Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsFinancial Analysis Ratios Summary

Financial Analysis Ratios Summary

Uploaded by

rosemarie tolentinoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Guide Questions WhatsappDocument1 pageGuide Questions Whatsapprosemarie tolentinoNo ratings yet

- Guide Questions WawaDocument1 pageGuide Questions Wawarosemarie tolentinoNo ratings yet

- CASE ANALYSIS FOR BIRLA - Global Indian ConglomerateDocument2 pagesCASE ANALYSIS FOR BIRLA - Global Indian Conglomeraterosemarie tolentinoNo ratings yet

- Notes Taken During 3 July APQP PPAP ClassDocument2 pagesNotes Taken During 3 July APQP PPAP Classrosemarie tolentinoNo ratings yet

- 5 GT SPC Work Book (Dr2) 30318Document2 pages5 GT SPC Work Book (Dr2) 30318rosemarie tolentinoNo ratings yet

Financial Analysis Ratios Summary

Financial Analysis Ratios Summary

Uploaded by

rosemarie tolentino0 ratings0% found this document useful (0 votes)

11 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

11 views2 pagesFinancial Analysis Ratios Summary

Financial Analysis Ratios Summary

Uploaded by

rosemarie tolentinoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 2

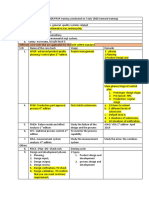

402 | CHAPTER 16

Reread Formula Cee a oe)

Current

Ichentenat reeemet Current Assets $1730000 4,

liquidity; the ability to meet Current Liabilities $290,000

near-term obligations)

Quick

eee ee Cash + Short-term Investments + Accts, Rec. $1550000_ 5,

of liquidity; the ability to meet Current Liabilities $290,000 ”

near-term obligations)

Deane ary

Debt to Total Assets

(Chapter 13: Percentage of cTotal Debt S1190,0007 Tho

assets financed by long-term Total Assets $4,100,000

and short-term debt)

Debt to Total Equity Total Debt $1,190,000

(Chapter 13: Proportion of Toul cauny ——— =o

financing that is debt-related) VERE So

‘Times Interest Eamed Income Before Income Taxes and Interest $1,400,000

(Chapter 13: Ability to meet nennGhage roo 7

Interest obligations)

Deed arIcy Coat

Accounts Receivable

Turnover Net Credit Sales

(Chapter 7: Frequency of ore =e 4.88

Ca ee Average Net Accounts Receivable $725,000

‘tpolicies)

Inventory Turnover

(Chapter 8: Frequency of inventory Cost of Goods Sold $1,160,000_ sg

rotation; to monitor inventory ‘Average Inventory $200,000

management)

ES

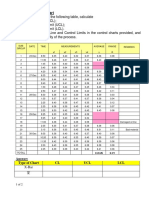

FINANCIAL ANALYSIS ANDTHE STATEMENT OF CASH FLOWS | 403

BCT ai ry Coat

Net Profit on Sales

(Chapter 5:Proftabilty on Net income are

sales; for comparison and Net Sales $3,250,000

trend analysis)

Gross Profit Margin

(Chapter 5: Gross prof- Gross Profit $2,090,000 _ gy,

itrate; for comparison and Net Sales $3,250,000

‘rend analysis)

Return on Assets Net Interest & $1,100,000

eae let Income + Interest Expense 100.000 55,

utilization in ‘Average Assets $3,865,000

producing returns)

Return on Equity

(Chapter 15: Effectiveness of Net Income - Preferred Dividends $1,000,000 _ gay

‘equity investment “Average Common Equity $2,095,000

in producing returns)

Cea reed nr) Cea ner

EPS

(Chapter 15: Amount of Income Available to Common $1,000000_ 4, 4,

earnings attributableto each Weighted-Average Number of Common Shares 905,000,

share of common stock)

PIE

(Chapter 15:The price of the Market Price Pes Share a;

stock in relation to earnings Earnings Per Share $1

peer share)

Dividend Rate/Yield

(Chapter 15: Direct yield to pesrenelceshbaiende — 80.055 a. s5%

investors through Market Price Per Share $10

dividend payments)

Dividend Payout Ratio

(Chapter 15: Proportion of ‘Annual Cash Dividend $0055 _ oy,

‘earnings distributed Earnings Per Share suit

as dividends)

Book Value

(Chapter 15: The amount See _, $2610.00 59 97

of stockholders equity per Common Shares Outstanding 970,000

‘common share outstanding)

SL

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Guide Questions WhatsappDocument1 pageGuide Questions Whatsapprosemarie tolentinoNo ratings yet

- Guide Questions WawaDocument1 pageGuide Questions Wawarosemarie tolentinoNo ratings yet

- CASE ANALYSIS FOR BIRLA - Global Indian ConglomerateDocument2 pagesCASE ANALYSIS FOR BIRLA - Global Indian Conglomeraterosemarie tolentinoNo ratings yet

- Notes Taken During 3 July APQP PPAP ClassDocument2 pagesNotes Taken During 3 July APQP PPAP Classrosemarie tolentinoNo ratings yet

- 5 GT SPC Work Book (Dr2) 30318Document2 pages5 GT SPC Work Book (Dr2) 30318rosemarie tolentinoNo ratings yet