Professional Documents

Culture Documents

Prepaid Expense and Unearned Revenue

Prepaid Expense and Unearned Revenue

Uploaded by

Accounting Stuff0 ratings0% found this document useful (0 votes)

13 views2 pagesPrepaid expense refers to expenses paid in advance that will be recognized over future periods. There are two methods for recording prepaid expenses over time: the asset method decreases the prepaid expense account and increases the expense account, while the expense method decreases the expense account and increases the prepaid expense account. Similarly, unearned revenue refers to cash received in advance of services rendered; the liability method decreases unearned revenue and increases revenue, while the revenue method decreases revenue and increases unearned revenue.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPrepaid expense refers to expenses paid in advance that will be recognized over future periods. There are two methods for recording prepaid expenses over time: the asset method decreases the prepaid expense account and increases the expense account, while the expense method decreases the expense account and increases the prepaid expense account. Similarly, unearned revenue refers to cash received in advance of services rendered; the liability method decreases unearned revenue and increases revenue, while the revenue method decreases revenue and increases unearned revenue.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

13 views2 pagesPrepaid Expense and Unearned Revenue

Prepaid Expense and Unearned Revenue

Uploaded by

Accounting StuffPrepaid expense refers to expenses paid in advance that will be recognized over future periods. There are two methods for recording prepaid expenses over time: the asset method decreases the prepaid expense account and increases the expense account, while the expense method decreases the expense account and increases the prepaid expense account. Similarly, unearned revenue refers to cash received in advance of services rendered; the liability method decreases unearned revenue and increases revenue, while the revenue method decreases revenue and increases unearned revenue.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Prepaid Expense

● Prepaid Expense is a type of asset account that refers to a prepayment or

advance payment of expenses to be incurred in future certain periods.

● Prepaid Expenses could be recorded or journalized and adjusted using the

following methods:

○ Asset Method

○ Expense Method

Asset Method Expense Method

Journalizing Prepaid Expense xx Expense xx

Cash xx Cash xx

Adjusting Expense xx Prepaid Expense xx

Prepaid Expense xx Expense xx

Note: The amount of Prepaid Expense Note: The amount of Prepaid Expense

used at the end of the period will be left at the end of the period will be used.

used.

Example:

Asset Method Expense Method

Journalizing Prepaid Expense 2,400 Expense 2,400

Journalizing: Paid 2,400 cash Cash 2,400 Cash 2,400

for future advertising

Adjusting Expense 1,000 Prepaid Expense 1,400

Adjusting: An amount of 1,400 Prepaid Expense 1,000 Expense 1,400

from the advertising paid on Note: The amount of Prepaid Expense Note: The amount of Prepaid Expense

November 1 is still unused which has expired at the end of the left unused at the end of the period will

period will be used. be used.

Unearned Revenue

● Unearned Revenue is a type of liability account that refers to the advance cash

payment made by the customer for the services to be rendered in a certain

period.

● Unearned Revenue could be recorded or journalized and adjusted using the

following methods:

○ Liability Method

○ Revenue Method

Liability Method Revenue Method

Journalizing Cash xx Cash xx

Unearned Revenue xx Revenue xx

Adjusting Unearned Revenue xx Revenue xx

Revenue xx Unearned Revenue xx

Note: The amount of Unearned Note: The amount of Unearned

Revenue finally earned at the end of the Revenue not yet rendered at the end of

period will be used. the period will be used.

Example:

Liability Method Revenue Method

Journalizing Cash 2,600 Cash 2,600

Journalizing: Received 2,600 Unearned Revenue 2,600 Service Revenue 2,600

cash for future services to be

provided to a customer

Adjusting Unearned Revenue 1,400 Service Revenue 1,200

Adjusting: Services worth Service Revenue 1,400 Unearned Revenue 1,200

1,200 are not yet provided to Note: The amount of Unearned

Note: The amount of Unearned

the customer who paid on Revenue not yet rendered at the end of

November 30 Revenue finally earned at the end of the

period will be used. the period will be used.

You might also like

- Module 4Document67 pagesModule 4Chicos tacos100% (3)

- ACCTG1 Chapter 6Document2 pagesACCTG1 Chapter 6Mark Kevin JavierNo ratings yet

- Notes On Adjusting EntriesDocument6 pagesNotes On Adjusting EntriesRedNo ratings yet

- Adjusting EntriesDocument13 pagesAdjusting EntriesJodi SaligumbaNo ratings yet

- FABM1 Q2M1 Adjusting Entries1Document5 pagesFABM1 Q2M1 Adjusting Entries1rheyangabriel123No ratings yet

- PDF Installment Sales Reviewer Problems - CompressDocument43 pagesPDF Installment Sales Reviewer Problems - CompressMischievous Mae0% (1)

- AdjustingDocument2 pagesAdjustingjerrelyneuricaviernesNo ratings yet

- Adjusting EntriesDocument14 pagesAdjusting EntriesSeri CrisologoNo ratings yet

- Basic Accounting Practice - Adjusting Entries-3Document34 pagesBasic Accounting Practice - Adjusting Entries-3randel10caneteNo ratings yet

- Accounting 1&2 ReviewerDocument6 pagesAccounting 1&2 Reviewerben tenNo ratings yet

- ACT103 - Topic 5Document4 pagesACT103 - Topic 5Juan FrivaldoNo ratings yet

- Adjusting Entries: Accrued Expense Accrued IncomeDocument3 pagesAdjusting Entries: Accrued Expense Accrued IncomeRyanKingNo ratings yet

- Activity 5 1Document13 pagesActivity 5 1Trice DomingoNo ratings yet

- Adjusting EntriesDocument23 pagesAdjusting EntriesMarie Ann JoNo ratings yet

- Warren SM Ch.09 FinalDocument23 pagesWarren SM Ch.09 FinalAA BB MMNo ratings yet

- Adjusting EntriesDocument3 pagesAdjusting EntriesNatallie Almodiel ValenzuelaNo ratings yet

- Acc ReviewerDocument36 pagesAcc ReviewerDia BaronNo ratings yet

- Adjusting THE AccountsDocument51 pagesAdjusting THE AccountsShai Anne Cortez100% (1)

- Accounting Process 2Document2 pagesAccounting Process 2Glen JavellanaNo ratings yet

- Receivable FinancingDocument34 pagesReceivable FinancingmaryzeenNo ratings yet

- Receivable Financing: Pledge, Assignment, and FactoringDocument30 pagesReceivable Financing: Pledge, Assignment, and FactoringJoy UyNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesDyenNo ratings yet

- LESSON 2 ReviewerDocument8 pagesLESSON 2 ReviewerJehan VonneNo ratings yet

- Basic Accounting Adjusting Entry - Accruals and DeferralsDocument5 pagesBasic Accounting Adjusting Entry - Accruals and DeferralsKenneth TallmanNo ratings yet

- Adjusting Journal EntriesDocument2 pagesAdjusting Journal EntriesMicah Danielle S. TORMONNo ratings yet

- 2 Adjusting Journal EntriesDocument6 pages2 Adjusting Journal EntriesJerric CristobalNo ratings yet

- Adv Class 2Document19 pagesAdv Class 2genesis roldanNo ratings yet

- Adjusting EntriesDocument11 pagesAdjusting EntriesBenjaminJrMoronia100% (1)

- 1st Year - 6th SheetDocument9 pages1st Year - 6th SheetAhmed Ameen Nour EldinNo ratings yet

- Chapter 3Document14 pagesChapter 3mayhipolito01No ratings yet

- Accounting Adjustments: Section 6Document17 pagesAccounting Adjustments: Section 6Shavane DavisNo ratings yet

- Adjusting Process ValixDocument28 pagesAdjusting Process ValixjepsyutNo ratings yet

- Review On Basic Accounting: Universidad de Sta. IsabelDocument4 pagesReview On Basic Accounting: Universidad de Sta. IsabelRegina BengadoNo ratings yet

- Module 3 - Accounts Receivable Part II - 111702467Document11 pagesModule 3 - Accounts Receivable Part II - 111702467shimizuyumi53No ratings yet

- The Accounting Process-A ReviewDocument11 pagesThe Accounting Process-A ReviewLeoreyn Faye MedinaNo ratings yet

- 112.material For Receivable FinancingDocument8 pages112.material For Receivable FinancingJalanur MarohomNo ratings yet

- Adjusting The BooksDocument19 pagesAdjusting The BooksDan Gideon CariagaNo ratings yet

- Installment SalesDocument5 pagesInstallment SalesBryan ReyesNo ratings yet

- AC316 Accounting For Special Transactions Pas 18 or Ias 18: RevenueDocument5 pagesAC316 Accounting For Special Transactions Pas 18 or Ias 18: RevenueKristan John ZernaNo ratings yet

- Advanced Financial Accounting and Reporting G.P. Costa Installment SalesDocument6 pagesAdvanced Financial Accounting and Reporting G.P. Costa Installment SalesmkNo ratings yet

- Accruals and prepaymentsDocument11 pagesAccruals and prepaymentsareejayesha4No ratings yet

- Adj. EntriesDocument41 pagesAdj. EntriesElizabeth Espinosa Manilag100% (2)

- ReceivablesDocument31 pagesReceivablesKate MercadoNo ratings yet

- Lecture - Notes On Accounting ProcessDocument7 pagesLecture - Notes On Accounting ProcessNica PunzalanNo ratings yet

- For MidtermDocument107 pagesFor MidtermAngelica RubiosNo ratings yet

- Accounting For Merchandising CompaniesDocument11 pagesAccounting For Merchandising CompaniesJesseca JosafatNo ratings yet

- Financial-Accounting ArDocument5 pagesFinancial-Accounting Arearlalegre48No ratings yet

- Adjusting EntriesDocument18 pagesAdjusting EntriesAmie Jane MirandaNo ratings yet

- Lecture No.7Document20 pagesLecture No.7emanelshehawy44No ratings yet

- Receivable Financing CH14 by LailaneDocument30 pagesReceivable Financing CH14 by LailaneEunice BernalNo ratings yet

- Installment Sales Reviewer. Problems and Solutions.Document43 pagesInstallment Sales Reviewer. Problems and Solutions.Kate Alvarez91% (22)

- Installment Home Branch Liquidation LT Constn ContractsDocument47 pagesInstallment Home Branch Liquidation LT Constn ContractsbigbaekNo ratings yet

- Updates On Far QuestionsDocument3 pagesUpdates On Far QuestionsJurie BalandacaNo ratings yet

- Act.4 - Jose de Jesus Vargas EstradaDocument8 pagesAct.4 - Jose de Jesus Vargas EstradaJesus VargasNo ratings yet

- 04 Accounts Receivable Answer KeyDocument9 pages04 Accounts Receivable Answer Keywheein aegiNo ratings yet

- Lecture No.8 - 9Document29 pagesLecture No.8 - 9emanelshehawy44No ratings yet

- Unit II Lesson 5 and 6 ADJUSTING ENTRIES and FSDocument25 pagesUnit II Lesson 5 and 6 ADJUSTING ENTRIES and FSAlezandra SantelicesNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- Optimizing Inventory Management With Inventory Control and Ordering Methods in The Automotive IndustryDocument7 pagesOptimizing Inventory Management With Inventory Control and Ordering Methods in The Automotive IndustryInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Gec: CTCP Cơ Khí Gang Thép I. Business Overview: HydropowerDocument8 pagesGec: CTCP Cơ Khí Gang Thép I. Business Overview: HydropowerHuy Quang ĐỗNo ratings yet

- Income Based ValuationDocument25 pagesIncome Based ValuationApril Joy ObedozaNo ratings yet

- Raw Materials InventoryDocument4 pagesRaw Materials InventoryMikias DegwaleNo ratings yet

- Corporate Valuation and Value Based ManagementDocument10 pagesCorporate Valuation and Value Based ManagementjhatpatzeroNo ratings yet

- Week 4 Determination of Forward and Futures PricesDocument20 pagesWeek 4 Determination of Forward and Futures Prices胡丹阳No ratings yet

- Topic: Mergers and Takeover Practice QuestionsDocument7 pagesTopic: Mergers and Takeover Practice QuestionsUzair KamranNo ratings yet

- Practical Accounting 1Document21 pagesPractical Accounting 1Christine Nicole BacoNo ratings yet

- Auditing ProblemsDocument5 pagesAuditing ProblemsIohc NedmiNo ratings yet

- MC 05 Accounting For Merchandising ActivitiesDocument5 pagesMC 05 Accounting For Merchandising ActivitiesPrincess Kaye PitogoNo ratings yet

- Bata - Icmd 2009 (B04)Document4 pagesBata - Icmd 2009 (B04)IshidaUryuuNo ratings yet

- Asynchronous Class Fabm 1Document4 pagesAsynchronous Class Fabm 1barrettacarlyn.22No ratings yet

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniNo ratings yet

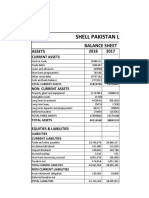

- Shell Pakistan LTD: Assets 2018 2017Document11 pagesShell Pakistan LTD: Assets 2018 2017mohammad bilalNo ratings yet

- IAcctg1 Accounts Receivable ActivitiesDocument10 pagesIAcctg1 Accounts Receivable ActivitiesYulrir Alesteyr HiroshiNo ratings yet

- Question 1. Grizzlies Inc. Was Organized On January 2, 2021, With Authorized Capital Stock of 50,000Document5 pagesQuestion 1. Grizzlies Inc. Was Organized On January 2, 2021, With Authorized Capital Stock of 50,000lois martinNo ratings yet

- Whitney Holding Corp: FORM 10-QDocument60 pagesWhitney Holding Corp: FORM 10-QOSRNo ratings yet

- CH 4 Solutionsdocx PDF FreeDocument129 pagesCH 4 Solutionsdocx PDF FreeYang LeksNo ratings yet

- Exemplu Test Examen - BFoctober11qpDocument8 pagesExemplu Test Examen - BFoctober11qpSima RoxanaNo ratings yet

- Project Report-Corporate RestructuringDocument26 pagesProject Report-Corporate Restructuringchahvi bansal100% (1)

- MAS Compilation of QuestionsDocument21 pagesMAS Compilation of QuestionsInocencio Tiburcio67% (3)

- Practice Question 1 - Published AccountsDocument2 pagesPractice Question 1 - Published AccountsGnanendran MBA100% (1)

- Accounting Ratios Chapter Notes - Accountancy Class 12 - Commerce PDF DownloadDocument20 pagesAccounting Ratios Chapter Notes - Accountancy Class 12 - Commerce PDF DownloadNubic IndiaNo ratings yet

- FINMAN MIDTERMS FinalDocument5 pagesFINMAN MIDTERMS FinalJennifer RasonabeNo ratings yet

- Module 2-Accounting Mechanics: Journal, Ledger and Trial BalanceDocument13 pagesModule 2-Accounting Mechanics: Journal, Ledger and Trial Balancenahar570No ratings yet

- Course Topics and Objectives: Topic Lesson Topic Subtopics ObjectivesDocument15 pagesCourse Topics and Objectives: Topic Lesson Topic Subtopics Objectivessiewsuan82No ratings yet

- Income Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Document14 pagesIncome Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Dr. Satish Jangra100% (1)

- Bikash Kumar (821022)Document56 pagesBikash Kumar (821022)harshkeshwani07No ratings yet

- Corporate Restructuring Strategies in India - An Overview: February 2021Document10 pagesCorporate Restructuring Strategies in India - An Overview: February 2021Jayshree YadavNo ratings yet

- BU1243 - International Trade Finance - Quiz #1Document9 pagesBU1243 - International Trade Finance - Quiz #1Vipul TyagiNo ratings yet