Professional Documents

Culture Documents

Tugas AKL 1 TM 9

Tugas AKL 1 TM 9

Uploaded by

Dila PujiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tugas AKL 1 TM 9

Tugas AKL 1 TM 9

Uploaded by

Dila PujiCopyright:

Available Formats

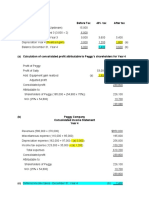

TUGAS EXERCISE

AKUNTANSI KEUANGAN LANJUTAN 1

E. 8-1

Alokasi Sango’s Net Income:

Controlling Interest (income)

($250,000 x 60% x 6/12) + ($250,000 x 80% x 6/12) $175,000

NCI Share

($250,000 x 40% x 6/12) + ($250,000 x 20% x 6/12) $75,000

Preacquisition Income

($0) $0

Alokasi Sango’s Dividends:

Dividends to Pablo

($40,000 x 60%) + ($40,000 x 80%) $56,000

NCI

($40,000 x 40%) + ($40,000 x 20%) $24,000

Preacquisition Interest

($0) $0

E. 8-2

1. Cost to obtain control over Edma HF $99,000

Implied fair value of Edma HF ($99,000 / 45%) $220,000

The fair value of 15% interest ($220,000 x 15%) $33,000

Cost to obtain 30% of Edma HF’s interest $31,000

($10,000 + $21,000)

Gain from revaluation of investment in Edma HF $ 2,000

2. Income from Edma HF in 2014 $ 9,000

($60,000 x 60% x 3 /12)

3. Cost to purchase 5% interest $10,000

Cost to purchase 10% interest $21,000

Cost to purchase 45% interest $99,000

Gain on revaluation of investment $ 2,000

Income from Edma HF in 2014 $ 9,000

Investment in Edma HF at the end of 2014 $141,000

E. 8-3

Investment in Siomay $5.400.000

Cash $5.400.000

Investment in Siomay $675.000

Income from Siomay ($750.000 x 90%) $675.000

Cash $50.000

Investment in Siomay $50.000

E. 8-4

Implied FV of investment ($3,500,000 / 80%) $4,375,000

Carrying value of share sold ($4,375,00 x 70%) 3,062,500

Selling value 3,000,000

Loss from the deconsolidation $62,500

E. 8-6

1. Investment in Ngon

Investment balance Dec 31, 2016 ($2,400,000 x 90%) $2,160,000

Cost of new shares ($24 x 100,000 shares) 2,400,000

Investment in Ngon after new investment $4,560,000

2. Goodwill from new investment

Ngon’s stockholders’ equity after issuance

($2,400,000 + $2,400,000) $4,800,000

Huanh’s ownership percentage

(180,000 + 100,000 shares) / 300,000 shares 0,9333

Huanh’s BV after issuance 4,480,000

Less : Huanh’s BV before issuance (2,160,000)

Increase i BV from purchase

(BV acquired) $2,320,000

Cost of 100,000 shares $2,400,000

BV acquired (2,320,000)

Less : undervalued land ($10,000 x 0,9333) 9,333

Goodwill from acquisition of new shares 70,667

Total goodwill ($70,667/0,9333) $75,717,347

P. 8-1

Preliminary computations:

Price to acquire 75% percent interest of Rayan SAL $3,750,000

Implied fair value of Rayan SAL

($3,750,000 / 75%) $5,000,000

Rayan SAL’s stockholders’ equity at July 1 $4,850,000

Excess of fair value over book value $ 150,000

Excess allocated to:

Overvalued inventory ($100,000)

Goodwill $250,000 c

75% of Rayan SAL’s net income for half year $487,500

(75% x ($4,800,000 - $2,700,000 + $150,000 – $950,000) / 2)

Amortization of overvalued inventory $ 75,000

(75% x $100,000)

Unrealized gain on sale of land ($ 112,500)

(75% x $150,000)

Income from Rayan SAL’s $ 450,000 a

25% of Rayan SAL’s net income $ 162,500

(25% x ($4,800,000 - $2,700,000 + $150,000– $950,000) / 2)

Amortization of overvalued inventory $ 25,000

(25% x $100,000)

Unrealized gain on sale of land ($ 37,500)

(25% x $150,000)

Noncontrolling interest share: $ 150,000 b

Investment in Rayan SAL before adjustment $ 3,637,500

Add: Income from Rayan SAL $ 450,000

Adjusted investment in Rayan SAL $ 4,087,500

P. 8-2

1. Pop Corporation membeli 80% saham Son sebesar $10.600.000

Underlying Equity = 80% x$13.000.000

= $10.400.000

Goodwill = excess of investment FV over BV

= $1.000.000

Investment in Son 1, Jan 2018 = Underlying Equity + Goodwill

=$10.400.000 + $1.000.000

= $11.400.000

2. Percentage interest in Son after additional stock issuance

Shares owned 480,000 / 800,000 outstanding shares = 60% interest

3. Journal entry on Pop’s books to adjust for the additional shares issuance

No gain or loss recognized on issuance of additional shares

Investment in Son 1,000

Other PIC 1,000*

*($19,000 x 60%) – ($13,000 x 80%) = 1,000

P. 8-3

Preliminary computations:

Price to acquire 90% percent interest of Piero SAA $3,600,000

Implied fair value of Piero SAA ($3,600,000 / 90%) $4,000,000

Piero SAA’s stockholders’ equity at January 1 $3,800,000

Goodwill $ 200,000 c

Income from Piero SAA’s for the first quarter $ 225,000

(90% x ($4,500,000 - $2,800,000 - $700,000) x 3 / 12)

Income from Piero SAA’s for the last three quarters $ 525,000

(70% x ($4,500,000 - $2,800,000 - $700,000) x 9 / 12)

Income from Piero SAA for 2014 ($225,000 + $525,000) $ 750,000 a

Noncontrolling interest share for the first quarter: $ 25,000

(10% x ($4,500,000 - $2,800,000 - $700,000) x 3 / 12)

Noncontrolling interest share for the last three quarters: $ 225,000

(30% x ($4,500,000 - $2,800,000 - $700,000) x 9 / 12)

Noncontrolling interest share for 2014 $ 250,000 b

Investment in Piero SAA before adjustment $2,835,000

Add: Income from Piero SAA for the las three quarters $ 525,000

Adjusted investment in Piero SAA $3,360,000

Noncontrolling interest January 1:

10% of Implied fair value of Piero SAA at January 1 $ 400,000 c

Noncontrolling interest March 31

20% of implied fair value of Piero SAA at March 31 $ 850,000 c

(20% x ($4,000,000 + $250,000))

P. 8-4

Entries on Pop’s books

Option 1 : Pop sells 30,000 shares of Son

Cash 1,500

Investment in Son 870

Additional PIC 630

To record sale of 30,000 shares at $50 per share. No gain or loss is recognized since Pop maintains a

controlling interest.

Option 2 : Son issues and sells 40,000 shares to the public

Investment in Son 630

Additional PIC 630

To record adjustment in ownership:

BV after sales of 40,000 shares ($12,440 x 75%) $9,330

BV before sales of 40,000 shares ($10,440 x 5/6) (8,700)

Increase in BV of investment from sale $630

Option 3 : Son reissues 40,000 shares of treasury stock

Investment in Son 630

Additional PIC 630

Consolidated stockholder’s equity

At January 1, 2017

Option 1 Option 2 Option 3

Common stock $10,000 $10,000 $10,000

Additional PIC 3,630 3,630 3,630

R/E 7,000 7,000 7,000

NCI 2,610 3,110 3,110

Total stockholder’s equity $23,240 $23,740 $23,740

NCI under option 1 : $10,440 x 25%

NCI under option 2 and 3 : $12,440 x 25%

P. 8-5

Preliminary computations:

Cost of 9,000 shares (90% interest) January 1, 2016 $ 810,000

Implied total fair value of Sun ($810,000 / 90%) $ 900,000

Book value of Sun ($500,000 + $300,000) (800,000)

Excess fair value over book value = Goodwill $ 100,000

1. Investment balance December 31, 2016

Cost January 1, 2016 (9,000 shares ́ $90) $ 810,000

Add: Share of Sun's 2016 income ($50,000 ́ 90%) 45,000

Investment in Sun December 31 $ 855,000

2. Goodwill at December 31, 2017 (Pam purchased additional shares)

Goodwill from January 1, 2016 purchase $ 100,000

Goodwill from January 1, 2017 purchase:

Book value before purchase $ 850,000

Book value after purchase (1,350,000)

Book value acquired (500,000)

Cost of additional 5,000 shares 500,000

Goodwill from January 1, 2017 $0

Goodwill at December 31, 2017 $ 100,000

3. Additional paid-in capital (outsider purchased additional shares)

Book value after issuance ($1,350,000 ́ 60%) $ 810,000

Book value before issuance ($850,000 ́ 90%) (765,000)

Additional paid-in capital (gain is not recognized) $ 45,000

4. Noncontrolling interest December 31, 2017 (outsider purchased shares)

Subsidiary equity January 1, 2016 $ 800,000

Increase for 2016 50,000

Increase for 2017 70,000

Sale of additional shares 500,000

Book value $1,420,000

Goodwill 100,000

Fair value of Sun equity December 31, 2017 $1,520,000

Noncontrolling interest percentage 6,000/15,000 shares 40%

Noncontrolling interest December 31, 2017 $ 608,000

P. 8-6

1. Investment in Son December 31, 2017

Investment in Son January 2, 2016 $ 98,000

Increase for 2011 ($30,000 retained earnings increase x 70%) 21,000

Purchase of additional 20% interest June 30, 2012 37,000

Increase 2017:

($30,000 ́ 1/2 year ́ 70%) + ($30,000 ́ 1/2 year ́ 90%) 24,000

Dividends 2012: ($10,000 ́ 90%) (9,000)

Investment in Son December 31, 2017 $171,000

2. Goodwill December 31, 2017

January 2, 2016 purchase:

Cost of 70% interest $ 98,000

Implied fair value of Son ($98,000 / 70%) $140,000

Less: Book value of Son 120,000

Goodwill $ 20,000

June 30, 2017 purchase:

Cost of 20% interest $ 37,000

Implied fair value of Son ($37,000 / 20%) $185,000

Less: Book value of Son 165,000

Goodwill - December 31, 2017 $ 20,000

3. Consolidated net income

Sales $600,000

Cost of sales (400,000)

Expenses (70,000)

Consolidated net income 130,000

Noncontrolling interest share* 6,000

Controlling share of net income $124,000

* Noncontrolling share is 10% for full year plus

20% for ½ year.

Alternative:

Pop’s reported income = Controlling share of net income $124,000

4. Consolidated retained earnings December 31, 2017

Beginning retained earnings $200,000

Add: Controlling share of Consolidated net income — 2017 124,000

Less: Dividends (64,000)

Consolidated retained earnings — ending $260,000

Alternative solution:

Pop’s reported ending retained earnings = Consolidated

Retained earnings — ending $260,000

5. Noncontrolling interest December 31, 2017

Equity of Son December 31, 2017 $170,000

Goodwill 20,000

Fair value of Son $190,000

Noncontrolling interest percentage 10%

Noncontrolling interest December 31, 2017 $ 19,000

You might also like

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Tugas 10Document3 pagesTugas 10Reyhan ArioNo ratings yet

- Akl Week 8Document5 pagesAkl Week 8Rifda AmaliaNo ratings yet

- Online Ass Advance Acc NEWDocument6 pagesOnline Ass Advance Acc NEWRara Rarara30No ratings yet

- TugasCh15 - Heru Kurnia Azra - 1910536018Document9 pagesTugasCh15 - Heru Kurnia Azra - 1910536018Heru Kurnia AzraNo ratings yet

- Final ExamDocument5 pagesFinal ExamSultan LimitNo ratings yet

- Jawaban Review Uts Inter 2 - FixDocument8 pagesJawaban Review Uts Inter 2 - FixCaratmelonaNo ratings yet

- Sazkiya Aldina - Lat Soal AKL 1 Chapter 2Document3 pagesSazkiya Aldina - Lat Soal AKL 1 Chapter 2sazkiyaNo ratings yet

- Muh. SyukurDocument6 pagesMuh. SyukurDrawing For LifeNo ratings yet

- Tax Homework Chapter 4Document7 pagesTax Homework Chapter 4RosShanique ColebyNo ratings yet

- Preliminary ComputationsDocument3 pagesPreliminary ComputationsFarrell DmNo ratings yet

- Lab Pengantar AkuntansiDocument6 pagesLab Pengantar Akuntansirahadatul aishyNo ratings yet

- Anggita Awidiya 041911333129 AKL 1 Pertemuan 13Document4 pagesAnggita Awidiya 041911333129 AKL 1 Pertemuan 13anggitaawidiyaNo ratings yet

- Solution E2-3 1: Preliminary ComputationsDocument3 pagesSolution E2-3 1: Preliminary ComputationsRifda AmaliaNo ratings yet

- Assignment 3 ACC 401Document9 pagesAssignment 3 ACC 401ShannonNo ratings yet

- AKL Chapter9Document3 pagesAKL Chapter9Farrell DmNo ratings yet

- JAWABAN CHAPTER 17 - INVESTMENTS (Revisi)Document3 pagesJAWABAN CHAPTER 17 - INVESTMENTS (Revisi)CaratmelonaNo ratings yet

- QUIZ PARTNERSHIP OPERATIONS With SolutionDocument3 pagesQUIZ PARTNERSHIP OPERATIONS With SolutionMonica TeofiloNo ratings yet

- Ass. Chapter 11 Shareholders Equity (Part 2)Document12 pagesAss. Chapter 11 Shareholders Equity (Part 2)Jea Ann CariñozaNo ratings yet

- Tugas Pertemuan 12 - Alya Sufi Ikrima - 041911333248Document3 pagesTugas Pertemuan 12 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- AKL ch10Document4 pagesAKL ch10Farrell DmNo ratings yet

- Tugas TM 8 Abdul Azis Faisal 041611333243Document4 pagesTugas TM 8 Abdul Azis Faisal 041611333243Abdul AzisNo ratings yet

- Chapter 5 Solutions To PostDocument43 pagesChapter 5 Solutions To PostJax TellerNo ratings yet

- Dewi Nabilah Anwar - Akl1 Week 2Document3 pagesDewi Nabilah Anwar - Akl1 Week 2Soe BagyoNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Intermediate Accounting 1 (Chap 17)Document10 pagesIntermediate Accounting 1 (Chap 17)Natalie Anne Bambico MercadoNo ratings yet

- Lab 3 - Stock Investment: FATA 2015Document3 pagesLab 3 - Stock Investment: FATA 2015Firda ZhafirahNo ratings yet

- Chapter17 BuenaventuraDocument8 pagesChapter17 BuenaventuraAnonnNo ratings yet

- CHP 7 Select Text SolutionsDocument8 pagesCHP 7 Select Text SolutionsAditya RoyNo ratings yet

- Akl Soal 3 - Kelompok 2Document9 pagesAkl Soal 3 - Kelompok 2M KhairiNo ratings yet

- Akl Soal 3 Kelompok 2Document9 pagesAkl Soal 3 Kelompok 2dikaNo ratings yet

- A031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)Document2 pagesA031191120 - Rezky Aprilianti (Latihan Soal P.2-5 & P.2-8)Rezky ApriliantiNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Akuntansi Menengah 2Document5 pagesAkuntansi Menengah 2ANGELOXAK202No ratings yet

- NURUL ARYANI - AKL1 - Forum 2Document3 pagesNURUL ARYANI - AKL1 - Forum 2Nurul AryaniNo ratings yet

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Jawaban Soal Hitungan Bab 4Document16 pagesJawaban Soal Hitungan Bab 4Aheir lessNo ratings yet

- Pindi Yulinar Rosita - Excercise Chapt 5Document32 pagesPindi Yulinar Rosita - Excercise Chapt 5Pindi YulinarNo ratings yet

- Solution E15-18 1: Revaluation EntryDocument3 pagesSolution E15-18 1: Revaluation EntryTk KimNo ratings yet

- FABULAR Intercompany DividendsDocument6 pagesFABULAR Intercompany DividendsRico, Jalaica B.No ratings yet

- DocumentDocument3 pagesDocumentcryNo ratings yet

- Assignment Akl Bab 4 (Kel. 7)Document5 pagesAssignment Akl Bab 4 (Kel. 7)Nadiyah ShofwahNo ratings yet

- Advance Financial Assignment #2Document10 pagesAdvance Financial Assignment #2peterNo ratings yet

- Assignment#4Document3 pagesAssignment#4Kristine Esplana ToraldeNo ratings yet

- Lets Try This 4Document2 pagesLets Try This 4syramaebillones26No ratings yet

- Advanced CHP 16 Bagian Exercise Yg Salah Buat Prnya!!!!!!!!!!!!!1Document4 pagesAdvanced CHP 16 Bagian Exercise Yg Salah Buat Prnya!!!!!!!!!!!!!1AschNo ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- 1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Document9 pages1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Maulana AmriNo ratings yet

- Sol. Man. - Chapter 10 - She (Part 1) - 2021Document18 pagesSol. Man. - Chapter 10 - She (Part 1) - 2021Ventilacion, Jayson M.No ratings yet

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- Shareholders' Equity Problems (Gallery Company)Document19 pagesShareholders' Equity Problems (Gallery Company)Nikki San GabrielNo ratings yet

- Bài tập chương 13Document10 pagesBài tập chương 132021agl12.phamhoangdieumyNo ratings yet

- Diskusi After UTS - 5I - Mutia Maulida - 2102015028 - Consolidation With Loss On Intercompany SaleDocument6 pagesDiskusi After UTS - 5I - Mutia Maulida - 2102015028 - Consolidation With Loss On Intercompany SaleNova AnggrainiNo ratings yet

- Solutions To End-of-Chapter Three ProblemsDocument13 pagesSolutions To End-of-Chapter Three ProblemsAn HoàiNo ratings yet

- Chapter 2 - Shareholder's Equity MCDocument19 pagesChapter 2 - Shareholder's Equity MCJoshua AbanalesNo ratings yet

- FM II Assignment 12 SolutionDocument3 pagesFM II Assignment 12 SolutionSinpaoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Combat Decision Making Process at The Tactical LevelDocument156 pagesCombat Decision Making Process at The Tactical LevelGreg Jackson100% (1)

- 02 - Property Tables and ChartsDocument2 pages02 - Property Tables and ChartsjhamilcarNo ratings yet

- Dick and Carey Instructional Design ModeDocument7 pagesDick and Carey Instructional Design Modebidadari86No ratings yet

- PetroBowl - QuizletDocument8 pagesPetroBowl - QuizletAndreas DimasNo ratings yet

- Intelsat VI: International Satellite DirectoryDocument1 pageIntelsat VI: International Satellite DirectorySaravanan ArumugamNo ratings yet

- Oral Questions For CSS NC II 2Document5 pagesOral Questions For CSS NC II 2Rhix JohnNo ratings yet

- Consolidated Invoice - Nexa Equity - Project ScubaDocument3 pagesConsolidated Invoice - Nexa Equity - Project ScubarhenkeNo ratings yet

- Male Pattern Blondeness: Technique: Natural Level: ColorDocument1 pageMale Pattern Blondeness: Technique: Natural Level: ColorLeo CabelosNo ratings yet

- DFC (Malaysia) FormDocument2 pagesDFC (Malaysia) FormWong Hui HwaNo ratings yet

- About Them Philanthropy: See AlsoDocument3 pagesAbout Them Philanthropy: See AlsojanelauraNo ratings yet

- Strategic Information Systems Planning (SISP) : Arwa A. Altameem, Abeer I. Aldrees and Nuha A. AlsaeedDocument3 pagesStrategic Information Systems Planning (SISP) : Arwa A. Altameem, Abeer I. Aldrees and Nuha A. Alsaeedsteviani lellyanaNo ratings yet

- Medication Use in Pregnancy and The Pregnancy and Lactation Labeling RuleDocument3 pagesMedication Use in Pregnancy and The Pregnancy and Lactation Labeling RuleMaria Emilia Menendez100% (1)

- World History 2147, Shayaan.Document15 pagesWorld History 2147, Shayaan.Ifrah DarNo ratings yet

- Data - Sheet Hora CV Act DetailsDocument2 pagesData - Sheet Hora CV Act DetailsAnand K. MouryaNo ratings yet

- NCE-T HCIA LectureDocument95 pagesNCE-T HCIA LectureSayed Rahim NaderiNo ratings yet

- National Building Code - PD 1096 Summary - TOAZ - INFODocument6 pagesNational Building Code - PD 1096 Summary - TOAZ - INFOAlray GolisNo ratings yet

- Absolute Containers Brochure 2019 2 27 PDFDocument19 pagesAbsolute Containers Brochure 2019 2 27 PDFEduardo SolanoNo ratings yet

- Cruise Control Repair W123Document8 pagesCruise Control Repair W123Michael RynworthNo ratings yet

- ArmCAD 2005 Handbuch EnglischDocument521 pagesArmCAD 2005 Handbuch EnglischGoran MrkelaNo ratings yet

- VALIX - Chapter 5Document28 pagesVALIX - Chapter 5glenn langcuyan100% (1)

- 1 Communicative English SkillsDocument24 pages1 Communicative English Skillskiya0191% (35)

- ACI Basic - LEARN WORK ITDocument12 pagesACI Basic - LEARN WORK ITravi kantNo ratings yet

- Case Study in Textile PrintingDocument33 pagesCase Study in Textile PrintingAun Na-DonNo ratings yet

- Castilex Industrial Corporation V VasquezDocument3 pagesCastilex Industrial Corporation V VasquezJaz SumalinogNo ratings yet

- Research Paper On Emotional StabilityDocument8 pagesResearch Paper On Emotional Stabilityegw48xp5100% (1)

- Kaugaliang Pilipino Quarter 3 Week 2Document20 pagesKaugaliang Pilipino Quarter 3 Week 2Linegevan IacgarNo ratings yet

- Potent Drugs HandlingDocument4 pagesPotent Drugs HandlingOMKAR BHAVLENo ratings yet

- FinanceDocument26 pagesFinanceBhargav D.S.No ratings yet

- RA RME LUCENA Apr2018 PDFDocument8 pagesRA RME LUCENA Apr2018 PDFPhilBoardResultsNo ratings yet

- 53 Mitsubishi 1B F4A41 F4A4B EtcDocument18 pages53 Mitsubishi 1B F4A41 F4A4B EtcEduardo Alvarez Huiza0% (1)