Professional Documents

Culture Documents

Ch-2, Unit-6, Rectification of Error

Ch-2, Unit-6, Rectification of Error

Uploaded by

AFTAB KHAN0 ratings0% found this document useful (0 votes)

86 views6 pagesThe document contains questions related to rectification of errors in accounting records. It provides details of errors found in various books of accounts like cash book, sales book, purchases book etc. of different businesses. It also provides past year questions on rectification of errors asked in Foundation exams. The questions test the ability to identify the nature of errors, pass rectifying journal entries for errors before and after preparation of trial balance, and identify the impact of errors on financial statements.

Original Description:

CA FOUNDATION

Original Title

Ch-2, unit-6, Rectification of Error

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains questions related to rectification of errors in accounting records. It provides details of errors found in various books of accounts like cash book, sales book, purchases book etc. of different businesses. It also provides past year questions on rectification of errors asked in Foundation exams. The questions test the ability to identify the nature of errors, pass rectifying journal entries for errors before and after preparation of trial balance, and identify the impact of errors on financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

86 views6 pagesCh-2, Unit-6, Rectification of Error

Ch-2, Unit-6, Rectification of Error

Uploaded by

AFTAB KHANThe document contains questions related to rectification of errors in accounting records. It provides details of errors found in various books of accounts like cash book, sales book, purchases book etc. of different businesses. It also provides past year questions on rectification of errors asked in Foundation exams. The questions test the ability to identify the nature of errors, pass rectifying journal entries for errors before and after preparation of trial balance, and identify the impact of errors on financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

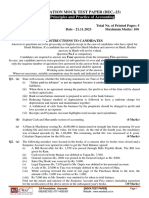

SHEKHAWAT ACADEMY CA FOUNDATION l ACCOUNTS

Chapter - 3: Rectification of Errors

Marks Distribution in past papers

M-18 N-18 M-19 N-19

Marks 6M 10M 6M 10M

Ques. No. 1(a); 1(c) 2(a) 1(a); 1(c) 2(a)

Theory Question

Q1. State with reasons, whether the following statement are True or False:

I. If the effect of errors committed cancel out, the errors will be called compensating errors and the trial

balance will disagree. (PP-M18) (2M)

II. If the amount is posted in the wrong account or it is written on the wrong side of the account, it is called

error of principle. (PP-M19) (2M)

III. The rationale behind the opening of a suspense account is to tally the trial balance.

Rectification Before Preparation of Trial Balance

Q2. How would you rectify the following errors in the book of Rama & Co.? (ICAI SM)

I. The total to the Purchases Book has been undercast by Rs. 100.

II. The Returns Inward Book has been undercast by Rs. 50.

III. A sum of Rs. 250 written of as depreciation on Machinery has not been debited to Depreciation Account.

IV. A payment of Rs. 75 for salaries (to Mohan) has been posted twice to Salaries Account.

V. The total of Bills Receivable Book Rs. 1,500 has been posted to the credit of Bills Receivable Account.

VI. An amount of Rs.151 for a credit sale to Hari, although correctly entered in the Sales Book, has been

posted as Rs. 115.

VII. Discount allowed to Satish Rs. 25 has not been entered in the Discount Column of the Cash Book. the

amount has been posted correctly to the credit of his personal accounts.

NOTE: Assume that errors are to rectified before preparation of trial balance.

Rectification After Preparation of Trial Balance

Q3. The following errors were found in the book of Ram Prasad & Sons. Give the necessary entries to correct

them. (ICAI SM)

I. Rs. 500 paid for furniture purchased has been charged to ordinary Purchases Account.

II. Repairs made were debited to Building Account for Rs. 50.

III. An amount of Rs.100 withdrawn by the proprietor for his personal use has been debited to Trade

Expenses Account.

IV. Rs.100 paid for rent debited to Landlord’s Account.

V. Salary Rs.125 paid to a clerk due to him has been debited to his personal account.

VI. Rs.100 received from Shah & Co. has been wrongly entered as from Shaw & Co.

VII. Rs. 700 paid in cash for a typewriter was charged to office Expenses Account.

Q4. Give the journal entries (with narration) to rectify the following errors located in the books of a trader

after preparing the trial balance (PP-M19) (4M)

1 - CA. SHAINDRA SHEKHAWAT

SHEKHAWAT ACADEMY CA FOUNDATION l ACCOUNTS

I. An amount of Rs. 4500 received on amount of interest was credited to the commission account

II. A sale of Rs. 2760 was posted from sales book to the debit of M/S Sobhagya Traders at Rs. 2670

III. Rs. 35,000 paid for purchase of Air conditioner for the personal use of proprietor debited to machinery

a/c

IV. Goods returned by the customer for Rs. 5,000. The same have been taken into stock but no entry passed

in the books of a/c

Q5. Rectification of errors (RTP-M19)

1. Goods of the value of Rs. 10,000 returned by Mr. Sharma were entered in the sales Day book and posted

there from to the credit of his account.

2. An amount of Rs. 15000 entered in the sales Returns Book, has been posted to the debit of Mr. Philip who

returned the goods.

3. A sale of Rs. 20,000 made to Mr. Ghanshyam was correctly entered in the sales Day book but wrongly

posted to the debit of Mr. Radheshyam as Rs.2000

4. Bad debt aggregating Rs. 45,000 were written off during the year in the sales ledger but were not

adjusted in the General Ledger; and

5. The total of Discount allowed column in the cash book for the month of September, 2018 amounting to

Rs. 25000 was not posted.

Q6. Correct the following errors (i) without opening a Suspense Account and (ii) opening a Suspense Account:

(ICAI SM)

I. The Sales Book has been totalled Rs. 100 shorts.

II. Goods worth Rs. 150 returned by Green & Co. have not been recorded anywhere.

III. Goods purchased Rs. 250 have been posted to the debit of the supplier Gupta & Co.

IV. Furniture purchased from Gulab & Bros, Rs. 1,000 has been entered in Purchases Day Book.

V. Discount received from Red & Black Rs. 15 has not been entered in the Discount Column of the Cash

Book.

VI. Discount allowed to G. Mohan & Co. Rs. 18 has not been entered in the Discount Column of the Cash

Book. The account of G. Mohan & Co. has, however, been correctly posted.

VII. Rs. 1,000 paid for the purchase of a motor cycle for Mr. Dutt had been charged to “Miscellaneous

Expenses Account”.

VIII. Goods amounting to Rs. 100 had been returned by customer and were taken in to inventory, but no entry

in respect thereof, was made into the books.

IX. A sale of Rs. 200 to Singh & Co. was wrongly credited to their account. Entry was made correctly made in

sales book.

Q7. On-going through the Trial balance of Ball Bearings Co. Ltd. you find that the debit is in excess by Rs. 150.

This was credited to “Suspense Account”. On a close scrutiny of the books the following mistakes were

noticed:

I. The totals of debit side of “Expenses Account” have been cast in excess by Rs. 50.

II. The “Sales Account” has been totalled in short by Rs. 100.

III. One item of purchase of Rs. 25 has been posted from the day book to ledger as Rs. 250.

IV. The sale returns of Rs. 100 from a party has not been posted to that account though the Party’s account

has been credited.

2 - CA. SHAINDRA SHEKHAWAT

SHEKHAWAT ACADEMY CA FOUNDATION l ACCOUNTS

V. A cheque of Rs. 500 issued to the Suppliers’ account (shown under Trade payables) towards his dues has

been wrongly debited to the purchases.

VI. A credit sale of Rs. 50 has been credited to the Sales and also to the Trade receivables Account.

You are required to

I. Pass necessary journal entries for correcting the above;

II. Show how they affect the Profits; and

III. Prepare the “Suspense Account” as it would appear in the ledger.

Q8. The trial balance of Mr. W & H failed to agree and the difference Rs. 20,570 was put into suspense pending

investigation which disclosed that:

I. Purchase returns day book had been correctly entered and totalled at Rs. 6,160, but had not been posted

to the ledger.

II. Discounts received Rs. 1,320 had been debited to discounts allowed.

III. The Sales account had been under added by Rs. 10,000.

IV. A credit sale of Rs. 1,470 had been debited to a customer account at Rs. 1,740.

V. A vehicle bought originally for Rs. 7,000 four years ago and depreciated to Rs. 1,200 had been sold for

VI. Rs. 1,500 in the beginning of the year but no entries, other than in the bank account had been passed

through the books.

VII. An accrual of Rs. 560 for telephone charges had been completely omitted.

VIII. A bad debt of Rs. 1,560 had not been written of and provision for doubtful debts should have been

maintained at 10% of Trade receivables which are shown in the trial balance at Rs. 23,390 with a credit

provision for bad debts at Rs. 2,320.

IX. Tools bought for Rs. 1,200 had been inadvertently debited to purchases.

X. The proprietor had withdrawn, for personal use, goods worth Rs. 1,960. No entries had been made in the

books.

Required:

a) Pass rectification entries without narration to correct the above errors before preparing annual accounts.

b) Prepare a statement showing effect of rectification on the reported net profit before correction of these

errors.

Q9. A merchant’s trial balance as on June 30, 2017 did not agree. The difference was put to a Suspense

Account. During the next trading period, the following errors were discovered:

I. The total of the Purchases Book of one page, Rs. 4,539 was carried forward to the next page as Rs. 4,593.

II. A sale of Rs. 573 was entered in the Sales Book as Rs. 753 and posted to the credit of the customer.

III. A return to a creditor, Rs. 510 was entered in the Returns Inward Book; however, the creditor’s account

was correctly posted.

IV. Cash received from C. Das, Rs. 620 was posted to the debit of G. Das.

V. Goods worth Rs. 840 were dispatched to a customer before the close of the year but no invoice was made

out.

VI. Goods worth Rs. 1,000 were sent on sale or return basis to a customer and entered in the Sales Book. At

the close of the year, the customer still had the option to return the goods. The sale price was 25% above

cost.

3 - CA. SHAINDRA SHEKHAWAT

SHEKHAWAT ACADEMY CA FOUNDATION l ACCOUNTS

Rectification after Preparation of Balance Sheet (i.e. Next year)

Q10. Mr. Roy was unable to agree the Trial Balance last year and wrote off the difference to the Profit and Loss

Account of that year. Next Year, he appointed a Chartered Accountant who examined the old books and found

the following mistakes:

I. Purchase of a scooter was debited to conveyance account Rs. 3,000.

II. Purchase account was over-cast by Rs. 10,000.

III. A credit purchase of goods from Mr. P for Rs. 2,000 entered as a sale.

IV. Receipt of cash from Mr. A was posted to the account of Mr. B Rs. 1,000.

V. Receipt of cash from Mr. C was posted to the debit of his account, Rs. 500.

VI. Rs. 500 due by Mr. Q was omitted to be taken to the trial balance.

VII. Sale of goods to Mr. R for Rs. 2,000 was omitted to be recorded.

VIII. Amount of Rs. 2,395 of purchase was wrongly posted as Rs. 2,593.

IX. Mr. Roy used 10% depreciation on vehicles.

Q11. The following mistakes were located in the books of a concern after its books were closed and a suspense

Account was opened in order to get the trial balance agreed (RTP-M20 & PP-N18) (10M):

I. Sales Day Book was overcast by Rs. 1,000

II. A sale of Rs. 5,000 to X was wrongly debited to the account of Y.

III. General Expenses Rs. 180 was posted in the general ledger as Rs. 810

IV. A bill Receivable for Rs. 1,550 was passed through Bills Payable Book. The bill was given by P.

V. Legal Expenses Rs. 1190 paid to Mrs. Neetu was debited to her personal account

VI. Cash received from ram was debited to Shayam Rs. 1500.

VII. While carrying forward the total of one page of the purchase book to the next, the amount of Rs. 1235

was written as Rs. 1325.

Find out the nature and amount of the Suspense Account and pass entries (including narration) for the

rectification of the above errors in the subsequent year’s books

Q12. The following errors were committed by the Accountant of Geeta Dye-Chem (RTP-M18 & N19)

I. Credit sale of Rs. 400 to Trivedi & Co. was posted to the credit of their account.

II. Purchase of Rs. 420 from Mantra & Co. passed through Sales Day Book as Rs. 240

How would you rectify the errors assuming that;

a. They are detected before preparation of Trial balance.

b. They are detected after preparation of trial Balance but before preparing Final Accounts, the

difference was taken to suspense A/c

c. They are detected after preparing Final Accounts.

HOME WORK

Q13. Correct the following errors (i) without and (ii) with opening a suspense A/c (PP-N19) (10M)

I. The sales book has been totalled for Rs. 2100 short

II. Goods worth Rs. 1800 returned by Gaurav & Co. have not been recorded anywhere.

III. Goods worth Rs. 2250 have been posted to the debit of the supplier Sen Brothers

IV. Furniture purchased from Mary Associates Rs. 15000 has been entered in the purchase day book

V. Discount received from Black and White Rs. 1200 has not been entered in the books

4 - CA. SHAINDRA SHEKHAWAT

SHEKHAWAT ACADEMY CA FOUNDATION l ACCOUNTS

VI. Discount allowed to Radhe Mohan & Co. Rs. 180 has not been entered in the Discount Column of the

cashbook. The account of Radhe Mohan & Co. has however, been correctly posted.

Q14. Classify of errors under the three categories- Errors of Omission, Errors of Commission and Errors of

principle. (RTP-N18)

I. Sale of furniture credited to sales account amounting Rs. 10,000

II. Purchase worth Rs. 4500 from M not recorded in subsidiary book

III. Credit Sale wrongly passed through the Purchase Book amount Rs. 10,000.

IV. Machinery sold on credit to Mohan recorded in journal proper but omitted to be posted Amount Rs 500.

V. Goods worth Rs. 5000 purchased on credit from Ram recorded in the purchase book as Rs. 500

Q15. Give the journal entries (narrations not required) to rectify the following (PP-M18) (4M)

I. Purchase of Furniture on credit from Nigam for Rs. 3000 posted to Shubham account as Rs. 300

II. A sales Return of Rs. 5000 to Jyothi was not entered in the financial accounts though it was duly taken in

the stock book.

III. Investments were sold for Rs. 75000 at a profit of Rs. 15000 and passed through sales account

IV. An amount of Rs. 10,000 withdrawn by the proprietor (darshan) for his personal use has been debited to

Trade Expense account.

Q16. Miss Daisy was unable to agree the trial balance last year and wrote off the difference to the profit and

loss account of that year. On verifying the old books by a chartered accountant next year, the following

mistakes were found:

I. Purchase account was undercast by ₹ 8,000

II. Sale of goods to Mr. Rahim for Rs. 2,500 was omitted to be recorded

III. Receipt of cash from Mr. Ashok was posted to the account of Mr. Abu Rs. 1,200

IV. Amount of Rs. 4,167 of sales was wrongly posted as Rs. 4,617

V. Repairs to machinery was debited to machinery account Rs. 1,800

VI. A credit purchase of goods from Mr. Paul for Rs. 3,000 entered as sale.

Q17. Give journal entries to rectify the following (ICAI SM):

I. A purchase of goods from Ram amounting to Rs. 150 has been wrongly entered through the Sales Book.

II. A Credit sale of goods amounting Rs. 120 to Ramesh has been wrongly passed through the Purchase

Book.

III. On 31st December, 2016 goods of the value of Rs. 300 were returned by Hari Saran and were taken

inventory on the same date but no entry was passed in the books.

IV. An amount of Rs. 200 due from Mahesh Chand, which had been written off as a Bad Debt in a previous

year, was unexpectedly recovered, and had been posted to the personal account of Mahesh Chand.

V. A Cheque for Rs. 100 received from Man Mohan was dishonored and had been posted to the debit of

Sales Returns Account.

Q18. The following errors, affecting the account for the year 2015 were detected in the books of Jain Brothers,

Delhi: (ICAI SM)

I. Sale of old Furniture Rs. 150 treated as sale of goods.

II. Receipt of Rs. 500 from Ram Mohan credited to Shyam Sunder.

5 - CA. SHAINDRA SHEKHAWAT

SHEKHAWAT ACADEMY CA FOUNDATION l ACCOUNTS

III. Goods worth Rs. 100 brought from Mohan Narain have remained unrecorded so far.

IV. A return of Rs. 120 from Mukesh posted to his debit.

V. A return of Rs. 90 to Shyam Sunder posted as Rs. 9 in his account.

VI. Rent of proprietor’s residence, Rs. 600 debited to rent A/c.

VII. A payment of Rs. 215 to Mohammad Sadiq posted to his credit as Rs. 125.

VIII. Sales Book added Rs. 900 short.

IX. The total of Bills Receivable Book Rs. 1,500 left unposted.

Q19. Write out the Journal Entries to rectify the following errors, using a Suspense Account. (ICAI SM)

I. Goods of the value of Rs. 100 returned by Mr. Sharma were entered in the Sales Day Book and posted

therefrom to the credit of his account;

II. An amount of Rs. 150 entered in the Sales Returns Book, has been posted to the debit of Mr. Philip, who

returned the goods;

III. A sale of Rs. 200 made to Mr. Ghanshyam was correctly entered in the Sales Day Book but wrongly

posted to the debit of Mr. Radheshyam as Rs. 20;

IV. Bad Debts aggregating Rs. 450 were written off during the year in the Sales ledger but were not adjusted

in the General Ledger; and

V. The total of “Discount Allowed” column in the Cash Book for the month of September, 2015 amounting to

Rs. 250 was not posted.

Q20. Mr. A closed his books of account on September 30, 2016 in spite of a difference in the trial balance. The

difference was Rs. 830 the credits being short; it was carried forward in a Suspense Account. In 2017 following

errors were located:

I. A sale of Rs. 2,300 to Mr. Lala was posted to the credit of Mrs. Mala.

II. The total of the Returns Inward Book for July, 2016 Rs. 1,240 was not posted in the ledger.

III. Freight paid on a machine Rs. 5,600 was posted to the Freight Account as Rs. 6,500.

IV. White carrying forward the total in the Purchases Account to the next page, Rs. 65,590 was written

instead of Rs. 56,950.

V. A sale of machine on credit to Mr. Mehta for Rs. 9,000 on 30th sept. 2016 was not entered in the books at

all. The book value of the machine was Rs. 6,750.

6 - CA. SHAINDRA SHEKHAWAT

You might also like

- Murry Pits Case StudyDocument6 pagesMurry Pits Case StudyFareed ShahwaniNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- "The Irresistible Offer" Short Film Business PlanDocument22 pages"The Irresistible Offer" Short Film Business PlanAndrew Yakovlev100% (8)

- 54103bos43406 p1Document31 pages54103bos43406 p1Aman GuptaNo ratings yet

- 8 Rectification of Error 08-2022 RegularDocument5 pages8 Rectification of Error 08-2022 RegularVasanta ParateNo ratings yet

- SuspenseDocument2 pagesSuspenseDipankar MallickNo ratings yet

- ERRORS QUESTIONS Copy - 081525Document7 pagesERRORS QUESTIONS Copy - 081525saliminmohammed19No ratings yet

- CAFC - Accountancy - Revision NotesDocument19 pagesCAFC - Accountancy - Revision Notesrmercy323No ratings yet

- A1 Correction of ErrorsDocument21 pagesA1 Correction of ErrorsdiggywilldoitNo ratings yet

- Dashboard myCBSEguideDocument1 pageDashboard myCBSEguidediyasingla1212No ratings yet

- A1757587756 - 23892 - 20 - 2019 - Rectification of ErrorsDocument27 pagesA1757587756 - 23892 - 20 - 2019 - Rectification of ErrorsGaurav AnandNo ratings yet

- 40 Marks Test I BRS & ROE I CTC ClassesDocument4 pages40 Marks Test I BRS & ROE I CTC Classesbhuvannagarwal.pktNo ratings yet

- Module - 7 Problems On Rectification of ErrorsDocument2 pagesModule - 7 Problems On Rectification of ErrorsYash PratapNo ratings yet

- SET B 11th Acc BRS N RECT.Document2 pagesSET B 11th Acc BRS N RECT.Mohammad Tariq AnsariNo ratings yet

- FINANCIAL ACCOUNITNG B.com-I Rizwan AnjumDocument2 pagesFINANCIAL ACCOUNITNG B.com-I Rizwan AnjumsajidNo ratings yet

- Rectification of ErrorDocument2 pagesRectification of ErrorHARDIK SINGHVINo ratings yet

- Chapter 16 - Rectification of ErrorsDocument31 pagesChapter 16 - Rectification of ErrorsSumanyuu NNo ratings yet

- CBSE Class 11 Accountancy Worksheet - Question BankDocument17 pagesCBSE Class 11 Accountancy Worksheet - Question BankUmesh JaiswalNo ratings yet

- 28 Days Accounts Challenge-1Document13 pages28 Days Accounts Challenge-1krishnaeatpute777No ratings yet

- Section "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiDocument4 pagesSection "B" (Short-Answer Questions) (30 Marks) : Government Boys Degree College (M) Gulistan-E-Johar, KarachiArshad KhanNo ratings yet

- Assignment Rectification of ErrorsDocument1 pageAssignment Rectification of ErrorsNida FatimaNo ratings yet

- Worksheet RoeDocument2 pagesWorksheet RoeJaijeet SinghNo ratings yet

- Chapter 5: Rectification of ErrorsDocument7 pagesChapter 5: Rectification of ErrorsSuresh LamsalNo ratings yet

- Fall 2009 Past PaperDocument4 pagesFall 2009 Past PaperKhizra AliNo ratings yet

- Fundermentals of AccountingDocument4 pagesFundermentals of AccountingBENARD LUKIBIANo ratings yet

- Error of CorrectionDocument8 pagesError of CorrectionTeo Yu XuanNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument25 pagesPaper - 1: Principles & Practice of Accounting Questions True and Falsegargee thakareNo ratings yet

- Trial BalanceDocument6 pagesTrial BalanceUpeksha PintoNo ratings yet

- CFN 9305 Accounts Question Paper PDFDocument2 pagesCFN 9305 Accounts Question Paper PDFDivya PunjabiNo ratings yet

- Accounting ProcessesDocument80 pagesAccounting ProcessesTikMoj Tube100% (1)

- TS Grewal Solutions For Class 11 Accountancy Chapter 13 - Rectification of ErrorsDocument57 pagesTS Grewal Solutions For Class 11 Accountancy Chapter 13 - Rectification of ErrorsDhruv ThakkarNo ratings yet

- Accounts RTP Foundation Nov 2020Document25 pagesAccounts RTP Foundation Nov 2020Jayasurya MuruganathanNo ratings yet

- Assignment 3Document2 pagesAssignment 3Sudhir SinhaNo ratings yet

- For Girl Pa A RDocument3 pagesFor Girl Pa A RMuhammad BilalNo ratings yet

- Kendriya Vidyalaya Sangathan, Mumbai Region Term-II Examination 2021-22 Accountancy (055) Set-Iii XIDocument5 pagesKendriya Vidyalaya Sangathan, Mumbai Region Term-II Examination 2021-22 Accountancy (055) Set-Iii XIIRSHAD HUSSAINNo ratings yet

- Uspense Account DRDocument4 pagesUspense Account DRYousaf JamalNo ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- Model Question Paper Class 11 AccountsDocument97 pagesModel Question Paper Class 11 AccountsAbel Soby Joseph100% (3)

- Accounting Final Sendup 2013Document3 pagesAccounting Final Sendup 2013Mozam MushtaqNo ratings yet

- Rectification of ErrorsDocument4 pagesRectification of ErrorsRoshini ANo ratings yet

- 21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23Document5 pages21.11.23 CA-FOUNDATION MOCK TEST PAPER ACCOUNTS Dec. 23RohitNo ratings yet

- Exercise Receivables 1Document9 pagesExercise Receivables 1Asyraf AzharNo ratings yet

- Exercise Receivables 1Document8 pagesExercise Receivables 1Asyraf AzharNo ratings yet

- Part 1 Accounting Unsolved Papers PDFDocument113 pagesPart 1 Accounting Unsolved Papers PDFSameer Hussain50% (2)

- Jaiib Accounting & Finance For Bankers: Presentation by Bharat SharmaDocument55 pagesJaiib Accounting & Finance For Bankers: Presentation by Bharat SharmaBHARATNo ratings yet

- Vidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"Document5 pagesVidya Sagar: Foundation Major Test - 1 (Series - 3) Nov - 20 "Principles and Practice of Accounting"sonubudsNo ratings yet

- Exercise 3Document2 pagesExercise 3Ju Ing GanNo ratings yet

- Paper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsoryDocument25 pagesPaper - 1: Principles and Practice of Accounting: Question No. 1 Is CompulsorySaurabh JainNo ratings yet

- Accounts Suggested Ans CAF Nov 20Document25 pagesAccounts Suggested Ans CAF Nov 20Anshu DasNo ratings yet

- Class Test 2 Date: Name: - Grade: AS Level Unit: Verification: Bank Reconciliation Verification: Ledger Control A/c Subject: AccountingDocument6 pagesClass Test 2 Date: Name: - Grade: AS Level Unit: Verification: Bank Reconciliation Verification: Ledger Control A/c Subject: AccountingDRNo ratings yet

- Practice QuestionDocument4 pagesPractice QuestionnabayeelNo ratings yet

- Screenshot 2023-12-18 at 2.00.45 AMDocument3 pagesScreenshot 2023-12-18 at 2.00.45 AMrameetkaur04No ratings yet

- 20uafam01 BM01 20ubmam01 Principles of Financial AccountingDocument3 pages20uafam01 BM01 20ubmam01 Principles of Financial AccountingArshath KumaarNo ratings yet

- 22ODBBT103Document5 pages22ODBBT103Pallavi JaggiNo ratings yet

- Rectification of Error1Document4 pagesRectification of Error1Typical GamerNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument29 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalsePiyush GoyalNo ratings yet

- W3 AssignmentDocument6 pagesW3 AssignmentRizky AkbarNo ratings yet

- Chapter 2 ROE 1Document17 pagesChapter 2 ROE 1adityatiwari122006No ratings yet

- CA Foundation Accounts RTP Nov22Document29 pagesCA Foundation Accounts RTP Nov22adityatiwari122006No ratings yet

- Bcom 2 Sem Commerce Business Law Bcompc201 2022Document2 pagesBcom 2 Sem Commerce Business Law Bcompc201 2022AFTAB KHANNo ratings yet

- Inventory CA FOUNDATIONDocument8 pagesInventory CA FOUNDATIONAFTAB KHANNo ratings yet

- Ch-3 BRSDocument8 pagesCh-3 BRSAFTAB KHANNo ratings yet

- Tally NotesDocument13 pagesTally NotesAFTAB KHANNo ratings yet

- Philippine Central Islands CollegeDocument17 pagesPhilippine Central Islands CollegeJoseph AlogNo ratings yet

- Grocery Store ManagementDocument24 pagesGrocery Store ManagementBrijesh DwivediNo ratings yet

- Prestige Institute of Management: GwaliorDocument5 pagesPrestige Institute of Management: GwaliormanendraNo ratings yet

- About The Pallet Design System - PalletdesignsystemDocument16 pagesAbout The Pallet Design System - PalletdesignsystemAddison MeraldNo ratings yet

- Accountancy SQPDocument13 pagesAccountancy SQPDeepak Kr. VishwakarmaNo ratings yet

- Solved Myles Etter and Crystal Santori Are Partners Who Share inDocument1 pageSolved Myles Etter and Crystal Santori Are Partners Who Share inAnbu jaromiaNo ratings yet

- Dafza Companies Set 2Document18 pagesDafza Companies Set 2aarm70116No ratings yet

- Creative Designer - JDDocument4 pagesCreative Designer - JDJoel SadhanandNo ratings yet

- Giezelle Ros Alianza Bachelor of Technical-Vocational Teacher Education AS 8: Teaching Common Competencies in Agri-Fishery Arts Sir Jeric A. AngustiaDocument1 pageGiezelle Ros Alianza Bachelor of Technical-Vocational Teacher Education AS 8: Teaching Common Competencies in Agri-Fishery Arts Sir Jeric A. AngustiaGiezelle RosNo ratings yet

- No Plastic Packaging: Tax InvoiceDocument1 pageNo Plastic Packaging: Tax InvoicePROKLEAR NanoNo ratings yet

- Firstsource AnnualReport 2019-20Document199 pagesFirstsource AnnualReport 2019-20Siddharth RoyNo ratings yet

- Term Paper On Uber VS PathaoDocument17 pagesTerm Paper On Uber VS Pathaosimeen srabaniNo ratings yet

- What Makes Fashion Consumers "Click"? Generation of Ewom Engagement in Social MediaDocument21 pagesWhat Makes Fashion Consumers "Click"? Generation of Ewom Engagement in Social MediaOmar AhsanNo ratings yet

- Investment Property ProblemsDocument3 pagesInvestment Property ProblemsAbigail TalusanNo ratings yet

- Strategy 1Document8 pagesStrategy 1HEMANTH KUMAR.KOLANo ratings yet

- CFS and SFSDocument225 pagesCFS and SFSrajNo ratings yet

- Motivational LetterDocument2 pagesMotivational LetterTanvir TonmoyNo ratings yet

- MKT Term PaperDocument14 pagesMKT Term PaperDewan Ashikul AlamNo ratings yet

- Circular Economy at The Company Level An Empirical Study Based On Sustainability ReportsDocument11 pagesCircular Economy at The Company Level An Empirical Study Based On Sustainability ReportsMiren Heras SánchezNo ratings yet

- UntitledDocument24 pagesUntitledcentral parkNo ratings yet

- An Efficiency Analysis On The TPA ClusteringDocument5 pagesAn Efficiency Analysis On The TPA Clusteringsolehhudin auliaNo ratings yet

- Bescom 9th Annual ReportDocument101 pagesBescom 9th Annual ReportRamwa3No ratings yet

- WOR Annual Report 2022Document220 pagesWOR Annual Report 2022ALNo ratings yet

- Management Theory 2 - Rroth - Capstone EditDocument8 pagesManagement Theory 2 - Rroth - Capstone Editapi-631598645No ratings yet

- Product & Services of Fortis Healthcare: Quality Tertiary CareDocument5 pagesProduct & Services of Fortis Healthcare: Quality Tertiary CareTYB92BINDRA GURSHEEN KAUR R.No ratings yet

- Contemporary Management Philosophies and ToolsDocument11 pagesContemporary Management Philosophies and ToolsYula ParkNo ratings yet

- Price List E-CeraDocument4 pagesPrice List E-CeraQOQO TEAMNo ratings yet

- P&R AnalysisDocument29 pagesP&R Analysiscontact.xinanneNo ratings yet