Professional Documents

Culture Documents

E-Governance and Fraud Control in The Nigerian Public Service An Assessment of Integrated Personnel and Payroll Information System

E-Governance and Fraud Control in The Nigerian Public Service An Assessment of Integrated Personnel and Payroll Information System

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

E-Governance and Fraud Control in The Nigerian Public Service An Assessment of Integrated Personnel and Payroll Information System

E-Governance and Fraud Control in The Nigerian Public Service An Assessment of Integrated Personnel and Payroll Information System

Copyright:

Available Formats

Volume 7, Issue 10, October – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

E-Governance and Fraud Control in the Nigerian

Public Service: An Assessment of Integrated

Personnel and Payroll Information System

1 2

Opara, Stella C, Olisakwe Chimdindu N

1 2

Department of Public Administration Department of Accountancy

Cairtas University Amorji Nike Enugu State- Nigeria. University of Nigeria, Enugu Campus- Enugu State. Nigeria

Abstract:- The study examined the effect of Electronics- I. INTRODUCTION

Governance on fraud control in the Nigeria Public

service: An assessment of the Integrated Personnel and The predominance of corruption in any society

Payroll Information System. The objective of the study invariably means backwardness and underdevelopment. The

was to determine the extent the implementation of level of corruption in a country, determines the level of

Integrated personnel and payroll information system development, and it affects societies in multiple ways, in

program has impacted on payroll fraud in the Ministry, worst cases; it costs lives (Transparency International,

ascertain the extent Integrated personnel and payroll 2017). Nigeria as a country has been battling with the issue

information system has enhanced the accurate payment of corruption for a very long time. This corruption

of salaries and remittance of payroll deduction of permeates the political, economic, social, and virtually every

employees to third parties; and the extent Integrated sector of the economy. Nigerian public service was a model

personnel and payroll information system has enhanced to emulate from inception. According to Ogunrui and

the management of Federal staff records. The objectives Erhijakpor (2009:106), misappropriation of public funds

were developed into hypothses. The study adopted the was difficult and very rare during that era, and that the

fraud diamond theory; applied a descriptive survey service was very efficient, and greatly contributed to the

research design with structured questionnaire as the formulation and implementation of public policies.

instrument for data collection on population of 223. The However, over time, inefficiency and corruption became rife

data collected were analyzed using table and in the Nigerian civil service, and this had eaten deep into the

percentages, while the hypotheses were tested using the fabrics of the Nigerian public servants (El-Rufai, 2010). It

chi-square statistical tool. The findings of the study was at this stage of rethink that many Nigerians started

revealed amongst others that the implementation of nursing the idea of reforms into the public service generally.

Integrated personnel and payroll information system

program has reasonably eliminated payroll fraud in the According to the World Bank (2002), there was a

Federal Ministry of Finance, Abuja also, the Integrated strong consensus in the international development

personnel and payroll information system has to a great community on the need for civil public reforms in

extent enhanced the accurate payment of salaries and developing nations. It was therefore a topical issue of the

remittance of payroll deduction of employees of the moment as developing nations all over the world engaged in

the struggle to better their existence through the process of

Federal Ministry of Finance, Abuja to third parties. The

study recommended that the federal government should reforms for efficient and effective service delivery. In

continue to ensure strict implementation of the pursuance of the global reform agenda, Muranaet al (2016)

integrated personnel and payroll information system opined that Nigeria’s development objective is to be in the

program in order to completely eliminate payroll fraud, league of the 20 leading economies in the world by the year

accurate payment of salaries and remittance of payroll 2020. The main philosophy underlying vision 20-20-20

deductions of employees not just the Federal Ministry of therefore is the transcendence of the country from the

Finance, Abuja but in all the MDAs in the country. category of a developing nation struggling to attain the

millennium development goals (MDGs). This aspiration

Keywords:- IPPIS, E -governance, Civil Service. emerged at the twilight of the last millennium in 1999, when

Nigeria embraced democracy after several years of military

dictatorship (BPSR, 2009).

IJISRT22OCT842 www.ijisrt.com 1644

Volume 7, Issue 10, October – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

According to Micah &Moses (2018), the Nigerian civil but it tends to worsen with time, resulting to greater

service witnessed several administrative and public service difference in accessing reliable data for human resources

reform programmes dating as far back as pre-independence. planning and management, chaotic state of pension

The major reforms which this study focuses on came up as administration; ‘ghost worker’ syndrome and various forms

from 1999 and beyond with the heralding of the new civilian of payroll and credential fraud.

regimes of Chief Olusegun Obasanjo and Umaru Musa

Yar’Adua/Goodluck Jonathan. The Nigeria vision of the Ghost worker syndrome is not a new thing in Nigerian

public service reforms of 1999 was to positively transform Public service, where a non existing employee is being paid

the civil service into an ideal, competent, professional, monthly. There are multiple payments of emoluments to a

development-oriented, public-spirited, and customer- single employee and credentials are falsified. People have

friendly, capable of responding effectively and exhibiting access to their age of retirement. It is a big challenge, that at

core values of political neutrality, impartiality, integrity, this age when almost every aspect of the world economy is

loyalty, transparency and accountability that was improved computerized, Nigeria is still depending on manual records

upon to the point of being competitively well remunerated for her personnel and payroll information. Workers data are

and innovative, according to Bureau of Public Service kept in paper files, their salaries are calculated manually and

Reform (BPSR, 2009). as such mistakes and fraud in form of overpayment,

underpayment and payment of ghost workers always occur.

Consequently, in the words of Adekunle (2016),the Government of Nigeria does not have the accurate number

reforms came in the major aspects of government of civil servants and her budget is always an estimate. This

administration which include: Restructuring of the civil has created some loop holes, whereby some ministries

service; Monetization policy; Civil service salary review; budget more than they require and use the excess for some

Overhaul of procurement system; Sustained crusade against other things other than payment of salary and allowances. In

corruption; Capacity building; ICT development; Review of the insight of the above, this study tends to examine the

the public service rules; Regulations and procedures; effect of Integrated Personnel and Payroll Information

Rightsizing the civil service; Integrated payroll and System on reduction of fraud in Nigerian public service with

Personnel Information System (IPPIS); and Due process. preference to the Federal Ministry of Finance, Budget and

These major reforms were introduced and implemented national planning Abuja.

since the inception of Obasanjo’s regime and YarAdua’s

administration, and were targeted at realizing the vision of II. CONCEPTUAL REVIEW

the public service reform agenda aforementioned.

A. ELECTRONIC GOVERNANCE

In Nigeria all the Ministries, Departments and E- Governance refers to the use of internet technology as

Agencies (MDA’s) draw their personnel cost from the a platform to exchanging information, providing services

Consolidated Revenue Fund (CRF). The exert number of and transacting with citizens, Business and other arms of

Personnel being paid in the Nation cannot be easily government. E-governance is also a democratic practice that

ascertained due to non-availability of required and necessary is gradually gaining universal acceptance and applicability.

information. As a result of none availability of the exert It refers to a governmental type aimed at achieving effective

number of Public servants in the country, it has become service delivery from government to citizens, moving

difficult for government to have an accurate wage data for governance from traditionalist bureaucratization to

planning and budgeting purpose.The IPPIS project as the modernist participatory administration. E-governance is not

core subject of this study started as a world Bank-assisted just merely computerizing existing government; it is

programme under the Economic Reforms and Governance transforming the existing government. E-governance is the

Project (ERGP) and was instituted in 2006 to provide a ICT-enabled route to achieving good governance.

reliable and comprehensive database for the public service

to facilitate manpower planning; eliminate records and The application of ICT to disseminate information to

payroll fraud; facilitate easy storage, update and retrieval of the citizens, businesses and among sections, units or

personnel records for administrative and pension processes; departments of government, faster and better delivery of

and facilitate staff remuneration payment with minimal public services, improving internal efficiency, cost

leakages and wastages. The Integrated Personnel and reduction, boosting income, reorganising administrative

Payroll Information System (IPPIS) project seeks to resolve processes for improved quality of services (UN, 2005).

this and also reduce the Federal Government expenditure on Similarly, e-governance is the process of enhancing

Overheads. In 2007, the Federal Government of Nigeria and governance system through the application of ICT within

the World Bank initiated Integrated Personnel and Payroll and without the various levels of government (Okot-Uma,

Information System (Bhoi, 2017). 2000).In a similar vein, Backus (2001), views e- governance

as the use of electronic means in the network of relationship

Englewood (2018) contends that amongst the between government and the public, government and

objectives of the reforms of Government is to entrench businesses, as well as in operations within governmental

transparency and accountability in the public service Human systems to simplify and improve democracy, government

Resources (HR) records and payroll administration. and business aspects of governance. Gil-Garcia and Luna-

Successive Government has observed gross inadequacies in Reyes (2006) aligned their perception of e-governance to the

the payroll and personnel records in the public service. foregoing, when they assert that enhancing managerial

Several efforts have been made to reduce these challenges, effectiveness, promoting democratic values and

IJISRT22OCT842 www.ijisrt.com 1645

Volume 7, Issue 10, October – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

mechanisms, a regulatory framework aimed at initiating B. The Concept of Integrated Payroll and Personnel

intensive information and the advancement of knowledge Information System (IPPIS)

society via the use of ICT is e-governance. Closely related The Integrated Payroll and Personnel Information

to the above, E-governance is the performance of System (IPPIS) is information Communications Technology

governance using the electronic gadgets to disseminate (ICT) based computerized Human Resource and accounting

information that are characterised with speed, efficiency and Management Information System project initiated by the

transparency to the citizens and agencies of government for Federal Government of Nigeria (FGN) to improve the

performing government administrative activities (United effectiveness and efficiency of payroll administration for its

Nations Educational, Scientific and Cultural Organization Ministries, Departments and Agencies (IPPIS, OAGF,

[UNESCO], 2005). 2019). IPPIS provides a platform for computer application

in government payroll management as it calculates each

Deducing from the above, electronic governance is the employees monthly basic pay, bonuses, arrears, national

use of electronic media in governance to facilitate data housing fund and pension contributions.

storage, accessibility, transparency and interaction between

and among levels, organs of governments and the public According to Nwaodu et al (2014),The IPPIS

which include business organisations and the citizens. All introduced in the Federal Service was a major step towards

the definitions cited above corroborate the fact that E- reforming and transforming the service for better service

governance entails the use of electronic media in delivery in the country. The IPPIS is an enterprise-wide,

governance to facilitate the interface between and among integrated, computerize and efficient human resource

segments within and without the government. Kariuki and management information system that is used by the

Kiragu (2011), identify the different interactions that exist in ministries, departments, agencies and local governments to

e-governance to include systems and services between undertake human resource management activities from

government to citizens (G2C), Government to Business recruitment to separation, including payroll and pension

(G2B), Government to Government (G2G) and Government processing. The IPPIS is designed to make use of modern

to Employees (G2E). Out of the listed levels of interactions, information and communication technologies to help the

IPPIS can be categorised under Government to Employees government manage the human resource of the public

(G2E), which denotes a regular interface between the service more efficiently and effectively (Kinyeki, 2015).

government and its employees. This interaction is not a one

way traffic mode between the government and the The IPPIS, which is an ICT-based system, is a

employees. It is a dual mode relationship to help employees principal component of the public sector reform initiative

maintain communication with the government and their own that was designed to achieve a set of objectives. These

colleagues using online tools, sources and articles. With this objectives include to:

arrangement, documents can now be stored and shared with Facilitate planning: Having all the civil service records in

other colleagues online. Paperlessness of the office and the a centralized database will aid manpower planning as well

ease with which to send documents back and forth as assist in providing information for decision making;

withcolleagues across the globe as substitute to printouts are Aid Budgeting: An accurate recurrent expenditure on

other accrued advantages. In addition, personnel records of emoluments could be planned and budgeted for on a

employees are maintained with the aid of a software via the yearly basis;

interface of G2E. The software helps keep all personnel Monitor the monthly payment of staff emoluments against

information in one location and also promotes regular what was provided for in the budget to ensure convenient

update of personnel information such as social security staff remuneration payment with minimum leakages and

numbers, tax information, current address and other wastages;

information (https://en.wikipedia.org/wiki/E- governance). Ensure database integrity so that personnel information

IPPIS as an example of G2E, deals typically with personnel are correct and intact using database integrity constraints

and payroll related issues. It keeps vital information such as that built into ICT-based system that once entered cannot

names, addresses, employment information of employees, be manipulated by unauthorized This will prevent

and also a good interactive framework for calculating and alteration of sensitive employee data like dates of birth

printing payroll checks, as its operational focus, is majorly and appointment;

on electronic personnel records and electronic payment Eliminate payroll fraud, such as the ghost workers

(Chima, Ahmadu and Folorunsho 2019). HR/payroll syndrome where a non-existing employee is being paid

database integration automates many of the functions of monthly; multiple payments of emoluments to a single

payroll, saving time and ensuring correct accounting and employee; and credentials falsification;

prompt payment of salaries. Facilitate easy storage, uploading and retrieval of

From the above, it can be deduced that IPPIS is an aspect of personnel records for administrative and pension

electronic governance. processes;

Provide a good working environment that is conducive

and supportive to the operations of modern, proactive

service that is innovative and technologically driven

(OAGF: IPPIS Operational Manual, 2008).

IJISRT22OCT842 www.ijisrt.com 1646

Volume 7, Issue 10, October – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

C. The Concept of Fraud The public service or the public bureaucracy on the

Larson (2018) defined fraud as an act that is intentionally other hand, is often referred to as the “enlarged” service. It

deceptive and is designed to provide the perpetrator with an is made up of other service outside of the core civil service,

unlawful gain or access to resources or to deny a right to a and inclusive of the civil service, to encompass the

victim. Fraud involves the false representation of facts, following:

whether by intentionally withholding important information The police service and other security agencies.

or providing false statements to another party for the The armed forces (army, navy, air force)

specific purpose of gaining something that may not have The national (or state) assembly services

been provided without the deception. The judicial service

Parastatals and agencies-regulatory agencies, educational

However, the Payroll fraud and ghost workers fraud

institutions, research institutes, infrastructure agencies,

are arguably the biggest and most persistent type of fraud in

statutory agencies and other services providers owned by

Nigeria costing the government hundreds of billions of

government and established by Acts of the National

Nigeria every year in lost revenue to the fraudsters.

Assembly.

Osisiomaet al (2016) defined Ghost workers and payroll

fraud as processes of employee impersonations that have Companies or enterprise in which Government or its

salary cost implication on the government. It includes all agency owns controlling shares or interest (Uzochukwu,

illegal, unauthorized, unqualified, fictitious and non-existing 2018).

staff that makes salary claims from the government coffers. E. WAYS INTEGRATED PERSONNEL AND PAYROLL

The foregoing implies that underage, overage, backdated INFORMATION SYSTEM HAS IMPACTED ON FRAUD

employments, inherited employments, unqualified staff and REDUCTION IN NIGERIAN PUBLIC SERVICE

unauthorized staffs even though they report for work daily; The Integrated Payroll and Personnel Information

are categorized as part of ghost workers and payroll fraud in System (IPPIS) is one of the transformation agenda of the

the public service. In some instances, these fraudulent public federal government of Nigeria. It has an aim to create a

officeholders forge the necessary documents and centralized database system for Nigerian public service with

authorizations to add an employee on the payroll. a single, accurate source of employee information that

provides integration with other business applications. IPPIS

commenced in April 2007 and by year 2010, it had been

Ghost workers are therefore nonexistent employees implemented in around 17 Ministries, Departments and

whose names and other particulars are kept on the Agencies. But prior to its commencement by the federal

organization's payroll and salaries paid to them but received government, there were a lot of challenges faced,

by others (most likely the fraud) who had the name included particularly personnel information and payroll. Launched by

or left in the register. Ghost workers may be kept on the the former Coordinating Minister for the Economy, Dr

payroll if payroll managers delay in removing the names of Ngozi Okonjo-Iweala, the system uncovered most of the

individuals who no longer staff of the organization from the fraud using biometric data capture machine. Because ghosts’

payroll (Lekubu, 2013). In some cases, payroll clerks may workers have no fingerprints, the bubble burst for those

include names of fictitious or separated employees on the behind the inflated staff figures. The fake workers who have

payroll, forge their signatures, and collect the salaries on regularly survived the pay at sight charade of the ministries,

their behalf (Izedonmi&Ibadin, 2012). departments and agencies (MDAs) stood out like sore

thumbs. The level of collusion here is really the issue and

And due to the large number of employees in the until such issues are sorted out, government will continue to

public sector, head count exercises are usually conducted by lose billions of Naira to unscrupulous officials (Agbatogun,

governments to identify the ghost workers and remove them 2019).

from the staff roll (Tanzi, 2013). But these exercises hardly

yield the required results again because of collusion by The introduction of the IPPIS in the Nigerian civil

insiders. service has immensely contributed to the reduction of fraud

as regards payroll fraud and ghost workers in the country’s

D. THE NIGERIAN CIVIL SERVICE public service. The Nigerian Public service is reportedly

Civil service refers to all organization that exists as part heavily burdened with a fraud especially payroll fraud and

of government’s machinery for implementing policies and ghost workers who not only unexpectedly write job

programmes as well as for delivering services to meet the applications and present themselves for interviews, but who

need of citizens. According to Smith (2007),the civil service also open bank accounts and collect salaries, despite their

is part of the public service. It is often referred to as the human shortcomings! Curiously, the CBN‟s “know your

“core” service because it directly services the executive customers” directive to banks was obviously no deterrent to

branch of government. Accordingly, officers in ministries the establishment of bank accounts for such ghosts (Micah

and extra ministerial departments and those whose & Moses, 2018)..

recruitment and career progression are determined by the

Federation and the Federal Civil Service Commission are

civil servants.

IJISRT22OCT842 www.ijisrt.com 1647

Volume 7, Issue 10, October – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

In July 2011, the Rivers State Universal Basic 2012, that on completion of a successful nationwide

Education Board reported losses of N2.4bn annually to 1477 biometric verification of pensioners, his team detected

ghost workers, while the National Identity Management 71,133 fake pensioners. Furthermore, N151bn fraud was

Commission, also revealed that, after conducting a biometric also uncovered in Pension offices across the country.

data exercise, it had uncovered 4000 ghost workers out of Inexplicably, despite the available documentary evidence,

about 10,300 employees on its payroll. Furthermore, the especially from banks, none of the identified beneficiaries of

Ekiti State Governor, Dr. Kayode Fayemi, in the first tenor the ghost worker scam has ever been prosecuted and

also observed ghost workers, prior to his administration, convicted or indeed, constrained to return either all the

Ekiti State government lost over N3bn annually to ghost stolen funds or forfeit all assets or property derived there

workers out of a projected annual budget of N80bn from. Inexplicably, over 3years, thereafter, these invisible

(Garbade, 2018).Unfortunately, the federal government is „blood sucking‟ demons still oppressively flourish and

not immune to such fraudulent revenue leakages; Indeed, in haunt us, as the following, more recent media reports

2001, the incumbent Accountant General of the Federation, confirm. Federal Government probes 11,000 ghost workers‟

Chief Joseph Naiyeju, reported the discovery of 40,000 (King, 2016).

ghost workers following a man-power verification exercise.

Similarly, 6000 ghost workers were detected after the IPPIS is targeted at eliminating a financial form of

completion of a staff audit. corruption such as ghost workers, multiple salaries,

overpayment of salaries and undue entitlements. There are

In May 2009, the House of Representative Committees shreds of evidence across other African countries that show

on Customs and Excise also discovered that about 50% of that the implementation of IPPIS is effective in detecting

the 20,000 workforce in the Nigeria Customs Service were and deterring financial fraud. With particular reference to

ghost worker. Former Finance Minister, Mr. Olusegun Nigeria just like other African countries presented above,

Aganga, in July 2011, reported that the federal government Muranaet al, (2016) contend that the introduction of IPPIS

had removed a total of 43,000 ghost workers from the old as a reform measure in the public financial management

payroll of 112,000 employees in several MDAs, between system in Nigeria has achieved a lot. The table 2.1 below

2010 and 2011, through the implementation of the IPPIS. presents the details of this assertion.

Curiously, the Chairman of the Nigeria Pension Reform

Task team, Ahaji Abdulrasheed Maina disclosed in February

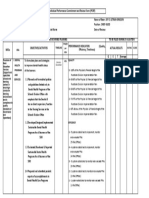

System Period Effect on Ghost Workers Effect on payroll Source

Name

IPPIS 2010 43, 000 ghost workers removed 12 billion was saved. It reduced Gabriel (2011)

government monthly payroll by

N2.2 billion

2013 46,821 ghost workers in 215 Leyira& Temple

Ministries, Departments and Agencies (2018)

2014 The number of ghost workers removed Bola &Kauther

rose to 60,000 (2016)

2016 N185billion saved since inception Adekunle (2016)

Table 1: Effect On Ghost Workers

Source: Researcher’s construct 2022

From the table 1 above, IPPIS as outlined by Gabriel have been removed and N185 billion was saved by the

(2011) saved N12 billion in the first phase alone as a result government since its inception. Despite the success story of

of eliminating payroll fraud. Also, it reduced the IPPIS, Bola (2016), reported that a civil servant was

government monthly payroll by N2.2 billion. From this, it is detected to be collecting 20 salaries from different places.

evident that when there is a reduction in fraud, there will be This, according to Bola et al was detected courtesy of the

a corresponding reduction in the amount budgeted for application of Bank Verification Number (BVN) along with

payment in salaries. Moreover, IPPIS led to the removal of IPPIS in certain MDAs where IPPIS was introduced.

forty-three thousand (43,000) ghost workers from various

MDAs at an annual cost of over N12 billion (Kadiri, 2018). The above shows that if BVN was not introduced, the

However, it was not clear how long the ghost workers had particular civil servant may not have been detected despite

been on the payroll and who had been collecting salaries and the existence of IPPIS. Notwithstanding the shortcomings

fringe benefits on behalf of the ghost workers. noticed in Nigeria and other countries cited above, the

policy has proven its usefulness in exposing and deterring

Also, Okafor (2012), asserted that seventeen thousand certain financial crimes committed in the Public Service,

(17,000) fraudulent workers were eliminated from the which can ardently be reported to have contributed to

Power Holding Company of Nigeria (PHCN) payroll alone. reducing corruption in Nigeria and in other countries where

Moreover, Bola &Kauther (2016) reported that as of 2014, the initiative is being implemented (Muranaet al, 2016).

the ghost names removed, had risen to sixty thousand (60,

000) while Adekunle (2016), revealed that towards the end

of 2016, over sixty-five thousand (65,000) ghost workers

IJISRT22OCT842 www.ijisrt.com 1648

Volume 7, Issue 10, October – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

F. FACTORS MILITATING AGAINST THE EFFECTIVE the factor as espoused by Wolfe and Hermanson(2004) are

IMPLEMENTATION OF IPPIS IN THE REDUCTION present in the public service fraud environment in Nigeria.

OF FRAUD IN NIGERIAN PUBLIC SERVICE For Example, the prior system of manual personnel and

It is pertinent to note that, to a great extent, IPPIS has its wage management system basically was an open invitation

enormous advantages and benefits, but however, is no doubt to commit fraud. Thus, the overworked manual system was

without its challenges. As noted by Mauldin & Ruchala, an opportunity. Capability to commit the fraud is provided

obvious challenges marred the effectiveness of IPPIS by insiders in positions of authority who see the extra

implementation till date. However, some of these challenges money to be made as an incentive while it is rationalized by

were either as a result of the nation under development in the difficult economic environment and other corruption

terms of technological infrastructure and expertise or simply going up higher up in the food chain of the government.

the unwillingness of the authority to fully carry out the

implementation. Some of the challenges enumerated by III. RESEARCH METHODOLOGY

Ibrahim et al (2017) and Mauldin & Ruchala (2016) are:

The descriptive survey design was employed in the

The noncompliance of all MDA’s to join the system.

study. The data for this study were gathered through primary

Incompetence on the part of the IPPIS staff, which reflects

and secondary sources. The primary data were derived from

in the computation of inaccurate data by officers when

the questionnaire administered to the 223 employees of the

filling IPPIS forms.

Federal Ministry of Finance, Budget and National Planning

IPPIS cumbersomeness in getting errors committed on the Abuja of which their responses were elicited in line with the

system corrected. subject matter of the research study. While the secondary

Workers waiting endlessly for errors made on their data were sourced from textbooks, newspaper, magazines

accounts to be corrected. and seminar papers, journals and other unpublished papers.

Difficulty in getting information from the IPPIS office as

whatever one gets is almost final. Sometimes there are A. Data Analysis and Discussion

human errors which could lead to omission in salary The raw scores gathered from the responses of our

payments. respondents were assembled, tallied and their frequency and

Also, because IPPIS is a garbage in garbage out system, percentage worked out. These frequencies and percentages

public servants who make errors in their data input are were used to present the research questions that guided the

sure to get errors on their records and subsequently get study. The research questions were presented in likert scale

affected. form. The three hypotheses postulated for the study were

Lack of sufficient skills transfer to government personnel tested using Chi-Square(x2) at significant level of 0.05.

which prolong consultants stay on the project.

Poor state of supporting infrastructure such as low internet B. TEST OF HYPOTHESIS.

penetration, technological barrier etc. The responses in selected questions of the questions of

Problem associated with transfer of pay point due to the the questionnaire were used in testing of the hypothesis. The

posting of employees from IPPIS MDA to non-IPPIS criteria for decision are: Accept H1: if the calculated value

MDA. of the chi square is less than the critical value. Reject H0: If

Resistance from stake holders which have prolonged the calculated value of chi square is greater than the critical

implementation, etc. value.

G. THEORETICAL SYNTHESIS Hypothesis One

Fraud diamond theory as proposed by Wolfe and Hi: The implementation of Integrated Personnel and Payroll

Hermanson(2004) was adopted for the study. They posit that Information System has to a great extent eliminated payroll

fraud is occurs due to four factors. These are the: fraud in the Federal Ministry of Finance, Abuja

Incentive/Pressure, Opportunity, capability and Degree of Freedom

Rationalization. According to Wolfe and Hermanson (2004), df = (r-1) x (c-1)

most frauds would not occur without the right person with Where R=5, c=4

the right ability to carry out the fraud. Furthermore, the right df = (5-1) (4-1)

person will have to observe and take advantage of an = 4 x 3 = 12

“Opportunity to commit the fraud considering that and df = 12

incentive and rationalization can draw the person toward it.

But the person must have the capability to recognize the If 0.05 level of significance at 12 degree of freedom,

open doorway as an opportunity and to take advantage of it the critical value X2 otherwise called chi-square tabulated

by walking through, not just once, but time and time again. (X2 tab) is given as = 21.026

A closer study of the fraud syndrome indicates that most of

IJISRT22OCT842 www.ijisrt.com 1649

Volume 7, Issue 10, October – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Cell location Fo Fe fo-fe ∑(fo-fe)2 ∑(fo-fe)2

Fe

R1C1 50 41.6 8.4 70.56 1.70

R1C2 50 41.6 8.4 70.56 1.70

R1C3 10 8.3 1.7 2.89 0.35

R1C4 10 8.3 1.7 2.89 0.35

R2C1 57 47.5 9.5 90.25 1.9

R2C2 38 31.7 6.3 39.69 1.25

R2C3 3 2.5 0.5 0.25 0.1

R2C4 22 18.3 3.7 13.69 0.75

R3C1 27 22.5 4.5 20.25 0.9

R3C2 30 25 5 25 1

R3C3 33 27.5 5.5 30.25 1.1

R3C4 30 25 5 25 1

R4C1 100 83.3 16.7 278.9 3.35

R4C2 10 8.3 1.7 2.89 0.35

R4C3 5 4.7 0.3 0.09 0.01

R4C4 5 4.7 0.3 0.09 0.01

R5C1 45 37.5 7.5 56.25 1.5

R5C2 33 27.5 5.5 30.25 1.1

R5C3 15 12.5 2.5 6.25 0.5

R5C4 27 22.5 4.5 20.25 0.9

TOTAL 600 19.82

Table 2: CALCULATED CHI-SQUARE TABLE

Calculated value = 19.82

Critical Value = 21.026

Decision:- Result. Comparing the calculated value of 19.82 Degree of Freedom

against the critical value of 21.026 at ( 0.05 level of df = (r-1) x (c-1)

significance at 18 degree of freedom ) the null hypothesis Where R=7, c=4

was rejected. Thus the alternate hypothesis was accepted df = (7-1) (4-1)

which states that the implementation of Integrated Personnel = 6 x 3 = 18

and Payroll Information System has significantly eliminated df = 18

payroll fraud in the Federal Ministry of Finance, Abuja.

If 0.05 level of significance at 18 degree of freedom,

Hypotheses 2: the critical value X2 otherwise called chi-square tabulated

(X2 tab) is given as = 28.71

Hi: The Integrated Personnel and Payroll Information

System have enhanced the accurate payment of salaries and

remittance of payroll deductions of employees of the

Federal Ministry of Finance, Abuja to third parties.

Ho: The Integrated Personnel and Payroll Information

System have not enhanced the accurate payment of salaries

and remittance of payroll deductions of employees of the

Federal Ministry of Finance, Abuja to third parties.

IJISRT22OCT842 www.ijisrt.com 1650

Volume 7, Issue 10, October – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Cell location Fo Fe fo-fe ∑(fo-fe)2 ∑(fo-fe)2

Fe

R1C1 43 35.8 7.2 51.84 1.45

R1C2 37 30.8 6.2 38.44 1.25

R1C3 23 19.2 3.8 14.44 0.75

R1C4 17 14.7 2.3 5.29 0.36

R2C1 55 45.8 9.2 84.64 1.85

R2C2 40 33.3 6.7 44.89 1.35

R2C3 20 16.7 3.3 10.89 0.65

R2C4 5 4.2 0.8 0.64 0.15

R3C1 70 58.3 11.7 136.89 2.35

R3C2 40 33.3 6.7 44.89 1.35

R3C3 5 4.2 0.8 0.64 0.15

R3C4 5 4.2 0.8 0.64 0.15

R4C1 39 32.5 6.5 42.25 1.3

R4C2 37 30.8 6.2 38.44 1.25

R4C3 23 19.2 3.8 14.44 0.75

R4C4 21 17.5 3.5 12.25 0.7

R5C1 40 33.3 6.7 44.89 1.35

R5C2 50 41.7 8.3 68.89 1.65

R5C3 20 16.7 3.3 10.89 0.65

R5C4 10 8.3 1.7 2.89 0.35

R6C1 35 29.2 5.8 33.64 1.15

R6C2 47 39.2 7.8 60.84 1.55

R6C3 25 20.8 4.2 17.64 0.85

R6C4 13 10.8 2.2 4.84 0.45

R7C1 38 31.7 6.3 39.69 1.25

R7C2 46 38.3 7.7 59.29 1.55

R7C3 22 18.3 3.7 13.69 0.75

R7C4 14 11.7 2.3 5.29 0.45

TOTAL 840 27.81

Table 3: CALCULATED CHI-SQUARE TABLE

Calculated value = 27.81

Critical Value = 28.87

Decision. Comparing the calculated value of 27.81 against Ho: Integrated personnel and payroll information system

the critical value of 28.87 at ( 0.05 level of significance at has not enhance the management of Federal staff records

18 degree of freedom ) the null hypothesis was rejected.

Therefore, the alternate hypothesis accepted which states Degree of Freedom

that the Integrated Personnel and Payroll Information df = (r-1) x (c-1)

System have enhanced the accurate payment of salaries and Where R=5, c=4

remittance of payroll deductions of employees of the df = (5-1) (4-1)

Federal Ministry of Finance, Abuja to third parties; = 4 x 3 = 12

df = 12

Hypotheses 3

If 0.05 level of significance at 12 degree of freedom,

Hi: Integrated personnel and payroll information system has the critical value X2 otherwise called chi-square tabulated

significantly enhanced the management of Federal staff (X2 tab) is given as = 21.026

records

IJISRT22OCT842 www.ijisrt.com 1651

Volume 7, Issue 10, October – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Cell location Fo Fe fo-fe ∑(fo-fe)2 ∑(fo-fe)2

Fe

R1C1 43 35.8 7.2 51.84 1.45

R1C2 37 30.8 6.2 38.44 1.25

R1C3 23 19.2 3.8 14.44 0.75

R1C4 17 14.7 2.3 5.29 0.36

R2C1 55 45.8 9.2 84.64 1.85

R2C2 40 33.3 6.7 44.89 1.35

R2C3 20 16.7 3.3 10.89 0.65

R2C4 5 4.2 0.8 0.64 0.15

R3C1 70 58.3 11.7 136.89 2.35

R3C2 40 33.3 6.7 44.89 1.35

R3C3 5 4.2 0.8 0.64 0.15

R3C4 5 4.2 0.8 0.64 0.15

R4C1 100 83.3 16.7 278.9 3.35

R4C2 10 8.3 1.7 2.89 0.35

R4C3 5 4.7 0.3 0.09 0.01

R4C4 5 4.7 0.3 0.09 0.01

R5C1 57 47.5 9.5 90.25 1.9

R5C2 50 41.7 8.3 68.89 1.7

R5C3 10 8.3 1.7 2.89 0.35

R5C4 3 2.5 0.5 0.25 0.1

TOTAL 600 19.82

Table 4: CALCULATED CHI-SQUARE TABLE

Calculated value = 20.05

Critical Value = 21.026

Decision: Comparing the calculated value of 20.05 against The third finding revealed that integrated personnel

the critical value of 21.026 at ( 0.05 level of significance at and payroll information system have significantly enhanced

18 degree of freedom ) the null hypothesis was rejected. the management of Federal staff records in the ministry of

Therefore, the alternate hypothesis is accepted which states finance, Budget and National planning Abuja.

that Integrated personnel and payroll information system has

significantly enhanced the management of Federal staff V. CONCLUSION AND POLICY RECOMMENDATION

records.

Based on the aforementioned findings, the paper found

IV. DISCUSSION OF FINDINGS empirical evidence to conclude that the implementation of

IPPIS has to a great extent reduced payroll fraud in the

Our first finding revealed that the implementation of Federal Ministry of Finance, Abuja and enhanced

IPPIS has to a large extent reduced payroll fraud in the Transparency in Payroll administration in the Nigerian Civil

Federal Ministry of Finance, Budget and National Planning Service. The use of ICT in governance is generally seen as a

Abuja; the implementation of IPPIS in the Federal Ministry necessary tool to ensure

of Finance, Abuja led to the uncover of most of the payroll transparency in the process, accountability for activities and

fraud using biometric data capture machine; IPPIS replaced a faster means of the decision-making process. Government

the ineffective manual and file-based personnel system by all of the world have accepted electronic governance as a

the Federal Ministry of Finance, Abuja operated which new way of leadership, restructuring the administrative

promotes fraud in the Ministry; IPPIS usage in the Federal process,

Ministry of Finance, Abuja reduced fraudulent financial improving internal efficiency, reducing cost and a new way

practices in the Ministry; and that the massive financial of delivering information and service.This paper further

losses occasioned by payroll fraud are gradually being recommends that Government should continue to ensure

discovered and eliminated by reason of the introduction of strict implementation of the Integrated personnel and payroll

IPPIS in the Federal Ministry of Finance, Abuja information system program in order to completely

eliminate payroll fraud in not just the Federal Ministry of

The second finding discovered that IPPIS have Finance, Abuja but in all the MDAs; ensure strict

enhanced the accurate payment of salaries and remittance of compliance with laid down rules and regulations governing

payroll deductions of employees of the Ministry to third the operation of IPPIS as well as compliance with the

parties; IPPIS enhanced the accurate payment of salaries and provisions of Financial Regulations and the Civil Service

remittance of payroll deductions of employees of the Rule, so as to continuously detect and block any loophole

Ministry to third parties; IPPIS is effective in detecting and that will give room to fraud; and the government should

deterring financial fraud linking payment of salaries and ensure that all the MDAs , state and even Local Government

remittance

IJISRT22OCT842 www.ijisrt.com 1652

Volume 7, Issue 10, October – 2022 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

staff enroll in IPPIS to help further reduce the Government [12.] IPPIS. About Integrated Payroll and Personnel

Overheads. Information System (IPPIS). 2018; Retrieved on

29/04/18 from https://www.ippis.gov.ng/what-is3

REFERENCES [13.] King D. K. (2016).Multiple Jeopardy, Multiple

Consciousnesses: The Context Of A Black Feminist

[1.] AbdulsalamNasiru, Kaoje, Kabir, Nabila, Sani, Idris, Ideology in Race, Gender and Class. Dec 5 (pp. 36-

Jafaru Abdu, Gambarawa, and Lawal Ibrahim 57). Routledge.

Ubandawaki. (2020). Integrated Personnel and [14.] Kinyeki, C. (2015). Adoption and Implementation of

Payroll Information System (IPPIS) and the Integrated Personnel and Payroll Database in

Transparency in Government Payroll Administration Kenya Government Ministries. Masters Dissertation.

in Nigerian Civil Service: A Unique Approach. Asian University of Nairobi, Kenya.

Journal of Economics, Business and Accounting [15.] Larson A. (2016). Fraud, Silent Fraud, and Innocent

19(3): 1-8, 2020; Article no.AJEBA.61704 ISSN: Misrepresentation. Expert Law. Retrieved 29th May

2456-639X. 2018.

[2.] Adongoi T, Victor EA. (2018). Corruption in the civil [16.] Lekubu BK (2013).Issues of Corruption in South

service: A study of payroll fraud in selected Africa’s Municipalities. InConference Proceedings

ministries, departments and agencies (MDAs) in published by the South African Association of Public

Bayelsa State, Nigeria. Research on Humanities and Administration and Management (SAAPAM). Aug

Social Sciences. Vol. 6, No. 3, 53-63. 15. Department of Public Administration &

[3.] Agbatogun T. O. (2019). Financial Accountability, Management, Tshwane University of Technology.

Transparency and Management. [17.] Mauldin EG, Ruchala LV. Towards a Metatheory of

[4.] Chima Paul, and FolorunshoOluwaseun Grace. Accounting. International Journal of Intellectual

(2020). Electronic governance and corruption in Discourse (IJID) ISSN: 2636-4832 Volume 3, Issue 1

Nigeria: Combing insights from Integrated Payroll [18.] Micah LC, Moses T. (2018). IPPIS and the Ghost

and Personnel Information System (IPPIS) workers’ syndrome in Nigeria’s public sector.

Implementation. International Journal of Intellectual Scholars Journal of Economics, Business and

Discourse (IJID) ISSN: 2636-4832 Volume 3, Issue Management.5(8): 773-778. 12.

1. [19.] Murana AO, Olayinka SM, Omotayo I. B. (2016).

[5.] Enakirerhi LI and Temile SO. (2017). IPPIS in The Impacts of the Nigerian Public Sector. The

Nigeria: Challenges, Benefits and Prospects, American Political Science Review 80(1), 107-119

International Journal of Social Science and [20.] Nwaodu, N, Adam, D &Okereke, O. (2014). A

Economic Research. 02(05), Pp 3490 Review of Anti-Corruption Wars in Nigeria. Africa’s

[6.] Garbade K.D, John C.P, Paul J.S.(2004).Recent Public Service Delivery & Performance Review

Innovations in Treasury 2(3).153-174 available@https://apsdpr.org/index.p

Cash.Available:https://www.accountingcoach.co hp/apsdpr/article/view Nyerere, J (1999).

m/blog/what-is-payroll-accounting on October. [21.] Osisioma B.C, Akembor C. &Okaro (2016). Effect of

[7.] Haruna I, Joseph A, Samson A.J. (2015). Integrated Integrated Personnel and Payroll Information System

Personnel Payroll and Information System (IPPIS): (IPPIS) on Federal Government Recurrent

Panacea for Ghost Workers Syndrome in Nigerian Expenditure in Nigeria. Awka:SCOA HERITAGE

Public Service. International Journal of Public NIG. LTD

Administration and Management Research [22.] Smith, D. J. (2007). A Culture of Corruption:

(IJPAMR).2(5):55-64. Everyday Deception and Popular Discontent in

[8.] Ibanichuka EAL, Sawyer M. E. (2019). Integrated Nigeria. Princeton, New Jersey: Princeton University

payroll system and government recurrent expenditure Press.

in Nigeria. International Journal of Advanced [23.] Uzochukwu M. (2018). Corruption in Nigeria:

Academic Research, Economic Evaluation. ;5(4):16- Review, Causes, Effects and Solutions.

37. availablehttps://soapboxie.com/worl d-

[9.] Ibrahim A, Amina A, Yaaba BN. (2017). Treasury politics/Corruption-in-Nigeria

Single Account Implementation in Nigeria Advances [24.] Accounting and Taxation Review.3(1):104-117

in Management. A publication of the Department of [25.] Wolfe D.T. and Hermanson D.R. (2004). The Fraud

Business Administration; University of Ilorin Diamond: Considering the Four Elements of

Nigeria.16(17):35-56. Fraud.The Certified Public Accountants (CPA)

[10.] Iyanda D.O (2012). Corruption: Definitions, Theories Journal. 16(17):Pp 3490.

And Concepts. Arabian Journal of Business and

Management Review, 2(4), 37-45.

[11.] Izedonmi F, Ibadin P.O. (2012). Forensic accounting

and financial crimes: adopting the inference,

relevance and logic solution approach. African

Research Review. 6(4):125-39.

IJISRT22OCT842 www.ijisrt.com 1653

You might also like

- AO 0037-LHS Maturity LevelsDocument10 pagesAO 0037-LHS Maturity LevelsJustine Grace TolentinoNo ratings yet

- Sustainable Development Plan of The PhilippinesDocument3 pagesSustainable Development Plan of The PhilippinesZanter GuevarraNo ratings yet

- Recent Philippine Budget Reforms: Separating The Chaff From The Grain, The Whimsical From The RealDocument24 pagesRecent Philippine Budget Reforms: Separating The Chaff From The Grain, The Whimsical From The RealJez JanNo ratings yet

- The Implementation of Inclusive Education in Madrasah: An Exploratory Study of Teacher and Parents PerceptionDocument10 pagesThe Implementation of Inclusive Education in Madrasah: An Exploratory Study of Teacher and Parents PerceptionagunkNo ratings yet

- The Effectiveness of Free Anti-Rabies Program To Convince Patient To Adhere On VaccinationDocument9 pagesThe Effectiveness of Free Anti-Rabies Program To Convince Patient To Adhere On VaccinationDhel CahiligNo ratings yet

- Institutional Profile of 2013 - National Dengue Control UnitDocument26 pagesInstitutional Profile of 2013 - National Dengue Control UnitNational Dengue Control Unit,Sri LankaNo ratings yet

- Ao2017 0012Document49 pagesAo2017 0012disasternursinNo ratings yet

- Ao2019 0060Document19 pagesAo2019 0060Charlemagne Sabio GalamgamNo ratings yet

- Fhsis CHNDocument35 pagesFhsis CHNJocyl Faith SumagaysayNo ratings yet

- Presentation On The PIP Updating Guidelines PDFDocument48 pagesPresentation On The PIP Updating Guidelines PDFNiel Edar Balleza100% (1)

- Iloilo City Regulation Ordinance 2015-029Document4 pagesIloilo City Regulation Ordinance 2015-029Iloilo City Council100% (1)

- Ao2021-0007 LDMGMTDocument22 pagesAo2021-0007 LDMGMTAllen Chester100% (1)

- Strategy 202207 MarketingDocument52 pagesStrategy 202207 Marketingritik patelNo ratings yet

- Mindanao State University School of Graduate StudiesDocument4 pagesMindanao State University School of Graduate StudiesJan-e JGNo ratings yet

- 2021 Budget BrieferDocument24 pages2021 Budget Brieferyg loveNo ratings yet

- HEAPS OrientationDocument14 pagesHEAPS OrientationJojie HugoNo ratings yet

- Andrew James BernidoDocument3 pagesAndrew James BernidoAndrew James BernidoNo ratings yet

- Bicol University: Government-Owned and Controlled CorporationDocument4 pagesBicol University: Government-Owned and Controlled CorporationAra LimNo ratings yet

- SWOT Analysis 2016Document6 pagesSWOT Analysis 2016Jester Ambojnon TuklingNo ratings yet

- Final MTP RabiesDocument123 pagesFinal MTP RabiesMarietta Fragata RamiterreNo ratings yet

- Cycle 53 Call For Proposals FinalDocument5 pagesCycle 53 Call For Proposals Finaljo202williamsNo ratings yet

- DOH 2018 Annual Report - Full ReportDocument44 pagesDOH 2018 Annual Report - Full Reportregie cuaresma100% (1)

- Government Budgeting PrinciplesDocument10 pagesGovernment Budgeting PrinciplesDenika ToledoNo ratings yet

- National Development Planning Process: PNP Strategic Initiatives Workshop Zoom Conference, 25 May 2022Document49 pagesNational Development Planning Process: PNP Strategic Initiatives Workshop Zoom Conference, 25 May 2022BonoNo ratings yet

- Ao 2022 OmnibusDocument13 pagesAo 2022 OmnibusZandra Lyn AlundayNo ratings yet

- Module 2 - Essentials of Ethics and Public IntegrityDocument43 pagesModule 2 - Essentials of Ethics and Public Integrityricardo viganNo ratings yet

- Republic Act No 10354Document16 pagesRepublic Act No 10354Ellen Glae DaquipilNo ratings yet

- New - Budgeting in The National Government SC PresentationDocument75 pagesNew - Budgeting in The National Government SC PresentationBeatrice ErilloNo ratings yet

- Ordinance No: Ordinance A Trust The Proceeds Philhealth Covid 19 Community Isolation Benefit Isolation UnitsDocument5 pagesOrdinance No: Ordinance A Trust The Proceeds Philhealth Covid 19 Community Isolation Benefit Isolation UnitsJohn Philip TiongcoNo ratings yet

- MPA ReportDocument4 pagesMPA ReportAngelica MercadoNo ratings yet

- Effect of Information and Communication Technology On Organizational Performance in NigeriaDocument7 pagesEffect of Information and Communication Technology On Organizational Performance in NigeriaEditor IJTSRDNo ratings yet

- Challenges and Strategies of Rural Electrification Program For Electric Cooperatives in Central Luzon, PhilippinesDocument9 pagesChallenges and Strategies of Rural Electrification Program For Electric Cooperatives in Central Luzon, PhilippinesIOER International Multidisciplinary Research Journal ( IIMRJ)No ratings yet

- 2020 Eo 0031 Creation of Municipal Rabies Prevention and Control CommitteeDocument1 page2020 Eo 0031 Creation of Municipal Rabies Prevention and Control Committeemaryson primoNo ratings yet

- FAQs - Local Health Systems Management ToolsDocument2 pagesFAQs - Local Health Systems Management ToolsPhilippe Ceasar C. BascoNo ratings yet

- QAT For BDRRM Plan and Committee - English - 0Document20 pagesQAT For BDRRM Plan and Committee - English - 0Dona JojuicoNo ratings yet

- Pretest:: Bit - ly/DO49 - PretestDocument175 pagesPretest:: Bit - ly/DO49 - PretestTherese Angelie CamacheNo ratings yet

- Sodexo Case Study: SumTotal Serves Up Complete Talent Management and Succession Planning For SodexoDocument2 pagesSodexo Case Study: SumTotal Serves Up Complete Talent Management and Succession Planning For SodexoSumTotal Talent ManagementNo ratings yet

- 2019 AFP FOI ReportDocument29 pages2019 AFP FOI ReportDark Hudas100% (1)

- The Philippine Presidents: Arroyo, Aquino and DuterteDocument18 pagesThe Philippine Presidents: Arroyo, Aquino and DuterteIvy Vianca YoloresNo ratings yet

- Guideline On Provisional Certifiaction As Primary Care Provider For FCM ResidentsDocument2 pagesGuideline On Provisional Certifiaction As Primary Care Provider For FCM ResidentsJames Lagamayo JavierNo ratings yet

- Topics On Public FiscalDocument2 pagesTopics On Public Fiscalcarla guban-oñes100% (1)

- ICS LectureDocument21 pagesICS LectureLavin T. MalabuyocNo ratings yet

- Health-Care Waste ManagementDocument7 pagesHealth-Care Waste Managementscience worldNo ratings yet

- Ian Roxborough - Theories of Underdevelopment (1981)Document182 pagesIan Roxborough - Theories of Underdevelopment (1981)Barna BoseNo ratings yet

- CSO AccreditationDocument5 pagesCSO AccreditationSouth SepakaNo ratings yet

- Doh Mtra PDFDocument8 pagesDoh Mtra PDFElaine DabuNo ratings yet

- IPCRF 1 NewDocument1 pageIPCRF 1 NewMARY JERICA OCUPENo ratings yet

- Monthly Reporting Matrix For EO12 and AO 2017-0005 FinalDocument36 pagesMonthly Reporting Matrix For EO12 and AO 2017-0005 FinalAt Day's Ward100% (1)

- 2023 Peoples Proposed Budget PDFDocument59 pages2023 Peoples Proposed Budget PDFᜃᜒᜈ᜔ᜎᜒ ᜇᜒᜋᜈ᜔ᜇᜒᜋᜈ᜔No ratings yet

- DOH AO No - 2020 0022Document17 pagesDOH AO No - 2020 0022MariaChristinaVaronaTemplanzaNo ratings yet

- NTPC Policy CSR Sustainability PDFDocument11 pagesNTPC Policy CSR Sustainability PDFutkarshNo ratings yet

- Activity ProposalDocument3 pagesActivity ProposalMash JumahariNo ratings yet

- Valenzuela AOP 2022 Enhanced Form 1Document6 pagesValenzuela AOP 2022 Enhanced Form 1John Philip TiongcoNo ratings yet

- Annex B.2 and B.3 LIPH 2023-2025 Forms 19oct2021Document3 pagesAnnex B.2 and B.3 LIPH 2023-2025 Forms 19oct2021MishelleBainoLadaoNo ratings yet

- Airbnb in India Comparison With Hotels, and Factors Affecting Purchase IntentionsDocument13 pagesAirbnb in India Comparison With Hotels, and Factors Affecting Purchase Intentionsfadli adninNo ratings yet

- Balian Community College School of Midwifery Balian Pangil, LagunaDocument54 pagesBalian Community College School of Midwifery Balian Pangil, LagunaThriska Ravven ResurreccionNo ratings yet

- An Overview: Chona G. Dazon, BSN, RNDocument35 pagesAn Overview: Chona G. Dazon, BSN, RNrlinaoNo ratings yet

- CSR PracticeDocument13 pagesCSR PracticeSadia AkterNo ratings yet

- African Union & The Developmental TransformationDocument20 pagesAfrican Union & The Developmental TransformationThomas Crook100% (1)

- Integrated Personnel and Payroll Information System (IPPIS) and Transparency in Government Payroll Administration in Nigerian Civil Service-A Unique ApproachDocument8 pagesIntegrated Personnel and Payroll Information System (IPPIS) and Transparency in Government Payroll Administration in Nigerian Civil Service-A Unique ApproachSani IdrisNo ratings yet

- Visitor Perception Related to the Quality of Service in Todo Tourism VillageDocument10 pagesVisitor Perception Related to the Quality of Service in Todo Tourism VillageInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Quizlet's Usefulness for Vocabulary Learning: Perceptions of High-Level and Low-Level Chinese College EFL LearnersDocument5 pagesQuizlet's Usefulness for Vocabulary Learning: Perceptions of High-Level and Low-Level Chinese College EFL LearnersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Enhancing Estimating the Charge Level in Electric Vehicles: Leveraging Force Fluctuation and Regenerative Braking DataDocument6 pagesEnhancing Estimating the Charge Level in Electric Vehicles: Leveraging Force Fluctuation and Regenerative Braking DataInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Health Care - An Android Application Implementation and Analyzing user Experience Using PythonDocument7 pagesHealth Care - An Android Application Implementation and Analyzing user Experience Using PythonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Gravity Investigations Applied to the Geological Framework Study of the Mambasa Territory in Democratic Republic of CongoDocument9 pagesGravity Investigations Applied to the Geological Framework Study of the Mambasa Territory in Democratic Republic of CongoInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A New Model of Rating to Evaluate Start-ups in Emerging Indian MarketDocument7 pagesA New Model of Rating to Evaluate Start-ups in Emerging Indian MarketInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Intrusion Detection System with Ensemble Machine Learning Approaches using VotingClassifierDocument4 pagesIntrusion Detection System with Ensemble Machine Learning Approaches using VotingClassifierInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Proof of Concept Using BLE to Optimize Patients Turnaround Time (PTAT) in Health CareDocument14 pagesA Proof of Concept Using BLE to Optimize Patients Turnaround Time (PTAT) in Health CareInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Developing Digital Fluency in Early Education: Narratives of Elementary School TeachersDocument11 pagesDeveloping Digital Fluency in Early Education: Narratives of Elementary School TeachersInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Optimizing Bio-Implant Materials for Femur Bone Replacement:A Multi-Criteria Analysis and Finite Element StudyDocument5 pagesOptimizing Bio-Implant Materials for Femur Bone Replacement:A Multi-Criteria Analysis and Finite Element StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design and Implementation of Software-Defined ReceiverDocument8 pagesDesign and Implementation of Software-Defined ReceiverInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Naturopathic Approaches to Relieving Constipation: Effective Natural Treatments and TherapiesDocument10 pagesNaturopathic Approaches to Relieving Constipation: Effective Natural Treatments and TherapiesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Crop Monitoring System with Water Moisture Levels Using ControllerDocument8 pagesCrop Monitoring System with Water Moisture Levels Using ControllerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Oral Anti-Diabetic Semaglutide: A GLP-1 RA PeptideDocument11 pagesOral Anti-Diabetic Semaglutide: A GLP-1 RA PeptideInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Year Wise Analysis and Prediction of Gold RatesDocument8 pagesYear Wise Analysis and Prediction of Gold RatesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Government's Role in DMO-based Urban Tourism in Kayutangan area of Malang cityDocument8 pagesThe Government's Role in DMO-based Urban Tourism in Kayutangan area of Malang cityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Fahfi/Mochaina Illegal Gambling Activities and its Average Turnover within Limpopo ProvinceDocument8 pagesFahfi/Mochaina Illegal Gambling Activities and its Average Turnover within Limpopo ProvinceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis of the Quality of Community Satisfaction in Public Services in Tanjungpinang Class I State Detention HouseDocument13 pagesAnalysis of the Quality of Community Satisfaction in Public Services in Tanjungpinang Class I State Detention HouseInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Inclusive Leadership in the South African Police Service (SAPS)Document26 pagesInclusive Leadership in the South African Police Service (SAPS)International Journal of Innovative Science and Research TechnologyNo ratings yet

- A Study to Assess the Effectiveness of Bronchial Hygiene Therapy (BHT) on Clinical Parameters among Mechanically Ventilated Patients in Selected Hospitals at ErodeDocument7 pagesA Study to Assess the Effectiveness of Bronchial Hygiene Therapy (BHT) on Clinical Parameters among Mechanically Ventilated Patients in Selected Hospitals at ErodeInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Effects of Nanoplastics on Human Health: A Comprehensive StudyDocument7 pagesEffects of Nanoplastics on Human Health: A Comprehensive StudyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Zilebesiran: The First siRNA Drug Therapy for HypertensionDocument5 pagesZilebesiran: The First siRNA Drug Therapy for HypertensionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Analysis of the Effectiveness of Based Public Services Information and Communication Technology (ICT)Document10 pagesAnalysis of the Effectiveness of Based Public Services Information and Communication Technology (ICT)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Income Diversification of Rural Households in Bangladesh (2022-23)Document5 pagesIncome Diversification of Rural Households in Bangladesh (2022-23)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Effectiveness of Organizing Crossing Transport Services in the Maritime Area of Riau Islands ProvinceDocument10 pagesEffectiveness of Organizing Crossing Transport Services in the Maritime Area of Riau Islands ProvinceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design and Analysis of Various Formwork SystemsDocument6 pagesDesign and Analysis of Various Formwork SystemsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Environmental Sanitation – A Therapy for Healthy Living for Sustainable Development. A Case Study of Argungu Township Kebbi State, North Western NigeriaDocument15 pagesEnvironmental Sanitation – A Therapy for Healthy Living for Sustainable Development. A Case Study of Argungu Township Kebbi State, North Western NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Association Between Gender and Depression Among College StudentsDocument4 pagesAssociation Between Gender and Depression Among College StudentsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Reintegration of Dairy in Daily American Diets: A Biochemical and Nutritional PerspectiveDocument1 pageReintegration of Dairy in Daily American Diets: A Biochemical and Nutritional PerspectiveInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Appraisal of Nursing Care Received and it’s Satisfaction: A Case Study of Admitted Patients in Afe Babalola Multisystem Hospital, Ado Ekiti, Ekiti StateDocument12 pagesAppraisal of Nursing Care Received and it’s Satisfaction: A Case Study of Admitted Patients in Afe Babalola Multisystem Hospital, Ado Ekiti, Ekiti StateInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- E - Governance: Submission OnDocument26 pagesE - Governance: Submission OnDipeeka100% (4)

- SSB Advertisement 001.2015Document11 pagesSSB Advertisement 001.2015Chandrika DasNo ratings yet

- E-Nothi Write-UpDocument7 pagesE-Nothi Write-UpHossain FahadNo ratings yet

- Tamil Nadu E-District: Application Training ManualDocument24 pagesTamil Nadu E-District: Application Training ManualSivamani CNo ratings yet

- Introduction To E-CommerceDocument32 pagesIntroduction To E-CommerceV.F.MUHAMMED ISMAIL THOUHEEDNo ratings yet

- Chapter 3701Document40 pagesChapter 3701NAGENDRA ANUMULANo ratings yet

- Gs 123Document21 pagesGs 123Eman Arshad AliNo ratings yet

- MoU With OMCs Nov 2018Document3 pagesMoU With OMCs Nov 2018ranjan4me0% (1)

- Satisfaction Level of Salaried Taxpayers Towards E-Filing: Demographic PerspectiveDocument4 pagesSatisfaction Level of Salaried Taxpayers Towards E-Filing: Demographic PerspectiveSugandha GuptaNo ratings yet

- Basic Concept of E-Commerce: International Research Journal of Multidisciplinary StudiesDocument5 pagesBasic Concept of E-Commerce: International Research Journal of Multidisciplinary StudiesPhương LêNo ratings yet

- Module 5 & 6Document48 pagesModule 5 & 6JithuHashMi100% (1)

- Digital Ethiopia 2025 - A Strategy For Ethiopia Inclusive ProsperityDocument155 pagesDigital Ethiopia 2025 - A Strategy For Ethiopia Inclusive Prosperityace187No ratings yet

- National E - Gov PlanDocument17 pagesNational E - Gov PlanShivendu Shekhar SinghNo ratings yet

- The E-Governance (E-GOV) Information Management Models: Khalid A. FakeehDocument7 pagesThe E-Governance (E-GOV) Information Management Models: Khalid A. FakeehJitesh ChaharNo ratings yet

- Key Issues in Implementing E-Governance in Nepal: Ganesh Prasad AdhikariDocument3 pagesKey Issues in Implementing E-Governance in Nepal: Ganesh Prasad AdhikariRabindra AcharyaNo ratings yet

- NEPAL Tax Reform Strategic PlanDocument44 pagesNEPAL Tax Reform Strategic PlanPaxton Walung LamaNo ratings yet

- Mee SevaDocument43 pagesMee Sevasivaji ganesh NNo ratings yet

- ARTA Citizens Charter 2021 1st Edition PDFDocument258 pagesARTA Citizens Charter 2021 1st Edition PDFJimmy JoseNo ratings yet

- Unit 1-E-Governance PDFDocument10 pagesUnit 1-E-Governance PDFPuskar AdhikariNo ratings yet

- E-Governan: Submitted To: Ms. Harsimran Submitted By: (1611330) (1611333)Document13 pagesE-Governan: Submitted To: Ms. Harsimran Submitted By: (1611330) (1611333)HaRsimran MalhotraNo ratings yet

- Concepts and Forms of Accountability: Niaz Ahmed KhanDocument45 pagesConcepts and Forms of Accountability: Niaz Ahmed KhanJaniceNo ratings yet

- E Governance in IndiaDocument12 pagesE Governance in IndiaSiddharthJainNo ratings yet

- Gujarat - List of E-Governance InitiativesDocument21 pagesGujarat - List of E-Governance InitiativesDeepak Pareek100% (1)

- Punjab Industrial Policy 2022Document274 pagesPunjab Industrial Policy 2022Tarun JainNo ratings yet

- Informatics PracticesDocument54 pagesInformatics PracticesRaghav ChopraNo ratings yet

- E Commerce(s)Document20 pagesE Commerce(s)mohammedNo ratings yet

- Assignment On Citizens' CharterDocument17 pagesAssignment On Citizens' CharterRayonNo ratings yet

- Egov July 2010Document60 pagesEgov July 2010Shubhendu ParthNo ratings yet

- Parcel SP QRDocument8 pagesParcel SP QRGunina GNo ratings yet