Professional Documents

Culture Documents

5th Semester Syllabus

5th Semester Syllabus

Uploaded by

Riya GuptaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5th Semester Syllabus

5th Semester Syllabus

Uploaded by

Riya GuptaCopyright:

Available Formats

Bhalotia Classes (OFFICE: 9883034569) (SIR: 8820696761)

Admission going for 5th Semester Honours/pass. Contact at above.

SYLLABUS FOR 5th SESMESTER:

GROUP: ACCOUNTING & FINANCE:

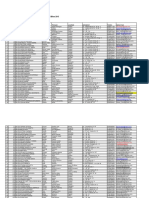

5th Semester: HONS

Subject's Name Marks Course fees: Faculty

Corporate Accounting 100 2,500 Ravi Bhalotia

Taxation II 100 2,500 Ravi Bhalotia

Advance Business Mathematics + 50 + 50 2,500 Ravi Bhalotia

Macro Economics Abhishek sir

Auditing & Assurance 100 2,500 CA Shruti

Chamaria

All Practical Subjects + Eco 300 7,500

All Subjects 400 10,000

If you join any all practical papers then all theory paper will be provided free of cost for

1st 50 students. Effective cost will be ₹ 7,500.

Morning Batch (8 am Approx); Day Batch (2.30 pm Approx)

Practical classes on Mon, Wed, Fri, Sat. Theory Classes on Tue, Thu

Theory classes will run in day batch, Morning batch theory will start on sufficient

admissions only.

Practical Classes: 4 days Approx; Theory Classes 2 Days Approx

Classes for Marketing, Taxation & E-business may be arranged on sufficient demand.

Online, offline, Recorded classes (except Audit)

Gpay or Phonepe or Paytm at 8820696761/9883034569 and send the screenshot.

- 1 – ADMISSION GOING ON FOR B.COM 5TH SEMESTER ALL SUBJECTS. CONTACT

Bhalotia Classes (OFFICE: 9883034569) (SIR: 8820696761)

Admission going for 5th Semester Honours/pass. Contact at above.

5th Semester: General

Subject's Name Marks Course fees: Faculty

Corporate Accounting 100 2,500 Ravi Bhalotia

Taxation II 100 2,500 Ravi Bhalotia

Auditing & Assurance 100 2,500 CA Shruti

Chamaria

All Subjects 300 7,500

If you join any all practical papers then all theory paper will be provided free of cost for

1st 50 students. Effective cost will be ₹ 5,000.

Morning Batch (8 am Approx); Day Batch (2.30 pm Approx)

Practical classes on Mon, Wed, Fri, Sat. Theory Classes on Tue, Thu

Theory classes will run in day batch, Morning batch theory will start on sufficient

admissions only.

Practical Classes: 4 days Approx; Theory Classes 2 Days Approx

Classes for Marketing, Taxation & E-business may be arranged on sufficient demand.

Online, offline, Recorded classes (except Audit)

- 2 – ADMISSION GOING ON FOR B.COM 5TH SEMESTER ALL SUBJECTS. CONTACT

Bhalotia Classes (OFFICE: 9883034569) (SIR: 8820696761)

Admission going for 5th Semester Honours/pass. Contact at above.

AUDITING & ASSURANCE: (BOTH FOR HONS & PASS)

Internal Assessment: 20 marks

Semester-end Examinations: 80 marks

Total 100 marks

UNIT – I CONCEPT, NEED AND PURPOSE OF AUDIT (10 Marks) (5 + 5)

• Definition-Nature-Scope and Objectives of Independent Financial Audit

• Basic Principles Governing an Audit, Concept of Auditor’s Independence

• Errors and Fraud-Concepts, Means of doing Fraud, Auditor’s Responsibility towards Detection and

Prevention of Fraud, Difference between Audit and Investigation

• Classification of Audit- Organization Structure wise (Statutory, Non-statutory); Objective wise (Internal

and Independent Financial Audit); Periodicity wise (Periodical, Continuous, Interim, Final); Technique

wise (Balance Sheet, Standard, Systems, EDP);

• Standards on Auditing (SA)- Concept and Purpose

(This unit should be studied with SA 200 [REVISED] and SA 240 [REVISED])

UNIT – II AUDIT PROCEDURES AND TECHNIQUES (15 Marks) (5 + 10)

• Auditing Engagement-Audit Planning- Audit Programme (Concept)

• Documentation: Audit Working Paper, Ownership and Custody of Working Papers-Audit file

(Permanent and Current) – Audit Note Book- Audit Memorandum.

• Audit Evidence – Concept, Need, Procedures to obtain Audit Evidence

• Routine Checking, Test Checking and Auditing in Depth

• Concept of Analytical Procedure and Substantive Testing in Auditing.

• Audit of Educational Institutions, Hospitals and Hotels

(This unit should be studied with SA 210, SA 230, SA 300, SA 500, SA 520 and SA 530)

UNIT – III AUDIT RISK AND INTERNAL CONTROL SYSTEM (10 Marks)

• Audit Risk – Concept and Types only.

• Internal Control- Definition, Objectives

• Internal Check- Definition, Objectives

• Internal Audit- Definition, Objectives, Regulatory Requirement, Reliance by Statutory Auditor on

Internal Auditor’s Work

(This unit should be studied with SA 610)

- 3 – ADMISSION GOING ON FOR B.COM 5TH SEMESTER ALL SUBJECTS. CONTACT

Bhalotia Classes (OFFICE: 9883034569) (SIR: 8820696761)

Admission going for 5th Semester Honours/pass. Contact at above.

UNIT – IV: VOUCHING, VERIFICATION AND VALUATION (10 Marks)

• Vouching: Meaning, Objectives - Difference with Routine Checking – Factors to be Considered during

Vouching - Vouching of Following Items: i) Receipts: Cash Sale, Collection from Debtors, Interest and

Dividend from Investment, Sale of Fixed Assets. ii) Payments: Cash Purchase, Payment to Creditors,

Payment of Wages and Salaries, Advertisement Expenses, Travelling Expenses, Research and

Development Expenditure, Prepaid Expenses.

• Verification and Valuation: Concept, Objectives, Importance, Difference with Vouching, Difference

between Verification and Valuation, Verification of following items: i) Non- Current Assets: Goodwill,

Patent and Copy Right, Leasehold Land, Plant and Machinery, ii) Investments iii) Current Assets:

Inventory, Loan and Advance, Cash and Bank Balances iv) Non-current Liability: Secured Loan v)

Current Liability: Trade Payables (Sundry Creditors).

UNIT - V COMPANY AUDIT (15 Marks) (1 Question of 15 Marks)

• Qualification, Disqualification, Appointment and Rotation, Removal and Resignation, Remuneration,

Rights, Duties and Liabilities of Company Auditor

• Branch Audit and Joint Audit

• Depreciation – Concept and Provisions of the Companies Act

• Divisible Profit and Dividend (Final, Interim and Unclaimed/Unpaid): Provisions of the Act, Legal

Decisions and Auditor’s Responsibility

UNIT – VI AUDIT REPORT AND CERTIFICATE (10 Marks)

• Definition – Distinction between Report and Certificate- Different Types of Report

• Contents of Audit Report (As per Companies Act and Standards on Auditing)

• True and Fair View – Concept

• Materiality – Concept and Relevance

(This unit should be studied with SA 700)

UNIT – VII OTHER THRUST AREAS (10 Marks)

• Cost Audit – Concepts, Objectives Relevant Provisions of Companies Act

• Management Audit - Concepts, Objectives, Advantages

• Tax Audit – Concepts, Objectives, Legal Provisions

• Social Audit – Propriety Audit – Performance Audit – Environment Audit (Concepts only)

Notes:

1) The provisions of the Companies Act, 1956 which are still in force would form part of the syllabus till

the time their corresponding or new provisions of the Companies Act, 2013 are enforced.

2) If new Laws or Rules are enacted in place of the existing laws and rules, the syllabus would include the

corresponding provisions of such new laws and rules with immediately following Academic Year.

3) Students are expected to develop analytical mind for answering problem based questions along with

the theoretical questions.

- 4 – ADMISSION GOING ON FOR B.COM 5TH SEMESTER ALL SUBJECTS. CONTACT

Bhalotia Classes (OFFICE: 9883034569) (SIR: 8820696761)

Admission going for 5th Semester Honours/pass. Contact at above.

TAXATION-II: (BOTH FOR HONS & PASS)

Module I: Direct Tax

Internal Assessment: 10 marks

Semester-end Examinations: 40 marks

Unit 1 : Computation of Total Income and Tax Payable (15 Marks /Lecture 15).

a) Rate of tax applicable to different assesses (except corporate assessee)

b) Computation of tax liability of an individual, Firm (excluding application of AMT)

Unit 2 : TAX MANAGEMENT (25 Marks /Lecture 15).

a) Provision for Filing of Return: Date of filing of return, relevant forms of return, different types of

returns, return by whom to be signed, PAN, TAN

b) Assessment of Return: Self assessment u/s140A, Summary assessment u/s 143(1), Scrutiny

assessment u/s 143(3) and Best judgement assessment u/s 144.

c) Advance Tax: Who is liable to pay, due dates and computation of advance tax (excluding corporate

assessees)

d) Interest & Fees: Section 234A, 234B, 234C, 234F (simple problems on interest and fees)

e) TDS: Provisions regarding TDS from salary, interest on securities, horse racing, lottery.

- 5 – ADMISSION GOING ON FOR B.COM 5TH SEMESTER ALL SUBJECTS. CONTACT

Bhalotia Classes (OFFICE: 9883034569) (SIR: 8820696761)

Admission going for 5th Semester Honours/pass. Contact at above.

Module II: INDIRECT TAXES

Internal Assessment: 10 marks

Semester-end Examinations: 40 marks

Unit-3:

Basic Concepts of indirect Tax and overview of GST:

Concept of indirect Tax; Difference between direct tax and indirect tax; Concept, objectives, structure and types

of GST; Taxes subsumed into GST; Application of SGST, CGST, UTGST and IGST; Non-applicability of GST, Rates of

GST and Compensation Cess.

Definitions:

Aggregate turnover, Business, Capital goods, Casual taxable person, Goods, lnput, lnput tax, lnput tax credit,

Output tax, Person, Place of business, Registered Person, Services, Taxable person, Turnover in state and union

territory (5 Marks /Lecture 5).

Unit4:

Taxable event. supply - Concept. time. value and place. charge, of GST:

Meaning of taxable event, Supply as per CSST Act (excluding detailed discussion on Sch l, Sch-ll and lll), lnward

supply, outward supply, Non-taxable supply, Taxable supply, Exempt supply, Continuous supply of goods,

composite supply, mixed supply, intrastate and interstate supply of goods, zero rated supply (basic concepts

only)

Time of supply of goods -

Need for determination, provisions in relation to forward and reverse charge only.

Value of supply -

inclusion and exclusion of items for computation of value of supply under transaction value, value inclusive of

tax.

Place of supply:

Need for ascertainment only.

Lew of GST under GGST:

Basis of charge, Forward and reverse charge (basic concepts only). (15 Marks /Lecture 15).

Unit-5: Input and Output Tax computation. lnput Tax Credit (lTG) and Composition Scheme

under GST

Tax invoice and Bill of Supply (Basic Concepts only)

ITC -

Meaning, Conditions for enjoyment of ITC and time limit to avail ITC (Sec 16 only), utilisation for payment

(simple problems).

Composition scheme-

Meaning, applicability & rate, Eligible Person, Determination of aggregate turnover (simple problems).

Time of Payment of GST (10 Marks /Lecture 10).

Unit 6 : Customs

Basic concepts, Taxable event, Territorial water, Indian customs water, Goods, Types of Customs duties – Basic,

Additional, Protective, Safeguard, Counter-veiling duty on subsidised goods, Anti Dumping, Valuation of Custom

Duty. (L-8 / M-10)

- 6 – ADMISSION GOING ON FOR B.COM 5TH SEMESTER ALL SUBJECTS. CONTACT

Bhalotia Classes (OFFICE: 9883034569) (SIR: 8820696761)

Admission going for 5th Semester Honours/pass. Contact at above.

CORPORATE ACCOUNTING (HONS & PASS BOTH)

Internal Assessment: 20 marks

Semester-end Examinations: 80 marks

Total 100 marks

Unit – I: Company – Introduction And Accounting for Shares & debentures [20L, 20 Marks]

• Meaning of Company; Maintenance of Books of Accounts; Statutory Books; Annual Return

• Issue of Shares – issue, forfeiture, reissue, issue other than in cash consideration and issue to the

promoters; Pro-rata issue of shares. Issue of debentures. Sweat equity.

• Right and Bonus Share – Rules, Accounting

• Underwriting of shares and debentures: Rules; Determination of Underwriters Liability – with marked,

• unmarked & firm underwriting; Accounting.

• Employee Stock Option Plan – meaning; rules; Vesting Period; Exercise Period. Accounting for ESOP.

Meaning and Accounting of ESPS.

Unit – 2: Buy back and Redemption of preference shares [10L, 10 Marks]

• Buy Back of Securities – meaning, rules and Accounting.

• Redemption of Preference Shares – Rules and Accounting (with and without Bonus Shares)

Unit – 3: Company Final Accounts [15L, 15 Marks]

Introduction to Schedule III; Treatment of Tax; transfer to reserve, Dividend and applicable tax (out of current

profit, out of past reserve); Preparation of Statement of Profit & Loss and Balance Sheet. (tax on net profit

without recognizing deferred tax)

Unit – 4: Redemption of debenture [10L, 10 Marks]

Redemption of Debenture – Important Provisions, Accounting for Redemption: by conversion, by lot, by

purchase in the open market (cum and ex-interest), held as Investment and Use of Sinking Fund

Unit – 5: Valuation [10L, 10 Marks]

• Goodwill – valuation using different methods, i.e., Average Profit, Super Profit, Capitalisation and

Annuity.

• Shares – Valuation using different methods: Asset approach, Earnings approach, Dividend Yield,

Earnings- Price, Cum-div and Ex-div, Majority and Minority view and Fair Value

Unit – 6: Company Merger And Reconstruction [15L, 15 Marks]

• Amalgamation, Absorption and Reconstruction– Meaning; relevant standard and meaning of different

terms, Accounting in the books of Transferor Company. Accounting in the books of Transferee (based

on relevant accounting standard); intercompany transactions (excluding inter-company share holding).

• Internal reconstruction – meaning, provisions and Accounting, Surrender of Shares for redistribution;

preparation of Balance Sheet after reconstruction

Relevant Accounting Standards issued by the Institute of Chartered Accountants of India are to be

followed.

- 7 – ADMISSION GOING ON FOR B.COM 5TH SEMESTER ALL SUBJECTS. CONTACT

Bhalotia Classes (OFFICE: 9883034569) (SIR: 8820696761)

Admission going for 5th Semester Honours/pass. Contact at above.

HONOURS ONLY

Macroeconomics and Advanced Business Mathematics

Module I

Macroeconomics

Internal Assessment: 10 marks

Semester-end Examinations: 40 marks

Total 50 marks

Unit – I:Introduction

Concepts and variables of Macroeconomics. [L 2 / Marks:2]

Unit – II: National Income Accounting

Concepts and measurement of National Income (numerical examples preferred); Circular flow of income – Real

and Nominal GDP –Implicit deflator. [L 6 / Marks:6]

Unit – III: Determination of Equilibrium Level of National Income

Simple Keynesian Model; Consumption, saving and investment functions – National income determination;

Investment multiplier, Government expenditure multiplier, Tax multiplier, Balanced Budget multiplier. [L 10 /

Marks:10]

Unit – IV: Commodity market and Money market equilibrium

Concept of demand for Money: Liquidity Preference Approach; Derivation of IS and LM curves –Shifts of IS and

LM curves-equilibrium in IS-LM model – Effectiveness of monetary and fiscal policies. [L 10 / Marks:10]

Unit – V: Money, Inflation and Unemployment

Concept of supply of money; Measures of money supply – High powered money – Money multiplier. Concept

of Inflation – Demand-pull and Cost-push theories of inflation – Monetary and fiscal policies to control inflation;

Unemployment: Voluntary and Involuntary, Frictional and Natural Rate of Unemployment (Concepts only). [L

12 / Marks:12]

- 8 – ADMISSION GOING ON FOR B.COM 5TH SEMESTER ALL SUBJECTS. CONTACT

Bhalotia Classes (OFFICE: 9883034569) (SIR: 8820696761)

Admission going for 5th Semester Honours/pass. Contact at above.

Module II

Advanced Business Mathematics

Internal Assessment: 10 marks

Semester-end Examinations: 40 marks

Total 50 marks

Unit – I: Functions, Limit and Continuity:

Definition of functions, Classification of functions, Different types of functions(excluding Trigonometrical

functions), Elementary ideas of limit and continuity through the use of simple algebraic functions. [ 8 L /8

Marks]

Unit – II: Differentiation and Integration:

Derivative and its meaning; Rules of differentiation; Geometrical interpretation; Significance of derivative as

rate measure; Second order derivatives; Integration as anti-derivative process; Standard forms; Integration by

substitution. [ 8 L /8 Marks]

Unit – III: Applications of Derivative and Integration:

Maximum and minimum values ; Cost function ; Demand function ; Profit function; Increasing and decreasing

functions ; Rate measure, Applied problems on Average cost (AC), Average variable cost (AVC), Marginal cost

(MC), Marginal revenue (MR), Simple area calculation by integration method. [ 8 L /8 Marks]

Unit – IV: Determinants:

Determinants upto third order, Elementary properties of determinants, Minors and co-factors, Solution of a

system of linear equations by Cramer's Rule (up to three variables). [ 8 L /8 Marks]

Unit – V: Matrix:

Definition of matrix, Types of matrices, Operations on matrices (addition, subtraction, multiplication), Adjoint of

a matrix, Inverse of a matrix , Solution of a system of linear equations by matrix inversion method (up to three

variables). [ 8 L /8Marks]

- 9 – ADMISSION GOING ON FOR B.COM 5TH SEMESTER ALL SUBJECTS. CONTACT

You might also like

- Kante Sir NotesDocument345 pagesKante Sir Notesmank100% (7)

- Volo's Guide To Monsters - 1Document7 pagesVolo's Guide To Monsters - 1Saz100% (1)

- Case Study M&SDocument3 pagesCase Study M&S68Rohan Chopra0% (1)

- Useful For Certified Accounting & Audit Professional 1Document340 pagesUseful For Certified Accounting & Audit Professional 1nageswara kuchipudi100% (1)

- Iibf & Nism Adda: Certified Treasury ProfessionalsDocument365 pagesIibf & Nism Adda: Certified Treasury Professionalsnageswara kuchipudi0% (1)

- Audit Notes 5th Semester CUDocument123 pagesAudit Notes 5th Semester CUβιshακhα•様75% (4)

- Cfa ProgramDocument30 pagesCfa Programdeeppawar91No ratings yet

- Risk in Financial ServicesDocument342 pagesRisk in Financial Servicesnageswara kuchipudi100% (1)

- Head Strong: The Bulletproof Plan To Activate Untapped Brain Energy To Work Smarter and Think Faster-In Just Two Weeks - Dave AspreyDocument5 pagesHead Strong: The Bulletproof Plan To Activate Untapped Brain Energy To Work Smarter and Think Faster-In Just Two Weeks - Dave Aspreyzikibuse25% (4)

- 6th Semester Syllabus: Accounting & Finance GroupDocument6 pages6th Semester Syllabus: Accounting & Finance GroupAloysius BhuiyaNo ratings yet

- Chartered Accountacy Course OverviewDocument40 pagesChartered Accountacy Course OverviewAbhinav Madaan100% (1)

- Indian Institute of Banking & Finance: Certificate Examination in Risk in Financial ServicesDocument10 pagesIndian Institute of Banking & Finance: Certificate Examination in Risk in Financial Servicesbenzene4a1No ratings yet

- Acctng&aud 290518 PDFDocument9 pagesAcctng&aud 290518 PDFManohar VennapusaNo ratings yet

- Audit 5sem BhalotiaDocument123 pagesAudit 5sem Bhalotiatamal mondal0% (1)

- Risk in Financial ServicesDocument308 pagesRisk in Financial ServicesAkhilesh SinghNo ratings yet

- PGD Brochure 10th BatchDocument13 pagesPGD Brochure 10th BatchSaiful Islam PatwaryNo ratings yet

- 01Document6 pages01Sheen SiNo ratings yet

- Part-II (Semester III & IV)Document11 pagesPart-II (Semester III & IV)Inderjeet Singh ToorNo ratings yet

- M. Com II TaxationDocument7 pagesM. Com II TaxationShree PatilNo ratings yet

- New Ca Course SchemeDocument6 pagesNew Ca Course SchemeDeepak Iyer DeepuNo ratings yet

- CA Course DetailsDocument14 pagesCA Course DetailsCA testNo ratings yet

- Part-II (Semester III & IV) 12.3.18Document23 pagesPart-II (Semester III & IV) 12.3.18Asif KhanNo ratings yet

- 6 Trim 6 FIN - Corporate Tax PlanningDocument3 pages6 Trim 6 FIN - Corporate Tax Planning27vxjtfbh8No ratings yet

- Performa For Bank Loan: Amit PrajapatiDocument2 pagesPerforma For Bank Loan: Amit PrajapatiAmit PrajapatiNo ratings yet

- Indian Institute of Banking & Finance: Certified Credit ProfessionalDocument10 pagesIndian Institute of Banking & Finance: Certified Credit ProfessionalsvijayswarupNo ratings yet

- IntroDocument91 pagesIntrodimpi1234No ratings yet

- (WWW - Entrance-Exam - Net) - B.com. Hons. Accounting 2016 ExaminationDocument18 pages(WWW - Entrance-Exam - Net) - B.com. Hons. Accounting 2016 ExaminationDrexiser GamingNo ratings yet

- Acc GST RevisedDocument8 pagesAcc GST RevisedKshama GiriNo ratings yet

- Intermediate Course DetailsDocument1 pageIntermediate Course DetailsmahabodhicaacademyNo ratings yet

- (Hons) Part IIIDocument30 pages(Hons) Part IIIabsthodNo ratings yet

- Cacpt PPT ProjectDocument53 pagesCacpt PPT ProjectRJ Rishabh TyagiNo ratings yet

- 5th Semester Bcom Auditing Notes Blotia EditDocument214 pages5th Semester Bcom Auditing Notes Blotia EditKnowledge NiwasNo ratings yet

- Courses: Common Proficiency Test (CPT) About The TestDocument5 pagesCourses: Common Proficiency Test (CPT) About The TestPurushothaman YogeswaranNo ratings yet

- 5th Semester Bcom Auditing Notes Blotia EditDocument115 pages5th Semester Bcom Auditing Notes Blotia EditKnowledge NiwasNo ratings yet

- Ou Bcom SyllabusDocument48 pagesOu Bcom SyllabussuccessplanNo ratings yet

- Certificate Course On Income Tax Return FillingDocument1 pageCertificate Course On Income Tax Return Fillingponnada sairamNo ratings yet

- Deb Del 130 2017 51 PPR Bachelor of CommerceDocument10 pagesDeb Del 130 2017 51 PPR Bachelor of CommerceNiyor KalitaNo ratings yet

- Ca CS CmaDocument25 pagesCa CS CmachiragpramodwaghelaNo ratings yet

- Syllabus BCOMACCT NEP2023-2024Document13 pagesSyllabus BCOMACCT NEP2023-2024Vdj AtmaNo ratings yet

- The Chartered AccountantDocument12 pagesThe Chartered AccountantSyed Feroz Ali MadaniNo ratings yet

- Career Options in CommerceDocument11 pagesCareer Options in CommercesanjeevknlNo ratings yet

- Business Valuation and Corporate RestructuringDocument8 pagesBusiness Valuation and Corporate Restructuringuruuva phenixNo ratings yet

- IQMS SAI 9-14 Transition Flyer - March 2016Document3 pagesIQMS SAI 9-14 Transition Flyer - March 2016Rushabh KapadiaNo ratings yet

- CCIDocument30 pagesCCIRamaiah KarumudiNo ratings yet

- IQMS SAI 9-14 Transition Flyer - April 2016Document3 pagesIQMS SAI 9-14 Transition Flyer - April 2016Rushabh KapadiaNo ratings yet

- Indian Institute of Banking & Finance: Certified Credit ProfessionalDocument9 pagesIndian Institute of Banking & Finance: Certified Credit ProfessionalABHIJITH G KUMARNo ratings yet

- CeCOC or CeCP-Low-240518 PDFDocument9 pagesCeCOC or CeCP-Low-240518 PDFDeepNo ratings yet

- Codd Rules With ExamplesDocument50 pagesCodd Rules With Examplespuja kumariNo ratings yet

- Course Outline - MIS 1103Document4 pagesCourse Outline - MIS 1103Md. Abu SayeedNo ratings yet

- UG-BCom H - G SyllabusDocument129 pagesUG-BCom H - G Syllabushussain shahidNo ratings yet

- Work of Chartered AccountantDocument10 pagesWork of Chartered AccountantDimple DamniwalaNo ratings yet

- 06 Regulation of The Public Accounting PracticeDocument6 pages06 Regulation of The Public Accounting PracticeJane DizonNo ratings yet

- Curriculum: 2016-18 (Batch) Faculty of Commerce and ManagementDocument72 pagesCurriculum: 2016-18 (Batch) Faculty of Commerce and ManagementDeepak PaulNo ratings yet

- How To Become A Company SecretaryDocument21 pagesHow To Become A Company SecretaryPriyanshu PalNo ratings yet

- PMQ - Brochure - Internal - Audit ICSIDocument4 pagesPMQ - Brochure - Internal - Audit ICSISriramNo ratings yet

- 74932bos Transition Scheme NsetDocument47 pages74932bos Transition Scheme NsetShubhamNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingNo ratings yet

- Wiley CMA Learning System Exam Review 2013, Financial Planning, Performance and Control, Online Intensive Review + Test BankFrom EverandWiley CMA Learning System Exam Review 2013, Financial Planning, Performance and Control, Online Intensive Review + Test BankNo ratings yet

- Wiley CMA Learning System Exam Review 2013, Financial Planning, Performance and Control, + Test BankFrom EverandWiley CMA Learning System Exam Review 2013, Financial Planning, Performance and Control, + Test BankRating: 5 out of 5 stars5/5 (1)

- Wiley CMAexcel Learning System Exam Review 2015: Part 1, Financial Planning, Performance and ControlFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 1, Financial Planning, Performance and ControlNo ratings yet

- Wiley CMA Learning System Exam Review 2013, Complete Set, Online Intensive Review + Test BankFrom EverandWiley CMA Learning System Exam Review 2013, Complete Set, Online Intensive Review + Test BankNo ratings yet

- Accounting & Auditing Clerk: Passbooks Study GuideFrom EverandAccounting & Auditing Clerk: Passbooks Study GuideNo ratings yet

- (A3) The Genuine Marks of The Disciples of ChristDocument7 pages(A3) The Genuine Marks of The Disciples of ChristDenmark SaviduriaNo ratings yet

- Purchase Order: NPWP: 03.343.037.2-047.000 12208599Document2 pagesPurchase Order: NPWP: 03.343.037.2-047.000 12208599Oscar OkkyNo ratings yet

- Pantone PDFDocument55 pagesPantone PDFMj Jack Rachmanto100% (1)

- Neuropathic Pain: DR - Dr.Thomas Eko P. Sps (K) Bagian/Smf Neurologi FK Unud/ Rsup DenpasarDocument85 pagesNeuropathic Pain: DR - Dr.Thomas Eko P. Sps (K) Bagian/Smf Neurologi FK Unud/ Rsup DenpasarCox AbeeNo ratings yet

- Handout - Education in EmergenciesDocument31 pagesHandout - Education in EmergenciesFortunatoNo ratings yet

- Neom 1revDocument8 pagesNeom 1revSanyam JainNo ratings yet

- CodaDocument15 pagesCodaShashi KartikyaNo ratings yet

- Design For Manufacture and Assembly: The Boothroyd-Dewhurst ExperienceDocument22 pagesDesign For Manufacture and Assembly: The Boothroyd-Dewhurst ExperienceGraham MooreNo ratings yet

- Advent Jesse Tree - 2013Document35 pagesAdvent Jesse Tree - 2013Chad Bragg100% (1)

- G.R. NO. L-5486 Dela Pena vs. HidalgoDocument18 pagesG.R. NO. L-5486 Dela Pena vs. HidalgoSheridan AnaretaNo ratings yet

- Rephrasing Exercises Second TermDocument6 pagesRephrasing Exercises Second TermLulu SancNo ratings yet

- The Expanding Universe - Sir Arthur Stanley Eddington - Cambridge University Press - 1987Document153 pagesThe Expanding Universe - Sir Arthur Stanley Eddington - Cambridge University Press - 1987cramerps2084No ratings yet

- Motor Claim Form THE ORIENTAL INSURANCE CO. LTD.Document4 pagesMotor Claim Form THE ORIENTAL INSURANCE CO. LTD.rajiv.surveyor7145No ratings yet

- Research On Process of Raising Funds Through QipDocument5 pagesResearch On Process of Raising Funds Through QipRachit SharmaNo ratings yet

- Classroom ArrangementsDocument5 pagesClassroom Arrangementsapi-427868008No ratings yet

- Covert Extinction TherapyDocument6 pagesCovert Extinction TherapyAnet Augustine AnetNo ratings yet

- Alter Ego 181 PreviewDocument20 pagesAlter Ego 181 PreviewJohn LloydNo ratings yet

- CGR Project Report DDGGDDDocument21 pagesCGR Project Report DDGGDDTanvi KodoliNo ratings yet

- A Project Report On Financial Analysis at B D K LTD HubaliDocument104 pagesA Project Report On Financial Analysis at B D K LTD HubaliBabasab Patil (Karrisatte)100% (1)

- Chapter 6 Learning English For Specific PurposesDocument19 pagesChapter 6 Learning English For Specific PurposesMaRy ChUy HRNo ratings yet

- Main Slokas With MeaningDocument114 pagesMain Slokas With MeaningRD100% (1)

- Lista MF 01 - 05 - 2015Document11 pagesLista MF 01 - 05 - 2015CsordásCsaba-JózsefNo ratings yet

- Nilai Konversi Uji Kuat Tekan Variasi Bentuk Paving Block Terhadap Bentuk Sampel Uji Sni 03-0691-1996Document9 pagesNilai Konversi Uji Kuat Tekan Variasi Bentuk Paving Block Terhadap Bentuk Sampel Uji Sni 03-0691-1996MiratulHazanahNo ratings yet

- Hardrock Fabrication (P) Limited: SL - NO. Part No. Description TA66096Document5 pagesHardrock Fabrication (P) Limited: SL - NO. Part No. Description TA66096AMSONIC ROCKSNo ratings yet

- Clone 123C3: Monoclonal Mouse Anti-Human CD56 Code M7304Document3 pagesClone 123C3: Monoclonal Mouse Anti-Human CD56 Code M7304Jaimier CajandabNo ratings yet

- Barangay SinabaanDocument1 pageBarangay SinabaanOmar Dizon IINo ratings yet

- Apbush DBQDocument2 pagesApbush DBQMaria Ines Carrillo100% (1)