Professional Documents

Culture Documents

Debt Investments

Debt Investments

Uploaded by

Airam Daisy MordenoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Debt Investments

Debt Investments

Uploaded by

Airam Daisy MordenoCopyright:

Available Formats

INVESTMENT IN DEBT SECURITIES - PROBLEMS

PROBLEM 1: DEBT SECURITIES – BUSINESS MODEL

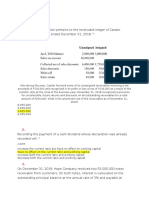

On January 1, 2019, Sun Company purchased the debt instruments of Silk Company with a face

value of P5,000,000 bearing interest rate of 8% for P4,621,006 to yield 10% interest per year. The

bonds mature on January 1, 2024 and pay interest annually on December 30. On December 31,

2019 the prevailing rate of interest is 9%.

Question 1: If the investment is designated as FVPI, what amount of unrealized gain or loss should

the company disclose in their December 31, 2019 profit or loss?

a. None

b. P26,559 unrealized gain

c. P154,907 unrealized gain

d. P217,008 unrealized gain

Question 2: If the investment is designated as FVOCI, what amount of unrealized gain or loss

should the company disclose in their December 31, 2019 other comprehensive income?

a. None

b. P26,559 unrealized gain

c. P154,907 unrealized gain

d. P217,008 unrealized gain

Question 3: If the investment is designated as Amortized Cost, at what amount should the

investment be reported in the company’s statement of financial position for the year ended

December 31, 2019?

a. P4,621,006

b. P4,683,107

c. P4,751,418

d. P4,838,014

PROBLEM 2: RECLASSIFICATION OF DEBT INSTRUMENTS

On January 2, 2019, Saint Company Invested in a 4-year 10% bond with a face value of P6,000,000

in which interest is to be paid every December 31. The bonds has an effective interest rate of 9%

and was acquired for P6,194,383. On December 31, 2019, the security has a fair value of

P6,229,862 which is based on the prevailing market rate of 8.5%.

Question 1: Assume that the debt security was classified initially as Investment at Fair Value to

profit or loss, assume further that during the year 2019 there was a change in the business model

and cash flow characteristics but they decided to make a reclassification on January 2, 2020 to

Investment at Fair value to Other Comprehensive Income. On December 31, 2020, the debt

investment has a fair value of P6,213,992 which is based on the prevailing rate of 8%. What

amount should be debt investment be reported in the December 31, 2020 statement of financial

position?

a. P6,082,949

b. P6,159,400

c. P,6,213,992

d. P6,229,862

Question 2: Assume that the debt security was classified initially as Investment at Fair Value to

Profit or Loss, assume further that during the year 2019 there was a change in the business model

and cash flow characteristics but they decided to make a reclassification on January 2, 2020 to

Investment at Amortized Cost. On December 31, 2020, the debt investment has a fair value of

P6,213,992 which is based on the prevailing rate of 8%. What amount should the debt investment

be reported in the December 31, 2020 statement of financial position?

a. P6,082,949

b. P6,159,400

c. P6,213,992

d. P6,229,862

Question 3: Assume that on the date of acquisition the debt security was designated as Investment

at Amortized Cost, but the investment at amortized cost valuation was reclassified on January 1,

2020 as Investment at fair value to profit or loss, at what amount of gain or loss should the

company recognize on the date of transfer/ reclassification?

a. None

b. P35,479

c. P77,984

d. P113,373

Question 4: Assume that on the date of acquisition the debt security was designated as Investment

at Amortized Cost, but the investment at amortized cost valuation was reclassified on January 1,

2020 as Investment at fair value to other comprehensive income, at what amount of gain or loss

should the company recognize in the profit or loss on the date of transfer/ reclassification?

a. None

b. P35,479

c. P77,984

d. P113,373

Question 5: Assume that on the date of acquisition the debt security was designated as Investment

at Fair value to Other Comprehensive Income, but the investment at was reclassified on January

1, 2020 as Investment at Amortized Cost, at what amount should the investment account be

reported in the statement of financial position as of December 31, 2020?

a. P6,105,547

b. P6,151,878

c. P6,159,400

d. P6,229,862

Question 6: Assume that on the date of acquisition the debt security was designated as Investment

at Other Comprehensive Income, but the investment at was reclassified on January 1, 2020 as

Investment at Fair Value to Profit or Loss, what amount of gain or loss should the company

recognize in the profit loss on the date of transfer/ reclassification?

a. None

b. P35,479

c. P77,984

d. P113,37

You might also like

- Training Bond AgreementDocument2 pagesTraining Bond AgreementRehina Daligdig87% (47)

- QuizDocument13 pagesQuizAnnie Lind0% (3)

- Financial Accounting and Reporting (Basic Accounting Quizbowl)Document67 pagesFinancial Accounting and Reporting (Basic Accounting Quizbowl)Kae Abegail Garcia0% (1)

- Form 1455Document6 pagesForm 1455Shevis Singleton Sr.100% (17)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- 1 LTN Buy Trade InformationDocument3 pages1 LTN Buy Trade InformationReneNo ratings yet

- Balance Statement ReportingDocument12 pagesBalance Statement ReportingahnaflionheartNo ratings yet

- Investment in Debt Securities Qualifying Exam Review Sample QuestionsDocument7 pagesInvestment in Debt Securities Qualifying Exam Review Sample QuestionsHannah Jane Umbay100% (1)

- Accounting For Investments in Debt InstrumentsDocument4 pagesAccounting For Investments in Debt InstrumentsKeahlyn Boticario CapinaNo ratings yet

- Karkits CorporationDocument4 pagesKarkits Corporation김우림0% (3)

- Microsoft Word - FAR02 - Accounting For Debt InvestmentsDocument4 pagesMicrosoft Word - FAR02 - Accounting For Debt InvestmentsDisguised owl0% (1)

- FAR AssessmentDocument4 pagesFAR AssessmentLuna VNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument3 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionAbigail Ann PasiliaoNo ratings yet

- Microsoft Word - FAR01 - Accounting For Equity InvestmentsDocument4 pagesMicrosoft Word - FAR01 - Accounting For Equity InvestmentsDisguised owlNo ratings yet

- FAR 4309 Investment in Debt Securities 2Document6 pagesFAR 4309 Investment in Debt Securities 2ATHALIAH LUNA MERCADEJASNo ratings yet

- Midterm FarDocument7 pagesMidterm FarShannen D. CalimagNo ratings yet

- Ap-600Q: Investing Cycle: Audit of Investment: - T R S ADocument13 pagesAp-600Q: Investing Cycle: Audit of Investment: - T R S AChristine Jane AbangNo ratings yet

- Takehome Quiz Ae 121Document3 pagesTakehome Quiz Ae 121Crissette RoslynNo ratings yet

- Handout No. 4+Document6 pagesHandout No. 4+Zyrelle DelgadoNo ratings yet

- Pas 32 Pfrs 9 Part 2Document8 pagesPas 32 Pfrs 9 Part 2Carmel Therese100% (1)

- Module 3 InvestmentDocument12 pagesModule 3 InvestmentKim JisooNo ratings yet

- ACC 226 Investment in AssociateDocument3 pagesACC 226 Investment in AssociateJAYBIE ENDAYANo ratings yet

- Investment in Joint VentureDocument13 pagesInvestment in Joint Venturekhyla Marie NooraNo ratings yet

- Problem No. 1Document6 pagesProblem No. 1Jinrikisha TimoteoNo ratings yet

- Consolidated FAR UC QUESTIONDocument15 pagesConsolidated FAR UC QUESTIONNathalie GetinoNo ratings yet

- Debt Invest. For Prac - SolvingDocument2 pagesDebt Invest. For Prac - SolvingShekainah BNo ratings yet

- Long Quiz Investments Class IJ (5:30-7:30 TWFS)Document5 pagesLong Quiz Investments Class IJ (5:30-7:30 TWFS)Jolina AynganNo ratings yet

- Investment in AssociateDocument5 pagesInvestment in AssociateJanice CuetoNo ratings yet

- Intermediate AccountingDocument7 pagesIntermediate AccountingPrinx CarvsNo ratings yet

- FinAcc 3 QuizzesDocument9 pagesFinAcc 3 QuizzesStella SabaoanNo ratings yet

- Problem No. 1Document5 pagesProblem No. 1Jinrikisha TimoteoNo ratings yet

- Integrated Topic 1 (Far-004a)Document4 pagesIntegrated Topic 1 (Far-004a)lyndon delfinNo ratings yet

- InvestmentsDocument2 pagesInvestmentsAlora EuNo ratings yet

- Gen008 P1 ExamDocument11 pagesGen008 P1 ExamMary Lyn DatuinNo ratings yet

- EXAM About INTANGIBLE ASSETS 4Document3 pagesEXAM About INTANGIBLE ASSETS 4BLACKPINKLisaRoseJisooJennieNo ratings yet

- Far FinalDocument24 pagesFar FinalJon MickNo ratings yet

- Acctg 41 DepartmentalDocument12 pagesAcctg 41 DepartmentalMelrose Eugenio ErasgaNo ratings yet

- Theories (Chapter 22-25)Document9 pagesTheories (Chapter 22-25)Chester GuioguioNo ratings yet

- Accounting For Investments: TheoriesDocument20 pagesAccounting For Investments: TheoriesJohn AlbateraNo ratings yet

- Local Media1480136231510497513Document6 pagesLocal Media1480136231510497513Rowena TamboongNo ratings yet

- Accountancy Philippines Daily Review For Far June 05 2020: Question No. 1Document10 pagesAccountancy Philippines Daily Review For Far June 05 2020: Question No. 1Danna NuquiNo ratings yet

- ACCO 30053 - Audit of Investments - MARPDocument10 pagesACCO 30053 - Audit of Investments - MARPBanna SplitNo ratings yet

- Usc Part 2020 (Far) - RetakeDocument25 pagesUsc Part 2020 (Far) - RetakeVince AbabonNo ratings yet

- Unit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Document9 pagesUnit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Alyna JNo ratings yet

- Diagnostic Investments QuestionsDocument5 pagesDiagnostic Investments Questionscourse heroNo ratings yet

- Equity Handout 4th YearDocument9 pagesEquity Handout 4th YearMildred Angela DingalNo ratings yet

- Ad2 1Document13 pagesAd2 1MarjorieNo ratings yet

- Handout Investment in Debt Securities Answer KeyDocument4 pagesHandout Investment in Debt Securities Answer KeyJaimell LimNo ratings yet

- Afar 2019Document9 pagesAfar 2019TakuriNo ratings yet

- ASSET 2019 Mock Boards - FARDocument7 pagesASSET 2019 Mock Boards - FARKenneth Christian WilburNo ratings yet

- AFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)Document7 pagesAFAR-11 (Consolidated FS - Intercompany Sales of Fixed Assets)Shiela NacasiNo ratings yet

- CFR 1 Quiz 1Document7 pagesCFR 1 Quiz 1Ahmed SamadNo ratings yet

- FTME Key To CorrectionDocument12 pagesFTME Key To CorrectionABMAYALADANO ,ErvinNo ratings yet

- ACCTGREV1 - 002 Notes Payable and RestructuringDocument2 pagesACCTGREV1 - 002 Notes Payable and RestructuringRenz Angel M. RiveraNo ratings yet

- FarDocument19 pagesFarsarahbeeNo ratings yet

- 2nd Long Quiz StudentDocument8 pages2nd Long Quiz StudentDumb MushNo ratings yet

- P1Document2 pagesP1Let it beNo ratings yet

- (Final) Acco 102 - Intermediate Accounting 1Document19 pages(Final) Acco 102 - Intermediate Accounting 1JONA CAÑESONo ratings yet

- College of Business, Entrepreneurship and AccountancyDocument8 pagesCollege of Business, Entrepreneurship and AccountancyCherry Ann RoblesNo ratings yet

- Handout 5.0 ACP 312 Consolidated FS Subsequent To Date of Acquisition Stock Acquisition v2.0Document3 pagesHandout 5.0 ACP 312 Consolidated FS Subsequent To Date of Acquisition Stock Acquisition v2.0Rhea Jane ParconNo ratings yet

- ACC 107 Practice ExamDocument29 pagesACC 107 Practice ExamAJ Jahara GapateNo ratings yet

- Audit Problem Investments Part 2Document6 pagesAudit Problem Investments Part 2Rio Cyrel CelleroNo ratings yet

- CFAS-MC Ques - Review of The Acctg. ProcessDocument5 pagesCFAS-MC Ques - Review of The Acctg. ProcessKristine Elaine RocoNo ratings yet

- How to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingFrom EverandHow to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingNo ratings yet

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- UntitledDocument1 pageUntitledAiram Daisy MordenoNo ratings yet

- UntitledDocument1 pageUntitledAiram Daisy MordenoNo ratings yet

- Airam Daisy F. Mordeno ACT214 Art AppreciationDocument1 pageAiram Daisy F. Mordeno ACT214 Art AppreciationAiram Daisy MordenoNo ratings yet

- Airam Daisy F. Mordeno Activity 9Document1 pageAiram Daisy F. Mordeno Activity 9Airam Daisy MordenoNo ratings yet

- Airam Daisy F. Mordeno ACT214 Art AppreciationDocument1 pageAiram Daisy F. Mordeno ACT214 Art AppreciationAiram Daisy MordenoNo ratings yet

- Bacostmx - HW3Document5 pagesBacostmx - HW3Airam Daisy MordenoNo ratings yet

- HUDCO Tax Free Bond Application FormDocument8 pagesHUDCO Tax Free Bond Application FormVenkatesh DoodamNo ratings yet

- Module 5 - Mathematics of FinanceDocument6 pagesModule 5 - Mathematics of FinanceBangunan Mengfie Jr.No ratings yet

- Restoring Integrity Statement: ResolutionDocument11 pagesRestoring Integrity Statement: ResolutionLyka Dennese SalazarNo ratings yet

- FIN331-004 2010 Fall Exam2 AnswersDocument7 pagesFIN331-004 2010 Fall Exam2 AnswersAnmol NadkarniNo ratings yet

- 48-Hour Take-Home Exercises Session 2Document10 pages48-Hour Take-Home Exercises Session 2nilik10923No ratings yet

- Assignment 5 - CH 10 - The Cost of Capital PDFDocument6 pagesAssignment 5 - CH 10 - The Cost of Capital PDFAhmedFawzy0% (1)

- Fee Information Sheets Ug 2023.Document72 pagesFee Information Sheets Ug 2023.AkashNo ratings yet

- AB Bank - 2022Document131 pagesAB Bank - 2022Mostafa Noman DeepNo ratings yet

- Something of ValueDocument18 pagesSomething of ValueForkLogNo ratings yet

- Essentials of Investments 8th Edition Bodie Test BankDocument22 pagesEssentials of Investments 8th Edition Bodie Test BankJoanSmithrgqb100% (51)

- BIEF Major Choice Finance 1920191203104134Document20 pagesBIEF Major Choice Finance 1920191203104134GiorgioNo ratings yet

- Mercurio LIBOR Market Models With Stochastic BasisDocument39 pagesMercurio LIBOR Market Models With Stochastic BasisvferretNo ratings yet

- Jawaban Soal Assignment Advanced Accounting Patar Andreas ManaluDocument12 pagesJawaban Soal Assignment Advanced Accounting Patar Andreas ManaluSolution Manual100% (1)

- Deduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToDocument169 pagesDeduction, Collection and Recovery of Tax: After Studying This Chapter, You Would Be Able ToRajNo ratings yet

- Risk Management Interest Rate RiskDocument70 pagesRisk Management Interest Rate Riskapi-27174321No ratings yet

- BodyDocument104 pagesBodySantosh ChhetriNo ratings yet

- Financial Mkts in PakistanDocument11 pagesFinancial Mkts in PakistanXeeshan Bashir100% (1)

- CAIA Level I - Credit DerivativesDocument21 pagesCAIA Level I - Credit Derivativescfafrmcaia100% (1)

- Kiryas Joel Aqueduct Connection Project Business PlanDocument7 pagesKiryas Joel Aqueduct Connection Project Business PlanthrnewsdeskNo ratings yet

- MGT201 Solved Mid Term Subjective For Mid Term ExamDocument22 pagesMGT201 Solved Mid Term Subjective For Mid Term ExammaryamNo ratings yet

- Fundamental Analysis and Technical Analysis Project Report On Power SectorDocument91 pagesFundamental Analysis and Technical Analysis Project Report On Power Sectorgouttam pandaNo ratings yet

- Seminar Risk ManagementDocument9 pagesSeminar Risk ManagementDương Nguyễn TùngNo ratings yet

- Mutual Funds: Prepared by - Pratik MananiDocument29 pagesMutual Funds: Prepared by - Pratik MananimananipratikNo ratings yet

- BHARATBondETF PresentationDocument24 pagesBHARATBondETF PresentationJaackson SabastianNo ratings yet

- The Philippine Capital Markets and The World Interest Rate: April 2017Document8 pagesThe Philippine Capital Markets and The World Interest Rate: April 2017kim cheNo ratings yet