Professional Documents

Culture Documents

Vodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar Limited

Vodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar Limited

Uploaded by

asdfqwerasdOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar Limited

Vodafone International Holdings B.V. vs. Union of India 1. About Hutchision Essar Limited

Uploaded by

asdfqwerasdCopyright:

Available Formats

VODAFONE INTERNATIONAL HOLDINGS B.V. VS. UNION OF INDIA 1. ABOUT HUTCHISION ESSAR LIMITED: 1.

Hutchison Essar Limited (HEL) is an Indian Company which is the joint venture of Hutchison Telecommunication International Limited (HTIL) Group and Essar Group. 2. HEL is carrying on the business of providing telecommunication services in India. 2. ABOUT LIMITED: HUTCHISION TELECOMMUNICATION INTERNATIONAL

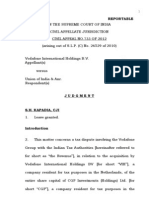

1. Hutchison Telecommunication International Limited is a foreign company, registered in Hong Kong 3. HOW VODAFONE ACUIRED CONTROL OVER HEL: 1. HTIL has a wholly owned subsidiary company CGP Investment Ltd. (CGP) which is also a foreign company registered in Cayman Islands, Mauritius. 2. The company CGP holds directly more than 50% shares in HEL. 3. Vodafone International Holdings B.V., registered in Netherland with a view to acquire the controlling interest in HEL purchased the 100% shares in CGP from HTIL.

GRAPHICAL REPRESENTAION BALANCE SHEET OF HTIL Liabilities Assets Investment 100% Share of CGP XXXXX XXXX XXXXX 1 Purchased share of CGP from HTIL for $11 billion in 2007 Thus acquired the business of CGP VODAFONE INTERNATIONAL HOLDINGS B.V.

BALANCE SHEET OF CGP Liabilities Assets Investment > 50% Share in HEL XXXXX XXXX XXXXX 2 Indirectly purchased >50% share of HEL

BALANCE SHEET OF HEL Liabilities Assets 3 Acquired the controlling interest in HEL Thus acquired the business in India

XXXXX

XXXXX

4. ISSUES INVOLVED 1. Whether HTIL by reason of instant transaction, had earned income liable for capital gain tax in India as this income was earned towards sale consideration of transfer of its business/ economic interests in India as a group in favour of Vodafone. 2. Whether, on payment made by the Vodafone to HTIL on such transaction, Vodafone was liable to deduct tax at source under Section 195 from the sale consideration paid to HTIL. 5. SHOW CASUE NOTICE UNDER SECTION 201 The Income tax department issued a show cause notice on September 19, 2007 under section 201 to Vodafone as to why it should not be treated as an assessee in default for not deducting TDS (amounting to $1.7 billion as capital gain tax) under section 195 on the payment made to HTIL which is taxable in India in hands of HTIL as capital gains. 6. WRITE PETITION BY VODAFONE Vodafone filed a writ petition in Bombay High Court challenging the legal validity of the show cause notice inter-alia on the grounds that a) The transaction being one for purchase of CGP between two non- residents there can be no question of any tax on capital gains b) Even assuming the transaction is taxable, Vodafone is not an assessee in default as the provisions of section 201 do not apply to such a transaction, c) The 2008 amendment to section 201 making amendment retrospective from 2002 is unconstitutional, d) There is no transfer of any capital asset in India, and e) Duty to deduct tax will only arise if the entity has presence in India.

7. FACTS PRODUCED BY REVENUE AUTORITY BEFOR HIGH COURT 1. The Vodafone made declaration to various authorities, including the SEC in USA, to the effect that the transaction is one for purchase of HTILs interest in Indian companies. 2. Vodafone has not only become a successor-in- interest of HTIL in the joint venture between HTIL and Essar, it is now de facto a co- licensee with the Essar Group to operate mobile telephony in India. 3. Hutchison Essar was renamed as Vodafone Essar. 4. The profit resulting from the transaction was to HTIL as, after the transaction, the HTIL distributed the profit to its shareholders at the rate of HK$ 6.15 per share. 9. DECISION OF BOMABY HIGH COURT ON 03.12.2008 The facts produced by the revenue weighted heavily with the High Court while holding that prima facie there is a transfer of capital asset situated in India. The Bombay High Court, on dismissing writ, held as under: Against ground no-a) 1. The transfer of CGP by HTIL to Vodafone amounts to transfer to controlling interest in Indian Company HEL to Vodafone. The dominant purpose of sale of shares of CGP was to transfer the controlling interest of Indian Company. 2. Applicability of Section 9: Vodafone has acquired a source of income in India; HTIL by reason of this transaction has earned capital gains taxable in India as the income was earned towards sale consideration of transfer to Vodafone of its Indian business/ economic interest as a group. It was held that the income of HTIL was deemed to have accrued or arise in India and therefore, it squarely fell within the ambit of section 9 and hence, chargeable to Income Tax under the head capital gains. Against ground no-d) 3. In the instant case, the subject matter of transfer as contacted between the parties is not actually the shares of a Cayman Island Company, but the assets situated in India. (Issue 1. Resolved through 1, 2, 3 above)

Further on the other grounds of Vodafone order of High court is silent: But we can analyze them as follow: Ground no-e) 4. For the applicability of Section 195, presence of person, responsible to deduct tax, in India, is not required. For the applicability of this section following conditions are required to be satisfied:1. Payment is made by any person, 2. Payment is made to a NRI or foreign company 3. Payment is in the nature of Interest or sum (other than salaries) chargeable to tax in India Since Vodafone PRIMA FACIE had satisfied all the above conditions, it was liable to deduct tax on the payment made to HTIL. Ground b) 5. As per the amended Section 201, where a person Who is required to deduct any amount in accordance with the provisions of Income tax Act 1. Does not deduct , or 2. After so deducting - Fails to pay - Does not pay the whole or any part of the tax, as required by or under the Income tax Act, he shall be deemed to an assessee in default under section 201. Ground c) 6. Making retrospective amendment is constitutionally valid. (Issue 2 resolved through 4,5,and 6 above)

DECISION IN SHORT: Bombay High Court dismissed the Writ Petition of Vodafone, challenging the notice issued by the income tax department, calling upon Vodafone to show cause why it should not be declared as assessee in default for not deducting the consideration paid to HTIL. The dominant purpose of the transaction was to acquire controlling interest which one foreign company held in the Indian company. This transaction would certainly be subject to municipal laws of India, including the Income Tax Act. 10.SPECIAL LEAVE PETITION WITH SUPREM COURT Vodafone filed a Special Leave petition with the Supreme Court challenging the order of Bombay High Court which upheld the Show Cause notice issued by the Income tax department. 11.DECISION OF HONERABLE SUPREME COURT ON 23.01.2009 1. The supra court dismissed the Special leave petition of Vodafone. 2. While dismissing the SLP Supreme Court directed Vodafone to go back to the assessing officer, furnish all the necessary documents including the agreement (which had not been submitted earlier before the AO or the High Court), for deciding the issue of jurisdiction of the Indian authorities and other issue. As per the law laid down in Management of Express Newspapers vs. Workers AIR 1963 SC 569, the High Court should ordinarily not embark upon deciding questions of fact which require appreciation of evidence, the question in regard to the jurisdictional issue should be decided by the AO as a preliminary issue and the assessee shall be entitled to question the decision of the AO on that preliminary issue before the High Court. The question of law to that extent remains open.

12.Comment on above judgment 1. In favour: This ruling will generate significant revenue for the government 2. In Against: - At a time when companies worldwide are rethinking their strategies and risk aversion is growing, the judgment sends powerful signals which may adversely affect the flow of foreign direct investment into India. - Although the ruling will generate significant revenue for the government, this will be in the short term only. In the long term it will act as a restraint for investors that view India as a good business prospect (particularly in the current market conditions), resulting in a significant slowdown of investment into the country in the form of both foreign direct investment and foreign institutional investment. - Such an interpretation of Indian tax law and the use of retrospective changes in law expose many previous buyers and sellers of shares outside India to significant amounts of tax and create significant uncertainty for such transactions going forward. Companies will undoubtedly face underlying issues regarding this taxation on two levels: in India and in the holding company's jurisdiction. In many cases tax treaties will provide no protection from such a double tax liability.

Amit Kumar mishra amit83india@gmail.com CA finalist (with one group)

You might also like

- Income TAX: Prof. Jeanefer Reyes CPA, MPADocument37 pagesIncome TAX: Prof. Jeanefer Reyes CPA, MPAmark anthony espiritu75% (4)

- Ashish Kumar AFB 2011-13003Document26 pagesAshish Kumar AFB 2011-13003Kumar BishalNo ratings yet

- India - VodafoneDocument4 pagesIndia - VodafonedecheNo ratings yet

- Vodafone Tax Case: Analysis of Key IssuesDocument10 pagesVodafone Tax Case: Analysis of Key IssuesShishir SinghNo ratings yet

- Analysis of Vodafone Tax CaseDocument9 pagesAnalysis of Vodafone Tax Caserjt163100% (1)

- Involved Stakeholders (Parties)Document3 pagesInvolved Stakeholders (Parties)shrutNo ratings yet

- Analysis of Vodafone CaseDocument13 pagesAnalysis of Vodafone CaseRinni JainNo ratings yet

- P.S.Subrahmanyam A.Niroopa Rani Mahanth Swaroop Rajesh Kumar Das Narendra Singh Himanshu Behl WG CDR P.MehtaDocument51 pagesP.S.Subrahmanyam A.Niroopa Rani Mahanth Swaroop Rajesh Kumar Das Narendra Singh Himanshu Behl WG CDR P.MehtaNiroopa RaniNo ratings yet

- Vodafone Tax CaseDocument15 pagesVodafone Tax CaseBharti BansalNo ratings yet

- Investment in India The Vodafone EffectDocument4 pagesInvestment in India The Vodafone Effectaruba ansariNo ratings yet

- International Tax Alert: Vodafone RulingDocument6 pagesInternational Tax Alert: Vodafone RulingSanghita ChakrabortyNo ratings yet

- Corporate Tax PlanningDocument5 pagesCorporate Tax PlanningAravind Swamy NathanNo ratings yet

- Vodafone Case FinalDocument5 pagesVodafone Case FinalNishit SaraiyaNo ratings yet

- Vodafone Tax Saga: Group 4Document17 pagesVodafone Tax Saga: Group 4Saharsh SaraogiNo ratings yet

- Rajesh VodafoneDocument9 pagesRajesh VodafoneMahanth SwaroopNo ratings yet

- Hand Out Vodafone International Holdings BDocument11 pagesHand Out Vodafone International Holdings Bprernachopra88No ratings yet

- Slaughter and May: Vodafone's Supreme Court Victory in IndiaDocument3 pagesSlaughter and May: Vodafone's Supreme Court Victory in IndiaKundan PrasadNo ratings yet

- The Vodafone - Hutchison Case and Its Implications: Shantanu SurpureDocument10 pagesThe Vodafone - Hutchison Case and Its Implications: Shantanu Surpuredeath_wishNo ratings yet

- Recent Foreign Taxation Issues: Ggi Asian Conference, Itpg Meet, Beijing, China October 2010Document12 pagesRecent Foreign Taxation Issues: Ggi Asian Conference, Itpg Meet, Beijing, China October 2010Raghu MarwahNo ratings yet

- Taxguru - In-Vodafone Case AnalysisDocument22 pagesTaxguru - In-Vodafone Case AnalysisGokul RaviNo ratings yet

- Against Vodafone: Anusha PatilDocument42 pagesAgainst Vodafone: Anusha Patilvinay kamatNo ratings yet

- 04 - Vodafone Case AnalysisDocument17 pages04 - Vodafone Case AnalysisSakthi NathanNo ratings yet

- Facts of Vodafone's Case (Case Study)Document3 pagesFacts of Vodafone's Case (Case Study)Nanasaheb MarkadNo ratings yet

- A Indirect Transfer Taxation in IndiaDocument12 pagesA Indirect Transfer Taxation in IndiaNikhil ModyNo ratings yet

- Retrospective Tax by Financial Bill 2012: Iilm Institute For Higher Eduction, GurgaonDocument8 pagesRetrospective Tax by Financial Bill 2012: Iilm Institute For Higher Eduction, Gurgaonshantanu_malviya_1No ratings yet

- Vodafone Case StudyDocument35 pagesVodafone Case StudyRidhima SharmaNo ratings yet

- Vodafone CaseDocument125 pagesVodafone CaseMridul CrystelleNo ratings yet

- Executive Summary of Vodafone Case Pronounced by Supreme Court of India PDFDocument3 pagesExecutive Summary of Vodafone Case Pronounced by Supreme Court of India PDFHarshVardhanNo ratings yet

- Vodafone Case Analysis: Internal Assignment-2Document7 pagesVodafone Case Analysis: Internal Assignment-2KK SinghNo ratings yet

- KPMG Flash News Vodafone International Holdings BV PDFDocument6 pagesKPMG Flash News Vodafone International Holdings BV PDFManisha SinghNo ratings yet

- Analysis of Vodafone CaseDocument13 pagesAnalysis of Vodafone CaseanishaNo ratings yet

- Vodafone SummaryDocument4 pagesVodafone SummaryAbhinav AggarwalNo ratings yet

- Brief Facts of The Case 2. The Hutchison Group, Hong Kong First Invested Into The Telecom Business in India in 1992Document2 pagesBrief Facts of The Case 2. The Hutchison Group, Hong Kong First Invested Into The Telecom Business in India in 1992Amrutha GayathriNo ratings yet

- Vodafone-Hutch M & ADocument12 pagesVodafone-Hutch M & AKapil BhagavatulaNo ratings yet

- Project On:: Case Study On Vodafone Holdings B.V. v. Union of India and AnrDocument15 pagesProject On:: Case Study On Vodafone Holdings B.V. v. Union of India and AnranumodiNo ratings yet

- Vodafone-Hutch Tax Dispute: International Business Law Assignment-I Term-V Submitted By-Udit Chauhan 22/058Document3 pagesVodafone-Hutch Tax Dispute: International Business Law Assignment-I Term-V Submitted By-Udit Chauhan 22/058Udit ChauhanNo ratings yet

- Double Tax Avoidance AgreementDocument20 pagesDouble Tax Avoidance AgreementSuchismita PatiNo ratings yet

- Richter Holding LimitedDocument3 pagesRichter Holding LimitedUsman KhanNo ratings yet

- Vodafone CaseDocument2 pagesVodafone Caseimahere_suryaNo ratings yet

- Vodafone Hutch CaseDocument6 pagesVodafone Hutch CaseAbhijeet RoyNo ratings yet

- Conclusion of Vodafone CaseDocument4 pagesConclusion of Vodafone CaseAlex FrancisNo ratings yet

- Vodafone International Holdings ... Vs Union of India & Anr On 20 January, 2012Document82 pagesVodafone International Holdings ... Vs Union of India & Anr On 20 January, 2012silvernitrate1953No ratings yet

- Article On Vodafone For WebsiteDocument7 pagesArticle On Vodafone For WebsiteVignesh .mNo ratings yet

- Vodafone Casse SummaryDocument4 pagesVodafone Casse SummaryAman D SharanNo ratings yet

- Indirect Transfer of Ambuja CementsDocument6 pagesIndirect Transfer of Ambuja CementsKunwarbir Singh lohatNo ratings yet

- Vodafone CaseDocument4 pagesVodafone CaseKushal TibrewalNo ratings yet

- Vodafone Tax CaseDocument1 pageVodafone Tax CasebhatnagarriteshNo ratings yet

- Vodafone Case - Supreme Court DecisionDocument275 pagesVodafone Case - Supreme Court Decisionraghul_sudheeshNo ratings yet

- Vodafone Case SummaryDocument3 pagesVodafone Case SummaryShubham NathNo ratings yet

- Vodafone Tax Case: Arindam Daschowdhury (PGDM 100109) Deepak B.S. (PGDM 100110)Document16 pagesVodafone Tax Case: Arindam Daschowdhury (PGDM 100109) Deepak B.S. (PGDM 100110)vishala4No ratings yet

- IIMT Vodafone Impact On M&A 2013Document110 pagesIIMT Vodafone Impact On M&A 2013ravichandranNo ratings yet

- EY Tax Alert Vodafone Case StudyDocument9 pagesEY Tax Alert Vodafone Case Studyrbharat87No ratings yet

- Vodafone Tax CaseDocument13 pagesVodafone Tax CasePriyanka RajputNo ratings yet

- Dr. Ram Manohar Lohiya National Law UniversityDocument12 pagesDr. Ram Manohar Lohiya National Law UniversityVipin VermaNo ratings yet

- Decision of Court: Campaign CPPSTDocument2 pagesDecision of Court: Campaign CPPSTAvinash KeshriNo ratings yet

- Ca JaDocument1 pageCa JaLynn NazarethNo ratings yet

- SC Judgement in Vodafone Case (2012)Document256 pagesSC Judgement in Vodafone Case (2012)RCR Wireless News IndiaNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Act370. Assignment. Omar Faruk Khan RafiDocument35 pagesAct370. Assignment. Omar Faruk Khan RafiOmar Faruk Khan RafiNo ratings yet

- PF TransferDocument11 pagesPF TransfersinniNo ratings yet

- q17 Iaetrfcnrfc AnsDocument2 pagesq17 Iaetrfcnrfc AnsIan De DiosNo ratings yet

- Sales Tax3650193129439Document12 pagesSales Tax3650193129439tayyabNo ratings yet

- LAST-PAY-CERTIFICATE-FORM-SEDiNFO.NET.xlsDocument2 pagesLAST-PAY-CERTIFICATE-FORM-SEDiNFO.NET.xlsSyed Jalil abbas100% (1)

- P60 End of Year Certificate 2021 P60 End of Year CertificateDocument1 pageP60 End of Year Certificate 2021 P60 End of Year CertificateIsmael GomesNo ratings yet

- Lesson 2 - Intro To Income TaxationDocument34 pagesLesson 2 - Intro To Income TaxationKaryl Magno Pajaroja100% (1)

- BIR VAT Ruling No. 076-99Document3 pagesBIR VAT Ruling No. 076-99Adrian CabanaNo ratings yet

- E-Way Bill: Government of IndiaDocument1 pageE-Way Bill: Government of IndiaShefali MandowaraNo ratings yet

- Advanced Accounting Solutions Manual by Guerrero and PeraltaDocument2 pagesAdvanced Accounting Solutions Manual by Guerrero and PeraltaSachie Beltejar0% (4)

- 05.06.2024 - Letter From Council Members To RDCDocument2 pages05.06.2024 - Letter From Council Members To RDCIndiana Public Media NewsNo ratings yet

- US Internal Revenue Service: p3847Document32 pagesUS Internal Revenue Service: p3847IRSNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Philam Dollar Bond FundDocument17 pagesPhilam Dollar Bond FundJulie Ann MirandaNo ratings yet

- For Any Transactional Queries Related To Donations Please ContactDocument1 pageFor Any Transactional Queries Related To Donations Please ContactChristo JeniferNo ratings yet

- Gujranwala Electric Power Company - Electricity Consumer Bill (Mdi)Document2 pagesGujranwala Electric Power Company - Electricity Consumer Bill (Mdi)Rana AmjadNo ratings yet

- 2nd Statement: Sale of A Stock Dealer of Shares of Stocks Directly To A Buyer Is Subject To TheDocument9 pages2nd Statement: Sale of A Stock Dealer of Shares of Stocks Directly To A Buyer Is Subject To Theishinoya keishiNo ratings yet

- Facts:: Paseo Realty and Development Corp. vs. CaDocument2 pagesFacts:: Paseo Realty and Development Corp. vs. CaJupiterNo ratings yet

- "Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or ProfessionDocument5 pages"Isolated Activity": Sybbi / Sybaf PGBP Direct Taxation-II Chapter 5:-Profits & Gains of Business or Professionas2207530No ratings yet

- Filling Up Forms AccuratelyDocument51 pagesFilling Up Forms AccuratelydanteNo ratings yet

- Tax Components: Petrol DieselDocument4 pagesTax Components: Petrol DieselUrvashi AroraNo ratings yet

- Real Property Assessment &taxation - Engr NonatoDocument54 pagesReal Property Assessment &taxation - Engr NonatoBrenda Olshopee100% (3)

- Invoice INV-0030Document1 pageInvoice INV-0030Threshing FlowNo ratings yet

- Assessment of Tax Collection Problems (Acase Study On Sokoru WoredaDocument49 pagesAssessment of Tax Collection Problems (Acase Study On Sokoru WoredaAbdurehman B Hasen100% (1)

- FS2122-INCOMETAX-01A: BSA 1202 Atty. F. R. SorianoDocument7 pagesFS2122-INCOMETAX-01A: BSA 1202 Atty. F. R. SorianoKatring O.No ratings yet

- July21 SS PDFDocument5 pagesJuly21 SS PDFSYAZWINA SUHAILINo ratings yet

- Gross Income (Residence Vs Source) 2023Document22 pagesGross Income (Residence Vs Source) 2023molemothekaNo ratings yet

- ThesisDocument449 pagesThesisHang VeasnaNo ratings yet

- Ch08 Donor's TaxDocument8 pagesCh08 Donor's TaxHazel CruzNo ratings yet