Professional Documents

Culture Documents

02homework 1 Chap2 (Part 1) TF (E)

02homework 1 Chap2 (Part 1) TF (E)

Uploaded by

Nur Athirah0 ratings0% found this document useful (0 votes)

15 views3 pagesThe document provides information about financial statements and accounting concepts through a series of statements and questions. It defines key terms like balance sheets, income statements, current and fixed assets, current and long term liabilities, revenues, expenses, net income, and tax rates. It also includes numerical examples for AZRA Corp, R&R Corp, Siti O Corp, and Cristiano Ronaldinho Corp to calculate their income statements and net income for various years based on given sales, costs, expenses and tax rates.

Original Description:

Original Title

02Homework 1 chap2 (part 1)TF (E)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides information about financial statements and accounting concepts through a series of statements and questions. It defines key terms like balance sheets, income statements, current and fixed assets, current and long term liabilities, revenues, expenses, net income, and tax rates. It also includes numerical examples for AZRA Corp, R&R Corp, Siti O Corp, and Cristiano Ronaldinho Corp to calculate their income statements and net income for various years based on given sales, costs, expenses and tax rates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views3 pages02homework 1 Chap2 (Part 1) TF (E)

02homework 1 Chap2 (Part 1) TF (E)

Uploaded by

Nur AthirahThe document provides information about financial statements and accounting concepts through a series of statements and questions. It defines key terms like balance sheets, income statements, current and fixed assets, current and long term liabilities, revenues, expenses, net income, and tax rates. It also includes numerical examples for AZRA Corp, R&R Corp, Siti O Corp, and Cristiano Ronaldinho Corp to calculate their income statements and net income for various years based on given sales, costs, expenses and tax rates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

Study Questions 2A (Part 1)

1. Financial statements provide useful information about a company’s financial position on

financing and investing activities at a point in time and summarize operating activities for a period

of time ( )

2. Basically financial statement consist of Balance sheet and customer identification ( ).

3. The income statement answer the question ‘how profitable is your business’. ( )

4. A current asset has a life of less than 2 years ( )

5. Short term notes refer to the amount borrowed from a creditor that are due within 10 years ( )

6. Balance sheet is a financial statement showing a firm’s accounting value on a particular date.

7. The difference between the total value current assets and current liabilities is the long term

debt . ( )

8. Net working capital = Current Asset – Current Liabilities ( )

9. Liquidity refers to the speed and ease with which an asset can be converted to fixed assets

10. A highly liquid asset is therefore one that can be quickly sold without significant loss of value

11. Liquidity is valuable ( )

12. The more liquid a business is the less likely it is to experience financial distress. ( )

13. The use of debt in a firm’s capital structure is called a financial leverage ( )

14. The more debt a firm has, the less degree of financial leverage. ( )

15. Book value refer to the value of assets that are actually NOT worth. ( )

16. Income statement comprise of revenues less sales for the period ( )

17. Sales –expenses = Profit ( )

18. The income statement answer the main question “ How long you take your personal loan to

set your business’’ ( )

19. Cost of goods sold is the cost of producing or acquiring the goods or services to be sold ( )

20. The less current asset that a firm has relative to its current liabilities, the greater the firm’s

liquidity. ( )

21. Operating expenses refer to those expenses relate to marketing and distributing product &

services ( )

22. Operating income is also known as earnings before interest and taxes ( )

23. Interest expense refer to the interest paid on the firm’s outstanding debt ( )

24. Net income represent the amount of loss to a firm ( )

25. Short term note represent amounts borrowed from bank or other lending sources that are due

and payable within 12 months. ( )

26 Income statement provide a report of investments made and their cost for a specific period of

time . ( )

27. Income statement provide all firm’s assets and liabilities for a defined period of time ( )

28. Revenue minus cost of goods sold minus operating expenses equal to EBIT. ( )

29. Benchmarking is where the firm’s ratio values are compared to those of a key competitor or

group of competitors, primarily to identify areas for improvement. ( )

30. Cash, accruals, inventory and account receivables are examples of current assets ( )

Study Questions 2B (Part 1)

1. Preparing Financial statement

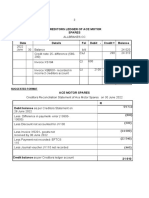

Base on the following information for AZRA corp. , you need to prepare an (a)income

statement for 2010 & 2011 and also balance sheet for 2010 and 2011. Use a 35% tax

rate throughout.

2010 2011

Sales RM4,300 RM4,500

Cost of good sold 2,000 2,500

Depreciation 700 900

Interest 100 190

Dividends 200 250

Current Assets 2,205 2,429

Net fixed assets 7,344 7,650

Current liabilities 1,003 1,255

Long term debt 3,106 2,085

2. During 2007, R&R Corp. had sales of RM900,000. Cost of goods sold, administrative

and selling expenses and depreciation expenses were RM620,000, RM120,000 and

RM30,000, respectively. In addition, the company had an interest expense of RM5,000

and tax rate of 35%.

a) What is R&R’s net income for 2007?

Study Questions 2C (Part 1)

1. During 2008, Siti O Corp. had sales of RM125,000. Cost of goods sold,RM75,000

administrative and selling expenses , RM33,500 and depreciation expenses were

RM4,500, In addition, the company had an interest expense of RM3,000 and tax rate of

50%. a) What is Siti O’s net income for 2008?

2.During 2008, Cristiano Ronaldinho corporation. had sales of RM160,000. Cost of

goods sold,RM96,000 administrative and selling expenses , RM37,000 and depreciation

expenses were RM10,000, In addition, the company had an interest expense of

RM6,100 and tax rate of 50%. a) What is Cristiano Ronaldinho’s net income for 2008?

You might also like

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Analysis of Investment Options Mba ProjectDocument59 pagesAnalysis of Investment Options Mba Projectbalki12383% (12)

- Attempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDocument23 pagesAttempt Any Four Case Study Case 1: Zip Zap Zoom Car CompanyDiabolic Colt100% (1)

- ASSIGNMENT in Financial Accounting For QS ProjectsDocument9 pagesASSIGNMENT in Financial Accounting For QS ProjectsFahmy KfNo ratings yet

- Hammersmith and Fulham in Sterling Interest Swap Loss of About 600 Million in 1988Document9 pagesHammersmith and Fulham in Sterling Interest Swap Loss of About 600 Million in 1988Noor Afzan AbdullahNo ratings yet

- Stein Stan - Secrets For Profiting in Bull and Bear MarketsDocument5 pagesStein Stan - Secrets For Profiting in Bull and Bear MarketsAnmol Bajaj100% (3)

- 2021 Exam Information & Learning Objective Statements: CMT Level IiDocument26 pages2021 Exam Information & Learning Objective Statements: CMT Level IiJamesMc1144No ratings yet

- Stock-Trak Project Final Preparation GuidlinesDocument1 pageStock-Trak Project Final Preparation GuidlinesKim Yoo SukNo ratings yet

- Chapter 6 Financial Statement Ratio AnalysisDocument9 pagesChapter 6 Financial Statement Ratio AnalysisHafeezNo ratings yet

- Wa0007.Document67 pagesWa0007.Natgrace AnsahbonNo ratings yet

- NMLS Accounting - Lecture 3 Revised September 25 2023Document9 pagesNMLS Accounting - Lecture 3 Revised September 25 2023tajhtechzNo ratings yet

- Chapter Two HandoutDocument24 pagesChapter Two HandoutNati AlexNo ratings yet

- AFA Tut11 Anaylsis & Interpretation of FSDocument9 pagesAFA Tut11 Anaylsis & Interpretation of FSJIA HUI LIMNo ratings yet

- Finance ManagementDocument18 pagesFinance Managementsainath mistry100% (1)

- Exercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotDocument15 pagesExercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotCherry Doong CuantiosoNo ratings yet

- Assignment 2 - FSADocument7 pagesAssignment 2 - FSAzazaNo ratings yet

- Contemporary Financial Management 10th Edition Moyer Solutions Manual 1Document15 pagesContemporary Financial Management 10th Edition Moyer Solutions Manual 1carlo100% (46)

- Analysis and Interpretation 2020Document58 pagesAnalysis and Interpretation 2020Vimbai NyakudangaNo ratings yet

- Ratio Analysis: Categories of RatiosDocument7 pagesRatio Analysis: Categories of RatiosAhmad vlogsNo ratings yet

- 01 s601 SFM - 2 PDFDocument4 pages01 s601 SFM - 2 PDFMuhammad Zahid FaridNo ratings yet

- Cashflowstatement 150402074118 Conversion Gate01Document30 pagesCashflowstatement 150402074118 Conversion Gate01vini2710No ratings yet

- F5 Bafs 1 AnsDocument6 pagesF5 Bafs 1 Ansouo So方No ratings yet

- FS and Ratios Addtl ExercisesDocument5 pagesFS and Ratios Addtl ExercisesRaniel PamatmatNo ratings yet

- FMA Assgnments - EX 2022Document12 pagesFMA Assgnments - EX 2022Natnael BelayNo ratings yet

- Financial Statements 2, ModuleDocument4 pagesFinancial Statements 2, ModuleSUHARTO USMANNo ratings yet

- R22 Financial Statement Analysis IFT NotesDocument15 pagesR22 Financial Statement Analysis IFT NotesIndustrial Trainig EAGNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (33)

- FIN101 Principles of FinanceDocument6 pagesFIN101 Principles of FinanceIshrat KhanNo ratings yet

- How To Prepare A Cash Flow StatementDocument8 pagesHow To Prepare A Cash Flow StatementSudhakar Chalamalla100% (1)

- FIN 254 - Ratio Analysis NotesDocument52 pagesFIN 254 - Ratio Analysis Notestarek khanNo ratings yet

- Financial Accounting Cat 1 JonathanDocument14 pagesFinancial Accounting Cat 1 JonathanjonathanNo ratings yet

- Chapter 5Document23 pagesChapter 52t65xn9qqzNo ratings yet

- Account 1srsDocument5 pagesAccount 1srsNayan KcNo ratings yet

- FINANCIAL ACCOUNTING & REPORTING - JA-23 - Suggested - AnswersDocument11 pagesFINANCIAL ACCOUNTING & REPORTING - JA-23 - Suggested - AnswerssummerfashionlimitedNo ratings yet

- Financial Statements: Prepared By: Muhammad AkhtarDocument11 pagesFinancial Statements: Prepared By: Muhammad AkhtarMuhammad akhtarNo ratings yet

- Bacc 237 Assignment Two (Multiple Choice)Document10 pagesBacc 237 Assignment Two (Multiple Choice)TarusengaNo ratings yet

- Individual/Group Assignments (Optional) Assignment 1Document3 pagesIndividual/Group Assignments (Optional) Assignment 1Robin GhotiaNo ratings yet

- Cash FlowsDocument15 pagesCash FlowsAkshat DwivediNo ratings yet

- Bangladesh Open University: BBA Program Semester: 192 (8 Level-AIS & Finance)Document11 pagesBangladesh Open University: BBA Program Semester: 192 (8 Level-AIS & Finance)monir mahmudNo ratings yet

- Evocative Projected FsDocument17 pagesEvocative Projected FsExequiel AmbasingNo ratings yet

- ACCOUNTING & FIN LST 113547Document12 pagesACCOUNTING & FIN LST 113547Joshua RisinamhodziNo ratings yet

- Lecture # 82Document2 pagesLecture # 82Umer AsifNo ratings yet

- MBAG-9 YR1 - ACCFI - 17 August 2021 - S1Document12 pagesMBAG-9 YR1 - ACCFI - 17 August 2021 - S1landu.connieNo ratings yet

- Accounting and Financial Management - Question PaperDocument11 pagesAccounting and Financial Management - Question PaperKim-Rushay WilliamsNo ratings yet

- Financial Plan: Maranatha University College: Entrepreneurship Remy Puoru LecturerDocument22 pagesFinancial Plan: Maranatha University College: Entrepreneurship Remy Puoru LecturerGodwin QuarcooNo ratings yet

- Finance 745Document5 pagesFinance 745Sara KarenNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial ManagementFahadNo ratings yet

- Assignment FinalDocument10 pagesAssignment FinalJamal AbbasNo ratings yet

- FM One - Ch2Document15 pagesFM One - Ch2Tsegay ArayaNo ratings yet

- Laporan Arus KasDocument20 pagesLaporan Arus KasSyuhadakAl-FasuruniNo ratings yet

- Cashflowstatement 150402074118 Conversion Gate01Document39 pagesCashflowstatement 150402074118 Conversion Gate01vini2710No ratings yet

- Financial Statements, Cash Flow, and TaxesDocument43 pagesFinancial Statements, Cash Flow, and TaxesshimulNo ratings yet

- Chapter IXDocument3 pagesChapter IXCleo IlaoNo ratings yet

- EIA1001 - Exercise 6 Topic CFDocument4 pagesEIA1001 - Exercise 6 Topic CFshaikhsafwan7788No ratings yet

- Project Work ICMATDocument31 pagesProject Work ICMATAvishi KushwahaNo ratings yet

- 71487bos57500 p8Document29 pages71487bos57500 p8OPULENCENo ratings yet

- 1 Financial Statements Exercises 2022Document9 pages1 Financial Statements Exercises 2022Alyssa TolcidasNo ratings yet

- Mba ZC415 Ec-3r First Sem 2022-2023Document4 pagesMba ZC415 Ec-3r First Sem 2022-2023Ravi KaviNo ratings yet

- FM in Construction 2Document23 pagesFM in Construction 2YosiNo ratings yet

- Financial Statements, Taxes and Cash Flow: Chapter TwoDocument21 pagesFinancial Statements, Taxes and Cash Flow: Chapter TwoKids SocietyNo ratings yet

- New Financial Management Chapter LastDocument18 pagesNew Financial Management Chapter LastbikilahussenNo ratings yet

- Chap 2Document10 pagesChap 2Houn Pisey100% (1)

- Chapter TwoDocument16 pagesChapter TwoHananNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Chp2 Soln Mar14Document7 pagesChp2 Soln Mar14Nur AthirahNo ratings yet

- SGDN1043 (A)Document2 pagesSGDN1043 (A)Nur AthirahNo ratings yet

- Chp2 SA AnsDocument4 pagesChp2 SA AnsNur AthirahNo ratings yet

- Practise Writing Test 2Document2 pagesPractise Writing Test 2Nur AthirahNo ratings yet

- Chp2 - Practice 2 - Ans-1Document5 pagesChp2 - Practice 2 - Ans-1Nur AthirahNo ratings yet

- Chapter 1 (Mapping)Document1 pageChapter 1 (Mapping)Nur AthirahNo ratings yet

- Alfalah RatioDocument7 pagesAlfalah RatioNur AthirahNo ratings yet

- A212 Reading Test PracticeDocument9 pagesA212 Reading Test PracticeNur AthirahNo ratings yet

- 01IMG - aLFALAH (Part Ratio)Document10 pages01IMG - aLFALAH (Part Ratio)Nur AthirahNo ratings yet

- 2 - Personal Statement GuideDocument20 pages2 - Personal Statement GuideNur AthirahNo ratings yet

- 04ratio Question (Homework 3)Document7 pages04ratio Question (Homework 3)Nur AthirahNo ratings yet

- 05answer All Ratio (Latest)Document8 pages05answer All Ratio (Latest)Nur AthirahNo ratings yet

- 02 Study Questions 2A (Ratio)Document2 pages02 Study Questions 2A (Ratio)Nur AthirahNo ratings yet

- Swing Trading Simplified - Larry D SpearsDocument115 pagesSwing Trading Simplified - Larry D SpearsPedja100% (2)

- A231 - MC 3 PPE-StudentsDocument4 pagesA231 - MC 3 PPE-StudentsHafiza ZahidNo ratings yet

- CF Report Fall 2018Document24 pagesCF Report Fall 2018Tamal GhoshNo ratings yet

- Alagappa University Sem II SyllabusDocument5 pagesAlagappa University Sem II SyllabusSe SathyaNo ratings yet

- A Building That Was Purchased December 31Document2 pagesA Building That Was Purchased December 31muhaNo ratings yet

- Revised Class Schedule - BBA Program (Spring-2024)Document20 pagesRevised Class Schedule - BBA Program (Spring-2024)sheikhjahangir0777No ratings yet

- Summer Internship Project Report On: Benchmarking-Working Capital of Specific Indian IndustriesDocument5 pagesSummer Internship Project Report On: Benchmarking-Working Capital of Specific Indian Industriesanjali shilpa kajalNo ratings yet

- Financial Statement Analysis1Document6 pagesFinancial Statement Analysis1Mihai Bejan0% (1)

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- PRELEC 4 ReportDocument7 pagesPRELEC 4 ReportSel BarrantesNo ratings yet

- Assess Hutchison WhampoaDocument4 pagesAssess Hutchison WhampoaAyesha KhalidNo ratings yet

- Kel 3 Bahasa Inggris Niaga - Modul 2 KB 2Document19 pagesKel 3 Bahasa Inggris Niaga - Modul 2 KB 2Putra RakhmadaniNo ratings yet

- Mergers and Acquisitions Question List and Exercices Valuation With Full SolutionsDocument5 pagesMergers and Acquisitions Question List and Exercices Valuation With Full SolutionsAbdelhadi KaoutiNo ratings yet

- Creditors Reconciliation Question Suggested SolutionDocument2 pagesCreditors Reconciliation Question Suggested SolutionShweta SinghNo ratings yet

- History of Foreign Exchange Market in India: TripledDocument7 pagesHistory of Foreign Exchange Market in India: TripledAvinash SoniNo ratings yet

- Chapter 1 - FMDocument23 pagesChapter 1 - FMYoutube OnlyNo ratings yet

- Bernard Baruch - November 2005Document3 pagesBernard Baruch - November 2005insightinvestingNo ratings yet

- Advanced Accounting - Dayag 2015 - Chapter 15 - Multiple Choice Solution (29-35)Document1 pageAdvanced Accounting - Dayag 2015 - Chapter 15 - Multiple Choice Solution (29-35)John Carlos Doringo100% (1)

- Ind As 33Document18 pagesInd As 33Savin AdhikaryNo ratings yet

- Explaining The Price Anomaly of KRX Preferred StocksDocument11 pagesExplaining The Price Anomaly of KRX Preferred Stockstjl84No ratings yet

- Chapter 16Document10 pagesChapter 16RAden Altaf Wibowo PutraNo ratings yet

- Lecture Session 8 - Currency Option Contingency GraphsDocument9 pagesLecture Session 8 - Currency Option Contingency Graphsapi-19974928No ratings yet

- Market Profile-Futures TradingDocument6 pagesMarket Profile-Futures TradingAlp Dhingra100% (2)

- Cost Advantage Chapter 7Document4 pagesCost Advantage Chapter 7Md.Yousuf AkashNo ratings yet

- T8 Financial Strategy III (Suggested Answers)Document3 pagesT8 Financial Strategy III (Suggested Answers)xinghe666No ratings yet