Professional Documents

Culture Documents

IHS Markit Indonesia Manufacturing PMI™

IHS Markit Indonesia Manufacturing PMI™

Uploaded by

yolandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IHS Markit Indonesia Manufacturing PMI™

IHS Markit Indonesia Manufacturing PMI™

Uploaded by

yolandaCopyright:

Available Formats

News Release

Embargoed until 0730 WIB (0030 UTC) 1 April 2021

IHS Markit

Indonesia Manufacturing PMI™

Indonesia PMI hits record high

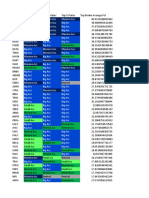

Key findings Indonesia Manufacturing PMI

sa, >50 = improvement since previous month

55

Sharpest increases in output and new orders in

50

decade-long survey

45

Employment stabilises 40

35

Fastest rise in input costs since October 2018 30

Data were collected 12-24 March 2021. 25

'11 '12 '13 '14 '15 '16 '17 '18 '19 '20 '21

The Indonesia manufacturing PMI posted its highest reading in a Source: IHS Markit.

decade of data collection during March amid sharp accelerations

in rates of growth in output and new orders. There were signs

of emerging pressure on capacity, which led firms to stabilise

employment. Comment

Meanwhile, higher raw material costs and supply-chain

disruption led to a further acceleration in the pace of input price Commenting on the latest survey results, Andrew Harker,

inflation, but firms raised their own selling prices at a softer Economics Director at IHS Markit, said:

pace. “The Indonesian manufacturing sector ended the first

The IHS Markit Indonesia Manufacturing Purchasing Managers’ quarter of the year on a high, with firms ramping up

Index™ (PMI™) posted 53.2 in March, up from 50.9 in February production in response to the strongest influx of new orders

and the highest reading since the survey began in April 2011. in the decade-long survey so far. These positive results add to

The index signalled a solid improvement in business conditions hopes that the sector is on a fast upward trajectory, with the

which outpaced the previous survey peak seen in June and July obvious caveat that the COVID-19 pandemic could hit back at

2014. any time.

The record improvement in the health of the sector was "Signs of pressure on capacity meant that employment

registered thanks to accelerated growth of new orders and stabilised in March, and if trends in workloads remain

output, both of which increased to the greatest extent in the positive we can expect outright employment growth in the

decade-long survey so far. near future."

Production increased for the fifth month in a row, with panellists

generally linking the latest expansion to the rise in new orders.

In turn, those firms that secured greater new order volumes

often mentioned stronger client demand. The coronavirus

disease 2019 (COVID-19) pandemic continued to impact export

business, however. New export orders decreased for the

sixteenth successive month, albeit at the softest pace since last

November.

Firms were increasingly confident that improvements in

output would be sustained over the coming year, with business

confidence hitting a 50-month high. An end to the pandemic,

continued...

© 2021 IHS Markit

IHS Markit Indonesia Manufacturing PMI™

higher sales and marketing efforts were all projected to support Indonesia Manufacturing PMI Employment Index

sa, >50 = growth since previous month

output growth.

55

The sharp increase in new orders imparted pressure on operating

capacity in March. Backlogs of work rose for the first time in 21 50

months. In response, firms paused job shedding, following 12

successive months of employment reductions. 45

Rising workloads also encouraged firms to expand their 40

purchasing activity, which they did at a solid pace that was the

joint-third fastest in the survey's history. 35

When purchasing items, manufacturers were faced with a 30

combination of sharply rising input costs and delivery delays. '14 '15 '16 '17 '18 '19 '20 '21

The rate of input cost inflation quickened for the sixth successive

Source: IHS Markit.

month and was the fastest since October 2018. Panellists

reported higher raw material prices, sometimes linked to supply

shortages.

Shortages of raw materials, shipping delays and poor weather

conditions all contributed to a fourteenth consecutive

lengthening of suppliers' delivery times, although the latest

increase in lead times was the softest since last November.

Firms kept their stocks of purchases broadly unchanged, while

the use of inventories to help meet sales meant that stocks of

finished goods decreased for the second month running.

Finally, output prices were raised in response to the

aforementioned increase in input costs. That said, in contrast to

the picture for input prices, charges were increased at a slower

pace than in February.

Contact

Andrew Harker Joanna Vickers

Economics Director Corporate Communications

IHS Markit IHS Markit

T: +44 1491 461 016 T: +44 207 260 2234

andrew.harker@ihsmarkit.com joanna.vickers@ihsmarkit.com

Methodology About IHS Markit

The IHS Markit Indonesia Manufacturing PMI™ is compiled by IHS Markit from responses to monthly IHS Markit (NYSE: INFO) is a world leader in critical information, analytics and solutions for the major

questionnaires sent to purchasing managers in a panel of around 400 manufacturers. The panel is industries and markets that drive economies worldwide. The company delivers next-generation

stratified by detailed sector and company workforce size, based on contributions to GDP. information, analytics and solutions to customers in business, finance and government, improving

their operational efficiency and providing deep insights that lead to well-informed, confident

Survey responses are collected in the second half of each month and indicate the direction of change

decisions. IHS Markit has more than 50,000 business and government customers, including 80

compared to the previous month. A diffusion index is calculated for each survey variable. The index

percent of the Fortune Global 500 and the world’s leading financial institutions.

is the sum of the percentage of ‘higher’ responses and half the percentage of ‘unchanged’ responses.

The indices vary between 0 and 100, with a reading above 50 indicating an overall increase compared IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and

to the previous month, and below 50 an overall decrease. The indices are then seasonally adjusted. product names may be trademarks of their respective owners © 2021 IHS Markit Ltd. All rights

reserved.

The headline figure is the Purchasing Managers’ Index™ (PMI). The PMI is a weighted average of the

following five indices: New Orders (30%), Output (25%), Employment (20%), Suppliers’ Delivery Times If you prefer not to receive news releases from IHS Markit, please email joanna.vickers@ihsmarkit.

(15%) and Stocks of Purchases (10%). For the PMI calculation the Suppliers’ Delivery Times Index is com. To read our privacy policy, click here.

inverted so that it moves in a comparable direction to the other indices.

Underlying survey data are not revised after publication, but seasonal adjustment factors may be

revised from time to time as appropriate which will affect the seasonally adjusted data series. About PMI

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 40 countries and also for key

March 2021 data were collected 12-24 March 2021. regions including the eurozone. They are the most closely watched business surveys in the world,

favoured by central banks, financial markets and business decision makers for their ability to provide

For further information on the PMI survey methodology, please contact economics@ihsmarkit.com.

up-to-date, accurate and often unique monthly indicators of economic trends.

ihsmarkit.com/products/pmi.html.

Disclaimer

The intellectual property rights to the data provided herein are owned by or licensed to IHS Markit. Any unauthorised use, including but not limited to copying, distributing, transmitting or otherwise of any data

appearing is not permitted without IHS Markit’s prior consent. IHS Markit shall not have any liability, duty or obligation for or relating to the content or information (“data”) contained herein, any errors, inaccuracies,

omissions or delays in the data, or for any actions taken in reliance thereon. In no event shall IHS Markit be liable for any special, incidental, or consequential damages, arising out of the use of the data. Purchasing

Managers’ Index™ and PMI™ are either registered trade marks of Markit Economics Limited or licensed to Markit Economics Limited. IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates.

© 2021 IHS Markit

You might also like

- PMI Indonesia Oktober 2021Document2 pagesPMI Indonesia Oktober 2021Arie HendriyanaNo ratings yet

- S&P Global Indonesia Manufacturing PMI: Solid Growth of Indonesian Manufacturing Sector in AprilDocument2 pagesS&P Global Indonesia Manufacturing PMI: Solid Growth of Indonesian Manufacturing Sector in Aprilgita pNo ratings yet

- Pmi Usa010424Document2 pagesPmi Usa010424Marcelo PàivaNo ratings yet

- Caixin China General Manufacturing PMI: Embargoed Until: 09:45 (Beijing) / 01:45 (UTC), April 1 2019Document3 pagesCaixin China General Manufacturing PMI: Embargoed Until: 09:45 (Beijing) / 01:45 (UTC), April 1 2019Valter SilveiraNo ratings yet

- IHS Markit Thailand Manufacturing PMI™: Manufacturing Sector Expansion Accelerates To New RecordDocument2 pagesIHS Markit Thailand Manufacturing PMI™: Manufacturing Sector Expansion Accelerates To New Recordpitchaya.ppchNo ratings yet

- Analysis of IIP PMI and InflationDocument17 pagesAnalysis of IIP PMI and Inflationsanjay josephNo ratings yet

- Supply Chain Disruption During Manufacturing Boom in 2021Document2 pagesSupply Chain Disruption During Manufacturing Boom in 2021Maria MeranoNo ratings yet

- IHS Markit Eurozone Manufacturing PMIDocument3 pagesIHS Markit Eurozone Manufacturing PMIRenáta NémethNo ratings yet

- S&P Global India Manufacturing PMI: Firms Rebuild Input Stocks at Near-Record Pace Amid Demand StrengthDocument2 pagesS&P Global India Manufacturing PMI: Firms Rebuild Input Stocks at Near-Record Pace Amid Demand StrengthTraditional SamayalNo ratings yet

- IHS Markit Flash Germany PMI: News ReleaseDocument3 pagesIHS Markit Flash Germany PMI: News ReleaseValter SilveiraNo ratings yet

- PMI Brasil S&P GlobalDocument3 pagesPMI Brasil S&P Globalrborgesdossantos37No ratings yet

- IHS Markit Flash Eurozone PMI: News ReleaseDocument4 pagesIHS Markit Flash Eurozone PMI: News ReleaseAdam SamsonNo ratings yet

- USA July 2020 PMI ManuDocument27 pagesUSA July 2020 PMI ManuCuriousMan87No ratings yet

- Mni Chicago Press Release 2018 03Document2 pagesMni Chicago Press Release 2018 03Flavia Daniela Gallegos BarrigaNo ratings yet

- PMI China October 2021Document4 pagesPMI China October 2021Arie HendriyanaNo ratings yet

- Ihs Markit Us Services Pmi™: News ReleaseDocument3 pagesIhs Markit Us Services Pmi™: News ReleaseValter SilveiraNo ratings yet

- IHS Markit Flash Germany PMI: News ReleaseDocument3 pagesIHS Markit Flash Germany PMI: News ReleaseValter SilveiraNo ratings yet

- PMI BrasilDocument3 pagesPMI Brasilrborgesdossantos37No ratings yet

- HSBC India Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseDocument3 pagesHSBC India Manufacturing PMI™: HSBC Purchasing Managers' Index™ Press ReleaseRonitsinghthakur SinghNo ratings yet

- S&P Global / BME Germany Manufacturing PMI®: May Sees Further Decline in New Orders Amid Multiple Headwinds To DemandDocument2 pagesS&P Global / BME Germany Manufacturing PMI®: May Sees Further Decline in New Orders Amid Multiple Headwinds To Demandsameer bakshiNo ratings yet

- Ug Pmi Eng 2303 LiteDocument10 pagesUg Pmi Eng 2303 LiteMbaihayo HillaryNo ratings yet

- Pmi EuaDocument4 pagesPmi Euarborgesdossantos37No ratings yet

- S&P Global Flash United Kingdom PMI: News ReleaseDocument4 pagesS&P Global Flash United Kingdom PMI: News Releaserborgesdossantos37No ratings yet

- Pmi UsDocument4 pagesPmi Usgustavo.kahilNo ratings yet

- Caixin China General Services PMI Press ReleaseDocument5 pagesCaixin China General Services PMI Press ReleaseDinheirama.comNo ratings yet

- India's September Manufacturing PMI Sees Fastest Pace of Growth in Over 8 Years - Times of IndiaDocument2 pagesIndia's September Manufacturing PMI Sees Fastest Pace of Growth in Over 8 Years - Times of IndiaAkhilGovindNo ratings yet

- Mni Chicago Press Release 2019 12Document2 pagesMni Chicago Press Release 2019 12VictorNo ratings yet

- Business Expectations Survey: Fourth Quarter 2017Document12 pagesBusiness Expectations Survey: Fourth Quarter 2017Rommel LoretoNo ratings yet

- BenchamrkDocument36 pagesBenchamrkAmirah RahmatNo ratings yet

- Mni Chicago Press Release 2019 03Document2 pagesMni Chicago Press Release 2019 03Valter SilveiraNo ratings yet

- HCOB Flash Germany PMI: German Business Activity Rises Only Marginally in June As Growth SlowsDocument4 pagesHCOB Flash Germany PMI: German Business Activity Rises Only Marginally in June As Growth SlowsmonthehenridanielNo ratings yet

- News Release: Markit Flash U.S. Manufacturing PMIDocument4 pagesNews Release: Markit Flash U.S. Manufacturing PMIDavid TaggartNo ratings yet

- EI Mar Caixin PMI 1Document11 pagesEI Mar Caixin PMI 1nguyennauy25042003No ratings yet

- BUE Report 2018 - Q2Document19 pagesBUE Report 2018 - Q2eric_stNo ratings yet

- Tutorial PKPDocument4 pagesTutorial PKPRyanAthaillahNo ratings yet

- IHS Markit Eurozone Manufacturing PMI - Final Data: News ReleaseDocument3 pagesIHS Markit Eurozone Manufacturing PMI - Final Data: News ReleaseValter SilveiraNo ratings yet

- Ihs Markit Is SectorsDocument2 pagesIhs Markit Is SectorsKapilanNavaratnamNo ratings yet

- IHS Markit Eurozone Manufacturing PMI - Final Data: News ReleaseDocument3 pagesIHS Markit Eurozone Manufacturing PMI - Final Data: News ReleaseValter SilveiraNo ratings yet

- Stanbic Bank Kenya PMI™: Kenyan New Orders Fall For First Time in Over Two YearsDocument2 pagesStanbic Bank Kenya PMI™: Kenyan New Orders Fall For First Time in Over Two Yearsh3493061No ratings yet

- Q2 News 6Document2 pagesQ2 News 6Kaizer James CaguioaNo ratings yet

- Profile of Growth Firms:: A Summary of Industry Canada ResearchDocument14 pagesProfile of Growth Firms:: A Summary of Industry Canada ResearchcatsdeadnowNo ratings yet

- IIP - Vs - PMI, DifferencesDocument5 pagesIIP - Vs - PMI, DifferencesChetan GuptaNo ratings yet

- PMI™ Glossary: July 2017Document46 pagesPMI™ Glossary: July 2017sbdNo ratings yet

- IHS Markit Brazil Manufacturing PMI®: Factory Orders and Output Contract For Second Straight Month in AprilDocument2 pagesIHS Markit Brazil Manufacturing PMI®: Factory Orders and Output Contract For Second Straight Month in AprilRafa BorgesNo ratings yet

- IHS Markit Flash U.S. PMI ™: News ReleaseDocument3 pagesIHS Markit Flash U.S. PMI ™: News ReleaseValter SilveiraNo ratings yet

- Feb2019ug Pmi Eng 1903Document4 pagesFeb2019ug Pmi Eng 1903klakakouatmanNo ratings yet

- HsbcpmidecDocument2 pagesHsbcpmidecChrisBeckerNo ratings yet

- Business Expectations Survey: Second Quarter 2017Document13 pagesBusiness Expectations Survey: Second Quarter 2017Rommel LoretoNo ratings yet

- Flash German Composite PMIDocument3 pagesFlash German Composite PMIyiyangNo ratings yet

- Un ArticuloDocument26 pagesUn ArticuloGree GreeNo ratings yet

- Business Expectations Survey: First Quarter 2017Document13 pagesBusiness Expectations Survey: First Quarter 2017Rommel LoretoNo ratings yet

- GermanyDocument3 pagesGermanyLuke Campbell-SmithNo ratings yet

- Make UK Manufacturing Outlook 2023 Q1Document19 pagesMake UK Manufacturing Outlook 2023 Q1samNo ratings yet

- S&P Global Myanmar Manufacturing PMI™: Manufacturing Sector Worsens As Output and New Orders Contract at Quicker RatesDocument2 pagesS&P Global Myanmar Manufacturing PMI™: Manufacturing Sector Worsens As Output and New Orders Contract at Quicker RatesThiha ZawNo ratings yet

- Au Jibun Bank Flash Japan Composite PMI®: Private Sector Output Stabilises Amid Stronger Service Sector ExpansionDocument4 pagesAu Jibun Bank Flash Japan Composite PMI®: Private Sector Output Stabilises Amid Stronger Service Sector ExpansionyiyangNo ratings yet

- Make UK Manufacturing Outlook 2023 Q1Document19 pagesMake UK Manufacturing Outlook 2023 Q1Guido FawkesNo ratings yet

- Sectoral Analysis India Riding The Growth WaveDocument32 pagesSectoral Analysis India Riding The Growth WaveRajeev DudiNo ratings yet

- CEOs Survey, May 2024Document19 pagesCEOs Survey, May 2024barbaraoida59No ratings yet

- 2020 Manufacturing Industry OutlookDocument10 pages2020 Manufacturing Industry OutlookDavid SchumakherNo ratings yet

- 5 6089418062631535689Document74 pages5 6089418062631535689yolandaNo ratings yet

- Equity Research: Company UpdateDocument6 pagesEquity Research: Company UpdateyolandaNo ratings yet

- Sucor Sunrise: Jakarta Composite Index UpdateDocument6 pagesSucor Sunrise: Jakarta Composite Index UpdateyolandaNo ratings yet

- Indonesia Daily: UpdateDocument7 pagesIndonesia Daily: UpdateyolandaNo ratings yet

- Wijaya Karya: IndonesiaDocument7 pagesWijaya Karya: IndonesiayolandaNo ratings yet

- Equity Research: Sectoral ReportDocument5 pagesEquity Research: Sectoral ReportyolandaNo ratings yet

- Pembelian Ke-Harga Jumlah Lot Total Beli: Bbri 100,000,000Document6 pagesPembelian Ke-Harga Jumlah Lot Total Beli: Bbri 100,000,000yolandaNo ratings yet

- IR Presentation: Mitsubishi UFJ Financial Group, IncDocument90 pagesIR Presentation: Mitsubishi UFJ Financial Group, IncyolandaNo ratings yet

- Equity Research: Company FocusDocument13 pagesEquity Research: Company FocusyolandaNo ratings yet

- Jasa Armada Indonesia: Equity ResearchDocument4 pagesJasa Armada Indonesia: Equity ResearchyolandaNo ratings yet

- Equity Research: Result UpdateDocument8 pagesEquity Research: Result UpdateyolandaNo ratings yet

- 5 6336574399516246815Document8 pages5 6336574399516246815yolandaNo ratings yet

- Article 1: (Sept 16 2020) US Broke Rules by Imposing Tariffs On ChinaDocument9 pagesArticle 1: (Sept 16 2020) US Broke Rules by Imposing Tariffs On ChinaPranave NellikattilNo ratings yet

- IHS Markit Flash U.S. PMI ™: News ReleaseDocument3 pagesIHS Markit Flash U.S. PMI ™: News ReleaseValter SilveiraNo ratings yet

- Mint Delhi 05 07 2021Document16 pagesMint Delhi 05 07 2021VikingNo ratings yet

- J P Morgan Asset Management Outlook 2024Document100 pagesJ P Morgan Asset Management Outlook 2024Thanh LongNo ratings yet

- Container Full Report SMOO Q3 2023Document8 pagesContainer Full Report SMOO Q3 2023danke22No ratings yet

- Analytics With MT5Document258 pagesAnalytics With MT5msamala09100% (1)

- BSP Selected Economic Financial IndicatorsDocument8 pagesBSP Selected Economic Financial IndicatorsGlenNo ratings yet

- PMI SL Purchasing Managers' Index: S D C B S LDocument2 pagesPMI SL Purchasing Managers' Index: S D C B S LSemitha KanakarathnaNo ratings yet

- SSRN Id4029211Document14 pagesSSRN Id4029211Basiru NjieNo ratings yet

- NewsPib July 2022Document164 pagesNewsPib July 2022Girish HPNo ratings yet

- IATADocument5 pagesIATAzainNo ratings yet

- Guide To The Markets AsiaDocument87 pagesGuide To The Markets Asiaengenharia_carlosNo ratings yet

- PMIDocument4 pagesPMINancy ElsherbiniNo ratings yet

- Intro Stock Market PDFDocument65 pagesIntro Stock Market PDFthilaksafaryNo ratings yet

- Laporan Tahunan Dan Keberlanjutan IBKI 2021Document338 pagesLaporan Tahunan Dan Keberlanjutan IBKI 2021Ivena Oriana 201210003No ratings yet

- JPM Equity Strategy 2021-03-15 - 3677865Document31 pagesJPM Equity Strategy 2021-03-15 - 3677865gustavomorgadoNo ratings yet

- JPMorgan Global Manufacturing PMI May 2023Document3 pagesJPMorgan Global Manufacturing PMI May 2023Phileas FoggNo ratings yet

- Global Sales and Production Around The World Webinar - May 2023Document47 pagesGlobal Sales and Production Around The World Webinar - May 2023nguyenngoctuan066No ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 1st-8th January 2023Document38 pagesBeepedia Weekly Current Affairs (Beepedia) 1st-8th January 2023Sovan KumarNo ratings yet

- S&P Global Flash US Composite PMI: News ReleaseDocument4 pagesS&P Global Flash US Composite PMI: News ReleaseRafael BorgesNo ratings yet

- Tsi Monthly Steel Review April 2016Document4 pagesTsi Monthly Steel Review April 2016ecaph244No ratings yet

- United States ISM Purchasing Managers Index (PMI) - August 2023 DataDocument9 pagesUnited States ISM Purchasing Managers Index (PMI) - August 2023 DataDinheirama.comNo ratings yet

- Kathleen Brooks On ForexDocument36 pagesKathleen Brooks On ForexLawalNo ratings yet

- Economics in The Time of COVID HAFIDZ ASH SHALIHDocument9 pagesEconomics in The Time of COVID HAFIDZ ASH SHALIHErlangga Wisnu0% (1)

- Passive Fund Factsheet January 2024Document97 pagesPassive Fund Factsheet January 2024asaultpraveenNo ratings yet

- Global Industrial Outlook Deck Feb 2024Document46 pagesGlobal Industrial Outlook Deck Feb 2024Aprizal PratamaNo ratings yet

- Individual Case Study Ret542 Siti Nurfaizah 2021393321Document16 pagesIndividual Case Study Ret542 Siti Nurfaizah 2021393321Siti NurfaizahNo ratings yet

- Purchasing Managers' Index Report May 2009Document4 pagesPurchasing Managers' Index Report May 2009Swedbank AB (publ)No ratings yet

- IHS Markit Brazil Manufacturing PMI®: Factory Orders and Output Contract For Second Straight Month in AprilDocument2 pagesIHS Markit Brazil Manufacturing PMI®: Factory Orders and Output Contract For Second Straight Month in AprilRafa BorgesNo ratings yet

- Ibtex071112023Document42 pagesIbtex071112023amar9247No ratings yet