTito TalesNo ratings yet

- Details of Listed TFCsDocument6 pagesDetails of Listed TFCsAhsan SeedNo ratings yet

- Store LedegrDocument6 pagesStore LedegrAdib Ahnaf NafiNo ratings yet

- ELSS - Effective Way of Tax Planning & Creation of WealthDocument2 pagesELSS - Effective Way of Tax Planning & Creation of WealthLoknath AgarwallaNo ratings yet

- Lifo and Fifo MethodDocument12 pagesLifo and Fifo MethodSrinivas R. Khode50% (8)

- Rka Bok 2018 Final Update 1 - 2Document233 pagesRka Bok 2018 Final Update 1 - 2asmiyatunNo ratings yet

- Questions Folder - 2024Document22 pagesQuestions Folder - 2024Shumail AkhundNo ratings yet

- Chapter 4 Inventorie Ifa 4Document38 pagesChapter 4 Inventorie Ifa 4Nigussie BerhanuNo ratings yet

- Cost Accounting Unit 2 - Methods of Pricing Material IssuesDocument8 pagesCost Accounting Unit 2 - Methods of Pricing Material IssuesSHANMUGHA SHETTY S SNo ratings yet

- Trend Analysis: September 2020Document6 pagesTrend Analysis: September 2020Sharmarke Mohamed AhmedNo ratings yet

- United States Nonfarm PayrollsDocument1 pageUnited States Nonfarm PayrollsLuis ChigchónNo ratings yet

- FM - Modern Portfolio Theory 4Document8 pagesFM - Modern Portfolio Theory 4Lipika haldarNo ratings yet

- HedgingDocument2 pagesHedgingParvathareddy RishithaNo ratings yet

- Advance Management Accounting: Individual AssignmentDocument10 pagesAdvance Management Accounting: Individual AssignmentAditya AnandaNo ratings yet

- Slide Idriss Tsafack CIREQDocument50 pagesSlide Idriss Tsafack CIREQNielNo ratings yet

- Gj-Ud BuanaDocument1 pageGj-Ud BuanaAldi HidayatullahNo ratings yet

- Ar EdfhcfDocument45 pagesAr EdfhcfPrasen RajNo ratings yet

- Material Planning and EstimationDocument2 pagesMaterial Planning and Estimationsundeep drgNo ratings yet

- NuclearDocument24 pagesNuclearsundeep drgNo ratings yet

- Materials PolicyDocument11 pagesMaterials Policysundeep drgNo ratings yet

- Creer DevtDocument28 pagesCreer Devtsundeep drgNo ratings yet

- Purchasing IIDocument16 pagesPurchasing IIsundeep drgNo ratings yet

- Conflict MGTDocument33 pagesConflict MGTsundeep drgNo ratings yet

- Competence BuidingDocument33 pagesCompetence Buidingsundeep drgNo ratings yet

- Chapter 9Document30 pagesChapter 9Thức NguyễnNo ratings yet

- CH 08Document22 pagesCH 08Abdalelah FrarjehNo ratings yet

- Rater-Reliability of A 5S Audit ChecklistDocument1 pageRater-Reliability of A 5S Audit ChecklistAizz D'Tech AbeNo ratings yet

- Chapter 5 Lean Enterprise Sakichi ToyodaDocument10 pagesChapter 5 Lean Enterprise Sakichi ToyodaAMIEL TACULAONo ratings yet

- Wiwien Tantio M: Personal ProfileDocument1 pageWiwien Tantio M: Personal ProfileDwi AgnesiaNo ratings yet

- Assignment 2: ERP - BPI (MM Cycle) (10 Marks)Document3 pagesAssignment 2: ERP - BPI (MM Cycle) (10 Marks)Karthik ManjunathNo ratings yet

- QUIZ 3. Audit of Inventories ManuscriptDocument3 pagesQUIZ 3. Audit of Inventories ManuscriptJulie Mae Caling MalitNo ratings yet

- Quiz 5 InventoryDocument4 pagesQuiz 5 InventoryCindy CrausNo ratings yet

- Group 4 - StartechDocument7 pagesGroup 4 - StartechSubhasish BalaNo ratings yet

- Nicmar: Stores and Inventory Management (Infrastructure Projects)Document19 pagesNicmar: Stores and Inventory Management (Infrastructure Projects)searchers007No ratings yet

- Chapter-9 Inventory Text-2 MathsDocument50 pagesChapter-9 Inventory Text-2 Mathsbckup789No ratings yet

- Methods of Inventory Control - BHM - MGDocument12 pagesMethods of Inventory Control - BHM - MGmanik ghoshNo ratings yet

- Inventory p1Document5 pagesInventory p1Rüel DellovaNo ratings yet

- Assessment of Inventory Management Practices at The Ethiopian Pharmaceuticals Supply AgencyDocument3 pagesAssessment of Inventory Management Practices at The Ethiopian Pharmaceuticals Supply AgencyshewameneBegashawNo ratings yet

- Principles of Inventory Management Oct 2018Document5 pagesPrinciples of Inventory Management Oct 2018Ahmad AliNo ratings yet

- Unit - Iv Materials ManagementDocument4 pagesUnit - Iv Materials Managementsabha5121021No ratings yet

- Pepco Co Establishes A Petty Cash Fund For Payments ofDocument1 pagePepco Co Establishes A Petty Cash Fund For Payments ofAmit PandeyNo ratings yet

- CH 1Document20 pagesCH 1MathewosNo ratings yet

- Nilofar SipDocument8 pagesNilofar Siptechpert.hr22No ratings yet

- On May 1 2014 Lowell Company Began The Manufacture ofDocument1 pageOn May 1 2014 Lowell Company Began The Manufacture ofAmit PandeyNo ratings yet

- LearnSmart Assignment 6Document5 pagesLearnSmart Assignment 6Bei Recordi DesignNo ratings yet

- Class 02 (Material Costing)Document14 pagesClass 02 (Material Costing)FizaNo ratings yet

- INVENTORIESDocument64 pagesINVENTORIESLuisa Janelle BoquirenNo ratings yet

- SAP MM Tables + Tcode + MM ReportDocument7 pagesSAP MM Tables + Tcode + MM ReportNguyen Ngoc Minh100% (2)

- AIA Test 1 2021Document4 pagesAIA Test 1 2021Zukiswa Sibiya0% (1)

- "First Purchased, First Sold ": Note Well That Under FIFO-periodic and FIFO Perpetual, The Inventory Costs Are The SameDocument4 pages"First Purchased, First Sold ": Note Well That Under FIFO-periodic and FIFO Perpetual, The Inventory Costs Are The SameKristia AnagapNo ratings yet

- PAS 8 Accounting Policies, Estimates and ErrorsDocument3 pagesPAS 8 Accounting Policies, Estimates and Errorspanda 1No ratings yet

- A Study On Inventory ManagementDocument3 pagesA Study On Inventory ManagementEditor IJTSRDNo ratings yet

- 01 Input Output: CKD Ti CKD Mi PurchaseDocument1 page01 Input Output: CKD Ti CKD Mi PurchaseJulian RazifNo ratings yet