Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

24 viewsStep 1

Step 1

Uploaded by

Carls AligwayThe document records 11 transactions involving the purchase and payment of equipment and supplies, collection of receivables, payment of expenses, withdrawal of cash by the owner, obtaining a loan, and hiring of an accountant by a business. Debits and credits are recorded for cash, equipment, accounts payable, tax expense, owner's capital and drawings, notes payable, and various expense accounts. An income statement and balance sheet are provided at the end to summarize the financial position of the business.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Activity 6Document12 pagesActivity 6danica gomezNo ratings yet

- Quizzes - Chapter 9 - Acctg Cycle of A Service BusinessDocument12 pagesQuizzes - Chapter 9 - Acctg Cycle of A Service BusinessAmie Jane Miranda50% (4)

- Chapter 08Document26 pagesChapter 08Dan ChuaNo ratings yet

- TOP 3-2-045 Small Arms - Hand and Shoulder Weapons and MachinegunsDocument87 pagesTOP 3-2-045 Small Arms - Hand and Shoulder Weapons and Machinegunsktech_stlNo ratings yet

- Training Design For BasketballDocument3 pagesTraining Design For BasketballRiza Mae Buendicho Castor100% (3)

- Alyssa C. Del Pilar Bsa-1 Brfabm1 225Document28 pagesAlyssa C. Del Pilar Bsa-1 Brfabm1 225Ken Sann89% (9)

- Step 1: Transaction Analysis: Chapter 3: The 10-Steps in The Accounting CycleDocument16 pagesStep 1: Transaction Analysis: Chapter 3: The 10-Steps in The Accounting CycleSteffane Mae Sasutil100% (1)

- Video Lesson Chapter 7 Fabm2 Journal and LedgerDocument27 pagesVideo Lesson Chapter 7 Fabm2 Journal and LedgerRon louise Pereyra100% (8)

- Chapter 6 - Business Transactions & Their AnalysisDocument10 pagesChapter 6 - Business Transactions & Their AnalysisJaycel Yam-Yam VerancesNo ratings yet

- 10-3 Adapter For JDBC Install and Users GuideDocument270 pages10-3 Adapter For JDBC Install and Users GuideSushma wMEDINo ratings yet

- Step 3 4Document7 pagesStep 3 4Carls AligwayNo ratings yet

- FAR - Module 6 - Act. 6 AnswerDocument15 pagesFAR - Module 6 - Act. 6 AnswerAngel Justine Bernardo100% (6)

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- Assignment - J&RDocument6 pagesAssignment - J&RJie SapornaNo ratings yet

- S. Roces (Closing)Document11 pagesS. Roces (Closing)Jesseric RomeroNo ratings yet

- Pakam, Khiezna E. Bsac-1b Assignment 3-FarDocument5 pagesPakam, Khiezna E. Bsac-1b Assignment 3-FarKhiezna PakamNo ratings yet

- BKP 9 Accounting EquationDocument16 pagesBKP 9 Accounting EquationPhilpNil8000No ratings yet

- Chapter 2 Practice KEYDocument17 pagesChapter 2 Practice KEYmartinmuebejayiNo ratings yet

- Review Questions: Chart of AccountsDocument4 pagesReview Questions: Chart of AccountsHasan NajiNo ratings yet

- AccountingDocument4 pagesAccountingAnne AlagNo ratings yet

- Cash Flows: Required: Prepare Statement of Cash Flows For The Year 2020 Bank ReconciliationDocument6 pagesCash Flows: Required: Prepare Statement of Cash Flows For The Year 2020 Bank ReconciliationMa.Jennelyn AlarconNo ratings yet

- Department of Accountancy: Holy Angel UniversityDocument14 pagesDepartment of Accountancy: Holy Angel UniversityJohn Edwinson Jara0% (1)

- 2020 AnswerDocument15 pages2020 Answertanjimalomturjo1No ratings yet

- Contoh Soal Recording ProcessDocument8 pagesContoh Soal Recording ProcessWilliam Sugiarto100% (1)

- AssignmentDocument3 pagesAssignmentstefhannyhallegado913No ratings yet

- Accounting 1 QuizDocument2 pagesAccounting 1 QuizGringo KodetaNo ratings yet

- Exercises and Problem Debit 2-A May 2 CashDocument16 pagesExercises and Problem Debit 2-A May 2 CashRenz MoralesNo ratings yet

- Transaction S Assets Liabilities Owner'S Equity Debit Credit Debit Credit Debit CreditDocument2 pagesTransaction S Assets Liabilities Owner'S Equity Debit Credit Debit Credit Debit CreditErineaNo ratings yet

- Tutorial 2 Journalizing PostingDocument5 pagesTutorial 2 Journalizing Postinglalala lalalaNo ratings yet

- Fabm1 Q2 PPT W2Document24 pagesFabm1 Q2 PPT W2esmeraylunaaaNo ratings yet

- BKP 9 Accounting EquationDocument13 pagesBKP 9 Accounting EquationPhilpNil8000No ratings yet

- Topic 3. Recording Business TransactionsDocument35 pagesTopic 3. Recording Business TransactionsHNo ratings yet

- Quiz For Non-AccountantsDocument3 pagesQuiz For Non-AccountantsWycliffe Luther RosalesNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Anne FabmDocument3 pagesAnne FabmISTORYANo ratings yet

- Accounting Cycle Practice Exercises Step 1 To 4Document4 pagesAccounting Cycle Practice Exercises Step 1 To 4mallarilecarNo ratings yet

- CHAPTER 3 Bai TapDocument19 pagesCHAPTER 3 Bai TapPhuong Anh HoangNo ratings yet

- Lecture - RevisedDocument8 pagesLecture - RevisedDanny LeonenNo ratings yet

- MULTIPLE CHOICES-answer KeyDocument7 pagesMULTIPLE CHOICES-answer KeyLiaNo ratings yet

- Quizzes Chapter 9 Acctg Cycle of A Service BusinessDocument26 pagesQuizzes Chapter 9 Acctg Cycle of A Service BusinessJames CastañedaNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their AnalysisDocument18 pagesSol. Man. - Chapter 6 - Business Transactions and Their AnalysisAmie Jane MirandaNo ratings yet

- Chapter 4 - Accounting FundamentalsDocument19 pagesChapter 4 - Accounting Fundamentalsclariza100% (1)

- Journal EntryDocument15 pagesJournal EntryNajOh Marie D ENo ratings yet

- Las 6Document4 pagesLas 6Venus Abarico Banque-AbenionNo ratings yet

- Recording of Business TransactionsDocument30 pagesRecording of Business TransactionsAnthony John BrionesNo ratings yet

- Accounting Cycle SimulationDocument15 pagesAccounting Cycle SimulationMc Clent CervantesNo ratings yet

- Accounting Analysis of TransactionsDocument14 pagesAccounting Analysis of TransactionscamilleNo ratings yet

- To Record The Purchase of EquipmentDocument13 pagesTo Record The Purchase of EquipmentShane Nayah100% (1)

- Problem Set 1Document6 pagesProblem Set 1Arvin Operania TolentinoNo ratings yet

- Accounting Cycle. FAR1Document12 pagesAccounting Cycle. FAR1Gajulin, April JoyNo ratings yet

- Tugas Kelompok Ke-1 Week 3/ Sesi 4: EssayDocument5 pagesTugas Kelompok Ke-1 Week 3/ Sesi 4: Essayadelia zahraNo ratings yet

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- Financial Accounting Ii Sample QuizDocument2 pagesFinancial Accounting Ii Sample QuizThea FloresNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Part Ia Journal Entries - FarDocument5 pagesPart Ia Journal Entries - Farshe kioraNo ratings yet

- Topic 6.Document5 pagesTopic 6.Ernie AbeNo ratings yet

- Chapter 01 Transaction AnalysisDocument28 pagesChapter 01 Transaction Analysistanvir ahmedNo ratings yet

- Advanced Accounting - Test 1: B. Prepare The Journal Entries To Transfer Dan To Corp. Under TrusteeshipDocument6 pagesAdvanced Accounting - Test 1: B. Prepare The Journal Entries To Transfer Dan To Corp. Under TrusteeshipFrilincia Maria HosianaNo ratings yet

- SAP BAPI Training Material PDFDocument3 pagesSAP BAPI Training Material PDFSubhas Chandra SantraNo ratings yet

- DAR Vs CADocument6 pagesDAR Vs CAPamela ParceNo ratings yet

- Irjet V2i233 PDFDocument4 pagesIrjet V2i233 PDFAnonymous SOQFPWBNo ratings yet

- AP Physics1 KE and PE WorksheetDocument3 pagesAP Physics1 KE and PE WorksheetTrevor RivardNo ratings yet

- Position Paper - CFS - KenyaDocument1 pagePosition Paper - CFS - Kenyarw95No ratings yet

- Retaliatory Hacking: The Hack Back: The Legality ofDocument4 pagesRetaliatory Hacking: The Hack Back: The Legality ofjay.reaper4No ratings yet

- Debt SettlementDocument8 pagesDebt Settlementjackie555No ratings yet

- Morcom Public Safety DASDocument2 pagesMorcom Public Safety DASAla'a AbdullaNo ratings yet

- Netflix EnriquezDocument4 pagesNetflix EnriquezJoshua ReyesNo ratings yet

- A Study of Big Data Characteristics: October 2016Document5 pagesA Study of Big Data Characteristics: October 2016Johnny AndreatyNo ratings yet

- Introduction To Python: A Dynamically Typed Programming Language Allowing Multiple Paradigms - OO, FunctionalDocument34 pagesIntroduction To Python: A Dynamically Typed Programming Language Allowing Multiple Paradigms - OO, Functionalsabar5No ratings yet

- Resume: Name: XXXXXX XXXXXX XXXXXXXXXDocument2 pagesResume: Name: XXXXXX XXXXXX XXXXXXXXXAditya Sangita Kisan SonawaneNo ratings yet

- CASE STUDY Booklet Nigeria Final VersionDocument22 pagesCASE STUDY Booklet Nigeria Final VersionMaria ButacuNo ratings yet

- VG5 Series Installation & Quick-Start Manual: (Revision F)Document113 pagesVG5 Series Installation & Quick-Start Manual: (Revision F)Edward Oswaldo Martinez RochaNo ratings yet

- An Engineering Assessment of The Strength and Deformation Properties of Brisbane RocksDocument15 pagesAn Engineering Assessment of The Strength and Deformation Properties of Brisbane RocksG MendietaNo ratings yet

- Conditionals&WishClauses English Exam CenterDocument16 pagesConditionals&WishClauses English Exam CenterI love you Pubg GanjaliNo ratings yet

- 2 Stage Air Compressor Report PDFDocument31 pages2 Stage Air Compressor Report PDFChandan JobanputraNo ratings yet

- Compass 3.5 PL2 Release NoteDocument65 pagesCompass 3.5 PL2 Release NoteValerie SuzeNo ratings yet

- WIKIDocument5 pagesWIKIPiyushNo ratings yet

- MBA Internship ReportDocument47 pagesMBA Internship Reportডক্টর স্ট্রেইঞ্জ100% (1)

- Rosenzweig 1999 0164Document3 pagesRosenzweig 1999 0164Particle Beam Physics LabNo ratings yet

- MN006055A01-AC Enus MOTOTRBO Customer Programming Software 2.0 Online HelpDocument647 pagesMN006055A01-AC Enus MOTOTRBO Customer Programming Software 2.0 Online HelpDyego FelixNo ratings yet

- Unit 2 Creativity PDFDocument40 pagesUnit 2 Creativity PDFNabilah100% (1)

- Activity On Ohms Law For Laboratory (Bautista)Document5 pagesActivity On Ohms Law For Laboratory (Bautista)Dan Patrick BautistaNo ratings yet

- Combination StrategyDocument5 pagesCombination StrategyNadya ShaminiNo ratings yet

- Tetfund Minutes of 49TH Meeting of Research and Publications CommitteeDocument3 pagesTetfund Minutes of 49TH Meeting of Research and Publications CommitteeSnr Comr Ekop VictorNo ratings yet

- Digital Wireless BasicsDocument376 pagesDigital Wireless BasicsGokulraj PandiyanNo ratings yet

Step 1

Step 1

Uploaded by

Carls Aligway0 ratings0% found this document useful (0 votes)

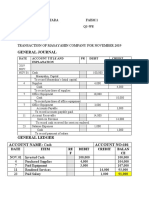

24 views4 pagesThe document records 11 transactions involving the purchase and payment of equipment and supplies, collection of receivables, payment of expenses, withdrawal of cash by the owner, obtaining a loan, and hiring of an accountant by a business. Debits and credits are recorded for cash, equipment, accounts payable, tax expense, owner's capital and drawings, notes payable, and various expense accounts. An income statement and balance sheet are provided at the end to summarize the financial position of the business.

Original Description:

Accounting

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document records 11 transactions involving the purchase and payment of equipment and supplies, collection of receivables, payment of expenses, withdrawal of cash by the owner, obtaining a loan, and hiring of an accountant by a business. Debits and credits are recorded for cash, equipment, accounts payable, tax expense, owner's capital and drawings, notes payable, and various expense accounts. An income statement and balance sheet are provided at the end to summarize the financial position of the business.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

24 views4 pagesStep 1

Step 1

Uploaded by

Carls AligwayThe document records 11 transactions involving the purchase and payment of equipment and supplies, collection of receivables, payment of expenses, withdrawal of cash by the owner, obtaining a loan, and hiring of an accountant by a business. Debits and credits are recorded for cash, equipment, accounts payable, tax expense, owner's capital and drawings, notes payable, and various expense accounts. An income statement and balance sheet are provided at the end to summarize the financial position of the business.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

Step 1

Pre-forma Entries

1. 850,000

Date Account titles Debit Credit

Cash 850,000

Owner’s Capital 90,000

to record owner’s initial investment.

2. Purchased laundry supplies on account.

Date Account titles Debit Credit

Equipment 90,000

Cash 90,000

to record acquisition of equipment on cash

basis

3. Purchased laundry machine for cash

Date Account titles Debit Credit

Equipment 150,000

Accounts Payable 150,000

to record acquisition of equipment on

accounts.

4. Paid taxes and licenses due to the government

Date Account titles Debit Credit

Tax and License Expense 4,000

Cash 4,000

to record the settlement of taxes and

licenses fee.

5. Mr. Severo Santos withdrew P10,000 cash from the business for his personal use.

Date Account titles Debit Credit

Cash 10,000 10,000

Owner’s drawings

to record the settlement of taxes and

licenses fee.

6. The business borrowed money from Allied Bank Corporation

Date Account titles Debit Credit

Cash 100,000 100,000

Notes Payable

to record the loan obtained.

7. Bank issued a debit memo, P1,000 for interest and bank charges.

Date Account titles Debit Credit

Account expense 1,000 1,000

Cash

to record the settlements of accounts

payable.

8. Cash received of P45,000 representing collection from the clients.

Date Account titles Debit Credit

Cash 45,000 45,000

Accounts Receivable

to record the collection of accounts

receivable.

9. Partial payment of accounts, P60,000.

Date Account titles Debit Credit

Accounts Payable 60,000 60,000

Cash

to record the collection of accounts

receivable.

10. Mr. Severo hired an accountant for his business as he has plenty of things to

attain to at P10,000 per month effective April 1.

Date Account titles Debit Credit

Salaries Expense 10,000 10,000

Cash

to record the collection of accounts

receivable.

11. Paid the following expenses: Rental – P5,000; Light and water – P12,000 and

Salaries-10,000

Date Account titles Debit Credit

Expenses 27,000

Cash 27,000

to record the collection of accounts

receivable.

ASSETS LIABILITY EQUITY

1. Cash – 850,000 Owner’s Capital-850,000

2. Equipment- 90,000 Accounts Payable- 90,000

3. equipment- 150,000

Cash- (150,000)

4. Cash (4,000) Tax expense- (4,000)

5. cash( 10,000) Owner’s drawing (10,000)

6. Cash 100,000 Notes Payable- 100,000

7. Cash- (1,000) Expense- (1,000)

8. Cash- 45,000

Accounts Receivable(45,000)

9. Cash- (60,000) Accounts Payable-(60,000)

10. cash- (10,000) Salaries expense- (10,000)

11.Cash (27,000) Expense (27,000)

928, 000 130,000 798,000

You might also like

- Activity 6Document12 pagesActivity 6danica gomezNo ratings yet

- Quizzes - Chapter 9 - Acctg Cycle of A Service BusinessDocument12 pagesQuizzes - Chapter 9 - Acctg Cycle of A Service BusinessAmie Jane Miranda50% (4)

- Chapter 08Document26 pagesChapter 08Dan ChuaNo ratings yet

- TOP 3-2-045 Small Arms - Hand and Shoulder Weapons and MachinegunsDocument87 pagesTOP 3-2-045 Small Arms - Hand and Shoulder Weapons and Machinegunsktech_stlNo ratings yet

- Training Design For BasketballDocument3 pagesTraining Design For BasketballRiza Mae Buendicho Castor100% (3)

- Alyssa C. Del Pilar Bsa-1 Brfabm1 225Document28 pagesAlyssa C. Del Pilar Bsa-1 Brfabm1 225Ken Sann89% (9)

- Step 1: Transaction Analysis: Chapter 3: The 10-Steps in The Accounting CycleDocument16 pagesStep 1: Transaction Analysis: Chapter 3: The 10-Steps in The Accounting CycleSteffane Mae Sasutil100% (1)

- Video Lesson Chapter 7 Fabm2 Journal and LedgerDocument27 pagesVideo Lesson Chapter 7 Fabm2 Journal and LedgerRon louise Pereyra100% (8)

- Chapter 6 - Business Transactions & Their AnalysisDocument10 pagesChapter 6 - Business Transactions & Their AnalysisJaycel Yam-Yam VerancesNo ratings yet

- 10-3 Adapter For JDBC Install and Users GuideDocument270 pages10-3 Adapter For JDBC Install and Users GuideSushma wMEDINo ratings yet

- Step 3 4Document7 pagesStep 3 4Carls AligwayNo ratings yet

- FAR - Module 6 - Act. 6 AnswerDocument15 pagesFAR - Module 6 - Act. 6 AnswerAngel Justine Bernardo100% (6)

- Assignment POSTING TO THE LEDGERDocument7 pagesAssignment POSTING TO THE LEDGERJie SapornaNo ratings yet

- Assignment - J&RDocument6 pagesAssignment - J&RJie SapornaNo ratings yet

- S. Roces (Closing)Document11 pagesS. Roces (Closing)Jesseric RomeroNo ratings yet

- Pakam, Khiezna E. Bsac-1b Assignment 3-FarDocument5 pagesPakam, Khiezna E. Bsac-1b Assignment 3-FarKhiezna PakamNo ratings yet

- BKP 9 Accounting EquationDocument16 pagesBKP 9 Accounting EquationPhilpNil8000No ratings yet

- Chapter 2 Practice KEYDocument17 pagesChapter 2 Practice KEYmartinmuebejayiNo ratings yet

- Review Questions: Chart of AccountsDocument4 pagesReview Questions: Chart of AccountsHasan NajiNo ratings yet

- AccountingDocument4 pagesAccountingAnne AlagNo ratings yet

- Cash Flows: Required: Prepare Statement of Cash Flows For The Year 2020 Bank ReconciliationDocument6 pagesCash Flows: Required: Prepare Statement of Cash Flows For The Year 2020 Bank ReconciliationMa.Jennelyn AlarconNo ratings yet

- Department of Accountancy: Holy Angel UniversityDocument14 pagesDepartment of Accountancy: Holy Angel UniversityJohn Edwinson Jara0% (1)

- 2020 AnswerDocument15 pages2020 Answertanjimalomturjo1No ratings yet

- Contoh Soal Recording ProcessDocument8 pagesContoh Soal Recording ProcessWilliam Sugiarto100% (1)

- AssignmentDocument3 pagesAssignmentstefhannyhallegado913No ratings yet

- Accounting 1 QuizDocument2 pagesAccounting 1 QuizGringo KodetaNo ratings yet

- Exercises and Problem Debit 2-A May 2 CashDocument16 pagesExercises and Problem Debit 2-A May 2 CashRenz MoralesNo ratings yet

- Transaction S Assets Liabilities Owner'S Equity Debit Credit Debit Credit Debit CreditDocument2 pagesTransaction S Assets Liabilities Owner'S Equity Debit Credit Debit Credit Debit CreditErineaNo ratings yet

- Tutorial 2 Journalizing PostingDocument5 pagesTutorial 2 Journalizing Postinglalala lalalaNo ratings yet

- Fabm1 Q2 PPT W2Document24 pagesFabm1 Q2 PPT W2esmeraylunaaaNo ratings yet

- BKP 9 Accounting EquationDocument13 pagesBKP 9 Accounting EquationPhilpNil8000No ratings yet

- Topic 3. Recording Business TransactionsDocument35 pagesTopic 3. Recording Business TransactionsHNo ratings yet

- Quiz For Non-AccountantsDocument3 pagesQuiz For Non-AccountantsWycliffe Luther RosalesNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Anne FabmDocument3 pagesAnne FabmISTORYANo ratings yet

- Accounting Cycle Practice Exercises Step 1 To 4Document4 pagesAccounting Cycle Practice Exercises Step 1 To 4mallarilecarNo ratings yet

- CHAPTER 3 Bai TapDocument19 pagesCHAPTER 3 Bai TapPhuong Anh HoangNo ratings yet

- Lecture - RevisedDocument8 pagesLecture - RevisedDanny LeonenNo ratings yet

- MULTIPLE CHOICES-answer KeyDocument7 pagesMULTIPLE CHOICES-answer KeyLiaNo ratings yet

- Quizzes Chapter 9 Acctg Cycle of A Service BusinessDocument26 pagesQuizzes Chapter 9 Acctg Cycle of A Service BusinessJames CastañedaNo ratings yet

- Sol. Man. - Chapter 6 - Business Transactions and Their AnalysisDocument18 pagesSol. Man. - Chapter 6 - Business Transactions and Their AnalysisAmie Jane MirandaNo ratings yet

- Chapter 4 - Accounting FundamentalsDocument19 pagesChapter 4 - Accounting Fundamentalsclariza100% (1)

- Journal EntryDocument15 pagesJournal EntryNajOh Marie D ENo ratings yet

- Las 6Document4 pagesLas 6Venus Abarico Banque-AbenionNo ratings yet

- Recording of Business TransactionsDocument30 pagesRecording of Business TransactionsAnthony John BrionesNo ratings yet

- Accounting Cycle SimulationDocument15 pagesAccounting Cycle SimulationMc Clent CervantesNo ratings yet

- Accounting Analysis of TransactionsDocument14 pagesAccounting Analysis of TransactionscamilleNo ratings yet

- To Record The Purchase of EquipmentDocument13 pagesTo Record The Purchase of EquipmentShane Nayah100% (1)

- Problem Set 1Document6 pagesProblem Set 1Arvin Operania TolentinoNo ratings yet

- Accounting Cycle. FAR1Document12 pagesAccounting Cycle. FAR1Gajulin, April JoyNo ratings yet

- Tugas Kelompok Ke-1 Week 3/ Sesi 4: EssayDocument5 pagesTugas Kelompok Ke-1 Week 3/ Sesi 4: Essayadelia zahraNo ratings yet

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- Financial Accounting Ii Sample QuizDocument2 pagesFinancial Accounting Ii Sample QuizThea FloresNo ratings yet

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Part Ia Journal Entries - FarDocument5 pagesPart Ia Journal Entries - Farshe kioraNo ratings yet

- Topic 6.Document5 pagesTopic 6.Ernie AbeNo ratings yet

- Chapter 01 Transaction AnalysisDocument28 pagesChapter 01 Transaction Analysistanvir ahmedNo ratings yet

- Advanced Accounting - Test 1: B. Prepare The Journal Entries To Transfer Dan To Corp. Under TrusteeshipDocument6 pagesAdvanced Accounting - Test 1: B. Prepare The Journal Entries To Transfer Dan To Corp. Under TrusteeshipFrilincia Maria HosianaNo ratings yet

- SAP BAPI Training Material PDFDocument3 pagesSAP BAPI Training Material PDFSubhas Chandra SantraNo ratings yet

- DAR Vs CADocument6 pagesDAR Vs CAPamela ParceNo ratings yet

- Irjet V2i233 PDFDocument4 pagesIrjet V2i233 PDFAnonymous SOQFPWBNo ratings yet

- AP Physics1 KE and PE WorksheetDocument3 pagesAP Physics1 KE and PE WorksheetTrevor RivardNo ratings yet

- Position Paper - CFS - KenyaDocument1 pagePosition Paper - CFS - Kenyarw95No ratings yet

- Retaliatory Hacking: The Hack Back: The Legality ofDocument4 pagesRetaliatory Hacking: The Hack Back: The Legality ofjay.reaper4No ratings yet

- Debt SettlementDocument8 pagesDebt Settlementjackie555No ratings yet

- Morcom Public Safety DASDocument2 pagesMorcom Public Safety DASAla'a AbdullaNo ratings yet

- Netflix EnriquezDocument4 pagesNetflix EnriquezJoshua ReyesNo ratings yet

- A Study of Big Data Characteristics: October 2016Document5 pagesA Study of Big Data Characteristics: October 2016Johnny AndreatyNo ratings yet

- Introduction To Python: A Dynamically Typed Programming Language Allowing Multiple Paradigms - OO, FunctionalDocument34 pagesIntroduction To Python: A Dynamically Typed Programming Language Allowing Multiple Paradigms - OO, Functionalsabar5No ratings yet

- Resume: Name: XXXXXX XXXXXX XXXXXXXXXDocument2 pagesResume: Name: XXXXXX XXXXXX XXXXXXXXXAditya Sangita Kisan SonawaneNo ratings yet

- CASE STUDY Booklet Nigeria Final VersionDocument22 pagesCASE STUDY Booklet Nigeria Final VersionMaria ButacuNo ratings yet

- VG5 Series Installation & Quick-Start Manual: (Revision F)Document113 pagesVG5 Series Installation & Quick-Start Manual: (Revision F)Edward Oswaldo Martinez RochaNo ratings yet

- An Engineering Assessment of The Strength and Deformation Properties of Brisbane RocksDocument15 pagesAn Engineering Assessment of The Strength and Deformation Properties of Brisbane RocksG MendietaNo ratings yet

- Conditionals&WishClauses English Exam CenterDocument16 pagesConditionals&WishClauses English Exam CenterI love you Pubg GanjaliNo ratings yet

- 2 Stage Air Compressor Report PDFDocument31 pages2 Stage Air Compressor Report PDFChandan JobanputraNo ratings yet

- Compass 3.5 PL2 Release NoteDocument65 pagesCompass 3.5 PL2 Release NoteValerie SuzeNo ratings yet

- WIKIDocument5 pagesWIKIPiyushNo ratings yet

- MBA Internship ReportDocument47 pagesMBA Internship Reportডক্টর স্ট্রেইঞ্জ100% (1)

- Rosenzweig 1999 0164Document3 pagesRosenzweig 1999 0164Particle Beam Physics LabNo ratings yet

- MN006055A01-AC Enus MOTOTRBO Customer Programming Software 2.0 Online HelpDocument647 pagesMN006055A01-AC Enus MOTOTRBO Customer Programming Software 2.0 Online HelpDyego FelixNo ratings yet

- Unit 2 Creativity PDFDocument40 pagesUnit 2 Creativity PDFNabilah100% (1)

- Activity On Ohms Law For Laboratory (Bautista)Document5 pagesActivity On Ohms Law For Laboratory (Bautista)Dan Patrick BautistaNo ratings yet

- Combination StrategyDocument5 pagesCombination StrategyNadya ShaminiNo ratings yet

- Tetfund Minutes of 49TH Meeting of Research and Publications CommitteeDocument3 pagesTetfund Minutes of 49TH Meeting of Research and Publications CommitteeSnr Comr Ekop VictorNo ratings yet

- Digital Wireless BasicsDocument376 pagesDigital Wireless BasicsGokulraj PandiyanNo ratings yet