Professional Documents

Culture Documents

Blue Book - Set 8-7

Blue Book - Set 8-7

Uploaded by

Anna TungCopyright:

Available Formats

You might also like

- AUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersDocument10 pagesAUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersVincent Larrie MoldezNo ratings yet

- Msds Pig IronDocument6 pagesMsds Pig Ironcampag12350% (2)

- Problems & Solutions - RNSDocument28 pagesProblems & Solutions - RNSAyushi0% (1)

- Project Question: Financial Management 1ADocument4 pagesProject Question: Financial Management 1AHashimRazaNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- 2019-12 ICMAB FL 001 PAC Year Question December 2019Document3 pages2019-12 ICMAB FL 001 PAC Year Question December 2019Mohammad ShahidNo ratings yet

- Tatty Company Analysis of Land For 2018: Requirement 1Document3 pagesTatty Company Analysis of Land For 2018: Requirement 1Hiroshi WakatoNo ratings yet

- B. Com I All PapersnDocument14 pagesB. Com I All Papersnrahim Abbas aliNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Financial Accounting and Reporting: RequirementsDocument4 pagesFinancial Accounting and Reporting: RequirementsebshuvoNo ratings yet

- 01.correction of Errors - 245038322 PDFDocument4 pages01.correction of Errors - 245038322 PDFMaan CabolesNo ratings yet

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocument14 pagesUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNo ratings yet

- IA Quiz ImadeDocument4 pagesIA Quiz ImadeKuro ZetsuNo ratings yet

- ACC304-IAS 1 Final AccountsDocument4 pagesACC304-IAS 1 Final AccountsGeorge AdjeiNo ratings yet

- FSQsDocument8 pagesFSQsNikesh KunwarNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/31caiexpertcontactNo ratings yet

- Acc Q4Document9 pagesAcc Q4risvana rahimNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- HAC Intro To FInancial Management QuestionPaperDocument6 pagesHAC Intro To FInancial Management QuestionPaperfortune maviyaNo ratings yet

- ACCT 410 Candel Financial StatementDocument14 pagesACCT 410 Candel Financial StatementAthia Adams-KerrNo ratings yet

- Hba 2401 Advanced Financial Reporting Cat March 2024Document5 pagesHba 2401 Advanced Financial Reporting Cat March 2024PhilipNo ratings yet

- ACCT 302 Final AccountDocument10 pagesACCT 302 Final AccountbismarkkwadzokpoNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Review Questions On Standard-1Document4 pagesReview Questions On Standard-1George Adjei100% (1)

- M - Limited Companies (After Edit)Document41 pagesM - Limited Companies (After Edit)PublicEnemy007No ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- 71592bos57621 Inter p1qDocument7 pages71592bos57621 Inter p1qRahul MishraNo ratings yet

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument4 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationUsama RajaNo ratings yet

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNo ratings yet

- RAC 102 - Principles of Financial Accounting 11 - Draft ExamDocument5 pagesRAC 102 - Principles of Financial Accounting 11 - Draft Examemmanuel mwitaNo ratings yet

- Icag Nov 2020-Group Discuss...Document6 pagesIcag Nov 2020-Group Discuss...Papa Ekow ArmahNo ratings yet

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- ExercisesDocument20 pagesExercisesRolivhuwaNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Assignment Due 29.01.21Document3 pagesAssignment Due 29.01.21Brandon SibandaNo ratings yet

- Seminar 8 PART BDocument3 pagesSeminar 8 PART BGaba RieleNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- Acc05 Far Handout 7Document5 pagesAcc05 Far Handout 7Jullia BelgicaNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Sole Trader - Final Accounts: The Following Trial Balance Was Extracted From The Books of K. Kelly On 31/12/2005Document8 pagesSole Trader - Final Accounts: The Following Trial Balance Was Extracted From The Books of K. Kelly On 31/12/2005MahmozNo ratings yet

- Bac 202 Second CatDocument2 pagesBac 202 Second CatBrian MutuaNo ratings yet

- Tutorial 7 - IntangibleDocument2 pagesTutorial 7 - IntangibleABABNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Use The Following Information For The Next Two (2) QuestionsDocument21 pagesUse The Following Information For The Next Two (2) QuestionsJennifer AdvientoNo ratings yet

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- 05 s101 FfaDocument5 pages05 s101 FfaMuhammad AsifNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- CL9BD LTD., Company Financial StatementsDocument2 pagesCL9BD LTD., Company Financial Statementsrumelrashid_seuNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- FAR-I Statement of Changes EquityDocument2 pagesFAR-I Statement of Changes EquityUmair AhmedNo ratings yet

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- AE 22 Activity 8Document2 pagesAE 22 Activity 8Venus PalmencoNo ratings yet

- Bản inDocument23 pagesBản inTrang VũNo ratings yet

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- Buscom Lecture-3Document4 pagesBuscom Lecture-3Dai SyNo ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- Required: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"Document2 pagesRequired: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"АннаNo ratings yet

- Zimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3Document7 pagesZimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3chauromweaNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Eagle Island UST/Agip Waterfront Communities Petition To NHRCDocument86 pagesEagle Island UST/Agip Waterfront Communities Petition To NHRCJustice & Empowerment InitiativesNo ratings yet

- KPMG MAR 2024 100502 PayslipDocument1 pageKPMG MAR 2024 100502 PayslipNeha JainNo ratings yet

- Čedomilj Mijatović PDFDocument28 pagesČedomilj Mijatović PDFRTK401RTK401No ratings yet

- 611 Series Tech 757454 ENd PDFDocument536 pages611 Series Tech 757454 ENd PDFMinhDuc HoNo ratings yet

- SD NotesDocument7 pagesSD NotesBasu AllannavarNo ratings yet

- Phil Tax Midterm ExamDocument25 pagesPhil Tax Midterm ExamDanica VetuzNo ratings yet

- Bhaichung BhutiyaDocument8 pagesBhaichung BhutiyaPriyankaSinghNo ratings yet

- MSDS - Prominent-Phenol - Red - Photometer - (USA)Document6 pagesMSDS - Prominent-Phenol - Red - Photometer - (USA)Tanawat ChinchaivanichkitNo ratings yet

- Unival™ Dmdg-6200 NT 7: High Density Polyethylene ResinDocument3 pagesUnival™ Dmdg-6200 NT 7: High Density Polyethylene Resinyesenia flores rosadoNo ratings yet

- MalalaDocument3 pagesMalalaapi-441535475No ratings yet

- Credit Schemes in HDFC, Nizamabad: Project Report Submitted To Jawaharlal Nehru Technological University, HyderabadDocument40 pagesCredit Schemes in HDFC, Nizamabad: Project Report Submitted To Jawaharlal Nehru Technological University, HyderabadBnaren NarenNo ratings yet

- PITKIN. Hanna. Obligation and ConsentDocument10 pagesPITKIN. Hanna. Obligation and ConsentYago PaivaNo ratings yet

- Updated Format of Form DIR-2 - Taxguru - inDocument3 pagesUpdated Format of Form DIR-2 - Taxguru - inHimanshu AggarwalNo ratings yet

- Executive Order No.877-A - Comprehensive Motor Vehicle Development Program - 03.06.2003 - 0Document17 pagesExecutive Order No.877-A - Comprehensive Motor Vehicle Development Program - 03.06.2003 - 0SamJadeGadianeNo ratings yet

- Franchisee Claim Report Format (1) (Version 1)Document32 pagesFranchisee Claim Report Format (1) (Version 1)ramanikarthiNo ratings yet

- Axure Templates - Free and Premium Axure RP Templates at UX UI GuideDocument2 pagesAxure Templates - Free and Premium Axure RP Templates at UX UI Guidenevin guptaNo ratings yet

- 5 - Pauls First Missionary JourneyDocument7 pages5 - Pauls First Missionary JourneyMike GNo ratings yet

- FSi9 - Key Changes - FreeDocument98 pagesFSi9 - Key Changes - FreeDiarra CisseNo ratings yet

- RN ERDAS APOLLO Essentials Image Web Server 2011Document18 pagesRN ERDAS APOLLO Essentials Image Web Server 2011Maca PacaNo ratings yet

- 2006 02-17-2006 2 CLJ 1 Majlis Perbandaran Ampang Jaya V Steven Phua EdDocument17 pages2006 02-17-2006 2 CLJ 1 Majlis Perbandaran Ampang Jaya V Steven Phua EdtcsNo ratings yet

- HRP GridDocument51 pagesHRP GridYassine LahlouNo ratings yet

- Quantum MeruitDocument2 pagesQuantum MeruitThe UntamedNo ratings yet

- Lietz HoldingsDocument2 pagesLietz Holdingsadeline_tan_4No ratings yet

- 6 Dividend Icai PDFDocument27 pages6 Dividend Icai PDFsuksesNo ratings yet

- 2024 03 25 - StatementDocument9 pages2024 03 25 - Statementngxjcbp8jdNo ratings yet

- Six Months in The Open (Scientology)Document91 pagesSix Months in The Open (Scientology)Geir Isene100% (2)

- Carandang v. Heirs of de GuzmanDocument3 pagesCarandang v. Heirs of de GuzmanAllyza RamirezNo ratings yet

- NeelamtilluckDocument10 pagesNeelamtilluckNeelam TilluckNo ratings yet

Blue Book - Set 8-7

Blue Book - Set 8-7

Uploaded by

Anna TungOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blue Book - Set 8-7

Blue Book - Set 8-7

Uploaded by

Anna TungCopyright:

Available Formats

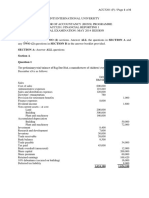

SECTION C (20 marks)

Answer ONE question in this section.

· · Jd C L' ·t d has drafted the trial balance as at

Before the preparation of the mcome statement, u y ompany 1m1 e

8.

31 December 2018 as follows:

Dr Cr

$ $

7 500

Accumulated depreciation - furniture, 1 January 2018 [note (ii)] 250 000

Accumulated depreciation - motor van, 1 January 2018

Administrative expenses 697 000

m~ 600 000

10% debentures 190 000

Furniture [note (ii)] 785 000

Inventory, 1 January 2018

1000000

Motor van 500 000

Ordinary shares capital 1987000

788 000

Purchases and sales . 828 600

Retained profits, 1 January 2018

257 800

()

Selling and distribution expenses 225 600

458 900

Trade receivables and trade payables 4 398 700

4 398 700

Additional information:

(i) It is the company's policy to depreciate its non-current assets on a straight-line basis at an annual

rate of 25%. Depreciation expenses are classified as administrative expenses.

(ii) On 30 September 2018, Judy Company Limited traded a piece of motor van, which bought on 1

October 2017 with a cost of $250 000 for a furniture. The trade-in value was agreed at $300 000.

No accounting record had been made for the above arrangement. In respect of this trade-in, the

company was required to pay $60 000 for the furniture, $10 000 for painting the company logo,

$8 000 for the insurance during its delivery and $25 000 annual maintenance fee. All these

expenditures had been recorded in furniture account.

(iii) $6 000 selling and distribution expenses had been prepaid. No accounting record had been made f

regarding the above. '..

(iv) In December 2018, goods cost at $60 000 were sent to a customer with $80 000 marked price on a

sale-or-return basis. These had been recorded as credit sales for the year. The goods had not been

included in the closing inventory. As at 31 December 2018, 50% of these goods were accepted by

the customer. The remaining 50% had been included in the closing inventory as at invoiced price.

(v) Inventory as at 31 December 2018 had a cost of$80 000. 10% of the inventory was slightly

damaged and had a net realizable value of $7 000.

KDSE BAFS-PAPER 2A SET 8 8 GOODREAD PUBLISHING LTD.

You might also like

- AUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersDocument10 pagesAUDITING PROBLEMS (CPAR First Preboards 2018) - AnswersVincent Larrie MoldezNo ratings yet

- Msds Pig IronDocument6 pagesMsds Pig Ironcampag12350% (2)

- Problems & Solutions - RNSDocument28 pagesProblems & Solutions - RNSAyushi0% (1)

- Project Question: Financial Management 1ADocument4 pagesProject Question: Financial Management 1AHashimRazaNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- 2019-12 ICMAB FL 001 PAC Year Question December 2019Document3 pages2019-12 ICMAB FL 001 PAC Year Question December 2019Mohammad ShahidNo ratings yet

- Tatty Company Analysis of Land For 2018: Requirement 1Document3 pagesTatty Company Analysis of Land For 2018: Requirement 1Hiroshi WakatoNo ratings yet

- B. Com I All PapersnDocument14 pagesB. Com I All Papersnrahim Abbas aliNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Financial Accounting and Reporting: RequirementsDocument4 pagesFinancial Accounting and Reporting: RequirementsebshuvoNo ratings yet

- 01.correction of Errors - 245038322 PDFDocument4 pages01.correction of Errors - 245038322 PDFMaan CabolesNo ratings yet

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocument14 pagesUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNo ratings yet

- IA Quiz ImadeDocument4 pagesIA Quiz ImadeKuro ZetsuNo ratings yet

- ACC304-IAS 1 Final AccountsDocument4 pagesACC304-IAS 1 Final AccountsGeorge AdjeiNo ratings yet

- FSQsDocument8 pagesFSQsNikesh KunwarNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document4 pagesCambridge International AS & A Level: ACCOUNTING 9706/31caiexpertcontactNo ratings yet

- Acc Q4Document9 pagesAcc Q4risvana rahimNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- HAC Intro To FInancial Management QuestionPaperDocument6 pagesHAC Intro To FInancial Management QuestionPaperfortune maviyaNo ratings yet

- ACCT 410 Candel Financial StatementDocument14 pagesACCT 410 Candel Financial StatementAthia Adams-KerrNo ratings yet

- Hba 2401 Advanced Financial Reporting Cat March 2024Document5 pagesHba 2401 Advanced Financial Reporting Cat March 2024PhilipNo ratings yet

- ACCT 302 Final AccountDocument10 pagesACCT 302 Final AccountbismarkkwadzokpoNo ratings yet

- 301 AFA II PL III Question CMA June 2021 Exam.Document4 pages301 AFA II PL III Question CMA June 2021 Exam.rumelrashid_seuNo ratings yet

- Review Questions On Standard-1Document4 pagesReview Questions On Standard-1George Adjei100% (1)

- M - Limited Companies (After Edit)Document41 pagesM - Limited Companies (After Edit)PublicEnemy007No ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- 71592bos57621 Inter p1qDocument7 pages71592bos57621 Inter p1qRahul MishraNo ratings yet

- Audit and Assurance: Certificate in Accounting and Finance Stage ExaminationDocument4 pagesAudit and Assurance: Certificate in Accounting and Finance Stage ExaminationUsama RajaNo ratings yet

- Test Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingDocument7 pagesTest Series: April, 2022 Mock Test Paper 2 Intermediate: Group - I Paper - 1: AccountingVishal MehraNo ratings yet

- RAC 102 - Principles of Financial Accounting 11 - Draft ExamDocument5 pagesRAC 102 - Principles of Financial Accounting 11 - Draft Examemmanuel mwitaNo ratings yet

- Icag Nov 2020-Group Discuss...Document6 pagesIcag Nov 2020-Group Discuss...Papa Ekow ArmahNo ratings yet

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- ExercisesDocument20 pagesExercisesRolivhuwaNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Assignment Due 29.01.21Document3 pagesAssignment Due 29.01.21Brandon SibandaNo ratings yet

- Seminar 8 PART BDocument3 pagesSeminar 8 PART BGaba RieleNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- Acc05 Far Handout 7Document5 pagesAcc05 Far Handout 7Jullia BelgicaNo ratings yet

- Chapter 21 - QB - Q1 - SolutionDocument4 pagesChapter 21 - QB - Q1 - SolutionRichard SibekoNo ratings yet

- Assets: Instruction: Write The Solution of The Problems Below (In Good Form)Document5 pagesAssets: Instruction: Write The Solution of The Problems Below (In Good Form)Christine CalimagNo ratings yet

- Sole Trader - Final Accounts: The Following Trial Balance Was Extracted From The Books of K. Kelly On 31/12/2005Document8 pagesSole Trader - Final Accounts: The Following Trial Balance Was Extracted From The Books of K. Kelly On 31/12/2005MahmozNo ratings yet

- Bac 202 Second CatDocument2 pagesBac 202 Second CatBrian MutuaNo ratings yet

- Tutorial 7 - IntangibleDocument2 pagesTutorial 7 - IntangibleABABNo ratings yet

- 2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Document3 pages2019-06 ICMAB FL 001 PAC Year Question JUNE 2019Mohammad ShahidNo ratings yet

- Use The Following Information For The Next Two (2) QuestionsDocument21 pagesUse The Following Information For The Next Two (2) QuestionsJennifer AdvientoNo ratings yet

- Advanced Accounting 2CDocument5 pagesAdvanced Accounting 2CHarusiNo ratings yet

- 05 s101 FfaDocument5 pages05 s101 FfaMuhammad AsifNo ratings yet

- HI5020 Tutorial Question Assignment T3 2020 FinalDocument7 pagesHI5020 Tutorial Question Assignment T3 2020 FinalAamirNo ratings yet

- CL9BD LTD., Company Financial StatementsDocument2 pagesCL9BD LTD., Company Financial Statementsrumelrashid_seuNo ratings yet

- Sem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201Document5 pagesSem3 14 Bcom Hons Sem-3 Financial Accounting II CC 3.1ch - 1201ruPAM DeyNo ratings yet

- FAR-I Statement of Changes EquityDocument2 pagesFAR-I Statement of Changes EquityUmair AhmedNo ratings yet

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- AE 22 Activity 8Document2 pagesAE 22 Activity 8Venus PalmencoNo ratings yet

- Bản inDocument23 pagesBản inTrang VũNo ratings yet

- Financial Accounting Part 3 PDFDocument6 pagesFinancial Accounting Part 3 PDFFiona Mirasol P. BeroyNo ratings yet

- Buscom Lecture-3Document4 pagesBuscom Lecture-3Dai SyNo ratings yet

- M.B.A (2019 Pattern)Document157 pagesM.B.A (2019 Pattern)girishpawarudgirkarNo ratings yet

- Required: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"Document2 pagesRequired: Prepare Statement of Profit or Loss For A For The Year To 30 June 2019 Using The Format in IAS 1 "Presentation of Financial Statements"АннаNo ratings yet

- Zimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3Document7 pagesZimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3chauromweaNo ratings yet

- CA Inter Accounts Q MTP 1 Nov 2022Document7 pagesCA Inter Accounts Q MTP 1 Nov 2022smartshivenduNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Eagle Island UST/Agip Waterfront Communities Petition To NHRCDocument86 pagesEagle Island UST/Agip Waterfront Communities Petition To NHRCJustice & Empowerment InitiativesNo ratings yet

- KPMG MAR 2024 100502 PayslipDocument1 pageKPMG MAR 2024 100502 PayslipNeha JainNo ratings yet

- Čedomilj Mijatović PDFDocument28 pagesČedomilj Mijatović PDFRTK401RTK401No ratings yet

- 611 Series Tech 757454 ENd PDFDocument536 pages611 Series Tech 757454 ENd PDFMinhDuc HoNo ratings yet

- SD NotesDocument7 pagesSD NotesBasu AllannavarNo ratings yet

- Phil Tax Midterm ExamDocument25 pagesPhil Tax Midterm ExamDanica VetuzNo ratings yet

- Bhaichung BhutiyaDocument8 pagesBhaichung BhutiyaPriyankaSinghNo ratings yet

- MSDS - Prominent-Phenol - Red - Photometer - (USA)Document6 pagesMSDS - Prominent-Phenol - Red - Photometer - (USA)Tanawat ChinchaivanichkitNo ratings yet

- Unival™ Dmdg-6200 NT 7: High Density Polyethylene ResinDocument3 pagesUnival™ Dmdg-6200 NT 7: High Density Polyethylene Resinyesenia flores rosadoNo ratings yet

- MalalaDocument3 pagesMalalaapi-441535475No ratings yet

- Credit Schemes in HDFC, Nizamabad: Project Report Submitted To Jawaharlal Nehru Technological University, HyderabadDocument40 pagesCredit Schemes in HDFC, Nizamabad: Project Report Submitted To Jawaharlal Nehru Technological University, HyderabadBnaren NarenNo ratings yet

- PITKIN. Hanna. Obligation and ConsentDocument10 pagesPITKIN. Hanna. Obligation and ConsentYago PaivaNo ratings yet

- Updated Format of Form DIR-2 - Taxguru - inDocument3 pagesUpdated Format of Form DIR-2 - Taxguru - inHimanshu AggarwalNo ratings yet

- Executive Order No.877-A - Comprehensive Motor Vehicle Development Program - 03.06.2003 - 0Document17 pagesExecutive Order No.877-A - Comprehensive Motor Vehicle Development Program - 03.06.2003 - 0SamJadeGadianeNo ratings yet

- Franchisee Claim Report Format (1) (Version 1)Document32 pagesFranchisee Claim Report Format (1) (Version 1)ramanikarthiNo ratings yet

- Axure Templates - Free and Premium Axure RP Templates at UX UI GuideDocument2 pagesAxure Templates - Free and Premium Axure RP Templates at UX UI Guidenevin guptaNo ratings yet

- 5 - Pauls First Missionary JourneyDocument7 pages5 - Pauls First Missionary JourneyMike GNo ratings yet

- FSi9 - Key Changes - FreeDocument98 pagesFSi9 - Key Changes - FreeDiarra CisseNo ratings yet

- RN ERDAS APOLLO Essentials Image Web Server 2011Document18 pagesRN ERDAS APOLLO Essentials Image Web Server 2011Maca PacaNo ratings yet

- 2006 02-17-2006 2 CLJ 1 Majlis Perbandaran Ampang Jaya V Steven Phua EdDocument17 pages2006 02-17-2006 2 CLJ 1 Majlis Perbandaran Ampang Jaya V Steven Phua EdtcsNo ratings yet

- HRP GridDocument51 pagesHRP GridYassine LahlouNo ratings yet

- Quantum MeruitDocument2 pagesQuantum MeruitThe UntamedNo ratings yet

- Lietz HoldingsDocument2 pagesLietz Holdingsadeline_tan_4No ratings yet

- 6 Dividend Icai PDFDocument27 pages6 Dividend Icai PDFsuksesNo ratings yet

- 2024 03 25 - StatementDocument9 pages2024 03 25 - Statementngxjcbp8jdNo ratings yet

- Six Months in The Open (Scientology)Document91 pagesSix Months in The Open (Scientology)Geir Isene100% (2)

- Carandang v. Heirs of de GuzmanDocument3 pagesCarandang v. Heirs of de GuzmanAllyza RamirezNo ratings yet

- NeelamtilluckDocument10 pagesNeelamtilluckNeelam TilluckNo ratings yet