Professional Documents

Culture Documents

Taxation of Employment Income

Taxation of Employment Income

Uploaded by

Jamvy Jose FernandezCopyright:

Available Formats

You might also like

- Sairam Pothuri Mar 20241713954431417Document1 pageSairam Pothuri Mar 20241713954431417Sai Ram PothuriNo ratings yet

- TEST BANK For Advanced Financial Accounting 13th Edition by Theodore Christensen Verified Chapter's 1 - 20 CompleteDocument70 pagesTEST BANK For Advanced Financial Accounting 13th Edition by Theodore Christensen Verified Chapter's 1 - 20 Completemarcuskenyatta275No ratings yet

- Week 1 Assignment Fundamental Principles in TaxationDocument5 pagesWeek 1 Assignment Fundamental Principles in TaxationIan Paolo CaylanNo ratings yet

- SW05Document7 pagesSW05Nadi HoodNo ratings yet

- Earnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928Document2 pagesEarnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928mashaNo ratings yet

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- f1040 2007Document2 pagesf1040 2007paycheck1No ratings yet

- Individual Taxpayers (Tabag2021)Document14 pagesIndividual Taxpayers (Tabag2021)Veel Creed100% (1)

- IllustrationsDocument3 pagesIllustrationsKristine Ira ConcepcionNo ratings yet

- Approved CAE - BSA BSMA BSAIS BSIA - ACC 311 - Clarito - Page-0055-0064Document17 pagesApproved CAE - BSA BSMA BSAIS BSIA - ACC 311 - Clarito - Page-0055-0064Peng GuinNo ratings yet

- 6728 Statement of Comprehensive IncomeDocument4 pages6728 Statement of Comprehensive IncomeJane ValenciaNo ratings yet

- CHAPTER 11 Compensation IncomeDocument15 pagesCHAPTER 11 Compensation IncomeGIRLNo ratings yet

- Tax Chap 14 To 15Document7 pagesTax Chap 14 To 15Jea XeleneNo ratings yet

- Ia3 BSDocument5 pagesIa3 BSMary Joy CabilNo ratings yet

- Assignment 1 - Discontinued Operation Test 10 ItemsDocument4 pagesAssignment 1 - Discontinued Operation Test 10 ItemsJeane Mae BooNo ratings yet

- Ias 12Document32 pagesIas 12Cat ValentineNo ratings yet

- Gross Estate QuizDocument29 pagesGross Estate QuizGanie Mar R. BiasonNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- BIR Form No. 1801 (Estate Tax Return)Document2 pagesBIR Form No. 1801 (Estate Tax Return)Juan Miguel UngsodNo ratings yet

- Statement of Comprehensive Income - Ia3Document16 pagesStatement of Comprehensive Income - Ia3SharjaaahNo ratings yet

- Taxation 2Document11 pagesTaxation 2MerEl Urbano De GuzmanNo ratings yet

- FA Mod1 2013Document551 pagesFA Mod1 2013Anoop Singh100% (2)

- Which of The Following Is/are False?: Taxation EasyDocument5 pagesWhich of The Following Is/are False?: Taxation EasysophiaNo ratings yet

- ACCN08B. Module 3 - Statement of Comprehensive IncomeDocument6 pagesACCN08B. Module 3 - Statement of Comprehensive IncomeYolly DiazNo ratings yet

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Yes, Since The Leased Portion Is Not ActuallyDocument2 pagesYes, Since The Leased Portion Is Not ActuallyResty VillaroelNo ratings yet

- Syllabi HRMA 40023 Project Management 2Document6 pagesSyllabi HRMA 40023 Project Management 2BSMA Third YearNo ratings yet

- Advanced Accounting 2 Guerrero 2013 Solution ManuaDocument2 pagesAdvanced Accounting 2 Guerrero 2013 Solution Manuajay BearNo ratings yet

- Estate TaxDocument2 pagesEstate Taxucc second yearNo ratings yet

- Philippine Christian University: Midterm Examination inDocument5 pagesPhilippine Christian University: Midterm Examination inleo pigafetaNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Chapter 1 Intro To AccoutingDocument32 pagesChapter 1 Intro To Accoutingprincekelvin09No ratings yet

- TAX. M-1401 Estate Tax: Basic TerminologiesDocument33 pagesTAX. M-1401 Estate Tax: Basic TerminologiesJimmyChaoNo ratings yet

- PRE BATTERY EXAM 2018 Part 1 FARDocument11 pagesPRE BATTERY EXAM 2018 Part 1 FARFrl RizalNo ratings yet

- Chapter 16 AnsDocument7 pagesChapter 16 AnsDave Manalo100% (5)

- Income Taxation IndividualDocument6 pagesIncome Taxation IndividualJessa BeloyNo ratings yet

- TAX2 3RD ED Solutions ManualDocument44 pagesTAX2 3RD ED Solutions ManualEzekiel Malazzab67% (6)

- Basic Accounting Equation Exercises 2Document2 pagesBasic Accounting Equation Exercises 2Ace Joseph TabaderoNo ratings yet

- 68125672575bdf96fc857f403531f1c9-copyDocument9 pages68125672575bdf96fc857f403531f1c9-copyyour unreal0% (1)

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- Quiz 2 Answer Key ACCO 30193Document1 pageQuiz 2 Answer Key ACCO 30193Lyra EscosioNo ratings yet

- Philippine Christian University: Income Taxation (Midterm Exam)Document5 pagesPhilippine Christian University: Income Taxation (Midterm Exam)Michael Brian Torres100% (1)

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- Midterm Quiz 1 Gross IncomeDocument3 pagesMidterm Quiz 1 Gross IncomeMjhayeNo ratings yet

- Conceptual Framework and Accounting Standards What Are Financial Markets?Document6 pagesConceptual Framework and Accounting Standards What Are Financial Markets?edrianclydeNo ratings yet

- DocumentDocument2 pagesDocumentAisaka Taiga0% (1)

- SAP Lessons 1-5Document53 pagesSAP Lessons 1-5143incomeNo ratings yet

- Retained EarningsDocument9 pagesRetained EarningsCamille GarciaNo ratings yet

- Far-Pw 5.23Document9 pagesFar-Pw 5.23Miguel ManagoNo ratings yet

- Intacc2 - Assignment 4Document3 pagesIntacc2 - Assignment 4Gray JavierNo ratings yet

- Intermediate Accounting III ReviewerDocument3 pagesIntermediate Accounting III ReviewerRenalyn PascuaNo ratings yet

- Value Added TaxDocument6 pagesValue Added TaxjamNo ratings yet

- Final Exam - Comprehensive - 10.24.16Document5 pagesFinal Exam - Comprehensive - 10.24.16YamateNo ratings yet

- PUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredDocument12 pagesPUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredGabrielle Marie RiveraNo ratings yet

- Partnership - Operation, LiquidationDocument4 pagesPartnership - Operation, LiquidationKenneth Bryan Tegerero TegioNo ratings yet

- AP.3403 Audit of Intangible AssetsDocument3 pagesAP.3403 Audit of Intangible AssetsMonica GarciaNo ratings yet

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- Illustration VATDocument8 pagesIllustration VATLeah Mae NolascoNo ratings yet

- M6 - Estate Tax Payable Students'Document17 pagesM6 - Estate Tax Payable Students'micaella pasionNo ratings yet

- Non Taxable Employee BenefitsDocument7 pagesNon Taxable Employee BenefitsGeomari D. BigalbalNo ratings yet

- Oroka Val's ThesisDocument274 pagesOroka Val's ThesisJamvy Jose FernandezNo ratings yet

- Ijbmer 2020110205Document7 pagesIjbmer 2020110205Jamvy Jose FernandezNo ratings yet

- Assignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Document2 pagesAssignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Jamvy Jose FernandezNo ratings yet

- Corporate TaxationDocument7 pagesCorporate TaxationJamvy Jose FernandezNo ratings yet

- Taxation of Other Items of Gross IncomeDocument6 pagesTaxation of Other Items of Gross IncomeJamvy Jose FernandezNo ratings yet

- Insurance AssignmentDocument4 pagesInsurance AssignmentJamvy Jose FernandezNo ratings yet

- Activity 3 Answer KeysDocument16 pagesActivity 3 Answer KeysJamvy Jose FernandezNo ratings yet

- Bill EditingDocument1 pageBill Editingjaspreet singhNo ratings yet

- Vat ComputationDocument18 pagesVat ComputationWillowNo ratings yet

- Morris Assoc Owned by Cindy Morris Provides Accounting ServDocument1 pageMorris Assoc Owned by Cindy Morris Provides Accounting ServAmit PandeyNo ratings yet

- Invoice INV-0030Document1 pageInvoice INV-0030Threshing FlowNo ratings yet

- Girnar Insurance Brokers Private Limited: Salary Slip For The Month of February - 2023Document2 pagesGirnar Insurance Brokers Private Limited: Salary Slip For The Month of February - 2023karanmitroo1No ratings yet

- Taxation - Reviewer TaskDocument3 pagesTaxation - Reviewer TaskLaguna HistoryNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- IPR ProjectDocument32 pagesIPR ProjectHemantPrajapatiNo ratings yet

- Table of Contents Answers: Pre-TestDocument67 pagesTable of Contents Answers: Pre-TestLachlanNo ratings yet

- Brief Introduction On Salary Components and Their Income Tax ApplicabilityDocument21 pagesBrief Introduction On Salary Components and Their Income Tax ApplicabilityAkshay ChauhanNo ratings yet

- CT Corporation IRS Form 6166 Certification of Tax ResidencyDocument2 pagesCT Corporation IRS Form 6166 Certification of Tax ResidencyMukesh YadavNo ratings yet

- TaxationDocument20 pagesTaxationKlare CadornaNo ratings yet

- Fabm 2 Endterm ExaminationDocument4 pagesFabm 2 Endterm Examinationreverewh ouyNo ratings yet

- Business Taxation 2 Lesson 1Document5 pagesBusiness Taxation 2 Lesson 1Darlyn Dalida San PedroNo ratings yet

- April Sathish Pay SlipDocument1 pageApril Sathish Pay Slipmsathish7428No ratings yet

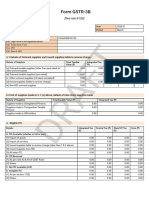

- Form GSTR-3B: (See Rule 61 (5) )Document2 pagesForm GSTR-3B: (See Rule 61 (5) )Pabitra Kumar PrustyNo ratings yet

- 2018 Xiaohe Huang Tax ReturnDocument48 pages2018 Xiaohe Huang Tax ReturnKaren Xie100% (2)

- MSC - A & F - Sigfred. G. Janga - 2014Document72 pagesMSC - A & F - Sigfred. G. Janga - 2014Felix MgimbaNo ratings yet

- Amol Srivastava April Income TaxDocument1 pageAmol Srivastava April Income TaxRemruata FanaiNo ratings yet

- Profit & Loss (Standard) : PT Fifa - Resa HarismaDocument1 pageProfit & Loss (Standard) : PT Fifa - Resa HarismaBikin OrtubanggaNo ratings yet

- Trial Salary SlipDocument5 pagesTrial Salary SlipTvs12346No ratings yet

- Assessment and Returns of IncomeDocument13 pagesAssessment and Returns of IncomeMaster KihimbwaNo ratings yet

- ACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Document1 pageACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Tenghour LyNo ratings yet

- Excersice VATDocument2 pagesExcersice VATThu HươngNo ratings yet

- Mominul Joyanto Mosarraf Soumendro HanifDocument5 pagesMominul Joyanto Mosarraf Soumendro HanifbanglauserNo ratings yet

- P45 - Ms Wenyi Zhao (2022) - Employee 4Document3 pagesP45 - Ms Wenyi Zhao (2022) - Employee 4Ming WuNo ratings yet

- Amazon 5Document2 pagesAmazon 5Vishakha SNo ratings yet

Taxation of Employment Income

Taxation of Employment Income

Uploaded by

Jamvy Jose FernandezOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxation of Employment Income

Taxation of Employment Income

Uploaded by

Jamvy Jose FernandezCopyright:

Available Formats

Taxation of Employment Income

Taxability of Employees

Minimum Wage Earner Regular Employee

An individual recipient of a minimum wage An employee not considered MWE.

as fixed by RTWPB of the DOLE (DOLE

can fix the rate or compensation per region)

Compensation Income is Exempt from tax

including HONsHa (holiday, overtime, Taxable: RIT or Final Tax

night shift differential, hazard pay).

Other Compensation or Other Income

Subject to TAX.

Compensation Income

Any remuneration for services performed by an employee for his employer under an

employee-employer relationship, UNLESS specifically EXCLUDED by the Tax Code

(exclusions from Gross income under SEC 32B). (Sec. 2 (a) BIR RR No. 8-2018

1. Regular Compensation

2. Supplemental Compensation

1. HONsHa

2. Fees, Commissions, Emoluments, and Honoraria

3. Retirement and Separation Pay

4. Profit Sharing and Taxable Bonuses

5. Exercise of Stock Option

6. 13th Month Pay and Other Benefits

Non-Taxable Income Benefits

Rule: Must meet the requirements, if not it is TAXABLE.

1. Exempt Retirement / Pension / Termination Benefits

1. Retirement / Pensions – 50 years old -1 first time -10 years na sa company RP

2. Termination – must be beyond the control of the employee EXCLUDED IN G.I

3. De Minimis Benefits

4. 13th Month Pay and Other Benefits not exceeding 90, 000 (INCLUDED IN G.I &

SUBSEQUENTLY DEDUCTED)

De-Minimis Benefits (Amount provided by law is exempt. Excess will be included as

an item of Gross Income)

(a) Monetized unused VL Credits of private employees not exceeding ten (10) days

during the year; (For example: Daily wage = 700, 12 days VL) (10 days is exempt

however the 2 days will be taxable = 2 x 700 = P1, 400)

(b) Monetized value of VL and SL credits paid to government officials and

employees; (10) days

(c) Medical cash allowance to dependents of employees, not exceeding P1, 500 per

employee per semester of P 250 per month; (1500 / 6 (semi annual = 250)

(d) Rice subsidy of P2, 000 or one sack of 50kg. rice per month amounting to not more

than P2, 000; (to compute for annual x 12)

(e) Uniform and clothing allowance not exceeding P6, 000 per annum; (yearly)

(f) Actual medical assistance not exceeding P10, 000 per annum; (RR No. 5-2011)

(yearly)

(g) Laundry allowance not exceeding P300 per month; (RR No. 5-2011) (Monthly)

(h) Employees achievement awards not exceeding P10,000 (RR No. 5-2011) (yearly)

(i) Gifts given during Christmas and major anniversary celebrations not exceeding

P5,000 per employee per annum; (RR No. 5-2011) (yearly)

(j) Daily meal allowance for overtime work and night/graveyard shift not exceeding

twenty-five percent (25%) of the basic minimum wage on a per region basis; (RR

No. 5-2011)

(k) Benefits received by an employee by virtue of a CBA and productivity incentive

schemes provided that the total monetary value received from both CBA and

productivity incentive schemes combined do not exceed P10, 000 per employee per

taxable year. (RR No. 5-2015)

Mandatory Contributions – deduction

GSIS, SSS, Medicare and Other Contributions – GSIS, SSS, Medicare and Pag-Ibig

contributions, and union dues of individuals.

Taxation of Compensation Income

Individuals earning purely compensation income shall be taxed based on the income tax rates

by the TRAIN law.

EXAMPLE:

A compensation income earner has a:

Monthly Compensation Income 65, 000;

13th Month pay 65, 000(13th & OB); Productivity based bonus 50, 000 (sc); Rice Allowance

3,000/month (de minimis subject to amt provided by law); Clothing Allowance 7,000;

Laundry 500/month; Contributions to Pag-Ibig/SSS/Union Dues 11,000.

1. Compute the taxable income if the employee is a Rank and File Employee

Compensation

Regular Compensation Income (65,000*12)

780,000

Supplemental Compensation 50,000

13th Month pay and other benefits (65,000

+ 15,400) 80,400

- Non-taxable and other benefits 80,400

- Mandatory Contributions 11,000

TAXABLE COMPENSATION

INCOME 819,000

(819, 000 – 800, 000) = 19, 000 x 30% = 5, 700 + 130, 000 = Tax Due: 135, 700

2. Compute the taxable income if the employee is a Managerial employee

Compensation

Regular Compensation Income (65,000*12)

780,000

Supplemental Compensation 50,000

13th Month pay and other benefits

65, 000

- Non-taxable and other benefits 65,000

- Mandatory Contributions 11,000

TAXABLE COMPENSATION

INCOME 819,000

Income Tax Filing (Substituted Filing System)

Taxpayer is no longer required to file income tax return provided the following requisites are

present:

1. Must be pure compensation earner. No other source of income.

2. Must have only one employer.

3. The tax withheld must be of equal to tax due on tax payable.

- Employee must file an Information Tax Return

- The BIR Form 1604 serves as Tax Return of the taxpayer.

You might also like

- Sairam Pothuri Mar 20241713954431417Document1 pageSairam Pothuri Mar 20241713954431417Sai Ram PothuriNo ratings yet

- TEST BANK For Advanced Financial Accounting 13th Edition by Theodore Christensen Verified Chapter's 1 - 20 CompleteDocument70 pagesTEST BANK For Advanced Financial Accounting 13th Edition by Theodore Christensen Verified Chapter's 1 - 20 Completemarcuskenyatta275No ratings yet

- Week 1 Assignment Fundamental Principles in TaxationDocument5 pagesWeek 1 Assignment Fundamental Principles in TaxationIan Paolo CaylanNo ratings yet

- SW05Document7 pagesSW05Nadi HoodNo ratings yet

- Earnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928Document2 pagesEarnings Statement: Benny D Oakley 11191 S. Wheeling Pike Fairmount IN 46928mashaNo ratings yet

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- f1040 2007Document2 pagesf1040 2007paycheck1No ratings yet

- Individual Taxpayers (Tabag2021)Document14 pagesIndividual Taxpayers (Tabag2021)Veel Creed100% (1)

- IllustrationsDocument3 pagesIllustrationsKristine Ira ConcepcionNo ratings yet

- Approved CAE - BSA BSMA BSAIS BSIA - ACC 311 - Clarito - Page-0055-0064Document17 pagesApproved CAE - BSA BSMA BSAIS BSIA - ACC 311 - Clarito - Page-0055-0064Peng GuinNo ratings yet

- 6728 Statement of Comprehensive IncomeDocument4 pages6728 Statement of Comprehensive IncomeJane ValenciaNo ratings yet

- CHAPTER 11 Compensation IncomeDocument15 pagesCHAPTER 11 Compensation IncomeGIRLNo ratings yet

- Tax Chap 14 To 15Document7 pagesTax Chap 14 To 15Jea XeleneNo ratings yet

- Ia3 BSDocument5 pagesIa3 BSMary Joy CabilNo ratings yet

- Assignment 1 - Discontinued Operation Test 10 ItemsDocument4 pagesAssignment 1 - Discontinued Operation Test 10 ItemsJeane Mae BooNo ratings yet

- Ias 12Document32 pagesIas 12Cat ValentineNo ratings yet

- Gross Estate QuizDocument29 pagesGross Estate QuizGanie Mar R. BiasonNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- BIR Form No. 1801 (Estate Tax Return)Document2 pagesBIR Form No. 1801 (Estate Tax Return)Juan Miguel UngsodNo ratings yet

- Statement of Comprehensive Income - Ia3Document16 pagesStatement of Comprehensive Income - Ia3SharjaaahNo ratings yet

- Taxation 2Document11 pagesTaxation 2MerEl Urbano De GuzmanNo ratings yet

- FA Mod1 2013Document551 pagesFA Mod1 2013Anoop Singh100% (2)

- Which of The Following Is/are False?: Taxation EasyDocument5 pagesWhich of The Following Is/are False?: Taxation EasysophiaNo ratings yet

- ACCN08B. Module 3 - Statement of Comprehensive IncomeDocument6 pagesACCN08B. Module 3 - Statement of Comprehensive IncomeYolly DiazNo ratings yet

- Case 9-30 Master Budget With Supporting SchedulesDocument2 pagesCase 9-30 Master Budget With Supporting SchedulesCindy Tran20% (5)

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Yes, Since The Leased Portion Is Not ActuallyDocument2 pagesYes, Since The Leased Portion Is Not ActuallyResty VillaroelNo ratings yet

- Syllabi HRMA 40023 Project Management 2Document6 pagesSyllabi HRMA 40023 Project Management 2BSMA Third YearNo ratings yet

- Advanced Accounting 2 Guerrero 2013 Solution ManuaDocument2 pagesAdvanced Accounting 2 Guerrero 2013 Solution Manuajay BearNo ratings yet

- Estate TaxDocument2 pagesEstate Taxucc second yearNo ratings yet

- Philippine Christian University: Midterm Examination inDocument5 pagesPhilippine Christian University: Midterm Examination inleo pigafetaNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Chapter 1 Intro To AccoutingDocument32 pagesChapter 1 Intro To Accoutingprincekelvin09No ratings yet

- TAX. M-1401 Estate Tax: Basic TerminologiesDocument33 pagesTAX. M-1401 Estate Tax: Basic TerminologiesJimmyChaoNo ratings yet

- PRE BATTERY EXAM 2018 Part 1 FARDocument11 pagesPRE BATTERY EXAM 2018 Part 1 FARFrl RizalNo ratings yet

- Chapter 16 AnsDocument7 pagesChapter 16 AnsDave Manalo100% (5)

- Income Taxation IndividualDocument6 pagesIncome Taxation IndividualJessa BeloyNo ratings yet

- TAX2 3RD ED Solutions ManualDocument44 pagesTAX2 3RD ED Solutions ManualEzekiel Malazzab67% (6)

- Basic Accounting Equation Exercises 2Document2 pagesBasic Accounting Equation Exercises 2Ace Joseph TabaderoNo ratings yet

- 68125672575bdf96fc857f403531f1c9-copyDocument9 pages68125672575bdf96fc857f403531f1c9-copyyour unreal0% (1)

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- Quiz 2 Answer Key ACCO 30193Document1 pageQuiz 2 Answer Key ACCO 30193Lyra EscosioNo ratings yet

- Philippine Christian University: Income Taxation (Midterm Exam)Document5 pagesPhilippine Christian University: Income Taxation (Midterm Exam)Michael Brian Torres100% (1)

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- Midterm Quiz 1 Gross IncomeDocument3 pagesMidterm Quiz 1 Gross IncomeMjhayeNo ratings yet

- Conceptual Framework and Accounting Standards What Are Financial Markets?Document6 pagesConceptual Framework and Accounting Standards What Are Financial Markets?edrianclydeNo ratings yet

- DocumentDocument2 pagesDocumentAisaka Taiga0% (1)

- SAP Lessons 1-5Document53 pagesSAP Lessons 1-5143incomeNo ratings yet

- Retained EarningsDocument9 pagesRetained EarningsCamille GarciaNo ratings yet

- Far-Pw 5.23Document9 pagesFar-Pw 5.23Miguel ManagoNo ratings yet

- Intacc2 - Assignment 4Document3 pagesIntacc2 - Assignment 4Gray JavierNo ratings yet

- Intermediate Accounting III ReviewerDocument3 pagesIntermediate Accounting III ReviewerRenalyn PascuaNo ratings yet

- Value Added TaxDocument6 pagesValue Added TaxjamNo ratings yet

- Final Exam - Comprehensive - 10.24.16Document5 pagesFinal Exam - Comprehensive - 10.24.16YamateNo ratings yet

- PUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredDocument12 pagesPUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredGabrielle Marie RiveraNo ratings yet

- Partnership - Operation, LiquidationDocument4 pagesPartnership - Operation, LiquidationKenneth Bryan Tegerero TegioNo ratings yet

- AP.3403 Audit of Intangible AssetsDocument3 pagesAP.3403 Audit of Intangible AssetsMonica GarciaNo ratings yet

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- Illustration VATDocument8 pagesIllustration VATLeah Mae NolascoNo ratings yet

- M6 - Estate Tax Payable Students'Document17 pagesM6 - Estate Tax Payable Students'micaella pasionNo ratings yet

- Non Taxable Employee BenefitsDocument7 pagesNon Taxable Employee BenefitsGeomari D. BigalbalNo ratings yet

- Oroka Val's ThesisDocument274 pagesOroka Val's ThesisJamvy Jose FernandezNo ratings yet

- Ijbmer 2020110205Document7 pagesIjbmer 2020110205Jamvy Jose FernandezNo ratings yet

- Assignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Document2 pagesAssignment (Page203) - Jamvy Fernandez - BSA2.1 - CY2Jamvy Jose FernandezNo ratings yet

- Corporate TaxationDocument7 pagesCorporate TaxationJamvy Jose FernandezNo ratings yet

- Taxation of Other Items of Gross IncomeDocument6 pagesTaxation of Other Items of Gross IncomeJamvy Jose FernandezNo ratings yet

- Insurance AssignmentDocument4 pagesInsurance AssignmentJamvy Jose FernandezNo ratings yet

- Activity 3 Answer KeysDocument16 pagesActivity 3 Answer KeysJamvy Jose FernandezNo ratings yet

- Bill EditingDocument1 pageBill Editingjaspreet singhNo ratings yet

- Vat ComputationDocument18 pagesVat ComputationWillowNo ratings yet

- Morris Assoc Owned by Cindy Morris Provides Accounting ServDocument1 pageMorris Assoc Owned by Cindy Morris Provides Accounting ServAmit PandeyNo ratings yet

- Invoice INV-0030Document1 pageInvoice INV-0030Threshing FlowNo ratings yet

- Girnar Insurance Brokers Private Limited: Salary Slip For The Month of February - 2023Document2 pagesGirnar Insurance Brokers Private Limited: Salary Slip For The Month of February - 2023karanmitroo1No ratings yet

- Taxation - Reviewer TaskDocument3 pagesTaxation - Reviewer TaskLaguna HistoryNo ratings yet

- Problems Accouting For Deferred Taxes Webinar ReoDocument7 pagesProblems Accouting For Deferred Taxes Webinar ReocrookshanksNo ratings yet

- IPR ProjectDocument32 pagesIPR ProjectHemantPrajapatiNo ratings yet

- Table of Contents Answers: Pre-TestDocument67 pagesTable of Contents Answers: Pre-TestLachlanNo ratings yet

- Brief Introduction On Salary Components and Their Income Tax ApplicabilityDocument21 pagesBrief Introduction On Salary Components and Their Income Tax ApplicabilityAkshay ChauhanNo ratings yet

- CT Corporation IRS Form 6166 Certification of Tax ResidencyDocument2 pagesCT Corporation IRS Form 6166 Certification of Tax ResidencyMukesh YadavNo ratings yet

- TaxationDocument20 pagesTaxationKlare CadornaNo ratings yet

- Fabm 2 Endterm ExaminationDocument4 pagesFabm 2 Endterm Examinationreverewh ouyNo ratings yet

- Business Taxation 2 Lesson 1Document5 pagesBusiness Taxation 2 Lesson 1Darlyn Dalida San PedroNo ratings yet

- April Sathish Pay SlipDocument1 pageApril Sathish Pay Slipmsathish7428No ratings yet

- Form GSTR-3B: (See Rule 61 (5) )Document2 pagesForm GSTR-3B: (See Rule 61 (5) )Pabitra Kumar PrustyNo ratings yet

- 2018 Xiaohe Huang Tax ReturnDocument48 pages2018 Xiaohe Huang Tax ReturnKaren Xie100% (2)

- MSC - A & F - Sigfred. G. Janga - 2014Document72 pagesMSC - A & F - Sigfred. G. Janga - 2014Felix MgimbaNo ratings yet

- Amol Srivastava April Income TaxDocument1 pageAmol Srivastava April Income TaxRemruata FanaiNo ratings yet

- Profit & Loss (Standard) : PT Fifa - Resa HarismaDocument1 pageProfit & Loss (Standard) : PT Fifa - Resa HarismaBikin OrtubanggaNo ratings yet

- Trial Salary SlipDocument5 pagesTrial Salary SlipTvs12346No ratings yet

- Assessment and Returns of IncomeDocument13 pagesAssessment and Returns of IncomeMaster KihimbwaNo ratings yet

- ACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Document1 pageACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Tenghour LyNo ratings yet

- Excersice VATDocument2 pagesExcersice VATThu HươngNo ratings yet

- Mominul Joyanto Mosarraf Soumendro HanifDocument5 pagesMominul Joyanto Mosarraf Soumendro HanifbanglauserNo ratings yet

- P45 - Ms Wenyi Zhao (2022) - Employee 4Document3 pagesP45 - Ms Wenyi Zhao (2022) - Employee 4Ming WuNo ratings yet

- Amazon 5Document2 pagesAmazon 5Vishakha SNo ratings yet