Professional Documents

Culture Documents

Summry of Articles

Summry of Articles

Uploaded by

muhammad amjad0 ratings0% found this document useful (0 votes)

7 views3 pagesThe document summarizes several studies on financial literacy:

1) Studies examined financial literacy levels in Karachi, Pakistan; the importance of financial literacy for investors; and entrepreneurial financial practices in Pakistan.

2) Other studies assessed awareness of financial literacy among non-business students, and validity of financial literacy levels among university students in Turkey.

3) Further studies demonstrated the impact of financial literacy and parental socialization on student saving behavior, and financial literacy levels and behaviors in Indonesia.

4) Additional studies evaluated financial proficiency of investors in Pakistan, financial literacy levels among university students in Ghana, and factors influencing money management habits among university students in Pakistan.

Original Description:

Original Title

Summry of articles

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes several studies on financial literacy:

1) Studies examined financial literacy levels in Karachi, Pakistan; the importance of financial literacy for investors; and entrepreneurial financial practices in Pakistan.

2) Other studies assessed awareness of financial literacy among non-business students, and validity of financial literacy levels among university students in Turkey.

3) Further studies demonstrated the impact of financial literacy and parental socialization on student saving behavior, and financial literacy levels and behaviors in Indonesia.

4) Additional studies evaluated financial proficiency of investors in Pakistan, financial literacy levels among university students in Ghana, and factors influencing money management habits among university students in Pakistan.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views3 pagesSummry of Articles

Summry of Articles

Uploaded by

muhammad amjadThe document summarizes several studies on financial literacy:

1) Studies examined financial literacy levels in Karachi, Pakistan; the importance of financial literacy for investors; and entrepreneurial financial practices in Pakistan.

2) Other studies assessed awareness of financial literacy among non-business students, and validity of financial literacy levels among university students in Turkey.

3) Further studies demonstrated the impact of financial literacy and parental socialization on student saving behavior, and financial literacy levels and behaviors in Indonesia.

4) Additional studies evaluated financial proficiency of investors in Pakistan, financial literacy levels among university students in Ghana, and factors influencing money management habits among university students in Pakistan.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

Ghaffar & Sharif (2016) determined the level of financial literacy in Karachi.

Surveyed 300 individuals belonged to Karachi and survey questionnaires were

used to gather primary data based on 10 questions about financial literacy.

Multivariate regression analysis (MRA) and ordinary least squares (OLS)

regressions are used to analyse the hypotheses. Findings indicate that middle-

aged and older people are careful in spending their money. Male respondents

typically have better saving habits. People with higher qualifications and larger

family sizes give their peers financial management advice. Respondents earning

high salaries agree that financial literacy does help one lead a financially secure

life.

Ansari, Albarrak, Sherfudeen & Aman (2022) determined important of literature

on financial literacy in order to help investors learn better. The study comprises a

review of 2182 articles published in peer-reviewed journals and employed

bibliometric techniques. Results indicate institutions and society are increasingly

emphasizing financial literacy to strengthen individual citizens’ responsibilities in

designing their investment strategies.

Junoha, Hidthiirb & Basheer (2019) Examined entrepreneurial financial practices

in Pakistan. Employed resource-based view to analyse the impact of entrepreneur

orientation on SMEs performance. The study has used a survey-based method

and 441 questionnaires were used and partial least square (PLS) is used to analyse

the data. Finding indicate that the impact of individual components of

entrepreneur orientation on performance and access to debt is neglected in this

approach.

Ahmed, Kashif & Ali (2016) assessed the awareness among non-business students

about financial literacy, its importance & financial decision, Survey questionnaire

were conducted on 278 students through the close ended questions along with

quantitative and qualitative data analysis techniques. Outcome signify the most

of non-business students were unable to manage the even personal or home

expenses, because of not having financial information regarding the financial

management

(Ozdemir, Temizel, Sonmez & Fikret Er (2015) investigated the validity of the level

of financial literacy in university student, Sample of 221 student were selected

from the Faculty of Economics and Administrative Sciences students in Turkey.

The financial literacy scale designed for OECD member countries (OECD, 2011)

was used in the study and cluster analysis was obtain to analyse hypotheses.

Findings determined a high level of financial literacy due to the content of the

education the students at the Faculty of Economics and Administrative Sciences

get.

Afsar, Chaudhary, Iqbal & Aamir (2018) demonstrated the impact of financial

literacy and parental socialization on the saving behavior on university students in

Azad Jammu & Kashmir. 400 students of Master of Business Administration were

determined as sample and utilized survey questionnaires. Pearson correlation and

multiple regression analysis are employed by using SPSS. Analyzed that financial

literacy and parental socialization positively leverage the saving behavior of

students and the students who have financial literacy reveal more saving

behavior.

Dwiastanti (2015) understand the financial literacy levels and financial behaviour

of Indonesian society. The survey questionnaire was conducted in 20 provinces

with a total number of respondents of 8,000 people. Descriptive analysis logistic

regression and ANOVA was used that showed financial literacy levels of

Indonesian society is still very low which only reaches 21.84%.

Suhail, Aleemi, Hassan, Imamuddin, & Asadullah (2020) evaluated the financial

proficiency of individual speculators/investors of the Pakistan stock exchange in

Karachi. A convenient sample of 231 Pakistani national financial

specialists/investors is utilized. Regression specification analysis and regression

analysis model LR1 were manipulated, indicated that the financial literacy of

Pakistani speculators’ is correspondingly higher than the average expected level

likewise there is a significant relationship between financial literacy and

investment decision. More specifically, females have a lower level of financial

education than males.

Oseifuah, Gyekye, & Formadi (2018) inspected the level of financial literacy

among undergraduate university students in the northern region of Ghana. An

adapted version of the OECD/INFE (2015) toolkit for measuring level of financial

literacy for a stratified random sample of 342 undergraduate students at the

University of Development Studies (UDS). Logistic regression and Chi-Square

statistical procedures were employed to analyse the data. Result indicates

student’s monthly pocket money rise their tendency to save will also be high is in

heeding with the theory of savings behaviour which posits that saving is a positive

function of disposable income.

Majida, Qureshi & Aftab (2021) evaluated influencing factors i.e., economics,

social, psychological, and access to finance as the forecasters of money

management habits among the university students in Pakistan. Due to the

existence of Covid-19 convenient sampling technique was used and quantitative

survey method along with 405 self-administered questionnaires were distributed.

Multiple regression analysis was directed to measure the factors. The outcomes

show that all the factors have a positive and scientifically obvious effect on the

money management behaviour of university students in Pakistan.

You might also like

- Human HeartDocument10 pagesHuman HeartEzlivia Pineda100% (1)

- Chapter 2Document6 pagesChapter 2vibermeoNo ratings yet

- Research Article On Financial Literacy Among College StudentsDocument25 pagesResearch Article On Financial Literacy Among College StudentsManju DahiyaNo ratings yet

- Perceived Financial Literacy and Savings Behavior of It Professionals in KeralaDocument7 pagesPerceived Financial Literacy and Savings Behavior of It Professionals in KeralaApril PaynsNo ratings yet

- 2021 Financial Literacyand Financial Behaviourof University Studentsin MalaysiaDocument14 pages2021 Financial Literacyand Financial Behaviourof University Studentsin MalaysiaHONEST PASCHALNo ratings yet

- RRL (Foreign Literature)Document6 pagesRRL (Foreign Literature)Joy QuitorianoNo ratings yet

- Evaluating The Financial Levels of Student ConsumersDocument8 pagesEvaluating The Financial Levels of Student ConsumersjojoivaninuguidanNo ratings yet

- Association of Financial Attitude, Financial Behaviour and Financial Knowledge Towards Financial Literacy: A Structural Equation Modeling ApproachDocument10 pagesAssociation of Financial Attitude, Financial Behaviour and Financial Knowledge Towards Financial Literacy: A Structural Equation Modeling ApproachRalph Adrian MielNo ratings yet

- Evaluating the Financial Levels of Student ConsumersDocument21 pagesEvaluating the Financial Levels of Student ConsumersjojoivaninuguidanNo ratings yet

- Research Manu FinalDocument4 pagesResearch Manu FinalABM1 TAMONDONGNo ratings yet

- Course: Business Research MethodsDocument9 pagesCourse: Business Research MethodsBhuvnesh KumawatNo ratings yet

- Understanding Financial Literacy Evidence From Kolkata's Gen ZDocument8 pagesUnderstanding Financial Literacy Evidence From Kolkata's Gen ZInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Financial Literacy and Financial Planning Among Teachers of Higher Education - A Comparative Study On Select VariablesDocument25 pagesFinancial Literacy and Financial Planning Among Teachers of Higher Education - A Comparative Study On Select VariablesRonald AlmagroNo ratings yet

- Financial Literacy and Financial Planning Among Teachers of Higher EducationDocument16 pagesFinancial Literacy and Financial Planning Among Teachers of Higher EducationTung TaNo ratings yet

- Financial Literacy Among The Millennial Generation - RelationshipsDocument16 pagesFinancial Literacy Among The Millennial Generation - RelationshipsYuslia Nandha Anasta SariNo ratings yet

- Senior High School Leaners' Financial Literacy and Numeracy: A Correlational Study Corresponding AuthorDocument14 pagesSenior High School Leaners' Financial Literacy and Numeracy: A Correlational Study Corresponding AuthoreuginemagturocaststudentNo ratings yet

- Mediation Effect of Financial Attitude On FinanciaDocument8 pagesMediation Effect of Financial Attitude On FinanciaDr-Rajshree Sharma PathakNo ratings yet

- A Correlative Study On The Accounting Literacy and Personal Budgeting of Accountants in The Philippines Group 4 3eDocument3 pagesA Correlative Study On The Accounting Literacy and Personal Budgeting of Accountants in The Philippines Group 4 3eEdnalyn RamosNo ratings yet

- Kokiii ResearchcDocument41 pagesKokiii ResearchckrissanglimbagoNo ratings yet

- Empirical Study On Financial Literacy, Investors' Personality, Overcon Dence Bias and Investment Decisions and Risk Tolerance As Mediator FactorDocument22 pagesEmpirical Study On Financial Literacy, Investors' Personality, Overcon Dence Bias and Investment Decisions and Risk Tolerance As Mediator FactorZubaria BashirNo ratings yet

- Proposal Draft 6Document7 pagesProposal Draft 6sebrinavaldez704No ratings yet

- 10) Impact of Financial Literacy On Investment DecisionsDocument11 pages10) Impact of Financial Literacy On Investment DecisionsYuri SouzaNo ratings yet

- Spending Practices and Money Management Strategies of Aspiring Accountants: An InvestigationDocument13 pagesSpending Practices and Money Management Strategies of Aspiring Accountants: An InvestigationRyan SabocoNo ratings yet

- Financial Socialization Agents Terhadap Financial Management Behavior Pada Mahasiswa AkuntansiDocument19 pagesFinancial Socialization Agents Terhadap Financial Management Behavior Pada Mahasiswa AkuntansiSakura FlowerNo ratings yet

- (Hamza, 2019 Financial Literacy InvestmentDocument11 pages(Hamza, 2019 Financial Literacy InvestmentGufranNo ratings yet

- Chapter - Ii Literature ReviewDocument37 pagesChapter - Ii Literature ReviewDrSankar CNo ratings yet

- 7150-Article Text-13046-1-10-20210522Document6 pages7150-Article Text-13046-1-10-20210522Hans SamillanoNo ratings yet

- Ijebea13 145Document7 pagesIjebea13 145Claire Ann LorenzoNo ratings yet

- Chapter Ii Reviwes AmirthaaDocument8 pagesChapter Ii Reviwes AmirthaaAMIRTHAA R R PSGRKCWNo ratings yet

- Chapter 1Document16 pagesChapter 1MAXIMMIN VIERNESNo ratings yet

- FinalestDocument28 pagesFinalestHoseoky FeverNo ratings yet

- Manage-A Study of Financial Literacy Among Micro-Kama Gupta - 1Document8 pagesManage-A Study of Financial Literacy Among Micro-Kama Gupta - 1Impact JournalsNo ratings yet

- Igi 2Document15 pagesIgi 2Claire Ann LorenzoNo ratings yet

- Association of Financial Attitude Financial BehaviDocument11 pagesAssociation of Financial Attitude Financial BehavilaluaNo ratings yet

- 7887 27264 1 PBDocument14 pages7887 27264 1 PBWahyu MaulanaNo ratings yet

- A StudyoffinancialliteracyDocument22 pagesA StudyoffinancialliteracyshanmcbeeNo ratings yet

- Study NotesDocument4 pagesStudy NotesJOANA BELEN CA�ETE JABONETANo ratings yet

- Ingale 2020Document25 pagesIngale 2020Rajendra LamsalNo ratings yet

- Financial Knowledge, Risk Attitude, Access AttitudeDocument14 pagesFinancial Knowledge, Risk Attitude, Access AttitudeRatnawati AbdullahNo ratings yet

- Volume 25 2020 Paper 7Document21 pagesVolume 25 2020 Paper 7Villarba ElishaNo ratings yet

- 3748 8303 1 SMDocument6 pages3748 8303 1 SMPatricia KiarraaNo ratings yet

- Andreitatulici, 8 An AnalysisDocument11 pagesAndreitatulici, 8 An AnalysisChristbelle DimaanoNo ratings yet

- 4529-Article Text-8663-1-10-20201230Document17 pages4529-Article Text-8663-1-10-20201230Juvy ParaguyaNo ratings yet

- Jurnal 2Document6 pagesJurnal 2evaNo ratings yet

- According To Rafi DRAFTDocument11 pagesAccording To Rafi DRAFTRogemae LorenNo ratings yet

- Self EfficacyDocument16 pagesSelf Efficacyejaybanaag041102No ratings yet

- 386 741 1 SMDocument11 pages386 741 1 SMamirhayat15No ratings yet

- Untitled DocumentDocument6 pagesUntitled DocumentashighatkashighatkNo ratings yet

- Ej1323284 PDFDocument14 pagesEj1323284 PDFmia guinooNo ratings yet

- S2-UPGRIM Liesfi, N. F. R., & Suranto, S. (2021) - THE EFFECT OF FINANCIAL LITERACY AND PERSONALITY TOWARDS STUDENTS'FINANCIAL MANAGEMENT ABILITYDocument10 pagesS2-UPGRIM Liesfi, N. F. R., & Suranto, S. (2021) - THE EFFECT OF FINANCIAL LITERACY AND PERSONALITY TOWARDS STUDENTS'FINANCIAL MANAGEMENT ABILITYsamagushidayatr3No ratings yet

- 1 PBDocument17 pages1 PBIDA NUR AENINo ratings yet

- Reviews of Related LiteratureDocument7 pagesReviews of Related LiteratureShereen Grace GaniboNo ratings yet

- The Influence of Socio-Demographic and Financial Knowledge Factors On Financial Management Practices of MalaysiansDocument18 pagesThe Influence of Socio-Demographic and Financial Knowledge Factors On Financial Management Practices of MalaysiansMary AngelieNo ratings yet

- Advanced Research Methods Project - For Merge - For MergeDocument9 pagesAdvanced Research Methods Project - For Merge - For MergeAsad MiraniNo ratings yet

- Sabriand Aw 2019Document14 pagesSabriand Aw 2019rucha pallewarNo ratings yet

- 310-Article Text-623-1-10-20230218Document13 pages310-Article Text-623-1-10-20230218ebdscholarship2023No ratings yet

- Paper 104Document13 pagesPaper 104Ryza Bernadette MuzonesNo ratings yet

- 24 1 3 QuesDocument9 pages24 1 3 Quesstephanieceprado84No ratings yet

- Assessing Lack of Financial Literacy Among Indian Students: Strategies For Enhanced Financial LiteracyDocument12 pagesAssessing Lack of Financial Literacy Among Indian Students: Strategies For Enhanced Financial LiteracyShaheen AbdullaNo ratings yet

- Relationship Between Financial Literacy and Investment Behavior of Salaried IndividualsDocument7 pagesRelationship Between Financial Literacy and Investment Behavior of Salaried IndividualsBala VigneshNo ratings yet

- ONX 620 QuickStart Guide v10Document133 pagesONX 620 QuickStart Guide v10Haiward RinconNo ratings yet

- 125 FINAL PDF Agile UX Research PDFDocument55 pages125 FINAL PDF Agile UX Research PDFMiranda Rogers100% (1)

- OISD ChecklistDocument3 pagesOISD ChecklistLoganathan DharmarNo ratings yet

- Technical Note 156 Correction Factors For Combustible Gas LEL Sensorsnr 02 16Document3 pagesTechnical Note 156 Correction Factors For Combustible Gas LEL Sensorsnr 02 16napoleon5976No ratings yet

- MESFETDocument2 pagesMESFETKarthik KichuNo ratings yet

- CESTARO - Plan-Tonificacion Inicial MujerDocument14 pagesCESTARO - Plan-Tonificacion Inicial MujerLucas Javier VidalNo ratings yet

- Bunuel Gmat QuesDocument2 pagesBunuel Gmat QuesAkansha SharmaNo ratings yet

- PHP Lab ProgrammsDocument10 pagesPHP Lab Programmsakshaya100% (1)

- Moisture States in AggregateDocument2 pagesMoisture States in AggregateJANET GTNo ratings yet

- Basic Rules and Tips in Group DiscussionsDocument2 pagesBasic Rules and Tips in Group Discussionssudarsanamma89% (9)

- Math Solo Plan NewDocument15 pagesMath Solo Plan NewMicah David SmithNo ratings yet

- Washing MachineDocument6 pagesWashing MachineianNo ratings yet

- HG-G8 Module 5 RTPDocument12 pagesHG-G8 Module 5 RTPJonoh Sebastian L TerradoNo ratings yet

- Mongodb DocsDocument313 pagesMongodb DocsDevendra VermaNo ratings yet

- Math4190 Lecture-04-02 HDocument11 pagesMath4190 Lecture-04-02 Hchandan.thakurNo ratings yet

- Ifgtb List Lds Mts 03feb15Document11 pagesIfgtb List Lds Mts 03feb15kaifiahmedNo ratings yet

- TR - 2D Game Art Development NC IIIDocument66 pagesTR - 2D Game Art Development NC IIIfor pokeNo ratings yet

- Solute Inputs in The Salar de Atacama (N. Chile) : V. Carmona, J.J. Pueyo, C. Taberner, G. Chong, M. ThirlwallDocument4 pagesSolute Inputs in The Salar de Atacama (N. Chile) : V. Carmona, J.J. Pueyo, C. Taberner, G. Chong, M. ThirlwallJosue FerretNo ratings yet

- Module 13 Physical ScienceDocument6 pagesModule 13 Physical ScienceElixa HernandezNo ratings yet

- A.1 Steak SauceDocument21 pagesA.1 Steak SauceNorhaslinda Mohd RoslinNo ratings yet

- 3 Methods For Crack Depth Measurement in ConcreteDocument4 pages3 Methods For Crack Depth Measurement in ConcreteEvello MercanoNo ratings yet

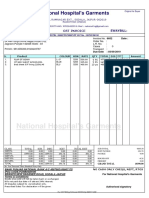

- National Hospital's GarmentsDocument1 pageNational Hospital's GarmentsShekhar GuptaNo ratings yet

- Activity 3.module 1Document4 pagesActivity 3.module 1Juedy Lala PostreroNo ratings yet

- OpAudCh02 CBET 01 501E ToraldeMa - KristineE.Document4 pagesOpAudCh02 CBET 01 501E ToraldeMa - KristineE.Kristine Esplana ToraldeNo ratings yet

- 03-737-800 Ramp & Transit Electrical PowerDocument92 pages03-737-800 Ramp & Transit Electrical PowerNicolas Sal100% (2)

- BCA 103 - Mathematical Foundation of Computer SC - BCADocument274 pagesBCA 103 - Mathematical Foundation of Computer SC - BCAVetri SelvanNo ratings yet

- Lab 27Document3 pagesLab 27api-239505062No ratings yet

- Acct Lesson 9Document9 pagesAcct Lesson 9Gracielle EspirituNo ratings yet

- Spitfire v2 Semff Combat Plane FullDocument1 pageSpitfire v2 Semff Combat Plane FullFilipe GonçalvesNo ratings yet