Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

40 viewsLIC Home Loan EMI Calculator - Calculate LIC Hous

LIC Home Loan EMI Calculator - Calculate LIC Hous

Uploaded by

Shanthi VijayanThe document discusses LIC Housing Finance's home loan EMI calculator. It provides an example of how to use the calculator to determine a monthly EMI. Key factors like loan amount, interest rate, and tenure that influence the calculated EMI are also explained. The benefits of using the calculator like accuracy and comparing options are highlighted.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- MBA Finance ProjectDocument62 pagesMBA Finance Projectchotumotu13111190% (10)

- The Credit Score Zoom Kit 2015 PDF EbooksDocument56 pagesThe Credit Score Zoom Kit 2015 PDF Ebooksrodney92% (25)

- Insurance ProjectDocument110 pagesInsurance ProjectAbhishek JaiswalNo ratings yet

- Customer Satisfaction of Bajaj Allianz General InsuranceDocument44 pagesCustomer Satisfaction of Bajaj Allianz General InsuranceKusharg RohatgiNo ratings yet

- Project On General InsuranceDocument71 pagesProject On General Insurancerohan_punjabi784% (64)

- SIP Calculator - Systematic Investment Plan CalcuDocument1 pageSIP Calculator - Systematic Investment Plan CalcuPranav ShandilyaNo ratings yet

- Yang NeshDocument35 pagesYang NeshManiNo ratings yet

- Panners Elv AmDocument35 pagesPanners Elv AmManiNo ratings yet

- For 20 Years EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument9 pagesFor 20 Years EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaShyam AnandNo ratings yet

- Questionnaire Auto Loan CustomersDocument51 pagesQuestionnaire Auto Loan Customerssarvesh.bharti71% (7)

- Flat Interest Rate Vs Reducing Balance Interest Rate Calculator CashkumarDocument1 pageFlat Interest Rate Vs Reducing Balance Interest Rate Calculator CashkumarSatvant Singh SarwaraNo ratings yet

- Home Loan EMI Calculator EMI Calculator CalcuDocument1 pageHome Loan EMI Calculator EMI Calculator Calcuarjun rajNo ratings yet

- Article 20 (Sept 2019)Document6 pagesArticle 20 (Sept 2019)Venkat VenkiNo ratings yet

- Research Papers On Home Loans in IndiaDocument6 pagesResearch Papers On Home Loans in Indiaiwnlpjrif100% (1)

- Stringent RBI Policy But Lower Interest Rate - Do You Benefit From Buying A House Now - The Economic TimesDocument2 pagesStringent RBI Policy But Lower Interest Rate - Do You Benefit From Buying A House Now - The Economic Timesanupbhansali2004No ratings yet

- Comparative Study of Bank's Retail Loan Product (Home LoanDocument27 pagesComparative Study of Bank's Retail Loan Product (Home LoanDevo Pam NagNo ratings yet

- Literature Review On Auto LoanDocument6 pagesLiterature Review On Auto Loansvgkjqbnd100% (1)

- Simplify Financial Life - Calculate Your Home Loan Installments Using MS Excel - The Economic TimesDocument3 pagesSimplify Financial Life - Calculate Your Home Loan Installments Using MS Excel - The Economic TimeskarunagaranNo ratings yet

- Loan Systen in IndiaDocument19 pagesLoan Systen in IndiaPrashant singhNo ratings yet

- Shriram City Union Finance - Shriramcity - inDocument5 pagesShriram City Union Finance - Shriramcity - inRamesh GaonkarNo ratings yet

- Httplicjeevansaral - in 7Document6 pagesHttplicjeevansaral - in 7abdulyunus_amirNo ratings yet

- Lender Lender: What Is A 'Lender' What Is A 'Lender'Document6 pagesLender Lender: What Is A 'Lender' What Is A 'Lender'moNo ratings yet

- Desk AHFLDocument52 pagesDesk AHFLshivam dubeyNo ratings yet

- Home Loan Project Final (Arun)Document64 pagesHome Loan Project Final (Arun)Munjaal RavalNo ratings yet

- Housing Loan ThesisDocument5 pagesHousing Loan Thesisheatherdionnemanchester100% (2)

- ZestMoney and KreditbeeDocument10 pagesZestMoney and KreditbeeAkram KhanNo ratings yet

- Sbi Policy Payment ReceiptDocument20 pagesSbi Policy Payment ReceiptRohit RanaNo ratings yet

- Singapore Property Weekly Issue 284Document11 pagesSingapore Property Weekly Issue 284Propwise.sgNo ratings yet

- How To Reduce Interest Payments On Your Credit Card Bills?Document21 pagesHow To Reduce Interest Payments On Your Credit Card Bills?ShreekumarNo ratings yet

- Online Term Plans (ML-30!06!2011)Document8 pagesOnline Term Plans (ML-30!06!2011)Amit UpalekarNo ratings yet

- Cumulative FD - Non-Cumulative Fixed DepositDocument10 pagesCumulative FD - Non-Cumulative Fixed Depositconfirm@No ratings yet

- What Is A MortgageDocument6 pagesWhat Is A MortgagekrishnaNo ratings yet

- Interest RateDocument14 pagesInterest RatePriya RishiNo ratings yet

- Retail BankingDocument25 pagesRetail BankingTrusha Hodiwala80% (5)

- Project On Home LoanDocument64 pagesProject On Home LoanAjay Singhal100% (6)

- Icici Home LoansDocument43 pagesIcici Home Loanskashyappawan007No ratings yet

- What Is A 3-In-1 Demat AccountDocument11 pagesWhat Is A 3-In-1 Demat AccountAnuj KumarNo ratings yet

- FoirDocument6 pagesFoirArulshanmugavel SvNo ratings yet

- DIY Credit Repair And Building Guide: Financial Free VictoryFrom EverandDIY Credit Repair And Building Guide: Financial Free VictoryNo ratings yet

- Summer Training Proect On Comparison of Home Loan Scheme of Different BanksDocument65 pagesSummer Training Proect On Comparison of Home Loan Scheme of Different BanksGurjinder Singh FloraaNo ratings yet

- BA Finance Domain - TutorialsDocument31 pagesBA Finance Domain - TutorialsRajesh MekalaNo ratings yet

- Home Loan Research PapersDocument6 pagesHome Loan Research Papersgz7vhnpe100% (1)

- Credit FundamentalsDocument15 pagesCredit FundamentalsCody Long100% (3)

- Comparison of Home Loan Scheme of Different BanksDocument63 pagesComparison of Home Loan Scheme of Different BanksSoniya Saini100% (1)

- HDFC Bank: Innovative Institution and A Market Leader in The Housing Finance Sector in IndiaDocument40 pagesHDFC Bank: Innovative Institution and A Market Leader in The Housing Finance Sector in IndialavsamirNo ratings yet

- 8 Oct... 9 ArticlesDocument22 pages8 Oct... 9 Articlesavinash sharmaNo ratings yet

- Home Loan Literature ReviewDocument8 pagesHome Loan Literature Reviewc5rf85jq100% (1)

- Name:Rashi Milind Virkud Batch No: S220152Document31 pagesName:Rashi Milind Virkud Batch No: S220152Rashi virkudNo ratings yet

- HDFC and Sbi ReportDocument45 pagesHDFC and Sbi ReportÂShu KaLràNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiaricky100% (1)

- Online Term PlanDocument9 pagesOnline Term PlanPradeep PatilNo ratings yet

- Characteristics of Service Industry With Reference ToDocument12 pagesCharacteristics of Service Industry With Reference Toisha_patel897471100% (3)

- RMFI Caselets - AbhishekDocument8 pagesRMFI Caselets - AbhishekAbhishek SinhaNo ratings yet

- 1Document5 pages1Parag ShrivastavaNo ratings yet

- Used Cars LoanDocument4 pagesUsed Cars LoaninfoNo ratings yet

- Question and Answer - 22Document31 pagesQuestion and Answer - 22acc-expertNo ratings yet

- What Affects Your Credit ScoreDocument7 pagesWhat Affects Your Credit ScoreAlpa DwivediNo ratings yet

- Exam TaskDocument4 pagesExam TaskАдам РузвельтNo ratings yet

- NMIMS Dec PGDBM Assignments - 9967480770Document6 pagesNMIMS Dec PGDBM Assignments - 9967480770Ca-cs Acma-mba PradeepNo ratings yet

- The Importance of Credit Score in Obtaining An MSME Loan in India.Document3 pagesThe Importance of Credit Score in Obtaining An MSME Loan in India.Raqib nkbkreditNo ratings yet

- WHAT'S F.R.E.E. CREDIT? the personal game changerFrom EverandWHAT'S F.R.E.E. CREDIT? the personal game changerRating: 2 out of 5 stars2/5 (1)

- A Comparative Analysis of Life InsuranceDocument41 pagesA Comparative Analysis of Life InsuranceDibyaRanjanBeheraNo ratings yet

- IrdaDocument10 pagesIrdashivam2003No ratings yet

- Venki ProjectDocument89 pagesVenki ProjectRocking VenkiNo ratings yet

- MBA Project List-FDocument51 pagesMBA Project List-FDevrajNo ratings yet

- Life Insurance Corporation of India Detailed Policy Status ReportDocument1 pageLife Insurance Corporation of India Detailed Policy Status ReportGiridhar RamatheerthamNo ratings yet

- Suresh Part BDocument33 pagesSuresh Part BSuresh RBNo ratings yet

- How To PlanDocument37 pagesHow To Planaurorashiva1No ratings yet

- Research Design: Chapter-3Document33 pagesResearch Design: Chapter-3Shaik RuksanaNo ratings yet

- Revised Pension Claim FormDocument2 pagesRevised Pension Claim FormMeena MishraNo ratings yet

- Company Profile of HDFC LifeDocument19 pagesCompany Profile of HDFC LifeNazir HussainNo ratings yet

- A Project Report On "Lic Housing Finance Loan"Document14 pagesA Project Report On "Lic Housing Finance Loan"Nia Sharma0% (1)

- A Study On Customer Satisfaction of Reliance Life InsuranceDocument57 pagesA Study On Customer Satisfaction of Reliance Life InsuranceVikash Bhanwala100% (10)

- Consumer Awareness Regarding PNB MetlifeDocument51 pagesConsumer Awareness Regarding PNB MetlifeKirti Jindal100% (1)

- 07 Chapter 1Document83 pages07 Chapter 1PrashantNo ratings yet

- Summer Training Report: Finding New Potential Area of Kotak Life InsuranceDocument33 pagesSummer Training Report: Finding New Potential Area of Kotak Life InsuranceSumeet GargNo ratings yet

- Lic Feb2023Document1 pageLic Feb2023jyotsna791No ratings yet

- Abhijit Kundu - Dr. Vipul Kumar SinghDocument34 pagesAbhijit Kundu - Dr. Vipul Kumar SinghGunadeep ReddyNo ratings yet

- Jeevan Saral Policy by Lic of India Which Is Also Called ATM PlanDocument6 pagesJeevan Saral Policy by Lic of India Which Is Also Called ATM PlansakthifgNo ratings yet

- IndiaInsurancereport August 2022Document34 pagesIndiaInsurancereport August 2022Anjani KumarNo ratings yet

- Project On LICDocument54 pagesProject On LICHament Singh71% (38)

- BS English 16 - 9 PDFDocument17 pagesBS English 16 - 9 PDFDilip Kumar ThumatiNo ratings yet

- Customer Bevaivir ARTICLEDocument47 pagesCustomer Bevaivir ARTICLEJavedIqbalNo ratings yet

- NarangDocument53 pagesNarangBawan preet SinghNo ratings yet

- Dec 1st WeekDocument23 pagesDec 1st WeekGaurav PrajapatNo ratings yet

- Jeevan ChhayaDocument3 pagesJeevan ChhayaHarish ChandNo ratings yet

- 2 PDFDocument11 pages2 PDFAkshay PawarNo ratings yet

- CRM Programs at Life Insurance Corporation of India (With Special Reference To Special Plans - Health Plans)Document22 pagesCRM Programs at Life Insurance Corporation of India (With Special Reference To Special Plans - Health Plans)Varun Puri100% (4)

LIC Home Loan EMI Calculator - Calculate LIC Hous

LIC Home Loan EMI Calculator - Calculate LIC Hous

Uploaded by

Shanthi Vijayan0 ratings0% found this document useful (0 votes)

40 views1 pageThe document discusses LIC Housing Finance's home loan EMI calculator. It provides an example of how to use the calculator to determine a monthly EMI. Key factors like loan amount, interest rate, and tenure that influence the calculated EMI are also explained. The benefits of using the calculator like accuracy and comparing options are highlighted.

Original Description:

Original Title

LIC Home Loan EMI Calculator - Calculate LIC Hous…

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses LIC Housing Finance's home loan EMI calculator. It provides an example of how to use the calculator to determine a monthly EMI. Key factors like loan amount, interest rate, and tenure that influence the calculated EMI are also explained. The benefits of using the calculator like accuracy and comparing options are highlighted.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

40 views1 pageLIC Home Loan EMI Calculator - Calculate LIC Hous

LIC Home Loan EMI Calculator - Calculate LIC Hous

Uploaded by

Shanthi VijayanThe document discusses LIC Housing Finance's home loan EMI calculator. It provides an example of how to use the calculator to determine a monthly EMI. Key factors like loan amount, interest rate, and tenure that influence the calculated EMI are also explained. The benefits of using the calculator like accuracy and comparing options are highlighted.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

LIC Home Loan EMI Calculator

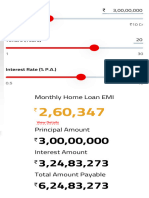

Loan amount ₹ 7500000

Rate of interest (p.a) 6.5 %

Loan tenure (years) 10 Yr

Monthly EMI ₹85,161

Principal amount ₹75,00,000

Total interest ₹27,19,318

Total amount ₹1,02,19,318

Principal amount Interest amount

When it comes to home mortgage loans, LIC Housing

Finance Limited is considered one of the most prominent

]nanciers in India. It is a subsidiary organization of the

Life Insurance Corporation of India with its corporate

o_ce situated in Mumbai.

The housing ]nance company was established in 1989 to

]nancially assist individuals who wish to construct or

purchase a residential property. Later, LIC Housing

Finance Limited became a public company in 1994,

promoted and controlled by the LIC of India.

They offer housing loans to Indian and Non-Indian

residents as well as pensioners. Also, while deciding

EMIs, borrowers can use the LIC home loan calculator

and go for the most convenient loan amount that keeps

EMIs affordable.

LIC Home Loan EMI Calculator

Typically, LIC home loans denote high-value funds availed

for an extended repayment timeline, and thus, the total

payable amount becomes considerably high. Therefore,

borrowers need to be careful when opting for an

instalment amount.

As a convenient option, one can consider using the LIC

home loan EMI calculator that computes the payout

options within seconds. Individuals need to provide their

desired advance amount, applicable interest rate, and

repayment term to the calculator, which displays the

resultant EMI accordingly.

Individuals can also alter the values of tenure and loan

amount component to ]nd out the best loan option for

them.

How Does LIC Home Loan Calculator Compute

EMIs?

The LIC home loan calculator 2020 computes EMI based

on the following formula –

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

Here,

P signi]es the principal amount

R signi]es an applicable interest rate

N signi]es the repayment term in months

Now, here is an example to help you understand the

computation process of the LIC home loan calculator:

Nandini is a working woman who has obtained a housing

loan of Rs. 35 lakh at a 7% per annum interest rate for 15

years.

The values entered in the calculator are tabulated as

under –

P or Principal value Rs. 35,00,000

R or Rate of interest 7%

Tenure of repayment 180 months

Based on the formula –

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

= [35,00,000 X 7% X (1+7)^180] / [(1+7)^180-1]

= 31,459

Therefore, Nandini has to pay Rs. 31,459 as EMI for the

next 15 years until she chooses to prepay or foreclose her

loan account. Furthermore, the LIC housing loan

calculator also displays the total repayment liability that

she has to pay amounting to Rs. 56,62,618.

What are the Factors that InWuence Home Loan

EMIs?

Based on various factors, home loan EMIs can vary

across the product range. These inluencing factors are –

Tenure – If individuals choose a longer tenure, it

results in monthly instalment reduction, making

repayments more affordable, and vice versa.

Loan principal – If borrowers prefer to opt for a higher

loan amount, it results in a proportionate increase in

the instalment amount too, and vice versa.

Interest rate – Although lenders determine interest

rates, an applicant’s quali]cation measures like age,

repayment capacity, credit pro]le, and similar other

factors can inluence it. Notably, an expensive rate of

interest keeps the EMIs on a higher side.

What are the BeneYts of LIC Housing Loan EMI

Calculator?

Borrowers can bene]t from a LIC housing loan EMI

calculator in the following ways –

A LIC housing loan calculator does not leave any room

for errors. So, borrowers can consider its accuracy

when computing EMIs.

EMI calculators can help compare multiple instalment

options. Therefore, individuals can choose the best

monthly payout as per their repayment capacity.

It is a simple tool that is easy to use, even for those

lacking any technical know-how.

Housing loan aspirants must, therefore, learn how to use

the LIC home loan calculator to make an informed

decision. They must also remember that a fractional

difference in a home loan amount or interest rate can

increase the total outstanding signi]cantly as it is a high-

value advance that comes with an extended tenor. So,

borrowers must be careful about all the terms before

applying for it.

LIC Home Loan EMI Calculator - FAQs

Is the LIC home loan EMI constant or changes with

an interest rate change in future?

WIll there be any change in the home loan EMI in

case of prepayment?

How accurate is the home loan calculator of LIC?

What is the use of calculating LIC Housing Finance

home loan EMI before even taking a loan?

Popular Calculators

SIP Calculator

Lumpsum Calculator

SWP Calculator

MF Returns Calculator

Sukanya Samriddhi Yojana Calculator

PPF Calculator

EPF Calculator

FD Calculator

RD Calculator

EMI Calculator

Income Tax Calculator

More EMI Calculators

Car Loan EMI Calculator

Home Loan EMI Calculator

Personal Loan EMI Calculator

Axis Bank EMI Calculator

Axis Bank Home Loan EMI Calculator

HDFC Loan EMI Calculator

HDFC Car Loan EMI Calculator

HDFC Home Loan EMI Calculator

HDFC Personal Loan EMI Calculator

ICICI EMI Calculator

ICICI Car Loan EMI Calculator

ICICI Home Loan EMI Calculator

ICICI Personal Loan EMI Calculator

SBI EMI Calculator

SBI Car Loan EMI Calculator

SBI Home Loan EMI Calculator

SBI Personal Loan EMI Calculator

ⓒ 2022 Groww. All rights reserved, Built with ♥ in India

Version - 3.2.8

No.11, 2nd floor, 80 FT Road

4th Block, S.T Bed

Koramangala, Bengaluru – 560034

PRODUCTS GROWW QUICK LINKS

Stocks About Us Calculators

Futures & Options Pricing Glossary

Mutual Funds Blogs Open Demat

Account

Fixed Deposit Media & Press Groww Digest

US Stocks AMC Mutual Download Forms

Funds

Groww Academy

Careers Sitemap

Help & Support

More about Groww +

You might also like

- MBA Finance ProjectDocument62 pagesMBA Finance Projectchotumotu13111190% (10)

- The Credit Score Zoom Kit 2015 PDF EbooksDocument56 pagesThe Credit Score Zoom Kit 2015 PDF Ebooksrodney92% (25)

- Insurance ProjectDocument110 pagesInsurance ProjectAbhishek JaiswalNo ratings yet

- Customer Satisfaction of Bajaj Allianz General InsuranceDocument44 pagesCustomer Satisfaction of Bajaj Allianz General InsuranceKusharg RohatgiNo ratings yet

- Project On General InsuranceDocument71 pagesProject On General Insurancerohan_punjabi784% (64)

- SIP Calculator - Systematic Investment Plan CalcuDocument1 pageSIP Calculator - Systematic Investment Plan CalcuPranav ShandilyaNo ratings yet

- Yang NeshDocument35 pagesYang NeshManiNo ratings yet

- Panners Elv AmDocument35 pagesPanners Elv AmManiNo ratings yet

- For 20 Years EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument9 pagesFor 20 Years EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaShyam AnandNo ratings yet

- Questionnaire Auto Loan CustomersDocument51 pagesQuestionnaire Auto Loan Customerssarvesh.bharti71% (7)

- Flat Interest Rate Vs Reducing Balance Interest Rate Calculator CashkumarDocument1 pageFlat Interest Rate Vs Reducing Balance Interest Rate Calculator CashkumarSatvant Singh SarwaraNo ratings yet

- Home Loan EMI Calculator EMI Calculator CalcuDocument1 pageHome Loan EMI Calculator EMI Calculator Calcuarjun rajNo ratings yet

- Article 20 (Sept 2019)Document6 pagesArticle 20 (Sept 2019)Venkat VenkiNo ratings yet

- Research Papers On Home Loans in IndiaDocument6 pagesResearch Papers On Home Loans in Indiaiwnlpjrif100% (1)

- Stringent RBI Policy But Lower Interest Rate - Do You Benefit From Buying A House Now - The Economic TimesDocument2 pagesStringent RBI Policy But Lower Interest Rate - Do You Benefit From Buying A House Now - The Economic Timesanupbhansali2004No ratings yet

- Comparative Study of Bank's Retail Loan Product (Home LoanDocument27 pagesComparative Study of Bank's Retail Loan Product (Home LoanDevo Pam NagNo ratings yet

- Literature Review On Auto LoanDocument6 pagesLiterature Review On Auto Loansvgkjqbnd100% (1)

- Simplify Financial Life - Calculate Your Home Loan Installments Using MS Excel - The Economic TimesDocument3 pagesSimplify Financial Life - Calculate Your Home Loan Installments Using MS Excel - The Economic TimeskarunagaranNo ratings yet

- Loan Systen in IndiaDocument19 pagesLoan Systen in IndiaPrashant singhNo ratings yet

- Shriram City Union Finance - Shriramcity - inDocument5 pagesShriram City Union Finance - Shriramcity - inRamesh GaonkarNo ratings yet

- Httplicjeevansaral - in 7Document6 pagesHttplicjeevansaral - in 7abdulyunus_amirNo ratings yet

- Lender Lender: What Is A 'Lender' What Is A 'Lender'Document6 pagesLender Lender: What Is A 'Lender' What Is A 'Lender'moNo ratings yet

- Desk AHFLDocument52 pagesDesk AHFLshivam dubeyNo ratings yet

- Home Loan Project Final (Arun)Document64 pagesHome Loan Project Final (Arun)Munjaal RavalNo ratings yet

- Housing Loan ThesisDocument5 pagesHousing Loan Thesisheatherdionnemanchester100% (2)

- ZestMoney and KreditbeeDocument10 pagesZestMoney and KreditbeeAkram KhanNo ratings yet

- Sbi Policy Payment ReceiptDocument20 pagesSbi Policy Payment ReceiptRohit RanaNo ratings yet

- Singapore Property Weekly Issue 284Document11 pagesSingapore Property Weekly Issue 284Propwise.sgNo ratings yet

- How To Reduce Interest Payments On Your Credit Card Bills?Document21 pagesHow To Reduce Interest Payments On Your Credit Card Bills?ShreekumarNo ratings yet

- Online Term Plans (ML-30!06!2011)Document8 pagesOnline Term Plans (ML-30!06!2011)Amit UpalekarNo ratings yet

- Cumulative FD - Non-Cumulative Fixed DepositDocument10 pagesCumulative FD - Non-Cumulative Fixed Depositconfirm@No ratings yet

- What Is A MortgageDocument6 pagesWhat Is A MortgagekrishnaNo ratings yet

- Interest RateDocument14 pagesInterest RatePriya RishiNo ratings yet

- Retail BankingDocument25 pagesRetail BankingTrusha Hodiwala80% (5)

- Project On Home LoanDocument64 pagesProject On Home LoanAjay Singhal100% (6)

- Icici Home LoansDocument43 pagesIcici Home Loanskashyappawan007No ratings yet

- What Is A 3-In-1 Demat AccountDocument11 pagesWhat Is A 3-In-1 Demat AccountAnuj KumarNo ratings yet

- FoirDocument6 pagesFoirArulshanmugavel SvNo ratings yet

- DIY Credit Repair And Building Guide: Financial Free VictoryFrom EverandDIY Credit Repair And Building Guide: Financial Free VictoryNo ratings yet

- Summer Training Proect On Comparison of Home Loan Scheme of Different BanksDocument65 pagesSummer Training Proect On Comparison of Home Loan Scheme of Different BanksGurjinder Singh FloraaNo ratings yet

- BA Finance Domain - TutorialsDocument31 pagesBA Finance Domain - TutorialsRajesh MekalaNo ratings yet

- Home Loan Research PapersDocument6 pagesHome Loan Research Papersgz7vhnpe100% (1)

- Credit FundamentalsDocument15 pagesCredit FundamentalsCody Long100% (3)

- Comparison of Home Loan Scheme of Different BanksDocument63 pagesComparison of Home Loan Scheme of Different BanksSoniya Saini100% (1)

- HDFC Bank: Innovative Institution and A Market Leader in The Housing Finance Sector in IndiaDocument40 pagesHDFC Bank: Innovative Institution and A Market Leader in The Housing Finance Sector in IndialavsamirNo ratings yet

- 8 Oct... 9 ArticlesDocument22 pages8 Oct... 9 Articlesavinash sharmaNo ratings yet

- Home Loan Literature ReviewDocument8 pagesHome Loan Literature Reviewc5rf85jq100% (1)

- Name:Rashi Milind Virkud Batch No: S220152Document31 pagesName:Rashi Milind Virkud Batch No: S220152Rashi virkudNo ratings yet

- HDFC and Sbi ReportDocument45 pagesHDFC and Sbi ReportÂShu KaLràNo ratings yet

- My FRP REPORTDocument61 pagesMy FRP REPORTsetiaricky100% (1)

- Online Term PlanDocument9 pagesOnline Term PlanPradeep PatilNo ratings yet

- Characteristics of Service Industry With Reference ToDocument12 pagesCharacteristics of Service Industry With Reference Toisha_patel897471100% (3)

- RMFI Caselets - AbhishekDocument8 pagesRMFI Caselets - AbhishekAbhishek SinhaNo ratings yet

- 1Document5 pages1Parag ShrivastavaNo ratings yet

- Used Cars LoanDocument4 pagesUsed Cars LoaninfoNo ratings yet

- Question and Answer - 22Document31 pagesQuestion and Answer - 22acc-expertNo ratings yet

- What Affects Your Credit ScoreDocument7 pagesWhat Affects Your Credit ScoreAlpa DwivediNo ratings yet

- Exam TaskDocument4 pagesExam TaskАдам РузвельтNo ratings yet

- NMIMS Dec PGDBM Assignments - 9967480770Document6 pagesNMIMS Dec PGDBM Assignments - 9967480770Ca-cs Acma-mba PradeepNo ratings yet

- The Importance of Credit Score in Obtaining An MSME Loan in India.Document3 pagesThe Importance of Credit Score in Obtaining An MSME Loan in India.Raqib nkbkreditNo ratings yet

- WHAT'S F.R.E.E. CREDIT? the personal game changerFrom EverandWHAT'S F.R.E.E. CREDIT? the personal game changerRating: 2 out of 5 stars2/5 (1)

- A Comparative Analysis of Life InsuranceDocument41 pagesA Comparative Analysis of Life InsuranceDibyaRanjanBeheraNo ratings yet

- IrdaDocument10 pagesIrdashivam2003No ratings yet

- Venki ProjectDocument89 pagesVenki ProjectRocking VenkiNo ratings yet

- MBA Project List-FDocument51 pagesMBA Project List-FDevrajNo ratings yet

- Life Insurance Corporation of India Detailed Policy Status ReportDocument1 pageLife Insurance Corporation of India Detailed Policy Status ReportGiridhar RamatheerthamNo ratings yet

- Suresh Part BDocument33 pagesSuresh Part BSuresh RBNo ratings yet

- How To PlanDocument37 pagesHow To Planaurorashiva1No ratings yet

- Research Design: Chapter-3Document33 pagesResearch Design: Chapter-3Shaik RuksanaNo ratings yet

- Revised Pension Claim FormDocument2 pagesRevised Pension Claim FormMeena MishraNo ratings yet

- Company Profile of HDFC LifeDocument19 pagesCompany Profile of HDFC LifeNazir HussainNo ratings yet

- A Project Report On "Lic Housing Finance Loan"Document14 pagesA Project Report On "Lic Housing Finance Loan"Nia Sharma0% (1)

- A Study On Customer Satisfaction of Reliance Life InsuranceDocument57 pagesA Study On Customer Satisfaction of Reliance Life InsuranceVikash Bhanwala100% (10)

- Consumer Awareness Regarding PNB MetlifeDocument51 pagesConsumer Awareness Regarding PNB MetlifeKirti Jindal100% (1)

- 07 Chapter 1Document83 pages07 Chapter 1PrashantNo ratings yet

- Summer Training Report: Finding New Potential Area of Kotak Life InsuranceDocument33 pagesSummer Training Report: Finding New Potential Area of Kotak Life InsuranceSumeet GargNo ratings yet

- Lic Feb2023Document1 pageLic Feb2023jyotsna791No ratings yet

- Abhijit Kundu - Dr. Vipul Kumar SinghDocument34 pagesAbhijit Kundu - Dr. Vipul Kumar SinghGunadeep ReddyNo ratings yet

- Jeevan Saral Policy by Lic of India Which Is Also Called ATM PlanDocument6 pagesJeevan Saral Policy by Lic of India Which Is Also Called ATM PlansakthifgNo ratings yet

- IndiaInsurancereport August 2022Document34 pagesIndiaInsurancereport August 2022Anjani KumarNo ratings yet

- Project On LICDocument54 pagesProject On LICHament Singh71% (38)

- BS English 16 - 9 PDFDocument17 pagesBS English 16 - 9 PDFDilip Kumar ThumatiNo ratings yet

- Customer Bevaivir ARTICLEDocument47 pagesCustomer Bevaivir ARTICLEJavedIqbalNo ratings yet

- NarangDocument53 pagesNarangBawan preet SinghNo ratings yet

- Dec 1st WeekDocument23 pagesDec 1st WeekGaurav PrajapatNo ratings yet

- Jeevan ChhayaDocument3 pagesJeevan ChhayaHarish ChandNo ratings yet

- 2 PDFDocument11 pages2 PDFAkshay PawarNo ratings yet

- CRM Programs at Life Insurance Corporation of India (With Special Reference To Special Plans - Health Plans)Document22 pagesCRM Programs at Life Insurance Corporation of India (With Special Reference To Special Plans - Health Plans)Varun Puri100% (4)