Professional Documents

Culture Documents

Breakout Trading Simple Proven Strategies

Breakout Trading Simple Proven Strategies

Uploaded by

Varun Vasurendran0%(1)0% found this document useful (1 vote)

60 views8 pagesBreakouts occur when a security's price breaches a support or resistance level, such as when moving above or below a trend line. There are different types of breakouts including reversal breakouts, which signal a change in trend, and continuation breakouts, which reinforce an existing trend. Traders can predict likely breakouts by watching for chart patterns like triangles where volatility is decreasing, signaling a breakout may be imminent. It is important to verify if a breakout is real or a "fake-out" using indicators like MACD and RSI to gauge momentum. Successful breakout trading involves identifying high probability setups and confirming breakouts are supported by both technicals and fundamentals.

Original Description:

Original Title

Breakout_Trading_Simple_Proven_Strategies

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBreakouts occur when a security's price breaches a support or resistance level, such as when moving above or below a trend line. There are different types of breakouts including reversal breakouts, which signal a change in trend, and continuation breakouts, which reinforce an existing trend. Traders can predict likely breakouts by watching for chart patterns like triangles where volatility is decreasing, signaling a breakout may be imminent. It is important to verify if a breakout is real or a "fake-out" using indicators like MACD and RSI to gauge momentum. Successful breakout trading involves identifying high probability setups and confirming breakouts are supported by both technicals and fundamentals.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0%(1)0% found this document useful (1 vote)

60 views8 pagesBreakout Trading Simple Proven Strategies

Breakout Trading Simple Proven Strategies

Uploaded by

Varun VasurendranBreakouts occur when a security's price breaches a support or resistance level, such as when moving above or below a trend line. There are different types of breakouts including reversal breakouts, which signal a change in trend, and continuation breakouts, which reinforce an existing trend. Traders can predict likely breakouts by watching for chart patterns like triangles where volatility is decreasing, signaling a breakout may be imminent. It is important to verify if a breakout is real or a "fake-out" using indicators like MACD and RSI to gauge momentum. Successful breakout trading involves identifying high probability setups and confirming breakouts are supported by both technicals and fundamentals.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

Chapter 1 - What Is A Breakout?

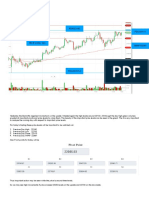

Breakouts occur when a security breaches a specific price level, such as a

support or resistance level. Perhaps the simplest example of this is when a

security is trading in a channel. For instance, the diagram below shows

EURGBP trading in a pricing channel and then breaking out of that channel

to the upside.

Of course, even if there is not a clearly defined channel, it is still possible to

identify breakouts by looking at trends. For example, if only the lower trend

line is drawn, then a breakout occurs when the price breaks through the trend

line. It is important to note that the movement needs to be in the opposite

direction to the trend to qualify as a breakout – in other words, a downside

movement in an ascending trend or upside movement in a descending trend.

Reversal Breakouts and Continuation

Breakouts

Another important type of breakout to look out for is when the market enters

a consolidation period. This is when a trend comes to a halt and the market

starts trading horizontally. At this point, the market is essentially taking a

breather, after which it can breakout in the same direction as the original

trend – a continuation breakout – or can start to move in the opposite

direction – a reversal breakout. The chart below shows an example of a

reversal breakout.

Triangle Breakouts

One other type of breakout that is quite common is with a triangle pattern.

This is when prices are converging with in a triangle and the price then

breaks out of the triangle. There are three different types of triangle:

Ascending triangles, where the upper resistance levels stays

constant while the lows keep on getting higher. This is typically

when the bulls are starting to get an upper hand on the bears.

These often lead to a breakout to the upside.

Descending triangles, which are the opposite of ascending

triangles and indicate that bears are gaining momentum. These are

often followed by a downside breakout.

Symmetrical triangles, which show that the bulls and bears are

relatively evenly balanced. These can lead to either an upside or

downside breakout.

The following chart shows a typical breakout from a symmetrical triangle.

Chapter 2 - How Can You Predict A

Breakout?

While reacting to a breakout can lead to profits, being able to predict an

upcoming breakout can give you a significant trading advantage. In other

markets, trading volumes are often used to predict breakouts, but volume

information is not available in forex markets. Instead, forex traders need to

look to volatility to position themselves for breakouts – volatility is

essentially the amount by which prices swing over any given period of time.

The goal is to look for securities with low volatility, since low volatility can

indicate an upcoming breakout. For instance, in a triangle pattern, the

volatility drops as the sides of the triangle grow closer – with a breakout

likely to happen as they start to meet. More generally, there are a number of

different ways of measuring volatility, including moving averages, Bollinger

bands and average true range (ATR). For instance, the upper and lower

Bollinger bands become closer to each other as volatility decreases, as shown

below.

Chapter 3- How Do You Know If A Breakout

Is Real?

While breakouts do occur regularly, the fact is that the vast majority of them

are false alarms – in fact, these are sometimes referred to as fake-outs. Fake-

outs also offer major trading opportunities, but they are more commonly

exploited by large institutional traders who are looking to take money from

smaller traders who have mistakenly taken the breakout bait.

It is often possible to tell whether a trend is running out of steam and heading

for a reversal breakout. For instance, MACD – which stands for Moving

Average Convergence/Divergence – is a good way of measuring how much

momentum there is in the market, with a high MACD indicating high

momentum. In other words, if prices are rising and the MACD is strongly

positive, then any downside breakout that occurs is likely to be a false one –

although there are no guarantees. On the other hand, if prices are rising and

the MACD is small or negative, then there is a good likelihood that any

downside breakout is real. The same applies with downward trends – if prices

are falling and the MACD is strongly negative, then an upside breakout is

unlikely.

Another indicator that can be used instead of MACD is the Relative Strength

Index – or RSI. This behaves in a similar manner to MACD, except that the

values vary between 0 and 100, with 50 indicating no real upward or

downward momentum. The RSI is also useful to determine whether the

market is overbought or oversold – a value below 30 is oversold, while the

value of over 70 is overbought.

The other thing key thing to look at is whether there is any fundamental news

– such as economic data or a global news event – that could be driving trader

sentiment. If there isn’t, then there is a good chance that the breakout isn’t

real.

Chapter 4- Step-by-Step - How to Trade a

Breakout

Here are the basic steps to follow when trading breakouts:

1. Look for chart patterns that could lead to breakouts, including

trend lines, ascending and descending channels, continuation

patterns and triangles. Pay attention to whether the most likely

breakout is a continuation or reversal.

2. Use volatility indicators to predict when breakouts are likely.

Good indicators to use include moving averages, Bollinger bands

and ATR.

3. Measure the strength of breakouts using momentum and strength

indicators such as MACD or RSI. Beware of false breakouts,

which often happen when the apparent breakout isn’t supported by

these indicators.

Always look for fundamental economic or other news that could be driving

trader sentiment. If this isn’t there, it is more likely that the breakout is really

a fake-out.

Chapter 5 – Final Comments

Breakouts offer strong profit opportunities for traders. However, it is very

important to focus on identifying whether breakouts are real, since the

majority are false alarms. In fact, institutional traders tend to trade against

breakouts, looking to take money from smaller traders who have misread the

breakout signals. Focus on chart patterns combined with low volatility to

predict upcoming breakouts, and be careful to confirm that the breakout is

supported by technical strength and fundamentals before committing to it.

You might also like

- Trade Entries Starter GuideDocument18 pagesTrade Entries Starter Guidehamza.editz100% (4)

- Baby PipsDocument69 pagesBaby PipsJuttaSportNo ratings yet

- High Probability Swing Trading Strategies: Day Trading Strategies, #4From EverandHigh Probability Swing Trading Strategies: Day Trading Strategies, #4Rating: 4.5 out of 5 stars4.5/5 (5)

- The Market MakersDocument13 pagesThe Market Makerssocio cursos94% (16)

- Anderson What Moves The Market ManualDocument143 pagesAnderson What Moves The Market ManualVarun Vasurendran67% (3)

- Price Action Trading - 6 Things To Look For Before You Place A TradeDocument20 pagesPrice Action Trading - 6 Things To Look For Before You Place A TradeSalman Munir100% (9)

- Breakout Trading Simple Proven StrategiesDocument16 pagesBreakout Trading Simple Proven StrategiesDeepak Mali100% (1)

- Range Trading - 4 Range Types and How To Trade ThemDocument11 pagesRange Trading - 4 Range Types and How To Trade ThemRamon Castellanos100% (2)

- Made by Big Joint: #TradegangDocument70 pagesMade by Big Joint: #TradegangBoyan Zrncic100% (2)

- Donchian Trading GuidelinesDocument12 pagesDonchian Trading GuidelinesCEOR73100% (1)

- Fiqhi Issues in Commodity Futures by Mohammad Hashim KamaliDocument35 pagesFiqhi Issues in Commodity Futures by Mohammad Hashim KamaliHafizuddinYusof100% (1)

- Breakout Trading - Simple, Proven Strategies For Identifying and Profiting From BreakoutsDocument13 pagesBreakout Trading - Simple, Proven Strategies For Identifying and Profiting From BreakoutsAmol KinhekarNo ratings yet

- Trading AddictsDocument9 pagesTrading AddictsKiran Krishna100% (1)

- 01 - Pullback - How To Enter Your Trades at A Discounted PriceDocument12 pages01 - Pullback - How To Enter Your Trades at A Discounted Priceramu100% (2)

- Breakout Trading Simple Proven StrategiesDocument16 pagesBreakout Trading Simple Proven StrategiesSantoshNo ratings yet

- Breakout Trading Simple Proven StrategiesDocument16 pagesBreakout Trading Simple Proven StrategiesChristyNo ratings yet

- FMC Price Action BookDocument114 pagesFMC Price Action BookTafara Michael100% (3)

- Catching The Pullback TradeDocument8 pagesCatching The Pullback Tradeanand_studyNo ratings yet

- Understanding ICT SBDocument20 pagesUnderstanding ICT SBayorus_sagNo ratings yet

- Breakout Trading Pt1Document4 pagesBreakout Trading Pt1Surya NayakNo ratings yet

- How To Trade Breakouts BFXDocument4 pagesHow To Trade Breakouts BFXAlain Denis MaboulaNo ratings yet

- 05 - Market Structure - Trend, Range and VolatilityDocument9 pages05 - Market Structure - Trend, Range and VolatilityRamachandra Dhar100% (3)

- At 11 06 21 Candlestick Charting - LoganDocument18 pagesAt 11 06 21 Candlestick Charting - LoganJoseph MarshallNo ratings yet

- Liquidity Grab With Support & Resistance IndicatorDocument6 pagesLiquidity Grab With Support & Resistance Indicatorst augusNo ratings yet

- Price ActionDocument243 pagesPrice ActionAteeque Mohd86% (7)

- Baby PipsDocument109 pagesBaby PipsMonty001100% (2)

- 1 How To Trade Breakouts Like A ProDocument6 pages1 How To Trade Breakouts Like A ProNasruLlaah Abdulkadir JaziirNo ratings yet

- The Triple Tap Strategy GuideDocument11 pagesThe Triple Tap Strategy Guidebenjy woodNo ratings yet

- Range Breakouts and Trading TacticsDocument12 pagesRange Breakouts and Trading TacticsNibbleTraderNo ratings yet

- Poliuu JkoDocument30 pagesPoliuu Jkoاندير انديرNo ratings yet

- TA Secrets #4 - Basic Chart PatternsDocument7 pagesTA Secrets #4 - Basic Chart PatternsBlueNo ratings yet

- (EN) Smart Money Concept-Forex MarketDocument115 pages(EN) Smart Money Concept-Forex MarketekawatNo ratings yet

- Continuation Setups: Ten Commandments of Futures TradingDocument11 pagesContinuation Setups: Ten Commandments of Futures TradingMvelo PhungulaNo ratings yet

- False Breakout - How To Avoid and Even Trade It?Document14 pagesFalse Breakout - How To Avoid and Even Trade It?vic beckham100% (1)

- How to find fake breakoutDocument14 pagesHow to find fake breakoutkaahrthikkaheanmanimaranNo ratings yet

- Module VDocument30 pagesModule VVarada RajaNo ratings yet

- Nearly Bulletproof Setups 29 Proven Stock Market Trading Strategies (Etc.) (Z-Library)Document126 pagesNearly Bulletproof Setups 29 Proven Stock Market Trading Strategies (Etc.) (Z-Library)Ajay BhattacharjeeNo ratings yet

- 8 Price ActionDocument16 pages8 Price Actiondinesh lalwani67% (3)

- Trade Entries StarterDocument15 pagesTrade Entries Starterrichard patrickNo ratings yet

- Mean Reversion Day Trading Strategies: Profitable Trading StrategiesFrom EverandMean Reversion Day Trading Strategies: Profitable Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- Keep An Eye On MomentumDocument5 pagesKeep An Eye On MomentumLe BinhNo ratings yet

- EnteringTradesPullback 620106Document4 pagesEnteringTradesPullback 620106Anonymous rOv67R100% (1)

- Falling Wedge PatternDocument5 pagesFalling Wedge PatternMOHD TARMIZI100% (1)

- The Jeff Clark Trader Guide To Technical Analysis Mvo759Document19 pagesThe Jeff Clark Trader Guide To Technical Analysis Mvo759Ethan Dukes100% (1)

- Price Action Trading Reversal and Continuation Patterns How to Read - Livro TradeDocument33 pagesPrice Action Trading Reversal and Continuation Patterns How to Read - Livro TradenicktafarelNo ratings yet

- Price Action Trading Reversal and Continuation Patterns How To ReadDocument33 pagesPrice Action Trading Reversal and Continuation Patterns How To Readshreyanmishra43No ratings yet

- Price Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)Document22 pagesPrice Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)kalpesh kathar100% (1)

- Price Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)Document22 pagesPrice Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)kalpesh kathar100% (1)

- MPDFDocument8 pagesMPDFবলবো নাNo ratings yet

- 02-Forex Price Action Explained-Svetlin MinevDocument153 pages02-Forex Price Action Explained-Svetlin MinevJorgeLm100% (2)

- Technical Analysis - CryptoWhaleDocument26 pagesTechnical Analysis - CryptoWhaledana100% (1)

- Double Top and Double Bottom Pattern Quick GuideDocument9 pagesDouble Top and Double Bottom Pattern Quick Guidejeevandran100% (1)

- Top 10 Chart PatternsDocument25 pagesTop 10 Chart Patternsthakkarps50% (2)

- Trend TradingDocument19 pagesTrend TradingJames WaweruNo ratings yet

- How to Use Stock Volume to Improve Your TradingDocument1 pageHow to Use Stock Volume to Improve Your TradingMuhammad Anees khanNo ratings yet

- Tphit3 Crew 1Document39 pagesTphit3 Crew 1Lawrence MosizaNo ratings yet

- Wedge Pattern Workbook - UnlockedDocument24 pagesWedge Pattern Workbook - Unlockedshah farizNo ratings yet

- UntitledDocument18 pagesUntitledSantiago Ramos89% (9)

- Techno-Funda BasicsDocument39 pagesTechno-Funda BasicsAnuranjan VermaNo ratings yet

- Trend Trading Strategies: Day Trading StrategiesFrom EverandTrend Trading Strategies: Day Trading StrategiesRating: 5 out of 5 stars5/5 (2)

- Day Trading Strategies For Beginners: Day Trading Strategies, #2From EverandDay Trading Strategies For Beginners: Day Trading Strategies, #2Rating: 5 out of 5 stars5/5 (1)

- 10 June 2020 NiftyDocument15 pages10 June 2020 NiftyVarun VasurendranNo ratings yet

- Abes - Prod.pw Hal.b308.e10921.atta04Document45 pagesAbes - Prod.pw Hal.b308.e10921.atta04Varun VasurendranNo ratings yet

- My Mindset & Risk Management Ground Rules & Secrets!Document15 pagesMy Mindset & Risk Management Ground Rules & Secrets!Varun VasurendranNo ratings yet

- Chart 230520 1Document1 pageChart 230520 1Varun VasurendranNo ratings yet

- 15 June 2020 Nifty MONDocument24 pages15 June 2020 Nifty MONVarun VasurendranNo ratings yet

- Oi Pulse FeaturesDocument20 pagesOi Pulse FeaturesVarun Vasurendran100% (1)

- MentoringDocument24 pagesMentoringVarun Vasurendran100% (1)

- July 24 2020Document12 pagesJuly 24 2020Varun VasurendranNo ratings yet

- July 27 2020Document12 pagesJuly 27 2020Varun VasurendranNo ratings yet

- July 28 2020Document12 pagesJuly 28 2020Varun VasurendranNo ratings yet

- The Last Kiss StrategyDocument9 pagesThe Last Kiss StrategyVarun VasurendranNo ratings yet

- Cbot Market Profile A Six Part Study GuiDocument346 pagesCbot Market Profile A Six Part Study GuiVarun VasurendranNo ratings yet

- Pivot Boss SummaryDocument36 pagesPivot Boss SummaryVarun Vasurendran100% (2)

- Capra Intra-Day Trading With Market Interals Part 2 ManualDocument60 pagesCapra Intra-Day Trading With Market Interals Part 2 ManualVarun Vasurendran100% (2)

- Blindly: Its Time To Adopt Smartest Technology Tool 91 99790 66966Document6 pagesBlindly: Its Time To Adopt Smartest Technology Tool 91 99790 66966Varun VasurendranNo ratings yet

- 200 Trading Psychology TruthsDocument32 pages200 Trading Psychology TruthsVarun Vasurendran100% (2)

- Capra Breadth Internal Indicators For Winning Swing and Posistion Trading ManualDocument58 pagesCapra Breadth Internal Indicators For Winning Swing and Posistion Trading ManualVarun VasurendranNo ratings yet

- The Essence of Trading PsychologyDocument78 pagesThe Essence of Trading PsychologyVarun VasurendranNo ratings yet

- Handout Classification of TakafulDocument10 pagesHandout Classification of TakafulLail M PimadaNo ratings yet

- Byproduct AccountingDocument13 pagesByproduct AccountingAbu NaserNo ratings yet

- Kicki Andersson PGLDocument15 pagesKicki Andersson PGLKicki AnderssonNo ratings yet

- Opportunity Hub Equity Crowdfunding Pitch DeckDocument23 pagesOpportunity Hub Equity Crowdfunding Pitch DeckRodney Sampson100% (3)

- Bookassetmgtnew PDFDocument516 pagesBookassetmgtnew PDFMayank Sahu100% (1)

- Tangazo La Kazi 6 Januari 2014Document45 pagesTangazo La Kazi 6 Januari 2014Aaron DelaneyNo ratings yet

- Group - 11 Bank Reconciliation Statement: CIA (Continuous Internal Assessment) 1Document13 pagesGroup - 11 Bank Reconciliation Statement: CIA (Continuous Internal Assessment) 1shriyanshu padhiNo ratings yet

- Buttons: AP/10/723,724, BUTTONS, ANCHAL Anchal GSTIN:32KDFPS7807P1ZPDocument9 pagesButtons: AP/10/723,724, BUTTONS, ANCHAL Anchal GSTIN:32KDFPS7807P1ZPRahul NathNo ratings yet

- Chapter 18 Issues in INternational AccountingDocument3 pagesChapter 18 Issues in INternational AccountingindraakhriaNo ratings yet

- Bernie Madoff CaseDocument15 pagesBernie Madoff CaseSaud AlnoohNo ratings yet

- WM Group C09-C15 (Mutual Funds)Document21 pagesWM Group C09-C15 (Mutual Funds)Prince JoshiNo ratings yet

- Piedmont Pricing ProcedureDocument113 pagesPiedmont Pricing ProcedureDipankar BiswasNo ratings yet

- Morocco: Financial System Stability Assessment-Update: International Monetary Fund Washington, D.CDocument41 pagesMorocco: Financial System Stability Assessment-Update: International Monetary Fund Washington, D.CPatsy CarterNo ratings yet

- Cfs NumericalsDocument12 pagesCfs NumericalsNeelu AhluwaliaNo ratings yet

- Term 2 - Grade 8 Financial Education Revision PaperDocument2 pagesTerm 2 - Grade 8 Financial Education Revision Paperris.aryajoshiNo ratings yet

- Bus 306 Exam 2 - Fall 2012 (A) - SolutionDocument15 pagesBus 306 Exam 2 - Fall 2012 (A) - SolutionCyn SyjucoNo ratings yet

- Dhruva Placement BrochureDocument24 pagesDhruva Placement BrochurePranav KolaganiNo ratings yet

- Apy ChartDocument1 pageApy ChartMohit PathaniaNo ratings yet

- General Insurance Track Reading Materials: Approach"Document6 pagesGeneral Insurance Track Reading Materials: Approach"lina_siscanu6356No ratings yet

- Chapter 6Document24 pagesChapter 6Rubén ZúñigaNo ratings yet

- Tcs Company Stock Value Date Op. Price High Price Low Price Cl. Price Traded Value January Stock PriceDocument4 pagesTcs Company Stock Value Date Op. Price High Price Low Price Cl. Price Traded Value January Stock PriceGopal Chandra SahaNo ratings yet

- Ch. 2. Asset Pricing Theory (721383S) : Juha Joenväärä University of Oulu March 2014Document31 pagesCh. 2. Asset Pricing Theory (721383S) : Juha Joenväärä University of Oulu March 2014Asma DahmenNo ratings yet

- Banking Law Unit 2Document17 pagesBanking Law Unit 2D. BharadwajNo ratings yet

- Summer Internship ReportDocument22 pagesSummer Internship ReportBeljohn AlappatNo ratings yet

- C5 Sa PIjm 8 W6 HH6 IrDocument7 pagesC5 Sa PIjm 8 W6 HH6 Irarun royNo ratings yet

- Exam PaperDocument4 pagesExam PaperRehairah MunirahNo ratings yet

- Chapter 9 Other Percentage TaxesDocument56 pagesChapter 9 Other Percentage TaxesKarylle BartolayNo ratings yet

- Escalation Clause - Sampaguita Vs PNBDocument34 pagesEscalation Clause - Sampaguita Vs PNBNovo FarmsNo ratings yet

- MCM Tutorial 2Document3 pagesMCM Tutorial 2SHU WAN TEHNo ratings yet