Professional Documents

Culture Documents

MBA (Finance)

MBA (Finance)

Uploaded by

Sunita BasakCopyright:

Available Formats

You might also like

- Transaction List B SUADocument5 pagesTransaction List B SUAPhuong Tran100% (24)

- ch13 Testbank Intermediate AccountingDocument43 pagesch13 Testbank Intermediate Accountingalaa96% (53)

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- FM 8 Module 1 Financial Planning and ForecastingDocument16 pagesFM 8 Module 1 Financial Planning and ForecastingJasper Mortos VillanuevaNo ratings yet

- Coursera IPO Financial Model WallstreetMojoDocument45 pagesCoursera IPO Financial Model WallstreetMojoritzNo ratings yet

- FinanceDocument12 pagesFinancearjun rawoolNo ratings yet

- Emba III Sem FinanceDocument10 pagesEmba III Sem Financejpaladi.2014No ratings yet

- Paper: Mba 333: Financial Management Credits-2 DescriptionDocument4 pagesPaper: Mba 333: Financial Management Credits-2 DescriptionDerek Cherian JojiNo ratings yet

- FIN 133 Fundamentals of Financial Management: Bcis, 5 SemesterDocument3 pagesFIN 133 Fundamentals of Financial Management: Bcis, 5 SemesterBishnu K.C.No ratings yet

- Il - 401 - Finance Management PDFDocument2 pagesIl - 401 - Finance Management PDFKairavi BhattNo ratings yet

- Board of Studies The Institute of Chartered Accountants of IndiaDocument16 pagesBoard of Studies The Institute of Chartered Accountants of IndiaadityaNo ratings yet

- 3rd Year SyllebusDocument45 pages3rd Year SyllebusAMIRNo ratings yet

- Fundamentals of Financial Management PDFDocument187 pagesFundamentals of Financial Management PDFSukanya Som100% (1)

- Board of Studies The Institute of Chartered Accountants of IndiaDocument16 pagesBoard of Studies The Institute of Chartered Accountants of IndiaRakeshNo ratings yet

- SyllabiDocument2 pagesSyllabiShailesh RajhansNo ratings yet

- Syllabus: International Institute of Professional Studies Davv, IndoreDocument8 pagesSyllabus: International Institute of Professional Studies Davv, IndoreKavish SharmaNo ratings yet

- 169final New SyllabusDocument17 pages169final New SyllabusNeethu ThomasNo ratings yet

- Syllabus Mba - Iind Year FinanceDocument6 pagesSyllabus Mba - Iind Year FinanceTheRHKapadiaCollegeNo ratings yet

- Stage-6 S-601 - Strategic Financial ManagementDocument4 pagesStage-6 S-601 - Strategic Financial ManagementMir Obaid Ullah ShahNo ratings yet

- MCom Pages DeletedDocument9 pagesMCom Pages DeletedRajneesh BharadwajNo ratings yet

- Basic Finance E-BookDocument140 pagesBasic Finance E-BooksatstarNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementtrilochanmahapatraNo ratings yet

- 169final New Syllabus PDFDocument15 pages169final New Syllabus PDFNavin Man Singh ShresthaNo ratings yet

- Salim Sir+SyllabusDocument2 pagesSalim Sir+SyllabusMohammad Salim HossainNo ratings yet

- Asset Class-Securities & Financial AssetsDocument5 pagesAsset Class-Securities & Financial AssetsShivamNo ratings yet

- FPTM 1.1Document8 pagesFPTM 1.1Vivek SharmaNo ratings yet

- Mba Finance Syllabus Nagpur UniversityDocument6 pagesMba Finance Syllabus Nagpur UniversityAniketsingh KatreNo ratings yet

- MBA Semester III Finance SyllausDocument7 pagesMBA Semester III Finance SyllausKutbuddin KaraNo ratings yet

- BBA 6 Sem Fin PDFDocument8 pagesBBA 6 Sem Fin PDFvidyashree patilNo ratings yet

- Syllabus 2020-22 FINTECHDocument58 pagesSyllabus 2020-22 FINTECHsukeshNo ratings yet

- Sem IvDocument10 pagesSem IvsouravNo ratings yet

- Third Semester Financial Management Specialization: 20 MBA FM 321 Working Capital ManagementDocument58 pagesThird Semester Financial Management Specialization: 20 MBA FM 321 Working Capital ManagementsukeshNo ratings yet

- SlbiDocument7 pagesSlbiBhupesh KansalNo ratings yet

- Corporate Finance NotesDocument99 pagesCorporate Finance NotesmwendaflaviushilelmutembeiNo ratings yet

- IAPM - Unit 1 - 2024Document61 pagesIAPM - Unit 1 - 2024vishalsingh9669No ratings yet

- 169final New SyllabusDocument17 pages169final New SyllabusBhawanath JhaNo ratings yet

- 22PGD202 CFDocument3 pages22PGD202 CFRohit KumarNo ratings yet

- P 1908 Consumar Behavior PensDocument10 pagesP 1908 Consumar Behavior PensLikhithaNo ratings yet

- Ug B.B.A English 104 62 Financial Management 9814Document324 pagesUg B.B.A English 104 62 Financial Management 9814Vyas ShraddhaNo ratings yet

- MBA Semester III SyllabusDocument6 pagesMBA Semester III SyllabusShashank RainaNo ratings yet

- 20 Page Commerce & AccountancyDocument20 pages20 Page Commerce & Accountancymikasha977No ratings yet

- BBA SyllabusDocument8 pagesBBA SyllabussmartculboflacmNo ratings yet

- AFM & ITR SyllabusDocument4 pagesAFM & ITR Syllabusmanusri ANo ratings yet

- Financial Management and Corporate FinanceDocument2 pagesFinancial Management and Corporate FinanceshriyaNo ratings yet

- Financial ManagementDocument91 pagesFinancial ManagementkamaltechnolkoNo ratings yet

- July'08-10 Final SyllabusDocument21 pagesJuly'08-10 Final SyllabusBhavana PandeyNo ratings yet

- Complete Book FM PDFDocument245 pagesComplete Book FM PDFRam IyerNo ratings yet

- LSE FN2191-Principles-of-Corporate-FinanceDocument2 pagesLSE FN2191-Principles-of-Corporate-Financesonia969696No ratings yet

- Paper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarksDocument12 pagesPaper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarkssangkitaNo ratings yet

- Sayllabus of Financial Advisors CertificationDocument6 pagesSayllabus of Financial Advisors Certificationrizwan matloobNo ratings yet

- Curriculum For Amfi-Mutual Fund (Basic) Module: Chapter One Concept and Role of Mutual Funds Section OneDocument10 pagesCurriculum For Amfi-Mutual Fund (Basic) Module: Chapter One Concept and Role of Mutual Funds Section OneJignesh MehtaNo ratings yet

- MBA-III-Investment Management Notes: Financial Accounting and Auditing VII - Financial Accounting (University of Mumbai)Document131 pagesMBA-III-Investment Management Notes: Financial Accounting and Auditing VII - Financial Accounting (University of Mumbai)asadNo ratings yet

- Financial Management - SyllabusDocument2 pagesFinancial Management - SyllabusAnonymous sMqylHNo ratings yet

- A Study On Ratio Analysis at HMT WATCHES LTD - BANGALOREDocument82 pagesA Study On Ratio Analysis at HMT WATCHES LTD - BANGALOREShahid Mushtaq100% (2)

- Syllabus IIP (MBA 4th Sem)Document7 pagesSyllabus IIP (MBA 4th Sem)Shakun VidyottamaNo ratings yet

- ICAI Final SyllabusDocument19 pagesICAI Final SyllabusrockwithakmNo ratings yet

- Syllabus B.Com (H) - 5th Sem. 2021-24Document10 pagesSyllabus B.Com (H) - 5th Sem. 2021-24Ravneet KaurNo ratings yet

- Accountancy Paper III Advance Financial Management Final BookDocument395 pagesAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- Valuation For Mergers Buyouts and RestructuringDocument17 pagesValuation For Mergers Buyouts and RestructuringCAclubindiaNo ratings yet

- SyllabusDocument10 pagesSyllabusPalak ShahNo ratings yet

- Syllabus BComHons.Document8 pagesSyllabus BComHons.ABC XYZNo ratings yet

- (Credit Hours 3) Corporate Financing Decisions: Text BooksDocument1 page(Credit Hours 3) Corporate Financing Decisions: Text Booksshraddha amatyaNo ratings yet

- Financial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsFrom EverandFinancial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Chap-1 Management Functions RolesDocument8 pagesChap-1 Management Functions RolesSunita Basak100% (1)

- Chap2 - Evolution of ManagementDocument5 pagesChap2 - Evolution of ManagementSunita BasakNo ratings yet

- Indemnity Bond Incase Nominee Not recorded-CDSLDocument2 pagesIndemnity Bond Incase Nominee Not recorded-CDSLSunita BasakNo ratings yet

- Chapter3 PlanningDocument7 pagesChapter3 PlanningSunita BasakNo ratings yet

- ControllingDocument9 pagesControllingSunita BasakNo ratings yet

- Chap-1 Form of BusinessDocument12 pagesChap-1 Form of BusinessSunita BasakNo ratings yet

- Indices and Surds Maths Study NotesDocument4 pagesIndices and Surds Maths Study NotesSunita BasakNo ratings yet

- Unit-2 - Overview of PlanningDocument6 pagesUnit-2 - Overview of PlanningSunita BasakNo ratings yet

- Unit-2 Delegation&DecentralizationDocument7 pagesUnit-2 Delegation&DecentralizationSunita BasakNo ratings yet

- SWOTDocument3 pagesSWOTSunita BasakNo ratings yet

- Chapter 18Document29 pagesChapter 18Sunita BasakNo ratings yet

- POM MCQ Set1Document8 pagesPOM MCQ Set1Sunita BasakNo ratings yet

- Mock Paper 3Document5 pagesMock Paper 3Sunita BasakNo ratings yet

- Cost Sheet Prepation-NotesDocument12 pagesCost Sheet Prepation-NotesSunita BasakNo ratings yet

- Type of Economy - ExtraNotesDocument7 pagesType of Economy - ExtraNotesSunita BasakNo ratings yet

- Material CostingDocument7 pagesMaterial CostingSunita BasakNo ratings yet

- Z Test ProportionsDocument9 pagesZ Test ProportionsSunita BasakNo ratings yet

- Icse Class 10 Maths Mock Sample Paper 1 With SolutionsDocument23 pagesIcse Class 10 Maths Mock Sample Paper 1 With SolutionsSunita BasakNo ratings yet

- ICSE-Class-10-Maths-Mock TestDocument4 pagesICSE-Class-10-Maths-Mock TestSunita BasakNo ratings yet

- Questions EconomicsDocument2 pagesQuestions EconomicsSunita BasakNo ratings yet

- CH 01Document27 pagesCH 01Sunita BasakNo ratings yet

- Problems PEDDocument1 pageProblems PEDSunita BasakNo ratings yet

- Ped SumsDocument2 pagesPed SumsSunita BasakNo ratings yet

- Cost SheetDocument17 pagesCost SheetSunita BasakNo ratings yet

- Personality 181005082012Document46 pagesPersonality 181005082012Sunita BasakNo ratings yet

- Labour Cost VarianceDocument30 pagesLabour Cost VarianceSunita BasakNo ratings yet

- Flexible BudgetDocument3 pagesFlexible BudgetSunita BasakNo ratings yet

- Final AccountDocument4 pagesFinal AccountSunita BasakNo ratings yet

- Business AdministrationDocument41 pagesBusiness AdministrationSunita BasakNo ratings yet

- Cost Sheet FormatDocument3 pagesCost Sheet FormatSunita BasakNo ratings yet

- Chapter 2-Plant and Intangable AssetDocument10 pagesChapter 2-Plant and Intangable Assetkefe100% (1)

- Reconstruction InternalDocument12 pagesReconstruction InternalsviimaNo ratings yet

- Perjanjian Pinjaman Polisi: Policy Loan AgreementDocument2 pagesPerjanjian Pinjaman Polisi: Policy Loan Agreementlimited legacyNo ratings yet

- 3 Statement & DCF ModelDocument17 pages3 Statement & DCF ModelarjunNo ratings yet

- 3 Statement Model TemplateDocument16 pages3 Statement Model TemplateDamn SonNo ratings yet

- FINE3015 2122 - CourseOutline Sem1Document2 pagesFINE3015 2122 - CourseOutline Sem1Wang Hon YuenNo ratings yet

- Session 3Document31 pagesSession 3Anmol PanwarNo ratings yet

- Ar 2022 MBSSDocument293 pagesAr 2022 MBSSLeo Agung HastiNo ratings yet

- (2020 - 2021) Chapter 6 - Commercial BanksDocument32 pages(2020 - 2021) Chapter 6 - Commercial Banksmapdit choboonNo ratings yet

- Single Entry and Double EntryDocument8 pagesSingle Entry and Double EntryBhavesh Narayani100% (1)

- Excel FinanceFormulas Vol.2.0.0Document115 pagesExcel FinanceFormulas Vol.2.0.0Ѵїиєєт ВдҩшдиїNo ratings yet

- CDD - APPENDIX - A - R6.7 - Sept 14 - 2017Document3 pagesCDD - APPENDIX - A - R6.7 - Sept 14 - 2017Boy NormanNo ratings yet

- CFO or Controller or Finance Manager or Finance Director or FinaDocument3 pagesCFO or Controller or Finance Manager or Finance Director or Finaapi-78061220No ratings yet

- Business Failure and SuccessDocument4 pagesBusiness Failure and SuccessKioko NziokaNo ratings yet

- Capital BudgetingDocument19 pagesCapital BudgetingJane Masigan50% (2)

- CH 12 Intangible Assets Issues Characteristics of Intangible Assets - CompressDocument7 pagesCH 12 Intangible Assets Issues Characteristics of Intangible Assets - CompressDiniNo ratings yet

- Accounting Assignment P4-5A: Anya's Cleaning ServiceDocument10 pagesAccounting Assignment P4-5A: Anya's Cleaning ServiceTamzid Islam0% (1)

- Goodland Group Limited Annual Report 2015Document127 pagesGoodland Group Limited Annual Report 2015WeR1 Consultants Pte LtdNo ratings yet

- Importance of Documents in Incorporation of Company: Jamia Millia IslamiaDocument33 pagesImportance of Documents in Incorporation of Company: Jamia Millia Islamiamohit kumarNo ratings yet

- Determinants of Capital Structure in Malaysia Electrical and Electronic SectorDocument6 pagesDeterminants of Capital Structure in Malaysia Electrical and Electronic SectoryebegashetNo ratings yet

- Module 5 - Adjusting AccountsDocument16 pagesModule 5 - Adjusting AccountsMJ San PedroNo ratings yet

- Finance 2 - Chapter 1Document5 pagesFinance 2 - Chapter 1Thomas-Jay DerbyshireNo ratings yet

- Chapter 4 Solution..Document53 pagesChapter 4 Solution..HanaSuhanaNo ratings yet

- Income From Business and Profession HandoutDocument29 pagesIncome From Business and Profession HandoutAnantha Krishna BhatNo ratings yet

- Allowable Deductions (Sec. 34) DeductionsDocument20 pagesAllowable Deductions (Sec. 34) DeductionsRon Ramos100% (1)

- Financial Management - Model Questions Subject Code: Mb0045 BOOK ID: (B1134) Second Semester Section A - 1 MarkDocument13 pagesFinancial Management - Model Questions Subject Code: Mb0045 BOOK ID: (B1134) Second Semester Section A - 1 MarkYash koradiaNo ratings yet

MBA (Finance)

MBA (Finance)

Uploaded by

Sunita BasakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBA (Finance)

MBA (Finance)

Uploaded by

Sunita BasakCopyright:

Available Formats

FM 301: TAXATION MODULE

(4 Credit: 40 hrs)

I: DIRECT TAX

1. Concepts: Cannons of Taxation, Person, Assessee, Income, Previous Year, Assessment Year,

Gross Avoidance, Planning, Exemption, Planning, Exemption, Deduction, Rebate, Relief. [2L]

2. Residential Status and Tax Incidence: Individual and Corporate. [4L]

3. Income Exempted from Tax: Individual and Corporate. [2L]

4. Computation of Taxable Income of Individual, HUF and Corporate: Heads of Income – Salaries,

Income from House Property, Profits and Gains from Business or Profession, Capital Gains, Income from

Other sources. Deduction from Gross Total Income – 80CCC, 80D, 80DDB, 80E, 80G, 80GG, 80GGA, 80C,

80U; Set Off and Carry Forward of Losses – Principles, Meaning, Inter – sources and Inter – head Set Off,

Carry Forward and Set Off of Losses under sections 71, 72and 73. [8L]

5. Computation of Tax for Individual, H.U.F and Corporate: Rate of Tax and Surcharge Tax, Rebate

Tax Management – Submission of Return and Procedure of Assessment, PAN, TAN, Preliminary ideas of

Deduction and Collection of Tax at Source, Advance Payment of Tax, Refund of Tax, Minimum Alternate

Tax. [8L]

MODULE II: INDIRECT TAX

6. Goods and Service Tax: GST in India. Features and Advantages, Structure of GST in India: CGST,

SGST, UTGST, IGST, Taxes subsumed by GST, Commodities kept outside the scope of GST. Procedure for

Registration; Deemed Registration, Cancellation of Registration, Revocation of Cancellation of

Registration. Levy and Collection of Tax under GST: 16 Rates structure of GST, Scope of supply,

Composition Scheme under GST [8L]

7. Tax Planning: Scheme of Tax Planning, Tax Planning for Salaries, Tax Planning for Profits and

gains of Business or Profession, Tax Planning for Capital Gains. [6L]

1. Case Study [2L] Suggested Readings:Lal and Vasisht, Direct Taxes, Pearson Education

2. Singahnia, Direct Taxes, Taxman

3. Singhania, Indirect Taxes, Taxman

4. Bhagawati Prasad, Direct tax law and Practice.

5. Gaur and Narang, Income Tax law and Practices, Kalyani Publisher

6. T. B. Chatterjee and V. Jalan, How to handle - GST-TDS and GST-TCS, GST audit, GST Annual

Return, Book Corporation

7. Mundra & Mundra, Taxation-I & Taxation-II , Law point Publication.

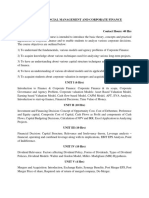

FM 302 - CORPORATE FINANCE

1. Introduction to Corporate Finance: Scope, Objectives, Functions; Role of Financial Manager;

Agency Problem 2L

2. Capital Structure: Concepts, Components of Capital, Leverage, theories of Capital Structure

5L

3. Cost of Capital: Cost of equity; cost of debt; weighted average cost of capital; Project/divisional

cost of capital 4L

4. The Financing Decision: The Financing Process, the Financing Mix – Trade-off and Pecking Order

Theory, the Optimal Financing Mix, the Financing Mix and choices 2L

5. Working Capital Management: Concepts; operating cycle; management of Debtors and Inventories;

Cash Budgeting 4L

6. Investment Decision:

Different criteria for taking investment decisions --- payback period, net present value, internal rate of

return, Profitability Index

Dealing with mutually exclusive projects; capital rationing; projects with different life cycles – equivalent

annual value 4L

7. Capital Budgeting:: Capital budgeting process; different types of project investments; basic

concepts in estimating cash flows for evaluating investment proposals; evaluation of independent

investment; replacement and mutually exclusive investments 5L

8. Risk in Capital Budgeting: Concept of risk; Statistical techniques; beta, Risk Adjusted Discount

Rate, Certainty Equivalent, Sensitivity Analysis, Monte Carlo Simulation, Real Options and Decision Trees

5L

9. Measuring and Rewarding Performance: Economic Value Added(EVA), Advantages of EVA 1L

10. The Dividend Decision: Dividend theories; considerations in deciding on dividend policy; bonus

issues;share splits; buybacks, 4L

11. Corporate Re-structuring: Rationale for Mergers & Acquisitions; valuation of

company; financing of M&A; share swaps 4L

Suggested Books:

Financial Management by Prasanna Chandra Financial Management by Khan & Jain

Reference Books:

Financial Management by I.M. Pandey, Vikas

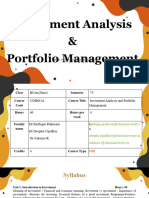

FM - 303 INVESTMENT ANALYSIS & PORTFOLIO MANAGEMENT

1. Introduction to Investment & Portfolio Management: [2L] Investment and speculation; factors

in investment decision making; investment decision process; financial markets overview; approach to

investment decisions

2. Risk and Return: [2L]

Definition of Risk and Return; risk measurement; covariance and correlation; beta of a security

3. Security Valuation: [6L]

Valuation of Shares – different techniques; valuation of Bond – YTM; duration of bond; concept of

Immunization

4. Security Analysis: [10L]

Fundamental Analysis; calculation of intrinsic value of security; Technical Analysis; difference between

Fundamental and Technical Analysis; Dow Theory;

Elliot Wave Theory; Various charts and graphs used in Technical Analysis

– support and resistance levels; Line and Candlestick Chart; various patterns; analytical tools like MA,

MACD, ROC, RSI

5. Portfolio Theory: [6L]

Concept of Portfolio; measurement of Portfolio risk and return, Traditional theory; Modern Portfolio

theory -- Markowitz theory; Efficient Frontier; selection of Optimum Portfolio.

6. Sharp Single Index Model: advantages over Markowitz theory/model [4L]

7. CAPM Model: [4L]

Concept and interpretation – Security Market Line (SML) and Capital Market Line (CML); analysis and

interpretation; application

8. Arbitrage Pricing theory and Multi Factor Theory. [2L]

9. Portfolio Evaluation: Techniques of analyzing portfolio performance [1L]

10. Analysis and modification of portfolio. [1L]

11. Efficient Market Hypothesis: [2L] Concept of market efficiency; different types of market

efficiency and their interpretation

12. Case Studies

Suggested Books:1) Security Analysis & Portfolio Management by Pandian;

2) Investment Analysis & Portfolio Management by Prasanna Chandra;

3) Security Analysis & Portfolio Management by Nagarajan & Jayabal

You might also like

- Transaction List B SUADocument5 pagesTransaction List B SUAPhuong Tran100% (24)

- ch13 Testbank Intermediate AccountingDocument43 pagesch13 Testbank Intermediate Accountingalaa96% (53)

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- FM 8 Module 1 Financial Planning and ForecastingDocument16 pagesFM 8 Module 1 Financial Planning and ForecastingJasper Mortos VillanuevaNo ratings yet

- Coursera IPO Financial Model WallstreetMojoDocument45 pagesCoursera IPO Financial Model WallstreetMojoritzNo ratings yet

- FinanceDocument12 pagesFinancearjun rawoolNo ratings yet

- Emba III Sem FinanceDocument10 pagesEmba III Sem Financejpaladi.2014No ratings yet

- Paper: Mba 333: Financial Management Credits-2 DescriptionDocument4 pagesPaper: Mba 333: Financial Management Credits-2 DescriptionDerek Cherian JojiNo ratings yet

- FIN 133 Fundamentals of Financial Management: Bcis, 5 SemesterDocument3 pagesFIN 133 Fundamentals of Financial Management: Bcis, 5 SemesterBishnu K.C.No ratings yet

- Il - 401 - Finance Management PDFDocument2 pagesIl - 401 - Finance Management PDFKairavi BhattNo ratings yet

- Board of Studies The Institute of Chartered Accountants of IndiaDocument16 pagesBoard of Studies The Institute of Chartered Accountants of IndiaadityaNo ratings yet

- 3rd Year SyllebusDocument45 pages3rd Year SyllebusAMIRNo ratings yet

- Fundamentals of Financial Management PDFDocument187 pagesFundamentals of Financial Management PDFSukanya Som100% (1)

- Board of Studies The Institute of Chartered Accountants of IndiaDocument16 pagesBoard of Studies The Institute of Chartered Accountants of IndiaRakeshNo ratings yet

- SyllabiDocument2 pagesSyllabiShailesh RajhansNo ratings yet

- Syllabus: International Institute of Professional Studies Davv, IndoreDocument8 pagesSyllabus: International Institute of Professional Studies Davv, IndoreKavish SharmaNo ratings yet

- 169final New SyllabusDocument17 pages169final New SyllabusNeethu ThomasNo ratings yet

- Syllabus Mba - Iind Year FinanceDocument6 pagesSyllabus Mba - Iind Year FinanceTheRHKapadiaCollegeNo ratings yet

- Stage-6 S-601 - Strategic Financial ManagementDocument4 pagesStage-6 S-601 - Strategic Financial ManagementMir Obaid Ullah ShahNo ratings yet

- MCom Pages DeletedDocument9 pagesMCom Pages DeletedRajneesh BharadwajNo ratings yet

- Basic Finance E-BookDocument140 pagesBasic Finance E-BooksatstarNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementtrilochanmahapatraNo ratings yet

- 169final New Syllabus PDFDocument15 pages169final New Syllabus PDFNavin Man Singh ShresthaNo ratings yet

- Salim Sir+SyllabusDocument2 pagesSalim Sir+SyllabusMohammad Salim HossainNo ratings yet

- Asset Class-Securities & Financial AssetsDocument5 pagesAsset Class-Securities & Financial AssetsShivamNo ratings yet

- FPTM 1.1Document8 pagesFPTM 1.1Vivek SharmaNo ratings yet

- Mba Finance Syllabus Nagpur UniversityDocument6 pagesMba Finance Syllabus Nagpur UniversityAniketsingh KatreNo ratings yet

- MBA Semester III Finance SyllausDocument7 pagesMBA Semester III Finance SyllausKutbuddin KaraNo ratings yet

- BBA 6 Sem Fin PDFDocument8 pagesBBA 6 Sem Fin PDFvidyashree patilNo ratings yet

- Syllabus 2020-22 FINTECHDocument58 pagesSyllabus 2020-22 FINTECHsukeshNo ratings yet

- Sem IvDocument10 pagesSem IvsouravNo ratings yet

- Third Semester Financial Management Specialization: 20 MBA FM 321 Working Capital ManagementDocument58 pagesThird Semester Financial Management Specialization: 20 MBA FM 321 Working Capital ManagementsukeshNo ratings yet

- SlbiDocument7 pagesSlbiBhupesh KansalNo ratings yet

- Corporate Finance NotesDocument99 pagesCorporate Finance NotesmwendaflaviushilelmutembeiNo ratings yet

- IAPM - Unit 1 - 2024Document61 pagesIAPM - Unit 1 - 2024vishalsingh9669No ratings yet

- 169final New SyllabusDocument17 pages169final New SyllabusBhawanath JhaNo ratings yet

- 22PGD202 CFDocument3 pages22PGD202 CFRohit KumarNo ratings yet

- P 1908 Consumar Behavior PensDocument10 pagesP 1908 Consumar Behavior PensLikhithaNo ratings yet

- Ug B.B.A English 104 62 Financial Management 9814Document324 pagesUg B.B.A English 104 62 Financial Management 9814Vyas ShraddhaNo ratings yet

- MBA Semester III SyllabusDocument6 pagesMBA Semester III SyllabusShashank RainaNo ratings yet

- 20 Page Commerce & AccountancyDocument20 pages20 Page Commerce & Accountancymikasha977No ratings yet

- BBA SyllabusDocument8 pagesBBA SyllabussmartculboflacmNo ratings yet

- AFM & ITR SyllabusDocument4 pagesAFM & ITR Syllabusmanusri ANo ratings yet

- Financial Management and Corporate FinanceDocument2 pagesFinancial Management and Corporate FinanceshriyaNo ratings yet

- Financial ManagementDocument91 pagesFinancial ManagementkamaltechnolkoNo ratings yet

- July'08-10 Final SyllabusDocument21 pagesJuly'08-10 Final SyllabusBhavana PandeyNo ratings yet

- Complete Book FM PDFDocument245 pagesComplete Book FM PDFRam IyerNo ratings yet

- LSE FN2191-Principles-of-Corporate-FinanceDocument2 pagesLSE FN2191-Principles-of-Corporate-Financesonia969696No ratings yet

- Paper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarksDocument12 pagesPaper H.V. (Honours) Corporate Accounting & Reporting MODULE I - 50 MarkssangkitaNo ratings yet

- Sayllabus of Financial Advisors CertificationDocument6 pagesSayllabus of Financial Advisors Certificationrizwan matloobNo ratings yet

- Curriculum For Amfi-Mutual Fund (Basic) Module: Chapter One Concept and Role of Mutual Funds Section OneDocument10 pagesCurriculum For Amfi-Mutual Fund (Basic) Module: Chapter One Concept and Role of Mutual Funds Section OneJignesh MehtaNo ratings yet

- MBA-III-Investment Management Notes: Financial Accounting and Auditing VII - Financial Accounting (University of Mumbai)Document131 pagesMBA-III-Investment Management Notes: Financial Accounting and Auditing VII - Financial Accounting (University of Mumbai)asadNo ratings yet

- Financial Management - SyllabusDocument2 pagesFinancial Management - SyllabusAnonymous sMqylHNo ratings yet

- A Study On Ratio Analysis at HMT WATCHES LTD - BANGALOREDocument82 pagesA Study On Ratio Analysis at HMT WATCHES LTD - BANGALOREShahid Mushtaq100% (2)

- Syllabus IIP (MBA 4th Sem)Document7 pagesSyllabus IIP (MBA 4th Sem)Shakun VidyottamaNo ratings yet

- ICAI Final SyllabusDocument19 pagesICAI Final SyllabusrockwithakmNo ratings yet

- Syllabus B.Com (H) - 5th Sem. 2021-24Document10 pagesSyllabus B.Com (H) - 5th Sem. 2021-24Ravneet KaurNo ratings yet

- Accountancy Paper III Advance Financial Management Final BookDocument395 pagesAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- Valuation For Mergers Buyouts and RestructuringDocument17 pagesValuation For Mergers Buyouts and RestructuringCAclubindiaNo ratings yet

- SyllabusDocument10 pagesSyllabusPalak ShahNo ratings yet

- Syllabus BComHons.Document8 pagesSyllabus BComHons.ABC XYZNo ratings yet

- (Credit Hours 3) Corporate Financing Decisions: Text BooksDocument1 page(Credit Hours 3) Corporate Financing Decisions: Text Booksshraddha amatyaNo ratings yet

- Financial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsFrom EverandFinancial Services Firms: Governance, Regulations, Valuations, Mergers, and AcquisitionsNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Chap-1 Management Functions RolesDocument8 pagesChap-1 Management Functions RolesSunita Basak100% (1)

- Chap2 - Evolution of ManagementDocument5 pagesChap2 - Evolution of ManagementSunita BasakNo ratings yet

- Indemnity Bond Incase Nominee Not recorded-CDSLDocument2 pagesIndemnity Bond Incase Nominee Not recorded-CDSLSunita BasakNo ratings yet

- Chapter3 PlanningDocument7 pagesChapter3 PlanningSunita BasakNo ratings yet

- ControllingDocument9 pagesControllingSunita BasakNo ratings yet

- Chap-1 Form of BusinessDocument12 pagesChap-1 Form of BusinessSunita BasakNo ratings yet

- Indices and Surds Maths Study NotesDocument4 pagesIndices and Surds Maths Study NotesSunita BasakNo ratings yet

- Unit-2 - Overview of PlanningDocument6 pagesUnit-2 - Overview of PlanningSunita BasakNo ratings yet

- Unit-2 Delegation&DecentralizationDocument7 pagesUnit-2 Delegation&DecentralizationSunita BasakNo ratings yet

- SWOTDocument3 pagesSWOTSunita BasakNo ratings yet

- Chapter 18Document29 pagesChapter 18Sunita BasakNo ratings yet

- POM MCQ Set1Document8 pagesPOM MCQ Set1Sunita BasakNo ratings yet

- Mock Paper 3Document5 pagesMock Paper 3Sunita BasakNo ratings yet

- Cost Sheet Prepation-NotesDocument12 pagesCost Sheet Prepation-NotesSunita BasakNo ratings yet

- Type of Economy - ExtraNotesDocument7 pagesType of Economy - ExtraNotesSunita BasakNo ratings yet

- Material CostingDocument7 pagesMaterial CostingSunita BasakNo ratings yet

- Z Test ProportionsDocument9 pagesZ Test ProportionsSunita BasakNo ratings yet

- Icse Class 10 Maths Mock Sample Paper 1 With SolutionsDocument23 pagesIcse Class 10 Maths Mock Sample Paper 1 With SolutionsSunita BasakNo ratings yet

- ICSE-Class-10-Maths-Mock TestDocument4 pagesICSE-Class-10-Maths-Mock TestSunita BasakNo ratings yet

- Questions EconomicsDocument2 pagesQuestions EconomicsSunita BasakNo ratings yet

- CH 01Document27 pagesCH 01Sunita BasakNo ratings yet

- Problems PEDDocument1 pageProblems PEDSunita BasakNo ratings yet

- Ped SumsDocument2 pagesPed SumsSunita BasakNo ratings yet

- Cost SheetDocument17 pagesCost SheetSunita BasakNo ratings yet

- Personality 181005082012Document46 pagesPersonality 181005082012Sunita BasakNo ratings yet

- Labour Cost VarianceDocument30 pagesLabour Cost VarianceSunita BasakNo ratings yet

- Flexible BudgetDocument3 pagesFlexible BudgetSunita BasakNo ratings yet

- Final AccountDocument4 pagesFinal AccountSunita BasakNo ratings yet

- Business AdministrationDocument41 pagesBusiness AdministrationSunita BasakNo ratings yet

- Cost Sheet FormatDocument3 pagesCost Sheet FormatSunita BasakNo ratings yet

- Chapter 2-Plant and Intangable AssetDocument10 pagesChapter 2-Plant and Intangable Assetkefe100% (1)

- Reconstruction InternalDocument12 pagesReconstruction InternalsviimaNo ratings yet

- Perjanjian Pinjaman Polisi: Policy Loan AgreementDocument2 pagesPerjanjian Pinjaman Polisi: Policy Loan Agreementlimited legacyNo ratings yet

- 3 Statement & DCF ModelDocument17 pages3 Statement & DCF ModelarjunNo ratings yet

- 3 Statement Model TemplateDocument16 pages3 Statement Model TemplateDamn SonNo ratings yet

- FINE3015 2122 - CourseOutline Sem1Document2 pagesFINE3015 2122 - CourseOutline Sem1Wang Hon YuenNo ratings yet

- Session 3Document31 pagesSession 3Anmol PanwarNo ratings yet

- Ar 2022 MBSSDocument293 pagesAr 2022 MBSSLeo Agung HastiNo ratings yet

- (2020 - 2021) Chapter 6 - Commercial BanksDocument32 pages(2020 - 2021) Chapter 6 - Commercial Banksmapdit choboonNo ratings yet

- Single Entry and Double EntryDocument8 pagesSingle Entry and Double EntryBhavesh Narayani100% (1)

- Excel FinanceFormulas Vol.2.0.0Document115 pagesExcel FinanceFormulas Vol.2.0.0Ѵїиєєт ВдҩшдиїNo ratings yet

- CDD - APPENDIX - A - R6.7 - Sept 14 - 2017Document3 pagesCDD - APPENDIX - A - R6.7 - Sept 14 - 2017Boy NormanNo ratings yet

- CFO or Controller or Finance Manager or Finance Director or FinaDocument3 pagesCFO or Controller or Finance Manager or Finance Director or Finaapi-78061220No ratings yet

- Business Failure and SuccessDocument4 pagesBusiness Failure and SuccessKioko NziokaNo ratings yet

- Capital BudgetingDocument19 pagesCapital BudgetingJane Masigan50% (2)

- CH 12 Intangible Assets Issues Characteristics of Intangible Assets - CompressDocument7 pagesCH 12 Intangible Assets Issues Characteristics of Intangible Assets - CompressDiniNo ratings yet

- Accounting Assignment P4-5A: Anya's Cleaning ServiceDocument10 pagesAccounting Assignment P4-5A: Anya's Cleaning ServiceTamzid Islam0% (1)

- Goodland Group Limited Annual Report 2015Document127 pagesGoodland Group Limited Annual Report 2015WeR1 Consultants Pte LtdNo ratings yet

- Importance of Documents in Incorporation of Company: Jamia Millia IslamiaDocument33 pagesImportance of Documents in Incorporation of Company: Jamia Millia Islamiamohit kumarNo ratings yet

- Determinants of Capital Structure in Malaysia Electrical and Electronic SectorDocument6 pagesDeterminants of Capital Structure in Malaysia Electrical and Electronic SectoryebegashetNo ratings yet

- Module 5 - Adjusting AccountsDocument16 pagesModule 5 - Adjusting AccountsMJ San PedroNo ratings yet

- Finance 2 - Chapter 1Document5 pagesFinance 2 - Chapter 1Thomas-Jay DerbyshireNo ratings yet

- Chapter 4 Solution..Document53 pagesChapter 4 Solution..HanaSuhanaNo ratings yet

- Income From Business and Profession HandoutDocument29 pagesIncome From Business and Profession HandoutAnantha Krishna BhatNo ratings yet

- Allowable Deductions (Sec. 34) DeductionsDocument20 pagesAllowable Deductions (Sec. 34) DeductionsRon Ramos100% (1)

- Financial Management - Model Questions Subject Code: Mb0045 BOOK ID: (B1134) Second Semester Section A - 1 MarkDocument13 pagesFinancial Management - Model Questions Subject Code: Mb0045 BOOK ID: (B1134) Second Semester Section A - 1 MarkYash koradiaNo ratings yet