Professional Documents

Culture Documents

Pakistan Market Technical Outlook 22 Sep 2022

Pakistan Market Technical Outlook 22 Sep 2022

Uploaded by

shahjahanabdulrehmanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pakistan Market Technical Outlook 22 Sep 2022

Pakistan Market Technical Outlook 22 Sep 2022

Uploaded by

shahjahanabdulrehmanCopyright:

Available Formats

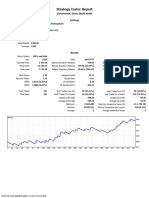

Pakistan Market: Technical Outlook September 22, 2022

KSE-

KSE-100; Slide to continue

KSE-100 index continued its declining trend to close at 40,966, down 255 points DoD.

Volumes stood at 170mn shares versus 157mn shares traded previously. The index is

expected to re-test support at 40,872 where a fall below that will target 40,670 which could

later extend to 39,540. However, the initial resistance lies in the range of 41,250-41,360

where a break above this range will target the 50-DMA at 41,782. The RSI and the MACD

are moving down, supporting a bearish view. We recommend investors to view any upside

as an opportunity to ‘Sell’, with risk defined above 50-DMA. The support and resistance

are at 40,772 and 41,258 levels, respectively.

ATRL: Downside likely

Strategy: ‘Sell on Strength’ - targeting Rs130.00; stoploss at Rs147.64.

ENGRO: Recovery trend remains intact

Strategy: ‘Buy on dips’ - targeting Rs240.01 & Rs241.29; stoploss at Rs230.00.

Raheel Ashraf

raheel.ashraf@js.com

92 (21) 111-574-111 Ext. 3098

Symbol Strategy Close High Low S2 S1 PIVOT R1 R2 14-DRSI 30-DMA 50-DMA 200-DMA

KSE-100 40,965.58 41,357.75 40,871.82 40,579.12 40,772.35 41,065.05 41,258.28 41,550.98 32.89 42,395.20 41,782.04 43,459.97

OGDC Stop selling above 73.37 72.50 76.50 71.12 67.99 70.25 73.37 75.63 78.75 21.58 81.65 81.43 83.56

PPL Stop selling above 60.95 59.92 60.95 59.00 58.01 58.96 59.96 60.91 61.91 20.34 68.61 68.85 73.65

ATRL Sell on Strength; target 130.00 141.82 147.10 140.00 135.87 138.85 142.97 145.95 150.07 31.24 157.30 152.51 147.64

PSO Sell on Strength; stoploss 164.98 162.28 164.98 162.00 160.11 161.19 163.09 164.17 166.07 29.66 176.03 175.76 173.43

SNGP Sell on Strength; stoploss 200-DMA 31.36 32.87 30.60 29.34 30.35 31.61 32.62 33.88 30.47 33.88 34.10 33.04

ENGRO Buy on dips; stoploss 230.00 233.02 234.00 230.00 228.34 230.68 232.34 234.68 236.34 42.34 240.01 241.29 263.26

DGKC Sell below 58.00 58.17 59.45 58.00 57.09 57.63 58.54 59.08 59.99 42.59 60.90 58.90 66.95

MLCF Stay long above 50-DMA 27.37 28.10 27.30 26.79 27.08 27.59 27.88 28.39 44.57 28.23 27.21 30.97

HBL Buy above 83.00 81.91 83.00 81.38 80.48 81.19 82.10 82.81 83.72 25.58 90.09 89.24 106.11

UBL Sell below 115.15 115.63 117.24 115.15 113.92 114.77 116.01 116.86 118.10 45.92 117.41 115.55 130.87

BOP Sell on Strength; stoploss 5.45 5.30 5.45 5.28 5.17 5.24 5.34 5.41 5.51 29.90 5.72 5.58 6.87

HCAR Stay long above 50-DMA 174.79 177.49 173.00 170.60 172.70 175.09 177.19 179.58 49.38 177.38 172.81 193.08

ISL Buy above 55.90 53.92 55.90 52.51 50.72 52.32 54.11 55.71 57.50 31.65 59.13 57.96 61.62

Disclaimer:

This report has been prepared for information purposes by the Research Department of JS Global Capital Ltd. The information and data on which this report is based are obtained from sources which we believe to be reliable but we do not

guarantee that it is accurate or complete. In particular, the report takes no account of the investment objectives, financial situation and particular needs of investors who should seek further professional advice or rely upon their own judgment

and acumen before making any investment. This report should also not be considered as a reflection on the concerned company’s management and its performances or ability, or appreciation or criticism, as to the affairs or operations of such

company or institution. Warning: This report may not be reproduced, distributed or published by any person for any purpose whatsoever. Action will be taken for unauthorized reproduction, distribution or publication.

Research Entity Notification Number: REP-084 JS Global Capital Limited | 17th Floor, The Centre, Plot # 28, SB-5, Abdullah Haroon Road, Saddar, Karachi | Tel: 92-21-111-574-111 |

www.JamaPunji.pk JS Research is available on Bloomberg, Thomson Reuters, CapitalIQ and www.jsgcl.com

You might also like

- INTERNSHIP REPORT On FBR For JawadDocument40 pagesINTERNSHIP REPORT On FBR For JawadJawad Ahmad100% (1)

- Business ProposalDocument6 pagesBusiness ProposalLouié ReyesNo ratings yet

- Analisis Ekonomi Dan Finansial Kereta Cepat Jakarta - Bandung Oldebes Temy Giantara Aleksander Purba Dwi HeriantoDocument12 pagesAnalisis Ekonomi Dan Finansial Kereta Cepat Jakarta - Bandung Oldebes Temy Giantara Aleksander Purba Dwi HeriantotresnaNo ratings yet

- Surf ExcelDocument14 pagesSurf ExcelEliim Rehman40% (5)

- Pakistan Market Technical Outlook 12 Oct 2022Document1 pagePakistan Market Technical Outlook 12 Oct 2022shahjahanabdulrehmanNo ratings yet

- Pakistan Market Technical Outlook 23 Feb 2023Document1 pagePakistan Market Technical Outlook 23 Feb 2023M ZubairNo ratings yet

- 20 Stocks Buy & Sell Levels For June 21 2021Document2 pages20 Stocks Buy & Sell Levels For June 21 2021james hillNo ratings yet

- PCSL Technical Outlook - 30-11-21 PDFDocument5 pagesPCSL Technical Outlook - 30-11-21 PDFArshad RashidNo ratings yet

- Daily Research Report 9-Dec-2022Document1 pageDaily Research Report 9-Dec-2022Dora phonixNo ratings yet

- 32 Stocks - Buy & Sell Levels May 04 2020Document2 pages32 Stocks - Buy & Sell Levels May 04 2020Sufyan SafiNo ratings yet

- Daily CallsDocument18 pagesDaily Callsreesty68_unfearyNo ratings yet

- Daily CallsDocument18 pagesDaily CallsArun DubeyNo ratings yet

- RR 0607201500536Document5 pagesRR 0607201500536Om PrakashNo ratings yet

- Stock Technical Report - MOL - 24.02.2024Document1 pageStock Technical Report - MOL - 24.02.2024Vijayaraj DuraiNo ratings yet

- HSL PCG "Currency Daily": 26 October, 2016Document6 pagesHSL PCG "Currency Daily": 26 October, 2016khaniyalalNo ratings yet

- DailyPrices 30 06 22Document1 pageDailyPrices 30 06 22emmanuel mtizwaNo ratings yet

- Technical and DerivativesDocument5 pagesTechnical and DerivativesSarvesh BhagatNo ratings yet

- Ashika Morning Report - 26.02.2024Document10 pagesAshika Morning Report - 26.02.2024Tirthankar DasNo ratings yet

- 012423-Bahana BeaconDocument5 pages012423-Bahana BeaconivanNo ratings yet

- Trader's Destination Intraday Calculators: Edit The Cells in Black Only, Dont Edit Any Other CellsDocument2 pagesTrader's Destination Intraday Calculators: Edit The Cells in Black Only, Dont Edit Any Other CellsKubera TradeNo ratings yet

- Stock Picks 14/10/2009Document2 pagesStock Picks 14/10/2009Anil MadalgereNo ratings yet

- Weekly Levels Playing Sheet Commodities & CurrenciesDocument2 pagesWeekly Levels Playing Sheet Commodities & CurrenciesAkshay WaghmareNo ratings yet

- Market StrategyDocument3 pagesMarket Strategyapi-3862995No ratings yet

- Highnoon Nov 26Document3 pagesHighnoon Nov 26SITU2412No ratings yet

- Daily Technical Report: Market AnalysisDocument4 pagesDaily Technical Report: Market AnalysisMohsin KhanNo ratings yet

- Technicals 18062008 AlsDocument4 pagesTechnicals 18062008 Alsapi-3862995No ratings yet

- TPF Daily Bulletin English Version (23!06!2022)Document8 pagesTPF Daily Bulletin English Version (23!06!2022)Gian AdityaNo ratings yet

- DailyPrices 26 06 20Document1 pageDailyPrices 26 06 20emmanuel mtizwaNo ratings yet

- Day Trader's Hit List: SharekhanDocument1 pageDay Trader's Hit List: Sharekhanyaar iduNo ratings yet

- Zimbabwe Stock Exchange Pricelist: The Complete List of ZSE Indices Can Be Obtained From The ZSE Website: WWW - Zse.co - ZWDocument1 pageZimbabwe Stock Exchange Pricelist: The Complete List of ZSE Indices Can Be Obtained From The ZSE Website: WWW - Zse.co - ZWBen GanzwaNo ratings yet

- Day-Trading SignalsDocument2 pagesDay-Trading SignalssunilghadshiNo ratings yet

- Shakil Rizvi Stock LTD.: 158-160 Motijheel C/A (4th Floor), Modhumita Building, Dhaka 1000Document2 pagesShakil Rizvi Stock LTD.: 158-160 Motijheel C/A (4th Floor), Modhumita Building, Dhaka 1000Onek KothaNo ratings yet

- Ashika Morning Report - 05.03.2024Document10 pagesAshika Morning Report - 05.03.2024Tirthankar DasNo ratings yet

- Research Desk - Stockbroking: Valuemax March 01, 2019Document12 pagesResearch Desk - Stockbroking: Valuemax March 01, 2019KeerthanaNo ratings yet

- Daily Notes: Philippine Seven Corporation (pse:SEVN)Document2 pagesDaily Notes: Philippine Seven Corporation (pse:SEVN)junNo ratings yet

- Daily Market Update Report 30-03-2020 PDFDocument6 pagesDaily Market Update Report 30-03-2020 PDFTejvinder SondhiNo ratings yet

- XAUUSD 1year HigerriskDocument25 pagesXAUUSD 1year HigerriskxhdjsjsssNo ratings yet

- Weekly Recap Mar 05 2023 EN - tcm10-29072Document4 pagesWeekly Recap Mar 05 2023 EN - tcm10-29072indraseenayya chilakalaNo ratings yet

- Stock Analysis of Power Finance CorporationDocument5 pagesStock Analysis of Power Finance CorporationDeepak YadavNo ratings yet

- HSL PCG "Currency Daily": 24 January, 2017Document6 pagesHSL PCG "Currency Daily": 24 January, 2017arun_algoNo ratings yet

- Mondol Securities Limited: Le Meridien (6th Floor), Block#2, Plot#79/A, Airport Road, Nikunja-2, Khilkhet, Dhaka-1229Document1 pageMondol Securities Limited: Le Meridien (6th Floor), Block#2, Plot#79/A, Airport Road, Nikunja-2, Khilkhet, Dhaka-1229Istiaque AhmadNo ratings yet

- DailyPrices 30 06 21Document1 pageDailyPrices 30 06 21emmanuel mtizwaNo ratings yet

- Ashika Morning Report - 29.11.2023Document10 pagesAshika Morning Report - 29.11.2023Tirthankar DasNo ratings yet

- Brief Technical Report: Gold - XauusdDocument8 pagesBrief Technical Report: Gold - XauusdMilan VaishnavNo ratings yet

- Sri Krishna College of Technology: Cut Off Marks of The Year 2020 - 2021 B.E. / B.Tech. Government QuotaDocument1 pageSri Krishna College of Technology: Cut Off Marks of The Year 2020 - 2021 B.E. / B.Tech. Government QuotaAnitha DNo ratings yet

- Technical Analysis of Stocks Using Psar, Adx, Rsi & Macd: Parabolic SARDocument3 pagesTechnical Analysis of Stocks Using Psar, Adx, Rsi & Macd: Parabolic SARDIVYA PANJWANINo ratings yet

- Daily Quotations: Friday September 29, 2017Document24 pagesDaily Quotations: Friday September 29, 2017Mudassir IjazNo ratings yet

- Technical Report NABEELDocument9 pagesTechnical Report NABEELSheikh NabeelNo ratings yet

- Sada Thioub FIFA 21 - 83 SEASON-REWARD - Prices and Rating - Ultimate Team FutheadDocument1 pageSada Thioub FIFA 21 - 83 SEASON-REWARD - Prices and Rating - Ultimate Team Futheadalpha jshadjkNo ratings yet

- Indian RenewableDocument10 pagesIndian Renewablegisiyab365No ratings yet

- Gaćinović - 90 FIFA Mobile 20 FIFARenderZ PDFDocument1 pageGaćinović - 90 FIFA Mobile 20 FIFARenderZ PDFArouetNo ratings yet

- ATS Active Trader v2.7 Trading System: TELEGRAM ChannelDocument1 pageATS Active Trader v2.7 Trading System: TELEGRAM ChannelKPH BaliNo ratings yet

- 8th ATMA by Dalta Rsi - AnalysisDocument44 pages8th ATMA by Dalta Rsi - Analysissuresh100% (2)

- Estefanía Banini FOUNDATIONS EA FC 24 - 85 - Rating and Price FUTBINDocument1 pageEstefanía Banini FOUNDATIONS EA FC 24 - 85 - Rating and Price FUTBINgitowa9284No ratings yet

- Nifty Today Previous Change: VIX Fut - CloseDocument4 pagesNifty Today Previous Change: VIX Fut - Closeshivratan007No ratings yet

- Ashika Morning Report - 28.02.2024Document11 pagesAshika Morning Report - 28.02.2024Tirthankar DasNo ratings yet

- Sunrise Market Pulse: Technical OverviewDocument4 pagesSunrise Market Pulse: Technical OverviewSana LaganikartaNo ratings yet

- HSL PCG "Currency Daily": 17 February, 2017Document6 pagesHSL PCG "Currency Daily": 17 February, 2017Dinesh ChoudharyNo ratings yet

- HSL PCG "Currency Daily": 23 December, 2016Document6 pagesHSL PCG "Currency Daily": 23 December, 2016shobhaNo ratings yet

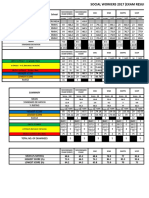

- 123social Workers 2017 Exam ResultDocument2 pages123social Workers 2017 Exam ResultATLASNo ratings yet

- OMSEC Morning Note 16 09 2022Document6 pagesOMSEC Morning Note 16 09 2022Ropafadzo KwarambaNo ratings yet

- Nifty Today Previous Change: Nifty Close vs. VIXDocument4 pagesNifty Today Previous Change: Nifty Close vs. VIXshivratan007No ratings yet

- JS-OMCs 04OCT22Document3 pagesJS-OMCs 04OCT22shahjahanabdulrehmanNo ratings yet

- Pakistan Morning News - 22-Sep-2022Document2 pagesPakistan Morning News - 22-Sep-2022shahjahanabdulrehmanNo ratings yet

- Pakistan Market Technical Outlook 12 Oct 2022Document1 pagePakistan Market Technical Outlook 12 Oct 2022shahjahanabdulrehmanNo ratings yet

- AKD Detailed Sep 21 2022Document8 pagesAKD Detailed Sep 21 2022shahjahanabdulrehmanNo ratings yet

- Sap-Sd Pricing Condition Technique & Pricing Procedure DetermniationDocument33 pagesSap-Sd Pricing Condition Technique & Pricing Procedure DetermniationLaxmi Narsimha Rao Mamidala100% (1)

- L12 - Variance AnalysisDocument44 pagesL12 - Variance Analysis王宇璇No ratings yet

- Departmental Account Problems & AnswerDocument7 pagesDepartmental Account Problems & Answeranand dpiNo ratings yet

- المفهوم المعاصر لأملاك الدولة الخاصةDocument22 pagesالمفهوم المعاصر لأملاك الدولة الخاصةzeidi.samiraaNo ratings yet

- Choosing Right ChartDocument8 pagesChoosing Right ChartBruno VicenteNo ratings yet

- Make My TripDocument2 pagesMake My TripVenkata ReddyNo ratings yet

- GRS Certified PCR, PIR GranulesDocument4 pagesGRS Certified PCR, PIR GranulesDhananjay VishwakarmaNo ratings yet

- HSBC Globle InvoiceDocument2 pagesHSBC Globle Invoicedesaib6189No ratings yet

- Samara UniversityDocument26 pagesSamara UniversityMekoninn HylemariamNo ratings yet

- Shipper Load ConfirmationDocument2 pagesShipper Load ConfirmationSteve Holloway JrNo ratings yet

- Teddy KeychainDocument31 pagesTeddy KeychainLine Larabie100% (2)

- Cremation Shed 2019-20Document29 pagesCremation Shed 2019-20Amjid ManhasNo ratings yet

- Government of West Bengal: Registration Authority: TAMLUK RTO Form 23 Certificate of RegistrationDocument1 pageGovernment of West Bengal: Registration Authority: TAMLUK RTO Form 23 Certificate of Registrationzaid AhmedNo ratings yet

- English For Bussiness I: UtilityDocument22 pagesEnglish For Bussiness I: UtilityChen OppaNo ratings yet

- Evaluacion Final - Escenario 8 - PRIMER BLOQUE-TEORICO - PRACTICO - GLOBALIZACION Y COMPETITIVIDAD - (GRUPO B01)Document7 pagesEvaluacion Final - Escenario 8 - PRIMER BLOQUE-TEORICO - PRACTICO - GLOBALIZACION Y COMPETITIVIDAD - (GRUPO B01)liliana rinconNo ratings yet

- Backward Stochastic Differential Equations in Financial MathematicsDocument34 pagesBackward Stochastic Differential Equations in Financial MathematicslerhlerhNo ratings yet

- Market StructuresDocument8 pagesMarket StructuresJojie De RamosNo ratings yet

- Mathematics of Finance Canadian 8th Edition Brown Kopp Solution ManualDocument41 pagesMathematics of Finance Canadian 8th Edition Brown Kopp Solution Manualflorence100% (34)

- Rates 09 June 2023-Interbank RateDocument1 pageRates 09 June 2023-Interbank RateAnesu ChimhowaNo ratings yet

- AP Economics10042021Document48 pagesAP Economics10042021tushu_hearthackerNo ratings yet

- A Monopolist Faces A Market Demand Curve Given by QDocument1 pageA Monopolist Faces A Market Demand Curve Given by Qtrilocksp SinghNo ratings yet

- Agreement For Pledge of SharesDocument5 pagesAgreement For Pledge of SharesPrerikaNo ratings yet

- Ucsp Quizzes 2019 2020Document5 pagesUcsp Quizzes 2019 2020Dhia Hermoso GuzadoNo ratings yet

- Macroeconomics 4th Edition Hubbard Solutions ManualDocument25 pagesMacroeconomics 4th Edition Hubbard Solutions ManualCourtneyCamposmadj100% (58)

- Lab Wiring 3Document10 pagesLab Wiring 3Nur Afiqah Mohamad NayanNo ratings yet

- SSC CGL Tier-1 Shift 1 - 17 08 2021Document31 pagesSSC CGL Tier-1 Shift 1 - 17 08 2021param.vennelaNo ratings yet